UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material Pursuant to §240.14a-12 |

| INHIBRX, INC. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

ADDITIONAL EMPLOYEE FAQs

February 6, 2024

References to the “Original FAQs”

mean the Q&A made available here

on January 23, 2024. Defined terms that are used but not defined in this Additional Employee FAQ are defined in the Original FAQs.

Q1: Why are employees still in a blackout?

A1: Inhibrx, Inc. (the “Company”

or “Inhibrx”) is undergoing a significant corporate event. Please remember that the blackout period is for the safety

of the Company and the employees, to protect against the possibility of insider trading and to prevent any appearance of impropriety or

unfair advantage that may damage the Company’s reputation.

Q2: When will the Company-wide blackout

be lifted?

A2: Our expectation is to lift the blackout

a few days after both the Proxy for the Transaction and the 10-K for the Company’s 2023 fiscal year are on file (which filings are

expected to precede the Closing). Employees will be notified when the blackout is lifted.

Q3: Will my Inhibrx stock options outstanding

at the Closing convert into equity (e.g., shares or stock options) in New Inhibrx?

A3: No, Inhibrx stock options will not convert

into New Inhibrx equity or equity awards.

Q4: Why won’t my Inhibrx stock options

convert into options in New Inhibrx?

A4: Stock options in Inhibrx Inc. provide a

holder with the right to acquire common stock of Inhibrx. Unless that right has been exercised at the time of a significant transaction,

a holder of Inhibrx stock options does not actually own any shares of Inhibrx common stock and does not have any rights associated with

being a stockholder, including the ability to convert shares of Inhibrx into shares of New Inhibrx. If an employee exercises his or her

Inhibrx options prior to Closing, the resulting shares will receive common stock treatment in the Spin-Off and subsequent Merger. (See

Original FAQs, Q16.)

Q5: What happens to my Inhibrx stock options

in the Spin-Off and the Merger?

A5: All unvested Inhibrx stock options will

fully vest immediately prior to the closing of the Spin-Off and the Merger, so all outstanding Inhibrx stock options will be eligible

to receive consideration as follows:

| • | Each

stock option (whether vested or unvested) that has a per share exercise price that is equal to or less than $30.00 will convert into

the right to receive, subject to tax withholding, (i) cash consideration equal to $30.00 (the per share amount of cash being paid to

common stock holders in the Merger), less the applicable per share exercise price and (ii) one CVR (which in turn, represents a right

to receive a cash payment of $5.00 if the milestone is achieved prior to June 30, 2027). (See Original FAQs, Q10.) |

| • | Each

stock option (whether vested or unvested) that has a per share exercise price greater than $30.00 (the per share amount of cash being

paid to common stock holders in the Merger), but less than $35.00 (representing the sum of the $30.00 cash consideration

described above, plus the potential $5.00 CVR milestone payment) will convert into the right to receive a cash payment if the

CVR milestone is achieved in the future. If the CVR milestone is met, the holder will receive a per share cash payment, subject to tax

withholding, equal to $35.00 less the exercise price of the stock option previously held. For example, if you have an option with

a per share exercise price equal to $32.00, your pre-tax payment upon achievement of the CVR milestone will be $35.00-$32.00 = $3.00

per option (See Original FAQs, Q13). |

| • | All

stock options (whether vested or unvested) with an exercise price that is equal to or greater than $35.00 will be cancelled without any

payment. |

As a reminder, the stock option consideration

payments in respect of currently unvested stock options is a benefit being provided to Inhibrx stock option holders as a result of the

Merger, and would not have occurred in the normal course or had the sale of INBRX-101 been structured as an asset sale.

Q6: Will employees receive new equity

in New Inhibrx? What will that look like?

A6: Company management plans to propose New

Inhibrx equity grants be made to New Inhibrx employees after the Closing. Management is in the process of creating the new equity plan

and will meet with the board of directors to discuss the same in the coming months. The value of New Inhibrx common shares (and consequently,

the value of New Inhibrx equity awards denominated in New Inhibrx common shares) likely will not be known with specificity until after

the Closing.

Q7: Can I take the cash payment received

in respect of my Inhibrx stock options and roll it directly into New Inhibrx stock?

A7: You are free to take the proceeds received

for your cancelled Inhibrx stock options and purchase New Inhibrx common stock after the Closing, subject to our insider trading policy.

However, please note that the settlement of your Inhibrx options and any subsequent purchase of New Inhibrx stock would still be separate

events, handled independently. We recommend that you consult with a tax or other financial advisor to the extent you have specific questions

regarding the impact of such actions on your personal tax situation.

Q8: Please explain the 4:1 reverse

stock split for New Inhibrx shares. What does this mean for Inhibrx stockholders and for potential New Inhibrx option holders?

