Kaiser Aluminum Corporation (NASDAQ:KALU), a leading producer of

semi-fabricated specialty aluminum products serving customers

worldwide with highly-engineered solutions for aerospace and

high-strength, packaging, general engineering, automotive

extrusions, and other industrial applications, today announced

third quarter 2023 results.

Management Commentary

“We were pleased to report third quarter results

largely within our expectations in a challenging market with

adjusted EBITDA of $48 million increasing $19 million over the

prior year period, slightly above our outlook,” said Keith A.

Harvey, President and Chief Executive Officer. “Demand for our

aerospace products remained robust as our operations have been

recovering to meet or exceed pre-pandemic peak levels, which we

believe will be attainable by the end of this year. We have

continued to flex our available capacity to capitalize on

strengthening aerospace demand as general engineering demand has

remained soft. Demand for packaging persisted during the quarter

but appeared to be slowing down. While beverage can destocking

appears to be abating, we are now seeing coated food products,

which make up a considerable amount of our shipments, enter into a

destocking phase. We remain focused on improving profitability in

our packaging products through strong contract management and a

shift towards higher margin, coated products further enabled by our

roll coat capacity expansion project. Despite market headwinds

including rising inflationary costs and challenging, short-term

demand issues impacting our operational efficiencies, we remain

uniquely positioned to execute our long-term strategy given our

strong market and liquidity positions and flexible cost structure

to navigate complex operating environments.”

|

Third Quarter 2023 Consolidated

Results(Unaudited)*(In millions of dollars, except

shipments, realized price and per share amounts) |

|

|

|

|

|

Quarterly |

|

|

|

|

3Q23 |

|

|

2Q23 |

|

|

1Q23 |

|

|

4Q22 |

|

|

3Q22 |

|

|

Shipments (millions of lbs.) |

|

|

299 |

|

|

|

314 |

|

|

|

299 |

|

|

|

302 |

|

|

|

282 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

744 |

|

|

$ |

814 |

|

|

$ |

808 |

|

|

$ |

776 |

|

|

$ |

749 |

|

|

Less hedged cost of alloyed metal1 |

|

|

(387 |

) |

|

|

(436 |

) |

|

|

(438 |

) |

|

|

(420 |

) |

|

|

(427 |

) |

|

Conversion revenue |

|

$ |

357 |

|

|

$ |

379 |

|

|

$ |

369 |

|

|

$ |

356 |

|

|

$ |

322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Realized price per pound ($/lb.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

2.48 |

|

|

$ |

2.59 |

|

|

$ |

2.70 |

|

|

$ |

2.57 |

|

|

$ |

2.66 |

|

|

Less hedged cost of alloyed metal |

|

|

(1.29 |

) |

|

|

(1.38 |

) |

|

|

(1.47 |

) |

|

|

(1.39 |

) |

|

|

(1.52 |

) |

|

Conversion revenue |

|

$ |

1.19 |

|

|

$ |

1.21 |

|

|

$ |

1.23 |

|

|

$ |

1.18 |

|

|

$ |

1.14 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

As reported |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income (loss) |

