false000170533800017053382023-10-202023-10-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 20, 2023

Spark Networks SE

(Exact name of registrant as specified in its charter)

|

Germany

|

|

001-38252

|

|

00-0000000

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

KOHLFURTER STRASSE 41/43

BERLIN, Germany 10999

(Address of principal executive offices, including zip code)

(+49) 30-868000

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: None

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act

of 1934 (§240.12b-2 of this chapter):

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Amended and Restated Forbearance Agreement and Collateral Agent Advance Agreement

As previously disclosed, on March 11, 2022, the Company entered into a Financing Agreement (the “Financing Agreement”) with Zoosk, Inc. (“Zoosk”) and Spark Networks,

Inc., the subsidiary guarantors party thereto, the lenders party thereto, and MGG Investment Group LP (“MGG”), as administrative agent and collateral agent, providing for senior secured term loans in the aggregate principal amount of $100 million.

On August 5, 2022, the Company entered into Amendment No.1 to Financing Agreement, which revised certain financial covenants related to the testing of the Company’s quarterly leverage ratio and the Company’s minimum market spend. On March 29, 2023,

the Company entered into Amendment No. 2 to Financing Agreement and Forbearance Agreement (the “Forbearance Agreement”) which granted forbearance until May 15, 2023 with respect to the Company’s receipt of a going concern opinion on the condition

that the Company retain a financial advisor, and amended the definition of Adjusted EBITDA in the Financing Agreement.

On May 15, 2023, the Company entered into Amendment No. 1 to Forbearance Agreement which extended the forbearance termination date to May 25, 2023 and added to the

forbearance the Company’s failure to deliver to the collateral agent a control agreement.

On May 25, 2023, the Company entered into Amendment No. 2 to Forbearance Agreement (the “Second Amendment”) which extended the forbearance period termination date to June

15, 2023 and removed from the forbearance the Company’s failure to deliver to the collateral agent a control agreement (as moot). No other changes were made to the Financing Agreement.

On June 15, 2023, the Company entered into Amendment No. 3 to Forbearance Agreement (the “Third Amendment”) which extended the forbearance period termination date to July

14, 2023, conditioned on (i) by June 19, 2023, the delivery to MGG of an engagement letter appointing Adrian Frankum of Ankura Consulting Group, LLC (“Ankura”) as special project officer, (ii) by June 30, 2023, the Company causing its financial

advisor to deliver to MGG a bottoms-up, step-by-step operational performance improvement plan with a fully integrated financial model, including restructuring options and future capital and liquidity requirements of the Company (the “Transition

Plan”), (iii) by July 7, 2023, approval by the Company’s board of directors of the Transition Plan, and (iv) by July 7, 2023, the Company engaging an auditor to provide an IDW-S6 opinion.

On July 14, 2023, the Company entered into Amendment No. 4 to Forbearance Agreement (the “Fourth Amendment”) which extended the forbearance period termination date to

July 21, 2023.

On July 21, 2023, the Company entered into Amendment No. 5 to Forbearance Agreement (the “Fifth Amendment”) which extended the forbearance period termination date to July

28, 2023 and added to the forbearance the Company’s failure to meet minimum marketing spend requirements over a twelve month period.

On July 28, 2023, the Company entered into Amendment No. 6 to Forbearance Agreement (the “Sixth Amendment”) which extended the forbearance period termination date to

August 4, 2023.

On August 4, 2023, the Company entered into Amendment No. 7 to Forbearance Agreement (the “Seventh Amendment”) which extended the forbearance period termination date to

August 11, 2023 and added to the forbearance the Company’s failure to maintain minimum liquidity.

On August 11, 2023, the Company entered into Amendment No. 8 to Forbearance Agreement (the “Eighth Amendment”) which extended the forbearance period termination date to

September 1, 2023.

On September 1, 2023, the Company entered into Amendment No. 9 to Forbearance Agreement (the “Ninth Amendment”) which extended the forbearance period termination date to

September 8, 2023 and added additional forbearances relating to the minimum liquidity ratio and minimum leverage ratio.

