false

2023-11-28

0001041514

Lesaka Technologies, Inc.

0001041514

2023-11-28

2023-11-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 28, 2023

LESAKA TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

|

Florida

|

000-31203

|

98-0171860

|

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

President Place, 4th Floor, Cnr.

Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

(Address of principal executive offices) (ZIP Code)

Registrant’s telephone number, including area code: 011-27-11-343-2000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbols |

|

Name of each exchange on which registered |

|

Common Shares

|

|

LSAK

|

|

NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b -2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) Resignation of Mr. Chris Meyer as Group Chief Executive Officer

On November 28, 2023, Lesaka Technologies, Inc. (the "Company") Group Chief Executive Officer, Mr. Chris Meyer, informed the Company's Board of Directors ("Board) of his intention to resign from his position as Group Chief Executive Officer of the Company effective as of February 29, 2024. Mr. Meyer will continue to serve on the Board until the Company's next annual meeting of shareholders. He will receive a fee of $124,000 per annum for his services as director from March 1, 2024, which will be paid quarterly based on his period of service to the Board. The Board and Mr. Meyer also agreed that he would provide consulting services from March 1, 2024, and Mr. Meyer will receive a monthly consulting fee of $11,333 per month for these services.

On December 4, 2023, and pursuant to Mr. Meyer's resignation, the Board agreed to remove the on-going employment condition in Mr. Meyer's existing restricted stock award agreements, however, these awards are eligible to continue to vest in accordance with the vesting terms included in the existing restricted stock award agreements, which in certain instances include specific performance conditions.

(c) Appointment of Ali Mazanderani as Executive Chairman

On December 4, 2023, the Company announced that, effective February 1, 2024, Mr. Ali Mazanderani will be appointed Executive Chairman and that Mr. Kuben Pillay will step down as Chairman of the Board and will be appointed the Company's Lead Independent Director. Messrs. Mazanderani and Pillay currently serve on the Board for a term that will expire at the Company's next annual meeting of shareholders.

(e) Approval of Employment Agreement and Option Grants for Mr. Mazanderani

Mr. Mazanderani and the Company entered into an employment agreement for his services as Executive Chairman , which will become effective on February 1, 2024. The Company and Mr. Mazanderani acknowledge that Mr. Mazanderani's commitment shall only be for fifty percent (50%) of full-time equivalence, as reasonably determined by the Board and that he will be subject to certain restrictive covenants and compliance with Company policies. Mr. Mazanderani will receive an annual base salary of $500,000, and the Company has agreed to reimburse certain business travel up to an amount of $100,000 per 12-month period from February 1, 2024, such amount to be pro-rated. Mr. Mazanderani will no longer receive fees for his services as a director from February 1, 2024.

Mr. Mazanderani will not be eligible for a short-term cash incentive award, or any other bonus program implemented by the Company, during the term of his employment agreement. The employment agreement does not provide for any severance benefits. Either party must provide the other party three months advance notice prior to terminating the employment agreement prior to January 31, 2028 in the absence of cause or a material breach.

On December 4, 2023, the Board approved and the Company granted Mr. Mazandarani an option to purchase 500,000 shares of the Company's common stock under the Company's Amended and Restated 2022 Stock Incentive Plan at an exercise price of $3.50 per share, the opening price of the Company's common stock on the grant date. This option will vest on the first anniversary of the grant date, provided that Mr. Mazandarani then continues to provide services as Executive Chair and subject to Mr. Mazanderani's continuous service on the Board through February 1, 2024. These options will vest immediately if Mr. Mazanderani's employment is terminated by the Company without cause on or before the first anniversary of the grant date. These 500,000 stock options may only be exercised during a period commencing from January 31, 2028 to January 31, 2029.

Subject to approval by the Company's shareholders at a shareholders' meeting by no later than June 30, 2024, Mr. Mazanderani will also be awarded the follow options to purchase shares of the Company's common stock:

- 1,000,000 stock options at an exercise price of $6.00 per share;

- 1,000,000 stock options at an exercise price of $8.00 per share;

- 1,000,000 stock options at an exercise price of $11.00 per share;

- 1,000,000 stock options at an exercise price of $14.00 per share.

These four million stock options may only be exercised during a period commencing from January 31, 2028 to January 31, 2029. Vesting of these stock options is subject to Mr. Mazanderani's continuous employment as Executive Chair through January 31, 2026.

The foregoing description of the agreements with Mr. Mazanderani does not purport to be complete and is qualified in its entirety by reference to the full text of such agreements, which are attached hereto as Exhibits 10.01 - 10.02 and are incorporated by reference herein.

