false

0001673481

0001673481

2024-08-14

2024-08-14

0001673481

LTRY:CommonStockParValue0.001PerShareMember

2024-08-14

2024-08-14

0001673481

LTRY:WarrantsToPurchaseOneShareOfCommonStockEachAtExercisePriceOf230.00Member

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 14, 2024

Lottery.com

Inc.

(Exact

Name of Registrant as Specified in Its Charter)

| Delaware |

|

001-38508 |

|

No.

81-1996183 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification No.) |

20808

State Hwy 71 W, Unit B

Spicewood,

Texas |

|

78669 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

(737)

309-4500

(Registrant’s

Telephone Number, Including Area Code)

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Exchange Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.001 per share |

|

LTRY |

|

The

Nasdaq Stock Market LLC |

| Warrants

to purchase one share of common stock, each at an exercise price of $230.00 |

|

LTRYW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act.

Item

1.01. Entry into a Material Definitive Agreement.

Acquisition

of S&MI, Ltd.

As

reported on form 8-K, filed February 21, 2024, on February 15, 2024, Lottery.com, Inc. (the “Company”) had entered into a

Memorandum of Understanding (the “MOU”) with S&MI Ltd. (dba “SportLocker.com”).

On

August 14, 2024, as attached hereto as Exhibit 10.1, the Company issued a press release stating that the acquisition of S&MI, Ltd.

(dba SportsLocker.com) is now scheduled to close by September 1, 2024.

On

August 14, 2024, the Company finalized an agreement for the acquisition of S&MI, Ltd. with its shareholders (the ““Share

Purchase and Sale Agreement”), wherein the Purchase Price is the total equivalent One

Million Dollars USD ($1,000,000.00) in restricted stock units of common shares in the Company. (the “Payment-In-Kind”)

fixed at Three Dollars USD ($3.00) per share (the “Fixed Price”). Purchase Price is to be paid out over five payments on

the following schedule:

| (a) |

First

Payment: One Hundred Fifty Thousand Dollars ($150,000.00) in restricted stock units of the Company, (50,000 shares, the “First

Payment”) issued on the first business day following the closing of the transaction on September 1, 2024 (the “Completion

Date” and the “First Issuance Date”). The restricted stock units of common shares of the Company underlying the

First Payment shall fully vest on the First Issuance Date and shall include full piggyback registration rights for the shareholders

of S&MI, Ltd.; |

| |

|

| (b) |

Second

Payment: Two Hundred Twelve Thousand Five Hundred Dollars ($212,500.00) in restricted stock units of common shares of the Company

(70,833 shares, the “Second Payment”) on the thirty-first (31st) day following the expiration of ninety (90) days after

the Completion Date (the “Second Issuance Date”). These restricted stock units of common shares shall fully vest on the

Second Issuance Date, and shall be restricted for a period of twelve (12) months immediately following the Completion Date; |

| |

|

| (c) |

Third

Payment: Two Hundred Twelve Thousand Five Hundred Dollars ($212,500.00) in restricted stock units of common shares of the Company

(70,833 shares, the “Third Payment”) on the thirty-first (31st) day following the expiration of one hundred eighty (180)

days after the Completion Date (the “Third Issuance Date”). These restricted stock units of common shares shall fully

vest on the Third Issuance Date, and shall be restricted for a period of eighteen (18) months immediately following the Completion

Date; |

| |

|

| (d) |

Fourth

Payment: Two Hundred Twelve Thousand Five Hundred Dollars ($212,500.00) in restricted stock units of common shares of the Company

(70,833 shares, the “Fourth Issuance”) on the thirty-first (31st) day following the expiration of two hundred seventy

(270) days after the Completion Date (the “Fourth Issuance Date”). These restricted stock units of common shares shall

fully vest on the Fourth Issuance Date and shall be restricted for a period of twenty-four (24) months immediately following the

