false000142214300014221432024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

KURA ONCOLOGY, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-37620 |

61-1547851 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

12730 High Bluff Drive, Suite 400, San Diego, CA |

92130 |

(Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (858) 500-8800

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

KURA |

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 7, 2024, Kura Oncology, Inc. (the “Company”) issued a press release announcing the Company’s financial results for the third quarter ended September 30, 2024 and providing a corporate update. A copy of this press release is furnished herewith as Exhibit 99.1.

The information contained in this Current Report on Form 8-K under Item 2.02 and Exhibit 99.1 hereto are being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section and will not be incorporated by reference into any registration statement filed by the Company, under the Securities Act of 1933, as amended, unless specifically identified as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

KURA ONCOLOGY, INC. |

|

|

|

|

Date: November 7, 2024 |

|

By: |

/s/ Teresa Bair |

|

|

|

Teresa Bair |

|

|

|

Chief Legal Officer |

Kura Oncology Reports Third Quarter 2024

Financial Results

– Topline results from registration-directed trial of ziftomenib in R/R NPM1-mutant AML expected in early 2025; Phase 1 results published in The Lancet Oncology –

– Data from 100 patients in Phase 1a dose-escalation study of ziftomenib combined with ven/aza in R/R AML and 7+3 in 1L adverse risk AML to be presented at ASH –

– Phase 1b expansion study of ziftomenib in combination with standards of care now enrolling at 600 mg in all cohorts –

– Preclinical data support opportunity for ziftomenib in GIST; proof-of-concept study expected to begin in 1H 2025 –

– First patient dosed in study of KO-2806 and adagrasib in KRASG12C-mutated NSCLC –

– $455.3 million in cash, cash equivalents and investments provide runway into 2027 –

– Management to host webcast and conference call today at 4:30 p.m. ET –

SAN DIEGO, Nov. 7, 2024 – Kura Oncology, Inc. (Nasdaq: KURA), a clinical-stage biopharmaceutical company committed to realizing the promise of precision medicines for the treatment of cancer, today reported third quarter 2024 financial results and provided a corporate update.

“We approach the end of 2024 in a strong position, with a series of important catalysts ahead,” said Troy Wilson, Ph.D., J.D., President and Chief Executive Officer of Kura Oncology. “First, we look forward to sharing a robust dataset from more than 100 patients in our Phase 1a dose-escalation study of ziftomenib in combination with standards of care in acute myeloid leukemia (AML) at the upcoming American Society of Hematology (ASH) Annual Meeting, followed by topline results from our registration-directed trial of ziftomenib in relapsed/refractory (R/R) NPM1-mutant (NPM1-m) AML early next year. In the meantime, we continue to enroll rapidly across all our ziftomenib studies, further supporting the broad development of our menin inhibitor programs.”

Recent Highlights

•Topline results from registration-directed trial of ziftomenib in early 2025 – In May 2024, Kura completed enrollment of 85 patients in the Phase 2 portion of KOMET-001, a registration-directed clinical trial of its menin inhibitor, ziftomenib, in patients with R/R NPM1-m AML. Ziftomenib is the first and only investigational therapy to be granted Breakthrough Therapy Designation (BTD) for the treatment of R/R NPM1-m AML, which accounts for approximately 30% of new AML cases annually and represents a disease of significant unmet need for which no approved targeted therapy exists. Results from the Phase 1 portion of KOMET-001 were recently published in the leading clinical oncology journal, The Lancet Oncology.

•Data from Phase 1a dose-escalation study of ziftomenib at ASH – Two abstracts reporting preliminary data from the Phase 1a dose-escalation study of ziftomenib in combination with standards of care in patients with NPM1-m and KMT2A-rearranged (KMT2A-r) AML have been accepted for presentation at the ASH Annual Meeting in December. As of the June 21, 2024 data cutoff, the abstracts continue to support a potential best-in-class safety and tolerability profile for ziftomenib, as well as robust and durable activity in combination with standards of care, including venetoclax plus azacitidine (ven/aza) as well as cytarabine plus daunorubicin (7+3). Kura expects to present a more mature dataset from more than 100 patients in the Phase 1a dose-escalation study in the presentations at ASH.

•Phase 1b expansion study of ziftomenib now enrolling in all cohorts – All four cohorts in the Phase 1a dose-escalation study have cleared the highest dose and advanced into the Phase 1b expansion study at 600 mg. The Phase 1b expansion study includes multiple combination cohorts, including ziftomenib plus ven/aza in newly diagnosed NPM1-m or KMT2A-r AML and ziftomenib plus 7+3 in newly diagnosed NPM1-m or KMT2A-r AML without qualification for high-risk disease. Each of the seven combination cohorts is expected to enroll at least 20 patients. A total of 45 patients have already enrolled in the study since the first dose-expansion cohort opened in August 2024. The Company anticipates sharing preliminary data from the Phase 1b expansion study at a medical meeting in 2025.