Item 7.01. Regulation FD Disclosure.

On December 4, 2023, the Company issued a press release announcing the resignation of Mr. Meyer as well as the appointment of Mr. Mazanderani as described in Item 5.02 above. A copy of the Company's press release is attached hereto as Exhibit 99.1.

The information furnished herewith pursuant to Item 7.01 of this current report shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01 Other Events

Mr. Kuben Pillay will step down as Chairman of the Board and will be appointed the Company's Lead Independent Director. Mr. Pillay currently serve on the Board for a term that will expire at the Company's next annual meeting of shareholders.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

LESAKA TECHNOLOGIES, INC. |

| |

|

|

| Date: December 4, 2023 |

By: |

/s/ Naeem E. Kola |

| |

Name: |

Naeem E. Kola |

| |

Title: |

Group Chief Financial Officer |

Exhibit 10.1

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT (this "Agreement") is made this 4th day of December, 2023 by and among Lesaka Technologies, Inc., a Florida corporation ("Company") and Ali Mazanderani ("Mazanderani"). Each of the Company and Mazanderani is a "Party" and, collectively, they are the "Parties."

WHEREAS, the Company desires to employ Mazanderani as its Executive Chairman and Mazanderani desires to be so employed in accordance with the terms and conditions set forth herein.

NOW, THEREFORE, in consideration of the foregoing and the mutual covenants and promises in this Agreement, the Parties agree as follows:

1. Employment. Mazanderani will be employed as the Company's Executive Chairman and Mazanderani hereby agrees to accept such employment and agrees to serve as the Company's Executive Chairman, all in accordance with the terms and conditions of this Agreement. The period of Mazanderani's employment under this Agreement shall commence on February 1, 2024 ("Commencement Date") and shall terminate on January, 31, 2028 (unless terminated earlier in accordance with this Agreement) (such period of employment, the "Employment Period"). The Parties acknowledge that Mazanderani's commitment shall only be for fifty percent (50%) of full-time equivalence, as reasonably determined by the Company's Board of Directors (the "Board"), during the Employment Period. In this Agreement, the Company and its subsidiaries are collectively referred to as the "Group." It is the Company's understanding that there is not any other agreement with a prior employer that would restrict Mazanderani in continuing to perform the duties of Mazanderani's position with the Company and Mazanderani represents that such is the case.

2. Position and Responsibilities. During the Employment Period, Mazanderani shall report to the Board and shall have the duties, responsibilities, functions and authority of Executive Chairman, including determining strategy, liaising with the Company's shareholders and other stakeholders and directing merger and acquisition activities and any other activities that are customary to the position of Executive Chairman. Mazanderani shall continue to serve as a member of the Board and board of directors (or similar governing body) of any other member of the Group as may be requested by the Board.

3. Location. The Parties agree that Mazanderani may work from his home office but may be required to make such business trips to visit the Company's offices as may be considered by the Board to be necessary to perform his duties and responsibilities. Mazanderani will be eligible for reimbursement of expenses incurred, directly or indirectly, with respect to business trips up to an amount of $100,000 per 12-month period from the Commencement Date, such amount to be pro-rated during each calendar year during the Employment Period and reasonably determined by the Remuneration Committee Compensation. During the employment period, the Company shall pay to Mazanderani a base salary at the rate of U.S. $500,000 per year (the "Base Salary"), less applicable tax withholding, payable in monthly instalments. Mazanderani shall not be eligible to participate in any bonus program maintained by the Company. Mazanderani shall not accrue paid time-off while providing services hereunder. As a part-time employee Mazanderani will only be eligible to participate in such Company benefit plans as the Company makes available to part-time employees, or as otherwise required by law. The Company reserves the right to cancel or change the benefit plans and programs it offers to its employees at any time.

4. Stock Incentive Plan participation. Mazanderani shall be eligible to participate in the Company's Amended and Restated 2022 Stock Incentive Plan (the "2022 Plan") or such other equity incentive plan(s) as may be implemented by the Board from time to time as determined and administered in the sole discretion of the Remuneration Committee of the Board.

5. Board Compensation. Mazanderani acknowledges that for so long as he is employed as Executive Chairman (or in any other employment position with the Company), Mazanderani will not receive any cash or equity compensation as a non-employee member of the Board but shall continue to vest in any outstanding equity awards granted to him as a non-employee director during periods of services under this Agreement. Should Mazanderani cease to serve as Executive Chairman (or any other employment position with the Company), but remain a non-employee member of the Board, he will be entitled to receive the annual cash and equity compensation payable to non-employee directors generally.

