UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): September 28, 2023

| AKERNA CORP. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-39096 |

|

83-2242651 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 1550 Larimer Street, #246, Denver, Colorado |

|

80202 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (888) 932-6537

| |

| (Former

name or former address, if changed since last report) |

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common Stock, par value $0.0001 per share |

|

KERN |

|

NASDAQ Capital Market |

| Warrants to purchase Common Stock |

|

KERNW |

|

NASDAQ Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

First

Amendment to Securities Purchase Agreement

As

previously reported, on April 28, 2023, Akerna Corp., a Delaware corporation (“Akerna”), entered into a securities purchase

agreement (the “SPA”) with Akerna Canada Ample Exchange Inc. (“Akerna Exchange”) and MJ Acquisition Corp. (“MJA”).

Upon the terms and subject to the satisfaction of the conditions described in the SPA, including approval of the transaction by Akerna’s

stockholders, Akerna will sell to MJA (or a subsidiary of MJA) all of the membership interests in MJ Freeway, LLC (“MJF”)

and Akerna Exchange will sell to MJA all of the outstanding capital stock of Ample Organics Inc. (“Ample”) (jointly, such

sales, the “Sale Transaction”).

On

September 28, 2023, Akerna, Akerna Exchange and MJA entered into a first amendment to the SPA (the “Amendment”) which amends

certain of the terms of the SPA. Principally, the Amendment:

| (i) | amends

Article I of the SPA to add certain definitions regarding the Amended and Restated Note (as defined below); |

| (ii) | amends

Article I to change the “Outside Date” as defined therein from September 29, 2023 to December 31, 2023; |

| (iii) | amends

Section 2.2 of the SPA to reduce the amount of cash to be paid at closing from $4 million to $2 million; |

| (iv) | amends

Section 5.14 of the SPA to add to the items of business in relation to which Akerna will seek stockholder approval at a special meeting

of the stockholders the issuance of shares of common stock of Akerna to MJA under the Amended and Restated Note; |

| (v) | adds

a new Section 5.19 which provides that prior to closing under the SPA, MJA will work in good faith on a best efforts basis across multiple

interested parties on behalf of and with the express approval of Akerna to secure for Akerna the highest purchase price possible for

the shares of Ample. Akerna shall cause the proceeds from such sale to be included in the assets of MJF effective as of the closing.

Notwithstanding the foregoing, in the event that the shares of Ample are sold to a third-party for a net purchase price above $700,000,

Akerna shall be entitled to retain all net proceeds in excess of $700,000; |

| (vi) | provides

that, within 3 business days of the Amendment, MJA will loan Akerna an additional $500,000 to fund Akerna’s working capital requirements;

and |

| (vii) | provides

that concurrently with the funding of the additional $500,000 loan to Akerna, Akerna will issue and amended and restated convertible

secured promissory note (“Amended and Restated Note”) to MJA which amends and restates the Secured Promissory Note dated

April 28, 2023 by and between Akerna and MJA (the ‘Original Note”) to (A) increase the principal amount of the Original Note

from $1,000,000 to $1,500,000, (B) provide for the forfeiture by MJA of the accrued and unpaid interest at the consummation of the transaction

under the SPA and (C) provide that contemporaneous with and immediately prior to the consummation of the transactions under the SPA provide

that contemporaneous with and immediately prior to the consummation of the transactions under the SPA, the principal amount of the shall

convert into such quantity of shares of common stock of the Company as equals (1) $1,500,000, multiplied by (2) the 5-day volume weighted

average price of the common stock of the Company as quoted on The Nasdaq Capital Market for the 5 trading days immediately preceding

the date of the consummation of the transactions under the SPA; provided however, that in no case shall Akerna be required to

issue to MJA such number of shares of common stock as would in the aggregate with all shares issued pursuant to the SPA and/or held or

controlled by MJA exceed 19.99% of the number of issued and outstanding shares of common stock of the Seller on the date hereof without

first obtaining the approval of stockholders of Akerna as required pursuant to the rules of the Nasdaq Stock Exchange. |

Except

as set forth above, no other amendments, revisions or additions were made to the SPA and all terms, conditions, covenants, representations

and warranties contained in the SPA shall remain in full force and effect as disclosed in Item 1.01 of Akerna’s Current Report

on Form 8-K as filed with the Commission on May 1, 2023, which disclosure is incorporated herein by reference.

