United States Securities and Exchange Commission Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 For the month of February 2024 Commission File Number 132-02847 INTER & Co, INC. (Exact name of registrant as specified in its charter) N/A (Translation of Registrant’s executive offices) Av Barbacena, 1.219, 22nd Floor Belo Horizonte, Brazil, ZIP Code 30 190-131 Telephone: +55 (31) 2138-7978 (Address of principal executive office) Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F. Form 20-F ☒ Form 40-F ☐ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): Yes ☐ No ☒ Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): Yes ☐ No ☒

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 4Q23 Earnings Presentation

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 This report may contain forward-looking statements regarding Inter, anticipated synergies, growth plans, projected results and future strategies. While these forward- looking statements reflect our Management’s good faith beliefs, they involve known and unknown risks and uncertainties that could cause the company’s results or accrued results to differ materially from those anticipated and discussed herein. These statements are not guarantees of future performance. These risks and uncertainties include, but are not limited to, our ability to realize the amount of projected synergies and the projected schedule, in addition to economic, competitive, governmental and technological factors affecting Inter, the markets, products and prices and other factors. In addition, this presentation contains managerial numbers that may differ from those presented in our financial statements. The calculation methodology for these managerial numbers is presented in Inter’s quarterly earnings release. Statements contained in this report that are not facts or historical information may be forward-looking statements under the terms of the Private Securities Litigation Reform Act of 1995. These forward-looking statements may, among other things, beliefs related to the creation of value and any other statements regarding Inter. In some cases, terms such as “estimate”, “project”, “predict”, “plan”, “believe”, “can”, “expectation”, “anticipate”, “intend”, “aimed”, “potential”, “may”, “will/shall” and similar terms, or the negative of these expressions, may identify forward looking statements. These forward-looking statements are based on Inter's expectations and beliefs about future events and involve risks and uncertainties that could cause actual results to differ materially from current ones. Any forward-looking statement made by us in this document is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. For additional information that about factors that may lead to results that are different from our estimates, please refer to sections “Cautionary Statement Concerning Forward-Looking Statements” and “Risk Factors” of Inter&Co Annual Report on Form 20-F. The numbers for our key metrics (Unit Economics), which include active users, as average revenue per active client (ARPAC), cost to serve (CTS), are calculated using Inter’s internal data. Although we believe these metrics are based on reasonable estimates, but there are challenges inherent in measuring the use of our business. In addition, we continually seek to improve our estimates, which may change due to improvements or changes in methodology, in processes for calculating these metrics and, from time to time, we may discover inaccuracies and make adjustments to improve accuracy, including adjustments that may result in recalculating our historical metrics. About Non-IFRS Financial Measures To supplement the financial measures presented in this press release and related conference call, presentation, or webcast in accordance with IFRS, Inter&Co also presents non-IFRS measures of financial performance, as highlighted throughout the documents. The non-IFRS Financial Measures include, among others: Adjusted Net Income, Cost to Serve, Cost of Funding, Efficiency Ratio, Underwriting, NPL > 90 days, NPL 15 to 90 days, NPL and Stage 3 Formation, Cost of Risk, Coverage Ratio, Funding, All-in Cost of Funding, Gross Merchandise Volume (GMV), Premiuns, Net Inflows, Global Services Deposits and Investments, Fee Income Ratio, Client Acquisition Cost, Cards+PIX TPV, Gross ARPAC, Net ARPAC, Marginal NIM 1.0, Marginal NIM 2.0, Net Interest Margin IEP + Non-int. CC Receivables (1.0), Net Interest Margin IEP (2.0), Cost-to-Serve, Risk-Adjusted Net Interest Margin IEP + Non-int. CC Receivables (1.0), Risk Adjusted Net Interest Margin IEP (2.0), Risk Adjusted Efficiency Ratio. A “non-IFRS financial measure” refers to a numerical measure of Inter&Co’s historical or financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with IFRS in Inter&Co’s financial statements. Inter&Co provides certain non-IFRS measures as additional information relating to its operating results as a complement to results provided in accordance with IFRS. The non-IFRS financial information presented herein should be considered together with, and not as a substitute for or superior to, the financial information presented in accordance with IFRS. There are significant limitations associated with the use of non-IFRS financial measures. Further, these measures may differ from the non-IFRS information, even where similarly titled, used by other companies and therefore should not be used to compare Inter&Co’s performance to that of other companies. Disclaimer 2

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Achieving growth & profitability Fi na nc ia ls 1 O perational Note 1: Definitions are in the Glossary section of this Earnings Presentation. Note 2: “Profit / (loss) before income tax” in the Income Statements of the IFRS Financial Statements. 3 Increasing Total Gross Revenue Revenue Growth R$2.2bn +29% YoY Record Ever 4Q23 Operational Leverage Record low Efficiency Ratio 51.4% +22 p.p. YoY improvement Record Ever 4Q23 Bottom Line Delivering Net Income R$160mm 8.5% ROE Record Ever 4Q23 30.4mm Number of Clients Growing Total Clients +1.0 mm QoQ Record Ever 4Q23 54.0% Activation Rate Increasing Active Clients1 +135 bps QoQ Record Since 4Q21 4Q23 R$ 253bn Transactional Growth Expanding TPV +30% YoY Record Ever 4Q23

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Agenda 1. CEO Overview 2. Business Updates 3. Financial Performance

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 • 603030 Update • Inter’s Ecosystem • Next Steps AGENDA 1.CEO Overview 2. Business Updates 3. Financial Performance Main topics

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Year 1/5: Check! Inter&Co | 2023 Investor Day 6 60/30/30 announcement in January 2023

