UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For

the month of August 2024

Commission

File Number: 001-41444

Intelligent

Living Application Group Inc.

Unit

2, 5/F, Block A, Profit Industrial Building

1-15

Kwai Fung Crescent, Kwai Chung

New

Territories, Hong Kong

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

| |

Intelligent Living Application Group Inc.

|

| |

|

| Date: August 28, 2024 |

By: |

/s/

Bong Lau |

| |

Name: |

Bong Lau |

| |

Title: |

Chief Executive Officer |

Exhibit

Index

Exhibit

99.1

Intelligent

Living Application Group Inc.

August

28, 2024

Dear

Stockholder:

You

are cordially invited to attend the 2024 Extraordinary General Meeting (the “Extraordinary Meeting”) of Stockholders of Intelligent

Living Application Group Inc. (the “Company”) to be held at Unit 2, 5/F, Block A, Profit Industrial Building, 1-15 Kwai Fung

Crescent, Kwai Chung, New Territories, Hong Kong, on September 23, 2024, at 10:00 a.m. local time.

Information

regarding each of the matters to be voted on at the Extraordinary Meeting is contained in the attached Proxy Statement and Notice of

Extraordinary General Meeting of Stockholders. We urge you to read the proxy statement carefully.

The

notice and proxy card are expected to be mailed to all stockholders of record on or about August 31, 2024.

Because

it is important that your shares be voted at the Extraordinary Meeting, we urge you to complete, date and sign the enclosed proxy card

and return it as promptly as possible in the accompanying envelope, whether or not you plan to attend in person. Even after returning

your proxy, if you are a stockholder of record and do attend the meeting and wish to vote your shares in person, you still may do so.

Sincerely,

| |

/s/

Bong Lau |

| |

Bong Lau |

| |

Chairman of the Board of Directors and Chief Executive

Officer |

Intelligent

Living Application Group Inc.

NOTICE

OF Extraordinary GENERAL MEETING OF STOCKHOLDERS

To Be Held September 23, 2024

TO

THE STOCKHOLDERS OF Intelligent Living Application Group Inc.:

NOTICE

HEREBY IS GIVEN that the 2024 Extraordinary General Meeting of Stockholders (the “Extraordinary Meeting”) of Intelligent

Living Application Group Inc. (the “Company”) will be held at Unit 2, 5/F, Block A, Profit Industrial Building, 1-15 Kwai

Fung Crescent, Kwai Chung, New Territories, Hong Kong, on September 23, 2024, at 10:00 a.m. local time, to consider and act upon the

following:

ORDINARY

RESOLUTION

| |

(A) |

a share consolidation of

the Company’s issued and unissued ordinary shares (the “Ordinary Shares”) be approved at a ratio of not

less than one (1)-for-two (2) and not more than one (1)-for-five (5) (the “Range”), with the exact ratio to be

set at a whole number within this Range to be determined by the Board of the Directors of the Company (the “Board”)

in its sole discretion within 90 calendar days after the date of passing of these resolutions (the “Share Consolidation”);

and |

| |

(B) |

in respect of any all fractional

entitlements to the issued consolidated shares resulting from the Share Consolidation, if so determined by the Board in its sole

discretion, the directors be and are hereby authorized to settle as they consider expedient any difficulty which arises in relation

to the Share Consolidation, including but without prejudice to the generality of the foregoing capitalizing all or any part of any

amount for the time being standing to the credit of any reserve or fund of the Company (including its share premium account and profit

and loss account) whether or not the same is available for distribution and applying such sum in paying up unissued Ordinary Shares

to be issued to shareholders of the Company to round up any fractions of Ordinary Shares issued to or registered in the name of such

shareholders of the Company following or as a result of the Share Consolidation. |

The

Board reserves its right to determine not to proceed with, and abandon, the Share Consolidation contemplated above if it determines in

its sole discretion that implementing the Share Consolidation is not in the best interests of the Company and its Shareholders. As such,

if the Board did not determine a ratio within such 90-day period, the Share Consolidation would not proceed and will be abandoned.

The

foregoing items of business are more fully described in the proxy statement that can be find on the website listed in this Notice. We

are not aware of any other business to come before the Extraordinary Meeting.

The

Board of Directors of the Company fixed 5:00 p.m., New York time on Augusg 23, 2024 as the record date (the “Record Date”)

for determining the shareholders entitled to receive notice of and to vote at the Extraordinary Meeting or any adjourned or postponement

thereof.