The above description of the material terms of

the Amendment isqualified in its entirety by reference to the full text of the Amendment which is

filed as Exhibit 2.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

The

following exhibits are filed as part of this report:

Additional

Information and Where to Find It

This

Current Report on Form 8-K may be deemed to be solicitation material with respect to the proposed transactions between Akerna and Gryphon

Digital Mining, Inc. (‘Gryphon”) and between Akerna and MJ Acquisition Corp. In connection with the proposed transactions,

Akerna has filed relevant materials with the United States Securities and Exchange Commission, or the SEC, including a registration statement

on Form S-4 that contains a prospectus and a proxy statement. Akerna will mail the proxy statement/prospectus to the Akerna stockholders,

and the securities may not be sold or exchanged until the registration statement becomes effective. Investors and securityholders of

Akerna and Gryphon are urged to read these materials because they will contain important information about Akerna, Gryphon and the proposed

transactions. This Current Report on Form 8-K is not a substitute for the registration statement, definitive proxy statement/prospectus

or any other documents that Akerna may file with the SEC or send to securityholders in connection with the proposed transactions. Investors

and securityholders may obtain free copies of the documents filed with the SEC on Akerna’s website at www.akerna.com, on the SEC’s

website at www.sec.gov or by directing a request to Akerna’s Investor Relations at (516) 419-9915.

This

Current Report on Form 8-K is not a proxy statement or a solicitation of a proxy, consent or authorization with respect to any securities

or in respect of the proposed transactions, and shall not constitute an offer to sell or the solicitation of an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Participants

in the Solicitation

Each

of Akerna, Gryphon, MJ Acquisition Corp. and their respective directors and executive officers may be deemed to be participants in the

solicitation of proxies from the stockholders of Akerna in connection with the proposed transactions. Information about the executive

officers and directors of Akerna are set forth in Akerna’s Definitive Proxy Statement on Schedule 14A relating to the 2022 Annual

Meeting of Stockholders, filed with the SEC on April 19, 2022. Other information regarding the interests of such individuals, who may

be deemed to be participants in the solicitation of proxies for the stockholders of Akerna, is set forth in the proxy statement/prospectus

included in Akerna’s registration statement on Form S-4 as filed with the SEC on May 12, 2023, as last amended on September 7,

2023. You may obtain free copies of these documents as described above.

Cautionary

Statements Regarding Forward-Looking Statements

This

Current Report on Form 8-K contains forward-looking statements based upon the current expectations of Gryphon and Akerna. Actual results

and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks

and uncertainties, which include, without limitation: (i) the risk that the conditions to the closing of the proposed transactions are

not satisfied, including the failure to timely obtain stockholder approval for the transactions, if at all; (ii) uncertainties as to

the timing of the consummation of the proposed transactions and the ability of each of Akerna, Gryphon and MJ Acquisition Co. to consummate

the proposed merger or asset sale, as applicable; (iii) risks related to Akerna’s ability to manage its operating expenses and

its expenses associated with the proposed transactions pending closing; (iv) risks related to the failure or delay in obtaining required

approvals from any governmental or quasi-governmental entity necessary to consummate the proposed transactions; (v) the risk that as

a result of adjustments to the exchange ratio, Akerna stockholders and Gryphon stockholders could own more or less of the combined company

than is currently anticipated; (vi) risks related to the market price of Akerna’s common stock relative to the exchange ratio;

