Key Tronic Corporation (Nasdaq: KTCC), a provider

of electronic manufacturing services (EMS), today announced its

results for the quarter ended September 28, 2024.

For the first quarter of fiscal year 2025, Key

Tronic reported total revenue of $131.6 million, compared to $150.1

million in the same period of fiscal year 2024. Revenue in the

first quarter of fiscal year 2025 was adversely impacted by

customer-driven design and qualification delays of three programs

that we believe impacted revenue by approximately $9 million. These

delays have since been resolved on two of these programs and

shipments have resumed in the second quarter.

Production in Key Tronic’s Mexico facilities in the first quarter

of fiscal year 2025 increased by approximately 10% sequentially

from the prior quarter.

The Company saw significant improvement in its

production efficiencies compared to the first quarter of fiscal

year 2024, primarily as a result of recent headcount reductions,

continued improvements in the supply chain and a favorable decline

in the exchange rate of the Mexican Peso. Gross margins were 10.1%

and operating margins were 3.4% in the first quarter of fiscal year

2025, up from 7.2% and 2.2%, respectively, in the same period of

fiscal year 2024.

Net income was $1.1 million or $0.10 per share for

the first quarter of fiscal year 2025, compared to net income of

$0.3 million or $0.03 per share for the same period of fiscal year

2024. Adjusted net income was $1.2 million or $0.11 per

share for the first quarter of fiscal year 2025, compared to $0.0

million or $0.00 per share for the same period of fiscal year 2024.

See “Non-GAAP Financial Measures,” below for additional information

about adjusted net income and adjusted net income per share.

“While we did not meet revenue expectations in our

first quarter of fiscal 2025 due to unavoidable delays for a few

programs, we are pleased to see our improved operating

efficiencies, margins, and liquidity,” said Brett Larsen, President

and CEO. “The recent workforce reductions in Mexico, trimming of

non-profitable programs, and making a concerted effort to improve

working capital are starting to pay off. We also

continued to reduce our inventories, which are now much more in

line with our revenue levels. Over the longer term, we expect that

these strategic changes will improve our overall

profitability.”

“During the first quarter, we also continued to win

new business, including new programs in manufacturing equipment,

vehicle lighting, and commercial pest control. We

believe we are well positioned for increased growth and

profitability in coming periods.”

The financial data presented for the first quarter

of fiscal 2025 should be considered preliminary and could be

subject to change, as the Company’s independent auditor has not

completed their review procedures.

Business Outlook

For the second quarter of fiscal 2025, Key Tronic

expects to report revenue in the range of $130 million to $140

million and earnings in the range $0.05 to $0.15 per diluted share.

These expected results assume an effective tax rate of 20% in the

coming quarter.

Conference Call

Key Tronic will host a conference call to discuss

its financial results at 2:00 PM Pacific (5:00 PM Eastern) today. A

broadcast of the conference call will be available at

www.keytronic.com under “Investor Relations” or by calling

888-394-8218 or +1-313-209-4906 (Access Code: 7268667). The Company

will also reference accompanying slides that can be viewed with the

webcast at www.keytronic.com under “Investor Relations”. A replay

will be available at www.keytronic.com under “Investor

Relations”.

About Key Tronic

Key Tronic is a leading contract manufacturer

offering value-added design and manufacturing services from its

facilities in the United States, Mexico, China and Vietnam. The

Company provides its customers with full engineering services,

materials management, worldwide manufacturing facilities, assembly

services, in-house testing, and worldwide distribution. Its

customers include some of the world’s leading original equipment

manufacturers. For more information about Key Tronic visit:

www.keytronic.com

Forward-Looking Statements

Some of the statements in this press release are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include, but are not limited to those including such

words as aims, anticipates, believes, continues, estimates,

expects, hopes, intends, plans, predicts, projects, targets, will,

or would, similar verbs, or nouns corresponding to such verbs,

which may be forward looking. Forward-looking statements also

include other passages that are relevant to expected future events,

performances, and actions or that can only be fully evaluated by

events that will occur in the future. Forward-looking statements in

this release include, without limitation, the Company’s statements

regarding its expectations with respect to financial conditions and

results, including revenue and earnings, cost savings from

headcount reduction and the Mexican Peso exchange rate, demand for

certain products and the effectiveness of some of its programs,

business from customers and programs, and impacts from operational

streamlining and efficiencies. There are many factors, risks and

uncertainties that could cause actual results to differ materially

from those predicted or projected in forward-looking statements,

including but not limited to: the future of the global economic

environment and its impact on our customers and suppliers; the

availability of components from the supply chain; the availability

of a healthy workforce; the accuracy of suppliers’ and customers’