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 We delivered outstanding results significantly ahead of schedule Total Clients Efficiency Ratio Return on Equity What we achieved in 1 year 4Q23 Our 5-year north star By 2027 ~60MM ~30% ~30% 30MM 51% 9% 7 Where we started 3Q22 Year 0 Year 1 Year 5 23MM 75% (2%) 53% 34% G ro w th O pe ra tio na l Le ve ra ge Pr of ita bi lit y Year 1 4Q23 Year 2 4Q24 Year 3 4Q25 Year 4 4Q26 Year 1 4Q23 Year 2 4Q24 Year 3 4Q25 Year 4 4Q26 Year 1 4Q23 Year 2 4Q24 Year 3 4Q25 Year 4 4Q26 19% Year 0 3Q22 Year 5 4Q27 Year 5 4Q27 Year 0 3Q22 Year 0 3Q22 Year 5 4Q27

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Banking Global Loyalty Credit Insurance Shopping Investments 8 Unmatched Financial Super App with broadest product offering

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 12.7 MM Pix 5.3 MM Inter Loop 1.0 MM Meu Porquinho 1.2 MM FGTS 14.8 MM Deposits1 7.1MM Debit Card1 5.8MM Bill Payment (Boleto)1 3.9 MM Credit Cards1 3.0 MM CDB1,2 2.3 MM Top-Ups1 1.4 MM Savings Dep.1 1.1 MM Cards Insurance1 9 Active Clients per Product in Million Note 1: Existing products before 1Q19, however the actual number of active clients starts only from 1Q20 in order to fit the graph. Note 2: Including “CDB Meu Porquinho”. Accelerating product adoption, benefiting from the power of our ecosystem 1 202 3 4 5 6 7 8 9 9 10 11 12 13 14 15 16 17 18 19 5 4 3 2 1 0 N um be r o f c lie nt s (m ill io n) Quarters of Relationship Older Funding Products Lending Products Newer Transactional Products

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Strongly positioned for 2024 and beyond Dilution of Expense Base Shifting ROE Loan Mix 2019 2020 2021 2022 2023 ROE Higher Engagement Improving Asset Quality Lowering BR and US Interest Rates 10 Investing Phase Compounding Phase Inflection point En do ge no us F ac to rs Ex og en ou s F ac to rs

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 1. CEO Overview 2.Business Updates 3. Financial Performance • Clients & Engagement • Business Verticals • Innovation • Marketshare AGENDA Main topics

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Continuing to increase activation while lowering CAC Client Acquisition Cost In R$, quarterly 55% 50% 45% 49% 44% 27% 32% 37% 45% 50% 55% 51% 56% 73% 68% 63% 29.0 32.1 28.3 30.4 29.8 27.1 25.9 24.6 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Marketing Costs Operational Costs -19% YoY 51.8% 51.7% 51.2% 51.0% 51.5% 52.2% 52.7% 54.0% 9.6 10.7 11.6 12.6 13.5 14.5 15.5 16.4 18.6 20.7 22.8 24.7 26.3 27.8 29.4 30.4 - 5 .0 1 0. 1 5.0 2 0. 2 5.0 3 0. 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Active Clients Total Number of Clients In Million Activation Rate increase 12 + 0.9 mm +135 bps Optimizing CAC across acquisition channels Inter Loop enhancing client’s engagement

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 55% 54% 53% 51% 51% 45% 46% 47% 49% 49% 19 18 20 21 24 158 163 177 198 230 178 181 197 219 253 0. 0 10. 0 20 .0 30 .0 40 .0 50 .0 60 .0 70 .0 4Q22 1Q23 2Q23 3Q23 4Q23 Debit Credit PIX Massive transactional platform: R$ 1 trillion run rate TPV +25% +36% +45% +43% % YoY +15% Cards + PIX TPV1 In R$ Billion Quarters of relationship Cards + PIX TPV per Active Client In R$ Thousand, monthly Sources: Banco Central do Brasil. Note 1: Height of PIX volume was reduced to fit on page. Note 2: Inter’s market share calculated using internal data on total transacted volume in 4Q23; Considers transactions within the Instant Payment System (SPI) only as of 4Q23. 13 Consistent PIX and credit volume growth 0 1 2 3 4 5 6 7 8 9 10 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 Th ou sa nd s 4Q23 1Q1860% 54% 52% 40% 46% 48% 43 66 83 269 512 768 312 578 851 0. 0 50 .0 100 .0 150 .0 20 0. 0 250 .0 2021 2022 2023 +25% +31% +50% +47% % YoY +20% +43% YoY 7.8% Pix Transactions Market Share 4Q232

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Enhancing performance across business verticals Shopping Insurance Investments Note 1: Number of transactions through Inter Shop during the quarter. 2.4 3.0 1.0 1.5 2. 0 2. 5 3. 0 3. 5 4Q22 4Q23 Active Clients In Million é 25% ~92 billion AuC +38% YoY +9 billion 3rd party F.I. +53% YoY +1 billion meu +239% QoQ +388’000 sales +20% YoY +47 million net revenues +36% YoY +1 billion consortium portfolio +122% YoY +10 million transactions +11% YoY +R$ 1 billion recurring +21% QoQ ~150 BNPL merchants New product 1.3 1.7 0.5 0.7 0.9 1.1 1.3 1.5 1.7 4Q22 4Q23 Active Clients In Million é 35% 2.8 4.7 0.0 1.0 2. 0 3. 0 4.0 5. 0 4Q22 4Q23 é 66% Active Clients In Million Meu Porquinho AuCGMV Leading shopping platform from a financial entity Broadest offering of digital insurance platform Cutting-edge investment platform 14

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 15 Global: high growth vertical driving engagement within wealthier clients > 2 million Global Clients ~3x More products adoption1 Note 1: Global Clients use 3.0 times more products when compared to active clients average. Note 2: Amount included in Demand Deposit balance on IFRS Financial Statement. Note 3: Assets under Inter&Co Securities Custody. Note 4: Securities under Inter&Co Securities Custody. 6 9 14 20 18 26 10 26 42 49 68 115 149 198 2 4 8 26 41 66 85 121 20 20 20 20 11 30 56 84 142 221 272 364 - 50 100 150 200 25 0 300 35 0 400 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 AuC & Deposits in US Dollars In USD Million Assets under Custody3 Deposit balance2 Securities4 Real estate fund US$ 579,97 Global Partnering with US Strong Brands & Many More

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 16 Loop: powerful strategy to create connection and loyalty between verticals • Credit Card Bills • “Conta com Pontos” (Balance Earns Points) • Missions Accomplishments ~60% Inter Loop clients spends more than regular clients1 Robust Structure for Seamless, Versatile, and Rich Client Experience Multiple Ways to Earn….. …..and Use Points Cashback Bills Discount Enhances Engagement Generate Revenues >1.5mm New active clients in 4Q23 ARPAC1 • Yield on Unused Points • Optimized Reserves >5.4mm Clients in 4Q23 Air Miles Investments Dollars Many more…& Now Multiple OptionsLoyalty Note 1: When comparing gross ARPAC from non-loop active clients.