|

$ |

19 |

|

|

$ |

36 |

|

|

$ |

19 |

|

|

$ |

(22 |

) |

|

$ |

3 |

|

|

Net income (loss) |

|

$ |

5 |

|

|

$ |

18 |

|

|

$ |

16 |

|

|

$ |

(26 |

) |

|

$ |

3 |

|

|

Net income (loss) per share, diluted2 |

|

$ |

0.34 |

|

|

$ |

1.14 |

|

|

$ |

0.99 |

|

|

$ |

(1.66 |

) |

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

$ |

20 |

|

|

$ |

37 |

|

|

$ |

20 |

|

|

$ |

3 |

|

|

$ |

3 |

|

|

EBITDA4 |

|

$ |

48 |

|

|

$ |

64 |

|

|

$ |

47 |

|

|

$ |

30 |

|

|

$ |

29 |

|

|

EBITDA margin5 |

|

|

13.3 |

% |

|

|

16.8 |

% |

|

|

12.7 |

% |

|

|

8.4 |

% |

|

|

8.9 |

% |

|

Net income (loss) |

|

$ |

7 |

|

|

$ |

20 |

|

|

$ |

7 |

|

|

$ |

(6 |

) |

|

$ |

(3 |

) |

|

EPS, diluted2 |

|

$ |

0.46 |

|

|

$ |

1.26 |

|

|

$ |

0.42 |

|

|

$ |

(0.35 |

) |

|

$ |

(0.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Hedged Cost of Alloyed Metal for 3Q23,

2Q23, 1Q23, 4Q22, and 3Q22 included $380.0 million, $428.8 million,

$436.7 million, $414.3 million, and $408.7 million, respectively,

reflecting the cost of aluminum at the average Midwest Transaction

Price and the cost of alloys used in the production process, as

well as metal price exposure on shipments that the Company hedged

with realized losses upon settlement of $6.5 million, $6.8 million,

$1.6 million, $6.1 million, and $18.4 million, in 3Q23, 2Q23, 1Q23,

4Q22, and 3Q22, respectively, all of which were included within

both Net sales and Cost of products sold, excluding depreciation

and amortization in the Company’s Statements of Consolidated Income

(Loss). 2. Diluted shares for EPS are calculated using the

treasury stock method. 3. Adjusted numbers exclude

non-run-rate items. For all Adjusted numbers and EBITDA refer to

Reconciliation of Non-GAAP Measures. 4. Adjusted EBITDA =

Consolidated operating income, excluding operating non-run-rate

items, plus Depreciation and amortization. 5. Adjusted EBITDA

margin = Adjusted EBITDA as a percent of Conversion Revenue.

* Please refer to GAAP financial statements.

Totals may not sum due to rounding.

Third Quarter 2023 Financial

Highlights

Net sales for the third quarter 2023 modestly

decreased to $744 million compared to $749 million in the prior

year period, reflecting a 6% increase in shipments offset by a 7%

decrease in average selling price per pound. The decrease in

average selling price reflected a 15% decrease in underlying

contained metal costs, partially offset by a 4% increase in

conversion revenue per pound.

Conversion revenue for the third quarter 2023 was

$357 million, reflecting an 11% increase compared to the prior year

period.

- Conversion revenue for the Company’s aerospace/high strength

applications was $134 million, reflecting a 72% increase resulting

from a 69% increase in shipments over the prior year quarter. The

improvement reflects continued strengthening demand for commercial

aerospace applications.

- Conversion revenue for packaging applications was $118 million,

reflecting a 9% decrease due to ongoing destocking in the market,

primarily for coated food products. Shipments increased 5% over the

prior year quarter, reflecting the impact of the magnesium related

declaration of force majeure during the third quarter 2022.

- Conversion revenue for general engineering applications was $75

million, reflecting a 16% decrease resulting from a 24% decrease in

shipments over the prior year quarter due to destocking at service

centers, primarily for the Company's plate products.

- Conversion revenue for automotive extrusions was $28 million,

reflecting a 16% increase resulting from a 6% increase in shipments

as well as improved pricing over the prior year quarter.

Reported net income for the third quarter 2023 was

$5 million, or $0.34 income per diluted share, compared to net

income and income per diluted share of $3 million and $0.16,

respectively, in the prior year period. Excluding the impact of

pre-tax, non-run-rate items of $3 million, adjusted net income was

$7 million for the third quarter 2023, compared to adjusted net

loss of $3 million in the prior year period. Adjusted income per

diluted share was $0.46 for the third quarter 2023, compared to

adjusted loss per diluted share of $0.21 for the third quarter

2022.

Adjusted EBITDA of $48 million in the third

quarter 2023 increased $19 million compared to the prior year

period and decreased $16 million compared to the second quarter

2023. Adjusted EBITDA as a percentage of conversion revenue was

13.3% in the third quarter 2023 compared to 8.9% in the prior year

period and 16.8% in the second quarter 2023.