6. Expenses; Reimbursement. The Company will, in accordance with applicable Company policies and guidelines approved by the Board, reimburse Mazanderani for all reasonable and necessary expenses incurred by Mazanderani in connection with Mazanderani's performance of services on behalf of the Company. For avoidance of doubt, Mazanderani will be responsible for all costs associated with work Mazanderani will do from his home office, including without limitation, costs of telephone, electricity, acquisition of office equipment, furniture, and internet access

7. Compliance with Company Policies. Mazanderani shall comply with all written Company policies, standards, rules and regulations (a "Company Policy" or collectively, the "Company Policies") and all applicable government laws, rules and regulations that are now or hereafter in effect. Mazanderani acknowledges receipt of copies of all written Company Policies that are in effect as of the date of this Agreement.

8. Restrictive Covenants Agreement. On the date hereof, Mazanderani shall execute a restrictive covenants agreement, in the form of Exhibit A attached hereto and made a part hereof (the "Restrictive Covenants Agreement").

9. Termination This Agreement may be terminated by the Company immediately at any time and without any payment in lieu of notice if, at any time, Mazanderani is guilty of misconduct or commits a breach of a material obligation under this Agreement or is guilty of any act which at common law would entitle the Company summarily to terminate this Agreement. Mazanderani's employment may also be terminated for operational requirements or for any other reason recognized in law. Except in the event of a summary dismissal, or by agreement, either party may terminate this Agreement by giving the other 90 calendar days' prior written notice of termination. Upon termination of employment under this Agreement, Mazanderani shall resign or be removed from all positions with the Group, and Mazanderani shall execute such documents as are necessary or desirable to effectuate such resignation or removal on written request by the Company.

10. Entire Agreement. This Agreement and the Restrictive Covenant Agreement, represent the entire agreement between the parties concerning the subject matter herein and expressly supersede any prior agreements that Mazanderani may have entered into regarding Mazanderani's employment as Executive Chairman of the Company.

11. Modification and Waiver. This is the full and complete agreement between Mazanderani and the Company. This Agreement may not be modified or amended, nor may any provisions of this Agreement be waived, except by an instrument in writing signed by the Parties. Action by the Company under this Section shall only be taken by action of Board written approval. No written waiver will be deemed to be a continuing waiver unless specifically stated therein, and each such waiver will operate only as to the specific term or condition waived and shall not constitute a waiver of such term or condition for the future or as to any act other than that specifically waived.

12. Notices. Any notice, consent, waiver and other communications required or permitted pursuant to the provisions of this Agreement must be in writing and will be deemed to have been properly given (a) when delivered by hand; or (c) when sent by email , in each case to any party at the mailing address, facsimile number or email address set forth below, or, with respect to any party set forth below, at such other address, facsimile number or email address specified in writing by such party to the other parties hereto in accordance with this Section 7:

| If to the Board or the Company: |

Lesaka Technologies, Inc.

President Place, 6th Floor

Cnr. Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

Facsimile: +27118807080

Attn: Naeem E. Kola

Email: Naeem.kola@lesakatech.com |

| |

|

| If to Mazanderani: |

Ali Mazanderani

XXX

XXX |

13. Tax Treatment. Mazanderani is encouraged to obtain his own tax advice regarding the compensation and benefits provided under this Agreement. Mazanderani agrees that the Company does not have a duty to design its compensation policies in a manner that minimizes Mazanderani's tax liabilities, and Mazanderani will not make any claim against the Company or Board related to tax liabilities arising from the compensation or benefits provided by the Company or its affiliates to Mazanderani.

14. Withholding. All forms of compensation and benefits referred to in this Agreement are subject to reduction to reflect applicable withholding and payroll taxes and other deductions required by law

15. Parachute Payments. In the event that any benefits provided for in this Agreement or otherwise payable to Mazanderani by the Company or its affiliates (i) constitute "parachute payments" within the meaning of Section 280G of the Internal Revenue Code of 1986, as amended (the "Code"), and (ii) but for this Section, would be subject to the excise tax imposed by Section 4999 of the Code, then compensation or benefits under this Agreement that are contingent upon a change in control shall be payable either (i) in full, or (ii) as to such lesser amount which would result in no portion of such compensation and benefits being subject to the excise tax under Section 4999 of the Code, whichever of the foregoing amounts, taking into account the applicable federal, state and local income taxes and the excise tax imposed by Section 4999, results in the receipt by Mazanderani on an after-tax basis, of the greatest amount of compensation and benefits from the Company and its affiliates, notwithstanding that all or some portion of such compensation and benefits may be taxable under Section 4999 of the Code.

