Filed pursuant to Rule 424(b)(2)

Registration Statement No. 333-276528

PROSPECTUS SUPPLEMENT

(To Prospectus dated January 16, 2024)

INTER & CO, INC.

(incorporated in the Cayman Islands)

32,000,000 Class A Common Shares

This is a public offering of Class A common shares of Inter & Co, Inc., or Inter. We are offering all of the Class A common shares to be sold in this offering.

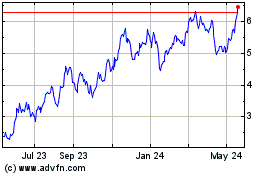

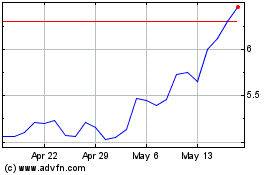

Our Class A common shares are listed on the Nasdaq Global Select Market under the symbol “INTR.” On January 17, 2024, the last reported sale price of our Class A common shares on the Nasdaq Global Select Market was US$4.54.

We have two classes of common shares: our Class A common shares and our Class B common shares. The rights of the holders of Class A common shares and Class B common shares are identical, except with respect to voting, conversion, and transfer restrictions applicable to the Class B common shares. Each Class A common share is entitled to one vote. Each Class B common share is entitled to 10 votes and is convertible into one Class A common share automatically upon transfer, subject to certain exceptions. Holders of Class A common shares and Class B common shares vote together as a single class on all matters unless otherwise required by law. Following this offering, our issued and outstanding Class B common shares will represent approximately 79% of the combined voting power of our outstanding common shares, assuming no exercise of the underwriters’ option to purchase additional shares. Our Class A common shares also trade in Brazil in the form of Brazilian Depositary Receipts, or BDRs. We are not offering BDRs in this offering.

Investing in our Class A common shares involves risks. See “Risk Factors” beginning on page S-32 of this prospectus supplement. | | | | | | | | | | | | | | |

| | Per Common Share | | Total |

Public offering price (1) | | US$ | 4.4000 | | | US$ | 140,800,000 | |

Underwriting discounts, fees and commissions paid by us (1)(2) | | US$ | 0.0880 | | | US$ | 2,816,000 | |

Proceeds, before expenses, to us (1) | | US$ | 4.3120 | | | US$ | 137,984,000 | |

__________________

(1)Assumes no exercise of the underwriters’ option to purchase additional Class A common shares.

(2)See “Underwriting” for a description of all compensation payable to the underwriters.

The underwriters have the option, exercisable in whole or in part, to purchase up to an additional 4,800,000 Class A common shares from us for 30 days after the date of this prospectus supplement. See “Underwriting—Option to Purchase Additional Class A Common Shares.”

Neither the Securities and Exchange Commission, or the SEC, nor any state securities commission has approved or disapproved these securities or determined if this prospectus supplement or the prospectus to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the Class A common shares against payment in New York, New York on or about January 22, 2024.

| | | | | | | | |

| Global Coordinators | |

| Goldman Sachs & Co. LLC | | BofA Securities, Inc. |

The date of this prospectus supplement is January 17, 2024

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement has been prepared by us solely for use in connection with the proposed offering of Class A common shares in the United States and elsewhere outside Brazil. Goldman Sachs & Co. LLC and BofA Securities, Inc. will collectively act as underwriters in this offering.

This offering has not been and will not be registered under any Brazilian securities law. Accordingly, our Class A common shares and the offering have not been and will not be registered with the Comissão de Valores Mobiliários. We are not offering BDRs in this offering.

We are responsible for the information contained and incorporated by reference in this prospectus supplement and in any related free-writing prospectus we prepare or authorize. Neither we nor the underwriters, nor any of their respective agents, have authorized anyone to provide any information other than that contained in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or to which we may have referred you. We, the underwriters and their respective agents take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. Neither we nor the underwriters have authorized any other person to provide you with different or additional information. Neither we or the underwriters, nor their respective agents, are making an offer to sell the Class A common shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in or incorporated by reference in this prospectus supplement, the accompanying prospectus or any free writing prospectus prepared by us is accurate only as of their respective dates or on the date or dates which are specified in such documents (except as otherwise indicated), and that any information in documents that we have incorporated by reference is accurate only as of the date of such document incorporated by reference, regardless of the time of delivery of this prospectus supplement or any sale of the Class A common shares. Our business, financial condition, results of operations, cash flows and prospects may have changed since those dates.

This document is divided in two parts. The first part is this prospectus supplement, which describes the terms of this offering of Class A common shares and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus dated January 16, 2024, including the documents incorporated by reference therein, provides more general information. Generally, when we refer to this prospectus supplement, we are referring to both parts of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or in any document incorporated by reference that was filed with the Securities and Exchange Commission, or SEC, before the date of this prospectus supplement, on the other hand, you should rely on the information in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having a later date (for example, a document incorporated by reference in this prospectus supplement) the statement in the document having the later date modifies or supersedes the earlier statement.

The offering is made in the United States and elsewhere solely on the basis of the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. Investors should take this into account when making investment decisions.

For investors outside the United States: Neither we nor the underwriters have done anything that would permit this offering or possession or distribution of this prospectus supplement or the accompanying prospectus in any jurisdiction, other than the United States, where action for that purpose is required. Persons outside the United States who come into possession of this prospectus supplement or the accompanying prospectus must inform themselves about, and observe any restrictions relating to, the offering of the Class A common shares and the distribution of this prospectus supplement or the accompanying prospectus outside the United States and in their jurisdiction.

Certain amounts and percentages included in or incorporated by reference in this prospectus supplement have been rounded for ease of presentation. Percentage figures included in this prospectus supplement have not been calculated in all cases on the basis of the rounded figures but on the basis of the original amounts prior to rounding.

For this reason, certain percentage amounts in this prospectus supplement may vary from those obtained by performing the same calculations using the figures in our audited consolidated financial statements and our unaudited condensed consolidated interim financial statements as of and for the three and nine-month periods ended September 30, 2023 and 2022. Some of the percentages and other amounts included in this prospectus supplement were rounded for ease of presentation. For this reason, certain of the totals in the tables presented may not be the exact sum total of the amounts that precede them.

We have translated some of the real amounts included in this prospectus supplement into U.S. dollars. You should not construe these translations as representations by us that the amounts actually represent these U.S. dollar amounts or could be converted into U.S. dollars at the rates indicated.

Contacting Inter

For further information on the collection, use, disclosure, transfer or processing of your personal data or the exercise of any of the rights listed above, please contact our investor relations office at ir@inter.co.

The following references in this prospectus supplement have the meanings shown below:

•“Inter” or the “Company,” “we,” “our,” “ours,” “us” or similar terms refer to Inter & Co, Inc., together with its consolidated subsidiaries.

•The “underwriters” means Goldman Sachs & Co. LLC and BofA Securities, Inc. who will together act as the underwriters of this offering.

The term “Brazil” refers to the Federative Republic of Brazil and the phrase “Brazilian government” refers to the federal government of Brazil. “Central Bank” refers to Banco Central do Brasil. References in the prospectus supplement to “real,” “reais” or “R$” refer to the Brazilian real, the official currency of Brazil and references to “U.S. dollar,” “U.S. dollars” or “US$” refer to U.S. dollars, the official currency of the United States.

INCORPORATION OF DOCUMENTS BY REFERENCE

The SEC allows us to “incorporate by reference” the information we file with it into this prospectus supplement. This means that we can disclose important information to you by referring you to another document filed separately with the SEC. The information incorporated by reference is considered to be a part of this prospectus supplement, except for any information superseded by information that is included directly in this document or incorporated by reference subsequent to the date of this document. You should read the information incorporated by reference because it is an important part of this prospectus supplement.