•Preclinical data support opportunity for ziftomenib in GIST – Last month, at the EORTC-NCI-AACR Symposium on Molecular Targets and Cancer Therapeutics in Barcelona, Kura reported preclinical data supporting the combination of ziftomenib and imatinib for the treatment of advanced gastrointestinal stromal tumors (GIST). The combination showed unexpectedly robust and durable antitumor activity in both imatinib-sensitive and imatinib-resistant GIST patient-derived xenograft models, and in all cases was significantly superior to imatinib monotherapy. The Company received FDA clearance of its Investigational New Drug application for ziftomenib for the treatment of advanced GIST in August and expects to initiate a proof-of-concept study in the first half of 2025 evaluating ziftomenib and imatinib in patients with advanced GIST who have failed imatinib.

•First patient dosed in study of KO-2806 and adagrasib in KRASG12C-mutated NSCLC – In August 2024, Kura began dosing patients in its study of KO-2806, a next-generation farnesyl transferase inhibitor (FTI), in combination with adagrasib in KRASG12C-mutated non-small cell lung cancer (NSCLC). The Company’s findings suggest that combining KO-2806 with adagrasib may drive tumor regressions and enhance both duration and depth of antitumor response in preclinical models of KRASG12C-mutated NSCLC. The study of KO-2806 and adagrasib is supported by a clinical collaboration and supply agreement with Mirati, now a Bristol Myers Squibb company.

•Preclinical data support potential for menin inhibitor in diabetes – In June 2024, Kura reported data showing that ziftomenib induces insulin production, improves insulin sensitivity and reduces insulin resistance in a preclinical in vivo model of type 2 diabetes. Ziftomenib demonstrated meaningful levels of glycemic control, including reduced fasting blood glucose levels and %HbA1C within 27 days, as well as consistent improvement in both insulin sensitivity and insulin production. The data were presented at the American Diabetes Association Scientific Sessions in Orlando. The Company expects to nominate a next generation menin inhibitor candidate targeting diabetes in the first half of 2025.

Financial Results

•Research and development expenses for the third quarter of 2024 were $41.7 million, compared to $29.3 million for the third quarter of 2023.

•General and administrative expenses for the third quarter of 2024 were $18.2 million, compared to $13.1 million for the third quarter of 2023.

•Net loss for the third quarter of 2024 was $54.4 million, compared to a net loss of $38.6 million for the third quarter of 2023. This included non-cash share-based compensation expense of $8.3 million, compared to $7.1 million for the same period in 2023.

•As of September 30, 2024, Kura had cash, cash equivalents and short-term investments of $455.3 million, compared to $424.0 million as of December 31, 2023.

•Based on its operating plan, management expects that cash, cash equivalents and short-term investments will fund current operations into 2027.

Forecasted Milestones

•Present updated data from the KOMET-007 trial of ziftomenib in combination with ven/aza and 7+3 at ASH in December 2024.

•Report topline results from the KOMET-001 registration-directed trial of ziftomenib in NPM1-mutant R/R AML in early 2025.

•Present preliminary data from the Phase 1b expansion portion of KOMET-007 at a medical meeting in 2025.

•Initiate proof-of-concept study evaluating ziftomenib and imatinib in patients with advanced GIST in the first half of 2025.

•Nominate a next generation menin inhibitor development candidate targeting diabetes in the first half of 2025.

•Identify the maximum tolerated dose for KO-2806 as a monotherapy in the second half of 2024.

•Initiate one or more expansion cohorts for the combination of KO-2806 and cabozantinib in renal cell carcinoma in the first half of 2025.

•Present data from the KURRENT-HN trial of tipifarnib in combination with alpelisib in PIK3CA-dependent head and neck squamous cell carcinoma (HNSCC) in the first half of 2025.

Conference Call and Webcast

Kura’s management will host a webcast and conference call at 4:30 p.m. ET / 1:30 p.m. PT today, November 7, 2024, to discuss the financial results for the third quarter 2024 and to provide a corporate update. The live call may be accessed by dialing (800) 225-9448 for domestic callers and (203) 518-9708 for international callers and entering the conference ID: KURAQ3. A live webcast and archive of the call will be available online from the investor relations section of the company website at www.kuraoncology.com.

About Kura Oncology

Kura Oncology is a clinical-stage biopharmaceutical company committed to realizing the promise of precision medicines for the treatment of cancer. The Company’s pipeline consists of small molecule drug candidates that target cancer signaling pathways. Ziftomenib, a once-daily, oral drug candidate targeting the menin-KMT2A protein-protein interaction, has received BTD for the treatment of R/R NPM1-m AML. Kura has completed enrollment in a Phase 2 registration-directed trial of ziftomenib in R/R NPM1-m AML (KOMET-001). The Company is also conducting a series of clinical trials to evaluate ziftomenib in combination with current standards of care in newly diagnosed and R/R NPM1-m and KMT2A-r AML. Kura is evaluating KO-2806, a next-generation FTI, in a Phase 1 dose-escalation trial as a monotherapy and in combination with targeted therapies (FIT-001). Tipifarnib, a potent and selective FTI, is currently in a Phase 1/2 trial in combination with alpelisib for patients with PIK3CA-dependent HNSCC (KURRENT-HN). For additional information, please visit Kura’s website at www.kuraoncology.com and follow us on X and LinkedIn.

