false

0000754811

0000754811

2024-02-08

2024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) Of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

U.S. GLOBAL INVESTORS, INC.

(Exact name of registrant as specified in its charter)

|

Texas

|

0-13928

|

74-1598370

|

|

(State of other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

7900 Callaghan Road, San Antonio, Texas 78229

(Address of principal executive offices) (Zip Code)

Registrant's telephone number, including area code: 210-308-1234

| |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Class A common stock, $0.25 par value per share

|

GROW

|

NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1934 (§240.12b-2 of this chapter)

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 8, 2024, U.S. Global Investors, Inc. issued a press release reporting earnings and other financial results for its quarter ended December 31, 2023. A copy of the press release is attached and being furnished as Exhibit 99.1.

The information in this current report on Form 8-K, including the accompanying Exhibit 99.1, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act"), or otherwise subject to the liability of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 — Financial Statement and Exhibits

(d) Exhibits

Exhibit 104 - Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

U.S. Global Investors, Inc. |

|

| |

|

|

| |

|

|

|

|

By:

|

/s/ Lisa Callicotte

|

|

|

|

|

Lisa Callicotte |

|

|

|

|

Chief Financial Officer |

|

Dated: February 9, 2024

Exhibit 99.1

|

Contact:

Holly Schoenfeldt

Director of Marketing

210.308.1268

hschoenfeldt@usfunds.com

|

|

For Immediate Release

U.S. Global Investors Reports Strong Results for December Quarter

******************************************************************************

SAN ANTONIO–February 8, 2024–U.S. Global Investors, Inc. (NASDAQ: GROW) (the “Company”), a registered investment advisory firm with longstanding experience in global markets and specialized sectors from gold mining to airlines, today reported net income of $1.2 million, or $0.09 per share, in the quarter ended December 31, 2023. That was up from a net loss of $176,000, or $0.01 per share, in the previous quarter and represents a 45% increase from the same quarter a year earlier.

The growth in net income was due in large part to a significant increase in net investment income, which was $1.4 million for the quarter ended December 31, 2023, compared to net investment income of $116,000 for the same period a year earlier. This increase included net unrealized gains on equity securities of $279,000, compared to net unrealized losses of $937,000 in the comparable period.

Operating revenues during the quarter were $2.8 million, while total assets under management (AUM) at quarter end were $2.1 billion, down from AUM of $2.4 billion a year ago.

“The decline in assets was predominantly driven by the U.S. Global Jets ETF (NYSE: JETS), which saw net outflows in 2023 as many foreign investors cut their exposure to ETFs due, we believe, to fear of a global recession,” says Frank Holmes, the Company’s CEO and Chief Investment Officer.

Strengthening the Moat Around Our Smart Beta 2.0 ETFs

The Company continues to strengthen the economic moat around two of its ETF offerings, JETS and the U.S. Global GO GOLD and Precious Metal Miners ETF (NYSE: GOAU). In this context, a moat is a term used to describe a company’s ability to maintain a competitive advantage over its rivals.

In December 2023, GOAU began trading on Peru’s Bolsa de Valores de Lima (Lima Stock Exchange), the ETF’s third international listing after New York City and Mexico City. GOAU joins JETS, which listed in Lima in December 2020. Besides New York and Lima, JETS is also available to buy in Europe, London and Mexico City.

“This move gives even more investors access to GOAU, a dynamic, rules-based ETF that has a distinctive quantitative and fundamental approach to stock-picking that we describe as quantamental,” continues Mr. Holmes. “Like JETS and our U.S. Global Sea to Sky Cargo ETF (NYSE: SEA), GOAU has a smart beta 2.0 construction, meaning it combines the ease of passive investing with the rigor of active investing. The stock selections and weightings in our three ETFs are based on more than simple market caps; a number of key financial factors are also taken into consideration. Each quarter, the ETFs are rebalanced and reconstituted.”

Healthy Liquidity and Capital Resources

As of December 31, 2023, the Company had net working capital of approximately $38.3 million, an increase of $840,000 from June 30, 2023. With approximately $27.5 million in cash and cash equivalents, plus investments in our funds and other securities, the Company has adequate liquidity to meet its current obligations.

Tune In to the Earnings Webcast

The Company has scheduled a webcast for 7:30 a.m. Central time on Friday, February 9, 2024, to discuss the Company’s key financial results for the quarter. Frank Holmes will be accompanied on the webcast by Lisa Callicotte, chief financial officer, and Holly Schoenfeldt, marketing and public relations manager. Click here to register for the earnings webcast or visit www.usfunds.com for more information.