It

is important that your shares are represented at the Extraordinary Meeting. We urge you to review the Proxy Statement and, whether or

not you plan to attend the Extraordinary Meeting in person, please vote your shares promptly by casting your vote via the internet or,

if you prefer to mail your proxy or voter instructions, please complete, sign, date, and return your proxy or vote instruction form in

the pre-addressed envelope provided, which requires no additional postage if mailed in the United States. You may revoke your vote by

submitting a subsequent vote over the internet or by mail before the Extraordinary Meeting, or by voting in person at the Extraordinary

Meeting.

If

you plan to attend the Extraordinary Meeting, please notify us of your intentions. This will assist us with meeting preparations. If

your shares are not registered in your own name and you would like to attend the Extraordinary Meeting, please follow the instructions

contained in the proxy materials that are being mailed to you and any other information forwarded to you by your broker, trust, bank,

or other holder of record to obtain a valid proxy from it. This will enable you to gain admission to the Extraordinary Meeting and vote

in person.

By

Order of the Board of Directors

| |

/s/

Bong Lau |

| |

Bong Lau |

| |

Chairman of the Board of

Directors and Chief Executive Officer |

Hong

Kong

August 28, 2024

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE Extraordinary Meeting of Members

TO BE HELD ON September 23, 2024

This

Notice and Proxy Statement are also available online at https://ts.vstocktransfer.com/irhlogin/I-INTELLIGENTLIVING and

the proxy material are available under the “Documents & Forms” tab.

TABLE

OF CONTENTS

| |

Page |

| |

|

| GENERAL INFORMATION |

1 |

| Purpose of Extraordinary

Meeting |

1 |

| Will there be any other

items of business on the agenda? |

1 |

| Who is entitled to vote

at the Extraordinary Meeting? |

1 |

| What constitutes a quorum

and how will votes be counted? |

2 |

| Votes Required |

2 |

| How do I vote? |

2 |

| Revoking Your Proxy |

3 |

| Proxy Solicitation Costs |

3 |

| PROPOSAL NO. 1(A) SHARE CONSOLIDATION |

3 |

| Purpose of Share Consolidation |

3 |

| Effects of the Share Consolidation |

4 |

| Procedure for Implementing

the Share Consolidation |

4 |

| Vote Required For Proposal

No. 1(A) |

5 |

| Recommendation of the Board

for Proposal No. 1(A) |

5 |

| PROPOSAL NO. 1(B) FRACTIONAL SHARES ARRANGEMENT |

5 |

| Vote Required For Proposal

No. 1(B) |

5 |

| Recommendation of the Board

for Proposal No. 1(B) |

5 |

| OTHER MATTERS |

5 |

Intelligent

Living Application Group Inc.

Unit

2, 5/F, Block A, Profit Industrial Building, 1-15 Kwai Fung Crescent, Kwai Chung, New Territories, Hong Kong

PROXY

STATEMENT

This

Proxy Statement and the accompanying proxy are being furnished with respect to the solicitation of proxies by the Board of Directors

(the “Board”) of Intelligent Living Application Group Inc., a Cayman Islands exempted company with limited liability (the

“Company,” “we,” “us” or “our”), for the Extraordinary General Meeting of Members (the

“Extraordinary Meeting”). The Extraordinary Meeting is to be held at 10:00 a.m., local time, on September 23, 2024, and at

any adjournment or adjournments thereof, at Unit 2, 5/F, Block A, Profit Industrial Building, 1-15 Kwai Fung Crescent, Kwai Chung, New

Territories, Hong Kong

We

will send or make these proxy materials available to shareholders on or about August 31, 2024.

GENERAL

INFORMATION

Purpose

of the Extraordinary Meeting

The

purposes of the Extraordinary Meeting are to seek shareholders’ approval of the following resolutions:

ORDINARY

RESOLUTION

| |

(A) |

a share consolidation of

the Company’s issued and unissued ordinary shares (the “Ordinary Shares”) be approved at a ratio of not

less than one (1)-for-two (2) and not more than one (1)-for-five (5) (the “Range”), with the exact ratio to be

set at a whole number within this Range to be determined by the Board of the Directors of the Company (the “Board”)

in its sole discretion within 90 calendar days after the date of passing of these resolutions (the “Share Consolidation”);

and |

| |

(B) |

in respect of any all fractional

entitlements to the issued consolidated shares resulting from the Share Consolidation, if so determined by the Board in its sole

discretion, the directors be and are hereby authorized to settle as they consider expedient any difficulty which arises in relation

to the Share Consolidation, including but without prejudice to the generality of the foregoing capitalizing all or any part of any

amount for the time being standing to the credit of any reserve or fund of the Company (including its share premium account and profit

and loss account) whether or not the same is available for distribution and applying such sum in paying up unissued Ordinary Shares

to be issued to shareholders of the Company to round up any fractions of Ordinary Shares issued to or registered in the name of such

shareholders of the Company following or as a result of the Share Consolidation. |