We incorporate by reference into this prospectus supplement our annual report on Form 20-F for the fiscal year ended December 31, 2022, filed with the SEC on April 28, 2023, and any amendments thereto, if any (the “2022 Form 20-F”). We incorporate by reference into this prospectus supplement the following current reports on Form 6-K:

•Our current report on Form 6-K furnished to the SEC on January 16, 2024 (File No. 001-41419; Accession No. 0001628280-24-001376), containing our unaudited condensed consolidated interim financial statements as of and for the three and nine-month periods ended September 30, 2023 and 2022. •Our current report on Form 6-K furnished to the SEC on January 16, 2024 (File No. 001-41419; Accession No. 0001628280-24-001370), containing (i) a discussion of our results of operations for the nine-month period ended September 30, 2023 and 2022 and (ii) other information relating to recent developments (or the “Disclosure 6-K”). We may also incorporate by reference any Form 6-K that we submit to the SEC after the date of this prospectus supplement and prior to the termination of this offering by identifying in such Form 6-K that it is being incorporated by reference into this prospectus supplement. Unless expressly incorporated by reference, nothing in this prospectus supplement shall be deemed to incorporate by reference information furnished to, but not filed with, the SEC.

Any statement contained in any document incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus supplement modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus supplement.

All of the documents that are incorporated by reference are available at the website maintained by the SEC at http://www.sec.gov. The information contained on, or accessible through, such website is not incorporated by reference into this prospectus supplement. In addition, we will provide at no cost to each person, including any beneficial owner, to whom this prospectus supplement has been delivered, upon the written or oral request of any such person to us, a copy of any or all of the documents referred to above that have been or may be incorporated into this prospectus by reference, including exhibits to such documents. Requests for such copies should be directed to: Avenida Barbacena, No. 1.219, 22nd floor, Belo Horizonte, State of Minas Gerais, 30190-131, Brazil, phone: +55 (31) 2138-7974, email: ir@inter.co.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights information contained elsewhere in or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary may not contain all the information that may be important to you and we urge you to read this entire prospectus supplement, the accompanying prospectus and the documents incorporated by reference therein carefully, including the section “Risk Factors— Certain Risks Related to Our Business” in the 2022 Form 20-F, incorporated by reference in this prospectus supplement; our audited consolidated financial statements and our unaudited condensed consolidated interim financial statements as of September 30, 2023 and for the three and nine-month period ended September 30, 2023 and 2022, before deciding to invest in our Class A common shares. Additionally, acronyms used repeatedly, defined and technical terms, specific market expressions and the full names of our main subsidiaries and other entities referenced in this prospectus are explained or detailed in our 2022 Form 20-F and in our Disclosure 6-K.

Overview

Our mission is to empower people to manage their finances and daily activities, through a simple and seamlessly integrated digital experience. We aim to bring the breadth of possibilities of the offline world to the palm of our client’s hands, with the convenience and scalability of our digital native super app, or Super App.

As we began our journey as a digital bank, we were attracted to a market that we believed was ripe for disruption given the lack of focus on what truly mattered: the client. Therefore, we positioned Inter at the INTERsection of technology and banking, leveraging what we believe is the best of both worlds: the agility and innovation of a Fintech with the credibility, funding potential and expertise of a traditional bank.

Banking disruptors globally have begun their journeys starting from different edges of the addressable market, with convergence taking place subsequently. We believe this is the case in Latin America, where different players emerged to challenge incumbent financial institutions in a wide range of core competencies, including payments, secured loans, unsecured consumer credit and investments.

In the case of Inter, our initial value proposition was our free digital bank account, seeking to democratize access to financial services. Since then, we have evolved to become a relevant player within the Brazilian banking system.

As of September 30, 2023, we had a total of R$29,064.0 million in liabilities with customers, mostly comprised by time and demand deposits, and R$39,571.6 million in Funding from what we believe is a highly diversified portfolio from approximately 15.5 million active clients. During the third quarter of 2023, the accumulated interbank deposit rate (the CDI) in Brazil was 13.3%. In comparison, our Cost of Funding for the third quarter of 2023 was 8.2%, or 61.7% of the the CDI accumulated during the same period. Based on data from the Central Bank, we estimate that during the same period the average cost of funding of incumbent and digital banks in Brazil was between 76% and 100% of CDI, respectively. We believe this cost advantage is due to our higher concentration of deposits. As of September 30, 2023, liabilities with customers and interbank deposits represented 76.9% of our Funding. Based on data from the Central Bank, we estimate that as of that same date incumbent and digital banks in Brazil had an average of 54% and 53%, respectively.

We believe that consumers seek a unique and digital experience to manage the complex activities in their daily lives, from paying bills in a fully digital format to buying daily essentials through an integrated e-commerce solution. To satisfy these clients, we built our Super App, which we believe is one of the most comprehensive mobile applications globally in terms of breadth of services.

We allow clients to capitalize on the full extent of our technology to solve many of their daily financial and non-financial needs across one single Super App, which include the following business verticals:

•Inter Banking & Spending – a fully digital account that allows clients to pay bills, spend on and offline, and transfer funds, among many other features.

•Inter Credit – lending solutions that enable clients to fund their life ambitions.

•Inter Shop & Commerce Plus – our marketplace solutions for clients to efficiently purchase goods and an ever-growing set of on-demand services to address our clients’ daily activities.

•Inter Invest – an open marketplace for investment products that empower clients to invest for their future.

•Inter Insurance – insurance brokerage services that enable our clients to protect all the important assets and aspects of their lives.

•Global – solution for Brazilian clients who are traveling abroad and for Brazilian residing in the US. This category of products brings many of our core financial and commerce ecosystems to a global experience.

•Loyalty – our reward program, which drives retention and activation in all verticals listed above, offering multiple opportunities for clients to earn and use points inside our SuperApp.

We strive to deliver this ever-growing immersive digital experience to our clients through a winning formula that is based on four key “pillars”:

(a)Full Bank Depository Capabilities – We have a fully licensed bank inside of Inter&Co (Banco Inter S.A.), which enables us to take free demand deposits and operate more efficiently.

(b)Consistent Culture of Innovation – Across our organization, we have cultivated an “Orange Blood” culture that sparks creativity among all Inter’s employees.

(c)Technology Platform – We have developed a technology platform that enables us to combine banking and commerce ecosystems in a single Super App, launch new products faster, constantly enhance existing capabilities, operate more efficiently, and reduce operating costs.

(d)Proprietary Data & Analytics – We have data capabilities that enable us to learn more about our clients and offer tailored solutions, personalized client service and underwrite more efficiently.

Inter’s business and growth is driven by our self-fulfilling flywheel:

We believe that our brand drives strong organic client acquisition and low client acquisition costs. In the first nine-months of 2023, we continued to attract new clients at an average of 1 million new active clients per quarter, the highest rate of organic growth in our history (that is, not including when we acquired Inter Payments in the first quarter of 2022). Powered by awareness and referrals, we strive to keep our client acquisition costs at below industry-average levels. In the third quarter of 2023, we decreased our client acquisition cost by 8% compared to the third quarter of 2022.

Note: Client acquisition cost, or CAC, represents our managerial estimate of the average cost of adding a new client to our platform, considering operating expenses for opening an account, such as onboarding personnel, embossing and sending cards, and digital marketing expenses with a focus on client acquisition, divided by the number of accounts opened in the quarter. We use CAC to monitor our costs and ability to efficiently grow our number of clients.