Selected Financial Data (unaudited): (dollars in thousands, except per share data)

| |

|

Three months ended

|

|

| |

|

12/31/2023

|

|

|

12/31/2022

|

|

|

Operating Revenues

|

|

$ |

2,818 |

|

|

$ |

3,728 |

|

|

Operating Expenses

|

|

|

2,626 |

|

|

|

2,820 |

|

|

Operating Income

|

|

|

192 |

|

|

|

908 |

|

| |

|

|

|

|

|

|

|

|

|

Total Other Income

|

|

|

1,473 |

|

|

|

178 |

|

|

Income Before Income Taxes

|

|

|

1,665 |

|

|

|

1,086 |

|

| |

|

|

|

|

|

|

|

|

|

Income Tax Expense

|

|

|

436 |

|

|

|

239 |

|

|

Net Income

|

|

$ |

1,229 |

|

|

$ |

847 |

|

| |

|

|

|

|

|

|

|

|

|

Net Income Per Share (Basic and Diluted)

|

|

$ |

0.09 |

|

|

$ |

0.06 |

|

| |

|

|

|

|

|

|

|

|

|

Avg. Common Shares Outstanding (Basic)

|

|

|

14,291,328 |

|

|

|

14,889,946 |

|

|

Avg. Common Shares Outstanding (Diluted)

|

|

|

14,291,396 |

|

|

|

14,890,031 |

|

| |

|

|

|

|

|

|

|

|

|

Avg. Assets Under Management (Billions)

|

|

$ |

1.9 |

|

|

$ |

2.5 |

|

####

About U.S. Global Investors, Inc.

The story of U.S. Global Investors goes back more than 50 years when it began as an investment club. Today, U.S. Global Investors, Inc. (www.usfunds.com) is a registered investment adviser that focuses on niche markets around the world. Headquartered in San Antonio, Texas, the Company provides investment management and other services to U.S. Global Investors Funds and U.S. Global ETFs.

Forward-Looking Statements and Disclosure

This news release and other statements by U.S. Global Investors may include certain “forward-looking statements,” including statements relating to revenues, expenses and expectations regarding market conditions. You can identify these forward-looking statements by the use of words such as “outlook,” “believes,” “expects,” “potential,” “opportunity,” “seeks,” “anticipates” or other comparable words. Such statements involve certain risks and uncertainties and should be read with corporate filings and other important information on the Company’s website, www.usfunds.com, or the Securities and Exchange Commission’s website at www.sec.gov.

These filings, such as the Company’s annual report and Form 10-Q, should be read in conjunction with the other cautionary statements that are included in this release. Future events could differ materially from those anticipated in such statements and there can be no assurance that such statements will prove accurate and actual results may vary. The Company undertakes no obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a statutory and summary prospectus for JETS here, GOAU here and for SEA here. Read it carefully before investing.

Investing involves risk, including the possible loss of principal. Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the funds. Brokerage commissions will reduce returns. Because the funds concentrate their investments in specific industries, the funds may be subject to greater risks and fluctuations than a portfolio representing a broader range of industries. The funds are non-diversified, meaning they may concentrate more of their assets in a smaller number of issuers than diversified funds.

The funds invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for investments in emerging markets. The funds may invest in the securities of smaller-capitalization companies, which may be more volatile than funds that invest in larger, more established companies.

The performance of the funds may diverge from that of the index. Because the funds may employ a representative sampling strategy and may also invest in securities that are not included in the index, the funds may experience tracking error to a greater extent than funds that seek to replicate an index. The funds are not actively managed and may be affected by a general decline in market segments related to the index.

Airline Companies may be adversely affected by a downturn in economic conditions that can result in decreased demand for air travel and may also be significantly affected by changes in fuel prices, labor relations and insurance costs. Gold, precious metals, and precious minerals funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The prices of gold, precious metals, and precious minerals are subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in these sectors. Cargo Companies may be adversely affected by downturn in economic conditions that can result in decreased demand for sea shipping and freight.

Foreign and emerging market investing involves special risks such as currency fluctuation and less public disclosure, as well as economic and political risk. By investing in a specific geographic region, such as China and/or Taiwan, a regional ETFs returns and share price may be more volatile than those of a less concentrated portfolio.

Fund holdings and allocations are subject to change at any time. Click to view fund holdings for JETS, GOAU and for SEA.

Distributed by Quasar Distributors, LLC. U.S. Global Investors is the investment adviser to JETS, GOAU and SEA.

v3.24.0.1

Document And Entity Information

|

Feb. 08, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

U.S. GLOBAL INVESTORS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 08, 2024

|

| Entity, Incorporation, State or Country Code |

TX

|

| Entity, File Number |

0-13928

|

| Entity, Tax Identification Number |

74-1598370

|

| Entity, Address, Address Line One |

7900 Callaghan Road

|

| Entity, Address, City or Town |

San Antonio

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78229

|

| City Area Code |

210

|

| Local Phone Number |

308-1234

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock

|

| Trading Symbol |

GROW

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000754811

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

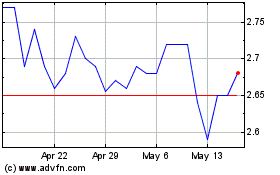

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Mar 2024 to Apr 2024

US Global Investors (NASDAQ:GROW)

Historical Stock Chart

From Apr 2023 to Apr 2024