UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| | | | | |

Filed by the Registrant x |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2)) |

x | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material under §240.14a‑12 |

| | | | | | | | |

| Key Tronic Corporation |

| (Name of Registrant as Specified In Its Charter) |

| N/A |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

x | No fee required. |

| |

o | Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

o | Fee paid previously with preliminary materials. |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

September 29, 2023

Dear Shareholder:

The attached Notice of Annual Meeting of Shareholders and Proxy Statement relates to the Annual Meeting of Shareholders of Key Tronic Corporation, a Washington corporation (the “Company” or “Key Tronic”), to be held on Thursday, October 26, 2023, at 10:00 a.m. Pacific Time at the principal executive offices of the Company, 4424 N. Sullivan Road – Upper Level, Spokane Valley, Washington 99216.

Whether or not you will attend the Annual Meeting in person and regardless of the number of shares you own, we request that you complete, sign, date and return the enclosed proxy card promptly in the accompanying postage-prepaid envelope. You may, of course, attend the Annual Meeting and vote in person, even if you previously have returned your proxy card.

Sincerely,

Craig D. Gates

President and Chief Executive Officer

Member of the Board of Directors

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held October 26, 2023

To the Shareholders of KEY TRONIC CORPORATION:

The Annual Meeting of Shareholders of Key Tronic Corporation, a Washington corporation (the “Company”) will be held on Thursday, October 26, 2023, at 10:00 a.m. Pacific Time at the principal executive offices of the Company, 4424 N. Sullivan Road - Upper Level, Spokane Valley, Washington 99216 (the “Annual Meeting”), for the following purposes:

1.To elect six directors of the Company to hold office until the next Annual Meeting of Shareholders and until their successors are elected and have qualified;

2.To hold an advisory vote to approve the compensation of the Company’s named executive officers, as disclosed in “Executive Compensation” herein; and

3.To ratify the appointment of Moss Adams LLP as independent registered public accounting firm for fiscal year 2024; and

4.To transact such other business as may properly come before the meeting and any

adjournments or postponements thereof.

Record holders of the Company’s Common Stock at the close of business on September 7, 2023 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. Even if you will attend the Annual Meeting, please complete, sign, date and return the enclosed proxy to the Company in the enclosed postage-prepaid envelope in order to ensure that your shares will be voted at the Annual Meeting. You may vote your shares in person at the Annual Meeting even if you previously have returned your proxy card to the Company.

| | | | | | | | |

| | |

| | By Order of the Board of Directors, |

| | |

| | John Theiss |

| | Secretary |

| | |

| Spokane Valley, Washington | | |

| September 29, 2023 | | |

YOUR VOTE IS IMPORTANT. PLEASE EXECUTE AND RETURN THE ENCLOSED CARD PROMPTLY, WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE ANNUAL MEETING.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SHAREHOLDER MEETING TO BE HELD ON October 26, 2023. The Proxy Statement and 2023 Annual Report to Shareholders are available at: www.edocumentview.com/ktcc.

PROXY STATEMENT

_______________________________________________________________

INTRODUCTION

General

The preceding Notice of Annual Meeting of Shareholders, this Proxy Statement (the “Proxy Statement”) and the enclosed proxy card are being furnished by Key Tronic Corporation, a Washington corporation (the “Company”), to the holders of outstanding shares of Common Stock, no par value, of the Company (“Common Stock”) in connection with the solicitation of proxies by the Board of Directors of the Company (the “Board of Directors” or the “Board”) from holders of such shares. The proxies are to be used at the Annual Meeting of Shareholders of the Company to be held on Thursday, October 26, 2023 at 10:00 a.m. Pacific Time at the principal executive offices of the Company, 4424 N. Sullivan Road - Upper Level, Spokane Valley, Washington 99216, and any adjournments or postponements thereof (the “Annual Meeting”). The proxies appoint Craig D. Gates and Brett R. Larsen, each of them and their substitutes, as proxy to vote all shares represented at the Annual Meeting pursuant to this proxy solicitation. This Proxy Statement and the enclosed proxy card are first being mailed to shareholders on or about September 29, 2023.

Record Date, Proxies, Revocation

Record holders of the Common Stock at the close of business on September 7, 2023 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. As of the Record Date, 10,761,871 shares of Common Stock were issued and outstanding. A proxy card for use at the Annual Meeting is enclosed with this Proxy Statement. All completed, signed and dated proxy cards returned to the Company will be voted at the Annual Meeting in accordance with the instructions thereon. If no instructions are given on an otherwise signed and dated proxy card, the proxy will be voted FOR the election of each of the nominees for director named below (“Proposal 1”), FOR approval of compensation of the Company’s named executive officers (“Proposal 2”), and FOR the ratification of the appointment of Moss Adams, LLP as the Company’s independent registered public accounting firm for fiscal year 2024 (“Proposal 3”). Any proxy may be revoked at any time before it has been voted by giving written notice of revocation to the Secretary of the Company at the address set forth above; by delivering a completed, signed proxy card bearing a date later than any earlier proxy; or by voting shares in person at the Annual Meeting. The mere presence at the Annual Meeting of the shareholder who has given a proxy will not revoke such proxy.

Voting

Each share of Common Stock outstanding is entitled to one vote on each proposal presented for a vote of the shareholders at the Annual Meeting. Under applicable law and the Company’s Restated Articles of Incorporation and Amended and Restated By-Laws, if a quorum exists at a meeting: (i) the six nominees for election as directors who receive the greatest number of votes cast for the election of directors by the shares present in person or represented by proxy and entitled to vote shall be elected directors, and (ii) Proposal 2 and Proposal 3 listed in the accompanying Notice of Annual Meeting of Shareholders will be approved if the number of votes cast in favor of the proposal exceeds the number of votes cast against it. In the election of directors, an abstention from voting or a broker non-vote (as described below) will have the practical effect of voting against the nominee. An abstention from voting or a broker non-vote will have no effect on Proposal 2 or Proposal 3 since neither represents a vote cast.

If you are a stockholder of record and do not submit your vote by proxy or vote in person at the annual meeting, your shares will not be voted. If you hold shares in street name and you do not return the voting instruction form, your broker, trustee or nominee (collectively referred to as “brokers”) may vote your shares in certain circumstances and on certain routine proposals. Brokers cannot vote “uninstructed” shares in non-routine matters, such as director elections and executive compensation matters. Thus, if you hold your shares in street name and you do not instruct your broker how to vote in the election of directors (Proposal 1) or the advisory vote to approve the compensation of the Company’s named executive officers (Proposal 2) your shares will not be voted. Brokers have discretion to vote uninstructed shares on ratification of the appointment of the independent registered public accounting firm (Proposal 3).When a broker cannot vote shares, the missing votes are referred to as “broker non-votes.” Those shares will be included in determining the presence of a quorum at the meeting and will have the effect described in the preceding paragraph.

PROPOSAL 1

ELECTION OF DIRECTORS

Six directors are to be elected at the Annual Meeting to serve until the next Annual Meeting of Shareholders and until their respective successors have been elected and have qualified. The six nominees receiving the highest number of affirmative votes will be elected as directors. In the event any nominee is unable or unwilling to serve as a nominee or director, the proxies may be voted for the balance of those nominees named and for any substitute nominee designated by the present Board of Directors or the proxy holders to fill such vacancy, or for the balance of those nominees named without nomination of a substitute, or the size of the Board of Directors may be reduced in accordance with the Amended and Restated By-Laws of the Company. The Board of Directors has no reason to believe that any of the persons named will be unable or unwilling to serve as a nominee or as a director if elected.

