Filed Pursuant to Rule 424(b)(3)

Registration No. 333-257583

Prospectus Supplement No. 7

(To Prospectus Dated April 12, 2023)

2,282,862 Shares of Common Stock

Up to 513,300 Shares of Common Stock Issuable Upon Exercise of the Warrants

Up to 332,500 Warrants

This prospectus supplement updates, amends and supplements the prospectus dated April 12, 2023 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form S-1, as amended (Registration No. 333-257583).

This prospectus supplement is being filed to update, amend and supplement the information in the Prospectus with the information contained in our Current Reports on Form 8-K filed with the Securities and Exchange Commission on December 28, 2023 and February 1, 2024 (the “Current Reports”). Accordingly, we have attached the Current Reports to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the offer and sale from time to time by the Selling Securityholders named in the Prospectus (the “Selling Securityholders”) of (i) up to 2,282,862 shares of our common stock, par value $0.0001 per share (“Common Stock”) and (ii) up to 332,500 warrants (the “Private Placement Warrants”) originally issued in a private placement in connection with the initial public offering (an “IPO”) of FinServ Acquisition Corp. (“FinServ”).

The Prospectus and this prospectus supplement also relate to the issuance by us of up to an aggregate of 513,300 shares of our Common Stock which consists of (i) 13,300 shares of Common Stock that are issuable upon the exercise of the Private Placement Warrants and (ii) 500,000 shares of Common Stock that are issuable upon the exercise of 12,500,000 warrants (the “Public Warrants” and, together with the Private Placement Warrants, the “Warrants”) originally issued in the IPO of FinServ.

You should read this prospectus supplement in conjunction with the Prospectus, including any amendments or supplements to it. This prospectus supplement is qualified by reference to the Prospectus, except to the extent that the information provided by this prospectus supplement supersedes information contained in the Prospectus. This prospectus supplement is not complete without, and may not be delivered or used except in conjunction with, the Prospectus, including any amendments or supplements to it.

Our Common Stock and our Public Warrants are listed on the Nasdaq Capital Market, under the symbols “KPLT” and “KPLTW,” respectively. On January 31, 2024, the closing price of our Common Stock was $10.75 and the closing price for our Public Warrants was $0.011.

We are an “emerging growth company” under federal securities laws and are subject to reduced public company reporting requirements. Investing in our securities involves a high degree of risks. See the section entitled “Risk Factors” beginning on page 11 of the Prospectus, and under similar headings in any amendments or supplements to the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is February 1, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 1, 2024

| | |

| KATAPULT HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-39116 | | 81-4424170 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

5360 Legacy Drive, Building 2

Plano, TX | | 75024 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(833) 528-2785 |

(Registrant’s telephone number, including area code:) |

| | |

| Not Applicable |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on

Which Registered |

| Common Stock, par value $0.0001 per share | | KPLT | | The Nasdaq Stock Market LLC |

| Redeemable Warrants | | KPLTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 1, 2024, Katapult Holdings, Inc., a Delaware corporation ("Katapult"), issued a press release regarding certain preliminary results for the fourth quarter ended December 31, 2023 A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

The information in this Current Report, including Exhibits 99.1 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Exhibit |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Date: | February 1, 2024 | | | /s/ Orlando Zayas | |

| | | | Name: | Orlando Zayas |

| | | | Title: | Chief Executive Officer |

| | | | | |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2023

| | |

| KATAPULT HOLDINGS, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-39116 | | 81-4424170 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

5360 Legacy Drive, Building 2

Plano, TX | | 75024 |

| (Address of principal executive offices) | | (Zip Code) |

| | |

(833) 528-2785 |

(Registrant’s telephone number, including area code:) |

| | |

5204 Tennyson Parkway, Suite 500

Plano, TX 75024 |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on

Which Registered |

| Common Stock, par value $0.0001 per share | | KPLT | | The Nasdaq Stock Market LLC |

| Redeemable Warrants | | KPLTW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On December 28, 2023, the Board of Directors (the “Board”) of Katapult Holdings, Inc. (the “Company”) approved and adopted amended and restated bylaws (the “Second Amended and Restated Bylaws”), which became effective the same day, to update for changes in the Delaware General Corporate Law (the “DGCL”) and implement edits related to the new Rule 14a-19 under the Securities Exchange Act of 1934, as amended (“Rule 14a-19”), including the following changes:

•Section 2.5 of the Second Amended and Restated Bylaws has been revised to reflect the updated Section 219(a) of the DGCL, which no longer requires the Company to make the stockholder list available for inspection during the stockholders’ meeting;

•Sections 2.10 and 3.17 of the Second Amended and Restated Bylaws have been amended to enhance procedural mechanics and disclosure requirements in connection with stockholder nominations of directors and submissions of proposals regarding other business at stockholders’ meetings, including (i) a requirement that detailed information be provided for parties from whom the proponent is receiving funding related to the proposal, (ii) a requirement that a nominee nominated by a stockholder for election to the Board of Directors provide written representations and agreements regarding their commitment not to become a party to any voting arrangements with third parties and their commitment to comply with the Company's stock ownership guidelines and applicable stock exchange rules, among other matters, (iii) a requirement that Nominating Persons (as defined therein) make a written representation to comply with the requirements of Rule 14a-19, (iv) a requirement if a proponent fails to comply with requirements of Rule 14a-19 or, if requested by the Company, fails to deliver reasonable evidence of the satisfaction of requirements of Rule 14a-19, then the nomination of any proposed nominee by such proponent shall be disregarded, and (v) a requirement that a Nominating Person directly or indirectly soliciting proxies from other stockholders use a proxy card color other than white, which shall be reserved for exclusive use by the Board, among other minor edits by the Company;

•Section 6.8 of the Second Amended and Restated Bylaws has been revised to reflect the latest provisions of Section 232 of the DGCL.

The Second Amended and Restated Bylaws also include certain technical, modernizing and clarifying changes.

The foregoing description of the Second Amended and Restated Bylaws does not purport to be complete and is qualified in its entirety by reference to the full text of the Second Amended and Restated Bylaws attached hereto as Exhibit 3.1 to this Current Report on Form 8-K, which is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Exhibit |

| | |

104 | | Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| Date: | December 28, 2023 | | | /s/ Orlando Zayas | |

| | | | Name: | Orlando Zayas |

| | | | Title: | Chief Executive Officer |

| | | | | |

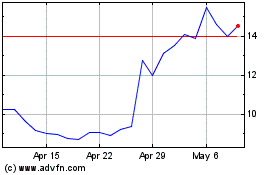

Katapult (NASDAQ:KPLT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Katapult (NASDAQ:KPLT)

Historical Stock Chart

From Apr 2023 to Apr 2024