With each new client, we capture behavioral and transaction data which we leverage to enhance activation, up-sell and cross-sell, and inform clients about the breadth of our product range, resulting in more engagement. As engagement increases, we generate more data which we use to tailor and improve the client experience. This better client experience results in more word-of-mouth referrals, helping to drive product awareness and strengthen our brand.

Our Products and Solutions

We believe that we offer one of the most complete set of products and solutions in Brazil. We have developed what we believe to be a complete banking ecosystem, and, when considering to launch a new product, we conduct a thorough analysis to estimate our marginal expected return in relation to our expected research and development investment. We have designed our product strategy with the purpose to deepen client relationships, improve unit economics, and strengthen our market position by creating:

•High Value Products – to generate more revenue per active client,

•High Volume Products – to generate more engagement per active client, and

•High Variety of Products – to capture more wallet share per active client.

We believe that our digital-native, client-centric culture allowed us to deliver a highly differentiated user experience to our over 15 million active clients as of September 30, 2023. Also, we have developed a truly global payments platform combining a fully digital backbone integrated with other payments platforms.

Sources: Central Bank, Caixa Economica Federal, ABECIP and internal data. Note: All figures as of September 2023. Note 1: Total Addressable Portfolio for FGTS Loans (credit backed by the balance in the debtor’s Brazilian compulsory pension plan) considers that each consumer will agree to collateralize loans with an aggregate amount equivalent to five years of permitted withdrawals from their FGTS account. Note 2: Internal estimates. Note 3: Considers transactions within the Instant Payment System (SPI) only.

Our platform has already consolidated more than ten products with more than one million active customers across different verticals, such as PIX, FGTS-backed loans (loans collateralized by the balance in the debtor’s Brazilian compulsory pension plan), debit cards, cards insurance, and others. Besides demonstrating our range of revenue diversification, we believe this also demonstrates our capabilities to provide diversified product lines and engage clients effectively across them.

Additionally, we have been increasingly evolved in our ability to accelerate the adoption of our products by our clients. As shown in the chart below, we were able to reach 1 million active clients in six quarters for our most recent product launches: PIX and Inter Loop. We expect that faster and consistent client engagement as well as organic cross-selling will continue to boost our client lifetime value and our results.

Note 1: Scale reduced to fit graph, PIX had 12.1 million clients 12 quarters after its launch. Note 2: Products launched before the first quarter of 2019, first quarter included in the chart was the first quarter of 2019 to fit the chart.

We believe our focus on client engagement has shown some promising results. We have observed that our average revenue per active client, or ARPAC, tends to steadily increase among our client cohorts as the cohorts age. As our clients become more engaged with the Super App and start engaging with products with higher profit margins such as loans, investments and cards, the value they generate for us increases. We believe that our focus on client engagement and offering innovative products and services contributes to this trend.

Complete Banking

Banking is the foundation to build our client base and generate attractive low-cost funding. We help our clients to manage their money, providing a complete digital checking account where we can deliver a broad range of financial solutions through the Super App.

Integrated Commerce

In addition to helping clients better manage their money, we also help them use their money more effectively. Through the Super App, our clients can shop on-line in a wide variety of stores, as well as purchase a plane ticket and book hotels, for example.

When we bring the Inter Financial and Inter Commercial ecosystems of our business together, we believe that we can provide better value to our clients and produce an information advantage for our platform. We use this synergy to grow client engagement and increase our ability to monetize the relationships that we are building on the banking side of the business.

Global Capabilities

This is the newest initiative of our business. We are extending the value we have created in banking and commerce across borders. We are expanding our Super App into the United States and began to offer a global account to our Brazilian clients traveling to or living in the US. According to the Brazilian Foreign Ministry, in 2022 there were nearly 2 million Brazilians living in the US, and, according to the US National Travel and Tourism Office (NTTO), 1.6 million Brazilian tourists traveled to the US in 2023. These potential clients know us and are a clear fit for the products in our global vertical.

This simple strategy results in seven business verticals, offered in one single Super App: (i) Inter Banking & Spending; (ii) Inter Credit; (iii) Inter Shop & Commerce Plus; (iv) Inter Invest; (v) Inter Insurance; (vi) Global; and (vii) Loyalty.

Below we describe each of them in more detail:

Inter Banking & Spending

With our banking platform, we can deliver financial solutions through our digital checking account, where we provide access to a wide range of products, including bill payments, transfers, withdrawals, debit cards, instant payments (PIX), among others, for individuals and small businesses.

Additionally, with all the transactional data from increased client engagement, we learn more about their financial lives and leverage these insights to improve our products, our underwriting and our cross-selling of other business verticals such as Inter Shop & Commerce Plus, Inter Invest and Inter Insurance.

With respect to the PIX market, according to data from the Central Bank, there were 9.7 billion individual PIX transactions with a total volume of R$3.8 trillion in the third quarter of 2023. During this same period, we were involved in 761 million PIX transactions with a total volume of R$198 billion.

In the third quarter of 2023, 8.5 million different Inter credit and debit cards were used to make purchases or payments, a 23% increase compared to the corresponding quarter of 2022, while the Total Payment Volume (Cards + PIX TPV) keeps increasing among all client cohorts as illustrated in the graph below.

Cards + PIX TPV per Active Client

Note: Graph considers PIX, credit card and debit card transacted volume per client cohort.

As of September 30, 2023, roughly 64% of our active clients have their primary banking relationship with us. When we compare among cohorts, we can see an acceleration in the primary relationship trends, with our newer clients surpassing the 70% mark within their four quarters of commencing their relationship with us.

Inter Credit

We believe the strength of our primary digital banking client relationship generates a strong competitive advantage. It enables us to grow our Gross Loan Portfolio efficiently and optimize our underwriting through the wealth of data that our platform provides coupled with machine learning and AI.

This optimized underwriting process has also allowed us to maintain stable asset quality trends over 2023 despite a challenging macroeconomic scenario, with non-performing loans over 90 days (NPL > 90 days) roughly stable during 2023, at 4.7% as of September 30, 2023, compared to 4.1% as of December 31, 2022. On non-performing loans from 15 to 90 days (NPL 15 to 90 days) we presented a slightly better trend at 4.3% as of September 30, 2023, compared to 4.1% as of December 31, 2022.

We also believe we kept an adequate amount of provisions to cover our NPL>90 days. As of September 30, 2023 and December 31, 2022, our provisions for expected credit loss represented 132% of our NPL>90 days, what we call coverage ratio.

As of September 30, 2023, we had a total of 29.4 million clients. Our loans and advances to custumers divided by our number of clients as of that same date was R$921 and our Gross Loan Portfolio divided by our number of clients as of that same date was R$962. We believe these figures indicate that we still have significant potential to

expand our credit portfolio through our existing clients, given their underleveraged profile. For comparison, as of December 31, 2023, the Brazilian minimum wage was R$1,320 per month.

Note: Gross Loan Portfolio is a Non-GAAP financial measure calculated as the sum of loans and advances to customers and loans to financial institutions.See “Special Note Regarding Non-GAAP Financial Measures” in our Disclosure 6-K.

Our loan book has evolved over the past few years: We went from a regional bank offering only real estate and payroll loans to a fully diversified lender offering a broad suite of credit products across all of Brazil.