Board Diversity

The Board believes the current nominees embody a diverse range of viewpoints, backgrounds and skills, including with respect to tenure and race/ethnicity. In accordance with Nasdaq’s new Board Diversity Rules, the following Board Diversity Matrix provides certain information regarding the composition of our Board as of July 1, 2023, Each of the categories listed in the table has the meaning as it is used in Nasdaq Rule 5605(f).

| | | | | | | | | | | | | | | | | |

| Board Diversity Matrix |

| Total Number of Directors | | 6 |

| | Female | Male | Non-Binary | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | |

| Directors | | 0 | 6 | 0 | 0 |

| Part II: Demographic Background | | | | | |

| African American or Black | | 0 | 0 | 0 | 0 |

| Alaskan Native or Native American | | 0 | 0 | 0 | 0 |

| Asian | | 0 | 1 | 0 | 0 |

| Hispanic or Latinx | | 0 | 0 | 0 | 0 |

| Native Hawaiian or Pacific Islander | | 0 | 0 | 0 | 0 |

| White | | 0 | 3 | 0 | 0 |

| Two or More Races or Ethnicities | | 0 | 2 | 0 | 0 |

| LGBTQ+ | | 0 |

| Did Not Disclose Demographic Background | | 1 |

The following information has been provided to the Company with respect to the nominees for election to the Board of Directors:

James R. Bean, age 73, has been a director of the Company since October 2006. Mr. Bean served as President and CEO of Preco Electronics, LLC from November 1999 to March 2020. From May 1997 to 1999 he held various management positions in Boise with Preco Electronics, LLC, which was sold to Sensata Technologies in March 2020. Mr. Bean remained with Sensata until his retirement in November 2022. Previously he held various management positions in manufacturing operations with Sun Microsystems, Inc., Apple Computer, Inc. and National Semiconductor, Inc. Mr. Bean is a graduate of New Mexico State University with a B.S. in Industrial Engineering. The Board of Directors has concluded that based upon Mr. Bean's business and financial expertise, current and prior senior management experience and education that he should serve as a director of the Company.

Craig D. Gates, age 64, has been a director of the Company since July 2009 and has been President and CEO of the Company since April 2009. Previously he was Executive Vice President of Marketing, Engineering and Sales since July 1997. He served as Vice President and General Manager of New Business Development from October 1995 to July 1997. He joined the Company as Vice President of Engineering in October 1994. From 1991 to October 1994, Mr. Gates served as Director of Operations, Electronics for the Microswitch Division of Honeywell Inc. From 1982 to 1991, Mr. Gates held various engineering and management positions within the Microswitch Division. Mr. Gates has a Bachelor of Science Degree in Mechanical Engineering and a Masters in Business Administration from the University of Illinois, Urbana. Mr. Gates also serves on the Board of Directors of CyberOptics Corporation. The Board of Directors has concluded that based upon Mr. Gates’ business expertise, current and prior senior management experience and education that he should serve as a director of the Company.

Ronald F. Klawitter, age 71, has been a director of the Company since October 2009 and formerly served as Executive Vice President of Administration, CFO and Treasurer of the Company from July 1997 through July 2015. Previously he was Vice President of Finance, Secretary and Treasurer of the Company since October 1995. He was Acting Secretary from November 1994 to October 1995 and Vice President of Finance and Treasurer from 1992 to October 1995. From 1987 to 1992, Mr. Klawitter was Vice President, Finance at Baker Hughes Tubular Service, a subsidiary of Baker Hughes, Inc. He has a Bachelor of Arts degree from Wittenberg University and is a Certified Public Accountant. The Board of Directors has concluded that based upon Mr. Klawitter’s business and financial expertise, current and prior management experience and education that he should serve as a director of the Company.

Dr. Subodh K. Kulkarni, age 59, has been a director of the Company since October 2018. Dr. Kulkarni has served as President and Chief Executive Officer at Rigetti Computing, Inc. since December 2022. Dr. Kulkarni is a seasoned public company CEO with thirty-plus years of experience in the semiconductor industry and a track record of success in scaling and commercializing cutting-edge technologies. Prior to joining Rigetti, Dr. Kulkarni was President, CEO, and member of the Board of CyberOptics Corporation, a developer and manufacturer of high precision sensors and inspection systems for the semiconductor and electronics industry. He held these roles from 2014 until CyberOptics was acquired by Nordson Corporation in November 2022. Prior to CyberOptics, Dr. Kulkarni was CEO of Prism Computational Sciences, a developer of software tools for scientific and commercial applications in the semiconductor industry. Earlier in his career, he held additional leadership positions, including Chief Technology Officer and Senior Vice President of OEM/Emerging business, global commercial business, R&D and manufacturing at Imation, a global scalable storage and data security company. Dr. Kulkarni began his career in research and management positions with 3M Corporation and IBM. He received his B.S. in chemical engineering from the Indian Institute of Technology, Mumbai, and later obtained a M.S. and Ph.D. in chemical engineering from MIT. Dr. Kulkarni currently serves as Chairman of the Board for Prism Computational Sciences.

Yacov A. Shamash, age 73, has been a director of the Company since 1989. He is a Professor of Electrical and Computer Engineering at Stony Brook University and was the Vice President of Economic Development from 2001 - 2019 and the Dean of Engineering and Applied Sciences at the campus from 2015. Professor Shamash developed and directed the NSF Industry/University Cooperative Research Center for the Design of Analog/Digital Integrated Circuits from 1989 to 1992 and also served as Chairman of the Electrical and Computer Engineering Department at Washington State University from 1985 until 1992. Dr. Shamash also serves on the Board of Directors of Applied DNA Sciences, Inc., Softheon Inc., Advanced Convergence Group and Comtech Telecommunications Corp.. The Board of Directors has concluded that based upon Dr. Shamash’s professional and management experience, service on public companies’ boards and education that he should serve as a director of the Company.

Patrick Sweeney, age 88, has been a director of the Company since July 2000. Mr. Sweeney was President and CEO of Hadco Corporation from 1991 through 1995 and formerly served as Hadco’s Vice President/Chief Financial Officer and Vice President of Operations. Prior to that Mr. Sweeney was the Vice President of International Manufacturing at Wang - USA from 1981 through 1986 and also served as Managing Director of Ireland for Digital Equipment Corporation and as Plant Manager of its Galway and Clonmel divisions. Mr. Sweeney also serves on the Board of Directors of Photo Machining Inc. The Board of Directors has concluded that based upon Mr. Sweeney’s business and financial expertise, senior management experience, service on public companies’ boards and education that he should serve as a director of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE ELECTION OF ALL NOMINEES NAMED ABOVE.

CORPORATE GOVERNANCE AND BOARD OF DIRECTORS MATTERS

Board Meetings

All directors hold office until the next Annual Meeting of Shareholders and until their successors have been elected and have qualified. There are no family relationships among any of the directors or executive officers of the

Company. The Company’s Board of Directors met five times during fiscal 2023. During fiscal 2023, each director attended 100% of the Board of Directors meetings and 100% of the meetings of committees of the Board of Directors on which the director served during the time he served on the Board or committee. It is the Company’s policy that nominees for election at the Annual Meeting attend the Annual Meeting. All nominees for election at the 2022 Annual Meeting attended the 2022 Annual meeting.

Directors’ Independence

The Board of Directors has determined that all members of the Company’s Board of Directors are “independent directors” within the meaning of the applicable Nasdaq Listing Rules (the “Nasdaq Rules”), except for Mr. Gates, the Company’s President and Chief Executive Officer.

The Board of Directors also has determined that all members of the Audit Committee (1) meet the definition of independence contained in the Nasdaq Rules; (2) meet the requirements of the Securities and Exchange Commission (“SEC”) Rule 10A-3(b)(1); (3) have not participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years; and (4) are able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement, as required by the Nasdaq Rules.