(vii) unexpected costs, charges or expenses resulting from either or both of the proposed transactions; (viii) potential adverse reactions

or changes to business relationships resulting from the announcement or completion of the proposed transactions; (ix) risks related to

the inability of the combined company to obtain sufficient additional capital to continue to advance its business plan; (x) risks associated

with the possible failure to realize certain anticipated benefits of the proposed transactions, including with respect to future financial

and operating results and (xi) risks related to the Panel not granting additional time for Akerna to regain compliance with the listing

rules and Akerna being suspended and delisted from The Nasdaq Capital Market. Actual results and the timing of events could differ materially

from those anticipated in such forward-looking statements as a result of these risks and uncertainties. These and other risks and uncertainties

are more fully described in periodic filings with the SEC, including the factors described in the section titled “Risk Factors”

in Akerna’s Annual Report on Form 10-K for the year ended December 31, 2022 and Quarterly Report on Form 10-Q for the quarter ended

June 30, 2023, each filed with the SEC, and in other filings that Akerna makes and will make with the SEC in connection with the proposed

transactions, including the proxy statement/prospectus described under “Additional Information and Where to Find It.” You

should not place undue reliance on these forward-looking statements, which are made only as of the date hereof or as of the dates indicated

in the forward-looking statements. Except as required by law, Akerna and Gryphon expressly disclaim any obligation or undertaking to

update or revise any forward-looking statements contained herein to reflect any change in its expectations with regard thereto or any

change in events, conditions or circumstances on which any such statements are based.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorized.

| Dated:

October 4, 2023 |

AKERNA

CORP. |

| |

|

| |

By: |

/s/

Jessica Billingsley |

| |

|

Name: |

Jessica

Billingsley |

| |

|

Title: |

Chief

Executive Officer |

4

Exhibit 2.1

FIRST AMENDMENT TO SECURITIES PURCHASE AGREEMENT

This First Amendment to Securities

Purchase Agreement (this “Amendment”), is dated as of September 28, 2023, by and among Akerna Corp., a Delaware corporation

(“Seller”), Akerna Canada Ample Exchange Inc., an Ontario corporation and a wholly owned subsidiary of Seller (“ExchangeCo”),

and MJ Acquisition Corp., a Delaware corporation (the “Buyer”). Capitalized terms used but not defined herein shall

have the meanings ascribed to them in the SPA (as defined below).

RECITALS

A. WHEREAS,

Seller, ExchangeCo and Buyer are parties to a Securities Purchase Agreement, dated as of April 28, 2023 (as amended to date, the “SPA”);

B. WHEREAS,

the Seller requires additional capital to fund its operations through to the closing of the transactions contemplated by the SPA; and

C. WHEREAS,

in connection with providing Seller with $500,000 in additional funding within 3 Business Days of the signing of this Amendment, Seller,

ExchangeCo and Buyer have agreed to amend certain provisions of the SPA including without limitation the amendment and restatement of

the secured promissory note evidencing the Akerna Loan and related security documents.

AGREEMENT

In consideration of the foregoing

and the mutual covenants and agreements herein contained, and intending to be legally bound hereby, the Parties agree as follows:

1. Modifications

to Article I.

| a. | The definition of “Akerna Loan” in Article I of the SPA is hereby amended and restated

in its entirety to read as follows: |

‘“Akerna Loan”

means a loan by Buyer to Seller in the principal amount of $1,500,000 to be evidenced by a secured promissory note and security documents

in substantially the form as agreed to by the Buyer and the Seller.”

| b. | The following definition of “Akerna A&R Promissory Note” is hereby added to Article

I to read as follows: |

| c. | ““Akerna A&R Promissory Note” means that certain Seller secured promissory

note evidencing a loan from Buyer to Seller in the principal amount of $1,500,000 in connection with the Akerna Loan.’ |

| d. | The definition of “Outside Date” in Article I of the SPA is hereby amended and restated

in its entirety to read as follows: |

‘“Outside Date”

means December 31, 2023.”

2. Modifications

to Section 2.2.

| a. | Section 2.2 of the SPA is hereby amended and restated to read in its entirety as follows: |

“(a) The aggregate purchase price

for the Securities shall be Two Million Dollars, ($2,000,000) subject to adjustment pursuant to Section 2.04 hereof (the “Purchase

Price”), consisting of cash to be paid at Closing.