Completion Date; and |

| |

|

| (e) |

Fifth

and Final Payment: Two Hundred Twelve Thousand Five Hundred Dollars ($212,500.00) in restricted stock units of common shares

of the Company (70,833 shares, the “Fifth and Final Payment”) on the thirty-first (31st) day following the expiration

of three hundred sixty-five days (365) days after the Completion Date (the “Fifth and Final Issuance Date”). These restricted

stock units of common shares shall fully vest on the Fifth and Final Issuance Date and shall be restricted for a period of thirty

(30) months immediately following the Completion Date. |

In

the event that the closing price of the restricted stock units of common shares of the Company to be issued to the shareholders of S&MI,

Ltd. is lower than the Fixed Purchase Price on the six (6) month anniversary of any issuance date of said shares (collectively the “Anniversary

Issuance Price”), then the Fixed Purchase Price shall be adjusted downward to the volume-weighted average price (“VWAP”)

of the common stock for the five (5) consecutive trading days immediately preceding the six (6) month anniversary date of said issuance

date. Accordingly, the Company shall be obligated to tender to the shareholders of S&MI, Ltd. additional restricted stock units of

common shares of the Company to make up the difference between the Fixed Purchase Price and the Anniversary Issuance Price.

The

foregoing description of the Share Purchase and Sale Agreement is not complete and is qualified in its entirety by the full text of the

Share Purchase and Sale Agreement, which is filed herewith as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference

herein.

Item

9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Lottery.com

Inc. |

| |

|

|

| |

By: |

/s/

Matthew McGahan |

| |

Name: |

Matthew

McGahan |

| |

Title: |

Chief

Executive Officer |

August

20, 2024

Exhibit

10.1

Exhibit 10.2

| |

FOR OFFICIAL

RELEASE |

| |

20808 State Highway 71 W Unit B |

| |

Spicewood,

TX 78669-6824 |

LOTTERY.COM

FINALIZES ACQUISITION OF S&MI LTD

LONDON,

August 14, 2024 — Lottery.com Inc. (Nasdaq: LTRY, LTRYW) (“Lottery.com” or the “Company”), a leading

online lottery services provider announces the finalization of the acquisition of S&MI Ltd., the technology company behind the SportLocker

brand and app, with the transaction set to close on September 1, 2024.

SportLocker

has already been rebranded as Sports.com, and is now set to develop a premier platform for sports fans worldwide over the course

of 2024/25. Sports.com is fast becoming a digital sports entertainment platform, introducing an immersive experience that combines innovative

technology, expansive content, and community-driven features.

Launching

into New Streaming Markets and Sports

In

2024 and 2025, Sports.com plans to venture into new streaming markets, covering a broader spectrum of sports. This includes not only

traditional sports, such as soccer, but also emerging arenas in esports like sim racing, which are increasing in popularity with real

world racing fans of Formula One, IndyCar and NASCAR. Fans can look forward to live streams of high-octane events, exclusive behind-the-scenes

content, and in-depth analyses across a variety of sports disciplines. Sports.com has also lined up strategic acquisitions that aim to

bolster the platform’s content offerings, providing fans with unparalleled access to exclusive events, teams, and personalities.

Introducing

Fully Immersive Streaming Technology

Planned

to debut next year, Sports.com’s groundbreaking fully immersive streaming technology will redefine how fans engage with live sports.

This innovation will allow real-time interactions, multi-angle viewing, and augmented reality experiences, ensuring maximum fan engagement

like never before.

Launching

a New Social Media Channel

To

further enhance community engagement, Sports.com will unveil a new social media channel dedicated exclusively to sports enthusiasts.

This platform will serve as a hub for fans to connect, discuss, and celebrate their favorite sports, teams, and moments, fostering a

vibrant and interactive community.

Creating

the Next-Gen Sports Entertainment Platform

Sports.com

is seeking to revolutionize digital sports entertainment by offering 24/7 sports news, live streaming, original documentaries, films,

and exclusive behind-the-scenes access. Fans will have the freedom to watch sports when and where they want, directly on their devices,

regardless of their location.

Global

Expansion and Focus on Women’s Sports

Initially

launching in the USA and Europe, with targeted efforts in the Middle East, Sports.com plans to extend its reach to Africa, India, South

America, Asia, and Australasia. A dedicated program for women’s sports will also be introduced, aiming to drive sponsorships and

generate new revenue streams for clubs and teams across the board.

