Innospec Inc. (NASDAQ: IOSP) today announced its financial results

for the second quarter ended June 30, 2022.

Total revenues for the second quarter were

$467.6 million, an increase of 32 percent from $354.5 million in

the corresponding period last year. Net income for the quarter was

$32.3 million or $1.29 per diluted share compared to $22.4 million

or 90 cents per diluted share recorded last year. EBITDA for the

quarter was $52.9 million compared to $50.6 million reported in the

same period a year ago.

Results for this quarter include some special

items, which are summarized in the table below. Excluding these

items, adjusted non-GAAP EPS in the second quarter was $1.58 per

diluted share, compared to $1.30 per diluted share a year ago.

Cash generation for the quarter was impacted by

an increase in working capital which resulted in cash used in

operations of $7.5 million before capital expenditures of $9.0

million. We closed the quarter with net cash of $71.4 million. In

the second quarter, the Company repurchased 18,700 of its common

shares at a cost of $1.8 million as part of the board-authorized

share repurchase program.

EBITDA, income before income taxes and net

income excluding special items, and related per-share amounts, are

non-GAAP financial measures that are defined and reconciled with

GAAP results herein and in the schedules below.

|

|

|

Quarter ended June 30, 2022 |

|

Quarter ended June 30, 2021 |

| (in millions, except

share and per share data) |

|

Income beforeincome taxes |

|

|

Netincome |

|

|

Diluted EPS |

|

|

Income beforeincome taxes |

|

|

Net income |

|

|

Diluted EPS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported GAAP amounts |

$ |

42.3 |

|

$ |

32.3 |

|

$ |

1.29 |

|

$ |

40.1 |

|

|

$ |

22.4 |

|

|

$ |

0.90 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency exchange

losses/(gains) |

|

4.8 |

|

|

3.7 |

|

|

0.15 |

|

|

(2.0 |

) |

|

|

(1.5 |

) |

|

|

(0.06 |

) |

| Amortization of acquired

intangible assets |

|

3.6 |

|

|

2.9 |

|

|

0.12 |

|

|

3.7 |

|

|

|

3.0 |

|

|

|

0.12 |

|

| Legacy costs of closed

operations |

|

0.8 |

|

|

0.6 |

|

|

0.02 |

|

|

0.9 |

|

|

|

0.7 |

|

|

|

0.03 |

|

| Change in UK statutory tax

rate |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

7.4 |

|

|

|

0.30 |

|

| Adjustment of income tax

provisions |

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

|

0.3 |

|

|

|

0.01 |

|

| |

|

9.2 |

|

|

7.2 |

|

|

0.29 |

|

|

2.6 |

|

|

|

9.9 |

|

|

|

0.40 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted non-GAAP

amounts |

$ |

51.5 |

|

$ |

39.5 |

|

$ |

1.58 |

|

$ |

42.7 |

|

|

$ |

32.3 |

|

|

$ |

1.30 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commenting on the second quarter results,

Patrick S. Williams, President and Chief Executive Officer,

said,

“This was another very good quarter for

Innospec. Sales increased with volume growth and price/mix

improvements across our businesses driving a 25 percent increase in

operating income over last year. Our focus remains on delivering

technologies and products that add value to our customers through

improved cost and performance.

In Performance Chemicals, continued strong

demand for our industry-leading mild, sulfate-free and natural

personal care chemistries drove the majority of margin improvement

and operating income grew 61 percent over the prior year. In

addition to personal care, sales grew in all other Performance

Chemicals end-markets. Personal care currently contributes over 75

percent of Performance Chemicals operating income, and we are

adding significant additional capacity backed by multi-year

contracts for these technologies. To further support

our long-term growth, last week we announced the acquisition of

adjacent land which significantly increases the available footprint

for future expansion at our primary US personal care manufacturing

facility.

In Fuel Specialties, price/mix improvements

drove an 11 percent increase in operating income over a strong

comparative quarter last year. Gross margins remained at the lower

end of our target range, and there continues to be potential for

gross margin improvement as inflation normalizes and mix improves.

Volumes increased on market share growth as we expanded our

industry-leading technology into new applications like renewable

diesel, low sulfur marine fuel, gasoline direct injection engines

and various non-fuels areas.