(b) The Purchase Price shall be allocated

as follows:

(i) eighty percent

(80%) of the Purchase Price shall be allocated to the Membership Interests; and

(ii) the balance of

the Purchase Price shall be allocated to the Shares; provided however that in the event that prior to the Closing, the Shares are

sold to a third-party purchaser in accordance with the provisions of Section 5.19 hereto, then the Purchase Price shall not be reduced

but will be allocated solely to the Purchase Price of the Membership Interests.”

3. Modifications

to Section 5.14(a)

| a. | Section 5.14(a) of the SPA is hereby amended and restated to read in its entirety as follows: |

“(a) Promptly after the Form S-4

Registration Statement has been declared effective by the SEC under the Securities Act, Seller shall (i) take reasonable action necessary

under applicable Law to call, give notice of and, within 60 calendar days after the date the S-4 Registration Statement is declared effective

by the SEC, hold a meeting of Seller’s stockholders for the purpose of seeking approval of (A) the issuance of shares of Seller’s

common stock pursuant to the terms of the Merger Transaction and under the applicable requirements of the Nasdaq Capital Markets, (B)

the change of control of Seller resulting from the Merger Transaction, to the extent such approval is necessary, (C) the amendment of

Seller’s certificate of incorporation to effect the Reverse Split, (D) if requested by Gryphon prior to the filing with the SEC

of the Proxy Statement / Prospectus, the amendment of Seller’s certificate of incorporation to increase the authorized shares of

Seller’s common stock, (E) the amendment of Seller’s certificate of incorporation to effect the name change of Seller, (F)

in accordance with Section 14A of the Exchange Act and the applicable SEC rules issued thereunder, seeking advisory approval of a proposal

to Seller’s stockholders for a non-binding, advisory vote to approve certain compensation that may become payable to Seller’s

named executed officers in connection with the completion of the Merger Transaction, if applicable, (G) approve the transactions under

this Agreement and the Ancillary Documents, and (H) approval of the issuance of shares of Seller’s common stock to the Buyer pursuant

to the conversion of principal amounts due and payable under the Akerna A&R Promissory Note based on the conversion provisions set

forth in the Akerna A&R Promissory Note (the matters contemplated by the foregoing clauses (A) – (H), collectively, the “Seller’s

Stockholder Matters”) and (ii) mail to Seller’s stockholders as of the record date established for the meeting of Seller’s

stockholder, the Proxy Statement / Prospectus (such meeting, the “Seller’s Stockholders’ Meeting”)

4. Modifications

to Article V.

| a. | A new Section 5.19 is added to the SPA to read in its entirety as follows: |

“Section 5.19 Third-Party Ample

Sale Transaction.

Prior to Closing, Buyer will work in good

faith on a best efforts basis across multiple interested parties on behalf of and with the express approval of Seller to secure for Seller

the highest purchase price possible for the Shares. Seller shall cause the proceeds from such sale to be included in the assets of MJF

effective as of the Closing. Notwithstanding the foregoing, in the event that that the Shares are sold to a third-party for a net purchase

price above $700,000, Seller shall be entitled to retain all net proceeds in excess of $700,000.”

5. Additional

Funding. Within three (3) Business Days of the date of this Amendment, the Buyer will fund an additional $500,000 to the Seller (the

“Additional Financing”), and concurrently with the funding of the Additional Financing, the Seller will execute and

deliver the Akerna A&R Promissory Note to (i) reflect the increase in the amount of the Loan under the Note from $1,000,000 to $1,500,000,