Cash Flow and Liquidity

Adjusted EBITDA of $158 million reported in the

first nine months of 2023, cash on hand, and a $4 million change in

working capital funded $120 million of capital investments, $33

million of interest payments and $38 million of cash returned to

stockholders through quarterly dividends.

As of September 30, 2023, the Company had cash and

cash equivalents of $45 million and borrowing availability under

the Company's revolving credit facility of $529 million providing

total liquidity of $574 million. There were no outstanding

borrowings under the revolving credit facility as of September 30,

2023.

On October 12, 2023, the Company announced the

declaration of a quarterly cash dividend of $0.77 per share which

is payable on November 15, 2023 to stockholders of record as of the

close of business on October 25, 2023.

Fourth Quarter 2023 Outlook

Kaiser remains well positioned in the current

mixed demand environment as a key supplier in diverse end markets

with multi-year contracts with strategic partners. Commercial

aerospace demand is expected to continue to strengthen and meet or

exceed record pre-pandemic 2019 levels by the end of 2023, with

business jet, defense and space markets all remaining strong. In

packaging, shipments are expected to decline as destocking has

shifted to coated food products, along with anticipated fourth

quarter seasonality, which will be partly offset by contractual

minimums in place with its customers. General engineering demand is

expected to decline due to continued plate destocking and the

anticipated fourth quarter seasonal decline. In automotive, the

Company expects the market to remain relatively consistent with the

third quarter 2023 due to the anticipated fourth quarter seasonal

decline and uncertainties from the UAW strike.

As a result, consolidated adjusted EBITDA in the

fourth quarter 2023 is expected to be in line to slightly higher as

compared to its adjusted fourth quarter 2022 results. The Company

continues to believe its full year 2022 adjusted EBITDA represented

the trough and remains cautiously optimistic its full year 2023

consolidated adjusted EBITDA and adjusted EBITDA margin will

improve as it pursues cost reductions in its operations, improves

manufacturing efficiencies and continues commercial actions to

improve pricing.

The Company’s capital investment plans remain

focused on supporting demand growth through capacity expansion,

sustaining its operations, enhancing product quality and increasing

operating efficiencies. Total capital investments in 2023 are

expected to be in the range of $170 million to $180 million, the

majority of which will be focused on growth initiatives, primarily

reflecting investments in the new roll coat line at the Warrick

facility.

Conference Call

Kaiser Aluminum Corporation will host a conference

call on Thursday, October 26, 2023, at 10:00 am (Eastern Time);

9:00 am (Central Time); 7:00 am (Pacific Time), to discuss its

third quarter results. To participate, the conference call can be

directly accessed from the U.S. and Canada at (877) 423-9813, and

accessed internationally at (201) 689-8573. The conference call ID

number is 13741354. A link to the simultaneous webcast can be

accessed on the Company’s website at

https://investors.kaiseraluminum.com. A copy of a presentation will

be available for download prior to the call and an audio archive

will be available on the Company’s website following the call.

Company Description

Kaiser Aluminum Corporation, headquartered in

Franklin, Tenn., is a leading producer of semi-fabricated specialty

aluminum products, serving customers worldwide with

highly-engineered solutions for aerospace and high-strength,

packaging, general engineering, automotive extrusions, and other

industrial applications. The Company’s North American facilities

produce value-added plate, sheet, coil, extrusions, rod, bar, tube,

and wire products, adhering to traditions of quality, innovation,

and service that have been key components of the culture since the

Company was founded in 1946. The Company’s stock is included in the

Russell 2000® index and the S&P Small Cap 600® index.