The Board of Directors has determined that James R. Bean, Ronald F. Klawitter, Subodh K. Kulkarni, Yacov A. Shamash and Patrick Sweeney, members of the Audit Committee, each has the requisite attributes of an “audit committee financial expert” as defined by SEC regulations and that such attributes were acquired through relevant education and/or experience.

The Board of Directors also monitors the independence of Compensation and Administration Committee members under rules of the SEC and Nasdaq Rules that are applicable to compensation committee members.

Board Leadership Structure and Role in Risk Oversight

The Board of Directors determines whether the roles of Chief Executive Officer and Chairman of the Board should be separated based upon its judgment of the structure which best meets the current needs of the Company and promotes the most effective communication between the Board and management. The Board currently separates the role of Chief Executive Officer and Chairman of the Board.

The Board oversees the Company’s risk directly and through its committees. The Board is assisted by its Audit Committee in performing its risk management oversight responsibilities with respect to financial reporting, internal controls cyber security risk, and legal and regulatory requirements. The Board is assisted by its Compensation and Administration Committee in performing its risk management oversight responsibilities with respect to risk relating to compensation programs and policies. The Board, with the assistance of its Governance and Nominating Committee, oversees risk management with respect to Board membership, structure and organization.

The Chairmen of the three Board Committees report to the Board on committee meetings at regular meetings of the Board of Directors. Management has the day to day responsibility for risk management and members of management make regular reports to the Board and its committees on identification, monitoring and mitigation of material risks.

Succession Planning

The Board of Directors is charged with monitoring and overseeing the process of planning for CEO and senior management succession. The Board of Directors identifies the qualities and characteristics it believes are necessary for an effective CEO and senior management and periodically reviews the development and progression of internal candidates against these standards.

Executive Sessions

At three of the four regular meetings of the Board of Directors held during fiscal year 2023, the independent directors met separately in executive session without management present.

Code of Conduct

The Board of Directors has adopted a written Code of Conduct which applies to all directors, officers and employees of the Company. The Code of Conduct is available on the Company’s website at www.keytronic.com. The Company intends to disclose on its website any amendments to or waivers of the Code of Conduct.

Insider Trading Policy/Prohibition of Speculative Transactions

The Board of Directors has adopted a written policy on Insider Trading which applies to all directors, officers and employees of the Company. The policy prohibits directors, officers and employees from engaging in short-term speculative transactions involving the Company’s securities, including short sales and buying or selling put or call options. The Company does not have any practices or policies regarding hedging.

Recoupment Policy

The Board of Directors has adopted a written Recoupment Policy which provides that in the event of a restatement of the Company’s consolidated financial statements, the Company shall have the right to recoup from any executive officer any portion of any bonus or other equity or non-equity incentive compensation received by the executive officer the grant of which was tied to the achievement of one or more specific performance targets, with respect to the period for which such financial statements are restated, regardless of whether the executive officer engaged in any misconduct or was at fault or responsible in any way for causing the restatement, if, as a result of such restatement, the executive officer would not have received such bonus or other compensation or portion thereof.

Shareholder Communications

Shareholders of Key Tronic Corporation may send written communications to the Board of Directors or any of its members by certified mail only, addressed to the Board of Directors or any member, c/o Secretary, Key Tronic Corporation, 4424 N. Sullivan Road, Spokane Valley, WA 99216. All such shareholder communications will be compiled by the Secretary and submitted to the Board of Directors or a Board member. In October 2022, the SEC adopted a final version of a new clawback rule. The Company intends to take action to comply with this rule consistent with the timing of its implementation.

Nominations to the Board

The Governance and Nominating Committee will consider written proposals from shareholders for directors to be elected at the annual meeting which are submitted to the Secretary of the Company at the address above, together with biographical information and references, not less than ten days nor more than fifty days prior to the annual meeting. Assuming that appropriate biographical information and references are provided for candidates recommended by shareholders, the Governance and Nominating Committee will evaluate those candidates by following substantially the same process and applying substantially the same criteria as for candidates recommended by other sources. No person recommended by a shareholder will become a nominee for director and be included in a proxy statement unless the Governance and Nominating Committee recommends, and the Board approves, such person.

Board Committees

The Board of Directors has three standing committees: the Audit Committee, the Compensation and Administration Committee, and the Governance and Nominating Committee. The committees each have written charters approved by the Board. The charters of the Audit Committee, the Compensation and Administration Committee and the Governance and Nominating Committee are available on the Company’s website at www.keytronic.com.

The Audit Committee, which currently consists of Messrs. Bean (Chairman), Klawitter, Kulkarni, Shamash and Sweeney met nine times during fiscal 2023. The Audit Committee monitors the integrity of the Company’s financial statements, financial reporting processes and systems of internal controls regarding finance, accounting, cyber security and legal compliance; selects and appoints the Company’s independent registered public accounting firm, pre-approves all audit and non-audit services to be provided to the Company by the Company’s independent registered public accounting firm, and establishes the fees and other compensation to be paid to the independent registered public accounting firm; monitors the qualifications, independence and performance of the Company’s independent registered public accounting firm; and establishes procedures for the receipt, retention, response to and treatment of complaints, including confidential, anonymous submissions by the Company’s employees, regarding accounting, internal controls or auditing matters, and provides an avenue of communication among the Board, the independent registered public accounting firm and management.

The Compensation and Administration Committee (“Compensation Committee”) which currently consists of Messrs. Shamash (Chairman), Bean and Sweeney, met six times during fiscal 2023. The Compensation Committee establishes and reviews annually the Company’s general compensation policies applicable to the Company’s executive officers and other key employees, reviews and recommends to the Board of Directors to approve the level of compensation awarded to the Company’s Chief Executive Officer and other officers and key management employees, prepares and delivers annually to the Board a report disclosing compensation policies applicable to the Company’s executive officers and the basis for the Chief Executive Officer’s compensation during the last fiscal year and makes recommendations to the Board regarding changes to existing compensation plans. The Compensation Committee considers the Chief Executive Officer’s recommendations on compensation for executive officers and other key employees (other than his own compensation). The Compensation Committee administers the Company’s incentive compensation plans including determining the individuals to receive awards and the terms of such awards.

The Compensation Committee also has the authority to engage and oversee an external independent compensation consultant to assist it by providing information, analysis and other advice relating to the Company’s compensation program. During fiscal year 2023, the Compensation Committee engaged Milliman, Inc. (“Milliman”), a national compensation consulting firm, to serve as its compensation consultant to advise on executive and director compensation matters, including competitive market pay practices for the Company’s executive officers and directors, and with data analysis and selection of the compensation peer group. The terms of Milliman’s engagement include reporting directly to the Compensation Committee. Milliman also coordinated with the Company’s management for data collection and information market comparisons for our executive officers. During fiscal year 2023, Milliman did not provide any other consulting or other services to us.

The Compensation Committee has evaluated its relationship with Milliman to ensure that it believes that such firm is independent from management. This process included a review of the services that Milliman provided, the quality of those services and the fees associated with those services provided during fiscal year 2023. Based on this review, as well as consideration of the factors affecting independence set forth in Rule 10C-1(b)(4) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Rule 5605(d)(3)(D) of the Nasdaq Rules, and such other factors as were deemed relevant under the circumstances, the Compensation Committee has determined that no conflict of interest was raised as a result of the work performed by Milliman.