The

Board reserves its right to determine not to proceed with, and abandon, the Share Consolidation contemplated above if it determines in

its sole discretion that implementing the Share Consolidation is not in the best interests of the Company and its Shareholders. As such,

if the Board did not determine a ratio within such 90-day period, the Share Consolidation would not proceed and will be abandoned.

The

Board recommends a vote FOR the resolutions.

Will

there be any other items of business on the agenda?

The

Board is not aware of any other matters that will be presented for consideration at the Extraordinary Meeting. Nonetheless, in case there

is an unforeseen need, the accompanying proxy gives discretionary authority to the persons named on the proxy with respect to any other

matters that might be brought before the Extraordinary Meeting or at any postponement or adjournment of the Extraordinary Meeting. Those

persons intend to vote that proxy in accordance with their judgment.

Who

is entitled to vote at the Extraordinary Meeting?

Only

shareholders of record of our Ordinary Shares of a par value of US$0.0001 each, as of 5:00 p.m., New York time on August 23, 2024 (the

“Record Date”) are entitled to notice and to vote at the Extraordinary Meeting and any adjournment or postponement

thereof. On the Record Date, no preferred shares were issued and outstanding.

Each

fully paid ordinary share is entitled to one vote on each matter properly brought before the Extraordinary Meeting. The enclosed proxy

card or voting instruction card shows the number of shares you are entitled to vote at the Extraordinary Meeting.

Shareholder

of Record: Shares Registered in Your Name

If

on the Record Date your shares were registered directly in your name with the Company, then you are a shareholder of record. As a shareholder

of record, you may vote in person at the Extraordinary Meeting or vote by proxy. Whether or not you plan to attend the Extraordinary

Meeting, to ensure your vote is counted, we encourage you to vote either by Internet or by filling out and returning the enclosed proxy

card.

Beneficial

Owner: Shares Registered in the Name of a Broker or Bank

If

on the Record Date your shares were held in an account at a brokerage firm, bank, dealer, or other similar organization, then you are

the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization.

The organization holding your account is considered the shareholder of record for purposes of voting at the Extraordinary Meeting. As

the beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. Your broker

will not be able to vote your shares unless your broker receives specific voting instructions from you. We strongly encourage you to

vote.

What

constitutes a quorum and how will votes be counted?

The

Extraordinary Meeting will be held if at least two shareholders entitled to vote and representing not less than one-third (1/3) of the

votes attached to all the voting shares of the Company then in issue are present, either in person or by proxy. Abstentions will be counted

as entitled to vote for purposes of determining a quorum. Broker non-votes and abstentions will not be taken into account in determining

the outcome of the proposal. In the event that there are not sufficient votes for a quorum, the Extraordinary Meeting may be adjourned

or postponed in order to permit the further solicitation of proxies.

Votes

Required

How

many votes are required to approve a proposal?

Assuming

a quorum as referenced above is reached:

Proposals 1(A) and 1(B) will be approved if passed by a simple majority of the votes cast by the shareholders entitled to vote at the

Extraordinary Meeting, in person or by proxy.

Only

shares that are voted are taken into account in determining the proportion of votes cast for the proposals. Any shares not voted (whether

by abstention, broker non-vote or otherwise) will not impact any of the votes.

How

do I vote?

Your

shares may only be voted at the Extraordinary Meeting if you are entitled to vote and present in person or are represented by proxy.

Whether or not you plan to attend the Extraordinary Meeting, we encourage you to vote by proxy to ensure that your shares will be represented.