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 17 Loop Auto Loan Overdraft Buy Now Pay Later PIX Crédito Meu Porquinho Global Super App US Securities International Card Mortgage FGTS Loan Home Equity Global Account Top-Ups Marketplace Life Insurance Duo Gourmet Retirement Plan Gift Card Home Broker Travel Consignado Credit & Debit Card Health Insurance 3rd Party Fixed Income FX PIX Cashback Savings Account Checking Account SMBs Loans Crypto Consortium Bill Payment Debt Renegotiation Investment Funds New products and innovations Older products and innovations •Capacity to execute multiple product launches in a year of obsessive cost efficiency Unique combination of innovation & efficiency

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 18 High growth potential, benefiting from our strong primary bank relationships Sources: Banco Central do Brasil for Bank Account, Pix, Payroll and Credit Card; Caixa Economica Federal for FGTS; Abecip for Home Equity and Inter&Co for FGTS anticipation market. Note 1: Inter’s market share calculated using internal data on total digital Brazilian users, as of December,2023. Note 2: Inter’s market share calculated using internal data on total transacted volume in 4Q23; Considers transactions within the Instant Payment System (SPI) only as of 4Q23. Note 3: Market size data considers personal credit portfolio balance with free resources and total payroll-deductible personal credit; Inter’s market share calculated as personal loans minus FGTS. Note 4: Total FGTS Deposits market as of November 2023; Total Addressable portfolio estimates figures considering an average of 5 years of anticipation and Total FGTS Anticipation market considers an implied 18% portfolio growth. Note 5: Total Credit Card Loans market includes balance of the credit portfolio with free funds for both legal entities and individuals. Note 6: Total Home Equity market includes the total secured real estate credit for individuals. Note 7: All figures as of December 2023. 6.1% 1.2Bn 1.6% 9.5Bn 2.5% 1.9Bn 0.8% 5.2Bn Payroll3,7 In R$ Bn Credit Card5,7 In R$ Bn FGTS4,8 In R$ Bn Home Equity PF6,7 In R$ Bn Pix2,7 In bn of transactions Bank Account1,7 In MM 626BnTotal Payroll Loan Market 552Bn ~200Bn ~77Bn Total FGTS Deposits Total Addressable Portfolio Total FGTS Anticip. Market Total Credit Card Market 20BnTotal Home Equity PF Market 11.4BnTotal Pix Market 194MMTotal Bank Accounts 14.2% 27.7MM Market Share 7.8% 0.9BnMetric Transaction-Based Credit-Based 576Bn ~64% Primary Banking Relationship Marketshare In %

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 1. CEO Overview 2. Business Updates 3.Financial Performance • Credit Portfolio • Asset Quality • Funding • Revenues • Expenses • Bottom line AGENDA Main topics

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 28% 26% 21% 19% 20% 19% 20% 20% 19% 20% 24% 14% 8% 6% 7% 7% 7% 7% 7% 7% 21% 19% 20% 20% 17% 20% 20% 20% 18% 17%3% 6% 3% 4% 5% 6% 6% 10% 18% 17% 14% 12% 14% 12% 12% 12% 12% 2% 4% 3% 2% 3% 3% 3% 3% 2% 16% 22% 27% 28% 30% 29% 29% 29% 31% 30% 17,2 22,7 29,8 22,7 23,8 25,1 27,0 29,8 2% 8% 4% 6% 5% 5% 4% 4% 4,8 8,8 17,5 24,5 31,0 24,0 25,1 26,5 28,3 31,0 0 .0 5 .0 10 .0 15 .0 2 0. 0 2 5. 0 3 0. 0 3 5. 0 2019 2020 2021 2022 2023 4Q22 1Q23 2Q23 3Q23 4Q23 Accelerating loan growth while maintaining focus on higher ROE products Note 1: Including hedge accounting results from each loan portfolio, as of note 27 of IFRS Financial Statements in line “Future and Swaps”. Note 3: Home Equity includes both business and individuals’ portfolio. +4% +14% +8% +36% +38% +26% +190% -33% % YoY % QoQ Real Estate Personal SMBs Agribusiness Credit Card Total FGTS Anticip. of CC Receiv. +31% Total Excl. Ant. of CC Receiv. Real Estate1 Personal + FGTS1 SMBs Credit Cards Annualized Implied Rates In % All-in Loan Rate -3% +12% +3% +15% +9% +10% +19% +2% +10% +42% Home Equity2+12% 12% 13% 12% 18% 12% 17%15% 20% 59% 69% 0 .0 % 10 .0 % 2 0. 0% 3 0. 0% 4 0. 0% 5 0. 0% 6 0. 0% 7 0. 0% 8 0. 0% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 +5% +10% +7% 20 +5% Gross Loan Portfolio In R$ Billion

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 ROE-driven loan portfolio growth 4Q23 Gross Loan Portfolio Growth and Balance In % YoY and in R$ Billion• Strong growth in FGTS and Home Equity, higher ROE products • Reacceleration of Credit Card loans as new collection strategies and limit allocation evolves Total Loan Portfolio Growth 31% R$ 1.9 Bn 190% R$ 5.2 Bn 8% Yo Y G ro w th Portfolio Size // 36% R$ 6.3 Bn Real Estate2 30% to 40% Payroll3 50% to 75% R$ 9.5 Bn 38% Credit Card 75% R$ 3.9 Bn 14% SMBs 80% FGTS 50% 42% R$ 2.3 Bn Home Equity1 30%RWA Weight Loan 21