On September 8, 2023, the Company entered into Amendment No. 10 to Forbearance Agreement (the “Tenth Amendment”), which extended the forbearance period termination date

to September 15, 2023.

On September 15, 2023, the Company entered into Amendment No. 11 to Forbearance Agreement (the “Eleventh Amendment”), which extended the forbearance period termination

date to September 22, 2023.

On September 22, 2023, the Company entered into Amendment No. 12 to Forbearance Agreement (the “Twelfth Amendment”), which extended the forbearance period termination

date to September 29, 2023.

On September 29, 2023, the Company entered into Amendment No. 13 to Forbearance Agreement (the “Thirteenth Amendment”), which extended the forbearance period termination

date to October 6, 2023.

On October 6, 2023, the Company entered into the Amended and Restated Forbearance Agreement and Collateral Agent Advance Agreement (the “Agreement”), which confirmed that

certain events of default have occurred and were continuing under the Financing Agreement and extended the forbearance period termination date to December 8, 2023 or earlier if certain termination events are triggered in connection with the

restructuring proceeding (the “StaRUG Proceeding”) in the Local Court Charlottenburg, Berlin, Germany - Restructuring Court. In addition, pursuant to the Agreement, MGG will provide certain Collateral Agent Advances (as defined therein) to the

Company as working capital in order to consummate the Restructuring Plan pursuant to the StaRUG Proceeding.

On October 20, 2023, the Company entered into Amendment No. 1 to the Amended and Restated Forbearance Agreement and Collateral Agent Advance Agreement (“Amendment No.

1”), which extends the period for which certain milestones related to the Restructuring Plan for the StaRUG Proceeding must be completed.

The foregoing description of Amendment No. 1 does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendment No. 1, a

copy of which is filed hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

Dated: October 25, 2023

|

By:

|

/s/ Frederic Beckley

|

|

|

|

Frederic Beckley

|

|

|

|

General Counsel & Chief Administrative Officer

|

Exhibit 99.1

EXECUTION VERSION

MGG INVESTMENT GROUP LP

One Penn Plaza, 53rd Floor

New York, New York 10119

October 20, 2023

Spark Networks, Inc.

3731 W South Jordan Pkwy

Ste 102-405

South Jordan, UT 84009

Attention: Colleen Brown

Email: birdnowbrown@gmail.com

Re: Amendment No. 1 to Amended and Restated

Forbearance Agreement and Collateral Agent Advance Agreement

Ladies and Gentlemen:

Reference is hereby made to (a) that certain Financing Agreement, dated as of March 11, 2022, as amended by

that certain Amended and Restated Amendment No. 1 to Financing Agreement, dated as of August 19, 2022, as further amended by that certain Amendment No. 2 to Financing Agreement and Forbearance Agreement, dated March 29, 2023, as further amended by that

certain Amendment No. 3 to Forbearance Agreement and Financing Agreement, dated as of June 15, 2023, as further amended by that certain Amendment No. 8 to Forbearance Agreement and Amendment No. 4 to Financing Agreement, dated as of August 11, 2023, as

further amended by that certain Amendment No. 9 to Forbearance Agreement and Amendment No. 5 to Financing Agreement, dated as of September 1, 2023 (as further amended, restated, amended and restated, supplemented, replaced or otherwise modified from

time to time, the “Financing Agreement”), by and among Spark Networks SE, a Societas Europaea (Europiiische Gesellschaft) with registered seat in Munich, Federal Republic of Germany, registered with the commercial register (Handelsregister) of

the local court (Amtsgericht) of Munich, Federal Republic of Germany under HRB 232591 (the “Parent”),