Available Information

For more information, please visit the Company’s

website at www.kaiseraluminum.com. The website includes a section

for investor relations under which the Company provides

notifications of news or announcements regarding its financial

performance, including Securities and Exchange Commission (SEC)

filings, investor events, and earnings and other press releases. In

addition, all Company filings submitted to the SEC are available

through a link to the section of the SEC’s website at www.sec.gov,

which includes: Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K and Proxy Statements for the

Company’s annual stockholders’ meetings, and other information

statements as filed with the SEC. In addition, the Company provides

a webcast of its quarterly earnings calls and certain events in

which management participates or hosts with members of the

investment community.

Non-GAAP Financial Measures

This earnings release contains certain non-GAAP

financial measures. A “non-GAAP financial measure” is defined as a

numerical measure of a company’s financial performance that

excludes or includes amounts so as to be different than the most

directly comparable measure calculated and presented in accordance

with GAAP in the statements of income, balance sheets, or

statements of cash flow of the Company. Pursuant to the

requirements of Regulation G, the Company has provided a

reconciliation of non-GAAP financial measures to the most directly

comparable financial measure in the accompanying tables.

The non-GAAP financial measures used within this

earnings release are conversion revenue, adjusted operating income,

adjusted EBITDA, adjusted net income, and adjusted earnings per

diluted share which exclude non-run-rate items and ratios related

thereto. As more fully described in these reports, “non-run-rate”

items are items that, while they may occur from period to period,

are particularly material to results, impact costs primarily as a

result of external market factors and may not occur in future

periods if the same level of underlying performance were to occur.

These measures are presented because management uses this

information to monitor and evaluate financial results and trends

and believes this information to also be useful for investors.

Reconciliations of certain forward looking non-GAAP financial

measures to comparable GAAP measures are not provided because

certain items required for such reconciliations are outside of the

Company's control and/or cannot be reasonably predicted or provided

without unreasonable effort.

Forward-Looking Statements

This press release contains statements based on

management’s current expectations, estimates and projections that

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995 involving known

and unknown risks and uncertainties that may cause actual results,

performance or achievements of the Company to be materially

different from those expressed or implied. These factors include:

(a) the effectiveness of management's strategies and decisions,

including strategic investments, capital spending strategies, cost

reduction initiatives, processes and countermeasures implemented to

address operational and supply chain challenges, and the execution

of those strategies; (b) general economic and business conditions,

reshoring, cyclicality, supply chain disruptions, and conditions

that impact demand drivers in the aerospace/high strength, aluminum

beverage and food packaging, general engineering, automotive and

other end markets the Company serves; (c) the Company’s ability to

participate in mature and anticipated new automotive programs

expected to launch in the future and successfully launch new

automotive programs; (d) changes or shifts in defense spending due

to competing national priorities; (e) pricing, market conditions

and the Company’s ability to effectively execute its commercial and

labor strategies, pass through cost increases, including the

institution of surcharges, and flex costs in response to inflation,

volatile commodity costs and changing economic conditions; (f)

developments in technology; (g) the impact of the Company's future

earnings, cash flows, financial condition, capital requirements and

other factors on its financial strength and flexibility; (h) new or

modified statutory or regulatory requirements; (i) the successful

integration of the acquired operations and technologies; and (j)

other risk factors summarized in the Company's reports filed with

the Securities and Exchange Commission including the Company's Form

10-K for the year ended December 31, 2022. All information in this

release is as of the date of the release. The Company undertakes no

duty to update any forward-looking statement to conform the

statement to actual results or changes in the Company’s

expectations.

|

Investor Relations and Public Relations

Contact: |

|

| Addo

Investor Relations |

|

|

Investors@KaiserAluminum.com |

|

| (949)

614-1769 |

|

|

|

|

Kaiser Aluminum Corporation and Subsidiary

CompaniesStatements of Consolidated Income (Loss)