16. Section 409A. To the extent (i) any payments to which Mazanderani becomes entitled under this Agreement, or any agreement or plan referenced herein, in connection with his termination of service as Executive Chairman with the Company constitute deferred compensation subject to Section 409A of the Code and (ii) Mazanderani is deemed at the time of such termination of service as Executive Chairman to be a "specified employee: under Section 409A of the Code, then such payment or payments shall not be made or commence until the earlier of (i) the expiration of the six (6)-month period measured from the date of Mazanderani's "separation from service" (as such term is at the time defined in regulations under Section 409A of the Code) with the Company; or (ii) the date of Mazanderani's death following such separation from service; provided, however, that such deferral shall only be effected to the extent required to avoid adverse tax treatment to Mazanderani, including (without limitation) the additional twenty percent (20%) tax for which Mazanderani would otherwise be liable under Section 409A(a)(1)(B) of the Code in the absence of such deferral. Upon the expiration of the applicable deferral period, any payments which would have otherwise been made during that period (whether in a single sum or in installments) in the absence of this paragraph shall be paid to Mazanderani or his beneficiary in one lump sum (without interest).

Except as otherwise expressly provided herein, to the extent any expense reimbursement or the provision of any in-kind benefit under this Agreement (or otherwise referenced herein) is determined to be subject to (and not exempt from) Section 409A of the Code, the amount of any such expenses eligible for reimbursement, or the provision of any in-kind benefit, in one calendar year shall not affect the expenses eligible for reimbursement or in kind benefits to be provided in any other calendar year, in no event shall any expenses be reimbursed after the last day of the calendar year following the calendar year in which Mazanderani incurred such expenses, and in no event shall any right to reimbursement or the provision of any in-kind benefit be subject to liquidation or exchange for another benefit.

To the extent that any provision of this Agreement is ambiguous as to its exemption or compliance with Section 409A, the provision will be read in such a manner so that all payments hereunder are exempt from Section 409A to the maximum permissible extent, and for any payments where such construction is not tenable, that those payments comply with Section 409A to the maximum permissible extent. To the extent any payment under this Agreement may be classified as a "short-term deferral" within the meaning of Section 409A, such payment shall be deemed a short-term deferral, even if it may also qualify for an exemption from Section 409A under another provision of Section 409A. Payments pursuant to this Agreement (or referenced in this Agreement), and each installment thereof, are intended to constitute separate payments for purposes of Section 1.409A-2(b)(2) of the regulations under Section 409A of the Code. Notwithstanding anything to the contrary in this Agreement, any reference herein to a termination of Mazanderani's employment is intended to constitute a "separation from service" within the meaning of Section 409A of the Code, and Section 1.409A-1(h) of the regulations promulgated thereunder, and shall be so construed.

17. Compensation Recoupment. All amounts payable to Mazanderani hereunder shall be subject to recoupment pursuant to any compensation recoupment and forfeiture policy adopted by the Board or any committee thereof or as required by law during the term of Mazanderani's service as Executive Chairman with the Company that is applicable generally to executive officers of the Company.

18. Survival. The provisions of this Agreement shall survive the termination of Mazanderani's service as Executive Chairman for any reason to the extent necessary to enable the parties to enforce their respective rights under this Agreement.

19. Governing Law. This Agreement shall be governed by the laws of the State of New York and, to the extent applicable, U.S. federal law, and the parties agree to submit to the jurisdiction of the state and federal courts sitting in New York, New York for all disputes hereunder.

20. Counterparts. This Agreement may be executed in separate counterparts and may be executed by facsimile or PDF copies, each of which is deemed to be an original and all of which, taken together, constitute one and the same agreement.

Remainder of Page Intentionally Blank; Signature Page to Follow

IN WITNESS WHEREOF, the Company has caused this Agreement to be executed by its duly authorized officer and Mazanderani has signed this Agreement, as of the date first above written.

| |

LESAKA TECHNOLOGIES, INC. |

| |

|

| |

By: /s/ Naeem E. Kola |

| |

Name: Naeem E. Kola |

| |

Title: Director |

| |

|

| |

|

| |

|

| |

/s/ Ali Mazanderani |

| |

Ali Mazanderani |

Exhibit A

Restrictive Covenants Agreement

Execution Version

LESAKA TECHNOLOGIES, INC.

RESTRICTIVE COVENANTS AGREEMENT

Your Information:

Name: Ali Mazanderani

Address: XXX

Start Date: February 1, 2024

Company: Lesaka Technologies, Inc., and any of its subsidiaries or affiliates, together with any of its and their respective successors or assigns (collectively, "us," "we," "our," or "the Company")

Address: Lesaka Technologies, Inc.