Enhanced

Partnerships and Content Delivery

Leveraging

the Company’s established partnerships with Mobile Network Operators (MNOs), Sports.com will offer localized branded sports content

services. This strategy enhances the value proposition for MNOs by catering to the growing demand for sports video content across various

markets.

Driving

Growth Through Premium Content and Strategic Collaborations

Sports.com’s

growth strategy focuses on premium content bundling and direct connections with MNOs for optimal user acquisition. Collaborations with

exclusive marketing partners will further aid in sustainably scaling user adoption.

Matthew

McGahan, Chairman and CEO of Lottery.com and Sports.com, commented:

“I

am thrilled to lead Sports.com into a new era where technology and passion for sport converge to create unparalleled experiences for

fans worldwide. Our vision is to revolutionize fan engagement, making every moment more interactive, accessible, and engaging. By leveraging

MNO partnerships, localized content services, and community-focused features with enhanced content and technology, we’re creating

a dynamic ecosystem where fans can not only consume sports but also connect and create in unprecedented ways.

Marc

Bircham, Director of Football Operations at Sports.com, added:

“The

acquisition heralds a new dawn in sports entertainment. Our upcoming ventures in motor sports, sim racing, and football are set to provide

fans with content that’s both engaging and groundbreaking. We’re not just changing how fans watch sports; we’re redefining

how they live them. “

Tim

Scoffham, Founding Partner of S&MI Ltd, said:

“With

the exciting lineup for 2024 and 2025, including new streaming markets, immersive technologies, and strategic acquisitions, we’re

uniquely positioned to offer sports fans an unparalleled experience year-round. Our vision has always been to create a comprehensive

platform that serves as the go-to destination for sports fans. Sports.com accelerates that goal, providing coverage of the most anticipated

events and exclusive content and insights in the sports world.”

-ends-

For

more information, please visit www.lottery.com or contact our media relations team at media@lottery.com.

Lottery.com

Contact: press@lottery.com

Important

Notice Regarding Forward-Looking Statements

This

press release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements, other than statements of present or historical fact included in this press release, regarding the company’s

future financial performance, as well as the company’s strategy, future operations, revenue guidance, projected costs, prospects,

plans and objectives of management are forward-looking statements. When used in this press release, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

management’s current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required by applicable law, Lottery.com disclaims any duty to update any forward-looking

statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date

of this press release. Lottery.com cautions you that these forward-looking statements are subject to numerous risks and uncertainties,

most of which are difficult to predict and many of which are beyond the control of Lottery.com. In addition, Lottery.com cautions you

that the forward-looking statements contained in this press release are subject to the following factors: (i) the outcome of any legal

proceedings that may be instituted against Lottery.com; (ii) Lottery.com’s ability to maintain effective internal controls over

financial reporting, including the remediation of identified material weaknesses in internal control over financial reporting relating

to segregation of duties with respect to, and access controls to, its financial record keeping system, and Lottery.com’s accounting

staffing levels; (iii) the effects of competition on Lottery.com’s future business; (iv) risks related to Lottery.com’s dependence

on its intellectual property and the risk that Lottery.com’s technology could have undetected defects or errors; (v) changes in

applicable laws or regulations; (vi) risks related to the COVID-19 pandemic and its effect directly on Lottery.com and the economy generally;

(vii) risks relating to privacy and data protection laws, privacy or data breaches, or the loss of data; (viii) the possibility that

Lottery.com may be adversely affected by other economic, business, and/or competitive factors; (ix) the ability of Lottery.com to achieve

its strategic and growth objectives as stated or at all; and (x) those factors discussed in the proxy statement/prospectus filed by Lottery.com

with the SEC under the heading “Risk Factors” and the other documents filed, or to be filed, by Lottery.com with the SEC.

Should one or more of the risks or uncertainties described in this press release materialize or should underlying assumptions prove incorrect,

actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning

these and other factors that may impact the operations and projections discussed herein can be found in the reports that Lottery.com

has filed and will file from time to time with the SEC. These SEC filings are available publicly on the SEC’s website at www.sec.gov.