Our product lines within this business vertical include real estate, SMB, payroll and personal loans, and credit cards. Our gross loan portfolio has reached R$28.3 billion as of September 30, 2023, representing a 15.5% increase compared to December 31, 2022. We distribute our products digitally, in our Super App. We aim to help clients to borrow more efficiently and at a lower cost by leveraging their most valuable assets, including their salary, real estate, and retirement funds.

Some of our product highlights of 2023 were: (i) Home-equity loans, in which we currently have approximately a 5.6% market share of the Brazilian portfolio, based on data from the Brazilian Association of Real Estate Loans and Savings Companies (Associação Brasileira das Entidades de Crédito Imobiliário e Poupança - ABECIP) and is

a product which we believe has a high profit margin, and (ii) FGTS-backed loans (loans collateralized by the balance in the debtor’s Brazilian compulsory pension plan), which we have been originating exclusively through our Super App.

Note 1: Home Equity includes both business and individuals’ portfolio.

However, despite our robust growth over the past few years and gain in market share across our products, we believe we have other opportunities for further growth such as payroll, credit card and others.

We estimate that the total addressable market in Brazil for loan portfolios is R$5 trillion. As of September 30, 2023, we have a market share of 13.7% of individual and bank accounts and 9.4% of corporate bank accounts in Brazil, based on data from the Central Bank. However, we believe that we can still grow our market share in credit products as it is currently below our market share for number of accounts.

Compared to our peers, we had a signficant increase in clients with a loan balance exceeding R$200 between September 30, 2022, and September 30, 2023. This highlights our ability to effectively leverage our extensive client base and drive sustainable growth in our business. The chart below describes the evolution in the number of clients with a loan balance above R$200 normalized on base 100 as of September 30, 2022.

Source: Central Bank and internal data. Note 1: Including only financial institutions with more than 4 millions clients in September, 2023.

Inter Shop & Commerce Plus

In November 2019, we launched our e-commerce platform, Inter Shop & Commerce, and our on-demand services platform, Commerce Plus. Our initial vision for the e-commerce offering stemmed from our desire to continue increasing our ability to leverage on our primary banking relationship status to improve our ability to garner client attention, frequency, recurrence and bundling.

Inter Shop & Commerce Plus delivered R$ 4.0 billion in GMV in 2022, representing a 13% increase compared to the year ended December 31, 2021.

We are able to generate significant revenues by bringing clients and sellers together, and these revenues can be used to boost our margins or to provide clients with cashback to increase engagement and retention.

Increasing our GMV enables us to generate more revenues and take rates, as well as provide clients with cashback to increase engagement and retention. Take rate corresponds to the fees that online marketplaces (such as Inter Shop) collect for enabling third-party transactions.

The integrated experience of the Inter Shop & Commerce Plus in the Super App allows us to maximize the array of potential offerings to our clients. For example, we can offer our clients a differentiated Buy Now Pay Later payment option in a closed-loop channel, which we believe improves our margins and returns. We can also use the Inter Shop & Commerce Plus platform to provide clients with incentives to save and help fund our balance sheet via deposits.

We deliver five core value propositions to our Inter Shop & Commerce Plus clients that underpin our differentiation. Those are:

(a)A Broad Product Suite: approaching 1 million Stock Keeping Unit (SKUs) across over 700 merchants;

(b)Superior Personalization: As a result of our ability to capture client behavioral data across Inter’s platforms, we provide highly customized special offers and promotions to our clients;

(c)Safety and Reliability: Our clients feel safe purchasing through the Super App knowing that we will keep their personal and financial information secure;

(d)Attractive Incentives: offering cashback to clients and attractive product exposition to retailers;

(e)SuperLimit: For those clients who prefer to increase their spending power and/or build their credit profile faster, we offer an option to receive a credit extension, called our “SuperLimit,” instead of cashback.

Commerce Plus offers solutions such as: (i) Doctor Inter (a telehealth platform); (ii) Inter Cel (Mobile Virtual Network); (iii) Duo Gourmet (subscription service for restaurant discounts and promotions); (iv) Inter Travel (book flights and hotels conveniently in-app); and (v) Gift Cards.

Inter Invest

Inter Invest was conceived as an all-in-one platform to offer a complete range of investment solutions and products to our clients. We offer clients the ability to invest in over 495 investment funds from 170 different asset managers, including fixed-income funds, mutual funds, top-tier hedge funds, and direct investments in bonds and stocks.

The success of our brokerage business has enabled us to continuously expand our offerings. We have built a sizable asset management platform, Inter Asset, which provides mutual funds developed in-house and customized solutions. We have also developed a robust capital markets platform for corporate clients, providing debt securities, trading, and custody services. As a result, we now have a self-reinforcing ecosystem that provides us with two important competitive advantages:

(a)We have a distribution channel for corporate issuers from our large investor base; and

(b)We have the ability to distribute the securities of our corporate issuer clients, which attracts more investors who are looking for diverse investment opportunities.

Additionally, through our Super App we enable our clients to seamlessly access Apex’s platform, which allows our clients to open an account with Apex and access a stock trading platform provided by Apex for investments in the United States in selected securities listed on stock exchanges (currently Nasdaq and NYSE) within our Super App. This feature allows clients to further diversify their risk into stocks in the United States and allocation strategies.

We segment our clients into four categories based on their assets under custody, as shown in the graph below. For the low AUC clients that prefer a self-service model, we offer a fully Digital experience that we can service profitably given our low-cost, tech-enabled platform. For higher AUC clients, we offer three types of personalized wealth advisory services: One, Black & WIN.

Regardless of the service level, our digital brokerage offering is completely democratized: we provide the same trading capabilities and products to everyone. We believe in the importance of empowering our clients with the resources to make the most informed investment decisions. That is why education in the form of research and community engagement content is a core part of our experience, as many of our clients are first-time investors and require additional information and/or suggestions on optimal investment portfolio allocation. For beginners, we provide educational content along with robo-advisory tools where a virtual investment assistant will ask a few questions, analyze the client’s profile and goals, and propose tailored-made investment options. For more experienced investors, we offer sell-side research reports produced by Inter’s macro, fixed income and equities research teams, and advanced trading tools.

As of September 30, 2023, we had 4.2 million active clients using Inter Invest, over 74% growth since September 30, 2022. Our penetration, defined as active investment clients divided by total clients, is 14% - which we believe highlights the growth potential of the segment even within our own current client base. In terms of Assets Under Custody (AUC), as of September 30, 2023, we have reached approximately R$83 billion, corresponding to a 33% growth compared to September 30, 2022, with R$19,761 in average AuC per active client as of September 30, 2023.

In addition to offering clients a wide range of investment alternatives, in a transparent and low-cost format, this business vertical stimulates cross-selling and helps us to achieve the position of primary bank of choice for our clients, which we believe leads to higher retention and lower churn over time.

Our initiatives and features at Inter Invest have been widely recognized: we were recognized as the Best Digital Brokerage in Brazil by iBest, in 2021. We intend to continue to develop new solutions to support our clients in their investments needs, aiming to continuously increase client wallet share over time.

Inter Insurance

We provide insurance brokerage services that enable our clients to protect important assets and aspects of their lives.

We sell over 26 different types of insurance solutions via a simple and integrated experience. As we collect more data from our clients, we are able to learn more about their protection needs and add new products to service them. For example, in the last quarter of 2022, we began to offer three new products: PIX insurance, Pet insurance and SME insurance.