President Place, 6th Floor, Cnr. Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg 2196, South Africa

In consideration of your employment or service with us and the compensation we have agreed to pay you, the receipt and sufficiency of which you acknowledge, you agree to this Restrictive Covenants Agreement (this "Agreement"), as follows:

1. This Agreement sometimes refers to your "Employment or Service." You understand that your "Employment or Service" means the entire period during which you are engaged by us as a consultant or employed by us as an employee, or otherwise providing services to us, including all times during which you have provided services to the Company prior to the Start Date and all times during and after work hours, whether you are actively employed or on any kind of leave of absence and whether you are engaged or employed full-time or part-time. In addition, it is understood that Employment or Service includes all periods commencing from the Start Date noted above, as well as any work performed for us prior to the Start Date.

2. Confidential Information. You agree to hold in the strictest confidence, not to use (except for the benefit of the Company) and not to disclose to any person or entity (directly or indirectly) any Confidential Information (as defined below) that you obtain or create during your Employment or Service, unless the Company grants you written authorization to do otherwise.

You understand that "Confidential Information" means all business, technical and other proprietary information in our custody or under our control, as well as any Company information not generally known by actual or potential competitors of the Company or by the public generally. Such information is Confidential Information no matter how you learned of it -- whether disclosed to you, directly or indirectly, in writing, orally, by drawings or inspection of documents or other tangible property or in any other manner or form, tangible or intangible. You understand specifically that Confidential Information includes, but is not limited to, the following types of information:

- information belonging to others who have entrusted such information to us, as further described in Section 4 below;

- information that would not have been known to our competitors or the public generally if you had not breached your obligations of confidentiality under this Agreement;

- information concerning research, inventions, discoveries, developments, techniques, processes, formulae, technology, designs, drawings, engineering, specifications, algorithms, finances, sales or profit figures, financial plans, customer lists, customers, prospective customers, potential investors, business plans, contracts, markets, investing plans, product plans, marketing, distribution or sales methods or systems, products, services, production plans, system implementation plans, business concepts, supplier or vendor information, business procedures or business operations related thereto;

- all computer software (in source, object, executable or other code forms and including all programs, modules, routines, interfaces and controls), data, databases, Internet designs and strategies, files and any documentation protocols and/or specifications related to the foregoing;

- all know-how and/or trade secrets;

- all unpublished copyrightable material;

- any use, model, variation, application, reduction to practice, discussion and any other communication or information in, regarding or relating to, or usable in or with any of the goods or services made, used or sold by us; and

- all reproductions and copies of such things.

3. Third Party Information Held by You. You recognize that you may have access to confidential information of former employers or other persons or entities with whom you have an agreement or duty to keep such information confidential. You will not use any such information in your Employment or Service, you will not disclose any such information to us or any of our directors, officers, agents or other employees, or induce any of them to use any such information, and you will not bring onto the premises of the Company any such information in any form, unless such person or entity has granted you written authorization to do so.

4. Third Party Information Held by the Company. You recognize that we have received, and in the future shall receive, from other persons or entities information that is confidential to such person or entity; and, therefore, such persons or entities require us to maintain the confidentiality of such information and to use it only for certain limited purposes. Consistent with the Company's agreement with such persons or entities, you agree to hold in the strictest confidence, not to use (except as necessary to carry out your duties for the Company) and not to disclose to any person or entity (directly or indirectly) any such information, unless we grant you written authorization to do otherwise. All such information shall also constitute and shall be treated as Confidential Information.

5. Company Property; Return. You will not remove (either physically or electronically) any property belonging to us or in our custody ("Company Property") from our premises, except as required in the ordinary course of your Employment or Service, unless we grant you written authorization to do so. Company Property includes all Confidential Information as well as Company related information that is not confidential, and tangible property and hard goods. Promptly upon the termination of your Employment or Service, and earlier if we so request at any time, you shall deliver to us (and shall not keep copies in your possession or deliver to anyone else) all of the Company Property, which may include, without limitation, all of the following items:

- documents and other materials containing or comprising Confidential Information, including in particular, but not limited to, all software, records, data, notes, reports, proposals, lists, correspondence, specifications, drawings, blueprints, sketches and laboratory notebooks, whether hard copies or soft copies (electronic or digital); and

- tangible property and equipment belonging to us (whether or not containing or comprising Confidential Information), including in particular, but not limited to, laptop computers, devices, solutions, samples, models, marketing materials, brochures, purchase order forms and letterhead, and all reproductions and copies of such things.

