As filed with the Securities and Exchange Commission on January 16, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

INTER & CO, INC.

(Exact name of Registrant as specified in its charter)

The Cayman Islands

(State or other jurisdiction of incorporation or organization)

Not Applicable

(I.R.S. Employer Identification Number)

Avenida Barbacena, No. 1.219, 22nd floor

30190-131 –Belo Horizonte, State of Minas Gerais, Brazil

Telephone: +55 31 2138-7974

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global, Inc.

122 East 42nd Street, 18th floor

New York, NY, 10168

United States

Telephone: +1 212 947 7239

(Name, address, and telephone number of agent for service)

Copy to:

Francesca L. Odell

Jonathan Mendes de Oliveira

Cleary Gottlieb Steen & Hamilton LLP,

One Liberty Plaza

New York, New York 10006

(212) 225-2000

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If only securities being registered on this Form are to be offered pursuant to dividend or interest reinvestment plans, please check the following box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: ☐

If this Form is a registration statement pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: ☐

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

| | | | | |

| Emerging growth company ☐ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

P R O S P E C T U S

INTER & CO, INC.

(Incorporated in the Cayman Islands)

Class A Common Shares

We may from time to time in one or more offerings offer and sell our Class A common shares. In addition, from time to time, the selling shareholders to be named in an applicable prospectus supplement, or the selling shareholders, may offer and sell the equity securities held by them. The selling shareholders may sell the equity securities through public or private transactions at prevailing market prices or at privately negotiated prices. We will not receive any proceeds from the sale of the equity securities by the selling shareholders.

The securities which may be sold by us and by the selling shareholders may be offered and sold in the same offering or in separate offerings; to or through underwriters, dealers, and agents; or directly to purchasers. The names of any underwriters, dealers, or agents involved in the sale of the securities, their compensation and any options to purchase additional securities granted to them will be described in the applicable prospectus supplement. For a more complete description of the plan of distribution of the securities, see the section entitled “Plan of Distribution” beginning on page 26 of this prospectus. This prospectus describes some of the general terms that may apply to the securities. We and the selling shareholders, as applicable, will provide specific terms of any offering in a supplement to this prospectus. Any prospectus supplement may also add, update, or change information contained in this prospectus. To the extent the applicable prospectus supplement is inconsistent, information in this prospectus is superseded by the information in the applicable prospectus supplement. You should carefully read this prospectus and the applicable prospectus supplement as well as the documents incorporated or deemed to be incorporated by reference in this prospectus before you purchase any of the securities.

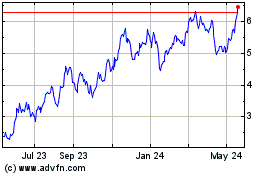

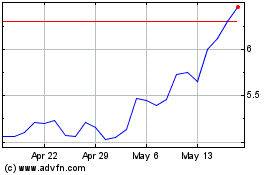

Our Class A common shares are currently listed on the Nasdaq Global Select Market, or Nasdaq, under the symbol “INTR.”

Investments in the securities involve risks. See “Risk Factors” on page 6 of this prospectus. You should carefully consider the risks and uncertainties discussed under the heading “Risk Factors” included in the applicable prospectus supplement or under similar headings in other documents which are incorporated by reference in this prospectus. Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is January 16, 2024.

TABLE OF CONTENTS

The securities are not being offered in any jurisdiction where the offer or sale is not permitted.

You should not assume that the information contained in or incorporated by reference in this prospectus or any prospectus supplement is accurate as of any date other than the date on the front cover of the applicable document.

Unless otherwise indicated or the context otherwise requires, all references in this prospectus or any prospectus supplement to “Inter & Co”, “Inter” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Inter & Co, Inc., together with its consolidated subsidiaries.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to the Central Bank of Brazil (Banco Central do Brasil). References in the prospectus to “real,” “reais” or “R$” refer to the Brazilian real, the official currency of Brazil, and references to “U.S. dollar,” “U.S. dollars” or “US$” refer to U.S. dollars, the official currency of the United States.

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement that we filed with the SEC, as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended, or the Securities Act. By using an automatic shelf registration statement, we may, at any time and from time to time, offer and sell the securities described in this prospectus in one or more offerings. This prospectus only provides a general description of the securities that may be offered. Each time we offer securities, we will prepare a prospectus supplement containing specific information about that particular offering. We may also add, update or change information contained in this prospectus by means of a prospectus supplement or by incorporating by reference information that we file or furnish to the SEC. As allowed by the SEC rules, this prospectus and any accompanying prospectus supplement do not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits and the documents incorporated by reference in the registration statement. Statements contained in this prospectus or an applicable prospectus supplement about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

You should carefully read this document and the applicable prospectus supplement. You should also read the documents we have referred you to under “Where You Can Find More Information” below for information on the Company, the risks we face and our financial statements. The registration statement and exhibits can be read at the SEC’s website or at the SEC as described under “Where You Can Find More Information.”

We are responsible for the information contained in or incorporated by reference into this prospectus, any prospectus supplement or any free writing prospectus prepared by on or behalf of us, and we have not authorized any other person to provide you with different or inconsistent information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell the securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus, in the applicable prospectus supplement, or any documents incorporated by reference is accurate only as of the date on the front cover of the applicable document. Our business, financial condition, results of operations and prospects may have changed since then.

WHERE YOU CAN FIND MORE INFORMATION

Inter & Co has filed with the SEC a registration statement (including amendments and exhibits to the registration statement) on Form F-3 under the Securities Act. This prospectus, which is part of the registration statement, does not contain all of the information set forth in the registration statement and the exhibits and schedules to the registration statement. For further information, we refer you to the registration statement and the exhibits and schedules filed as part of the registration statement. If a document has been filed as an exhibit to the registration statement, we refer you to the copy of the document that has been filed. Each statement in this prospectus relating to a document filed as an exhibit is qualified in all respects by the filed exhibit. Each statement regarding a contract, agreement or other document is qualified in its entirety by reference to the actual document.

We are subject to the informational requirements of the Exchange Act that are applicable to foreign private issuers. Accordingly, we are required to file reports and other information with the SEC, including annual reports on Form 20-F and furnish certain information on current reports on Form 6-K. You may inspect and copy the reports and other information filed with the SEC at the public reference facilities maintained by the SEC at 100 F Street, N.E., Washington D.C. 20549. In addition, the SEC maintains an Internet website at http://www.sec.gov, from which you can electronically access the registration statement and its materials. The information contained on, or accessible through, such website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus or any prospectus supplement, unless if explicitly incorporated by reference under “Incorporation of Documents by Reference.”

As a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content of proxy statements, and our executive officers, directors and principal shareholders are exempt from reporting and short swing profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we are not required under the Exchange Act to file periodic reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are registered under the Exchange Act.