We continue enhancing our insurance brokerage platform and transforming the way our clients engage with financial services by decreasing transaction costs at each transaction journey that our clients take with us, such as embedding a gadget insurance in an Inter Shop & Commerce Plus purchase, or embedding a travel insurance in an

Inter Travel sale. Revenues for Inter Insurance in 2022 grew 128.4% compared to its revenues in 2021. We were also able to increase the number of active clients of Inter Insurance to approximately 1.6 million on September 30, 2023 from 255 thousand on December 31, 2020.

We have also entered into agreements with Liberty Seguros and Sompo Seguros to distribute their insurance products, which provide for exclusivity in Brazil for up to 15 years for certain products. We have also partnered with Wiz – an insurance broker which has a 40% equity stake in Inter Insurance, to boost our insurance distribution platform.

Global

With our comprehensive Super App, we see the opportunity to take our Financial and Commerce solutions across borders. In January 2022, we acquired Inter&Co Payments, a remittance platform and global digital account provider with almost 150,000 clients, in order to accelerate our expansion plan.

We segment our Global products into two categories: (i) Brazilians; and (ii) US Residents.

While we remain at the beginning of our journey of expanding across borders, we are excited about the progress we have made so far. We have grown the number of Global Accounts to approximately 2 million accounts as of September 30, 2023, an increase of more than 80% over the beginning of 2023.

Loyalty

In May, 2023, we launched our seventh vertical, Loyalty. Through the product we called “Inter Loop”, we are using our robust banking structure as the backbone of our new rewards program and connecting all verticals to offer multiple options for our clients to earn and use points inside the Super App. We believe this new vertical shows a strong promise of opportunities for cross-selling, increasing engagement and monetization.

With Inter Loop, instead of being limited to cashback, our clients will earn points and have freedom to choose how to use them. Options to consume points include, in addition to other options we may launch in the future:

1.Cashback

2.Discounts in Inter shop;

3.Airline miles;

4.Investments; and

5.Donations to multiple charities.

We believe the breadth of our platform facilitates opportunities for our clients and us, with integration with our marketplace being the most obvious synergy. In that sense, we intend to leverage Inter Loop to promote cross-selling potential and create new revenue streams, such as from the sale of points, subscriptions, and others.

Inside Inter Loop, we innovated with “Conta com Pontos” which bring our clients a new way to earn points, and which also changes our banking reserve-requirements dynamics. These demand deposits are invested in certificates of deposit, and the yields are converted into points that are credited into clients’ accounts through Inter Loop.

In addition, this results in our demand deposit balances being transferred to time deposits (which yield close to the Brazilian interbank deposit rate, or the CDI), decreasing our required reserves held at the Central Bank (yielding zero) and freeing up resources for re-allocation.

As of September 30, 2023, Inter Loop had reached almost four million active clients, which on average, spend more than non-Inter-Loop clients. We believe this reinforces the value of our rewards program in generating increased customer loyalty and engagement.

Operational Highlights

In addition to the qualitative overview provided above, our company's performance can also be measured through several key performance indicators and Non-GAAP financial metrics, such as described below:

We have focused on diversifying our revenue streams by offering a range of products for clients of all ages, while at the same time keeping our costs controlled and promoting shareholder return. As of November 30, 2023, our number of clients increased to 30.1 million clients from 24.7 million, 16.4 million, 8.5 million and 4.1 million as of December 31, 2022, December 31, 2021, December 31, 2020 and December 31, 2019, respectively.

Our Efficiency Ratio also improved significantly to 52% during the third quarter of 2023 from 75% on the third quarter of 2022, due to our cost efficiency initiatives.

These efforts have contributed to a higher level of overall profitability, with an increase of 7.4 p.p. in ROAE to 5.7% in the third quarter of 2023 from -1.7% in the third quarter of 2022. Overall, we believe we are well-positioned to continue growing and delivering value to our clients and shareholders and well on our way to achieve our ’60-30-30’ goal, which is seeking to reach 60 million clients, a 30% Efficiency Ratio and 30% ROAE. This ’60-30-30’ goal is not a guidance or a projection of our current results and merely reflects an internal target, which we may or may not reach. Our ability to reach this goal is subject to economic, competitive, regulatory and financial market conditions and our business decisions in the future, among among other factors that are inherently subject to significant uncertainties and contingencies. See “Risk Factors” in our 2022 Form 20-F and “Forward-Looking Statement” in this prospectus supplement and in our 2022 Form 20-F.

As part of our cost-cutting efforts, we decreased our total number of employees to 3,266 as of September 30, 2023 from 4,057 as of September 30, 2022. During the same period, we were able to increase our number of active clients to 15.5 million as of September 30, 2023 from 11.6 million as of September 30, 2022.

In the third quarter of 2023, our Fee Revenue Ratio was of 35%, which indicates that our non-credit-related operations represented 35% of our revenues.

For more information on how we calculate the Non-GAAP Financial measures described above, see “Special Note Regarding Non-GAAP Financial Measures” in our Disclosure 6-K furnished to the SEC on January 16, 2024.

Selected Preliminary Estimated Results for Fourth Quarter 2023 and and Full Year 2023

The following section contains our preliminary estimates relating to certain operational and financial information as of and for the three-month period and year ended December 31, 2023. This information is preliminary and has not been audited or reviewed by our auditors. Our actual results as of and for the three-month period and year ended December 31, 2023 may vary from these estimated preliminary results and will not be finalized until after we close this offering. Factors that could cause actual results to differ from those described below are set forth in “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in our 2022 Form 20-F.

We expect our number of active clients to range between 16.3 million and 16.5 million clients on December 31, 2023, representing an expected growth ranging between 29.3% and 31.1% over our active clients on December 31, 2022.

We expect profit before income tax to be between R$195 million and R$205 million for the three-month period ended December 31, 2023, compared to a loss before income tax of R$20.3 million for the three-month period ended December 31, 2022.

We expect profit for the period is expected to be between R$150 million and R$155 million for the three-month period ended December 31, 2023, representing an expected increase between 420.6% and 438.0% compared to the three-month period ended December 31, 2022.

We expect Gross Loan Portfolio, a non-GAAP financial measure, to be between R$30.5 billion and R$31.5 billion as of December 31, 2023, representing an expected increase between 24.3% and 28.3% compared to December 31, 2022.

We expect Funding, a non-GAAP financial measure, to be between R$43.0 billion and R$44.0 billion as of December 31, 2023, representing an expected increase between 32.2% and 35.3% compared to December 31, 2022.

We expect return on average equity (ROAE), a non-GAAP measure, to be between 8.0% and 8.3% for the three-month period ended December 31, 2023, representing an expected increase between 6.4 p.p. and 6.7 p.p. compared to the three-month period ended December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the three-month period ended December 31, | | As of or for the Year Ended December 31, |

| 2023 | | 2022 | | Variation | | 2023 | | 2022 | | Variation |

| (Estimated) | | (Actual) | | | | (Estimated) | | (Actual) | | |

| (in millions of R$, except %) |

| Consolidated Income Statement Data | | | | | | | | | | | |

| Profit / (loss) before income tax | 195.0 - 205.0 | | (20.3) | | | n.m. | | 426.5 - 436.5 | | (178.6) | | | n.m. |

| Profit / (loss) | 150.0 - 155.0 | | 28.8 | | | 421% - 438% | | 342.5 - 347.5 | | (14.1) | | | n.m. |

| Consolidated Balance Sheet Data | | | | | | | | | | | |

| Gross Loan Portfolio | N/A | | N/A | | N/A | | 30.5 - 31.5 | | 24.5 | | | 24.3% –28.3% |

| Funding | N/A | | N/A | | N/A | | 43.0 - 44.0 | | 32.5 | | | 32.2% –35.3% |

| KPIs | | | | | | | | | | | |

| Return on average equity (ROE) | 8.0% - 8.3% | | 1.6 | % | | 6.4p.p.- 6.7p.p. | | 4.7% - 4.7% | | (0.2) | % | | n.m. |

| Active Clients (million clients) | N/A | | N/A | | N/A | | 16.3 - 16.5 | | 12.6 | | | 29.3% - 31.1% |

For more information on how we calculate the Non-GAAP Financial measures described above, see “Special Note Regarding Non-GAAP Financial Measures” in our Disclosure 6-K.