(Unaudited)1(In millions of dollars,

except share and per share amounts) |

|

|

|

|

|

Quarter Ended September 30, |

|

|

Nine Months Ended September

30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net sales |

|

$ |

743.6 |

|

|

$ |

748.9 |

|

|

$ |

2,365.3 |

|

|

$ |

2,651.9 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold, excluding depreciation and amortization |

|

|

665.2 |

|

|

|

694.9 |

|

|

|

2,114.7 |

|

|

|

2,459.2 |

|

|

Depreciation and amortization |

|

|

27.2 |

|

|

|

25.8 |

|

|

|

79.9 |

|

|

|

80.4 |

|

|

Selling, general, administrative, research and development |

|

|

30.5 |

|

|

|

25.2 |

|

|

|

92.4 |

|

|

|

82.9 |

|

|

Restructuring costs |

|

|

1.6 |

|

|

|

— |

|

|

|

4.2 |

|

|

|

— |

|

|

Other operating charges, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.2 |

|

|

Total costs and expenses |

|

|

724.5 |

|

|

|

745.9 |

|

|

|

2,291.2 |

|

|

|

2,625.7 |

|

|

Operating income |

|

|

19.1 |

|

|

|

3.0 |

|

|

|

74.1 |

|

|

|

26.2 |

|

|

Other (expense) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(11.4 |

) |

|

|

(12.1 |

) |

|

|

(35.4 |

) |

|

|

(36.5 |

) |

|

Other (expense) income, net |

|

|

(2.2 |

) |

|

|

12.7 |

|

|

|

8.9 |

|

|

|

7.4 |

|

|

Income (loss) before income taxes |

|

|

5.5 |

|

|

|

3.6 |

|

|

|

47.6 |

|

|

|

(2.9 |

) |

|

Income tax provision |

|

|

(0.1 |

) |

|

|

(1.1 |

) |

|

|

(8.0 |

) |

|

|

(0.3 |

) |

|

Net income (loss) |

|

$ |

5.4 |

|

|

$ |

2.5 |

|

|

$ |

39.6 |

|

|

$ |

(3.2 |

) |

|

Net income (loss) per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.34 |

|

|

$ |

0.16 |

|

|

$ |

2.48 |

|

|

$ |

(0.20 |

) |

|

Diluted2 |

|

$ |

0.34 |

|

|

$ |

0.16 |

|

|

$ |

2.46 |

|

|

$ |

(0.20 |

) |

|

Weighted-average number of common shares outstanding (in

thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

15,995 |

|

|

|

15,926 |

|

|

|

15,970 |

|

|

|

15,897 |

|

|

Diluted2 |

|

|

16,154 |

|

|

|

16,029 |

|

|

|

16,110 |

|

|

|

15,897 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Please refer to the Company's Form 10-Q for the quarter ended

September 30, 2023 for detail regarding the items in the

table.

- Diluted shares for EPS are calculated using the treasury stock

method.