You may request a copy of our SEC filings, at no cost, by contacting us at our principal executive office located at Avenida Barbacena, No. 1.219, 22nd floor, Belo Horizonte, State of Minas Gerais, 30190-131, Brazil. Our investor relations office can be reached at ir@inter.co.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with or furnish to it into this prospectus. This means that we can disclose important information to you by referring you to another document filed or furnished separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus, except for any information superseded by information that is included directly in this document or incorporated by reference subsequent to the date of this document. You should read the information incorporated by reference because it is an important part of this prospectus.

We incorporate by reference into this prospectus our Annual Report on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC on April 28, 2023, and any amendments thereto, if any (the “2022 Form 20-F”). We incorporate by reference into this prospectus the following current reports on Form 6-K:

•Our current report on Form 6-K furnished to the SEC on January 16, 2024 (File No. 001-41419; Accession No. 0001628280-24-001376), containing our unaudited condensed consolidated interim financial statements as of and for the three and nine-month periods ended September 30, 2023 and 2022. •Our current report on Form 6-K furnished to the SEC on January 16, 2024 (File No. 001-41419; Accession No. 0001628280-24-001370), containing (i) a discussion of our results of operations for the nine-month period ended September 30, 2023 and (ii) other information relating to recent developments. All subsequent reports that we file on Form 20-F under the Exchange Act after the date of this prospectus and prior to the termination of the offering of the Class A common shares offered by this prospectus shall also be deemed to be incorporated by reference into this prospectus and to be a part hereof from the date of filing such documents. We may also incorporate by reference any Form 6-K that we submit to the SEC after the date of this prospectus and prior to the termination of this offering by identifying in such Form 6-K that it is being incorporated by reference into this prospectus. Unless expressly incorporated by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC.

Any statement contained in any document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any prospectus supplement modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

All of the documents that are incorporated by reference are available at the website maintained by the SEC at http://www.sec.gov. Any other information contained on, or accessible through, such website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus or any prospectus supplement. In addition, we will provide at no cost to each person, including any beneficial owner, to whom this prospectus has been delivered, upon the written or oral request of any such person to us, a copy of any or all of the documents referred to above that have been or may be incorporated into this prospectus by reference, including exhibits to such documents. Requests for such copies should be directed to: Avenida Barbacena, No. 1.219, 22nd floor, Belo Horizonte, State of Minas Gerais, 30190-131, Brazil; phone: +55 (31) 2138-7974; email: ir@inter.co.

FORWARD-LOOKING STATEMENTS

This prospectus, the registration statement of which it forms a part, each prospectus supplement and the documents incorporated by reference into these documents contain estimates and forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time we or our representatives have made or may make forward-looking statements orally or in writing. Furthermore, such forward-looking statements may be included in various filings that we make with the SEC or press releases or oral statements made by or with the approval of one of our authorized executive officers. These forward-looking statements are subject to certain known and unknown risks and uncertainties, as well as assumptions that could cause actual results to differ materially from those reflected in these forward-looking statements.

These estimates and forward-looking statements are based mainly on our current expectations and estimates of future events and trends that affect or may affect our business, financial condition, results of operations, cash flow, liquidity, prospects and the trading price of our Class A common shares. Although we believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are subject to many significant risks, uncertainties and assumptions and are made in light of information currently available to us.

These statements appear throughout this prospectus and include statements regarding our intent, belief or current expectations in connection with:

•recent developments relating to actual events or concerns relating to liquidity constraints, defaults and non-performance by financial institutions;

•the impact of the ongoing wars in the Middle East and in Ukraine, and the impact of these events on the global economy, which are highly uncertain and difficult to predict;

•our future growth opportunities, expected earnings, expected capital expenditures, and future financing requirements;

•our ability to expand our business into markets outside of Brazil and in particular our ability to integrate the operations and obtain the benefits that we intend to achieve through our acquisition in the United States of USEND (now Inter&Co Payments, Inc.);

•general economic, political and business conditions both in Brazil and internationally, including in Brazil, developments and the perception of risks in connection with investigations and increasingly fractious relations among the Brazilian president and his administration, members of the Brazilian Congress and members of the Supreme Court, as well as policies and potential changes that have been or are proposed to be implemented, including economic and tax reforms, any of which may negatively affect growth prospects in the Brazilian economy as a whole;

•the socioeconomic, political and business environment in Brazil, including, but not limited to, foreign exchange rates, employment levels, population growth and consumer confidence;

•inflation as well as fluctuations in the real to the U.S. dollar and in interest rates;

•changes in applicable rules and regulations, including, but not limited to, those relating to taxation, employment, information technology, data privacy, and cybersecurity;

•our ability to implement our growth strategies;

•our ability to adequately finance our operations on favorable terms;

•our ability to satisfactorily serve our clients;

•our ability to attract and retain companies to offer their merchandise through our Inter Shop & Commerce Plus platform;

•our competitors and competitive position;

•changes in consumer preferences and consumer demand for our products and services;

•difficulties in maintaining and/or improving our products or in addressing client complaints and any negative publicity involving our products and services;

•increases in our operating costs, particularly in relation to our workforce; and

•other risk factors discussed under “Risk Factors” included in documents we file from time to time with the SEC that are incorporated by reference herein, including in our most recent Annual Report on Form 20-F, which is incorporated by reference herein.

The words “believe,” “understand,” “may,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “seek,” “intend,” “expect,” “should,” “could,” “forecast” and similar words are intended to identify forward-looking statements. You should not place undue reliance on such statements, which speak only as of the date they were made. Neither we nor any selling shareholders undertake any obligation to update publicly or to revise any forward-looking statements after we distribute this prospectus because of new information, future events or other factors. Our independent registered public accounting firm has neither examined nor compiled the forward-looking statements and, accordingly, do not provide any assurance with respect to such statements. In light of the risks and uncertainties described above, the future events and circumstances discussed in this prospectus might not occur and are not guarantees of future performance. Because of these uncertainties, you should not make any investment decision based upon these estimates and forward-looking statements. You are advised to consult any additional disclosures we have made or will make in our reports to the SEC on Forms 20-F and on Forms 6-K that are designated as being incorporated by reference into this prospectus. All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained in this prospectus.

RISK FACTORS

Any investment in the Class A common shares involves a high degree of risk. Before purchasing any securities, you should carefully consider and evaluate all of the information included and incorporated by reference in this prospectus or any applicable prospectus supplement, including the risk factors incorporated by reference from our most recent Annual Report on Form 20-F, as updated by other reports and documents we file with the SEC after the date of this prospectus that are incorporated by reference herein or in the applicable prospectus supplement. Additional risk factors that you should carefully consider may be included in a prospectus supplement or other offering materials relating to an offering of our Class A common shares.