Cautionary Statement Regarding Selected Preliminary Estimated Results

The selected preliminary estimated results for the three-month period ended December 31, 2023 and for the year ended December 31, 2023 are preliminary, unaudited and reflect our management’s current estimates.

While we have prepared these preliminary results in good faith and based on information available at the time of preparation, no assurance can be made that actual results and other information presented will not change as a result of our management’s review of results and other factors. These preliminary results are subject to finalization and closing of our accounting books and records (which have yet to be performed) and should not be viewed as a substitute for quarterly or annual financial statements prepared in accordance with IFRS. These preliminary results depend on several factors, including weaknesses in our internal controls and financial reporting process (as described under “Risk Factors”) and our ability to timely and accurately report our financial results. In addition, the estimates and assumptions underlying these preliminary results include, among other things, economic, competitive, regulatory and financial market conditions and business decisions that may not be accurately reflected and that are inherently subject to significant uncertainties and contingencies, including, among others, risks and uncertainties described in the section entitled “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” There can be no assurance that the underlying assumptions or estimates will be realized; in particular, while we do not expect that our selected preliminary estimated results will differ materially from our actual results for the three-month period ended December 31, 2023 and for the year ended December 31, 2023, we cannot assure you that our estimated preliminary results will be indicative of our financial results for the three-month period ended December 31, 2023 and for the year ended December 31, 2023. As a result, the selected preliminary estimated results cannot necessarily be considered predictive of actual operating results for the periods described above, and this information should not be relied on as such. You should read this information together with the sections of our 2022 Form 20-F entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements, including the notes thereto, included in our 2022 Form 20-F.

The selected preliminary estimated results presented above were prepared by and are the responsibility of our management. No independent registered public accounting firm has examined, compiled or otherwise performed any procedures with respect to the financial information contained in these preliminary estimated results. Accordingly, no independent registered public accounting firm has expressed any opinion or given any other form of assurance with respect thereto, and no independent registered public accounting firm assumes any responsibility for the preliminary estimated results. The report of the independent registered public accounting firm included elsewhere in this prospectus relates to our historical financial information. Such report does not extend to these preliminary estimated results and should not be read to do so.

By including in this prospectus a summary of selected preliminary estimated results regarding our financial and operating results, neither we nor any of our respective advisors or other representatives has made or makes any representation to any person regarding our ultimate performance compared to the information contained in these preliminary estimated results, and actual results may materially differ from those described above. We do not undertake any obligation unless required by applicable law to update or otherwise revise these preliminary estimated results set forth herein to reflect circumstances existing since their preparation or to reflect the occurrence of unanticipated events or to reflect changes in general economic or industry conditions, even in the event that any or all of the underlying assumptions are shown to be in error.

Our Subsidiaries and Key Investees

Banco Inter

Banco Inter S.A. is the main subsidiary of Inter&Co, Inc. It is a fully licensed bank, which offers a fully digital account that allow clients to pay bills and transfer cash, amongst other financial features.

For information about Banco Inter S.A., see “Item 4. Information on the Company - A.History and Development of the Company”

Inter Seguros

Inter Seguros brokers various types of insurance through a specialized and structured team to serve several business sectors, including, but not limited to corporate insurance, digital insurance and bank insurance. We have a 60% equity stake in Inter Seguros, with the remaining 40% stake held by Wiz.

Inter Seguros’ main focus is on the sale of insurance through our digital platform, offering the sale of a full range of products, such as Life insurance, Health insurance, Pet insurance, Travel insurance, among others. The products distributed by Inter Seguros are underwritten by our commercial partners: Liberty Seguros, Sompo Seguros, MetLife, Icatu, SulAmérica and Bamaq.

Inter DTVM

Inter DTVM is a securities distributor and funds administrator, established in August 2013, licensed by the CVM, which allows us to operate a digital platform in the investment market. The Central Bank authorized Inter DTVM to operate as a distributor of securities on November 20, 2013, having effectively started operations on the same date. The main activities of Inter DTVM are fiduciary management, asset management, distribution of investment products, controlling, custody, bookkeeping, and public offerings.

Inter Asset

Inter Asset is an asset manager that operates with investment funds, private wealth management, managing investment funds and private pension plans. Inter Asset’s purpose is to manage (i) securities portfolios and resources for third parties; and (ii) investment funds in general in the financial and securities market. We hold approximately 70% of Inter Asset through Banco Inter (with the remaining 30% held by Inter Asset’s founding shareholders).

Inter Shop & Commerce Plus

Inter Shop & Commerce Plus, through our subsidiary Inter Marketplace Intermediação de Negócios e Serviços Ltda, engages in sales promotion by offering non-financial products and services through partnerships available in our app. The sales experience and connection with our commercial partners occurs in three ways: (i) gift cards, (ii) affiliates and (iii) end-to-end. The first is the sale of prepaid cards from physical stores and/or online within the Inter application, for use in the partner store’s purchasing environment. In the second partnership model, Inter’s client searches in our Super App for the e-commerce page of the store from which they want to make a purchase and is then redirected to the website of the selected store (not hosted within our Super App). The latter model involves building the entire client purchase experience within our Super App.

Inter Shop & Commerce Plus offers other products in this partnership business model, such as: (i) Inter Pass, which consists of a subscription for a benefit program membership that provides additional cashback for members in multiple products and services offered by Inter; and (ii) Inter Cel, which is a mobile virtual network operator offered by the mobile carrier Vivo (Telefônica Brasil). Inter Shop & Commerce Plus also operates a coffee shop in some cities in Brazil through its subsidiary Inter Café Ltda. (“Inter Café”), an online retailer that sells Inter branded products (such as gadgets, notebooks and apparel) through its subsidiary Inter Boutiques Ltda. (“Inter Store”), a food business through its subsidiary Inter Food S.A. (“Inter Food”), and a travel and entertainment platform through its subsidiary Inter Viagens e Entretenimento Ltda. (“Inter Viagens”). It also offers benefits related to vehicles, such as the "Shell Box" which provides discounts on fuel refills, and "Car Tag" which is a partnership with vehicle tag companies.

Granito

Granito operates as a payment institution and credit card acquirer, developing customized products for its clients, which enhances the experience of corporate account holders that will have access to a wider range of products and services. As of the date of this prospectus supplement, we, through Banco Inter, hold 50% interest in Granito, the remaining interest being held by Banco BMG S.A., following our and BMG’s purchase each of an additional 5% stake from the founders of Granito in 2023.

Our investment in Granito is part of our strategy of acquiring or investing in innovative companies with a technology focus.

Acerto

In February 2021, we acquired a 60% equity interest in Acerto, which is a digital debt renegotiation platform, which is a core pillar of our client retention strategy. Acerto’s founders (who are also Acerto’s executives) hold the remainder of Acerto’s capital stock. Additionally, Acerto has its own long-term incentive plan providing for the acquisition of its shares by the beneficiaries of the plan. The exercise of such options by the beneficiaries may reduce our equity stake in Acerto by up to 2.5%.