The Governance and Nominating Committee, which currently consists of Messrs. Bean (Chairman), Klawitter, Kulkarni, Shamash and Sweeney met one time during fiscal 2023. The Committee makes recommendations to the Board regarding corporate governance, recommends for selection by the Board nominees for election as Directors and makes recommendations to the Board with respect to the structure and composition of the Board. The Committee evaluates potential director nominees based upon a number of criteria, including the potential nominee’s skills, relevant experience and independence. The Committee has no specific minimum qualifications which must be met by a potential director nominee. Each potential nominee is considered on a case by case basis. Potential nominees may be identified to the Committee by members of the Board, officers of the Company, shareholders or other persons. The Committee evaluates each potential nominee in the same manner regardless of the source of the potential nominee’s recommendation. Although the Company does not have a policy regarding diversity, the Governance and Nominating Committee does take into consideration the value of diversity among Board members in background, experience, education and perspective in considering potential nominees for recommendation to the Board for selection. The Company has not paid any third party a fee to assist in identifying and evaluating potential director nominees. The Committee has not rejected any potential nominee recommended within the preceding year by a beneficial owner of more than 5% of the Company’s Common Stock.

Related Person Transactions

In April 2007, the Board of Directors adopted a written policy and procedures for the approval or ratification of Interested Transactions with Related Parties. The policy and procedures supplement the Company’s Code of Conduct. The policy defines an “Interested Transaction” as any transaction, arrangement or relationship or series of similar transactions, arrangements or relationships (including any indebtedness or guarantee of indebtedness) in which (1) the aggregate amount involved will or may be expected to exceed $120,000 in any calendar year, (2) the Company is a participant, and (3) any Related Party has or will have a direct or indirect interest (other than solely as a result of being a director or a less than 10 percent beneficial owner of another entity).

The policy defines a “Related Party” as any (a) person who is or was (since the beginning of the last fiscal year for which the Company has filed a Form 10-K and proxy statement, even if they do not presently serve in that role) an executive officer, director or nominee for election as a director, (b) greater than 5 percent beneficial owner of the Company’s Common Stock, or (c) immediate family member of any of the foregoing. Immediate family member includes a person’s spouse, parents, stepparents, children, stepchildren, siblings, mothers- and fathers-in-law, sons- and daughters-in-law, and brothers- and sisters-in-law and anyone residing in such person’s home (other than a tenant or employee).

The Audit Committee is responsible for review, approval, ratification or disapproval of Interested Transactions. In determining whether to approve or ratify an Interested Transaction, the Committee will take into account, among other factors it deems appropriate, whether the Interested Transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the Related Party’s interest in the Transaction.

During fiscal year 2023, the Company had no Interested Transactions required to be disclosed pursuant to the SEC’s related persons disclosure.

During fiscal year 2022, the Company purchased surface mount technology inspection equipment and raw materials from CyberOptics. The purchases by the Company during fiscal year 2022 totaled $382,000. These transactions were conducted at arm’s length in the ordinary course of business of the Company and CyberOptics, and the terms of purchase were no more favorable to the Company than purchases by unaffiliated parties from CyberOptics.

BENEFICIAL OWNERSHIP OF SECURITIES

The following table provides certain information which has been furnished to the Company regarding beneficial ownership of the Common Stock as of the Record Date, with respect to (i) each person known by the Company to own beneficially more than 5% of the Company’s Common Stock; (ii) each director and nominee for director of the Company; (iii) each of the executive officers of the Company named in the Summary Compensation table; and (iv) all officers and directors of the Company as a group.

| | | | | | | | | | | | | | |

Name and Address of

Beneficial Owner* | | Number of Shares Beneficially Owned (1) | | Percent of Class (1) |

| MORE THAN 5% SHAREHOLDERS | | | | |

| Morgan Stanley | | 1,928,160 | (2) | 17.9 | % |

| Dimensional Fund Advisors LP | | 807,603 | (3) | 7.5 | % |

| Tieton Capital Management | | 742,950 | (4) | 6.9 | % |

| DIRECTORS AND EXECUTIVE OFFICERS | | | | |

| James R. Bean | | 6,786 | | | ** |

| Ronald F. Klawitter | | 194,697 | | (5) | 1.8 | % |

| Subodh K. Kulkarni | | 1,000 | | | ** |

| Yacov A. Shamash | | 42,326 | | (6) | ** |

| Patrick Sweeney | | 77,410 | | | ** |

| Craig D. Gates | | 221,719 | | (7) | 2.1 | % |

| Brett R. Larsen | | 34,039 | | (8) | ** |

| Mark R. Courtney | | 2,333 | | (9) | ** |

| Philip S. Hochberg | | 69,111 | | (10) | ** |

| Chad T. Orebaugh | | 5,562 | | (11) | ** |

| Duane D. Mackleit | | 50,231 | | (12) | ** |

| David H. Knaggs | | 4,916 | | (13) | ** |

All officers and directors as a group

(12 persons) | | 712,912 | | | 6.6 | % |

_____________

* Unless otherwise noted, the address for each named shareholder is in care of the Company at its principal executive offices.

** Less than 1%.

1. Percentage beneficially owned is based on 10,761,871 shares of Common Stock outstanding on the Record Date. A person or group of persons is deemed to beneficially own as of the record date any shares which such person or group of persons has the right to acquire within 60 days after the record date. In computing the percentage of outstanding shares held by each person or group of persons, any shares which such person or persons have the right to acquire within 60 days after the record date are deemed to be outstanding, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person.

2. Based solely on a Schedule 13G/A filed with the SEC on February 9, 2023 by Morgan Stanley and Morgan Stanley Smith Barney LLC (collectively, “Morgan Stanley”). The address for Morgan Stanley is 1585 Broadway, New York, NY 10036.

3. Based solely on a Schedule 13G/A filed with the SEC on February 2, 2023. The address for Dimensional Fund Advisors LP is 6300 Bee Cave Road, Building One, Austin, TX 78746.

4. Based solely on a Schedule 13G/A filed with the SEC on January 25, 2023. The address for Tieton Capital Management is 4700 Tieton Drive, Suite C, Yakima, WA 98908.

5. Includes Common Stock allocated to Mr. Klawitter as a participant in the Company’s 401(k) Retirement Savings Plan (16,384 shares) as of July 1, 2023, 1,600 shares owned directly by Mr. Klawitter’s daughter and 4,200 shares owned directly by Mr. Klawitter’s son.

6. Includes 1,100 shares owned directly by Dr. Shamash’s daughter.

7. Includes Common Stock allocated to Mr. Gates as a participant in the Company’s 401(k) Retirement Savings Plan (7,373 shares) as of July 1, 2023.

8. Includes Common Stock allocated to Mr. Larsen as a participant in the Company’s 401(k) Retirement Savings Plan (20,318 shares) as of July 1, 2023.

9. Includes Common Stock allocated to Mr. Courtney as a participant in the Company’s 401(k) Retirement Savings Plan (2,328 shares) as of July 1, 2023.

10. Includes Common Stock allocated to Mr. Hochberg as a participant in the Company’s 401(k) Retirement Savings Plan (40,573 shares) as of July 1, 2023.

11. Includes Common Stock allocated to Mr. Orebaugh as a participant in the Company’s 401(k) Retirement Savings Plan (6,201 shares) as of July 1, 2023.

12. Includes Common Stock allocated to Mr. Mackleit as a participant in the Company’s 401(k) Retirement Savings Plan (43,160 shares) as of July 1, 2023.

13. Includes Common Stock allocated to Mr. Knaggs as a participant in the Company’s 401(k) Retirement Savings Plan (5,207 shares) as of July 1, 2023.

EXECUTIVE COMPENSATION

Summary Compensation Table-Fiscal Years 2021-2023

The following table sets forth information concerning compensation for services rendered to the Company by the President and Chief Executive Officer, the Executive Vice President and Chief Financial Officer and the Company’s next most highly compensated executive officer. Collectively, these officers are the “named executive officers.”