We encourage you to read these risk factors in their entirety. In addition to these risks, other risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely affect our business operations and financial condition. Such risks could cause actual results to differ materially from anticipated results. This could cause the trading price of the securities to decline, perhaps significantly, and investors may lose part or all of their investment. You should not purchase the securities described in this prospectus unless you understand and know you can bear all of the investment risks involved.

In general, investing in the securities of issuers in emerging market countries such as Brazil involves risks that are different from the risks associated with investing in the securities of U.S. companies and companies located in other countries with more developed capital markets.

INTER & CO, INC.

Our mission is to empower people to manage their finances and daily activities, through a simple and seamlessly integrated digital experience. We aim to bring the breadth of possibilities of the offline world to the palm of our client’s hands, with the convenience and scalability of a digital native Super App. As we began our journey as a digital bank, we were attracted to a market that we believed was ripe for disruption given the lack of focus on what truly mattered: the client.

We allow clients to capitalize on the full extent of our technology to solve many of their daily financial and non-financial needs across one single Super App, which includes the following business verticals:

•Inter Banking & Spending – a fully digital account that allows clients to pay bills, spend on and offline, and transfer funds, among many other features.

•Inter Credit – lending solutions that enable clients to fund their life ambitions.

•Inter Shop & Commerce Plus – our marketplace solutions for clients to efficiently purchase goods and an ever-growing set of on-demand services to address our clients’ daily activities.

•Inter Invest – an open marketplace for investment products that empower clients to invest for their future.

•Inter Insurance – insurance brokerage services that enable our clients to protect all the important assets and aspects of their lives.

•Global – solution for Brazilian clients who are traveling abroad and for Brazilians residing in the US. This category of products brings many of our core financial and commerce ecosystems to a global experience.

•Loyalty - our reward program, which drives retention and activation by all verticals listed above, offering multiple opportunities for clients to earn and use points inside our SuperApp.

Inter & Co was incorporated on January 26, 2021, as an exempted company with limited liability in the Cayman Islands. Inter & Co’s principal executive office is located at Avenida Barbacena, No. 1.219, 22nd floor, Belo Horizonte, State of Minas Gerais, Brazil 30190-131. The telephone number for our Investor Relations Department, located at this address is +55 (31) 2138-7974 and the email is <ir@inter.co>. Inter & Co indirectly owns, through its wholly-owned subsidiaries, Inter US Holding, Inc. and Inter Holding Financeira, S.A., respectively, all shares of Banco Inter S.A.

Investors should contact our Investor Relations Department for any inquiries through the address, email and telephone number indicated above. Our principal website is <bancointer.com.br> and our Investor Relations Department website is <ri.bancointer.com.br/>. The information contained in, or accessible through, our website is not incorporated into this prospectus. In addition, the SEC maintains a website at http://www.sec.gov, from which you can electronically access this prospectus, and other information regarding issuers that file electronically with the SEC.

USE OF PROCEEDS

We intend to use the proceeds from the sale of the Class A common shares offered by us as set forth in the applicable prospectus supplement.

In the case of a secondary offering of Class A common shares, we will not receive any of the proceeds of the sale by any selling shareholders of the Class A common shares covered by this prospectus.

DESCRIPTION OF SHARE CAPITAL

We were incorporated on January 26, 2021, as a Cayman Islands exempted company with limited liability with the Cayman Islands Registrar of Companies. Our corporate purposes are (i) the business of holding equity participations in other entities and any matters ancillary or incidental thereto; and (ii) any matters necessary for, or ancillary or incidental to, the administration of our Company from time to time, and we are capable of exercising all the functions of a natural person of full capacity irrespective of any question of corporate benefit, as provided by Section 27(2) of the Companies Act.

Our affairs are governed principally by: (1) our memorandum and articles of association (as adopted at the relevant time); (2) the Companies Act; and (3) the common law of the Cayman Islands. As provided in our current Memorandum of Association, subject to Cayman Islands law, we have full capacity to carry on (i) the business of holding equity participations in other entities and any matters ancillary or incidental thereto; and (ii) any matters necessary for, or ancillary or incidental to, the administration of the Company from time to time. Our registered office is c/o Maples Corporate Services Limited, PO Box 309, Ugland House, Grand Cayman, KY1-1104, Cayman Islands.

As of the date of this prospectus, our authorized share capital is US$50,000 divided into 20,000,000,000 shares of a par value of US$0.0000025 each, of which 285,153,435 have been issued and are outstanding as Class A Shares of par value of US$0.0000025 each and 117,037,105 have been issued and are outstanding as Class B Shares of par value of US$0.0000025 each.

Each person owning Class A common shares held through the Depositary Trust Company, or DTC, must rely on the procedures thereof and on institutions that have accounts therewith to exercise any rights of a holder of the Class A common shares. Persons wishing to obtain certificates for their Class A common shares must make arrangements with DTC.

Our Class B common shares are not freely tradable and are not and will not be listed on any exchange.

The following discussion summarizes the material terms of the Class A common shares of Inter & Co which may be offered by this prospectus. This discussion does not purport to be complete and is qualified in its entirety by reference to the Articles of Association included as Exhibit 1.1 to our most recent Annual Report on Form 20-F.

Share Capital

Our Articles of Association authorize two classes of common shares: Class A common shares, which are entitled to one vote per share and Class B common shares, which are entitled to 10 votes per share and to maintain a proportional ownership and voting interest in the event that additional Class A common shares are issued. Any holder of Class B common shares may convert their shares at any time into Class A common shares on a share-for-share basis. The rights of the two classes of common shares are otherwise identical, except as described below.

As of the date of this prospectus, our total authorized share capital is US$50,000, divided into 20,000,000,000 shares with a par value of US$0.0000025 each, of which:

•10,000,000,000 shares are designated as Class A common shares;

•5,000,000,000 shares are designated as Class B common shares; and

•5,000,000,000 shares are undesignated.

The authorized but unissued shares that are presently undesignated may be issued by our board of directors as common shares of any class or as shares with preferred, deferred or other special rights or restrictions.

Treasury Stock

At the date of this prospectus, Inter & Co has no Class A common shares or Class B common shares in treasury.

Listing

Our Class A common shares are listed on Nasdaq under the symbol “INTR.” Settlement of any Class A common shares offered pursuant to this prospectus is expected to take place on or about the completion date of the relevant offering through DTC, in accordance with its customary settlement procedures for equity securities. If your shares are registered in the name of DTC, you will not be a shareholder or member of the company. Each person owning Class A common shares held through DTC must rely on the procedures thereof and on institutions that have accounts therewith to exercise any rights of a holder of the Class A common shares.

Our Class A common shares are listed in registered form and are not certificated.