IM Designs

In July 2021, we acquired a 50% equity interest in IM Designs. IM Designs is a company specialized in the development of new technologies and immersive tools which use 3D technology to develop project to visualize environments with virtual reality, augmented reality and mixed reality. IM Designs is dedicated to reshaping how people interact with the digital world, pushing to create an integrated, immersive, and personalized virtual reality without borders. To build this reality, they have created an ecosystem, providing seamless connections between users, creators, developers, and businesses. This ecosystem leads the way to brand new 3D experiences. With user focus and social impact leading the way, IM Designs seeks to revolutionize digital experiences by allowing collaborative and creative development on a unified platform. Featuring core values such as synergy and inventiveness, this company aims to connect individuals to limitless possibilities in the world of technology. The ultimate goal is to create immersive and interconnected digital spaces, making the future one that is more exciting and inspiring.

Inter&Co Payments. (Formerly USEND or Pronto Money Transfer Inc.)

In January 2022, we acquired Inter&Co Payments, Inc. (“Inter&Co Payments”), a California corporation, for a combination of cash and options convertible into Inter&Co Class A Shares. Certain managers, including the company’s founders, have continued to manage the business as officers of Inter&Co Payments. Inter&Co Payments operates in the U.S., Brazil and Canada and provides foreign exchange and payment services, offering, among other products, a digital account solution for both international money transfers and domestic use. Inter&Co Payments has licenses to act as a money transmitter in more than 40 states in the United States and can offer services to U.S. residents such as digital wallet, debit card and bill payment, among others.

YellowFi

On January 24, 2023, we acquired Inter US Finance, LLC (formerly YellowFi Mortgage LLC) (“Inter Mortgage”) and Inter US Management LLC (formerly YellowFi Management LLC) (“Inter US Management”), each a Florida limited liability company, for a combination of cash and Class A common shares. Antonio Cassio Segura, former CEO of BB Americas, who is the manager and founder of both YellowFi companies, will continue to manage these businesses. Inter Mortgage owns, manages and operates a mortgage lending and origination business in the states of Colorado, Florida and Georgia, and Inter US Management manages and operates the Brickell Bay Mortgage Opportunity Fund, a residential mortgage notes investment fund that holds promissory notes from various investors throughout the United States.

Our Client Service and Support

Online is our main channel of contact with clients.

In 2019, we launched our virtual service assistant, Babi, automating a portion of the calls and messages we receive and reducing client waiting time. In 2020, Banco Inter increased the capacity of its virtual service assistant, Babi, which brought greater robustness and agility in service, automating part of the calls received via chat and reducing the waiting time for clients. In 2021, Inter focused on expanding service channels, integrating new BPOS, developing and integrating with the new CRM, and service tools, such as Salesforce, both with the aim of creating more stability, reduce queues and increase performance and quality. In 2022, we continued to focus on simplifying our clients' lives beyond creating new day-to-day transactions at digital journeys, and Babi also became our WhatsApp engine orchestrating a new channel which has been well-succeeding for servicing and sales.

Through these initiatives, we processed over 9.6 million client inquiries that were solved in real time by artificial intelligence during 2023.

As more than 99% of our interactions are resolved in the first contact, we believe that currently most of our clients’ basic demands and transactions are already being resolved through our virtual assistant, which reduces our costs.

Geographic Presence and client profile

We are headquartered in Belo Horizonte, in the state of Minas Gerais, Brazil. Our digital strategy completely eliminates the need for physical retail branches and allows us to achieve broad coverage with low operational costs. We have clients in several Brazilian cities and, since the USEND acquisition, we also operate in the United States.

Inter Clients by States

Percentage of Inter clients by region, as of September 30, 2023

Source: IBGE

Note: Percentage of Brazilian population refers to percentage of the overall Brazilian population in the applicable age bracket. Income represented in Minimum Wages (“MW”); Source: IBGE

We believe that we have a significant opportunity to grow alongside our clients as approximately 70% of our client base are under the age of 35, and almost 50% are under 25 years old. We offer a wide range of products catering to all age groups, from digital accounts for young children, to INSS payroll loans for those who are retired.

Technology

Technology is the backbone of our operations. Our agility and capabilities enable us to perform a full cycle of product development in a short timeframe. With the extensive use of data, our employees can quickly measure the results of our product launches, receive immediate feedback from our client base, and make improvements by focusing our resources to deliver the best solutions to our clients. We call this powerful intelligence and analytics engine “InterMind”, combining insights machine, A.I. and a 360º vision of our clients.

Our new product launches create opportunities for monetization upside, with very limited initial capital deployment. This process also enables us to easily enter new business verticals, which we carefully select based on the extensive data sets that we have.

Our product launching capabilities and speed to market is enabled by an entrepreneurial team and our access to a modern cloud-based tech-stack backed by a modular architecture that enables our approach of continuously

expanding our products and services. Our application layer is composed of over 2,500 microservices in a modern, de-coupled and cloud-native architecture enabling agility, security, and scalability to foster our business verticals.

In 2021, we launched the proprietary Inter API gateway, which manages and enables all communications across our microservices at a lower cost compared to using a 3rd party solution. As we develop and launch new products, we only need to add new microservices and plug in to the current infrastructure, without rebuilding the existing one. This modularity was a critical part of what allowed Inter to expand its range of products with “plug-and-play” speed and agility.

We believe our software architecture is innovative and very well integrated, as it includes solutions such as cloud storage, proprietary API Gateway, artificial intelligence for data analysis, security systems that enable integration with technology tools from vendors and partners, among many others. We also continuously invest in the modernization of software and technology that allow for greater security, reliability and scalability.

Corporate Information

Inter is incorporated as an exempted company with limited liability in the Cayman Islands. Our principal executive office at Avenida Barbacena, No. 1.219, 22nd floor, Belo Horizonte, State of Minas Gerais, 30190-131, Brazil. Our investor relations office can be reached at ir@inter.co and our website address is https://investors.inter.co/en/. Information provided on our website is not part of this prospectus supplement or the accompanying prospectus and is not incorporated by reference herein or therein.

THE OFFERING

This summary highlights information presented in greater detail elsewhere in this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all the information you should consider before investing in our Class A common shares. You should carefully read this entire prospectus supplement and the accompanying prospectus before investing in our Class A common shares including “Risk Factors,” “Description of Share Capital,” our audited consolidated financial statements and our unaudited condensed consolidated interim financial statements as of September 30, 2023 and for the three and nine-month periods ended September 30, 2023 and 2022.