Forward-Looking Statements

This news release contains certain forward-looking statements that involve risks and uncertainties that could cause actual results to be materially different from historical results or from any future results expressed or implied by such forward-looking statements. Such forward-looking statements include statements regarding, among other things, the efficacy, safety and therapeutic potential of Kura’s product candidates, ziftomenib, KO-2806 and tipifarnib, progress and expected timing of Kura’s drug development programs and clinical trials and submission of regulatory filings, the presentation of data from clinical trials, plans regarding regulatory filings and future clinical trials, the strength of Kura’s balance sheet and the sufficiency of cash, cash equivalents and short-term investments to fund its current operating plan into 2027. Factors that may cause actual results to differ materially include the risk that compounds that appeared promising in early research or clinical trials do not demonstrate safety and/or efficacy in later preclinical studies or clinical trials, the risk that Kura may not obtain approval to market its product candidates, uncertainties associated with performing clinical trials, regulatory filings, applications and other interactions with regulatory bodies, risks associated with reliance on third parties to successfully conduct clinical trials, the risks associated with reliance on outside financing to meet capital requirements, and other risks associated with the process of discovering, developing and commercializing drugs that are safe and effective for use as human therapeutics, and in the endeavor of building a business around such drugs. You are urged to consider statements that include the words “may,” “will,” “would,” “could,” “should,” “believes,” “estimates,” “projects,” “promise,” “potential,” “expects,” “plans,” “anticipates,” “intends,” “continues,” “designed,” “goal,” or the negative of those words or other comparable words to be uncertain and forward-looking. For a further list and description of the risks and uncertainties the Company faces, please refer to the Company's periodic and other filings with the Securities and Exchange Commission, which are available at www.sec.gov. Such forward-looking statements are current only as of the date they are made, and Kura assumes no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KURA ONCOLOGY, INC. |

|

Statements of Operations Data |

|

(unaudited) |

|

(in thousands, except per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

41,705 |

|

|

$ |

29,328 |

|

|

$ |

117,700 |

|

|

$ |

82,702 |

|

General and administrative |

|

|

18,179 |

|

|

|

13,145 |

|

|

|

53,040 |

|

|

|

36,340 |

|

Total operating expenses |

|

|

59,884 |

|

|

|

42,473 |

|

|

|

170,740 |

|

|

|

119,042 |

|

Other income, net |

|

|

5,480 |

|

|

|

3,871 |

|

|

|

15,974 |

|

|

|

9,197 |

|

Net loss |

|

$ |

(54,404 |

) |

|

$ |

(38,602 |

) |

|

$ |

(154,766 |

) |

|

$ |

(109,845 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.63 |

) |

|

$ |

(0.50 |

) |

|

$ |

(1.80 |

) |

|

$ |

(1.53 |

) |

Weighted average number of shares used in computing net loss per share, basic and diluted |

|

|

86,950 |

|

|

|

77,241 |

|

|

|

85,834 |

|

|

|

71,845 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

KURA ONCOLOGY, INC. |

|

Balance Sheet Data |

|

(unaudited) |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash, cash equivalents and short-term investments |

|

$ |

455,297 |

|

|

$ |

423,957 |

|

Working capital |

|

|

422,817 |

|

|

|

397,218 |

|

Total assets |

|

|

478,837 |

|

|

|

448,935 |

|

Long-term liabilities |

|

|

14,694 |

|

|

|

16,399 |

|

Accumulated deficit |

|

|

(876,205 |

) |

|

|

(721,439 |

) |

Stockholders’ equity |

|

|

423,771 |

|

|

|

397,273 |

|

Contacts

Investors:

Pete De Spain

Executive Vice President, Investor Relations & Corporate Communications

(858) 500-8833

pete@kuraoncology.com

Media:

Cassidy McClain

Vice President

Inizio Evoke Comms

(619) 849-6009

cassidy.mcclain@inizioevoke.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

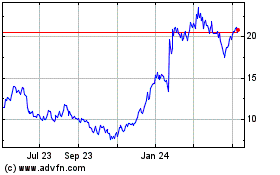

Kura Oncology (NASDAQ:KURA)

Historical Stock Chart

From Nov 2024 to Dec 2024

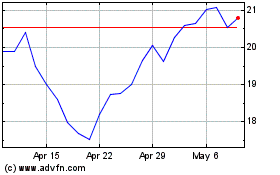

Kura Oncology (NASDAQ:KURA)

Historical Stock Chart

From Dec 2023 to Dec 2024