Transfer Agent and Registrar

We have appointed American Stock Transfer & Trust Company LLC as our agent in New York to maintain the shareholders’ register and to act as transfer agent, registrar and paying agent for the Class A common shares. Any Class A common shares offered pursuant to this prospectus will be traded on Nasdaq in book-entry form. The transfer agent, registrar and paying agent’s address is 6201 15th Avenue, Brooklyn — NY 11219, and its telephone number is +1 (800) 937-5449 or +1 (718) 921-8124.

Corporate Purpose

Our corporate purposes are (i) the business of holding equity participations in other entities and any matters ancillary or incidental thereto; and (ii) any matters necessary for, or ancillary or incidental to, the administration of our Company from time to time and we shall have and be capable of exercising all the functions of a natural person of full capacity irrespective of any question of corporate benefit, as provided by Section 27(2) of the Companies Act.

Issuance of Shares

Except as expressly provided in our Articles of Association, our board of directors has general and unconditional authority to allot, grant options over, offer or otherwise deal with or dispose of any unissued shares in the Company’s capital without the approval of our shareholders (whether forming part of the original or any increased share capital), either at a premium or at par, with or without preferred, deferred or other special rights or restrictions, whether in regard to dividend, voting, return of capital or otherwise and to such persons, on such terms and conditions, and at such times as the directors may decide, but so that no share shall be issued at a discount, except in accordance with the provisions of the Companies Act.

We will not issue bearer shares.

Our Articles of Association provide that at any time that there are Class A common shares in issue, additional Class B common shares may only be issued pursuant to (1) a share split, subdivision of shares or similar transaction or where a dividend or other distribution is paid by the issue of shares or rights to acquire shares or following capitalization of profits; (2) a merger, consolidation, or other business combination involving the issuance of Class B common shares as full or partial consideration; or (3) an issuance of Class A common shares, whereby holders of the Class B common shares are entitled to purchase a number of Class B common shares that would allow them to maintain their proportional ownership and voting interests in us (following our offer to each holder of Class B common shares to issue to such holder, upon the same economic terms and at the same price, such number of Class B common shares as would ensure such holder may maintain a proportional ownership and voting interest in us pursuant to our Articles of Association).

In light of: (a) the above provisions; and (b) the 10-to-one voting ratio between our Class B common shares and Class A common shares, holders of Class B common shares will in many situations continue to maintain control of all matters requiring shareholder approval. This concentration of ownership and voting power will limit or preclude your ability to influence corporate matters for the foreseeable future.

Fiscal Year

Our fiscal year begins on January 1 of each year and ends on December 31 of such year.

Voting Rights

A holder of a Class B common share is entitled, in respect of such share, to 10 votes per share, while a holder of a Class A common share is entitled, in respect of such share, to one vote per share. The holders of Class A common shares and Class B common shares vote together as a single class on all matters (including the appointment of directors) submitted to a vote of shareholders, except as provided below and as otherwise required by law.

Our Articles of Association provide as follows regarding the respective rights of holders of Class A common shares and Class B common shares:

•separate class consents from the holders of Class A common shares and Class B common shares, as applicable, shall be required for any variation to the rights attached to their respective class of shares; however, the Directors may treat the two classes of shares as forming one class if they consider that both such classes would be affected in the same way by a proposal;

•the rights conferred on holders of Class A common shares shall not be deemed to be varied by the creation or issuance of additional Class B common shares; and the rights conferred on holders of Class B common shares shall not be deemed to be varied by the creation or issuance of additional Class A common shares; and

•the rights attaching to the Class A common shares and the Class B common shares shall not be deemed to be varied by the creation or issuance of further shares ranking pari passu therewith, by the redemption or purchase of any shares of any class us, the cancellation of authorised but unissued shares of that class or the creation or issuance of shares with preferred or other rights, including, without limitation, shares with enhanced or weighted voting rights.

As set forth in our Articles of Association, our board of directors has authority to increase or decrease the number of shares comprising any such class or series (but not below the number of shares of any class or series of shares then outstanding) without the approval of the holders of Class A common shares and Class B common shares. However, our authorized share capital may only be increased by way of an “ordinary resolution,” which is defined in the Articles of Association as being a resolution (1) of a duly constituted general meeting passed by a simple majority of the votes cast by, or on behalf of, the shareholders entitled to vote present in person or by proxy and voting at the meeting; or (2) approved in writing by all of the shareholders entitled to vote at a general meeting in one or more instruments each signed by one or more of the shareholders and the effective date of the resolution so adopted shall be the date on which the instrument, or the last of such instruments, if more than one, is executed.

Conversion Rights

Each Class B common share may be converted into one Class A common share (i) upon delivery by the holder of such Class B common share of a notice to Inter & Co, at its registered office, in the form described in our Articles of Association, to effect a conversion of such Class B common share or (ii) automatically upon any transfer of such Class B common share, whether or not for value, except for certain limited transfers described in our Articles of Association. Such transfers include transfers to affiliates, one or more trustees of a trust established for the benefit of the shareholder or their affiliates, and partnerships, corporations and other entities owned or controlled by the shareholder or their affiliates, as well as to a non-affiliate transferee that agrees in writing with us to make a tender offer or exchange offer to all holders of Class A common shares, pursuant to the tag-along rights contained in the Articles of Association as described in “―Transfer of Shares―Tag Along.”

Upon conversion of Class B common shares into Class A common shares, the resulting Class A common shares may be transferred, subject to any restrictions under applicable law.

As set forth in Inter & Co’s Articles of Association, each Class B common share will convert automatically into one Class A common share and no Class B common shares will be issued thereafter if, at any time, the total number of votes of the outstanding Class B common shares represents less than 10% of the voting share rights of the Company. Additionally, the holders of a majority of the then outstanding Class B common shares have the right to require that all outstanding Class B common shares be converted.

Preemptive or Similar Rights

The Class B common shares are entitled to maintain a proportional ownership and voting interest in the event that additional Class A common shares are issued. As such, except for certain exceptions, if we intend to issue Class A common shares, we must first make an offer to each holder of Class B common shares to issue to such holder on the same economic terms such number of Class B common shares as would ensure that the proportion in nominal value of the issued common shares held by such holder as Class B common shares, after the issuance of such Class A common shares will be as nearly as practicable equal to the proportion in nominal value of the issued common shares held by such holder as Class B common shares before the said issuance. This right to maintain a proportional ownership interest does not apply in circumstances where fractional entitlements are rounded or otherwise settled or sold at the discretion of our board of directors or the making of an offer to a holder of Class B common shares would in the view of our board of directors pose legal or practical problems in or under the laws or securities rules of any jurisdiction or the requirements of any regulatory body or stock exchange such that our board of directors considers it necessary or expedient in the interests of the Company to exclude such holder from the offer, and the holders of two-thirds of the Class B common shares may consent in writing to our board of directors issuing of Class A common shares for cash without such offer being made. In addition, pursuant to our Articles of Association, preemptive rights will be deemed waived to the extent a holder of Class B common shares does not exercise such rights within the time period stated in the offer made by us to such holder of Class B common shares, which period must be at least 30 days beginning on the date the offer is deemed received by such holder.