Exhibit

10.3

|

FOR

OFFICIAL RELEASE |

| |

20808

State Highway 71 W Unit B |

| |

Spicewood,

TX 78669 -6824 |

LOTTERY.COM

FINALIZES AGREEMENT TERMS FOR S&MI LTD ACQUISITION

LONDON,

August 20, 2024 — Lottery.com Inc. (Nasdaq: LTRY, LTRYW) (“Lottery.com” or the “Company”), a leading

online lottery services provider, is pleased announce it has finalized terms for the acquisition of S&MI Ltd. (“S&MI”),

the innovative technology company behind the current Sports.com brand and app. The total acquisition price is to be satisfied with equity

of common stock in Lottery.com priced at $3.00 per share.

The

acquisition of S&MI significantly enhances the long-term value of the Sports.com brand, unlocking substantial growth opportunities

in key target markets, including the Middle East and North Africa. This acquisition will further strengthen Sports.com’s global

profile and future prospects, solidifying its position as a leading force in the industry.

The

acquisition is scheduled for completion on September 1, 2024. Following the successful completion of the acquisition, S&MI Ltd will

be renamed Sports.com Media Ltd. At that time, Lottery.com intends to appoint Marc Bircham to the board of directors of S&MI, bringing

his extensive experience in football and sports management to Lottery.com’s newest subsidiary.

Marc

is a respected figure in the world of soccer in the UK, Canada and the USA, known for both his playing career and his managerial roles.

Bircham started his professional career at Millwall FC before moving to Queens Park Rangers FC (QPR), where he became a fan favourite.

After hanging up his boots, Bircham transitioned into coaching and management, taking on roles at QPR, Chicago Fire, and Millwall, among

others. His deep understanding of the game and his experience in football operations make him an invaluable addition to the Sports.com

Media Ltd leadership team.

Clickshakers

Partnership

S&MI

continues to expand its global reach. Recently, S&MI entered into a partnership with Clickshakers, which recently launched in

Singapore with the leading telecommunications company, Singtel. Sports.com will be the beneficiary of that partnership post-completion

of the acquisition. Additionally, Clickshakers’ white-labeled service is in the final stages of approval to launch in the UK, partnering

with leading telcos to cover the full network nationally. Expansion plans also include France, where the service is set to launch with

Orange, SFR, and Bouygues Telecom, further broadening its platform and content offerings.

Majed

Al Sorour, President of Sports.com and formerly CEO of Golf Saudi, Managing Director of LIV Golf, and Board Member & Director of

Newcastle United Football Club, said:

“The

acquisition of S&MI Ltd represents a pivotal step in our journey to become a global leader in digital sports entertainment. With

S&MI’s cutting-edge platform and app, Sports.com is well positioned to deliver unparalleled experiences to sports fans worldwide.

We are particularly excited about the synergies this acquisition brings as we continue to innovate and expand our reach into new markets.

The addition of Marc Bircham to our board underscores our commitment to bringing in top-tier talent to drive our vision.”

Matthew

McGahan, Chairman and CEO of Lottery.com and Sports.com, added:

“The

acquisition of S&MI Ltd is an excellent fit for the Sports.com brand. It enables Sports.com to leverage S&MI’s advanced

platform and app, which will accelerate our growth and enhance our offerings. We look forward to appointing Marc Bircham to the board

of S&MI upon completion of the acquisition. Marc’s deep expertise in football and his passion for sports will be invaluable

as we expand the Sports.com platform and solidify our position as a leader in digital sports entertainment. Sports.com has enormous potential,

and the team is focused on expanding our reach and acquiring top-tier content. The Clickshakers deal is a prime example of our commitment

to this strategy.”