In Oilfield Services, operating income

approximately doubled versus the prior year. Under current market

conditions, significant room for improvement remains in sales,

margins and operating leverage. We expect sequential operating

income and margin expansion to continue in the coming

quarters.”

In Performance Chemicals, revenues of $169.0

million were up 32 percent from $128.2 million in the second

quarter last year. Volume growth of 6 percent and a positive

price/mix of 34 percent were partially offset by an adverse

currency impact of 8 percent. Gross margins increased by 1.2

percentage points from the same quarter last year to 25.8 percent.

Operating income for the quarter of $28.8 million was up 61 percent

on the prior year.

Revenues in Fuel Specialties were $176.4 million

for the quarter, a 23 percent increase from $143.1 million a year

ago. Volume growth of 3 percent and a positive price/mix of 27

percent were partially offset by an adverse currency impact of 7

percent. Gross margins of 32.3 percent were 2.7 percentage points

below last year. Operating income for the quarter of $31.5 million

was up 11 percent on last year.

Revenues in Oilfield Services were $122.2

million for the quarter, up 47 percent from $83.2 million in the

second quarter last year. Gross margins improved by 0.2 percentage

points from the same quarter last year to 32.2 percent. Operating

income of $4.5 million was approximately double the $2.2 million in

the prior year.

Corporate costs for the quarter were $18.5

million, compared with $11.6 million a year ago, up due mainly to

higher personnel-related expenses driven by increased share-based

compensation and performance related remuneration accruals.

The effective tax rate for the quarter was 23.6

percent compared to 44.1 percent in the same period last year which

included the enacted change in the U.K. tax rate impacting deferred

tax. The adjusted tax rate for the quarter was 22.8 percent

compared to 24.2 percent last year.

Net cash used in operating activities after

capital expenditure was $16.5 million for the quarter, as net

working capital increased. In addition, the Company distributed

$15.6 million to shareholders for the semi-annual dividend and

repurchased 18,700 of its common shares at a cost of $1.8 million.

As of June 30, 2022, Innospec had $71.4 million in cash and cash

equivalents and no debt.

Mr. Williams concluded,

“Our team continues to execute very well in a

challenging business environment, and we are pleased with the

strong double-digit sales and operating income growth achieved this

quarter. We believe that our businesses are well positioned to

navigate near-term headwinds which include higher interest rates,

persistent inflation and European energy concerns.

Entering the second half of 2022, we expect

demand to remain strong in the majority of our businesses. Volumes

and capacity additions in personal care, which makes up the

dominant share of Performance Chemicals operating income, are

backed by multi-year contracts. Fuel Specialties has traditionally

been a defensive business during recessionary times, and the

cost-saving, sustainability benefits of our products are well

aligned with current customer priorities. We feel that Oilfield

Services continues to have significant growth potential with the

target of returning to pre-COVID operating income levels over the

medium term.

Despite any near-term economic volatility, we

believe that our strong balance sheet positions us to return value

to shareholders through continued dividend growth and share

repurchases while funding our organic growth priorities and

M&A.”

Use of Non-GAAP Financial

Measures

The information presented in this press release

includes financial measures that are not calculated or presented in

accordance with Generally Accepted Accounting Principles in the

United States (GAAP). These non-GAAP financial measures comprise

EBITDA, income before income taxes excluding special items, net

income excluding special items and related per share amounts

together with net cash. EBITDA is net income per our consolidated

financial statements adjusted for the exclusion of charges for

interest expense, net, income taxes, depreciation, and

amortization. Income before income taxes, net income and diluted

EPS, excluding special items, per our consolidated financial

statements are adjusted for the exclusion of foreign currency

exchange losses/(gains), amortization of acquired intangible

assets, legacy costs of closed operations, change in the UK

statutory tax rate and adjustment of income tax provisions. Net

cash is cash and cash equivalents less total debt. Reconciliations

of these non-GAAP financial measures to their most directly

comparable GAAP financial measures are provided herein and in the

schedules below. The Company believes that such non-GAAP financial

measures provide useful information to investors and may assist

them in evaluating the Company’s underlying performance and

identifying operating trends. In addition, these non-GAAP measures

address questions the Company routinely receives from analysts and

investors and the Company has determined that it is appropriate to

make this data available to all investors. While the Company

believes that such measures are useful in evaluating the Company’s

performance, investors should not consider them to be a substitute

for financial measures prepared in accordance with GAAP. In

addition, these non-GAAP financial measures may differ from

similarly titled non-GAAP financial measures used by other

companies and do not provide a comparable view of the Company’s

performance relative to other companies in similar industries.