Equal Status

Except as expressly provided in our Articles of Association, Class A common shares and Class B common shares have the same rights and privileges and rank equally, share ratably and are identical in all respects as to all matters. In the event of any: (1) merger, consolidation, scheme, arrangement or other business combination requiring the approval of our shareholders entitled to vote thereon (whether or not we are the surviving entity); (2) tender or exchange offer to acquire any Class A common shares or Class B common shares by any third party pursuant to an agreement to which we are a party, or (3) tender or exchange offer by us to acquire any Class A common shares or Class B common shares, in each such case the holders of Class A common shares shall have the right to receive, or the right to elect to receive, the same form of consideration (as shall be adjusted, in the case of share or equivalent consideration, by the directors so as to account for the different economic and voting rights that exist or may exist between such consideration and the share classes) as the holders of Class B common shares, and (except as foresaid) the holders of Class A common shares shall have the right to receive, or the right to elect to receive, at least the same amount of consideration on a per share basis as the holders of Class B common shares.

Record Dates

For the purpose of determining shareholders entitled to notice of, or to vote at any general meeting of shareholders or any adjournment thereof, or shareholders entitled to receive dividend or other distribution payments, or in order to make a determination of shareholders for any other purpose, our board of directors may set a record date which shall not exceed 40 days prior to the date where the determination will be made.

General Meetings of Shareholders

As a condition of admission to a general meeting, a shareholder must be duly registered as a shareholder at the applicable record date for that meeting and, in order to vote, all calls or installments then payable by such shareholder to us in respect of the shares that such shareholder holds must have been paid.

Subject to any special rights or restrictions as to voting then attached to any shares, at any general meeting every shareholder who is present in person or by proxy (or, in the case of a shareholder being a corporation, by its duly authorized representative not being themselves a shareholder entitled to vote) shall have one vote per Class A common share and 10 votes per Class B common share.

As a Cayman Islands exempted company, we are not obliged by the Companies Act to call annual general meetings; however, our Articles of Association provide that in each year Inter & Co will hold an annual general meeting of shareholders, within the first four months following the end of its fiscal year. For the annual general

meeting of shareholders, the agenda shall be set by our board of directors and will include, among other things, the presentation of the annual accounts and the report of the directors (if any) and the aggregate compensation to be paid to our directors and officers will be subject to shareholder approval at our annual general meeting.

Also, we may, but are not required to (unless required by the laws of the Cayman Islands), hold other general meetings during the year.

General meetings of shareholders are generally expected to take place in Belo Horizonte, Brazil, but may be held elsewhere, including virtually, if the directors so decide.

Subject to regulatory requirements, the annual general meeting and any extraordinary general meetings must be called by not less than 21 clear days’ notice prior to the relevant shareholders meeting and convened by a notice discussed below. Alternatively, upon the prior consent of all holders entitled to receive notice that meeting may be convened by a shorter notice and in a manner deemed appropriate by those holders.

We will give notice of each general meeting of shareholders by publication on our website and in any other manner that we may be required to follow in order to comply with Cayman Islands law, Nasdaq and SEC requirements. The holders of registered shares may be given notice of a general meeting by means of letters sent to the addresses of those shareholders as registered in our shareholders’ register, or, subject to certain statutory requirements, by electronic means.

Holders whose shares are registered in the name of DTC or its nominee, which we expect will be the case for all holders of Class A common shares, will not be deemed to be shareholders or members of Inter & Co and must rely on the procedures of DTC regarding notice of general meetings and the exercise of rights of a holder of the Class A common shares.

A quorum for a general meeting consists of any one or more persons holding or representing by proxy not less than one-fourth of aggregate of the voting power of all shares in issue and entitled to vote upon the business to be transacted. If a quorum is not present within half an hour from the time appointed for the meeting to commence or if during such a meeting a quorum ceases to be present, a second meeting may be called with at least eight days’ notice to shareholders specifying the place, the day and the hour of the second meeting, as the Directors may determine, and if at the second meeting a quorum is not present within half an hour from the time appointed for the meeting to commence, the shareholders present shall be a quorum. In respect of a separate class meeting (other than an adjourned meeting) convened to sanction the modification of class rights, the necessary quorum is persons holding or representing by proxy not less than two-thirds of the issued Inter & Co shares of the applicable class.

A resolution put to a vote at a general meeting shall be decided on a poll. Generally speaking, an ordinary resolution to be passed by the shareholders at a general meeting requires the affirmative vote of a simple majority of the votes cast by, or on behalf of, the shareholders entitled to vote, present in person or by proxy and voting at a quorate general meeting and a special resolution requires the affirmative vote of at least a two-thirds majority of the votes cast by, or on behalf of, the shareholders entitled to vote who are present in person or by proxy and voting at a quorate general meeting. Both ordinary resolutions and special resolutions may also be passed by a unanimous written resolution signed by all the shareholders of our Company, as permitted by the Companies Act and our Articles of Association.

Pursuant to our Articles of Association, general meetings of shareholders are to be chaired by any person appointed by our board of directors, and in the event that the directors do not appoint any person, the chairman of our board of directors or in his absence the vice-chairman of the board of directors. If the chairman or vice-chairman of our board of directors is absent, the directors present at the meeting shall appoint one of them to be chairman of the general meeting. If neither the chairman, nor the vice-chairman, nor another director is present at the general meeting within 15 minutes after the time appointed for holding the meeting, the shareholders present in person or by proxy and entitled to vote may elect any one of the shareholders to be chairman. The order of business at each meeting shall be determined by the chairman of the meeting, and he or she shall have the right and authority to prescribe such rules, regulations and procedures and to do all such acts and things as are necessary or desirable for the proper conduct of the meeting, including, without limitation, the establishment of procedures for the maintenance of order and safety, limitations on the time allotted to questions or comments on the affairs of Inter &

Co, restrictions on entry to such meeting after the time prescribed for the commencement thereof, and the opening and closing of the polls.

