UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 4)*

Hollysys Automation Technologies Ltd.

(Name of Issuer)

Ordinary Shares, par value $0.001 per share

(Title of Class of Securities)

G45667105

(CUSIP Number)

|

Mengyun Tang

c/o Advanced Technology (Cayman) Limited

Suite 3501, 35/F, Jardine House

1 Connaught Place, Central

Hong Kong, China

+852-2165-9000 |

With Copies To:

| |

Marcia Ellis

Rongjing Zhao

Morrison & Foerster LLP

Edinburgh Tower, 33/F

The Landmark, 15 Queen’s Road Central

Hong Kong, China

+852-2585-0888

|

Spencer Klein

Mitchell Presser

John Owen

Morrison & Foerster LLP

250 West 55th Street

New York, NY 10019-9601

+1-212-468-8000

|

February 5, 2024

(Date of Event Which Requires Filing of this

Statement)

If the filing person has previously filed

a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Liang Meng |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

¨ |

| 6 |

|

Citizenship or Place of Organization

Hong Kong Special Administrative Region of People’s Republic

of China |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

IN |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III GP, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Ascendent Capital Partners III, L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7% |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Skyline Automation Technologies L.P. |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

AF |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

British Virgin Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7% |

| 14 |

|

Type of Reporting Person

PN |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

CUSIP No. G45667105

| |

|

|

|

|

|

|

| 1 |

|

Name of Reporting Persons

Advanced Technology (Cayman) Limited |

| 2 |

|

Check the Appropriate Box if a Member of a Group

(a) ¨

(b) ¨ |

| 3 |

|

SEC Use Only |

| 4 |

|

Source of Funds

WC |

| 5 |

|

Check Box if Disclosure of Legal Proceedings Is Required Pursuant to

Item 2(d) or 2(e)

☐ |

| 6 |

|

Citizenship or Place of Organization

Cayman Islands |

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With |

|

7 |

|

Sole Voting Power

0 |

| |

8 |

|

Shared Voting Power

8,491,875 |

| |

9 |

|

Sole Dispositive Power

0 |

| |

10 |

|

Shared Dispositive Power

8,491,875 |

| 11 |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

8,491,875 |

| 12 |

|

Check Box if the Aggregate Amount in Row (11) Excludes Certain Shares

¨ |

| 13 |

|

Percent of Class Represented by Amount in Row (11)

13.7%* |

| 14 |

|

Type of Reporting Person

CO |

| |

|

| * |

Based on 62,095,839 Ordinary Shares outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s Form 6-K filed with the Securities and Exchange Commission on January 5, 2024. |

| |

|

|

|

|

|

|

|

EXPLANATORY NOTE

This Amendment No. 4 (this “Schedule 13D Amendment”)

to the Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on November 6, 2023 (the “Original

Schedule 13D” and, as amended by Amendment No. 1 filed with the SEC on November 24, 2023, Amendment No. 2 filed

with the SEC on December 13, 2023, Amendment No. 3 filed with the SEC on January 2, 2024 and this Schedule 13D Amendment,

the “Schedule 13D”) is being filed by Mr. Liang Meng, Ascendent Capital Partners III GP Limited (“GPGP”),

Ascendent Capital Partners III GP, L.P. (“GPLP”), Ascendent Capital Partners III, L.P. (“ACP III”),

Skyline Automation Technologies L.P. (“Superior Fund”) and Advanced Technology (Cayman) Limited (“Advanced

Technology” and, together with Mr. Meng, GPGP, GPLP, ACP III and Superior Fund, the “Reporting Persons”),

with respect to Ordinary Shares, $0.001 par value per share (the “Ordinary Shares”), of Hollysys Automation Technologies

Ltd., a company organized under the laws of the British Virgin Islands (the “Issuer”).

The Reporting Persons are filing this Schedule 13D Amendment in connection

with the issuance of a letter to the shareholders of the Issuer on February 5, 2024 (the “Letter”), as described

in Item 4 of this Schedule 13D Amendment.

Other than as set forth below, all Items in the Original Schedule 13D

are materially unchanged. Capitalized terms used in this Schedule 13D Amendment which are not defined herein have the meanings given to

them in the Original Schedule 13D.

| Item 4. |

Purpose of Transaction. |

Item 4 of the Schedule 13D is hereby amended and supplemented to include

the following:

On February 5, 2024, Ascendent Capital Partners, an affiliate

of the Reporting Persons, issued the Letter, in which Ascendent Capital Partners discusses the voting recommendations with respect to the Merger, the Merger Agreement and the

related transactions.

The foregoing description of the Letter is a summary only and is qualified

in its entirety by reference to the Letter attached hereto as Exhibit 99.13, which is incorporated herein by reference.

| Item 5. |

Interest in Securities of the Issuer.. |

Item 5(a)-(b) of the Schedule 13D is hereby amended and restated

as follows:

| (a)-(b) |

The information on Items 7 to 11 and 13 on the cover pages of

this Schedule 13D Amendment is incorporated by reference herein. The percentage set forth in row 13 is based on 62,095,839 Ordinary Shares

outstanding as of December 28, 2023, as provided in the Issuer’s Proxy Statement filed as an exhibit to the Issuer’s

Form 6-K filed with the SEC on January 5, 2024.