Spark Networks, Inc., a Delaware corporation (“Spark Networks”), Zoosk, Inc., a Delaware corporation (“Zoosk”,

and together with the Parent, Spark Networks, and each other Person that executes a joinder agreement and becomes a “Borrower” thereunder, each, a “Borrower” and,

collectively, the “Borrowers”), each subsidiary of the Parent listed as a “Guarantor” on the

signature pages thereto (together with each other Person that executes a joinder agreement and becomes a “Guarantor” thereunder, each, a “Guarantor” and, collectively, the “Guarantors”), the lenders from time to time party thereto (each, a “Lender” and, collectively, the “Lenders”), MGG Investment Group LP, a Delaware limited partnership (“MGG”), as collateral agent for the Lenders (in such capacity, together with its successors and permitted

assigns in such capacity, the “Collateral Agent”), and MGG, as administrative agent for the Lenders (in such capacity, together with its successors and permitted assigns in

such capacity, the “Administrative Agent” and, together with the Collateral Agent, each, an “Agent” and, collectively, the “Agents”) and (b) that certain Amended and Restated Forbearance

Agreement and Collateral Agent Advance

Agreement, dated October 6, 2023 (the “A&R Forbearance Agreement”). Any

and all capitalized terms used in this letter agreement (this “Amendment”) which are defined in the Financing Agreement or the A&R Forbearance Agreement and which are not

otherwise defined in this Amendment shall have the same meaning in the Financing Agreement and A&R Forbearance Agreement, as applicable.

1. The parties hereto hereby amend and restate Section 5 of the A&R Forbearance Agreement in its entirety to read as follows:

“5. Agreements. The Loan Parties hereby covenant and agree, in

consideration of the Forbearance granted hereunder, as follows:

(a) As soon as possible and by no later than October 25, 2023 (or such later date as agreed to in writing by the Agents in their sole discretion), the Loan Parties shall have completed the drafting

of the Restructuring Plan for the StaRUG Proceeding, which Restructuring Plan shall be in form and substance satisfactory to the Agents.

(b) As soon as possible and by no later than November 3, 2023 (or such later date as agreed to in writing by the Agents in their sole discretion), the Loan Parties shall have filed a motion to the

Restructuring Court to schedule a meeting to discuss and vote on the Restructuring Plan (Erliiuterungs- and Abstimmungstermin — “Discussion and Voting Meeting”) pursuant to section 45 StaRUG.

(c) As soon as possible and by no later than November 6, 2023 (or such later date as agreed to in writing by the Agents in their sole discretion), the Loan Parties shall have distributed the notice

for the Discussion and Voting Meeting to the parties affected by the Restructuring Plan (Planbetroffenen).

(d) As soon as possible and by no later than December 12, 2023 (or such later date as agreed to in writing by the Agents in their sole discretion), the parties affected by the Restructuring Plan (Planbetroffenen) shall have held the Discussion and Voting Meeting and shall have voted on the Restructuring Plan for the StaRUG Proceeding.

(e) As soon as possible and by no later than December 19, 2023 (or such later date as agreed to in writing by the Agents in their sole discretion), the Restructuring Court shall have approved the

Restructuring Plan and such Restructuring Plan shall be consummated pursuant to the StaRUG Proceeding.”

2. The parties hereto hereby amend clause (a) of Section 6 of the A&R Forbearance Agreement by deleting “December 8, 2023” and replacing it with “December 19, 2023”.

3. Conditions to Effectiveness. This Amendment shall become effective only upon satisfaction in full of the following

conditions precedent, unless waived in writing by the Agents (the first date upon which all such conditions have been satisfied or waived, as the case may be, by the Agents being herein called the “Amendment Effective Date”):

(a) The Agents and the Lenders shall have executed this Amendment and received counterparts to this Amendment which bear the signatures of each of the Loan Parties.

4. Forbearance Agreement. Except as otherwise expressly provided herein, (i) the A&R Forbearance Agreement is, and

shall continue to be, in full force and effect and is hereby ratified and confirmed in all respects, except that on and after the date hereof (A) all references in the A&R Forbearance Agreement to “this Forbearance Agreement “, “hereto”,

“hereof’, “hereunder” or words of like import referring to the A&R Forbearance Agreement shall mean the A&R Forbearance Agreement as amended and modified by this Amendment, and (B) all references in the Financing Agreement or any other Loan

Document to the “Forbearance Agreement “, “thereto”, “thereof’, “thereunder” or words of like import referring to the A&R Forbearance Agreement shall mean the A&R Forbearance Agreement as amended and modified by this amendment. This Amendment

shall be effective only in the specific instances and for the specific purposes set forth herein and does not allow for any other or further departure from the terms and conditions of the A&R Forbearance Agreement or the Financing Agreement which

terms and conditions shall remain in full force and effect.