In addition to the matters required to be approved by shareholders by Cayman Islands law, our Articles of Association provide that the following matters shall be approved by ordinary resolution (requiring the affirmative vote of a simple majority of those shareholders attending and voting in person or by proxy at a quorate general meeting), unless the Companies Act requires a special resolution (requiring the affirmative vote of at least a two-thirds majority of those shareholders attending and voting in present or by proxy at a quorate general meeting):

•acquisitions where the issuance of Inter & Co shares (including shares issued pursuant to an earn-out provisions or similar type of provision and securities that are convertible, exercisable or exchangeable for Inter & Co shares) equals 20% or more of the pre-transaction outstanding shares or aggregate voting power outstanding of Inter & Co;

•acquisitions where the issuance of Inter & Co shares (including shares issued pursuant to an earn-out provisions or similar type of provision and securities that are convertible, exercisable or exchangeable for shares) equals 5% or more of the pre-transaction outstanding shares or aggregate voting power outstanding of Inter & Co when an officer, director or shareholder who beneficially own 5% of the total outstanding Shares or voting power of Inter & Co has a 5% or greater interest in the target or assets to be acquired (or such persons collectively have a 10% or greater interest in the target or assets to be acquired);

•transactions, other than a public offering, involving the sale, issuance or potential issuance by Inter & Co of Inter & Co shares (or securities that are convertible, exercisable or exchangeable for such shares), which alone or together with sales by officers, directors or shareholders who beneficially own 5% of the total outstanding shares or voting power of Inter & Co, equals 20% or more of the shares or voting power of the Company outstanding before the sale or issuance if such sale or issue price is lower than the closing price of Inter & Co shares the trading day immediately preceding the signing of the binding agreement in relation to such sale or issue or the average of the closing price of the shares the five trading days immediately preceding the signing of the binding agreement in relation to such sale or issue;

•the issuance of Inter & Co shares (or securities that are convertible, exercisable or exchangeable for shares) that will result in a change of control of Inter & Co;

•the adoption or material amendment of any incentive plan or equity compensation arrangement by Inter & Co other than in circumstances where shareholder approval would not be necessary pursuant to Nasdaq rules; and

•a merger or spin-off involving Inter & Co, with one or more businesses or entities.

Liquidation Rights

If we are voluntarily wound up, the liquidator, after taking into account and giving effect to the rights of preferred and secured creditors and to any agreement between us and any creditors that the claims of such creditors shall be subordinated or otherwise deferred to the claims of any other creditors and to any contractual rights of set-off or netting of claims between us and any person or persons (including without limitation any bilateral or any multi-lateral set-off or netting arrangements between us and any person or persons) and subject to any agreement between us and any person or persons to waive or limit the same, shall apply our property in satisfaction of its liabilities pari passu and subject thereto shall distribute the property amongst the shareholders according to their rights and interests in us.

Changes to Capital

Pursuant to the Articles of Association, we may from time to time by ordinary resolution (requiring the affirmative vote of a simple majority of those shareholders attending and voting in person or by proxy at a quorate general meeting):

•increase our authorized share capital by such sum, to be divided into shares of such amount, as the resolution shall prescribe;

•consolidate and divide all or any of our share capital into shares of a larger amount than its existing shares;

•convert all or any of our paid-up shares into stock and reconvert that stock into paid-up shares of any denomination;

•subdivide our existing shares or any of them into shares of a smaller amount, provided that in the subdivision the proportion between the amount paid and the amount, if any, unpaid on each reduced share shall be the same as it was in the case of the share from which the reduced share is derived; or

•cancel any shares which, at the date of the passing of the resolution, have not been taken or agreed to be taken by any person and diminish the amount of our share capital by the amount of the shares so cancelled.

Our shareholders may by special resolution (requiring the affirmative vote of at least a two-thirds majority of those shareholders attending and voting in person or by proxy at a quorate general meeting), subject to confirmation by the Grand Court of the Cayman Islands on an application by Inter & Co for an order confirming such reduction, reduce our share capital or any capital redemption reserve in any manner permitted by law.

In addition, subject to the provisions of the Companies Act and our Articles of Association, we may:

•issue shares on terms that they are to be redeemed or are liable to be redeemed;

•purchase our own shares (including any redeemable shares); and

•make a payment in respect of the redemption or purchase of its own shares in any manner authorized by the Companies Act, including out of our own capital.

Transfer of Shares

Class A common shares

Subject to any applicable restrictions set forth in the Articles of Association or applicable law, any of our shareholders may transfer all or any of their Class A common shares by an instrument of transfer in the usual or common form or in the form prescribed by Nasdaq or any other form approved by our board of directors.

The Class A common shares are traded on Nasdaq in book-entry form and may be transferred in accordance with our Articles of Association and Nasdaq’s rules and regulations.

Class B common shares

Each Class B common share will be converted into one Class A common share automatically upon any transfer of such Class B common share, whether or not for value, except for certain limited transfers described in our Articles of Association. Upon conversion of Class B common shares into Class A common shares, the resulting Class A common shares may be transferred, subject to any restrictions under applicable law.

Tag-along

Our Articles of Association provide that, subject to certain exceptions, if, in one or a series of transactions, (i) the controlling shareholder transfers Common Shares (as defined in our Articles of Association) representing our Voting Control (as defined in our Articles of Association) to a person or group of persons acting in concert, or (ii)

the controlling shareholder transfers all or part of its Common Shares to a person or group of persons acting in concert and such a person or group of persons obtain Voting Control within 12 months from the acquisition of the controlling shareholder’s Common Shares or from the receipt of payment by the controlling shareholder (such person or group of persons acting in concert described in (i) or (ii), the “new controlling shareholder”), then the new controlling shareholder shall make a tender offer or exchange offer (the “Offer”) to all holders of Class A common shares, pursuant to which the holders of Class A common shares shall have the right to elect to receive a price for each Class A common share equivalent to the weighted average price per share paid by the new controlling shareholder for the acquisition of Common Shares from the controlling shareholder during the 12-month period prior to the acquisition of Voting Control by the new controlling shareholder.

The new controlling shareholder shall commence the Offer within 30 days after the consummation acquisition of Voting Control; provided that if any filing with or approval by the SEC or other securities regulator or stock exchange is required under any applicable law in connection with such Offer, the new controlling shareholder shall make such applicable filings or seek such approval within 30 days after acquisition of Voting Control of the Company and procure that the Offer is commenced as soon as reasonably practicable thereafter.

Notwithstanding anything to the contrary herein, the obligation to make an Offer shall not apply:

•if the transfer of Voting Control or the transfer of all or part of the controlling shareholder’s Common Shares occurs as a result of (i) a public offering, (ii) a business combination, (iii) a tender offer or exchange offer conducted by a third party and addressed to all holders of Class A common shares, or (iv) open market transactions on a stock exchange;

•in connection with any transfer to affiliates, heirs or successors of the controlling shareholder;

•in connection with any transfer to one or more trustees of a trust established for the benefit of the controlling shareholder or an affiliate of the controlling shareholder;

•in connection with any transfer to a partnership, corporation or other entity exclusively owned or controlled by the controlling shareholder or an affiliate of the controlling shareholder; or

•in connection with any transfer to organizations that are exempt from taxation under Section 501(3)(c) of the United States Internal Revenue Code of 1986, as amended (or any successor thereto).