(ii) revise Section 1.5 (deemed payment) of the Note to (A) provide for the forfeiture by Buyer of the accrued and unpaid interest at

consummation of the transactions under the SPA and (B) provide that contemporaneous with and immediately prior to the consummation of

the transactions under the SPA, the principal amount of the A&R Promissory Note shall convert into such quantity of shares of common

stock of the Company as equals (1) $1,500,000 divided by (2) the 5-day volume weighted average price of the common stock of the Company

as quoted on The Nasdaq Capital Market for the 5 trading days immediately preceding the date of the consummation of the transactions under

the SPA; provided however, that in no case shall the Seller be required to issue to the Buyer such number of shares of common stock

as would in the aggregate with all shares issued pursuant to the SPA and/or held or controlled by the Buyer exceed 19.99% of the number

of issued and outstanding shares of common stock of the Seller on the date hereof without first obtaining the approval of stockholders

of the Seller as required pursuant to the rules of the Nasdaq Stock Exchange. Concurrently with the Additional Financing, the Seller and

its subsidiaries, on the one hand, and the Buyer, on the other hand, will also enter into amendments to the Security and Pledge Agreement

dated April 28, 2023 and the Guaranty Agreement dated April 28, 2023 to reflect the increase in the principal amount of the Note. The

Seller, the Buyer and HT Investments MA, LLC will also enter into an amendment to the Subordination and Intercreditor Agreement dated

April 28, 2023 to reflect the increase in the principal of amount of the Note.

6. Amendment

and Ratification. Except as specifically amended hereby, all terms, conditions, covenants, representations, and warranties contained

in the SPA shall remain in full force and effect and shall be binding upon the Parties.

7. Entire

Agreement; Assignment. The SPA, as amended hereby and together with the Ancillary Documents, the Note, the Security and Pledge Agreement,

the Guaranty Agreement and the Subordination and Intercreditor Agreement, constitutes the entire agreement among the Parties with respect

to the subject matter hereof and supersedes all other prior agreements and understandings, both written and oral, among the Parties with

respect to the subject matter hereof. This Amendment may not be assigned by any Party (whether by operation of law or otherwise) without

the prior written consent of each Party hereto. Any attempted assignment of this Amendment not in accordance with the terms of this Section

7 shall be void.

8. Parties

in Interest. This Amendment shall be binding upon and inure solely to the benefit of each Party and its successors and permitted assigns,

and nothing in this Amendment, express or implied, is intended to or shall confer upon any other Person any rights, benefits or remedies

of any nature whatsoever under or by reason of this Amendment.

9. Governing

Law. This Amendment and all disputes or controversies arising out of or relating to this Amendment, including the applicable statute

of limitations, shall be governed by and construed in accordance with the Laws of the State of Delaware, without giving effect to any

choice of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the application

of the Law of any jurisdiction other than the State of Delaware.

10. Counterparts;

Electronic Signatures. This Amendment may be executed manually or electronically in one or more counterparts, each of which shall

be deemed to be an original, but all of which shall constitute one and the same agreement. Delivery of an executed counterpart of a signature

page to this Amendment by facsimile, e-mail, or scanned pages shall be effective as delivery of a manually executed counterpart to this

Amendment.

[Signature page follows]

IN WITNESS WHEREOF, the Parties have caused this

Amendment to be executed as of the date first written above.

| |

AKERNA CORP. |

| |

|

|

| |

By: |

/s/ Jessica Billingsley |

| |

Name: |

Jessica Billingsley |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

AKERNA CANADA AMPLE EXCHANGE INC. |

| |

|

|

| |

By: |

/s/ Jessica Billingsley |

| |

Name: |

Jessica Billingsley |

| |

Title: |

Chief Executive Officer |

| |

|

|

| |

MJ ACQUISITION CORP. |

| |

|

|

| |

By: |

/s/ Scott Ogur |

| |

Name: |

Scott Ogur |

| |

Title: |

Authorized Representative |

[SIGNATURE PAGE TO FIRST

AMENDMENT TO SECURITIES PURCHASE AGREEMENT]

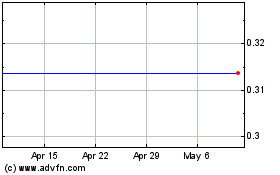

Akerna (NASDAQ:KERN)

Historical Stock Chart

From Apr 2024 to May 2024

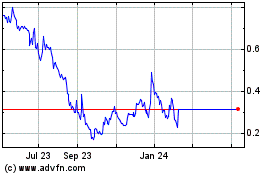

Akerna (NASDAQ:KERN)

Historical Stock Chart

From May 2023 to May 2024