|

Kaiser Aluminum Corporation and Subsidiary

CompaniesConsolidated Balance Sheets

(Unaudited)1(In millions of dollars,

except share and per share amounts) |

|

|

|

|

|

As of September 30, 2023 |

|

|

As of December 31, 2022 |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

44.6 |

|

|

$ |

57.4 |

|

|

Receivables: |

|

|

|

|

|

|

|

Trade receivables, net |

|

|

351.5 |

|

|

|

297.2 |

|

|

Other |

|

|

7.6 |

|

|

|

73.5 |

|

|

Contract assets |

|

|

52.6 |

|

|

|

58.6 |

|

|

Inventories |

|

|

488.6 |

|

|

|

525.4 |

|

|

Prepaid expenses and other current assets |

|

|

39.5 |

|

|

|

30.5 |

|

|

Total current assets |

|

|

984.4 |

|

|

|

1,042.6 |

|

|

Property, plant and equipment, net |

|

|

1,057.5 |

|

|

|

1,013.2 |

|

|

Operating lease assets |

|

|

34.6 |

|

|

|

39.1 |

|

|

Deferred tax assets, net |

|

|

5.0 |

|

|

|

7.5 |

|

|

Intangible assets, net |

|

|

51.1 |

|

|

|

55.3 |

|

|

Goodwill |

|

|

18.8 |

|

|

|

18.8 |

|

|

Other assets |

|

|

116.7 |

|

|

|

112.3 |

|

|

Total |

|

$ |

2,268.1 |

|

|

$ |

2,288.8 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

243.2 |

|

|

$ |

305.1 |

|

|

Accrued salaries, wages and related expenses |

|

|

50.7 |

|

|

|

45.2 |

|

|

Other accrued liabilities |

|

|

73.1 |

|

|

|

68.4 |

|

|

Total current liabilities |

|

|

367.0 |

|

|

|

418.7 |

|

|

Long-term portion of operating lease liabilities |

|

|

31.1 |

|

|

|

35.4 |

|

|

Pension and other postretirement benefits |

|

|

79.4 |

|

|

|

69.3 |

|

|

Net liabilities of Salaried VEBA |

|

|

17.0 |

|

|

|

16.5 |

|

|

Deferred tax liabilities |

|

|

8.0 |

|

|

|

4.9 |

|

|

Long-term liabilities |

|

|

85.5 |

|

|

|

74.7 |

|

|

Long-term debt, net |

|

|

1,039.4 |

|

|

|

1,038.1 |

|

|

Total liabilities |

|

|

1,627.4 |

|

|

|

1,657.6 |

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

Preferred stock, 5,000,000 shares authorized at both September 30,

2023 and December 31, 2022; no shares were issued

and outstanding at September 30, 2023 and December 31, 2022 |

|

|

— |

|

|

|

— |

|

|

Common stock, par value $0.01, 90,000,000 shares authorized at

both September 30, 2023 and December 31, 2022; 22,849,104

shares issued and 16,013,818 shares outstanding at September

30, 2023; 22,776,042 shares issued and 15,940,756 shares

outstanding at December 31, 2022 |

|

|

0.2 |

|

|

|

0.2 |

|

|

Additional paid in capital |

|

|

1,100.4 |

|

|

|

1,090.4 |

|

|

Retained earnings |

|

|

15.2 |

|

|

|

13.3 |

|

|

Treasury stock, at cost, 6,835,286 shares at both September 30,

2023 and December 31, 2022 |

|

|

(475.9 |

) |

|

|

(475.9 |

) |

|

Accumulated other comprehensive income |

|

|

0.8 |

|

|

|

3.2 |

|

|

Total stockholders' equity |

|

|

640.7 |

|

|

|

631.2 |

|

|

Total |

|

$ |

2,268.1 |

|

|

$ |

2,288.8 |

|

|

|

1. Please refer to the Company's Form 10-Q

for the quarter ended September 30, 2023 for detail regarding the

items in the table.

|

Reconciliation of Non-GAAP Measures -

Consolidated(Unaudited)(In millions of

dollars, except per share amounts) |

|

|

|

|

Quarterly |

|

|

|

3Q23 |

|

|

2Q23 |

|

|

1Q23 |

|

|

4Q22 |

|

|

3Q22 |

|

|

GAAP net income (loss) |

$ |

5.4 |

|

|

$ |

18.3 |

|

|

$ |

15.9 |

|

|

$ |

(26.4 |

) |

|

$ |

2.5 |

|

|

Interest expense |

|

11.4 |

|

|

|

12.1 |

|

|

|

11.9 |

|

|

|

11.8 |

|

|

|

12.1 |

|

|

Other expense (income), net |

|

2.2 |

|

|

|

2.5 |

|

|

|

(13.6 |

) |

|

|

1.0 |

|

|

|

(12.7 |

) |

|

Income tax provision (benefit) |

|

0.1 |

|

|

|

3.0 |

|

|

|

4.9 |

|

|

|

(8.6 |

) |

|

|

1.1 |

|

|

GAAP operating income (loss) |

|

19.1 |

|

|

|

35.9 |

|

|

|

19.1 |

|

|

|

(22.2 |

) |

|

|

3.0 |

|

|

Mark-to-market (gain) loss1 |

|

(0.3 |

) |

|

|

0.2 |

|

|

|

(0.1 |

) |

|

|

(0.5 |

) |

|

|

0.0 |

|

|

Restructuring cost |

|

1.6 |

|

|

|

1.2 |

|

|

|

1.4 |

|

|

|

2.2 |

|

|

|

— |

|

|

Acquisition charges2 |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.1 |

) |

|

Goodwill impairment |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

20.5 |

|

|

|

— |

|

|

Other operating NRR loss3,4 |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3.2 |