5. Release. Each Loan Party hereby acknowledges and agrees that: (a) neither it nor any of its Affiliates has any claim

or cause of action against, the Agents or any Lender (or any of their respective Affiliates, officers, directors, employees, attorneys, consultants or agents) and (b) the Agents and each Lender has heretofore properly performed and satisfied in a

timely manner all of its obligations to the Loan Parties and their Affiliates under the Financing Agreement and the other Loan Documents. Notwithstanding the foregoing, the Agents and the Lenders desire (and the Loan Parties agree) to eliminate any

possibility that any past conditions, acts, omissions, events or circumstances would impair or otherwise adversely affect any of the Agents’ and the Lenders’ rights, interests, security and/or remedies under the Financing Agreement and the other Loan

Documents. Accordingly, for and in consideration of the agreements contained in this Amendment and A&R Forbearance Agreement and other good and valuable consideration, each Loan Party (for itself and its Affiliates and the successors, assigns,

heirs and representatives of each of the foregoing) (collectively, the “Releasors”) does hereby fully, finally, unconditionally and irrevocably release and forever discharge

each Agent, each Lender and each of their respective Affiliates, officers, directors, employees, attorneys, consultants and agents (collectively, the “Released Parties”)

from any and all debts, claims, obligations, damages, costs, attorneys’ fees, suits, demands, liabilities, actions, proceedings and causes of action, in each case, whether known or unknown, contingent or fixed, direct or indirect, and of whatever

nature or description, and whether in law or in equity, under contract, tort, statute or otherwise, which any Releasor has heretofore had or now or hereafter can, shall or may have against any Released Party by reason of any act, omission or thing

whatsoever done or omitted to be done on or prior to the Amendment Effective Date arising out of, connected with or related in any way to this Amendment and A&R Forbearance Agreement, the Financing Agreement or any other Loan Document, or any

act, event or transaction related or attendant thereto, or the agreements of the Agents or any Lender contained therein, or the possession, use, operation or control of any of the assets of any Loan Party, or the making of any Loans, or the

management of such Loans or the Collateral on or prior to the Amendment Effective Date.

6. Affirmation of Obligations. Each of the Loan Parties hereby acknowledges, agrees and affirms (a) its Obligations

under the Financing Agreement and the other Loan Documents, including, without limitation, its guaranty obligations thereunder, (b) that such guaranty shall apply to the Obligations in accordance with the terms thereof, (c) the grant of the security

interest in all of its assets pursuant to the Loan Documents and (d) that such liens and security interests created and granted are valid and continuing and secure the Obligations in accordance with the terms thereof (subject to Permitted Liens).

Except as modified by this Amendment, each Loan Party acknowledges, ratifies, reaffirms, and agrees that each of the Loan Documents and the perfected liens and security interests created thereby in favor of the Agents for the benefit of the Lenders

in the Collateral are, and will remain, in full force and effect and binding on all of the Loan Parties and are hereby ratified and confirmed in all respects. Each Loan Party acknowledges, ratifies and reaffirms all of the terms and provisions of the

Loan Documents (including, without limitation, the Financing Agreement), except as modified herein, which are incorporated by reference as of the Amendment Effective Date as if set forth herein including, without limitation, all promises, agreements,

warranties, representations, covenants, releases and indemnifications contained therein.

7. Outstanding Indebtedness. Each of the Loan Parties hereby acknowledges and agrees that as of October 20, 2023, the

aggregate outstanding principal amount of the Loans is $102,624,000.94 and the aggregate outstanding principal amount of the Collateral Agent Advances is $3,000,000 and that such principal amounts are payable pursuant to the Financing Agreement

without defense, offset, withholding, counterclaim or deduction of any kind. The foregoing amount does not include interest, other fees, expenses and other amounts that are chargeable or otherwise reimbursable under the Financing Agreement and the

other Loan Documents.