For the purposes of the tag along rights, “controlling shareholder” means a shareholder or group of shareholders holding the Voting Control and “Voting Control” means the ownership, directly or indirectly, of shares possessing more than fifty per cent (50%) of the voting power of the Company.

Share Repurchase

The Companies Act and our Articles of Association permit us to purchase our own shares, subject to certain restrictions. Our board of directors may only exercise this power on behalf us, subject to the Companies Act, our Articles of Association and to any applicable requirements imposed from time to time by the SEC; or the applicable stock exchange on which our securities are listed, including Nasdaq.

Dividends and Capitalization of Profits

We have not adopted a dividend policy with respect to payments of any future dividend. Our board of directors has decided that it is not necessary to have a dividend policy because all of our dividend rules are set forth in our Articles of Association Subject to the Companies Act, our shareholders may, by resolution passed by a simple majority of the voting rights entitled to vote at a general meeting, declare dividends (including interim dividends) to be paid to shareholders, but no dividend shall be declared in excess of the amount recommended by our board of directors. Our board of directors may also declare dividends. Dividends may be declared and paid out of funds lawfully available to us. Except as otherwise provided by the rights attached to shares and our Articles of Association, all dividends shall be paid in proportion to the number of Class A common shares or Class B common shares a shareholder holds at the date the dividend is declared (or such other date as may be set as a record date); in each case other than: (1) any other share class with preference over Class A common shares and Class B common

shares eventually created, and (2) the partial payment of dividends to shares that are not fully paid up (as to par value).

The holders of Class A common shares and Class B common shares shall be entitled to share equally in any dividends that may be declared in respect of our common shares from time to time. In the event that a dividend is paid in the form of Class A common shares or Class B common shares, or rights to acquire Class A common shares or Class B common shares, (1) the holders of Class A common shares shall receive Class A common shares, or rights to acquire Class A common shares, as the case may be and (2) the holders of Class B common shares shall receive Class B common shares, or rights to acquire Class B common shares, as the case may be.

Appointment, Disqualification and Removal of Directors

We are managed by our board of directors. Our Articles of Association provide that our board of directors will be composed of such number of directors as a majority of directors in office may determine, provided that unless otherwise determined by our shareholders by special resolution, our board of directors shall consist of at least three and up to twelve directors. Our Articles of Association do not include a mandatory retirement age. Our Articles of Association also allow additional directors to be appointed through ordinary resolution. Our Articles of Association provide that our board of directors must include at least 20% of the total number of directors or two directors (whichever is greater) which are independent directors.

Shareholders appoint directors through ordinary resolution, which requires the affirmative vote of a simple majority of those shareholders attending and voting in person or by proxy at a quorate general meeting. Each director shall be appointed for a two-year term, unless they resign or their office is vacated earlier, provided, however, that such term shall be extended beyond two years in the event that no successor has been appointed (in which case such term shall be extended to the date on which such successor has been appointed).

We may also enter into agreements with one or more shareholders granting them the right to appoint and remove one or more directors on such terms as our board of directors may determine from time to time, and such directors may only be removed in accordance with the terms of such agreements and as otherwise set out in our Articles of Association.

Grounds for Removing a Director

A director may be removed with or without cause by ordinary resolution (requiring the affirmative vote of a simple majority of those shareholders attending and voting in person or by proxy at a quorate general meeting). The notice of general meeting must contain a statement of the intention to remove the director and must be served on the director not less than ten calendar days before the meeting. The director is entitled to attend the meeting and be heard on the motion for their removal.

The office of a director will be vacated automatically if such director (1) becomes prohibited by law from being a director; (2) becomes bankrupt or makes an arrangement or composition with his creditors; (3) dies or is in the opinion of all his or her co-directors, becomes incapable by reason of mental disorder of discharging his duties as director; (4) resigns his or her office by notice to us; or (5) has for three consecutive meetings of the board of directors been absent without permission of the directors, and the remaining directors resolve that his or her office be vacated.

Proceedings of our Board of Directors

Our business is to be managed and conducted by our board of directors. The quorum necessary for a board meeting shall be a simple majority of the directors then in office (but not less than two directors), and business at any meeting shall be decided by a majority of votes.

Subject to the provisions of our Articles of Association, our board of directors may regulate its proceedings as they determine is appropriate. Board meetings shall be held at least once every calendar quarter and shall take place either in Belo Horizonte, Brazil or at such other place, including virtually, as the directors may determine. The

independent members of our board of directors will also hold meetings separate from the other members of our board of directors at least once every calendar quarter.

Subject to the provisions of our Articles of Association, to any directions given by ordinary resolution of our shareholders and Nasdaq listing rules, our board of directors may from time to time at its discretion exercise all of our powers, including, subject to the Companies Act, the power to issue debentures, bonds and other securities of the company, whether outright or as collateral security for any debt, liability or obligation of our Company or of any third party.

Inspection of Books and Records

Holders of our shares have no general right under Cayman Islands law to inspect or obtain copies of the list of shareholders or our corporate records. However, our board of directors may determine from time to time whether and to what extent our accounting records and books shall be open to inspection by shareholders. Notwithstanding the above, our Articles of Association provide that the Company's annual accounts shall be presented at each annual general meeting.

Register of Members

Our Class A common shares are held through DTC, and DTC or Cede & Co., as nominee for DTC, will be recorded in the shareholders’ register as the holder of Class A common shares.

Under Cayman Islands law, we must keep a register of members that includes:

•the names and addresses of the shareholders, a statement of the shares held by each member, and of the amount paid or agreed to be considered as paid, on the shares of each member;

•whether voting rights attach to the shares in issue;

•the date on which the name of any person was entered on the register as a member; and

•the date on which any person ceased to be a member.

Under Cayman Islands law, our register of members is prima facie evidence of the matters set out therein (i.e. the register of members will raise a rebuttable presumption) and a shareholder registered in the register of members is deemed as a matter of Cayman Islands law to have prima facie legal title to the shares as set against his or her name in the register of members. The shareholders recorded in the register of members should be deemed to have legal title to the shares set against their name.

However, there are certain limited circumstances where an application may be made to a Cayman Islands court for a determination on whether the register of members reflects the correct legal position. Further, the Cayman Islands court has the power to order that the register of members maintained by a company should be rectified where it considers that the register of members does not reflect the correct legal position. If an application for an order for rectification of the register of members were made in respect of our common shares, then the validity of such shares may be subject to re-examination by a Cayman Islands court.

