New and Used Vehicle Markets Stabilizing, According to Open Lending Analysis

15 November 2024 - 9:00AM

Business Wire

Automotive lending enablement provider releases

data on national and regional vehicle registrations in the near-

and non-prime market for Q2 2024

Open Lending Corporation (NASDAQ: LPRO) (“Open Lending” or the

“Company”), an industry trailblazer in automotive lending

enablement and risk analytics solutions for financial institutions,

just released a new Near- and Non-Prime Consumer Brief, the latest

installment in its quarterly series of data reports on vehicle

registrations. The report found that, despite continued challenges

in the vehicle market, new vehicle registrations have risen and

used vehicle registrations have stabilized in the past year, though

supply remains below pre-Covid levels. Limited used vehicle

inventory and high interest rates continue to impact buyers,

creating pent-up demand among near- and non-prime consumers.

Using AutoCreditInsightTM data from Q2 2024, the report offers

insight into the opportunity for auto lenders to serve near- and

non-prime consumers, a vital audience segment for financial

institutions seeking member growth and greater yields in their auto

lending portfolio. Key findings include:

- The near- and non-prime new vehicle market is improving,

while the used vehicle market continues to stabilize. In Q2,

new vehicle registrations among near- and non-prime consumers rose

by 1% year-over-year and 7% compared to Q1. Used vehicle

registrations dropped to 95% of last year’s level and fell 5% from

Q1, reflecting ongoing supply and pricing challenges.

- New vehicle payments are rising where used vehicle payments

are starting to fall. The average monthly payment for new

vehicle loans increased $10 year-over-year in the second quarter of

2024, compared to a $10 decrease for used vehicle monthly payments

during the same period.

- Compact utility vehicles continue to be the top choice for

near- and non-prime borrowers, but other segments are gaining

popularity. Subcompact utility plus vehicles accounted for 13%

of new vehicles purchased by near- and non-prime consumers in Q2,

compared to just 5% in Q2 2020. Meanwhile, fewer borrowers

purchased new, full-size half-ton pick-up trucks, indicating a

shift towards more affordable and fuel-efficient vehicles.

“While the automotive market continues to show signs of

recovery, the cost of a vehicle is still a strain for many near-

and non-prime credit buyers who rely on used vehicle inventory,

which continues to sit below pre-Covid levels. But pent-up demand

now could mean better used vehicle options in 2025, as decreasing

interest rates prompt buyers to sell or trade in their current

vehicles,” said Kevin Filan, SVP of marketing at Open Lending. “For

automotive lenders, these shifting dynamics signal an opportunity

to forge new borrower relationships and help near- and non-prime

consumers access the vehicles they need. With Lending Enablement

Solutions like our Lenders Protection™, lenders can engage

responsibly with these consumers, helping them achieve car

ownership in a market that hasn’t fully adapted to their

needs."

Read the full report here.

Learn more at openlending.com.

About Open Lending

Open Lending (NASDAQ: LPRO) provides loan analytics, risk-based

pricing, risk modeling, and default insurance to auto lenders

throughout the United States. For over 20 years, we have been

empowering financial institutions to create profitable auto loan

portfolios with less risk and more reward. For more information,

please visit www.openlending.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114643585/en/

Media Inquiries press@openlending.com Investor

Relations Inquiries InvestorRelations@openlending.com

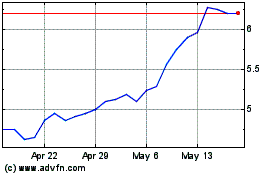

Open Lending (NASDAQ:LPRO)

Historical Stock Chart

From Jan 2025 to Feb 2025

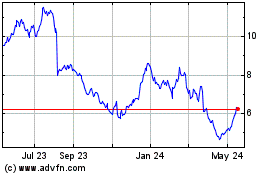

Open Lending (NASDAQ:LPRO)

Historical Stock Chart

From Feb 2024 to Feb 2025