6. Nondisparagement. You agree that you will not at any time make, publish or communicate to any person or entity or in any public forum any defamatory or disparaging remarks, comments or statements concerning the Company or its respective businesses, or any of its members, directors, employees and officers, except as may be required by law. This restriction does not bar you from participating or cooperating with any government agency; from making statements in connection with any lawsuit or other dispute resolution process; or otherwise making such statements when application of this restriction would be unlawful.

7. Duration; Nature. This Agreement is binding during your Employment or Service and shall survive any termination of your Employment or Service. This Agreement does not bind the Company or you to any specific period of employment or service, and shall not be construed in any manner as an employment or consulting agreement or to make your Employment or Service other than terminable at will at any time by us in our sole discretion.

8. No Conflicts. You are not a party to any existing agreement or employment that would prevent you from entering into and performing this Agreement in accordance with its terms, including, without limitation, an obligation to assign your Inventions or Intellectual Property Rights to a third party or any agreement subjecting you to a non-compete, except as identified in Attachment A hereto; and you will not enter into any other agreement that is in conflict with your obligations under this Agreement.

9. Disclosure of Obligations. You consent to the Company's notification to any third party of the existence of this Agreement.

10. Compliance. You acknowledge that the activities of the Company are subject to compliance with applicable laws and regulations (collectively, "Laws"), including without limitation Laws that may control the collection, storage, processing and distribution of personal information. You agree to comply with all applicable Laws and to notify your immediate supervisor or superior of any reason to believe that you, the Company, or any other person has violated any Law that may affect the Company or your performance or your obligations under this Agreement.

11. Equitable Relief. You agree that the provisions of this Agreement are reasonably necessary to protect our legitimate business interests. You agree that it would be impossible or inadequate to measure and calculate our damages from any breach of the covenants set forth in this Agreement, and that a breach of such covenants could cause serious and irreparable injury to us. Accordingly, we shall have available, in addition to any other right or remedy available to us, the right to seek an injunction from a court of competent jurisdiction restraining such a breach (or threatened breach) and specific performance of this Agreement. You further agree that no bond or other security shall be required in obtaining such equitable relief and you hereby consent to the issuance of such injunction and to the ordering of specific performance.

12. No License. Nothing in this Agreement shall be deemed to constitute the grant of any license or other right to you in respect of any Confidential Information, Company Property, Invention, Work, Intellectual Property Right or other data, tangible property or intellectual property of the Company.

13. Amendment and Assignment. No modification to any provision of this Agreement will be binding unless it is in writing and signed by both you and the Company. No waiver of any rights under this Agreement will be effective unless in writing signed by the Company. You recognize and agree that your obligations under this Agreement are of a personal nature and are not assignable or delegable in whole or in part by you. The Company may assign this Agreement to any affiliate or to any successor-in-interest (whether by sale of assets, sale of stock, merger or other business combination). All of the terms and provisions of this Agreement shall be binding upon and inure to the benefit of and be enforceable by the respective heirs, executors, administrators, legal representatives, successors and permitted assigns of you and the Company.

14. Notices. Any notice, consent, waiver and other communications required or permitted pursuant to the provisions of this Agreement must be in writing and will be deemed to have been properly given (a) when delivered by hand; or (c) when sent by email, in each case to any Party at the mailing address, facsimile number or email address set forth below, or, with respect to any Party set forth below, at such other address, facsimile number or email address specified in writing by such Party to the other Parties in accordance with this Section 7:

If to the Company: Lesaka Technologies, Inc.

President Place, 6th Floor

Cnr. Jan Smuts Avenue and Bolton Road

Rosebank, Johannesburg, South Africa

Facsimile: +27118807080

Attn: Naeem Kola

Email: Naeem.kola@lesakatech.com

If to Executive: Ali Mazanderani

XXX

XXX

15. Governing Law; Jurisdiction. This Agreement shall be governed by and interpreted in accordance with laws of the State of New York and, to the extent applicable, U.S. federal law, and the parties agree to submit to the jurisdiction of the state and federal courts sitting in New York, New York for all disputes hereunder.

16. Severability. If any provision of this Agreement or its application is adjudicated to be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability (a) shall not affect any other provision or application of this Agreement that can be given effect without the invalid or unenforceable provision or application and shall not invalidate or render unenforceable such provision or application in any other jurisdiction and (b) shall be limited or excluded from this Agreement to the minimum extent required so that this Agreement shall otherwise remain in full force and effect and enforceable in accordance with its terms. For the avoidance of doubt, if this Agreement is or becomes subject to any state or federal law affecting the Company's rights with respect to any of your obligations under this Agreement, this Agreement shall be deemed amended to the extent necessary to comply with such law.