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 3 4 5 6 7 8 9 10 11 12 3.4% 3.8% 3.8% 4.1% 4.4% 4.7% 4.7% 4.6% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 4.5% 4.5% 4.3% 4.1% 4.3% 4.2% 4.3% 4.0% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 NPL > 90 days1 In % NPL 15 to 90 days1 In % Note 1: Considering Gross Loan Portfolio, which includes anticipation of C.C. receivables. Note 2: Cohorts defined as the first date when the client has his limit available. NPL per cohort = NPL > 90 days balance of the cohort divided by total credit card portfolio of the same cohort. Note 3: NPL formation is calculated considering: (overdue balance higher than 90 days in the current quarter – overdue balance higher than 90 days in the previous quarter + write-off change in the current quarter) ÷ Credit Portfolio Balance in the previous quarter. Stage 3 Formation = ( Δ Stage 3 Balance + Write-Offs of the period ) ÷ Total Credit Balance of previous period. From 1Q23 onwards IFRS and BACEN GAAP write-off methodology converged. Credit Cards NPL > 90 days per cohort2 In % 1.0% 1.1% 1.3% 1.5% 1.5% 1.6% 1.6% 1.5% 1.0% 1.1% 1.3% 1.5% 1.5% 1.6% 1.6% 1.5% 0 .6 % 0 .8 % 1. 0% 1. 2% 1. 4% 1. 6% 1. 8% 2 .0 % 2 .2 % 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 NPL Formation Stage 3 Formation NPL and Stage 3 Formation3 In % All asset quality metrics presenting positive trends • Improving delinquency across metrics • New cohorts of credit cards continue to perform strongly Months of relationship 3Q23 4Q21 22

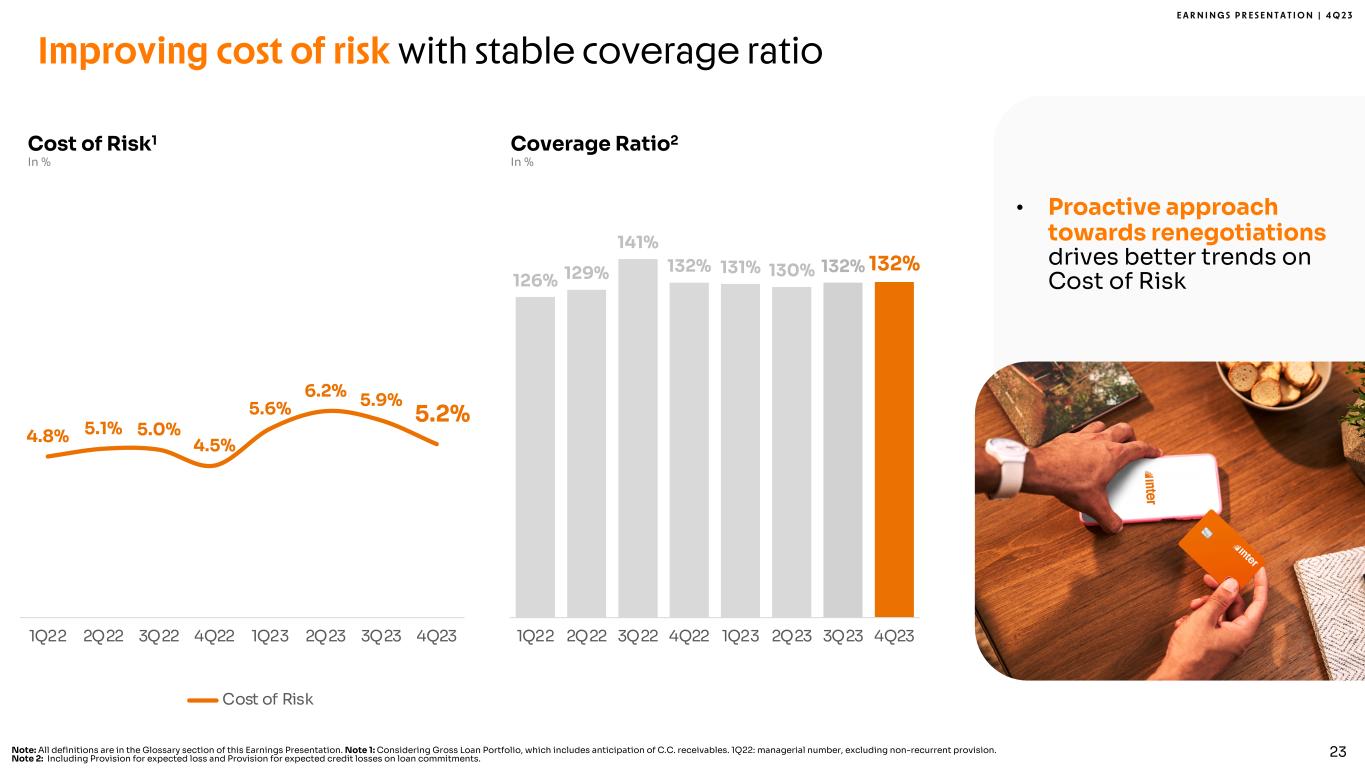

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Coverage Ratio2 In % 4.8% 5.1% 5.0% 4.5% 5.6% 6.2% 5.9% 5.2% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Cost of Risk 126% 129% 141% 132% 131% 130% 132% 132% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Cost of Risk1 In % Note: All definitions are in the Glossary section of this Earnings Presentation. Note 1: Considering Gross Loan Portfolio, which includes anticipation of C.C. receivables. 1Q22: managerial number, excluding non-recurrent provision. Note 2: Including Provision for expected loss and Provision for expected credit losses on loan commitments. Improving cost of risk with stable coverage ratio • Proactive approach towards renegotiations drives better trends on Cost of Risk 23