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($) | | Bonus ($) | | Option/SAR Awards ($)(1) | | Non-Equity Incentive Plan Compensation ($)(2) | | All Other Compensation ($)(3) | | Total ($) |

| Craig D. Gates, | | 2023 | | 905,367 | | | — | | | 52,250 | | | 543,220 | | | 12,200 | | | 1,513,037 | |

| President & Chief | | 2022 | | 799,549 | | | — | | | 68,250 | | | 511,711 | | | 11,600 | | | 1,391,110 | |

| Executive Officer | | 2021 | | 684,775 | | | — | | | 58,000 | | | 871,244 | | | 20,242 | | | 1,634,261 | |

| Brett R. Larsen, | | 2023 | | 475,952 | | | — | | | 23,513 | | | 199,900 | | | 12,200 | | | 711,565 | |

| Executive Vice President, | | 2022 | | 430,485 | | | — | | | 30,713 | | | 165,306 | | | 11,600 | | | 638,104 | |

| Chief Financial Officer | | 2021 | | 398,954 | | | — | | | 26,100 | | | 353,097 | | | 12,648 | | | 790,799 | |

| Philip S. Hochberg, | | 2023 | | 384,522 | | | — | | | 20,900 | | | 126,892 | | | 14,339 | | | 546,653 | |

| Executive Vice President, | | 2022 | | 346,006 | | | — | | | 27,300 | | | 110,722 | | | 11,600 | | | 495,628 | |

| Business Development | | 2021 | | 333,224 | | | — | | | 23,200 | | | 263,635 | | | 12,908 | | | 632,967 | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

1)The amounts reported in the “Option/SAR Awards” column reflect the fair value on the grant date of the stock appreciation rights, or SARS, granted to the named executive officers during the fiscal year. These values have been determined under generally accepted accounting principles used to calculate the value of equity awards for purposes of the Company’s financial statements. For a discussion of the assumptions and methodologies used to calculate the amounts reported above, please see the discussion of equity awards contained in Note 8 - “Stock Option and Benefit Plans” to the Consolidated Financial Statements in the Company’s 2023 Annual Report. Assuming the highest level of performance is achieved for the SARS granted during the 2023 fiscal year, the maximum value of such awards at the grant date would be $127,500 for Mr. Gates, $57,535 for Mr. Larsen and $51,000 for Mr. Hochberg.

2)Amounts reflect (a) annual cash incentive compensation, which is based on performance during the relevant fiscal year, pursuant to the annual incentive program and (b) any payout of long term performance unit awards for the three year performance period that ended in the relevant fiscal year, pursuant to the long term cash incentive program.

3)Includes for fiscal year 2023 payment for retro pay in the amount of $2,139 for Mr. Hochberg. Included for fiscal year 2021 payment for retro pay in the amount of $8,842 for Mr. Gates, $1,146 for Mr. Larsen, and $1,291 for Mr. Hochberg. Also includes for Mr. Hochberg a service award in the amount of $217.17 in fiscal year 2021.

Compensation of Named Executive Officers

The Summary Compensation Table above quantifies the value of the different forms of compensation earned by or awarded to the Company’s named executive officers for the fiscal years indicated above. The primary elements of each named executive officer’s total compensation reported in the table are base salary, long term equity incentives consisting of stock appreciation rights and the payout of annual and long term cash incentives. Named executive officers also received the other benefits listed in the “All Other Compensation” column of the Summary Compensation Table, as further described in the footnotes to the table.

The Summary Compensation Table should be read in conjunction with the tables and narrative descriptions that follow. The Grants of Plan-Based Awards in fiscal year 2023 table and the accompanying description of the material terms of the equity awards granted in fiscal year 2023, provides information regarding the long-term equity incentives awarded to the named executive officers in fiscal year 2023. The Outstanding Equity Awards at 2023 Fiscal Year-End and Option/SAR Exercises and Stock Vested tables provide further information on the named executive officers’ potential realizable value and actual value realized with respect to their equity awards. The “Potential Payments Upon Termination or Change in Control” section provides information on the benefits the named executive officers may be entitled to receive in connection with certain terminations of their employment and/or a change in control of the Company.

Description of Employment Agreements-Cash Compensation

The Company entered into employment contracts with Messrs. Gates, Larsen and Hochberg at the time each employee was first appointed an officer of the Company. Each of the employment contracts imposes upon the employee standard nondisclosure, confidentiality and non-competition provisions. Each of the employment contracts provides that the Company may terminate employment at any time. The employment contracts provide that upon termination of employment by the Company, other than for cause, the Company shall continue to pay employee’s base salary in effect prior to termination for a period of one year after termination. The employment contracts also provide that upon termination by the employee in the event the Company changes the substantive responsibilities and duties of the employee in such a way as to constitute a demotion, the Company shall continue to pay employee's base salary in effect prior to termination for a period of one year after termination. The contracts provide that upon termination of employment by the Company after a change of control, other than for cause, the Company shall continue to pay employee’s base salary in effect prior to termination for a period of two years after termination. The contracts condition the payment of severance upon execution of a release of claims and include provisions to comply with Internal Revenue Code Section 409A.

Grants of Plan- Based Award-Fiscal Year 2023

The following table sets forth information concerning individual grants of non-equity incentive plan awards and grants of equity incentive plan awards made during fiscal year 2023 to each of the named executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant Date | | Estimated Future Payouts

Under Non-Equity Incentive Plan Awards | | Estimated Future Payouts Under

Equity Incentive Plan Awards (#) | | Exercise or Base Price of

Option/SAR Awards ($/Sh) | | Grant Date Fair Value of Stock

And Option/SAR Awards ($) |

| Threshold

($) | | Target

($) | | Maximum

($) | | | | | | |

| Craig D. Gates | | 07/29/22(1) 07/29/22(2) 07/29/22(3) | |

87,906

200,000 | |

879,060

400,000 | |

1,318,590

600,000 | | 25,000

-

- | | 5.10

-

- | | 52,250

-

- |

| Brett R. Larsen | | 07/29/22(1) 07/29/22(2) 07/29/22(3) | |

32,285

95,000 | | 322,850

190,000 | | 484,275

285,000 | | 11,250

-

- | | 5.10

-

- | | 23,513

-

- |

| Philip S. Hochberg | | 07/29/22(1) 07/29/22(2) 07/29/22(3) | | 19,119

75,000 | |

191,191

150,000 | |

260,715

225,000 | | 10,000

-

- | | 5.10

-

- | | 20,900

-

- |

(1)Represents stock appreciation rights (SARS) awards during fiscal year 2023 under the 2010 Incentive Plan. SARS represent the right to receive payment per share of an exercised SAR in stock or cash, or a combination of stock and cash, equal to the excess of the share’s fair market value on the date of exercise over its fair market value on the date the SAR was granted (the closing price for the Common Stock on the date of grant).

(2)Represents threshold, target and maximum payouts under the annual Incentive Compensation Plan for fiscal year 2023. For actual payouts, if any, earned for fiscal year 2023 see the Summary Compensation Table.

(3)Represents threshold, target and maximum payouts under the Long-Term Incentive Plan for the 2023-2025 performance cycle. Payouts under the Long-Term Incentive Plan for the 2023-2025 performance cycle are dependent upon the achievement of goals for three years sales growth compared to peer group companies and return on invested capital.