You

may vote using any of the following methods:

| |

● |

By Internet. You

may vote by using the Internet in accordance with the instructions included in the proxy card. The Internet voting procedures are

designed to authenticate shareholders’ identities, to allow shareholders to vote their shares and to confirm that their instructions

have been properly recorded. |

| |

● |

By Mail. Shareholders

of record as of the Record Date may submit proxies by completing, signing and dating their proxy cards and mailing them in the accompanying

pre-addressed envelopes. If you return your signed proxy but do not indicate your voting preferences, your shares will be voted on

your behalf “FOR” each of the Proposals. Shareholders who hold shares beneficially in street name may provide voting

instructions by mail by completing, signing and dating the voting instruction forms provided by their brokers, banks or other nominees

and mailing them in the accompanying pre-addressed envelopes. |

| |

● |

By Fax. You may

vote by proxy by marking the enclosed proxy card, dating and signing it, and faxing it according to the fax number provided on the

enclosed proxy. |

| |

● |

In person at the Extraordinary

Meeting. Shares held in your name as the shareholder of record may be voted in person at the Extraordinary Meeting or at any

postponement or adjournment of the Extraordinary Meeting. Shares held beneficially in street name may be voted in person only if

you obtain a legal proxy from the broker, bank or nominee that holds your shares giving you the right to vote the shares. Even

if you plan to attend the Extraordinary Meeting, we recommend that you also submit your proxy or voting instructions by mail or Internet

so that your vote will be counted if you later decide not to attend the Extraordinary Meeting. |

Revoking

Your Proxy

Even

if you execute a proxy, you retain the right to revoke it and to change your vote by notifying us at any time but no later than two hours

before the commencement of the meeting or adjourned meeting, at which the proxy is voted. Mere attendance at the meeting will not revoke

a proxy. Such revocation may be effected by following the instructions for voting on your proxy card or vote instruction form. Unless

so revoked, the shares represented by proxies, if received in time, will be voted in accordance with the directions given therein. However,

if you are shareholder of record, delivery of a proxy would not preclude you from attending and voting in person at the meeting convened

and in such event, the instrument appointing a proxy shall be deemed to be revoked.

If

the Extraordinary Meeting is postponed or adjourned for any reason, at any subsequent reconvening of the Extraordinary Meeting, all proxies

will be voted in the same manner as the proxies would have been voted at the original convening of the Extraordinary Meeting (except

for any proxies that have at that time effectively been revoked or withdrawn), even if the proxies had been effectively voted on the

same or any other matter at a previous Extraordinary Meeting that was postponed or adjourned.

Proxy

Solicitation Costs

We

will bear the entire cost of this solicitation of proxies, including the preparation, assembly, printing, and mailing of the proxy materials

that we may provide to our shareholders. Copies of solicitation material will be provided to brokerage firms, fiduciaries and custodians

holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial

owners. We may solicit proxies by mail, and the officers and employees of the Company, who will receive no extra compensation therefore,

may solicit proxies personally or by telephone. The Company will reimburse brokerage houses and other nominees for their expenses incurred

in sending proxies and proxy materials to the beneficial owners of shares held by them.

PROPOSAL

NO. 1(A) – IN RESPECT OF SHARE CONSOLIDATION

Purpose

of Share Consolidation

The

Company’s ordinary shares are listed on The Nasdaq Capital Market under the trading symbol of “ILAG.” In order for

the ordinary shares to continue to be listed on The Nasdaq Capital Market, the Company must satisfy various listing standards established

by Nasdaq. Among others, Nasdaq Listing Rule 5550(a)(2) requires that listed shares maintain a minimum bid price of $1.00 per share (the

“Bid Price Rule”). On October 19, 2023, the Company received a letter from Nasdaq indicating that it is no longer in compliance

with the Bid Price Rule. The Company was provided 180 calendar days, or until April 16, 2024, to regain compliance. The listed security

of the Company did not regain compliance with the minimum $1 bid price per share requirement by April 16, 2024. However, Nasdaq Staff

has on April 17, 2024 determined that the Company is eligible for an additional 180 calendar day period, or until October 14, 2024, to

regain compliance. If at any time during this additional time period the closing bid price of the Company’s ordinary shares is

at least $1 per share for a minimum of 10 consecutive business days, Nasdaq will provide written confirmation of compliance and this

matter will be closed. If compliance cannot be demonstrated by October 14, 2024, Staff will provide written notification that the Company’s

securities will be delisted. At that time, the Company may appeal the Staff’s determination to a Hearings Panel of NASDAQ.

In

order to retain the compliance with the Bid Price Rule under NASDAQ Listing Rule, the closing bid price of the Company’s ordinary

shares should be at least $1.00 for a minimum of ten consecutive business days. As of the date of this proxy statement, the Company has

not yet regained the compliance with the Bid Price Rule.