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 30%, 2.1 47% 6.7 43% 9.9 36% 11.6 33% 14.4 33% 11.0 33% 11.7 31% 12.3 33% 14.4 32%, 2.3 33% 4.8 30% 6.9 32% 10.5 38% 16.3 35% 11.7 36% 13.0 38% 15.1 38% 16.3 25%; 1.7 12%; 1.7 16%, 3.6 19% 6.2 19% 8.1 20% 6.6 20% 7.0 19% 7.5 19% 8.1 13%; 0.9 8%; 1.1 11%; 2.6 13%; 4.2 11%; 4.7 13%; 4.2 11%; 3.9 12%, 4.7 11%, 4.7 7,0 14,3 23,0 32,5 43,5 33,5 35,7 39,6 43,5 2019 2020 2021 2022 2023 1Q23 2Q23 3Q23 4Q23 Leading funding franchise in Brazil Time Deposits2 Securities Issued Other1 Note 1: Includes saving deposits, creditors by resources to release and liabilities with financial institutions (securities sold under agreements to repurchase, interbank deposits and borrowing and onlending). Note 2: Excluding Conta com Pontos balance. Note 3: Includes Conta com Pontos correspondent balance and demand deposits. Transactional Deposits3 Total +11% % YoY % QoQ -1% +31% +8% +55% +8% +24% +17% +34% +10% Funding In R$ Billion• >14.8 million clients trusting Inter with their deposits • R$ 2 thousand of deposits per active client 24

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Low cost of funding continues to be strong competitive advantage Avg. CDI of Quarter All-in Cost of Funding All-in Cost of Funding % of CDI 10.3% 12.4% 13.5% 13.7% 13.7% 13.7% 13.3% 12.2% 5.6% 7.1% 7.9% 7.5% 8.1% 8.0% 8.2% 7.2% 54.9% 57.3% 59.0% 54.8% 59.7% 58.6% 61.7% 59.2% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 • Approximately 1p.p. improvement in funding cost • Transactional Deposits and lowering CDI rates boosting performance 25 All-in Cost of Funding In %, Annualized

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 70% 65% 74% 75% 65% 64% 65% 67% 69% 70% 65% 67%30% 35% 26% 25% 35% 36% 35% 33% 31% 30% 35% 33% 417 467 607 731 834 877 850 1,002 1,024 1,150 1,265 1,313 544 636 837 1,100 1,281 1,461 1,540 1,704 1,800 1,939 2,143 2,197 0 5 0 10 0 0 15 0 0 2 0 0 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Net Interest Income Net Fee Revenue Total Net Revenue Total Gross Revenue 67% 69% 70% 65% 67% 33% 31% 30% 35% 33%1.0 1.0 1.2 1.3 1.3 1.7 1.8 1.9 2.1 2.2 - 0 .5 1 .0 1 .5 2 .0 2 .5 4Q22 1Q23 2Q23 3Q23 4Q23 % YoY +29% +30% +31% +34% % QoQ +2% +7% +4% -2% Record revenues driven by NII growth • NII growth led by real estate and personal credit products • Stable fee revenue following strongest growth in prior quarter 26 82% 71% 72% 66% 68% 18% 29% 28% 34% 32% 0.7 1.0 2.2 3.6 4.8 1.3 3.1 6.0 8.1 - 1 .0 0 2 .0 0 3 .0 0 4 .0 0 5 .0 0 6 .0 0 7 .0 0 8 .0 0 9 .0 0 2019 2020 2021 2022 2023 +37% +26% Revenue In R$ Million % YoY +25% +33%

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Strong unit economics metrics showcasing the power of our business model ARPAC and CTS Evolution In R$, Monthly 16.1 16.6 12.8 13.5 14.9 17.1 17.9 17.7 28.1 31.6 30.1 29.7 32.1 33.6 35.0 33.4 45.6 47.3 45.9 46.9 45.9 46.1 47.7 45.9 33.6 32.2 28.6 30.6 28.8 29.6 30.5 30.2 17.5 15.7 15.8 17.1 13.8 12.5 12.7 12.5 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Cost-to-serve Margin per Active Client (Net of Interest Expenses) Margin per Active Client (Gross of Interest Expenses) Net ARPAC Gross ARPAC • Strong ARPAC with decreasing CTS • Second highest margin per active client Note: All definitions are in the Glossary section of this Earnings Presentation. Note 1: Including interns. 27 3.1 3.5 4.2 4.7 4.9 1.0 1.5 2. 0 2. 5 3. 0 3. 5 4. 0 4. 5 5. 0 5. 5 4Q22 1Q23 2Q23 3Q23 4Q23 Active Clients per Employee In Thousand +59% YoY

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Expanding risk-adjusted NIM as consequence of ROE-driven underwriting • Second highest risk- adjusted NIM since 2021 28 2.9% 3.9% 3.4% 4.4% 3.8% 4.1% 3.9% 4.3% 3.4% 4.6% 3.9% 5.1% 4.4% 4.8% 4.6% 5.0% 2. 0% 2. 5% 3. 0% 3. 5% 4. 0% 4. 5% 5. 0% 5. 5% 6. 0% 6. 5% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Risk-Adjusted NIM In % Risk-Adjusted1 NIM 2.0 Risk-Adjusted1 NIM 1.0 Note 1: Excluding Impairment losses on financial assets for Net Interest Margin. See glossary for full definition.