8. No Waiver. Except as expressly set forth herein, the terms and conditions of the Financing Agreement and the other

Loan Documents shall remain in full force and effect. Nothing in this Amendment and A&R Forbearance Agreement shall be deemed to be or construed as a waiver of any Existing Event of Default or any Event of Default that may occur because of any

Specified Event or of any right, remedy or claim of the Agents or the Lenders with respect thereto, and the Agents and the Lenders specifically reserve the right to exercise any such right, remedy or claim based upon any Event of Default now existing

or hereafter arising (except to the extent set forth herein in the case of Existing Events of Default or Events of Default that may occur because of any Specified Event).

9. Amendment as Loan Document; Enforcement. The Loan Parties, the Administrative Agent and the Lenders hereby

acknowledge and agree that this Amendment constitutes a “Loan Document” under the Financing Agreement. Accordingly, it shall be an Event of Default under the Financing Agreement if (i) any representation or warranty made by the Loan Parties under or

in connection with this Amendment shall have been untrue, false or misleading in any material respect when made, or (ii) the Loan Parties shall fail to perform or observe any term, covenant or agreement contained in this Amendment. Nothing contained

in this Amendment shall prejudice or otherwise affect the Lender’s rights to enforce the provisions contained herein upon the default by any Loan Party in the performance thereof.

10. Headings. Section headings used herein are for the convenience of the parties only and shall not constitute a part

of this Amendment for any other purpose.

11. Amendments; Extensions. The terms of this Amendment may be modified, waived, or amended and the Forbearance Period

may be extended only by a writing executed by all of the parties hereto.

12. Entire Agreement; Continuing Effect. This Amendment constitutes the entire understanding among the parties hereto as

to the subject matter hereof and supersedes any and all prior agreements or understandings concerning the Forbearance by the Administrative Agent or any of the Lenders in exercising any of their rights against the Loan Parties or their properties.

Except as expressly provided herein, the Loan Documents shall continue unchanged and in full force and effect, and all rights, powers and remedies of the Agents and the Lenders thereunder are expressly reserved and unaltered.

13. Expenses. The Borrowers hereby agree to pay all expenses incurred by the Agents and each of the Lenders in

connection with the matters relating to the negotiation, preparation and execution of this Amendment, and the modification or enforcement of any of the terms hereof, including, without limitation, the reasonable fees and disbursements of counsel to

the Agents and each of the Lenders.

14. Governing Law; Waiver of Jury Trial.

(a) This Amendment shall be governed by, construed under and enforced in accordance with the laws of the State of New York, without regard to choice of law principals.

(b) The Loan Parties, the Agents and the Lenders each hereby irrevocably waive all right to trial by jury in any action, proceeding or counterclaim (whether based on contract, tort or otherwise)

arising out of or relating to this Amendment or the actions of the Agents or the Lenders in the negotiation, administration, performance or enforcement hereof.

15. Arms-Length/Good Faith. This Amendment has been negotiated at arms-length and in good faith by the parties hereto.

16. Review and Construction of Documents. Each Loan Party hereby acknowledges, and represents and warrants to the Agents

and the Lenders, that:

(a) such Loan Party has had the opportunity to consult with legal counsel of their own choice and have been afforded an opportunity to review this Amendment with their legal counsel;

(b) such Loan Party has carefully reviewed this Amendment and fully understand all terms and provisions of this Amendment;

(c) such Loan Party has freely, voluntarily, knowingly and intelligently entered into this Amendment of their own free will and volition;

(d) none of the Agents or the Lenders has a fiduciary relationship with any Borrower or any Loan Party, and the relationship between the Agents and the Lenders, on the one hand, and the Loan

Parties, on the other hand, is solely that of creditor and debtor; and

(e) no joint venture exists among the Loan Parties, the Agents and the Lenders.