Marc

Bircham, Director at Sports.com, said:

“The

acquisition will mark the beginning of an exciting new era in sports entertainment. Our targeted initiatives in motorsports, sim racing,

and football will deliver content that not only captivates but also sets new standards in fan engagement. We’re not just transforming

the way fans watch sports; we’re elevating the entire experience to a new level of immersion and interaction.”

ends-

Lottery.com

Contact: press@lottery.com

Important

Notice Regarding Forward-Looking Statements

This

press release contains statements that constitute “forward-looking statements” within the meaning of Section 27A of the Securities

Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). All statements, other than statements of present or historical fact included in this press release, regarding the company’s

future financial performance, as well as the company’s strategy, future operations, revenue guidance, projected costs, prospects,

plans and objectives of management are forward-looking statements. When used in this press release, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

management’s current expectations and assumptions about future events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required by applicable law, Lottery.com disclaims any duty to update any forward-looking

statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date

of this press release. Lottery.com cautions you that these forward-looking statements are subject to numerous risks and uncertainties,

most of which are difficult to predict and many of which are beyond the control of Lottery.com. In addition, Lottery.com cautions you

that the forward-looking statements contained in this press release are subject to the following factors: (i) the outcome of any legal

proceedings that may be instituted against Lottery.com; (ii) Lottery.com’s ability to maintain effective internal controls over

financial reporting, including the remediation of identified material weaknesses in internal control over financial reporting relating

to segregation of duties with respect to, and access controls to, its financial record keeping system, and Lottery.com’s accounting

staffing levels; (iii) the effects of competition on Lottery.com’s future business; (iv) risks related to Lottery.com’s dependence

on its intellectual property and the risk that Lottery.com’s technology could have undetected defects or errors; (v) changes in

applicable laws or regulations; (vi) risks related to the COVID-19 pandemic and its effect directly on Lottery.com and the economy generally;

(vii) risks relating to privacy and data protection laws, privacy or data breaches, or the loss of data; (viii) the possibility that

Lottery.com may be adversely affected by other economic, business, and/or competitive factors; (ix) the ability of Lottery.com to achieve

its strategic and growth objectives as stated or at all; and (x) those factors discussed in the proxy statement/prospectus filed by Lottery.com

with the SEC under the heading “Risk Factors” and the other documents filed, or to be filed, by Lottery.com with the SEC.

Should one or more of the risks or uncertainties described in this press release materialize or should underlying assumptions prove incorrect,

actual results and plans could differ materially from those expressed in any forward-looking statements. Additional information concerning

these and other factors that may impact the operations and projections discussed herein can be found in the reports that Lottery.com

has filed and will file from time to time with the SEC. These SEC filings are available publicly on the SEC’s website at www.sec.gov.

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity File Number |

001-38508

|

| Entity Registrant Name |

Lottery.com

Inc.

|

| Entity Central Index Key |

0001673481

|

| Entity Tax Identification Number |

81-1996183

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

20808

State Hwy 71 W

|

| Entity Address, Address Line Two |

Unit B

|

| Entity Address, City or Town |

Spicewood

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78669

|

| City Area Code |

(737)

|

| Local Phone Number |

309-4500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock, par value $0.001 per share |

|

| Title of 12(b) Security |

Common

Stock, par value $0.001 per share

|

| Trading Symbol |

LTRY

|

| Security Exchange Name |

NASDAQ

|

| Warrants to purchase one share of common stock, each at an exercise price of $230.00 |

|

| Title of 12(b) Security |

Warrants

to purchase one share of common stock, each at an exercise price of $230.00

|

| Trading Symbol |

LTRYW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LTRY_CommonStockParValue0.001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LTRY_WarrantsToPurchaseOneShareOfCommonStockEachAtExercisePriceOf230.00Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

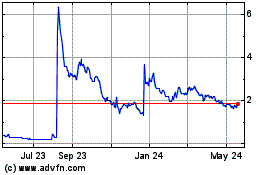

Lottery com (NASDAQ:LTRY)

Historical Stock Chart

From Jan 2025 to Feb 2025

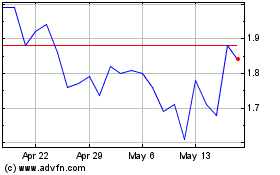

Lottery com (NASDAQ:LTRY)

Historical Stock Chart

From Feb 2024 to Feb 2025