Management uses adjusted EPS (the most directly comparable GAAP

financial measure for which is GAAP EPS) and adjusted net income

and EBITDA (the most directly comparable GAAP financial measure for

which is GAAP net income) to allocate resources and evaluate the

performance of the Company’s operations. Management believes the

most directly comparable GAAP financial measure is GAAP net income

and has provided a reconciliation of EBITDA and net income

excluding special items, and related per share amounts, to GAAP net

income herein and in the schedules below.

About Innospec Inc.

Innospec Inc. is an international specialty

chemicals company with approximately 1,900 employees in 24

countries. Innospec manufactures and supplies a wide range of

specialty chemicals to markets in the Americas, Europe, the Middle

East, Africa and Asia-Pacific. The Performance Chemicals

business creates innovative technology-based solutions for our

customers in the Personal Care, Home Care, Agrochemical, Mining and

Industrial markets. The Fuel Specialties business specializes in

manufacturing and supplying fuel additives that improve fuel

efficiency, boost engine performance and reduce harmful emissions.

Oilfield Services provides specialty chemicals to all elements of

the oil and gas exploration and production industry.

Forward-Looking Statements

This press release contains certain

"forward-looking statements" within the meaning of the Private

Securities Litigation Reform Act of 1995. All statements

other than statements of historical facts included or incorporated

herein may constitute forward-looking statements. Such

forward-looking statements include statements (covered by words

like “expects,” “estimates,” “anticipates,” “may,” “could,”

“believes,” “feels,” “plans,” “intends” or similar words or

expressions, for example) which relate to earnings, growth

potential, operating performance, events or developments that we

expect or anticipate will or may occur in the future.

Although forward-looking statements are believed by management to

be reasonable when made, they are subject to certain risks,

uncertainties and assumptions, including, the effects of the

COVID-19 pandemic, such as its duration, its unknown long-term

economic impact, measures taken by governmental authorities to

address it, the rise of variants, the effectiveness, acceptance and

distributions of COVID-19 vaccines and the effects of any

sanctions, export restrictions, inflation, supply chain disruptions

or increased economic uncertainty related to the ongoing conflict

between Russia and Ukraine and the manner in which the pandemic

and/or such conflict may precipitate or exacerbate other risks

and/or uncertainties, and our actual performance or results may

differ materially from these forward-looking statements.

Additional information regarding risks, uncertainties and

assumptions relating to Innospec and affecting our business

operations and prospects are described in Innospec’s Annual Report

on Form 10-K for the year ended December 31, 2021, Innospec’s

Quarterly Report on Form 10-Q for the quarter ended March 31, 2022

and other reports filed with the U.S. Securities and Exchange

Commission. You are urged to review our discussion of risks

and uncertainties that could cause actual results to differ from

forward-looking statements under the heading "Risk Factors” in such

reports. Innospec undertakes no obligation to publicly update

or revise any forward-looking statements, whether as a result of

new information, future events or otherwise.

Contacts:

Corbin BarnesInnospec

Inc.+44-151-355-3611corbin.barnes@innospecinc.com

|

|

|

INNOSPEC INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF INCOME |

|

|

|

|

|

|

|

Schedule 1 |

|

|

|

|

|

|

|

|

|

|

Three Months EndedJune 30 |

|

|

Six Months EndedJune 30 |

|

(in millions, except share and per share

data) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales |

$ |

467.6 |

|

|

$ |

354.5 |

|

|

$ |

940.0 |

|

|

$ |

694.1 |

|

| Cost of

goods sold |

|

(327.8 |

) |

|

|

(246.2 |

) |

|

|

(660.9 |

) |

|

|

(485.0 |

) |

| Gross

profit |

|

139.8 |

|

|

|

108.3 |

|

|

|

279.1 |

|

|

|

209.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

(83.4 |

) |

|

|

(62.7 |

) |

|

|

(168.3 |

) |

|

|

(126.3 |

) |

|

Research and development |

|

(10.1 |

) |

|

|

(8.6 |

) |

|

|

(20.2 |

) |

|

|

(17.6 |

) |

| Total

operating expenses |

|

(93.5 |

) |

|

|

(71.3 |

) |

|

|

(188.5 |

) |

|

|

(143.9 |

) |

|

Operating income |

|

46.3 |

|

|

|

37.0 |

|

|

|

90.6 |

|

|

|

65.2 |

|

| Other

(expense)/income, net |

|

(3.6 |

) |

|

|

3.4 |

|

|

|

0.7 |

|

|

|

6.4 |

|

| Interest

expense, net |

|

(0.4 |

) |

|

|

(0.3 |

) |

|

|

(0.8 |

) |

|

|

(0.7 |

) |

| Income

before income taxes |

|

42.3 |

|

|

|

40.1 |

|

|

|

90.5 |

|

|

|

70.9 |

|

| Income

taxes |

|

(10.0 |

) |

|

|

(17.7 |

) |

|

|

(21.7 |

) |

|

|

(25.1 |

) |

| Net

income |

$ |

32.3 |

|

|

$ |

22.4 |

|

|

$ |

68.8 |

|

|

$ |

45.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings

per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

1.30 |

|

|

$ |

0.91 |

|

|

$ |

2.77 |

|

|

$ |

1.86 |

|

|

Diluted |

$ |

1.29 |

|

|

$ |

0.90 |

|

|

$ |

2.76 |

|

|

$ |

1.84 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average shares outstanding (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

24,805 |

|

|

|

24,628 |

|

|

|

24,798 |

|

|

|

24,615 |

|

|

Diluted |

|

24,971 |

|

|

|

24,869 |

|

|

|

24,967 |

|

|

|

24,856 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INNOSPEC INC. AND SUBSIDIARIES |