As a result of the relationships described in Item 2, each of the Reporting

Persons may be deemed to share beneficial ownership of and the power to vote or direct the vote of and to dispose or direct the disposition

of the securities reported herein.

|

| Item 7. |

Material to be Filed as Exhibits. |

| |

|

Item

7 of the Schedule 13D is hereby amended and supplemented to include the following:

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete and correct.

Dated: February 5, 2024

| |

Liang Meng |

| |

|

|

| |

/s/ Liang Meng |

| |

|

|

| |

Ascendent Capital Partners III GP Limited |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III GP, L.P. |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Ascendent Capital Partners III, L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Skyline Automation Technologies L.P. |

| |

By: Ascendent Capital Partners III GP, L.P., its General Partner |

| |

By: Ascendent Capital Partners III GP Limited, its General Partner |

| |

|

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

| |

|

| |

Advanced Technology (Cayman) Limited |

| |

|

| |

By: |

/s/ Liang Meng |

| |

Name: |

Liang Meng |

| |

Title: |

Director |

Exhibit 99.13

Vote for Certainty and Secure Compelling Value

Dear Fellow Shareholders,

This week is the vote to approve the $26.50 per share all cash offer

for Hollysys Automation Technologies Ltd. (“Hollysys” or the “Company”). We are pleased that many

of you have voted in support of the Ascendent Capital Partners (“Ascendent”) transaction, recognizing that our offer

is the best and most certain route to secure compelling value for shareholders. Ascendent is committed to closing this deal expeditiously.

Our Reputation and Track Record

Ascendent was founded in 2011 and is led by a team of highly experienced

private equity investment professionals, who previously held leadership positions at JPMorgan and D. E. Shaw. We are an independent investment

firm with a deep institutional background, managing assets for some of the largest global institutional investors, including sovereign

wealth funds, corporate and state pensions, and international insurance companies. We have a long track record of success in privatizing

publicly listed companies and honoring our commitments to the target companies and their shareholders.

Our Transparent Process

Ascendent has been consistent and transparent in our engagement with

the Company and shareholders. We believe in facts and principles, and refrain from speculations, rumors, or unfounded allegations.

Our $26.50 per share all cash offer was agreed after a thorough, extensive

and robust negotiation process with the Special Committee. The Company’s board of directors (the “Board”) unanimously

determined that our proposal is the only viable offer, because of price, clarity, certainty of financing, and the collective reputation

and experience of Ascendent and our equity partners, such as Sinopec.

Our Corporate Governance Focus

We are strong advocates for best-in-class corporate governance in all

of our portfolio companies. Given our previous experience with the Company in 2021, and currently as the single largest shareholder, we

had concerns about the Company’s historical track record of corporate governance. This was reflected in the Schedule 13D we filed

on November 6, 2023, where we showed our support for the shareholder meeting requested by more than 30% of the shareholder base to

change the Board’s composition.

However, after we engaged with the Special Committee in its recent

sale process, its independence, professionalism and focus on shareholder value were apparent. The quality, reputation and background of

the Special Committee members underpinned our confidence in the integrity and transparency of the sale process. After an extensive, thorough,

and robust negotiation process, the Board unanimously concluded that our proposal maximizes shareholder value above all others.

Our Concerns about Unfounded Claims and Press Rumors

As a significant shareholder, we are concerned that various claims

and rumors have escalated to the point of causing confusion among shareholders. The increasingly desperate allegations by other parties

serve only to create uncertainty and mislead shareholders, distracting them from the concrete offer recommended by the Board that provides

clarity, cash, and the most certain path to closing a sale.

Vote for Certainty and Secure Compelling Value

Fellow shareholders, as we approach the extraordinary general meeting

on February 8th, in an environment of weakening market conditions and geopolitical uncertainty, let’s focus on the

clear benefits of the Ascendent offer: all cash offer from reputable and seasoned investors, significant price premium, and highest certainty

to close. We urge you to cast your vote now in support of securing this compelling value.

***

About Ascendent Capital Partners

Ascendent Capital Partners, headquartered in Hong Kong, is a private

equity investment management firm managing assets for global institutional investors, including sovereign wealth funds, endowments, pensions

and foundations. For additional information about Ascendent, please visit Ascendent's website at www.ascendentcp.com.

Contact Information

Ascendent Contact:

Ascendent Capital Partners - Derek

Cheung

Suite 3501, 35/F, Jardine House, 1 Connaught Place, Central,

Hong Kong

Email: derek@ascendentcp.com

Tel: +852 2165 9000

Media Contact:

FGS Global – Ben Richardson

Email: ben.richardson@fgsglobal.com

Tel: +852 6011 6658

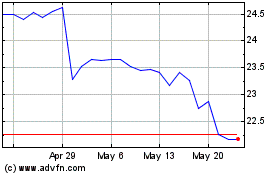

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Hollysys Automation Tech... (NASDAQ:HOLI)

Historical Stock Chart

From Dec 2023 to Dec 2024