Cheer Holding, Inc. (NASDAQ: CHR) ("Cheer Holding," or the

"Company"), a leading provider of advanced mobile internet

infrastructure and platform services, today announced its financial

results for the full year ended December 31, 2023.

Full Year 2023 Operating

Highlights

Total Downloads of CHEERS Apps was approximately

474 million as of December 31, 2023, compared to approximately 377

million as of December 31, 2022. Specifically:

CHEERS Video

- Monthly Active Users of CHEERS

Video increased by 5% to approximately 50.1 million.

- Daily Time Spent on CHEERS Video

was 59 minutes during the commercial year of 2023.

CHEERS e-Mall

- Monthly Active Users of CHEERS

e-Mall increased by 71% to approximately 6.5 million.

- Repurchase Rate on CHEERS e-Mall

was 39.6% during the commercial year of 2023.

CheerReal

- Monthly Active Users of CheerReal

platform was approximately 1.3 million.

- Number of Digital Art Collections

listed on CheerReal platform was 767 units.

CHEERS Telepathy

- Monthly Active Users of CHEERS

Telepathy platform was approximately 300 thousand.

CHEERS Open Data

- Total Number of User Engagement was

27 million.

- Platform Daily Usage was more than

150 thousand.

Full Year 2023 Financial

Highlights

- Revenues reached $152.3

million.

- Net Income reached $30.5

million.

- Net Cash Provided by Operating

Activities was approximately $42.2 million.

Full Year 2023 Selected Financial

Results

Revenues

Our revenues for the year ended December 31,

2023 were approximately $152.3 million, representing a decrease of

approximately $4.8 million, or 3.03% from approximately $157.1

million for the year ended December 31, 2022. The change in

revenues was mainly affected by depreciation of RMB during the year

ended December 31, 2023, leading to a lower USD amount in

translation of revenues from RMB into USD.

Without the impact of fluctuation of foreign

exchange rates, our revenues for the year ended December 31, 2023

increased by approximately RMB22.1 million (approximately $3.1

million), or 2.09% as compared with the revenues for the same

period of 2022. The increase in the revenues was primarily

attributable to increase in advertising revenues of approximately

RMB32.4 million as a result of continuous efforts to expand our

customer base through improving our content production quality.

For the years ended December 31, 2023 and 2022,

97.9% and 96.8% of our revenues derived from advertising

services.

Operating expenses

Operating expenses consists of cost of revenues,

selling and marketing, general and administrative and research and

development expense.

- Cost of revenues decreased by

approximately $1.0 million, or 2.54%, from approximately $40.6

million for the year ended December 31, 2022 to approximately $39.5

million for the year ended December 31, 2023. Similar to the

changes in revenues, the decrease in cost of revenues was primarily

caused by depreciation of RMB during the year ended December 31,

2023.

- Sales and marketing expenses

decreased by approximately $6.3 million, to approximately $76.2

million for the year ended December 31, 2023 from approximately

$82.5 million for the year ended December 31, 2022. The decrease

was mainly due to a decrease in promotion service charge of

approximately $5.9 million because the Company reduced cost in

marketing and promotion.

- General and administrative expenses

was stable at approximately $5.7 million and $5.9 million,

respectively, for the year ended December 31, 2023 and 2022.

- Research and development expenses

for the years ended December 31, 2023 and 2022 were approximately

$1.6 million and approximately $1.3 million, respectively. Such

increase was primarily due to the continued investment in the IT

infrastructure, user-friendliness upgrades, and continual

implementation on content driven strategies.

Net income

We had a net income of approximately $30.5

million in the year ended December 31, 2023, as compared to a net

income of approximately $26.4 million in the year ended December

31, 2022.

Cash, cash equivalents and working capital

As of December 31, 2023 and 2022, the Company’s

principal sources of liquidity were cash and cash equivalents of

approximately $194.2 million and $70.5 million, respectively.

Working capital at December 31, 2023 was approximately $260.7

million.