17. Counterparts. This Amendment may be signed in counterparts by the parties hereto, each of which, when so executed,

shall be deemed an original, but all such counterparts shall constitute one and the same agreement. Delivery of an executed counterpart of this Amendment by telecopier or electronic mail shall be equally effective as delivery of an original executed

counterpart of this Amendment.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be executed and delivered as of the date first above written.

| |

BORROWERS:

|

| |

|

|

|

| |

SPARK NETWORKS SE

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

SPARK NETWORKS, INC.

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

ZOOSK, INC.

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

|

|

|

| |

Email address for notice purposes,

effective with respect to the

Borrowers: birdnowbrown@gmail.com

|

Amendment No. 1 to A&R Forbearance Agreement

| |

GUARANTORS:

|

| |

|

| |

SPARK NETWORKS SERVICES GMBH

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

SPARK NETWORKS USA, LLC

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

SMOOCH LABS INC.

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

|

|

|

| |

MINGLEMATCH, INC.

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

SPARK NETWORKS LIMITED

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

LOV USA, LLC

|

| |

|

|

|

| |

By:

|

/s/ Kristie Goodgion

|

| |

|

Name:

|

Kristie Goodgion

|

| |

|

Title:

|

Chief Financial Officer

|

| |

|

|

|

| |

|

|

|

| |

Email address for notice purposes,

|

| |

effective with respect to the

|

| |

Guarantors: birdnowbrown@gmail.com

|

Amendment No. 1 to A&R Forbearance Agreement

| |

MGG INVESTMENT GROUP LP,

|

| |

as the Administrative Agent and the Collateral

Agent

|

| |

|

|

| |

By: MGG GP LLC, its general partner

|

| |

|

|

| |

By:

|

/s/ Kevin F. Griffin

|

| |

Name:

|

Kevin F. Griffin

|

| |

Title:

|

Chief Executive Officer

|

| |

|

|

| |

Email address for notice purposes:

|

| |

creditagreementnotices@mgginv.com

|

Amendment No. 1 to A&R Forbearance Agreement

| |

LENDERS:

|

| |

|

| |

MGG SPECIALTY FINANCE FUND II LP

|

| |

MGG SF EVERGREEN FUND LP

|

| |

MGG SF EVERGREEN UNLEVERED FUND LP

|

| |

MGG INSURANCE FUND SERIES INTERESTS

|

| |

OF THE SALI MULTI-SERIES FUND, LP

|

| |

MGG SF EVERGREEN MASTER FUND

|

| |

(CAYMAN) LP

|

| |

MGG SF EVERGREEN UNLEVERED MASTER

|

| |

FUND II (CAYMAN) LP

|

| |

MGG CANADA FUND LP

|

| |

MGG ONSHORE FUNDING II LLC

|

| |

MGG SF DRAWDOWN UNLEVERED FUND II

|

| |

(LUXEMBOURG) SCSp

|

| |

MGG SF DRAWDOWN UNLEVERED FUND III

|

| |

(LUXEMBOURG) SCSp

|

| |

MGG OFFSHORE FUNDING I LLC

|

| |

MGG SF EVERGREEN UNLEVERED FUND 2020 LP

|

| |

MGG SF DRAWDOWN UNLEVERED FUND III LP

|

| |

MGG SF DRAWDOWN UNLEVERED MASTER

|

| |

FUND III (CAYMAN) LP

|

| |

|

| |

By: MGG Investment Group LP, on behalf of each of

|

| |

the above, as Authorized Signatory

|

| |

|

| |

By:

|

/s/ Kevin Griffin

|

| |

|

Name:

|

Kevin Griffin |

| |

|

Title:

|

Chief Executive Officer |

| |

|

| |

Email address for notice purposes:

|

| |

creditagreementnotices@mgginv.com

|

Amendment No. 1 to A&R Forbearance Agreement

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

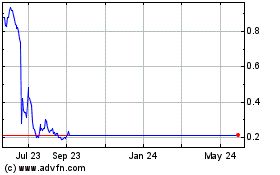

Spark Networks (NASDAQ:LOV)

Historical Stock Chart

From Apr 2024 to May 2024

Spark Networks (NASDAQ:LOV)

Historical Stock Chart

From May 2023 to May 2024