forecasts; development and success of customers’ programs and

products; timing and effectiveness of ramping of new programs;

success of new-product introductions; the risk of legal proceedings

or governmental investigations relating to the previously reported

financial statement restatements and related material weaknesses,

the May 2024 cybersecurity incident and the subject of the internal

investigation by the Company’s Audit Committee and related or other

unrelated matters; acquisitions or divestitures of operations or

facilities; technology advances; changes in pricing policies by the

Company, its competitors, customers or suppliers; impact of new

governmental legislation and regulation, including tax reform,

tariffs and related activities, such trade negotiations and other

risks; and other factors, risks, and uncertainties detailed from

time to time in the Company’s SEC filings.

Non-GAAP Financial Measures

To supplement our consolidated financial

statements, which are prepared in accordance with generally

accepted accounting principles in the United States (GAAP), we use

certain non-GAAP financial measures, adjusted net income and

adjusted net income per share, diluted. We provide these non-GAAP

financial measures because we believe they provide greater

transparency related to our core operations and represent

supplemental information used by management in its financial and

operational decision making. We exclude (or include) certain items

in our non-GAAP financial measures as we believe the net result is

a measure of our core business. We believe this facilitates

operating performance comparisons from period to period by

eliminating potential differences caused by the existence and

timing of certain income and expense items that would not otherwise

be apparent on a GAAP basis. Non-GAAP performance measures should

be considered in addition to, and not as a substitute for, results

prepared in accordance with GAAP. We strongly encourage investors

and shareholders to review our financial statements and

publicly-filed reports in their entirety and not to rely on any

single financial measure. Our non-GAAP financial measures may be

different from those reported by other companies. See the table

below entitled “Reconciliation of GAAP to non-GAAP measures” for

reconciliations of adjusted net income to the most directly

comparable GAAP measure, which is GAAP net income, and the

computation of adjusted net income per share, diluted.