About Cheer Holding, Inc.

As a preeminent provider of next-generation

mobile internet infrastructure and platform services in China,

Cheer Holding is dedicated to building a digital ecosystem that

integrates “platforms, applications, technology, and industry” into

a cohesive system, thereby creating a new, open business

environment for web3.0 that leverages AI technology. The Company is

developing a 5G+VR+AR+AI shared universe space that builds on

cutting-edge technologies including blockchain, cloud computing,

extended reality, and digital twin.

Cheer Holding’s portfolio includes a wide range

of products and services, such as Polaris Intelligent Cloud, CHEERS

Telepathy, CHEERS Open Data Platform, CHEERS Video, CHEERS e-Mall,

CheerReal, CheerCar, CheerChat, CHEERS Fresh Group-Buying

E-commerce Platform, Digital Innovation Research Institute, CHEERS

Livestreaming, variety show series, IP short video matrix, and

more. These offerings provide diverse application scenarios that

seamlessly blend “online/offline” and “virtual/reality”

elements.

With “CHEERS+” at the core of Cheer Holding’s

ecosystem, the Company is committed to consolidating and

strengthening its core competitiveness, and achieving long-term

sustainable and scalable growth.

For more information, please visit

http://ir.gsmg.co/.

Safe Harbor Statement

Certain statements made in this release are

“forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995. When used in this press release, the

words “estimates,” “projected,” “expects,” “anticipates,”

“forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,”

“will,” “should,” “future,” “propose” and variations of these words

or similar expressions (or the negative versions of such words or

expressions) are intended to identify forward-looking statements.

These forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the Company’s control, that

could cause actual results or outcomes to differ materially from

those discussed in the forward-looking statements. Important

factors, among others, are: the ability to manage growth; ability

to identify and integrate other future acquisitions; ability to

obtain additional financing in the future to fund capital

expenditures; fluctuations in general economic and business

conditions; costs or other factors adversely affecting our

profitability; litigation involving patents, intellectual property,

and other matters; potential changes in the legislative and

regulatory environment; a pandemic or epidemic; the occurrence of

any event, change or other circumstances that could affect the

Company’s ability to continue successful development and launch of

its metaverse experience centers; the possibility that the Company

may not succeed in developing its new lines of businesses due to,

among other things, changes in the business environment and

technological developments, competition, changes in regulation, or

other economic and policy factors; disruptions or other business

interruptions that may affect the operations of our products and

services, the possibility that the Company’s new lines of business

may be adversely affected by other economic, business, and/or

competitive factors; other factors, risks and uncertainties set

forth in documents filed by the Company with the Securities and

Exchange Commission from time to time, including the Company’s

latest Annual Report on Form 20-F filed with the SEC on March 22,

2023, as amended. The Company undertakes no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as required by

applicable law. Such information speaks only as of the date of this

release.

For investor and media inquiries, please

contact:

Wealth Financial Services LLC

Connie Kang, Partner

Email: ckang@wealthfsllc.com

Tel: +86 1381 185 7742 (CN)

CHEER HOLDING,

INC.(Formerly known as “Glory Star New Media Group

Holdings Limited”)CONSOLIDATED BALANCE

SHEETS(In U.S. dollars in thousands, except share

and per share data)

|

|

|

|

|

|

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

194,227 |

|

|

$ |

70,482 |

|

|

Restricted cash |

|

298 |

|

|

|

- |

|

|

Accounts receivable, net |

|

81,170 |

|

|

|

98,034 |

|

|

Prepayment and other current assets |

|

31,179 |

|

|

|

15,329 |

|

|

Total current assets |

|

306,874 |

|

|

|

183,845 |

|

|

Property, plant and equipment, net |

|

85 |

|

|

|

160 |

|

|

Intangible assets, net |

|

20,255 |

|

|

|

20,297 |

|

|

Deferred tax assets |

|

41 |

|

|

|

103 |

|

|

Unamortized produced content, net |

|

- |

|

|

|

807 |

|

|

Right-of-use assets |

|

377 |

|

|

|

750 |

|

|

Prepayment and other non-current assets, net |

|

- |

|

|

|

1 |

|

|

Total non-current assets |

|

20,758 |

|

|

|

22,118 |

|

|

TOTAL ASSETS |

$ |

327,632 |

|

|

$ |

205,963 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Short-term bank loans |