A8: Effecting a reverse stock split does not

have any impact on the value of the common stock of New Inhibrx. The value of a share of stock is always the trading price per share multiplied

by the number of shares. If a shareholder owns 40 shares at $5/share, the value of those shares is $200.00. If, following the 4:1 reverse

stock split, the same shareholder owns 10 shares at $20/share, the value of those shares is still $200.00. When New Inhibrx grants stock

options to its employees after the Closing, the exercise price per share of such award will be no less than the trading price per share

of New Inhibrx common stock at the time of grant.

Q9: Will Company management notify

employees of the Closing date in advance?

A9: The timing of the Closing is contingent

on a number of factors, many of which are out of the Company’s control. We understand that you have questions about this, and expect

that the Company will share information with employees as it becomes available.

Cautionary Statement Regarding Forward-Looking Statements

This communication contains

forward-looking statements about Sanofi’s proposed acquisition of the Company and the Company’s related spin-off of the assets

and liabilities associated with INBRX-105, INBRX-106 and INBRX-109, which involve substantial risks and uncertainties that could cause

actual results to differ materially from those expressed or implied by such statements. Such risks and uncertainties include, among other

things, risks related to the satisfaction or waiver of the conditions to closing the proposed acquisition (including the failure to obtain

necessary regulatory approvals and failure to obtain the requisite vote by the Company’s shareholders) in the anticipated timeframe

or at all, including the possibility that the proposed acquisition does not close; the possibility that competing offers may be made;

risks related to the ability to realize the anticipated benefits of the proposed acquisition, including the possibility that the expected

benefits from the acquisition will not be realized or will not be realized within the expected time period; the risk that the integration

of the Company and Sanofi will be more difficult, time consuming or costly than expected; risks and costs relating to the separation of

the assets and liabilities associated with INBRX-105, INBRX-106 and INBRX-109 and the consummation of the spin-off in the anticipated

timeframe or at all; changes to the configuration of the INBRX-105, INBRX-106 and INBRX-109 businesses included in the separation if implemented;

disruption from the transaction making it more difficult to maintain business and operational relationships; risks related to diverting

management’s attention from the Company’s ongoing business operation; negative effects of this announcement or the consummation

of the proposed transaction on the market price of the Company’s shares of common stock and/or operating results; significant transaction

costs; risks associated with the discovery of unknown liabilities prior to or after the closing of the proposed transactions; the risk

of litigation and/or regulatory actions related to the proposed transactions or the Company’s business; other business effects and

uncertainties, including the effects of industry, market, business, economic, political or regulatory conditions; the conflicts in the

Ukraine and the Middle East; future exchange and interest rates; changes in tax and other laws, regulations, rates and policies; and future

business combinations or disposals. Important factors, risks and uncertainties that could cause actual results to differ materially from

such forward looking statements also include but are not limited to the initiation, timing, progress and results of the Company’s

research and development programs as well as the Company’s preclinical studies and clinical trials; the Company’s ability

to advance therapeutic candidates into, and successfully complete, clinical trials; the Company’s interpretation of initial, interim

or preliminary data from the Company’s clinical trials, including interpretations regarding disease control and disease response;

the timing or likelihood of regulatory filings and approvals, including whether any product candidate, receives approval from the FDA,

or similar regulatory authority, for an accelerated approval process; the commercialization of the Company’s therapeutic candidates,

if approved; the pricing, coverage and reimbursement of the Company’s therapeutic candidates, if approved; the Company’s ability

to utilize the Company’s technology platform to generate and advance additional therapeutic candidates; the implementation of the

Company’s business model and strategic plans for the Company’s business and therapeutic candidates; the Company’s ability

to successfully manufacture the Company’s therapeutic candidates for clinical trials and commercial use, if approved; the Company’s

ability to contract with third-party suppliers and manufacturers and their ability to perform adequately; the scope of protection the

Company is able to establish and maintain for intellectual property rights covering the Company’s therapeutic candidates; the Company’s

ability to enter into strategic partnerships and the potential benefits of such partnerships; the Company’s estimates regarding

expenses, capital requirements and needs for additional financing; the ability to raise funds needed to satisfy the Company’s capital

requirements, which may depend on financial, economic and market conditions and other factors, over which the Company may have no or limited

control; the Company’s financial performance; the Company’s and the Company’s third party partners’ and service

providers’ ability to continue operations and advance the Company’s therapeutic candidates through clinical trials and the

ability of the Company’s third party manufacturers to provide the required raw materials, antibodies and other biologics for the

Company’s preclinical research and clinical trials in light of current market conditions or any pandemics, regional conflicts, sanctions,

labor conditions, geopolitical events, natural disasters or extreme weather events; the ability to retain the continued service of the

Company’s key professionals and to identify, hire and retain additional qualified professionals; and developments relating to the

Company’s competitors and the Company’s industry.