|

|

|

KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF OPERATIONS(In

thousands, except per share amounts)(Unaudited) |

|

|

|

|

Three Months Ended |

|

|

September 28, 2024 |

|

September 30, 2023 |

|

Net sales |

$ |

131,558 |

|

|

$ |

150,112 |

|

|

Cost of sales |

|

118,255 |

|

|

|

139,250 |

|

|

Gross profit |

|

13,303 |

|

|

|

10,862 |

|

|

Research, development and engineering expenses |

|

2,289 |

|

|

|

2,241 |

|

|

Selling, general and administrative expenses |

|

6,570 |

|

|

|

5,784 |

|

|

Gain on insurance proceeds, net of losses |

|

— |

|

|

|

(431 |

) |

|

Total operating expenses |

|

8,859 |

|

|

|

7,594 |

|

|

Operating income |

|

4,444 |

|

|

|

3,268 |

|

|

Interest expense, net |

|

3,263 |

|

|

|

3,011 |

|

|

Income before income taxes |

|

1,181 |

|

|

|

257 |

|

|

Income tax (benefit) provision |

|

57 |

|

|

|

(78 |

) |

|

Net income |

$ |

1,124 |

|

|

$ |

335 |

|

|

Net income per share — Basic |

$ |

0.10 |

|

|

$ |

0.03 |

|

|

Weighted average shares outstanding — Basic |

|

10,762 |

|

|

|

10,762 |

|

|

Net income per share — Diluted |

$ |

0.10 |

|

|

$ |

0.03 |

|

|

Weighted average shares outstanding — Diluted |

|

10,762 |

|

|

|

11,003 |

|

|

|

|

KEY TRONIC CORPORATION AND

SUBSIDIARIESCONSOLIDATED BALANCE SHEETS(In

thousands)(Unaudited) |

|

|

| |

|

September 28, 2024 |

|

June 29, 2024 |

|

ASSETS |

|

|

|

|

|

Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,555 |

|

|

$ |

4,752 |

|

|

Trade receivables, net of credit losses of $3,129 and $2,918 |

|

|

133,984 |

|

|

|

132,559 |

|

|

Contract assets |

|

|

23,626 |

|

|

|

21,250 |

|

|

Inventories, net |

|

|

95,845 |

|

|

|

105,099 |

|

|

Other, net of credit losses of $1,642 and $1,679 |

|

|

28,273 |

|

|

|

24,739 |

|

|

Total current assets |

|

|

288,283 |

|

|

|

288,399 |

|

|

Property, plant and equipment, net |

|

|

27,910 |

|

|

|

28,806 |

|

|

Operating lease right-of-use assets, net |

|

|

14,612 |

|

|

|

15,416 |

|

|

Other assets: |

|

|

|

|

|

Deferred income tax asset |

|

|

18,394 |

|

|

|

17,376 |

|

|

Other |

|

|

6,735 |

|

|

|

5,346 |

|

|

Total other assets |

|

|

25,129 |

|

|

|

22,722 |

|

|

Total assets |

|

$ |

355,934 |

|

|

$ |

355,343 |

|

|

LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

83,768 |

|

|

$ |

79,394 |

|

|

Accrued compensation and vacation |

|

|

6,870 |

|

|

|

6,510 |

|

|

Current portion of long-term debt |

|

|

3,057 |

|

|

|

3,123 |

|

|

Other |

|

|

18,450 |

|

|

|

15,149 |

|

|

Total current liabilities |

|

|

112,145 |

|

|

|

104,176 |

|

|

Long-term liabilities: |

|

|

|

|

|

Long-term debt, net |

|

|

109,675 |

|

|

|

116,383 |

|

|

Operating lease liabilities |

|

|

9,573 |

|

|

|

10,312 |

|

|

Deferred income tax liability |

|

|

74 |

|

|

|

263 |

|

|

Other long-term obligations |

|

|

124 |

|

|

|

219 |

|

|

Total long-term liabilities |

|

|

119,446 |

|

|

|

127,177 |

|

|

Total liabilities |

|

|

231,591 |

|

|

|

231,353 |

|

|

Shareholders’ equity: |

|

|

|

|

|

Common stock, no par value—shares authorized 25,000; issued and

outstanding 10,762 and 10,762 shares, respectively |

|

|

47,351 |

|

|

|

47,284 |

|

|

Retained earnings |

|

|

78,045 |

|

|

|

76,921 |

|

|

Accumulated other comprehensive income (loss) |

|

|

(1,053 |

) |

|

|

(215 |

) |

|

Total shareholders’ equity |

|

|

124,343 |

|

|

|

123,990 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

355,934 |

|

|

$ |

355,343 |

|

| |

|

|

|

|

|

KEY TRONIC CORPORATION AND

SUBSIDIARIESReconciliation of GAAP to non-GAAP measures(In

thousands, except per share amounts)(Unaudited) |

|

|

|

|

Three Months Ended |

|

|

September 28, 2024 |

|

September 30, 2023 |

|

GAAP net income |

$ |

1,124 |

|

|

$ |

335 |

|

|

Gain on insurance proceeds (net of losses) |

|

— |

|

|

|

(431 |

) |

|

Stock-based compensation expense |

|

67 |

|

|

|

59 |

|

|

Income tax effect of non-GAAP adjustments (1) |

|

(13 |

) |

|

|

74 |

|

|

Adjusted net income: |

$ |

1,178 |

|

|

$ |

37 |

|

| |

|

|

|

|

Adjusted net income per share — non-GAAP Diluted |

$ |

0.11 |

|

|

$ |

0.00 |

|

|

Weighted average shares outstanding — Diluted |

|

10,762 |

|

|

|

11,003 |

|

| |

|

|

|

|

(1) Income tax effects are calculated using an effective tax rate

of 20%, which approximates the statutory GAAP tax rate for the

presented periods. |

|

|

|

|

|

|

|

CONTACTS: |

|

Tony Voorhees |

|

Michael Newman |

| |

|

Chief Financial Officer |

|

Investor Relations |

| |

|

Key Tronic Corporation |

|

StreetConnect |

| |

|

(509)-927-5345 |

|

(206) 729-3625 |

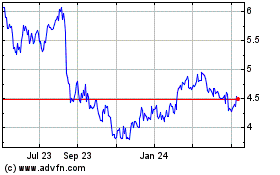

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Dec 2024 to Jan 2025

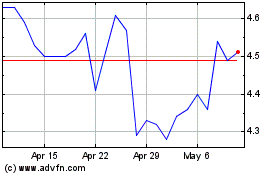

KeyTronic (NASDAQ:KTCC)

Historical Stock Chart

From Jan 2024 to Jan 2025