Signature Page Follows

I HAVE READ THIS AGREEMENT CAREFULLY AND I UNDERSTAND AND ACCEPT THE OBLIGATIONS THAT IT IMPOSES UPON ME WITHOUT RESERVATION, AND HEREBY ACKNOWLEDGE RECEIPT OF A COPY OF SUCH AGREEMENT. NO PROMISES OR REPRESENTATIONS HAVE BEEN MADE TO ME TO INDUCE ME TO SIGN THIS AGREEMENT. I SIGN THIS AGREEMENT VOLUNTARILY AND FREELY AND INTENDING TO BE LEGALLY BOUND.

| Dated: December 4, 2023 |

/s/ Ali Mazanderani |

| |

Ali Mazanderani |

Agreed and Acknowledged

LESAKA TECHNOLOGIES, INC.

By: /s/ Naeem E. Kola

Name: Naeem E. Kola

Title: Group Chief Financial Officer

ATTACHMENT A

A. Inventions made by me prior to my Employment or Service with the Company that I desire to be excepted from the Agreement to which this Attachment A is attached (if none, write "NONE"):

[NONE]

B. Prior agreements to which I am a party that may interfere with full compliance with the Agreement to which this Attachment A is attached (if none, write "NONE"):

[NONE]

| Dated: December 4, 2023 |

/s/ Ali Mazanderani |

| |

Ali Mazanderani |

Exhibit 99.1

Lesaka appoints fintech entrepreneur Ali Mazanderani as Chairman, Kuben Pillay as Lead Independent Director, and Chris Meyer to conclude tenure as Group CEO in February 2024

JOHANNESBURG, December 4, 2023 - Lesaka Technologies, Inc. (Nasdaq: LSAK; JSE: LSK) today announced that Chris Meyer will conclude his tenure as Lesaka Group CEO on February 29, 2024. During his nearly three years as Group CEO, Chris has led the successful turnaround and building of the Lesaka fintech platform. Chris will remain a director of Lesaka.

Commenting on the conclusion of his tenure as Group CEO, Chris said, "I have dedicated all my energy over the past nearly 3 years to the turnaround and rebuilding of the Lesaka platform, spending the majority of that time apart from my family in the UK. The vibrant and energized Lesaka of today looks very different to the business we took on almost 3 years ago, and I am exceptionally proud of what this extraordinary team has achieved. The Consumer division has returned to profitability and the Connect Group acquisition has been a resounding success. Furthermore we have built a strong leadership team, implemented a robust corporate governance and risk management framework, and developed a values system and culture which resonates with our 2,400 colleagues across Southern Africa. I believe we have achieved what we set out to do when we started this journey, and I feel that the time is right for me to return to my family and hand over to a new leader who will take this extraordinary group of people into an exciting future. Ali is an exceptional leader and fintech entrepreneur and is the perfect candidate to lead Lesaka in its next exciting growth phase."

Ali Mazanderani will assume the Executive Chairman role on February 1, 2024.

Ali has been a member of the Lesaka board since 2020. It was Ali's vision to build the leading fintech platform in Southern Africa that set Lesaka on its journey. He presented this strategy to the market at Lesaka's Q4 2020 earnings call and has played a key role in Lesaka's evolution, serving as a board director and a member of the Capital Allocation Committee.

Ali brings deep experience to the Lesaka executive team and is a well-known and respected global fintech leader and entrepreneur. Ali is co-founder and Chairman of Teya, a leading European fintech and has served as a director of global fintech companies, including StoneCo in Brazil and Network International in the UAE.

Ali commented, "During my three years on the board of Lesaka, I have seen the leadership team and the more than 2,400 employees across the group build a great foundation. I would especially like to thank Chris for the crucial role he has played in getting Lesaka to where it is today. The company is well positioned to deliver exceptional value to its stakeholders and benefit the communities it serves. I look forward to deepening my involvement with Lesaka and working with the entire team to realize our vision."

Kuben Pillay, Chairman of the Lesaka Board, commented, "On behalf of the Board, I want to thank Chris for his invaluable contributions to Lesaka. Chris achieved what he was tasked to do when we started this journey, and leaves Lesaka as a strong platform positioned for growth."

"We are excited by the appointment of Ali as Executive Chairman. Ali played an integral role in setting Lesaka on this journey to become the leading fintech driving financial inclusion. Given his deep experience and proven track-record in the fintech sector and in emerging markets (including South Africa), he is ideally suited to lead Lesaka through the next phase of growth."