Outstanding Equity Awards at Fiscal 2023 Year-End

The following table presents information regarding the outstanding stock appreciation rights awards held by each of the Company’s named executive officers as of July 1, 2023. No named executive officer has any other form of equity award outstanding.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Option Awards |

| Name | | Grant Date | |

Number of Securities Underlying Unexercised Options (#) Exercisable(1) | | Equity Incentive Plan Awards Number of Securities Underlying Unexercised Unearned Options (#)(1) | | Option

Exercise/Base Price ($) | | Option

Expiration Date |

| Craig D. Gates | | 07/29/22

08/09/21

07/23/20

07/26/19

07/27/18

| |

25,000

25,000 | | 25,000 25,000 25,000 | | 5.10

7.17

6.94

4.93

8.17 | | 07/29/27

08/09/26

07/23/25

07/26/24

07/27/23

|

| Brett R. Larsen | | 07/29/22

08/09/21

07/23/20

07/26/19

07/27/18

| |

11,250 11,250 | | 11,250 11,250 11,250

| | 5.10

7.17

6.94

4.93

8.17 | | 07/29/27

08/09/26

07/23/25

07/26/24

07/27/23

|

| Philip S. Hochberg | | 07/29/22

08/09/21

07/23/20

07/26/19

07/27/18

| |

10,000 10,000 | | 10,000 10,000 10,000 | | 5.10

7.17

6.94

4.93

8.17 | | 07/29/27

08/09/26

07/23/25

07/26/24

07/27/23

|

(1)Stock appreciation rights vest on the third anniversary of the grant date and have a five year term. Payouts under the stock appreciation rights are dependent upon the achievement of goals for three year’s return on invested capital compared to peer group companies.

Option/SAR Exercises and Stock Vested-Fiscal Year 2023

During fiscal year 2023, none of the named executive officers exercised any stock appreciation rights awards.

Pension Benefits

None of the named executive officers is covered by a pension plan.

Non-qualified Deferred Compensation

None of the named executive officers is covered by a defined benefit plan or other plan that provides for the deferral of compensation on a basis that is not tax-qualified.

Other Benefits

The Company offers the named executive officers and all other U.S. employees a 401(k) plan and life insurance, disability, medical and dental plans for which the named executive officers are charged the same rate as all other employees.

Potential Payments upon Termination or Change in Control

The following section describes the benefits that may become payable to the named executive officers in connection with a termination of their employment and/or a change in control of the Company.

Quantification of Severance and Change in Control Benefits. The tables below quantify the benefits that would have been payable to each of the named executive officers if the executive’s employment had terminated under the circumstances described above and/or a change in control of the Company had occurred on July 1, 2023. The first table presents the benefits the executive would have received if such a termination had occurred outside of the context of a change in control. The second table presents the benefits the executive would have received if such a termination occurred in connection with a change in control.

Severance Benefits (Outside of Change of Control)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Cash Severance ($)(1) | | Continuation of Health/Life Benefits ($)(2) | | Cash-Out of

Accrued and

Earned Vacation ($) | | Total ($) |

| Craig D. Gates | | 905,367 | | | — | | | — | | | 905,367 | |

| Brett R. Larsen | | 475,952 | | | — | | | — | | | 475,952 | |

| Philip S. Hochberg | | 384,522 | | | — | | | — | | | 384,522 | |

1.This amount represents 12 months of the executive’s base salary. Monthly base salary payments will terminate immediately upon the executive’s employment by a third party at a monthly base salary equal to or greater than the monthly base salary then being paid the executive by the Company. If the executive is paid a base salary by a third party lower than that being paid by the Company, the Company will continue to pay the difference for the remainder of the 12 month severance period.

2.The premiums that would be charged to continue health coverage for the applicable period pursuant to COBRA for the executive and his eligible dependents (to the extent that such dependents were receiving health benefits as of July 1, 2023) would be paid by the executive and the Company will not reimburse the executive for these premiums.

Change of Control Severance Benefits

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Cash Severance ($)(1) | | Continuation of Health/Life Benefits ($) (2) | | Cash-Out of

Accrued and Unpaid

Paid Time Off ($) | | Equity Acceleration ($)(3) | | Non-Equity Acceleration ($)(4) | | Total ($) |

| Craig D. Gates | | 1,810,734 | | | — | | | — | | | 14,250 | | | 400,000 | | | 2,224,984 | |

| Brett R. Larsen | | 951,904 | | | — | | | — | | | 6,413 | | | 190,000 | | | 1,148,317 | |

| Philip S. Hochberg | | 769,044 | | | — | | | — | | | 5,700 | | | 150,000 | | | 924,744 | |

1.For each of the named executive officers, this amount represents the sum of 24 months of the executive’s base salary. Monthly base salary payments will terminate immediately upon the executive’s employment by a third party at a monthly base salary equal to or greater than the monthly base salary then being paid the executive by the Company. If the executive is paid a base salary by a third party lower than that being paid by the Company, the Company will continue to pay the difference for the remainder of the 24 month severance period.

2.See footnote (2) to the previous table.

3.This amount represents the intrinsic value of the unvested portions of the executive’s stock appreciation rights (SARS) awards that would have accelerated on a termination of the executive’s employment as described above. This value is calculated by multiplying the amount by which $5.67 (the closing price of the Company’s common stock on the last trading day of fiscal 2023) exceeds the base price of the SARS by the number of SARS subject to the accelerated portion of the SARS. Each executive would have been entitled to full acceleration of his then-outstanding equity awards on such a termination.

4.This amount represents the target value of the unvested portion of the executive’s long term cash incentive plan awards that would have accelerated if the executive’s employment terminated upon a change in control of the Company on July 1, 2023.

DIRECTOR COMPENSATION

Non-Employee Director Compensation Table

The following table presents information regarding the compensation paid for fiscal year 2023 to members of the Board of Directors who are not also employees of the Company (referred to herein as “non-employee directors”).

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash ($) | | Option/SAR Awards ($)(1) | | Non-Equity Incentive Plan Compensation ($)(2) | | All Other

Compensation ($) | | Total ($) |

| James R. Bean | | 79,500 | | | 7,838 | | | — | | | — | | | 87,338 | |

| Ronald F. Klawitter | | 79,500 | | | 7,838 | | | — | | | — | | | 87,338 | |

| Subodh K. Kulkarni | | 79,500 | | | 7,838 | | | — | | | — | | | 87,338 | |

| Yacov A. Shamash | | 79,500 | | | 7,838 | | | — | | | — | | | 87,338 | |

| Patrick Sweeney | | 95,400 | | | 7,838 | | | — | | | — | | | 103,238 | |

(1)The amounts reported in the “Option/SAR Awards” column reflect the fair value on the grant date of the stock appreciation rights granted to the Company’s non-employee directors during fiscal year 2023 as determined under generally accepted accounting principles used to calculate the value of equity awards for purposes of the Company’s financial statements. For a discussion of the assumptions and methodologies used to calculate the amounts reported above, please see the discussion of equity awards contained in Note 8 - “Stock Option and Benefit Plans” to the Consolidated Financial Statements in the Company’s 2023 Annual Report.

(2)Amounts reflect any payout of long term performance unit awards for the three year performance period that ended in fiscal year 2023, pursuant to the long term cash incentive program.

