First Guaranty Bancshares, Inc. Announces Second Quarter 2023 Results

10 August 2023 - 5:47AM

First Guaranty Bancshares, Inc. ("First Guaranty") (NASDAQ: FGBI),

the holding company for First Guaranty Bank, announced its

unaudited financial results for the quarter

ending June 30, 2023.

Resilient: Springing back, rebounding. Returning

to the original form for position after being bent, compressed or

stretched. Recovering readily from illness, depression, adversity,

or the like; buoyant. Random House Webster’s Unabridged Dictionary

Second Edition.

Another good word is strong. An even better word

is tough. These are words that describe what First Guaranty has

been during a six month period in which we have survived wound

after wound, not of our own causing as we continue to deliver to

our shareholders, customers, and our staff members extraordinary

results.

The latest of these have been the FDIC deposit

insurance adjustment which was $450,000 for the second quarter.

Enough crying over spilt milk. This is what we

did to make it better. Our interest income for the second quarter

of 2023 increased to $43,781,000 compared to $32,540,000 for the

second quarter of 2022. For the six months ending June 30, 2023,

our interest income totaled $85,068,000 compared to $63,019,000.

Our interest expense stabilized at $22,868,000 for the quarter

compared to $41,854,000 for the six month period ending June 30,

2023.

We have significantly increased our loan

interest income to offset the increased cost of deposits which are

set by the Federal Reserve. For the quarter, we made over

$2,000,000 for our shareholders even after the FDIC assessment.

Basically, we have and will continue to make a

lot of money for our shareholders. We are working very hard to

control non-interest expense. We are working very hard to expand

our interest margin. Our lenders have done a great job working to

increase the rates we receive for our loans.

Let’s keep moving forward. Let’s be resilient.

Let’s be TOUGH.

About First Guaranty Bancshares,

Inc.

First Guaranty Bancshares, Inc. is the holding

company for First Guaranty Bank, a Louisiana state-chartered bank.

Founded in 1934, First Guaranty Bank offers a wide range of

financial services and focuses on building client relationships and

providing exceptional customer service. First Guaranty Bank

currently operates thirty-six locations throughout Louisiana,

Texas, Kentucky and West Virginia. First Guaranty’s common stock

trades on the NASDAQ under the symbol FGBI. For more information,

visit www.fgb.net.

Forward Looking Statements

This press release contains forward-looking

statements within the meaning of the U.S. federal securities laws.

Forward-looking statements are any statements other than statements

of historical fact which represent our current judgement about

possible future events. We believe these judgements are reasonable,

but these statements are not guarantees of any future events or

financial results, and our actual results may differ materially due

to a variety of factors, many of which are described in our most

recent Annual Report on Form 10-K and our other filings with the

U.S. Securities and Exchange Commission. We caution readers not to

place undue reliance on forward-looking statements. Forward-looking

statements speak only as of the date they are made, and we

undertake no obligation to update or otherwise revise any

forward-looking statements.

For full release click

here.

CONTACT: ALTON LEWIS, CEO AND ERIC DOSCH,

CFO

985.375.0350 / 985.375.0308

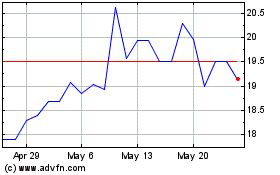

First Guaranty Bancshares (NASDAQ:FGBIP)

Historical Stock Chart

From Nov 2024 to Dec 2024

First Guaranty Bancshares (NASDAQ:FGBIP)

Historical Stock Chart

From Dec 2023 to Dec 2024