Kuben Pillay's role on the Board of Lesaka will change from Chairman to Lead Independent Director, effective February 1, 2024. Kuben will continue to chair the meetings of the board of directors, in line with best practice of corporate governance and independence.

About Lesaka (www.lesakatech.com)

Lesaka Technologies, (Lesaka™) is a South African Fintech company that utilizes its proprietary banking and payment technologies to deliver superior financial services solutions to merchants (B2B) and consumers (B2C) in Southern Africa. Lesaka's mission is to drive true financial inclusion for both merchant and consumer markets through offering affordable financial services to previously underserved sectors of the economy. Lesaka offers cash management solutions, growth capital, card acquiring, bill payment technologies and value-added services to formal and informal retail merchants as well as banking, lending, and insurance solutions to consumers across Southern Africa. The Lesaka journey originally began as "Net1" in 1997 and later repositioned and rebranded to Lesaka (2022), with the acquisition of Connect. As Lesaka, the business continues to grow its systems and capabilities to deliver meaningful fintech-enabled, innovative solutions for South Africa's merchant and consumer markets.

Lesaka has a primary listing on the NASDAQ (NasdaqGS: LSAK) and a secondary listing on the Johannesburg Stock Exchange (JSE: LSK). Visit www.lesakatech.com for additional information about Lesaka Technologies (Lesaka ™).

Forward-Looking Statements

This press release contains certain statements that may be considered forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and such statements are subject to the safe harbor created by those sections and the Private Securities Litigation Reform Act of 1995, as amended. Such statements may be identified by their use of terms or phrases such as "expects," "estimates," "projects," "believes," "anticipates," "plans," "could," "would," "may," "will," "intends," "outlook," "focus," "seek," "potential," "mission," "continue," "goal," "target," "objective," derivations thereof, and similar terms and phrases. Forward-looking statements are based upon the current beliefs and expectations of our management and are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, which could cause future events and actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. In this press release, statements relating to future financial results and future financing and business opportunities are forward-looking statements. Additional information concerning factors that could cause actual events or results to differ materially from those in any forward-looking statement is contained in our Form 10-K for the fiscal year ended June 30, 2023, as filed with the SEC, as well as other documents we have filed or will file with the SEC. We assume no obligation to update the information in this press release, to revise any forward-looking statements or to update the reasons actual results could differ materially from those anticipated in forward-looking statements.

Investor Relations Contact:

Phillipe Welthagen

Email: phillipe.welthagen@lesakatech.com

Mobile: +27 84 512 5393

FNK IR:

Rob Fink / Matt Chesler, CFA

Email: lsak@fnkir.com

Media Relations Contact:

Janine Bester Gertzen

Email: Janine@thenielsennetwork.com

v3.23.3

Document and Entity Information Document

|

Nov. 28, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Creation Date |

Nov. 28, 2023

|

| Document Period End Date |

Nov. 28, 2023

|

| Amendment Flag |

false

|

| Entity Registrant Name |

Lesaka Technologies, Inc.

|

| Entity Address, Address Line One |

President Place, 4th Floor, Cnr.

|

| Entity Address, Address Line Two |

Jan Smuts Avenue and Bolton Road

|

| Entity Address, City or Town |

Rosebank, Johannesburg

|

| Entity Address, Country |

ZA

|

| Entity Address, Postal Zip Code |

|

| Entity Incorporation, State Country Name |

FL

|

| City Area Code |

11

|

| Region code of country |

27

|

| Local Phone Number |

343-2000

|

| Entity File Number |

000-31203

|

| Entity Central Index Key |

0001041514

|

| Entity Emerging Growth Company |

false

|

| Entity Tax Identification Number |

98-0171860

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares

|

| Trading Symbol |

LSAK

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe date the document was made available and submitted, in YYYY-MM-DD format. The date of submission, date of acceptance by the recipient, and the document effective date are all potentially different.

| Name: |

dei_DocumentCreationDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

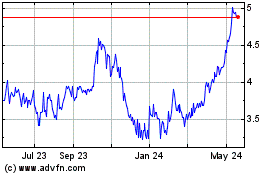

Lesaka Technologies (NASDAQ:LSAK)

Historical Stock Chart

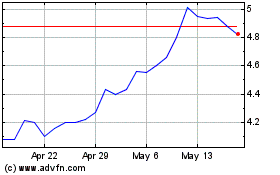

From Mar 2024 to Apr 2024

Lesaka Technologies (NASDAQ:LSAK)

Historical Stock Chart

From Apr 2023 to Apr 2024