The table below presents the number of outstanding and unexercised options/SAR awards held by each of the Company’s non-employee directors as of July 1, 2023.

| | | | | | | | | | | | | | |

| Director | | Number of Shares Subject to Outstanding Options/SAR Awards as of July 1, 2023 | | Number of Unvested Restricted Shares/Units as of July 1, 2023 |

| James. R. Bean | | 18,750 | | | — | |

| Ronald F. Klawitter | | 18,750 | | | — | |

| Patrick Sweeney | | 18,750 | | | — | |

| Subodh K. Kulkarni | | 15,000 | | | — | |

| Yacov A. Shamash | | 18,750 | | | — | |

Pay Versus Performance

As required by Section 953(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act, and Item 402(v) of Regulation S-K, we are providing the following information about the relationship between “compensation actually paid” to our CEO as principal executive officer (or “PEO) and to our other NEOs and certain metrics of financial performance of the Company. The following table shows the total compensation for our NEOs for the past two fiscal years as set forth in the Summary Compensation Table, the “Compensation Actually Paid” (or “CAP”) to our CEO as PEO, and, on an average basis, our other NEOs, and our total shareholder return. CAP figures do not reflect the actual amount of compensation earned by or paid to our NEOs during the applicable year as significant portions of this compensation depends on the achievement of performance criteria in subsequent fiscal periods.

| | | | | | | | | | | | | | | | | | | | |

Year(1) | Summary compensation table total for PEO(2) | Compensation actually paid to PEO(3) | Average summary compensation table total for non-PEO named executive officers(2) | Average compensation actually paid to non-PEO named executive officers(3) | Value of initial fixed $100 investment based on: Total shareholder return(4) | Net income |

2023 | $1,513,037 | $1,542,537 | $629,109 | $641,647 | $86.56 | $5,156,736 |

2022 | $1,391,110 | $1,346,860 | $566,866 | $548,060 | $67.33 | $3,377,205 |

| | | | | | |

| | | | | | |

1.Mr. Gates served as the Company’s Chief Executive Officer for the entirety of 2022 and 2023. Our non-PEO NEOs for 2022 and 2023 included Messrs. Larsen and Hochberg.

2.Amounts reported in this column represent the total compensation reported in the Summary Compensation Table for the applicable year.

3.To calculate “Compensation Actually Paid” under SEC disclosure rules, adjustments were made to the amounts reported in the Summary Compensation Table for the applicable year. Reconciliations of the adjustments for Messrs. Gates, Larsen and Hochberg are set forth in the tables below.

| | | | | | | | | | | | | | |

| PEO | NEOs - Average |

| 2023 | 2022 | 2023 | 2022 |

Less grant date fair value of current year SARs | $(52,250) | $(68,250) | $(22,206) | $(29,006) |

Year-end fair value of current year SARs | $63,250 | $52,250 | $26,881 | $22,206 |

Year-over-year change in fair value of unvested SARs | $22,000 | $(32,000) | $9,350 | $(13,600) |

| Change in fair value at vesting (from prior fiscal year end) of SARs granted in prior years for which vesting conditions were satisfied during current year | $(3,500) | $3,750 | $(1,488) | $1,594 |

| Less fair value as of prior fiscal year end of SARs granted in prior years that failed to meet vesting conditions during current year | $— | $— | $— | $— |

Dividends paid | $— | $— | $— | $— |

| Total Adjustments | $29,500 | $(44,250) | $12,537 | $(18,806) |

+

4.Pursuant to rules of the SEC, the comparison assumes $100 was invested on July 1, 2021. Historic stock price performance is not necessarily indicative of future stock price performance.

Relationship Between Pay and Performance

We believe the “Compensation Actually Paid” in each of the years reported above and over the multi-year cumulative period are reflective of the Compensation Committee’s emphasis on “pay-for-performance” as the “Compensation Actually Paid” fluctuated year-over-year, primarily due to the result of our stock performance.

Relationship between “Compensation Actually Paid” to the PEO and Average Other NEOs and the Company’s Cumulative TSR and Net Income. “Compensation Actually Paid” to the PEO and Average Other NEOs aligned with the trend in the Company’s Cumulative TSR and Net Income. This is generally because “Compensation Actually Paid” is influenced by year-over-year changes in stock prices due to the fact that a portion of the PEO’s and each

NEO’s compensation is equity-based and because base salary is influenced by year-over-year changes in revenues, which in turn effects net income.

Non-Employee Director Compensation

Equity Grants. Under the Company’s 2010 Incentive Plan, as approved by the shareholders in October 2010, as amended and restated October 23, 2014, the Company’s non-employee directors receive awards, subject to the non-employee director’s continued service to the Company through the vesting date.

Long-Term Incentive Plan Awards. Under the Company’s Long-Term Incentive Plan, non-employee directors receive long term non-equity incentive compensation awards.

Retainers and Meeting Fees. In addition, non-employee directors received annual retainers for attending Board and committee meetings as set forth in the following table:

| | | | | | | | |

| Annual Cash Retainer | | |

| Board Member, other than Chairman | $ | 81,000 |

| Chairman of the Board | | 97,200 |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

All non-employee directors are also reimbursed for their expenses incurred in attending Board meetings and committee meetings, as well as other Board-related travel expenses.

PROPOSAL 2

ADVISORY VOTE TO APPROVE THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act added Section 14A to the Exchange Act, which requires that we provide our shareholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the SEC.

As described in greater detail in the “Executive Compensation” section of this Proxy Statement the Company believes that compensation of its executive officers should encourage creation of shareholder value and achievement of strategic corporate objectives. The Company attempts to align the interest of its shareholders and management by integrating compensation with the Company’s short-term and long-term corporate strategic and financial objectives. In order to attract and retain the most qualified personnel, the Company intends to offer a total compensation package competitive with companies in our industry sector, taking into account relative company size, performance and geographic location as well as individual responsibilities and performance, while at the same time avoiding the encouragement of unnecessary or excessive risk taking.

This vote is advisory, which means that the vote on executive compensation is not binding on the Company, our Board of Directors or the Compensation Committee. The vote on this resolution is not intended to address any specific element of compensation, but rather relates to the overall compensation of our named executive officers, as described in this Proxy Statement in accordance with the compensation disclosure rules of the SEC. To the extent there is a significant vote against our named executive officers compensation as disclosed in this Proxy Statement, the Compensation Committee will evaluate whether any actions are necessary to address our shareholders concerns.

Therefore, we ask our shareholders to vote on the following resolution at the Annual Meeting:

RESOLVED, that the Company’s shareholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the 2023 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Summary Compensation Table and the other related tables and disclosure.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THE APPROVAL OF THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS, AS DISCLOSED IN THIS PROXY STATEMENT.

AUDIT COMMITTEE REPORT

The Audit Committee of the Company’s Board of Directors consists of five members. The Board of Directors has determined that all Audit Committee members meet the definition of independence within the meaning of the applicable Nasdaq Rules and are able to read and understand fundamental financial statements, including a company’s balance sheet, income statement, and cash flow statement, as required by the Nasdaq Rules and that James R. Bean, Ronald F. Klawitter, Subodh K. Kulkarni, Yacov A. Shamash and Patrick Sweeney each have the requisite attributes of an “audit committee financial expert” as defined by SEC regulations. The Audit Committee operates under a written charter adopted by the Board of Directors which is reviewed and reassessed for adequacy annually by the Audit Committee. The Audit Committee has met and reviewed and discussed the Company’s financial statements contained in the Annual Report on Form 10-K for the fiscal year ended July 1, 2023 with the Company’s management and Moss Adams, LLP (“Moss Adams”), the Company’s independent registered public accounting firm.

The Audit Committee has reviewed and discussed with Moss Adams the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (“PCAOB”) and the

Securities and Exchange Commission (“SEC”). Moss Adams has submitted to the Audit Committee and the Committee has reviewed the written disclosures and letter from Moss Adams as required by applicable requirements of the PCAOB regarding the independent accountant's communications with the audit committee concerning independence. The Audit Committee discussed with Moss Adams that firm’s independence. The Audit Committee has considered whether the provision of non-audit services is compatible with maintaining the principal auditor's independence. All services to be provided by Moss Adams are pre-approved by the Audit Committee or are pre-approved by a member of the Audit Committee and later ratified by the Committee.

Based upon the reviews and discussions described above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10K for the fiscal year ended July 1, 2023, for filing with the SEC. The foregoing report has been approved by all members of the Audit Committee.