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 % YoY -8% -10% +1% -23% % QoQ +2% +2% -5% +39% Data processing5 Advertising & marketing Other3 M&A2 Impressive results on expenses, which continues to be a top priority in 2024 Total Expenses -3% +3% Expenses Excl. M&A & SBC -27% +1% D&A +10% +9% Personnel4 Share-based comp.2 Expenses Breakdown1 In R$ Million Strong opportunity to continue delivering operating leverage Note 1: IFRS Financial Statements lines: “Personnel expenses”, “Depreciation and Amortization”, “Administrative Expenses”. Note 2: Share-based and M&A Expenses are included in Personnel Expenses in the Income Statement. Note 3: Others = third party services; rent, condominium fee and property maintenance; provisions for contingencies and Financial System services. Note 4: Personnel Expenses excluding Share-based and M&A Expenses. Salaries and benefits (including Board). Note 5: Data processing and information technology. 178 209 200 190 180 40 20 21 22 30 56 38 41 41 41 189 156 170 191 207 171 157 127 151 154 634 579 559 594 613 43 6 10 8 8 8 10 6 11 6 685 596 575 614 628 - 50 5 0 15 0 2 50 3 50 4 50 5 50 6 50 7 50 4Q22 1Q23 2Q23 3Q23 4Q23 -80% -0% -31% -50% 29 696 746 138 94 164 160 639 724 660 588 2,298 2,313 32 33 2,392 2,379 0 5 0 10 0 0 15 0 0 2 0 0 2 50 0 3 0 0 2022 2023 % YoY -1% -11% +7% -32% -1% -2% +13% -46% +4%

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Powerful combination of revenue growth and expense control driving efficiency Revenue vs. Expenses In %, index in a 100 basis 114 119 115 137 140 158 172 179 100 89 89 95 108 96 91 98 100 99 117 120 163 117 127 143 150 86 80 87 89 88 80 83 84 7 0 10 0 13 0 16 0 19 0 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 88.3% 71.9% 68.3% 75.0% 73.4% 62.4% 53.4% 52.4%51.4% 21.5% 18.7% 21.2% 22.3% 25.7% 18.0% 17.3% 18.0% 18.1% 66.8% 53.2% 47.1% 52.7% 47.7% 44.3% 36.1% 34.4% 33.2% 10 % 2 0% 3 0% 4 0% 5 0% 6 0% 7 0% 8 0% 9 0% 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Efficiency Ratio In % Net revenue1 Personnel Expenses Personnel + Administrative Expenses Administrative Expenses Total Administrative Eff. Ratio Personnel Eff. Ratio Note 1: Net revenue = net revenue - tax expenses. Note 2: Excluding Impairment losses on financial assets for Net revenue. See glossary for full definition. • 4th consecutive quarter with Efficiency Ratio Improvement • Considering Net Revenue after Provisions, the gain in efficiency is even more clear Risk Adjusted Efficiency Ratio2 In % 103% 99% 85% 80% 75% 6 0% 7 0% 8 0% 9 0% 10 0 % 1 0 % 4Q22 1Q23 2Q23 3Q23 4Q23 30

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Fee revenue continues covering a significant percentage of SG&A base 125 165 159 183 290 316 295 327 313 348 447 437 320 391 387 603 558 557 592 685 596 575 614 628 39% 42% 41% 30% 52% 57% 50% 48% 52% 60% 73% 70% 5% 15% 25% 35% 45% 55% 65% 75% - 200 400 600 800 1,000 1,200 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 % YoY % QoQ +22 p.p. -3 p.p. +6% +2% +34% -2% • Increasing fee revenues while implementing cost control initiatives to improve profitability Note: All definitions are in the Glossary section of this Earnings Presentation. Net Fee Revenue ÷ SG&A SG&A Net Fee Revenue 31 Net Fee Revenue and SG&A Evolution In R$ Million and in %

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 (179) 440 -350 -250 -150 -50 50 150 250 350 450 550 (14) 352 -350 -250 -150 -50 50 150 250 350 450 550 2022 2023 Note 1: Adjusted Net Income for the third quarter of 2022 is presented for illustrative purposes only and does not reflect our actual results. ‘3Q22 Adjusted’ (non-IFRS measure) excludes the non-recurring effects of deflation in 3Q22 and assumes the inflation projected for 2023 from the Focus Report of Brazilian Central Bank, divided by four. The unadjusted figure for deflation was R$ (30). Earnings Before Tax, Net Income & ROE In R$ Million and in %, Inter&Co Pre-tax Income Net Income ROE 32 Stellar year in profitability with run rate net income +R$ 640 million -0.2% 4.9% -10.0% -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% (111) (100) 12 (70) (20) 6 80 145 208 -200 -100 0 100 200 300 400 (56) (29) 16 (30) 29 24 64 104 160 23 -150 -50 50 150 250 350 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 -2.6% -1.4% 0.8% -1.7% 1.6% 1.4% 3.6% 5.7% 8.5% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 160 x 4 = 640MM run rate net income

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Closing Remarks

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Record low Efficiency Ratio 51.4% Delivering Net Income R$160mm 30.4mm Growing Total Clients Year 1/5: Check! 2019 2020 2021 2022 2023 Inflection point Dilution of Expense Base Shifting ROE Loan Mix Continuous Improvement in Engagement Improving Asset Quality Lowering BR and US Interest Rates En do ge no us F ac to rs Ex og en ou s F ac to rs ROE Investing Phase Compounding Phase

