James River Commences Litigation Against Fleming Intermediate Holdings to Enforce Stock Purchase Agreement

12 March 2024 - 12:00AM

James River Group Holdings, Ltd. (“James River” or the “Company”)

(NASDAQ: JRVR) announced that it has filed a complaint in the

Supreme Court, New York County, Commercial Division against Fleming

Intermediate Holdings (“Fleming”), a portfolio company of private

equity sponsor Altamont Capital Partners. The action seeks specific

performance of Fleming’s obligation to complete the acquisition of

JRG Reinsurance Company Ltd. (“JRG Re”) in accordance with the

Stock Purchase Agreement (the “SPA”) between the parties as of

November 8, 2023. James River will seek expedited relief from the

Court to require Fleming to close the transaction.

James River brings this action in response to

the refusal of Fleming to complete the fully negotiated transaction

that it executed in November. James River has taken all of the

contractually required steps to effect a closing, including the

receipt of all regulatory approvals. However, just hours prior to

the contractually required closing, Fleming claimed that it had no

obligation to close and did not attend the scheduled closing call.

Fleming subsequently demanded material economic changes to the

agreed-upon transaction terms.

The lawsuit makes clear that Fleming’s

self-serving complaints are flatly contradicted by the parties’

signed agreement. James River will take all actions necessary to

protect its interests, enforce James River’s rights under the SPA

and compel Fleming to complete the transaction in accordance with

its terms. As long as James River continues to own JRG Re, James

River will continue to operate and support JRG Re and its cedents

as it has throughout its ownership. The Company has prepared JRG Re

and its financials for sale according to the terms of the SPA.

Frank D’Orazio, the Company’s Chief Executive

Officer, commented, “James River is taking immediate action to

enforce its rights under the previously agreed upon transaction

with Fleming and ensure that Fleming fulfills its obligations to

the Company. We remain confident in the strength of JRG Re and its

team, and we believe that the steps we are taking are in the best

interests of James River and its shareholders.”

About James River Group Holdings,

Ltd.James River Group Holdings, Ltd. is a Bermuda-based

insurance holding company that owns and operates a group of

specialty insurance companies. The Company operates in two

specialty property-casualty insurance segments: Excess and Surplus

Lines and Specialty Admitted Insurance. Each of the Company’s

regulated U.S. insurance subsidiaries are rated “A-” (Excellent) by

A.M. Best Company. Visit James River Group Holdings, Ltd. on the

web at www.jrvrgroup.com.

James River Investor Contact:Brett

ShirreffsSVP, Finance, Investments and Investor Relations(919)

980-0524Investors@jrvrgroup.com

James River Media Contact:Adam Pollack /

Kaitlin Kikalo / Michael Reilly Joele Frank, Wilkinson Brimmer

Katcher+1-212-355-4449

Forward-Looking StatementsThis

press release contains forward-looking statements as that term is

defined in the Private Securities Litigation Reform Act of 1995. In

some cases, such forward-looking statements may be identified by

terms such as believe, expect, seek, may, will, should, intend,

project, anticipate, plan, estimate, guidance or similar words.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from those in the

forward-looking statements. Although it is not possible to identify

all of these risks and uncertainties, they include, among others,

the following: the inherent uncertainty of litigation and the

potential failure to obtain specific performance of the buyer’s

obligation to complete the acquisition of JRG Re announced on

November 8, 2023; the timing of the, or the potential failure to,

close the sale by the Company of the common shares of JRG Re

announced on November 8, 2023; the inherent uncertainty of

estimating reserves and the possibility that incurred losses may be

greater than our loss and loss adjustment expense reserves;

inaccurate estimates and judgments in our risk management may

expose us to greater risks than intended; downgrades in the

financial strength rating or outlook of our regulated insurance

subsidiaries impacting our ability to attract and retain insurance

business that our subsidiaries write, our competitive position, and

our financial condition; potential uncertainty regarding the

outcome of our exploration of strategic alternatives, and the

impacts that it may have on our business; the potential loss of key

members of our management team or key employees and our ability to

attract and retain personnel; adverse economic factors resulting in

the sale of fewer policies than expected or an increase in the

frequency or severity of claims, or both; the impact of a

persistent high inflationary environment on our reserves, the

values of our investments and investment returns, and our

compensation expenses; exposure to credit risk, interest rate risk

and other market risk in our investment portfolio; reliance on a

select group of brokers and agents for a significant portion of our

business and the impact of our potential failure to maintain such

relationships; reliance on a select group of customers for a

significant portion of our business and the impact of our potential

failure to maintain, or decision to terminate, such relationships;

our ability to obtain reinsurance coverage at prices and on terms

that allow us to transfer risk, adequately protect our company

against financial loss and that supports our growth plans; losses

resulting from reinsurance counterparties failing to pay us on

reinsurance claims, insurance companies with whom we have a

fronting arrangement failing to pay us for claims, or a former

customer with whom we have an indemnification arrangement failing

to perform its reimbursement obligations, and our potential

inability to demand or maintain adequate collateral to mitigate

such risks; inadequacy of premiums we charge to compensate us for

our losses incurred; changes in laws or government regulation,

including tax or insurance law and regulations; changes in U.S. tax

laws (including associated regulations) and the interpretation of

certain provisions applicable to insurance/reinsurance businesses

with U.S. and non-U.S. operations, which may be retroactive and

could have a significant effect on us including, among other

things, by potentially increasing our tax rate, as well as on our

shareholders; in the event we do not qualify for the insurance

company exception to the passive foreign investment company

(“PFIC”) rules and are therefore considered a PFIC, there could be

material adverse tax consequences to an investor that is subject to

U.S. federal income taxation; the Company or any of its foreign

subsidiaries becoming subject to U.S. federal income taxation; a

failure of any of the loss limitations or exclusions we utilize to

shield us from unanticipated financial losses or legal exposures,

or other liabilities; losses from catastrophic events, such as

natural disasters and terrorist acts, which substantially exceed

our expectations and/or exceed the amount of reinsurance we have

purchased to protect us from such events; potential effects on our

business of emerging claim and coverage issues; the potential

impact of internal or external fraud, operational errors, systems

malfunctions or cyber security incidents; our ability to manage our

growth effectively; failure to maintain effective internal controls

in accordance with the Sarbanes-Oxley Act of 2002, as amended

(“Sarbanes-Oxley”); changes in our financial condition, regulations

or other factors that may restrict our subsidiaries; ability to pay

us dividends; and an adverse result in any litigation or legal

proceedings we are or may become subject to. Additional information

about these risks and uncertainties, as well as others that may

cause actual results to differ materially from those in the

forward-looking statements, is contained in our filings with the

U.S. Securities and Exchange Commission ("SEC"), including our most

recently filed Annual Report on Form 10-K. These forward-looking

statements speak only as of the date of this release and the

Company does not undertake any obligation to update or revise any

forward-looking information to reflect changes in assumptions, the

occurrence of unanticipated events, or otherwise.

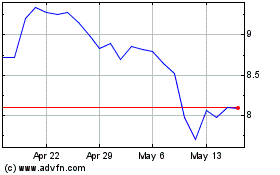

James River (NASDAQ:JRVR)

Historical Stock Chart

From Nov 2024 to Dec 2024

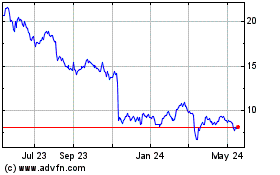

James River (NASDAQ:JRVR)

Historical Stock Chart

From Dec 2023 to Dec 2024