$ |

4,216 |

|

|

$ |

4,421 |

|

|

Accounts payable |

|

9,599 |

|

|

|

6,405 |

|

|

Contract liabilities |

|

130 |

|

|

|

147 |

|

|

Accrued liabilities and other payables |

|

3,764 |

|

|

|

2,632 |

|

|

Other taxes payable |

|

28,178 |

|

|

|

19,090 |

|

|

Lease liabilities current |

|

330 |

|

|

|

208 |

|

|

Total current liabilities |

|

46,217 |

|

|

|

32,903 |

|

|

Long-term bank loan |

|

1,408 |

|

|

|

- |

|

|

Lease liabilities non-current |

|

- |

|

|

|

471 |

|

|

Warrant liability |

|

- |

|

|

|

86 |

|

|

Total non-current liabilities |

|

1,408 |

|

|

|

557 |

|

|

TOTAL LIABILITIES |

$ |

47,625 |

|

|

$ |

33,460 |

|

|

|

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Ordinary shares (par value of $0.001 per share;

200,000,000 shares authorized as of December 31, 2023 and 2022;

10,070,012 and 6,812,440 shares issued and outstanding as of

December 31, 2023 and 2022, respectively)* |

$ |

10 |

|

|

$ |

7 |

|

|

Additional paid-in capital |

|

106,215 |

|

|

|

27,009 |

|

|

Statutory reserve |

|

1,411 |

|

|

|

1,411 |

|

|

Retained earnings |

|

181,162 |

|

|

|

150,685 |

|

|

Accumulated other comprehensive loss |

|

(8,869 |

) |

|

|

(6,684 |

) |

|

TOTAL CHEER HOLDING, INC SHAREHOLDERS’ EQUITY |

|

279,929 |

|

|

|

172,428 |

|

|

Non-controlling interest |

|

78 |

|

|

|

75 |

|

|

TOTAL EQUITY |

|

280,007 |

|

|

|

172,503 |

|

|

TOTAL LIABILITIES AND EQUITY |

$ |

327,632 |

|

|

$ |

205,963 |

|

|

|

|

|

|

|

|

|

|

CHEER HOLDING,

INC.(Formerly known as “Glory Star New Media Group

Holdings Limited”)CONSOLIDATED STATEMENTS OF

INCOME ANDCOMPREHENSIVE INCOME(In

U.S. dollars in thousands, except share and per share

data)