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 35 Appendix

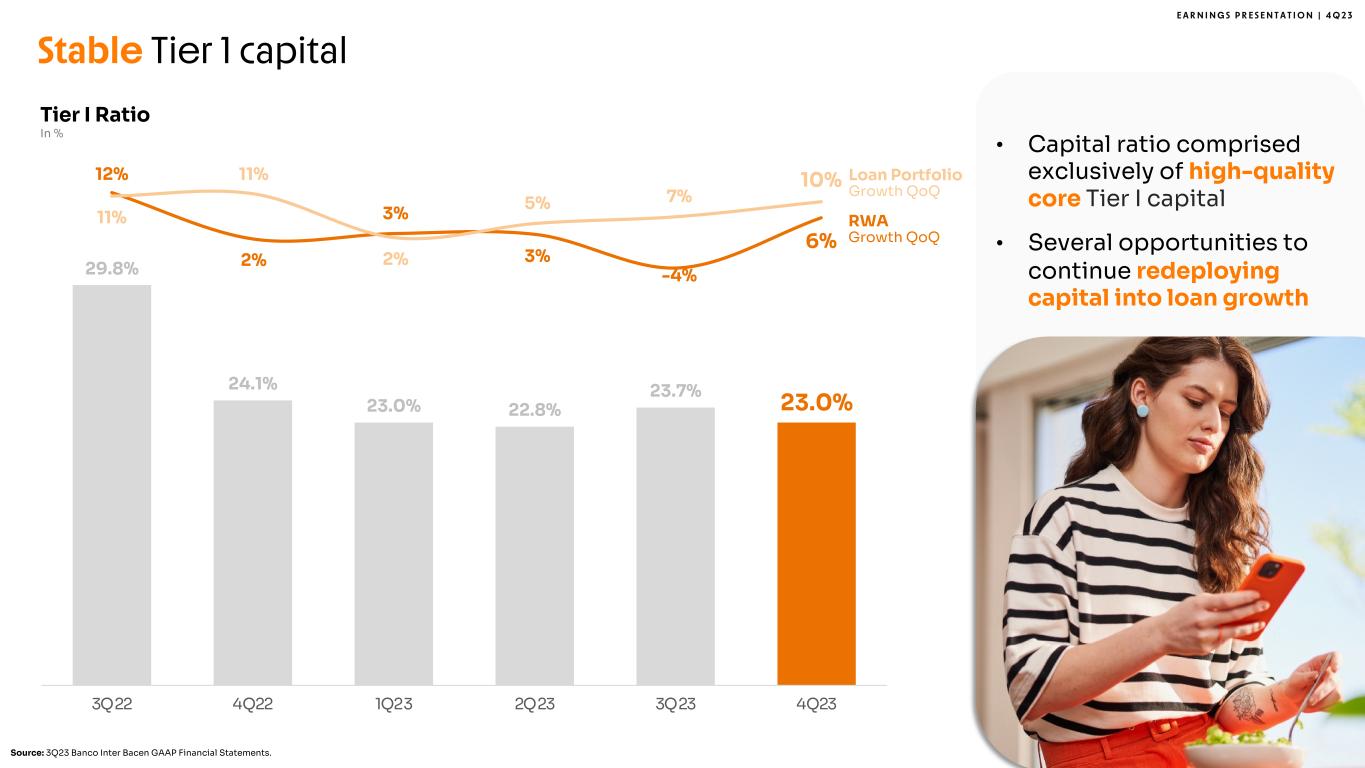

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Stable Tier 1 capital 29.8% 24.1% 23.0% 22.8% 23.7% 23.0% 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Tier I Ratio In % Source: 3Q23 Banco Inter Bacen GAAP Financial Statements. • Capital ratio comprised exclusively of high-quality core Tier I capital • Several opportunities to continue redeploying capital into loan growth 36 12% 2% 3% 3% -4% 6% 11% 11% 2% 5% 7% 10% -5% 0% 5% 10% 15% Loan Portfolio Growth QoQ RWA Growth QoQ

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Balance Sheet (In R$ Million) Income Statement (In R$ Million) 37 Variation % 4Q23 4Q22 ∆YoY Income Statement Interest income from loans 1,279 871 47% Interest expenses (752) (591) 27% Income from securities and derivatives 349 396 -12% Net interest income 876 675 30% Revenues from services and commissions 376 273 38% Expenses from services and commissions (36) (33) 8% Other revenues 97 87 12% Revenue 1,313 1,002 31% Impairment losses on financial assets (384) (265) 45% Net result of losses 928 737 26% Administrative expenses (365) (389) -6% Personnel expenses (221) (240) -8% Tax expenses (91) (69) 33% Depreciation and amortization (41) (56) -27% Income from equity interests in affiliates (1) (3) -58% Profit / (loss) before income tax 208 (20) N/M Income tax and social contribution (49) 49 N/M Profit / (loss) 160 29 454% 4Q23 4Q22 Variation % 12/31/2023 12/31/2022 ∆YoY Balance Sheet Assets Cash and cash equivalents 4,259 1,332 220% Amounts due from financial institutions 3,719 4,259 -13% Compulsory deposits 2,664 2,855 -7% Securities 16,868 12,449 36% Derivative financial instruments 4 - n/m Net loans and advances to customers 27,901 21,380 30% Non-current assets held-for-sale 174 167 4% Equity accounted investees 91 72 26% Property and equipment 168 188 -11% Intangible assets 1,345 1,239 9% Deferred tax assets 1,034 978 6% Other assets 2,125 1,426 49% Total assets 60,352 46,343 30% Liabilities Liabilities with financial institutions 9,522 7,907 20% Liabilities with clients 32,652 23,643 38% Securities issued 8,095 6,202 31% Derivative financial liabilities 15 38 -60% Other liabilities 2,471 1,464 69% Total Liabilities 52,755 39,254 34% Equity Total shareholder's equity of controlling shareholders 7,472 6,992 7% Non-controlling interest 125 97 29% Total shareholder's equity 7,597 7,089 7% Total liabilities and shareholder's equity 60,352 46,343 30%