|

|

|

— |

|

|

Operating income, excluding operating NRR items |

|

20.4 |

|

|

|

37.3 |

|

|

|

20.4 |

|

|

|

3.2 |

|

|

|

2.9 |

|

|

Depreciation and amortization |

|

27.2 |

|

|

|

26.4 |

|

|

|

26.3 |

|

|

|

26.5 |

|

|

|

25.8 |

|

|

Adjusted EBITDA5 |

$ |

47.6 |

|

|

$ |

63.7 |

|

|

$ |

46.7 |

|

|

$ |

29.7 |

|

|

$ |

28.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) |

$ |

5.4 |

|

|

$ |

18.3 |

|

|

$ |

15.9 |

|

|

$ |

(26.4 |

) |

|

$ |

2.5 |

|

|

Operating NRR items |

|

1.3 |

|

|

|

1.4 |

|

|

|

1.3 |

|

|

|

25.4 |

|

|

|

(0.1 |

) |

|

Non-operating NRR items6 |

|

1.4 |

|

|

|

1.4 |

|

|

|

(13.1 |

) |

|

|

0.9 |

|

|

|

(7.3 |

) |

|

Tax impact of above NRR items |

|

(0.7 |

) |

|

|

(0.8 |

) |

|

|

2.7 |

|

|

|

(5.5 |

) |

|

|

1.5 |

|

|

Adjusted net income (loss) |

$ |

7.4 |

|

|

$ |

20.3 |

|

|

$ |

6.8 |

|

|

$ |

(5.6 |

) |

|

$ |

(3.4 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share, diluted7 |

$ |

0.34 |

|

|

$ |

1.14 |

|

|

$ |

0.99 |

|

|

$ |

(1.66 |

) |

|

$ |

0.16 |

|

|

Adjusted earnings (loss) per diluted share7 |

$ |

0.46 |

|

|

$ |

1.26 |

|

|

$ |

0.42 |

|

|

$ |

(0.35 |

) |

|

$ |

(0.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Mark-to-market (gain) loss on derivative instruments includes

the (gain) loss on non-designated commodity hedges. Adjusted EBITDA

reflects the (gain) loss realized of such settlements.

- Acquisition costs are non-run-rate acquisition-related

transaction items, which include professional fees, as well as

non-cash hedging charges recorded in connection with the Warrick

acquisition.

- NRR is an abbreviation for non-run-rate; NRR items are

pre-tax.

- Other operating NRR items primarily represent the impact of

adjustments to environmental expenses and net periodic post

retirement service cost relating to Salaried VEBA.

- Adjusted EBITDA = Consolidated operating income, excluding

operating NRR items, plus Depreciation and amortization.

- Non-operating NRR items represents the impact of non-cash net

periodic benefit cost related to the Salaried VEBA excluding

service cost and debt refinancing charges.

- Diluted shares for EPS are calculated using the treasury stock

method and were excluded from the computations in periods of net

loss per share as their inclusion would have been

anti-dilutive.

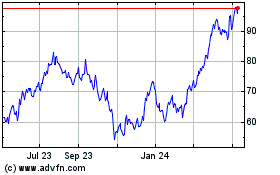

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Nov 2024 to Dec 2024

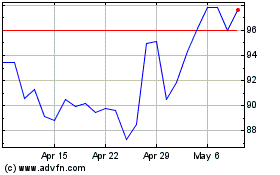

Kaiser Aluminum (NASDAQ:KALU)

Historical Stock Chart

From Dec 2023 to Dec 2024