|

|

|

|

|

|

|

|

Schedule 2A |

|

|

|

|

|

|

|

|

SEGMENTAL ANALYSIS OF RESULTS |

|

Three Months Ended June 30 |

|

|

Six Months Ended June 30 |

|

(in millions) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

sales: |

|

|

|

|

|

|

|

|

|

|

|

|

Performance Chemicals |

$ |

169.0 |

|

|

$ |

128.2 |

|

|

$ |

336.1 |

|

|

$ |

254.1 |

|

|

Fuel Specialties |

|

176.4 |

|

|

|

143.1 |

|

|

|

368.2 |

|

|

|

282.4 |

|

|

Oilfield Services |

|

122.2 |

|

|

|

83.2 |

|

|

|

235.7 |

|

|

|

157.6 |

|

|

|

|

467.6 |

|

|

|

354.5 |

|

|

|

940.0 |

|

|

|

694.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross

profit: |

|

|

|

|

|

|

|

|

|

|

|

|

Performance Chemicals |

|

43.6 |

|

|

|

31.6 |

|

|

|

84.4 |

|

|

|

63.0 |

|

|

Fuel Specialties |

|

56.9 |

|

|

|

50.1 |

|

|

|

117.6 |

|

|

|

95.0 |

|

|

Oilfield Services |

|

39.3 |

|

|

|

26.6 |

|

|

|

77.1 |

|

|

|

51.1 |

|

|

|

|

139.8 |

|

|

|

108.3 |

|

|

|

279.1 |

|

|

|

209.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

|

|

Performance Chemicals |

|

28.8 |

|

|

|

17.9 |

|

|

|

54.1 |

|

|

|

36.2 |

|

|

Fuel Specialties |

|

31.5 |

|

|

|

28.5 |

|

|

|

67.0 |

|

|

|

52.3 |

|

|

Oilfield Services |

|

4.5 |

|

|

|

2.2 |

|

|

|

7.0 |

|

|

|

3.4 |

|

|

Corporate costs |

|

(18.5 |

) |

|

|

(11.6 |

) |

|

|

(37.5 |

) |

|

|

(26.7 |

) |

| Total

operating income |

$ |

46.3 |

|

|

$ |

37.0 |

|

|

$ |

90.6 |

|

|

$ |

65.2 |

|

| |

|

|

|

|

Schedule 2B |

| |

|

|

|

|

|

| NON-GAAP

MEASURES |

|

Three Months Ended June 30 |

|

|

Six Months Ended June 30 |

|

(in millions) |

|

2022 |

|

|

2021 |

|

|

2022 |

|

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

32.3 |

|

|

$ |

22.4 |

|

|

$ |

68.8 |

|

|

$ |

45.8 |

|

| Interest expense, net |

|

0.4 |

|

|

|

0.3 |

|

|

|

0.8 |

|

|

|

0.7 |

|

| Income taxes |

|

10.0 |

|

|

|

17.7 |

|

|

|

21.7 |

|

|

|

25.1 |

|

| Depreciation and

amortization: |

|

|

|

|

|

|

|

|

|

|

|

|

Performance Chemicals |

|

5.3 |

|

|

|

5.3 |

|

|

|

10.7 |

|

|

|

10.7 |

|

|

Fuel Specialties |

|

1.5 |

|

|

|

1.3 |

|

|

|

3.1 |

|

|

|

2.6 |

|

|

Oilfield Services |

|

3.0 |

|

|

|

3.1 |

|

|

|

5.9 |

|

|

|

6.2 |

|

|

Corporate costs |

|

0.4 |

|

|

|

0.5 |

|

|

|

0.9 |

|

|

|

0.9 |

|

| EBITDA |

|

52.9 |

|

|

|

50.6 |

|

|

|

111.9 |

|

|

|

92.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

Performance Chemicals |

|

34.1 |

|

|

|

23.2 |

|

|

|

64.8 |

|

|

|

46.9 |

|

|

Fuel Specialties |

|

33.0 |

|

|

|

29.8 |

|

|

|

70.1 |

|

|

|

54.9 |

|

|

Oilfield Services |

|

7.5 |

|

|

|

5.3 |

|

|

|

12.9 |

|

|

|

9.6 |

|

| Corporate costs |

|

(18.1 |

) |

|

|

(11.1 |

) |

|

|

(36.6 |

) |

|

|

(25.8 |

) |

| |

|

56.5 |

|

|

|

47.2 |

|

|

|

111.2 |

|

|

|

85.6 |

|

| Other (expense)/income,

net |

|

(3.6 |

) |

|

|

3.4 |

|

|

|

0.7 |

|

|

|

6.4 |

|

| EBITDA |

$ |

52.9 |

|

|

$ |

50.6 |

|

|

$ |

111.9 |

|

|

$ |

92.0 |

|

EBITDA by segment includes operating income

relating to the segments, excluding depreciation and

amortization.

|

|

|

Schedule 3 |

|

INNOSPEC INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE SHEETS |

| |

|

(in millions) |

|

June 30,2022 |

|

|

December 31,2021 |

| Assets |

|

|

|

|

|

| |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

71.4 |

|

$ |

141.8 |

|

Trade and other accounts receivable |

|

339.9 |

|

|

284.5 |

|

Inventories |

|

362.2 |

|

|

277.6 |

|

Prepaid expenses |

|

12.2 |

|

|

18.0 |

|

Prepaid income taxes |

|

13.2 |

|

|

5.8 |

|

Other current assets |

|

0.4 |

|

|

0.4 |

| Total current assets |

|

799.3 |

|

|

728.1 |

| |

|

|

|

|

|

| Net property, plant and

equipment |

|

209.7 |

|

|

214.4 |

| Operating lease right-of-use

assets |

|

49.3 |

|

|

35.4 |

| Goodwill |

|

357.0 |

|

|

364.3 |

| Other intangible assets |

|

48.1 |

|

|

57.5 |

| Deferred tax assets |

|

6.0 |

|

|

6.4 |

| Pension asset |

|

161.8 |

|

|

159.8 |

| Other non-current assets |

|

6.7 |

|

|

5.0 |

| Total assets |

$ |

1,637.9 |

|

$ |

1,570.9 |

| |

|

|

|

|

|

| Liabilities and Stockholders’