The

Board believes that the delisting of the ordinary shares from The Nasdaq Capital Market would likely result in decreased liquidity. Such

decreased liquidity would result in the increase in the volatility of the trading price of the ordinary shares, a loss of current or

future coverage by certain analysts and a diminution of institutional investor interest. In addition, the Board believes that such delisting

could also cause a loss of confidence of corporate partners, customers and employees, which could harm the Company’s business and

future prospects.

To

enhance the Company’s ability to regain the compliance of the Bid Price Rule, the Board believes that it is in the best interest

of the Company and its stockholders to effectuate a Share Consolidation to increase the market price of the ordinary shares. As a result,

the Board is soliciting stockholders’ approval and authorization to the Board for a share consolidation of the issued and authorized

ordinary shares of the Company at a ratio a ratio between one (1)-for-two (2) and one (1)-for-five (5), accompanied by a corresponding

increase in the par value of the Company’s ordinary shares, to regain the compliance with Nasdaq.

In

evaluating whether or not to conduct the share consolidation, the Board also took into account various negative factors associated with

such corporate action. These factors include: the negative perception of share consolidation held by some investors, analysts and other

stock market participants; the fact that the share prices of some companies that have effected of share consolidation have subsequently

declined back to pre-consolidation levels; the adverse effect on liquidity that might be caused by a reduced number of shares outstanding;

and the costs associated with implementing a share consolidation.

The

Board considered these factors, and the potential harm of being delisted from The Nasdaq Capital Market. The Board determined that continued

listing on The Nasdaq Capital Market is in the best interest of the Company and its stockholders, and that the Share Consolidation is

probably necessary to maintain the listing of the Company’s ordinary shares on The Nasdaq Capital Market.

In

addition, there can be no assurance that, after the Share Consolidation, the Company would be able to maintain the listing of the Ordinary

Shares on The Nasdaq Capital Market. The Nasdaq Capital Market maintains several other continued listing requirements currently applicable

to the listing of the Ordinary Shares. Stockholders should recognize that if the Share Consolidation is effected, they will own a smaller

number of Ordinary Shares than they currently own. While the Company expects that the Share Consolidation will result in an increase

in the market price of the Ordinary Shares, it may not increase the market price of the Ordinary Shares in proportion to the reduction

in the number of Ordinary Shares outstanding or result in a permanent increase in the market price (which depends on many factors, including

our performance, prospects and other factors that may be unrelated to the number of shares outstanding).

If

the Share Consolidation is effected and the market price of the Company’s ordinary shares declines, the percentage decline as an

absolute number and as a percentage of the Company’s overall market capitalization may be greater than would occur in the absence

of the Share Consolidation. Furthermore, the liquidity of the Company’s ordinary shares could be adversely affected by the reduced

number of shares that would be outstanding after the Share Consolidation. Accordingly, the Share Consolidation may not achieve the desired

results that have been outlined above.

Fractional

Shares

No

fractional shares shall be issued upon the Share Consolidation. Upon approval of Proposal No. 1(A) and 1(B), the directors will be authorised

to settle as they consider expedient any difficulty which arises in relation to such fraction shares, including but not limited to rounding

up any fractions of Ordinary Shares for issuing to such shareholders of the Company who are entitled to fractional shares following or

as a result of the Share Consolidation.

Effects

of the Share Consolidation

Authorized

Shares and Unissued Shares

At

the time the Share Consolidation is effective, our authorized Ordinary Shares, will be consolidated at the ratio between one (1)-for-two

(2) and one (1)-for-five (5), accompanied by a corresponding increase in the par value of the Ordinary Shares, with the exact ratio to

be set at a whole number within this range, to be determined by the Board.

Issued

and Outstanding Shares

The

Share Consolidation will also reduce the number of issued and outstanding Ordinary Shares at the ratio between one (1)-for-two (2) and

one (1)-for-five (5), accompanied by a corresponding increase in the par value of the Ordinary Shares, with the exact ratio to be set

at a whole number within this range, to be determined by the Board.

Each

shareholder’s proportionate ownership of the issued and outstanding Ordinary Shares immediately following the effectiveness of

the Share Consolidation would remain the same, with the exception of adjustments related to the treatment of fractional shares (see above).

Proportionate

adjustments will be made based on the ratio of the Share Consolidation to the per share exercise price and the number of shares issuable

upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to

purchase, exchange for, or convert into, our ordinary shares. This will result in approximately the same aggregate price being required

to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of ordinary

shares being delivered upon such exercise, exchange or conversion, immediately following the Share Consolidation as was the case immediately

preceding the Share Consolidation.