| | | | | | | | |

| Class A common shares offered by us | | 32,000,000 Class A common shares (or 36,800,000 shares if the underwriters exercise in full their option to purchase additional shares). |

| | |

| Class A common shares to be outstanding immediately after this offering | | 317,153,435 Class A common shares (or 321,953,435 shares if the underwriters exercise in full their option to purchase additional shares). |

| | |

| Class B common shares outstanding | | 117,037,105 Class B common shares. |

| | |

| Voting rights | | Holders of our Class A common shares are entitled to one vote per share, and the holders of our Class B common shares are entitled to 10 votes per share. Each Class B common share may be converted into one share of Class A common shares at the option of the holder. If, at any time, the aggregate voting power of Class B common shares then outstanding is less than 10% of the aggregate voting power of Class A common shares and Class B common shares outstanding, then each Class B common share will automatically convert into one Class A common share. In addition, each Class B common share will convert automatically into one Class A common share upon any transfer, except for certain transfers to heirs and successors and/or affiliates of such holder of Class B common shares, one or more trustees of a trust established for the benefit of the shareholder or their affiliates, partnerships, corporations and other entities owned or controlled by the shareholder or their affiliates, organizations that are exempt from taxation under section 501(3)(c) of the United States Internal Revenue Code of 1986, as amended, as well as to a non-affiliate transferee that agrees in writing with us to make a tender offer or exchange offer to all holders of Class A common shares. Holders of Class A common shares and Class B common shares will vote together as a single class on all matters unless otherwise required by law. |

| | | | | | | | |

| | Upon consummation of this offering, assuming no exercise of the underwriters’ option to purchase additional shares,(1) holders of Class A common shares will hold approximately 21.3% of the combined voting power of our outstanding common shares and approximately 73.0% of our total equity ownership and (2) holders of Class B common shares will hold approximately 78.7% of the combined voting power of our outstanding common shares and approximately 27.0% of our total equity ownership. If the underwriters exercise their option to purchase additional shares in full, (1)holders of ClassA common shares will hold approximately 21.6% of the combined voting power of our outstanding common shares and approximately 73.3% of our total equity ownership and (2)holders of ClassB common shares will hold approximately 78.4% of the combined voting power of our outstanding common shares and approximately 26.7% of our total equity ownership. The rights of the holders of Class A common shares and Class B common shares are identical, except with respect to voting, conversion, and transfer restrictions applicable to the Class B common shares. |

| | |

Option to purchase additional shares | | We have granted the underwriters the right to purchase up to an additional 4,800,000 Class A common shares within 30 days of the date of this prospectus, at the public offering price, less underwriting discounts, on the same terms as set forth in this prospectus. |

| | |

| Listing | | Our Class A common shares are listed on the Nasdaq Global Select Market, or Nasdaq, under the symbol “INTR.” |

| | |

| Use of proceeds | | We intend to use the net proceeds from this offering and cash on hand for general corporate purposes and to pay related fees and expenses. See “Use of Proceeds.” |

| | |

| Dividend policy | | The amount of any distributions will depend on applicable law and many other factors, such as our results of operations, financial condition, cash requirements, prospects and other factors deemed relevant by our board of directors and shareholders. We do not anticipate paying any cash dividends in the foreseeable future. |

| | |

| Lock-up agreements | | We, our controlling shareholder and our directors and officers are entering into a 90-day lock-up agreement in connection with this offering. |

| | |

| Risk factors | | See “Risk Factors” and the other information included in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider before deciding to invest in Class A common shares. |

The number of Class A and Class B common shares to be outstanding after this offering does not include:

•the issuance of 1,620,375 Class A common shares issuable upon the settlement of outstanding restricted stock units, or RSUs, granted under the 2022 Omnibus Incentive Plan;

•the issuance of 7,799,805 Class A common shares issuable upon the settlement of RSUs and/or stock options and/or restricted stock and/or stock appreciation rights which are still to be granted under the 2022 Omnibus Incentive Plan;

•the issuance of 115,799 Class A common shares issuable upon the exercise of outstanding share options (with a weighted average exercise price of R$1.80 granted under Program 1 of the Fourth Stock and/or Units Option Plan of Banco Inter;

•the issuance of 2,519,138 Class A common shares issuable upon the exercise of outstanding share options with a weighted average exercise price of R$21.50 granted under Program 2 of the Fourth Stock and/or Units Option Plan of Banco Inter;

•the issuance of 2,815,750 Class A common shares issuable upon the exercise of outstanding share options with a weighted average exercise price of R$15.50 granted under Program 3 of the Fourth Stock and/or Units Option Plan of Banco Inter; and

•the issuance of 489,386 Class A common shares issuable upon the exercise of outstanding share options with a weighted average exercise price of US$1.92 granted under the Inter & Co Payments, Inc. Amended and Restated 2020 Equity Incentive Plan.

Unless otherwise indicated, all information contained in this prospectus assumes no exercise of the option granted to the underwriters to purchase up to 4,800,000 additional Class A common shares, in connection with the offering.

RISK FACTORS

This offering and an investment in our Class A common shares involves a high degree of risk. You should carefully consider the risks and uncertainties described below as well as those contained in the 2022 Form 20-F, which are incorporated by reference into this prospectus supplement and the accompanying prospectus, as well as the other information in this prospectus supplement before making an investment decision regarding our Class A common shares. These risks are those that we currently believe may adversely affect our business or the trading price of our Class A common shares. In general, investing in the securities of issuers whose operations are located in emerging market countries such as Brazil involves a higher degree of risk than investing in the securities of U.S. companies and companies located in other countries with more developed capital markets.

If any of the risks discussed in or incorporated by reference in this prospectus supplement and the accompanying prospectus actually occur, alone or together with additional risks and uncertainties that we are not currently aware of or do not currently deem material, our business, financial condition, results of operations and prospects may be materially adversely affected. If this were to occur, the value of our Class A common shares may decline and you may lose all or part of your investment. When determining whether to invest, you should also refer to the other information contained in and incorporated by reference into this prospectus supplement and the accompanying prospectus, including our financial statements and the related notes thereto. You should also carefully review the cautionary statements referred to under “Forward-Looking Statements.” Our actual results could be materially lower than those anticipated in this prospectus supplement.

Risks Relating to the Offering and Our Class A Common Shares

An active trading market for our common shares may not be sustainable. If an active trading market is not maintained, investors may not be able to resell their shares at or above the offering price and our ability to raise capital in the future may be impaired.

Although our Class A common shares are listed and being traded on Nasdaq, an active trading market for our shares may not be maintained following this offering. If an active market for our Class A common shares is not maintained, it may be difficult for you to sell shares you purchase in this offering without depressing the market price for the shares or at all. An inactive trading market may also impair our ability to raise capital to continue to fund operations by selling shares and may impair our ability to acquire other companies or technologies by using our shares as consideration. Currently, most of our Class A common shares trade in the form of BDRs in Brazil, on B3. As of January 7th, 2024, 63% of our outstanding Class A common shares were held in the form of BDRs, the average daily trading volume of our Class A common shares on Nasdaq in 2023 was US$ 1.0 million and the average daily trading volume of our BDRs on B3 on the same period was R$ 46.4 million (or approximately US$ 9.6 million, based on the commercial selling rate for U.S. dollars as of December 31, 2023 as reported by the Central Bank).

Sales of substantial amounts of our Class A common shares in the public market, or the perception that these sales may occur, could cause the market price of our Class A common shares to decline.

Sales of substantial amounts of our Class A common shares in the public market, or the perception that these sales may occur, could cause the market price of our Class A common shares to decline. This could also impair our ability to raise additional capital through the sale of our equity securities. Under our Articles of Association, we are authorized to issue up to 20,000,000,000 shares, of which 434,190,540 common shares will be outstanding following this offering. We, our controlling shareholder and our directors and officers have agreed not to offer, sell or transfer any Class A common shares or securities convertible into, or exchangeable or exercisable for, Class A common shares, for 90 days after the date of this prospectus. We cannot predict the size of future issuances of our shares or the effect, if any, that future sales and issuances of shares would have on the market price of our Class A common shares.

In addition, we have adopted the 2022 Omnibus Incentive Plan, under which we have the discretion to grant a broad range of equity-based awards to eligible participants. See “Directors, Senior Management and Employees—Long-Term Incentive Plan” in our 2022 Form 20-F. We intend to register all common shares that we may issue under the 2022 Omnibus Incentive Plan. Once we register these common shares, they can be freely sold in the public