James R. Bean (Chairman)

Ronald F. Klawitter

Subodh K. Kulkarni

Yacov A. Shamash

Patrick Sweeney

Principal Accountant Fees and Services. The following chart shows the aggregate audit and non-audit fees billed or expected to be billed to the Company by Moss Adams for professional services in the named categories for the fiscal years ended July 1, 2023 and July 2, 2022:

| | | | | | | | | | | |

| FY 2023 | | FY 2022 |

Audit Fees(1) | $ | 510,258 | | | $ | 548,876 | |

Audit Related Fees(2) | 28,875 | | | 26,250 | |

Tax Fees(3) | 143,766 | | | 187,899 | |

| All Other Fees | — | | | — | |

| Total | $ | 682,899 | | | $ | 763,025 | |

1.Audit fees consisted of professional services provided in connection with the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K, review of the interim consolidated financial statements included in the Company’s quarterly reports on Form 10-Q, review of documents filed with the SEC and statutory audits.

2.Audit related fees consisted of professional services provided in connection with the audit of the Company’s 401(k) Retirement Savings Plan and other consultation matters.

3.Tax fees for fiscal years 2022 and 2023 consisted of professional services provided for domestic income tax planning and compliance and the review of foreign tax returns and consultation on foreign tax matters. Tax fees for fiscal years 2022 and 2023 also included fees for performing a study relating to research and development tax credits.

Dismissal of Independent Registered Public Accounting Firm

On November 23, 2021, the Company, upon the recommendation of the Audit Committee, dismissed BDO as the Company’s independent registered public accounting firm. BDO served as the Company’s independent registered public accounting firm since 2003.

During the fiscal years ended July 3, 2021 and June 27, 2020 and the subsequent interim period through November 23, 2021, there were no disagreements with BDO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to their satisfaction, would have caused them to make reference in connection with their opinion to the subject matter of the disagreement.

Additionally, during the fiscal years ended July 3, 2021 and June 27, 2020 and the subsequent interim period through November 23, 2021, there were no reportable events as described in Item 304(a)(1)(v) of Regulation S-K except for the following event that has been remediated as described in the Company’s Annual Report on Form 10-K for the fiscal year ended July 2, 2022: BDO advised the Company of a material weakness in internal controls over financial reporting related to the design and operating effectiveness of certain controls over the accounting for inventory as well as the Company’s monitoring activities as it pertains to accounting for inventory at its domestic facilities. The Audit Committee discussed the subject matter of this event with BDO, and the Company has authorized BDO to respond fully to inquiries from any successor auditing firm with regard to the event and the remediation of the event.

The audit reports of BDO on the consolidated financial statements of the Company as of and for the fiscal years ended July 3, 2021 and June 27, 2020 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles.

BDO has provided the Company with a copy of its letter addressed to the SEC stating that BDO agrees with the disclosures made by the Company in response to Item 304(a) of Regulation S-K. A copy of BDO’s letter is filed as Exhibit 16.1 to the Company’s Current Report on Form 8-K filed with the SEC on November 30, 2021.

Engagement of New Independent Registered Public Accounting Firm

On November 30, 2021, the Company engaged Moss Adams as the Company’s independent registered public accounting firm for the Company’s fiscal year ending July 2, 2022. The appointment was approved by the Audit Committee.

During the Company’s two most recent fiscal years ended July 3, 2021 and June 27, 2020, and during the subsequent interim period through November 30, 2021, neither the Company nor anyone on its behalf consulted with Moss Adams regarding any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

PROPOSAL 3

RATIFICATION OF APPOINTMENT OF AUDITORS

The Audit Committee has retained Moss Adams, LLP (“Moss Adams”) as the Company’s independent registered public accounting firm for the fiscal year ending June 29, 2024. Representatives of Moss Adams are expected to be present at the Annual Meeting with the opportunity to make a statement, if they desire to do so, and they are expected to be available to respond to appropriate questions. In the event that ratification of this appointment of Moss Adams as the Company’s registered public accounting firm is not approved by a majority of the shares of Common Stock voting at the Annual Meeting in person or by proxy, the Audit Committee will review its future selection of its registered public accounting firm.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF MOSS ADAMS, LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

SHAREHOLDER PROPOSALS

Eligible shareholders who wish to present proposals for action at the Annual Meeting of Shareholders to be held in 2024 must submit their proposals in writing to John Theiss, Secretary, Key Tronic Corporation, 4424 N. Sullivan Road - Upper Level, Spokane Valley, Washington 99216. Under Rule 14a-8(e) of the Exchange Act, proposals submitted for inclusion in our proxy statement for the 2024 Annual Meeting must be received by the Secretary at the address above no later than May 24, 2024. In addition, any shareholder who intends to present a proposal at the 2024 Annual Meeting without inclusion of such proposal in our proxy materials must provide us notice of such proposal in the manner set forth above by August 7, 2024 or such proposal will be considered untimely. For such proposals that are untimely, the Company retains discretion to vote proxies it receives. For such proposals that are timely, the Company retains discretion to vote proxies it receives provided that (1) the Company includes in its proxy statement advice on the nature of the proposal and how it intends to exercise its voting discretion and (2) the proponent does not issue a proxy statement. We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements. In addition, to comply with the universal proxy rules (once effective), shareholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act no later than August 27, 2024.

OTHER MATTERS

Annual Report on Form 10-K

The 2023 Annual Report on Form 10-K (including exhibits), as amended, which we refer to as our “Form 10-K,” is available by accessing the Company’s website at www.keytronic.com or the SEC’s website at www.sec.gov. Stockholders may request a free copy of our Form 10-K by contacting Investor Relations at (509) 927-5500, investorrelations@keytronic.com. We will furnish any exhibit to our Form 10-K if specifically requested to do so.

Delinquent Section 16(a) Reports. Section 16(a) of the Exchange Act requires the Company’s executive officers and directors and persons who own more than 10% of the Company’s Common Stock (collectively, “Reporting Persons”) to file reports of ownership and changes in ownership with the SEC and NASDAQ.

Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section 16(a) forms which they file. Based solely on its review of the copies of such forms received or written representations from certain Reporting Persons that no Forms 5 were required, the Company believes that with respect to the fiscal year ended July 1, 2023 all the Reporting Persons complied with all applicable filing requirements.

Solicitation Expenses. The expense of printing and mailing proxy material will be borne by the Company. In addition to the solicitation of proxies by mail, solicitation may be made by certain directors, executive officers and other employees of the Company by personal interview, telephone or facsimile. No additional compensation will be paid for such solicitation. The Company will request brokers and nominees who hold stock in their names to furnish proxy material to beneficial owners of the shares and will reimburse such brokers and nominees for their reasonable expenses incurred in forwarding solicitation material to such beneficial owners. In addition, we have retained Georgeson LLP to aid in the solicitation of proxies and provide related advice and informational support. We currently estimate the fees payable to Georgeson LLP in connection with such services to be approximately $11,000, plus reimbursement of out of pocket expenses.

Other Business. The Board of Directors knows of no other business that will be presented to the Annual Meeting. If any other business is properly brought before the Annual Meeting, it is intended that proxies in the enclosed form will be voted in respect thereof in accordance with the judgment of the persons voting the proxies.

| | | | | | | | |

| Spokane Valley, Washington | | By Order of the Board of Directors, |

| September 29, 2023 | | John Theiss |

| | Secretary |

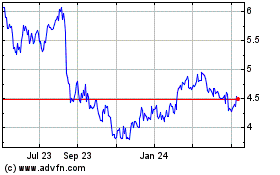

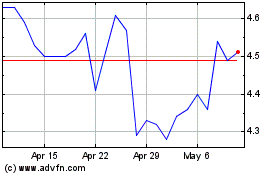

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Apr 2023 to Apr 2024