Exempted Company

We are an exempted company with limited liability under the Companies Act. The Companies Act distinguishes between ordinary resident companies and exempted companies. Where the proposed activities of a company are to be carried out mainly outside of the Cayman Islands, the registrant can apply for registration as an exempted company. The requirements for an exempted company are essentially the same as for an ordinary company except for the exemptions and privileges listed below:

•an exempted company does not have to file an annual return of its shareholders with the Registrar of Companies;

•an exempted company’s register of shareholders is not open to inspection;

•an exempted company does not have to hold an annual general meeting;

•an exempted company may issue shares with no par value;

•an exempted company may obtain an undertaking against the imposition of any future taxation (such undertakings are usually given for 20 years in the first instance);

•an exempted company may register by way of continuation in another jurisdiction and be deregistered in the Cayman Islands;

•an exempted company may register as a limited duration company; and

•an exempted company may register as a segregated portfolio company.

“Limited liability” means that the liability of each shareholder is limited to the amount unpaid by the shareholder on the shares of the company (except in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or other circumstances in which a court may be prepared to pierce or lift the corporate veil).

We are subject to reporting and other informational requirements of the Exchange Act, as applicable to foreign private issuers. Except as otherwise disclosed in this prospectus, we currently intend to comply with Nasdaq rules in lieu of following home country practice.

Anti-Takeover Provisions in our Articles of Association

Some provisions of our Articles of Association may discourage, delay or prevent a change in control or management that shareholders may consider favorable. In particular, our capital structure concentrates ownership of voting rights in the hands of holders of Class B common shares. These provisions, which are summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control to first negotiate with our board of directors. However, these provisions could also have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market price of the Class A common shares that often result from actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions that shareholders may otherwise deem to be in their best interests.

Two Classes of Common Shares

Our Class B common shares are entitled to 10 votes per share, while the Class A common shares are entitled to one vote per share. Since our controlling shareholder owns all of the Class B common shares, they have the ability to elect a majority of the directors and to determine the outcome of most matters submitted for a vote of shareholders. This concentrated voting control could discourage others from initiating any potential merger, takeover, or other change of control transaction that other shareholders may view as beneficial.

So long as the controlling shareholder has the ability to determine the outcome of most matters submitted to a vote of shareholders, third parties may be deterred in their willingness to make an unsolicited merger, takeover, or other change of control proposal, or to engage in a proxy contest for the appointment of directors. As a result, the fact that we have two classes of common shares may have the effect of depriving you as a holder of Class A common shares of an opportunity to sell Class A common shares at a premium over prevailing market prices and make it more difficult to replace our directors and management.

Preferred Shares

Our board of directors is given broad powers to issue one or more classes or series of shares with preferred rights. Such preferences may include, for example, dividend rights, conversion rights, redemption privileges, enhanced voting powers and liquidation preferences.

Despite the anti-takeover provisions described above, under Cayman Islands law, our board of directors may only exercise the rights and powers granted to them under the Articles of Association and the Companies Act, for what they believe in good faith to be in our best interests.

Protection of Non-Controlling Shareholders

The Grand Court of the Cayman Islands may, on the application of shareholders holding not less than one fifth of our shares in issue, appoint an inspector to examine our affairs and report thereon in a manner as the Grand Court shall direct.

Subject to the provisions of the Companies Act, any shareholder may petition the Grand Court of the Cayman Islands which may make a winding up order, if the court is of the opinion that this winding up is just and equitable.

Notwithstanding the U.S. securities laws and regulations that are applicable to us, general corporate claims against us by our shareholders must, as a general rule, be based on the general laws of contract or tort applicable in the Cayman Islands or their individual rights as shareholders as established by our Articles of Association.

The Cayman Islands courts ordinarily would be expected to follow English case law precedents, which permit a minority shareholder to commence a representative action against us, or derivative actions in our name, to challenge: (1) an act which is ultra vires or illegal; (2) an act which constitutes a fraud against the minority and the wrongdoers themselves are control shareholders; and (3) an irregularity in the passing of a resolution that requires a qualified (or special) majority.

Restricted Shares

Except as disclosed in our most recent Annual Report on Form 20-F under the caption “Item 7. Major Shareholders and Related Party Transactions―B. Related Party Transactions―Shareholders’ Agreements—Shareholders’ Agreement with SoftBank,” no shareholders of Inter & Co have formal registration rights. Holders of restricted or control shares, entities controlled by them or their permitted transferees will be able to sell their shares in the public market from time to time without registering them, subject to certain limitations on the timing, amount and method of those sales imposed by regulations promulgated by the SEC.

ENFORCEMENT OF CIVIL LIABILITIES

We are incorporated under the laws of the Cayman Islands as an exempted company with limited liability. We are registered in the Cayman Islands because of certain benefits associated with being a Cayman Islands company, such as political and economic stability, an effective judicial system, a favorable tax system, the absence of foreign exchange control or currency restrictions and the availability of professional and support services. However, the Cayman Islands have a less prescriptive body of securities laws as compared to the United States.

We have been advised by our Cayman Islands legal counsel, Maples and Calder (Cayman) LLP, that the courts of the Cayman Islands are unlikely (i) to recognize or enforce against us judgments of courts of the United States predicated upon the civil liability provisions of the securities laws of the United States or any state; and (ii) in original actions brought in the Cayman Islands to impose liabilities against us predicated upon the civil liability provisions of the securities laws of the United States or any state, so far as the liabilities imposed by those provisions are penal in nature. In those circumstances, although there is no statutory enforcement in the Cayman Islands of judgments obtained in the United States, the courts of the Cayman Islands will recognize and enforce a foreign money judgment of a foreign court of competent jurisdiction without retrial on the merits based on the principle that a judgment of a competent foreign court imposes upon the judgment debtor an obligation to pay the sum for which judgment has been given provided certain conditions are met. For a foreign judgment to be enforced in the Cayman Islands, such judgment must be final and conclusive and for a liquidated sum, and must not be in respect of taxes or a fine or penalty, inconsistent with a Cayman Islands judgment in respect of the same matter, impeachable on the grounds of fraud or obtained in a manner, and or be of a kind the enforcement of which is, contrary to natural justice or the public policy of the Cayman Islands (awards of punitive or multiple damages may well be held to be contrary to public policy). A Cayman Islands Court may stay enforcement proceedings if concurrent proceedings have been brought elsewhere.

Substantially all of our assets are located outside the United States, in Brazil. In addition, all of the members of our board of directors and all of our officers are residents of Brazil and all or a substantial portion of their respective assets are located outside the United States. As a result, it may be difficult for investors to effect service of process within the United States upon us or these persons, or to enforce against us or them judgments obtained in United States courts, including judgments predicated upon the civil liability provisions of the federal securities laws of the United States, any state in the United States or other jurisdiction outside Brazil.

As a result, two litigation scenarios may arise out of this transaction: (1) a claim being filed outside Brazil; and (2) a claim being filed in Brazil.

(1)A claim filed outside Brazil: In the case of a party filing a lawsuit related, for instance, to the offering within the United States or within any other country; or pursuing the enforcement of a foreign award based on civil liability provisions of the federal securities laws of the United States or the laws of any other country.