There

are no preferred shares currently issued and outstanding.

Procedure

for Implementing the Share Consolidation

As

soon as practicable after the effective date of the Share Consolidation, the Company’s shareholders will be notified that the Share

Consolidation has been effected through filing with SEC by the Company. The Company expects that its transfer agent, VStock Transfer,

LLC, will act as exchange agent for purposes of implementing the exchange of share certificates. If needed, holders of pre-consolidation

shares will be asked to surrender to the exchange agent certificates representing pre-consolidation Ordinary Shares in exchange for certificates

representing post-consolidation Ordinary Shares or, in the case of holders of non-certificated shares, such proof of ownership as required

by the exchange agent, in accordance with the procedures to be set forth in a letter of transmittal that the Company will send to its

registered shareholders. No new share certificates will be issued to a shareholder until such shareholder has surrendered such shareholder’s

outstanding share certificate(s) together with the properly completed and executed letter of transmittal to the exchange agent.

SHAREHOLDERS

SHOULD NOT DESTROY ANY SHARE CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Banks,

brokers or other nominees will be instructed to effect the Share Consolidation for their beneficial holders holding shares in “street

name.” However, these banks, brokers or other nominees may have different procedures from those that apply to registered shareholders

for processing the Share Consolidation. If a shareholder holds shares with a bank, broker or other nominee and has any questions in this

regard, shareholders are encouraged to contact their bank, broker or other nominee.

Vote

Required

Assuming

that a quorum is present, the affirmative vote of a simple majority of the votes cast by the shareholders entitled to vote at the Extraordinary

Meeting, in person or by proxy, is required to approve Proposal 1(A).

Recommendation

of the Board

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL No. 1(A).

PROPOSAL

NO. 1(B) – IN RESPECT OF FRACTIONAL SHARES

On

August 22, 2024, the Board approved, and directed that there be submitted to the shareholders of the Company for approval, that immediately

following the approval of the Share Consolidation proposal, the directors be and are hereby authorised to settle as they consider expedient

any difficulty which arises in relation to the Share Consolidation, including but without prejudice to the generality of the foregoing

capitalising all or any part of any amount for the time being standing to the credit of any reserve or fund of the Company (including

its share premium account and profit and loss account) whether or not the same is available for distribution and applying such sum in

paying up unissued Ordinary Shares to be issued to shareholders of the Company to round up any fractions of Ordinary Shares issued to

or registered in the name of such shareholders of the Company following or as a result of the Share Consolidation (the “Fractional

Shares Arrangement”).

If

the Share Consolidation proposal is not approved, then this Fractional Shares Arrangement will not be applicable.

Vote

Required

Assuming

that a quorum is present, the affirmative vote of a simple majority of the votes cast by the shareholders entitled to vote at the Extraordinary

Meeting, in person or by proxy, is required to approve Proposal No. 1(B).

Recommendation

of the Board

THE

BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF PROPOSAL No. 1(B).

OTHER

MATTERS

Our

Board is not aware of any business to come before the Extraordinary Meeting other than those matters described above in this Proxy Statement.

However, if any other matters should properly come before the Extraordinary Meeting, it is intended that proxies in the accompanying

form will be voted in accordance with the judgment of the person or persons voting the proxies.

Transfer

Agent and Registrar

The

transfer agent and registrar for our ordinary shares is VStock Transfer, LLC. Its address is 18 Lafayette Place, Woodmere, New York 11598,

and its telephone number is +1(212)828-8436.

Where

You Can Find More Information

We

file annual report and other documents with the SEC under the Exchange Act. Our SEC filings made electronically through the SEC’s

EDGAR system are available to the public at the SEC’s website at http://www.sec.gov. You may also read and copy any document we

file with the SEC at the SEC’s public reference room located at 100 F Street, NE, Room 1580, Washington, DC 20549. Please call

the SEC at (800) SEC-0330 for further information on the operation of the public reference room.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| August 28, 2024 |

/s/

Bong Lau |

| |

Bong Lau |

| |

Chairman of the Board and Chief Executive Officer |

Exhibit 99.2

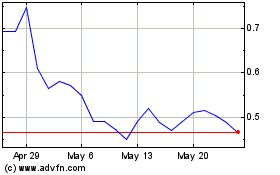

Intelligent Living Appli... (NASDAQ:ILAG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Intelligent Living Appli... (NASDAQ:ILAG)

Historical Stock Chart

From Feb 2024 to Feb 2025