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 Non-IFRS measures and KPIs 38 Activation Rate: Number of active clients at the end of the quarter Total number of clients at the end of the quarter Active clients: We define an active client as a customer at any given date that was the source of any amount of revenue for us in the preceding three months, or/and a customer that used products in the preceding three months. For Inter insurance, we calculate the number of active clients for our insurance brokerage vertical as the number of beneficiaries of insurance policies effective as of a particular date. For Inter Invest, we calculate the number of active clients as the number of individual accounts that have invested on our platform over the applicable period. Active clients per employee: Number of active clients at the end of the quarter Total number of employees at the end of the quarter, including interns Administrative efficiency ratio: Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Annualized interest rates: Yearly rate calculated by multiplying the quarterly interest by four, over the average portfolio of the last two quarters. All-in loans rate considers Real Estate, Personnal +FGTS, SMBs, Credit Card, excluding non-interest earnings credit card receivables, and Anticipation of Credit Card Receivables. Anticipation of credit card receivables: Disclosed in note 9.a of the Financial Statements, line " "Loans to financial institutions”. ARPAC gross of interest expenses: (Interest income + (Revenue from services and comissions − Cashback − Inter rewards) + Income from securities and derivarives + Other revenue) ÷ 3 Average of the last 2 quarters Active Clients ARPAC net of interest expenses: (Revenue − Interest expenses) ÷ 3 Average of the last 2 quarters Active Clients ARPAC per quarterly cohort: Total Gross revenue net of interest expenses in a given cohort divided by the average number of active clients in the current and previous periods1. Cohort is defined as the period in which the client started his relationship with Inter. 1 - Average number of active clients in the current and previous periods: For the first period, is used the total number of active clients in the end of the period. Assets under custody (AuC): We calculate assets under custody, or AUC, at a given date as the market value of all retail clients’ assets invested through our investment platform as of that same date. We believe that AUC, as it reflects the total volume of assets invested in our investment platform without accounting for our operational efficiency, provides us useful insight on the appeal of our platform. We use this metric to monitor the size of our investment platform. Card fee revenue: It is part of the “Revenue from services and commission” and “Other revenue” on IFRS Income Statement. Client acquisition cost (CAC): The average cost to add a client to the platform, considering operating expenses for opening an account, such as onboarding personnel, embossing and sending cards and digital marketing expenses with a focus on client acquisition, divided by the number of accounts opened in the quarter.

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 39 Card+PIX TPV: PIX, debit and credit cards and withdrawal transacted volumes of a given period. PIX is a Central Bank of Brazil solution to bring instant payments among banks and financial institutions in Brazil. Card+PIX TPV per active client: Card+PIX TPV for a given period divided by the number of active clients as of the last day of the period. Cost of funding: Interest expenses × 4 Average of last 2 quarters Interest bearing liabilities (demand deposits, time deposits, savings deposits, creditors by resources to release, securities issued, securities sold under agreements to repurchase, interbank deposits and others) Cost of risk: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers Cost of risk excluding anticipation of credit card receivables: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding anticipation of credit card receivables Cost of risk excluding credit card: Impairment losses on Minancial assets × 4 Average of last 2 quarters of Loans and advances to customers excluding credit card Cost-to-serve (CTS): Personnel Expense + Administrative Expenses − Total CAC ÷ 3 Average of the last 2 quarters Active Clients Coverage ratio: Provision for expected credit loss Overdue higher than 90 days Earning portfolio (IEP): Earnings Portfolio includes “Amounts due from financial institutions” + “Loans and advances to customers” + “Securities” + “Derivatives” from the IFRS Balance Sheet Efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Fee revenue ratio: Net result from services and commissions + Other revenue Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Funding: Demand Deposits + Time Deposits + Securities Issued + Savings Deposits + Creditors by Resources to Release + Securities sold under agreements to repurchase + Interbank deposits + Borrowing and onlending Global Services Clients: Includes Brazilian Global Account clients, US clients and international investors. Non-IFRS measures and KPIs

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 40 Gross loan portfolio: Loans and Advance to Customers + Loans to financial institutions Gross merchandise volume (GMV): Gross merchandise value, or GMV, for a given period as the total value of all sales made or initiated through our Inter Shop & Commerce Plus platform managed by Inter Shop & Commerce Plus. Gross take rate: Inter Shop gross revenue GMV Margin per active client gross of interest expenses: ARPAC gross of interest expenses – Cost to Serve Margin per active client net of interest expenses: ARPAC net of interest expenses – Cost to Serve Net fee income: Net result from services and commissions + Other Revenue Net interest income: Interest Income + Interest Expenses + Income from securities and derivatives Net revenue: Net interest income + Net result from services and commissions + Other revenue Net take rate: Inter Shop net revenue GMV NIM 1.0 – IEP – Credit Card Transactional Portfolio: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) – Credit card transactor portfolio NIM 2.0 – IEP Only: Net interest income x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) NPL 15 to 90 days: Overdue 15 to 90 days Loans and Advance to Costumers + Loans to Minancial institutions NPL > 90 days: Overdue higher than 90 days Loans and Advance to Costumers + Loans to Minancial institutions NPL formation: Overdue balance higher than 90 days in the current quarter – Overdue balance higher than 90 days inthe previous quarter + Write − off change in the current quarter Total loans and advance to customers in the previous quarter Non-IFRS measures and KPIs

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3 41 Risk-Adjusted NIM 2.0: Net interest income − Impairment losses on Minancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) SG&A: Administrative Expenses + Personnel Expenses + Depreciation and Amortization Stage 3 formation: Stage 3 balance in the current quarter – Stage 3 balance in the previous quarter +Write − off change in the current quarter Total loans and advance to customers in the previous quarter Tier I ratio: Tier I referential equity Risk weighted assets Total gross revenue: Interest income + Revenue from services and commissions − Cashback expenses − Inter rewards + Income from securities and derivatives + Other revenue Non-IFRS measures and KPIs Personal efficiency ratio: Personnel expense Net Interest Income + Net result from services and comissions + Other revenue − Tax expense Primary Banking Relationship: A client who has 50% or more of their income after tax for that period flowing to their bank account with us during the month. Return on average equity (ROE): (ProMit / (loss) for the quarter)× 4 Average of last 2 quarters of total shareholder`s equity Risk-adjusted efficiency ratio: Personnel expense + Administrative expenses + Depreciation and amortization Net Interest Income + Net result from services and comissions + Other revenue − Tax expense − Impairment losses on Minancial assets Risk-adjusted NIM 1.0 Net interest income − Impairment losses on Minancial assets x 4 Average of 2 Last Quarters Earning Portfolio (Loans to Minancial institutions + Securities + Derivatives + Net loans and advances to customers) – Credit card transactor portfolio

E A R N I N G S P R E S E N T A T I O N | 4 Q 2 3

SIGNATURE Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. INTER & Co, INC. By: /s/ Santiago Horacio Stel Name: Santiago Horacio Stel Title: Senior Vice President of Finance and Risks Date: February 07, 2024