You should carefully consider

the foregoing factors and the other risks and uncertainties that affect the Company’s business described in the “Risk Factors”

and “Special Note Regarding Forward-Looking Statements” sections of its Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other documents filed from time to time with the U.S. Securities and Exchange Commission (the “SEC”), all of which

are available at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events

and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the

date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation

to, and does not intend to, update or revise these forward-looking statements, whether as a result of new information, future events,

or otherwise, unless required by law. The Company does not give any assurance that it will achieve its expectations.

Additional Information

and Where to Find It

In connection with the

proposed acquisition, the Company will be filing documents with the SEC, including preliminary and definitive proxy statements relating

to the proposed acquisition. The definitive proxy statement will be mailed to the Company’s shareholders in connection with the

proposed acquisition. This communication is not a substitute for the proxy statement or any other document that may be filed by the Company

with the SEC. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PRELIMINARY AND DEFINITIVE PROXY

STATEMENTS AND ANY OTHER DOCUMENTS TO BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED ACQUISITION OR INCORPORATED BY REFERENCE IN

THE PROXY STATEMENT WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED ACQUISITION. Any vote

in respect of resolutions to be proposed at the Company’s shareholder meeting to approve the proposed acquisition or other responses

in relation to the proposed acquisition should be made only on the basis of the information contained in the Company’s proxy statement.

Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with

the SEC at the SEC’s web site at www.sec.gov or on the Company’s website at https://www.inhibrx.com.

No Offer or Solicitation

This communication is for

information purposes only and is not intended to and does not constitute, or form part of, an offer, invitation or the solicitation of

an offer or invitation to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of any securities, or the solicitation

of any vote or approval in any jurisdiction, pursuant to the proposed transaction or otherwise, nor shall there be any sale, issuance

or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in Solicitation

The Company, its respective

directors and certain of their respective executive officers may be deemed to be “participants” (as defined under Section

14(a) of the Securities Exchange Act of 1934) in the solicitation of proxies from shareholders of the Company with respect to the potential

transaction. Information about the identity of Company’s (i) directors is set forth in the section entitled “Our Board of

Directors” on page 11 of Company’s proxy statement on Schedule 14A filed with the SEC on April 13, 2023 (the “2023 Proxy”)

(and available here)

and (ii) executive officers is set forth in the section entitled “Our Executive Officers” on page 14 of the 2023 Proxy (and

available here).

Information about the compensation of Company’s non-employee directors is set forth in the section entitled “Non-Employee

Director Compensation Policy” starting on page 16 of the 2023 Proxy (and available here).

Information about the compensation of Company’s named executive officers is set forth in the section entitled “Executive Compensation”

starting on page 18 of the 2023 Proxy (and available here).

Transactions with related persons (as defined in Item 404 of Regulation S-K promulgated under the Securities Act of 1933) are disclosed

in the section entitled “Certain Relationships and Related Party Transactions” on page 31 of the 2023 Proxy (and available

here).

Information about the beneficial ownership of Company securities by Company’s directors and named executive officers is set forth

in the section entitled “Security Ownership of Certain Beneficial Owners and Management” starting on page 28 of the 2023 Proxy

(and available here).

Any change of the holdings

of the Company’s securities by its directors or executive officers from the amounts set forth in the 2023 Proxy have been reflected

in the following Statements of Beneficial Ownership on Form 4 filed with the SEC: Form 4, filed by Kayyem Jon Faiz, with the filing of

the Company on May 30, 2023; Form 4, filed by Manhard Kimberly, with the filing of the Company on May 30, 2023; Form 4, filed by Vuori

Kristiina MD, with the filing of the Company on May 30, 2023; and Form 4, filed by Forsyth Douglas, with the filing of the Company on

May 30, 2023. As of February 2, 2024, each of the “participants” set forth below “beneficially owned” (within

the meaning of Rule 13d-3 under the Securities Exchange Act of 1934) less than 1% of shares of common stock, par value $0.0001 share,

of the Company.

Additional information

regarding the identity of potential participants, and their direct or indirect interests, by security holdings or otherwise, will be included

in the definitive proxy statement relating to the proposed acquisition when it is filed with the SEC. These documents (when available)

may be obtained free of charge from the SEC’s website at www.sec.gov and the Company’s website at https://www.inhibrx.com.

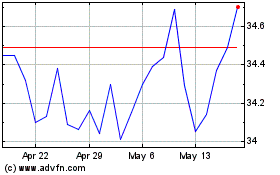

Inhibrx (NASDAQ:INBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Inhibrx (NASDAQ:INBX)

Historical Stock Chart

From Apr 2023 to Apr 2024