|

|

|

|

|

|

|

|

For the Years Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

152,327 |

|

|

$ |

157,079 |

|

|

$ |

153,012 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

(39,549 |

) |

|

|

(40,580 |

) |

|

|

(34,944 |

) |

|

Selling and marketing |

|

|

(76,200 |

) |

|

|

(82,534 |

) |

|

|

(77,520 |

) |

|

General and administrative |

|

|

(5,658 |

) |

|

|

(5,908 |

) |

|

|

(3,341 |

) |

|

Research and development |

|

|

(1,635 |

) |

|

|

(1,331 |

) |

|

|

(920 |

) |

|

Total operating expenses |

|

|

(123,042 |

) |

|

|

(130,353 |

) |

|

|

(116,725 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations |

|

|

29,285 |

|

|

|

26,726 |

|

|

|

36,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net |

|

|

3 |

|

|

|

(93 |

) |

|

|

(513 |

) |

|

Change in fair value of warrant liability |

|

|

86 |

|

|

|

(62 |

) |

|

|

809 |

|

|

Other income (expense), net |

|

|

1,215 |

|

|

|

282 |

|

|

|

(255 |

) |

|

Total other income |

|

|

1,304 |

|

|

|

127 |

|

|

|

41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income tax |

|

|

30,589 |

|

|

|

26,853 |

|

|

|

36,328 |

|

|

Income tax expense |

|

|

(61 |

) |

|

|

(413 |

) |

|

|

(976 |

) |

|

Net income |

|

|

30,528 |

|

|

|

26,440 |

|

|

|

35,352 |

|

|

Less: net gain (loss) attributable to non-controlling

interest |

|

|

51 |

|

|

|

(450 |

) |

|

|

65 |

|

|

Net income attributable to Cheer Holding, Inc.’s

shareholders |

|

$ |

30,477 |

|

|

$ |

26,890 |

|

|

$ |

35,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign currency translation (loss)

gain |

|

|

(2,233 |

) |

|

|

(13,357 |

) |

|

|

2,945 |

|

|

Comprehensive income |

|

|

28,295 |

|

|

|

13,083 |

|

|

|

38,297 |

|

|

Less: comprehensive gain (loss) attributable to

non-controlling interests |

|

|

3 |

|

|

|

(478 |

) |

|

|

119 |

|

|

Comprehensive income attributable to Cheer Holding, Inc.’s

shareholders |

|

$ |

28,292 |

|

|

$ |

13,561 |

|

|

$ |

38,178 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and dilutive* |

|

$ |

3.53 |

|

|

$ |

3.95 |

|

|

$ |

5.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in calculating earnings per

ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and dilutive* |

|

|

8,637,504 |

|

|

|

6,812,387 |

|

|

|

6,538,118 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHEER HOLDING,

INC.(Formerly known as “Glory Star New Media Group

Holdings Limited”)CONSOLIDATED STATEMENTS OF CASH

FLOWS(In U.S. dollars in thousands)

|

|

|

|

|

|

|

|

For the Years Ended December 31, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2021 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

30,528 |

|

|

$ |

26,440 |

|

|

$ |

35,352 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision (reversal of provision) for doubtful

