Transaction Values Fluent at $415 Million

with Additional Contribution by BlueFocus of $100 Million in Cash,

Canadian-Based Marketing Communications Company Vision7

International, and U.K.-Based Global Socially-Led Creative Agency

We Are Social

Data and Analytics Company to Spin-Off into

Standalone Public Company with Proposed Listing on NASDAQ;

Dedicated Focus on Innovation and Big Data Analytics to Drive

Continued Expansion in Multi-Billion Dollar Market

cogint Shareholders Expected to Receive Cash

Dividend and Shares of Data and Analytics Company Common Stock in

Connection with Closing the Business Combination

cogint Shareholders and BlueFocus to Own 37%

and 63% respectively of the Combined Marketing Services

Company

Creates World-Class Global Marketing

Services Company Powered by Creative, Digital and Performance

Marketing Capabilities

Cogint, Inc. (NASDAQ:COGT) today announced it has entered into a

definitive transaction agreement with BlueFocus International

Limited (“BlueFocus”), a wholly-owned Hong Kong subsidiary of

BlueFocus Communications Group Co. Ltd. (publicly traded Chinese

Company (SHE:300058)) under which cogint and BlueFocus will combine

their businesses. In the transaction, BlueFocus will contribute to

cogint (1) $100 million in cash, (2) Canadian-based marketing

communications company Vision7 International Inc., (3) U.K.-based

global socially-led creative agency We Are Very Social Limited, and

(4) Indigo Social, LLC. The transaction values cogint’s

performance-marketing business, Fluent, at $415 million. The

combined company is expected to have 2018 annual revenues in excess

of $500 million and adjusted EBITDA in excess of $75 million, with

customers around the globe.

cogint, through its data-driven, performance marketing solutions

company Fluent, has established a leading franchise of

differentiated, innovative products in the digital marketing

industry that is highly complementary to the existing portfolio of

BlueFocus. The combination provides Fluent with an immediate

international presence with access to the world’s leading brands,

and delivers differentiated, end-to-end solutions consisting of

Fluent’s unique customer acquisition and retention capabilities and

BlueFocus’s premier agency and creative services. BlueFocus will

retain Fluent’s presence in New York City and Fluent will continue

to be led by Ryan Schulke and Matt Conlin.

As part of the transaction, immediately prior to the closing,

cogint will spin-off its data and analytics operations and assets

into a public company, expected to be listed on NASDAQ, named Red

Violet, Inc. (“Red Violet”). The shares of Red Violet will be

distributed to cogint’s shareholders as of a record date to be

determined as a stock dividend upon closing of the transaction. The

arrangements will result in Red Violet launching with cash of $20

million dollars. Red Violet will be led by cogint’s current

management team with Derek Dubner, co-founder and Chief Executive

Officer of cogint, as Chief Executive Officer. Michael Brauser,

co-founder and Chairman of the Board of cogint, will be Chairman of

the Board of Red Violet.

“I’m very proud that we have created such an extraordinary value

proposition through this structured transaction,” said Michael

Brauser, cogint’s Chairman. “Since the day we founded cogint, we

have worked tirelessly to create enormous value for our

shareholders. This transaction does exactly that by providing a

significant value premium to our shareholders, a cash dividend, and

ownership in two publicly-traded companies with tremendous future

upside.”

“Fluent is uniquely positioned as the go-to data-driven,

performance marketing company for top brands to engage with

customers at massive scale,” said Derek Dubner, cogint’s CEO.

“Combining Fluent with BlueFocus’s international portfolio of

marketing services businesses is a compelling opportunity for

Fluent to achieve international scale and to integrate its unique

ability to build custom audiences for the world’s leading brands

with the BlueFocus portfolio of services. I am equally excited to

announce the spin-off of our data and analytics company and its new

brand identity, Red Violet. Red Violet is strongly positioned to

leverage its innovative technologies to power its continued

expansion within the risk management industry. This structured

transaction enhances the strategic focus and respective competitive

positions of both cogint companies.”

Benefits of the Transaction

- Compelling

transaction for cogint shareholders: The transaction

will deliver a significant and immediate premium to cogint

shareholders, with greater value certainty resulting from the

combination of cogint’s performance marketing business with

BlueFocus’s marketing services companies, as compared to cogint’s

performance marketing business’s standalone prospects. cogint’s

shareholders will also receive a cash dividend and are also

expected to realize substantial additional value from their

ownership interest in Red Violet’s spin-off.