Equity |

|

|

|

|

|

| |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

180.9 |

|

$ |

148.7 |

|

Accrued liabilities |

|

152.5 |

|

|

166.5 |

|

Finance leases |

|

- |

|

|

0.1 |

|

Current portion of operating lease liabilities |

|

14.1 |

|

|

12.4 |

|

Current portion of plant closure provisions |

|

6.6 |

|

|

5.2 |

|

Current portion of accrued income taxes |

|

15.1 |

|

|

3.7 |

| Total current liabilities |

|

369.2 |

|

|

336.6 |

| |

|

|

|

|

|

| Operating lease liabilities,

net of current portion |

|

35.2 |

|

|

23.1 |

| Plant closure provisions, net

of current portion |

|

49.2 |

|

|

51.3 |

| Accrued income taxes, net of

current portion |

|

20.8 |

|

|

30.6 |

| Unrecognized tax benefits |

|

16.3 |

|

|

16.3 |

| Deferred tax liabilities |

|

60.8 |

|

|

60.8 |

| Pension liabilities and

post-employment benefits |

|

16.4 |

|

|

17.8 |

| Other non-current

liabilities |

|

1.4 |

|

|

1.4 |

| Equity |

|

1,068.6 |

|

|

1,033.0 |

| Total liabilities and

equity |

$ |

1,637.9 |

|

$ |

1,570.9 |

|

Schedule 4 |

|

INNOSPEC INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

|

|

Six Months EndedJune 30 |

|

(in millions) |

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

| Cash

Flows from Operating Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

$ |

68.8 |

|

|

$ |

45.8 |

|

|

Adjustments to reconcile net income to cash provided by operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

20.8 |

|

|

|

20.6 |

|

|

Deferred taxes |

|

1.0 |

|

|

|

7.8 |

|

|

Non-cash movements on defined benefit pension plans |

|

(1.3 |

) |

|

|

(1.6 |

) |

|

Stock option compensation |

|

3.2 |

|

|

|

2.9 |

|

|

Changes in working capital |

|

(123.0 |

) |

|

|

(52.8 |

) |

|

Movements in accrued income taxes |

|

(4.2 |

) |

|

|

(1.7 |

) |

|

Movements in plant closure provisions |

|

- |

|

|

|

(0.6 |

) |

|

Movements in unrecognized tax benefits |

|

- |

|

|

|

0.3 |

|

|

Movements in other assets and liabilities |

|

(1.8 |

) |

|

|

0.9 |

|

| Net cash

(used in)/provided by operating activities |

|

(36.5 |

) |

|

|

21.6 |

|

|

|

|

|

|

|

|

| Cash

Flows from Investing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

| Capital

expenditures |

|

(17.4 |

) |

|

|

(19.5 |

) |

| Proceeds

on disposal of property, plant and equipment |

|

- |

|

|

|

0.3 |

|

| Net cash

used in investing activities |

|

(17.4 |

) |

|

|

(19.2 |

) |

|

|

|

|

|

|

|

| Cash

Flows from Financing Activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

- |

|

|

|

0.1 |

|

|

Repayment of finance leases |

|

(0.1 |

) |

|

|

(0.3 |

) |

| Dividend

paid |

|

(15.6 |

) |

|

|

(14.0 |

) |

| Issue of

treasury stock |

|

2.1 |

|

|

|

1.7 |

|

|

Repurchase of common stock |

|

(2.7 |

) |

|

|

(0.8 |

) |

| Net cash

used in financing activities |

|

(16.3 |

) |

|

|

(13.3 |

) |

| Effect of foreign currency

exchange rate changes on cash |

|

(0.2 |

) |

|

|

- |

|

| Net

change in cash and cash equivalents |

|

(70.4 |

) |

|

|

(10.9 |

) |

| Cash and

cash equivalents at beginning of period |

|

141.8 |

|

|

|

105.3 |

|

| Cash and

cash equivalents at end of period |

$ |

71.4 |

|

|

$ |

94.4 |

|

|

|

|

|

|

|

|

|

|

Amortization of deferred finance costs of $0.2

million (2021 - $0.2 million) are included in depreciation and

amortization in the condensed consolidated statements of cash flows

and in interest expense, net in the condensed consolidated

statements of income.

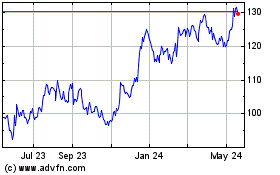

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Oct 2024 to Nov 2024

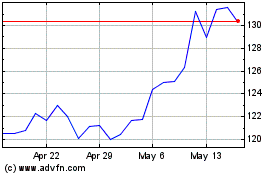

Innospec (NASDAQ:IOSP)

Historical Stock Chart

From Nov 2023 to Nov 2024