accounts |

|

|

2,096 |

|

|

|

440 |

|

|

|

(268 |

) |

|

Provision for unamortized produced content |

|

|

112 |

|

|

|

770 |

|

|

|

- |

|

|

Depreciation and amortization |

|

|

3,385 |

|

|

|

2,884 |

|

|

|

2,090 |

|

|

Amortization of right-of-use assets |

|

|

394 |

|

|

|

454 |

|

|

|

426 |

|

|

Deferred income tax expense (benefits) |

|

|

63 |

|

|

|

(53 |

) |

|

|

713 |

|

|

Share based compensation for employees |

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

Share based compensation for non-employees |

|

|

- |

|

|

|

391 |

|

|

|

181 |

|

|

Loss on disposal of property and equipment |

|

|

2 |

|

|

|

- |

|

|

|

- |

|

|

Gains on disposal of a subsidiary |

|

|

- |

|

|

|

- |

|

|

|

(26 |

) |

|

Amortization of loan origination fees |

|

|

16 |

|

|

|

76 |

|

|

|

104 |

|

|

Change in fair value of warrant liability |

|

|

(86 |

) |

|

|

62 |

|

|

|

(809 |

) |

|

Changes in assets and liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

15,205 |

|

|

|

(42,105 |

) |

|

|

19,904 |

|

|

Prepayment and other current assets |

|

|

(22,270 |

) |

|

|

16,872 |

|

|

|

(10,681 |

) |

|

Unamortized produced content |

|

|

682 |

|

|

|

170 |

|

|

|

(537 |

) |

|

Accounts payable |

|

|

3,325 |

|

|

|

(5,576 |

) |

|

|

4,750 |

|

|

Contract liabilities |

|

|

(14 |

) |

|

|

(356 |

) |

|

|

(87 |

) |

|

Accrued liabilities and other payables |

|

|

(370 |

) |

|

|

565 |

|

|

|

(9,236 |

) |

|

Other taxes payable |

|

|

9,477 |

|

|

|

7,346 |

|

|

|

4,964 |

|

|

Lease liabilities |

|

|

(371 |

) |

|

|

(641 |

) |

|

|

(389 |

) |

|

Net cash provided by operating activities |

|

|

42,174 |

|

|

|

7,739 |

|

|

|

46,455 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(3 |

) |

|

|

(25 |

) |

|

|

(72 |

) |

|

Prepayments for acquisition of intangible

assets |

|

|

- |

|

|

|

(7,964 |

) |

|

|

(2,718 |

) |

|

Cash disposed for sales of subsidiaries |

|

|

- |

|

|

|

- |

|

|

|

(12 |

) |

|

Return for short term investment |

|

|

- |

|

|

|

- |

|

|

|

1,751 |

|

|

Net cash used in investing activities |

|

|

(3 |

) |

|

|

(7,989 |

) |

|

|

(1,051 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from short-term bank loans |

|

|

4,660 |

|

|

|

6,096 |

|

|

|

5,114 |

|

|

Repayments of short-term bank loans |

|

|

(4,802 |

) |

|

|

(6,244 |

) |

|

|

(6,818 |

) |

|

Proceeds from long-term bank loans |

|

|

1,412 |

|

|

|

- |

|

|

|

- |

|

|

Payment of loan origination fees |

|

|

(58 |

) |

|

|

(87 |

) |

|

|

(68 |

) |

|

Contribution from shareholders |

|

|

(791 |

) |

|

|

743 |

|

|

|

- |

|

|

Borrowings from related parties |

|

|

1,600 |

|

|

|

- |

|

|

|

- |

|

|

Repayments to related parties |

|

|

- |

|

|

|

- |

|

|

|

(232 |

) |

|

Proceeds from issuance of ordinary shares in connection

with a private placement |

|

|

80,000 |

|

|

|

- |

|

|

|

15,290 |

|

|

Net cash provided by financing activities |

|

|

82,021 |

|

|

|

508 |

|

|

|

13,286 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes |

|

|

(149 |

) |

|

|

(7,078 |

) |

|

|

881 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash

equivalents |

|

|

124,043 |

|

|

|

(6,820 |

) |

|

|

59,571 |

|

|

Cash, cash equivalents and restricted cash, at beginning of

year |

|

|

70,482 |

|

|

|

77,302 |

|

|

|

17,731 |

|

|

Cash, cash equivalents and restricted cash, at end of

year |

|

$ |

194,525 |

|

|

$ |

70,482 |

|

|

$ |

77,302 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interests paid |

|

$ |

271 |

|

|

$ |

247 |

|

|

$ |

336 |

|

|

Income tax paid |

|

$ |

- |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONCASH INVESTING AND FINANCING ACTIVITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of intangible assets from

prepayments |

|

$ |

4,464 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECONCILIATION OF CASH, CASH EQUIVALENTS

AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEETS

|

|

|

|

|

|

|

|

|

|

|

December 31,2023 |

|

|

December 31,2022 |

|

|

Cash and cash equivalents |

|

$ |

194,227 |

|

|

$ |

70,482 |

|

|

Restricted cash |

|

|

298 |

|

|

|

- |

|

|

|

|

$ |

194,525 |

|

|

$ |

70,482 |

|

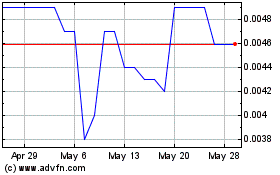

Cheer (NASDAQ:GSMGW)

Historical Stock Chart

From Apr 2024 to May 2024

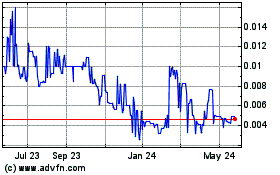

Cheer (NASDAQ:GSMGW)

Historical Stock Chart

From May 2023 to May 2024