- Additional

value creation through separation of businesses: As

cogint’s risk management and performance marketing businesses have

distinct financial and operating characteristics, the separation of

the businesses will simplify the management and organization

structures of each company, allowing each company to adopt

strategies and pursue objectives appropriate to their respective

needs to focus more exclusively on improving each company's

operations, and to enable the optimization of capital deployment

and investment strategies necessary to advance their respective

compelling innovation roadmaps. Further, the separation brings

greater clarity to the market place as to each company’s core

competencies, allowing each company to compete more effectively

within their respective markets.

- Greater

visibility into cogint businesses: The separation of

cogint’s risk management and performance marketing businesses

enables investors to better evaluate the financial performance,

strategies, and other characteristics of each company. This will

permit investors to make investment decisions based on each

company's own performance and potential, and enhance the likelihood

that the market will value each company appropriately.

cogint shareholders holding in aggregate 58.0% of the Company's

common stock have approved, by written consent, the issuance of

cogint shares to BlueFocus and other matters relating to the

business combination. The company expects to mail to its

shareholders an Information Statement describing the business

combination in detail. Closing of the transaction is conditioned on

the mailing of the Information Statement to cogint shareholders,

completion of the spin-off, and appropriate regulatory

approvals.

Advisors

Petsky Prunier is acting as exclusive financial advisor to

Cogint, Inc. PJT Partners is acting as financial advisor to

BlueFocus International Limited.

About cogint™

At cogint, we believe that time is your most valuable asset.

Through powerful analytics, we transform data into intelligence, in

a fast and efficient manner, so that our clients can spend their

time on what matters most – running their organizations with

confidence. Through leading-edge, proprietary technology and a

massive data repository, our data and analytical solutions harness

the power of data fusion, uncovering the relevance of disparate

data points and converting them into comprehensive and insightful

views of people, businesses, assets and their interrelationships.

We empower clients across markets and industries to better execute

all aspects of their business, from managing risk, conducting

investigations, identifying fraud and abuse, and collecting debts,

to identifying and acquiring new customers. At cogint, we are

dedicated to making the world a safer place, to reducing the cost

of doing business, and to enhancing the consumer experience.

Note to Investors Concerning Forward-Looking

Statements

This press release contains “forward-looking statements,” as

that term is defined under the Private Securities Litigation Reform

Act of 1995 (PSLRA), which statements may be identified by words

such as “expects,” “plans,” “projects,” “will,” “may,”

“anticipate,” “believes,” “should,” “intends,” “estimates,” and

other words of similar meaning. Such forward looking statements

include statements relating to the transaction between cogint and

BlueFocus, expected annual revenues and EBITDA of the combined

company, the delivery of a significant and immediate premium to

cogint shareholders, the spin-off of cogint’s data and analytics

operations and assets into a new public company, and the additional

value creation through the separation of such operations and

assets. Additional risks may include the risk that a condition to

closing of the proposed transaction may not be satisfied or that

the closing of the proposed transaction and spin-off might

otherwise not occur; the risk that a regulatory approval that may

be required for the proposed transaction is not obtained or is

obtained subject to conditions that are not anticipated; the

diversion of management time on transaction-related issues; the

ability to successfully integrate BlueFocus’s business; the ability

to successfully separate cogint’s data and analytics operations and

assets; the risk that the common stock of Red Violet is not listed

on NASDAQ; the risk that the transaction and its announcement could

have an adverse effect on cogint’s and BlueFocus’s ability to

retain customers and retain and hire key personnel; the risk that

any potential synergies from the transaction may not be fully

realized or may take longer to realize than expected, as well as

other non-historical statements about our expectations, beliefs or

intentions regarding our business, technologies and products,

financial condition, strategies or prospects. Readers are cautioned

not to place undue reliance on these forward-looking statements,

which are based on our expectations as of the date of this press

release and speak only as of the date of this press release and are

advised to consider the factors listed above together with the

additional factors under the heading “Forward-Looking Statements”

and “Risk Factors” in the Company’s Annual Report on Form 10-K, as

may be supplemented or amended by the Company’s Quarterly Reports

on Form 10-Q and other SEC filings. We undertake no obligation to

publicly update or revise any forward-looking statement, whether as

a result of new information, future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170907005735/en/

Cogint, Inc.Jordyn Kopin, 646-356-8469Director, Investor

RelationsJKopin@cogint.com

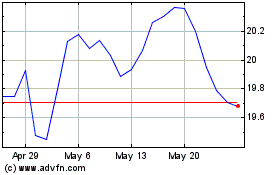

First Trust Latin Americ... (NASDAQ:FLN)

Historical Stock Chart

From Dec 2024 to Jan 2025

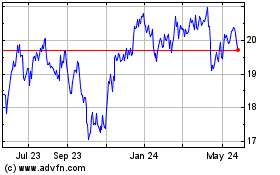

First Trust Latin Americ... (NASDAQ:FLN)

Historical Stock Chart

From Jan 2024 to Jan 2025