false

0000763532

0000763532

2024-01-25

2024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 25, 2024

LSI INDUSTRIES INC.

(Exact name of Registrant as Specified in its Charter)

|

Ohio

|

|

01-13375

|

|

31-0888951

|

|

(State or Other Jurisdiction of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

10000 Alliance Road, Cincinnati, Ohio

|

45242

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code (513) 793-3200

(Former name or former address, if changed since last report.)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value |

LYTS |

NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (17CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02 Results of Operation and Financial Condition.

On January 25, 2024, LSI Industries Inc. (“LSI” or the “Company”) issued a press release announcing operating results for the fiscal quarter ending December 31, 2023. A copy of the press release is furnished with this Form 8-K as Exhibit 99.1 and is incorporated by reference herein.

Item7.01.Regulation FD Disclosure.

On January 25, 2024, LSI is hosting a conference call for the benefit of its investors to discuss the results set forth in the press release described in Item 2.02 above. A copy of the presentation, which is available at www.lsicorp.com, related to this conference call is attached as Exhibit 99.2 to this report and is incorporated by reference herein.

LSI’s presentation discloses certain financial results both in accordance with generally accepted accounting principles (“GAAP”) and on a non-GAAP basis with adjustments for certain items. LSI’s management believes that presentation of these non-GAAP financial measures and their related reconciliations are useful to investors because the non-GAAP financial measures provide investors with a basis for comparing the results to financial results from prior periods.

Information in the presentation contains forward-looking statements regarding future events and performance of LSI. All such forward-looking statements are based largely on LSI’s experience and perception of current conditions, trends, expected future developments and other factors, and on management’s expectations, and are subject to risks and uncertainties that could cause actual results to differ materially, including, but not limited to, those factors described in the presentation and in LSI’s filings with the Securities and Exchange Commission. LSI disclaims any intention or obligation to update or revise any financial or other projections or other forward-looking statements, whether because of new information, future events or otherwise.

The information in each of Item 2.02 and Item 7.01 of this Form 8-K and in the press release attached as Exhibit 99.1 and the presentation attached as Exhibit 99.2 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in each of Item 2.02 and Item 7.01 of this Form 8-K and each of Exhibit 99.1 and Exhibit 99.2 shall not be incorporated by reference in any filing (whether made before or after the date hereof) or any other document under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in any such filing, except as shall be expressly set forth by specific reference in any such filing or document.

Item9.01 Financial Statements and Exhibits.

|

ExhibitNo.

|

|

Description

|

|

99.1

|

|

|

|

99.2

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

LSI INDUSTRIES INC.

|

| |

|

|

| |

|

BY:/s/ James E. Galeese

|

| |

|

James E. Galeese

|

| |

|

Executive Vice President, Chief Financial Officer

|

| |

|

|

Dated: January 25, 2024

Exhibit 99.1

LSI INDUSTRIES REPORTS FISCAL 2024 SECOND QUARTER RESULTS

AND DECLARES QUARTERLY CASH DIVIDEND

CINCINNATI, January 25, 2024 – LSI Industries Inc. (Nasdaq: LYTS, “LSI” or the “Company”) a leading U.S. based manufacturer of commercial lighting and display solutions, today reported financial results for the fiscal 2024 second quarter ended December 31, 2023.

FISCAL 2024 SECOND QUARTER

| |

●

|

Net Sales of $109.0 million

|

| |

●

|

Net Income of $5.9 million, or $0.20 per diluted share

|

| |

●

|

Adjusted Net Income of $6.4 million, or $0.21 per diluted share

|

| |

●

|

EBITDA of $10.2 million; Adjusted EBITDA $11.1 million or 10.1%/sales

|

| |

●

|

Gross Margin rate increased 240 bps y/y

|

| |

●

|

Free Cash Flow of $7.3 million, or approximately $44 million on a TTM basis

|

| |

●

|

Ratio of net debt to TTM Adjusted EBITDA of 0.4x

|

| |

●

|

Total Orders increased 10% y/y with growth in both reporting segments

|

During the fiscal 2024 second quarter, LSI increased market share across multiple, high-value vertical markets, consistent with the ongoing focus on quality of earnings, while effectively managing a temporary pause in project demand within its grocery vertical related to the pending merger of two large industry participants.

LSI reported net income of $5.9 million, or $0.20 per diluted share, on sales of $109.0 million in the second quarter. Adjusted gross profit margin increased 240 basis points to 29.0% over the prior-year period, driven by a higher-value sales mix, focused price discipline, and strong cost control. The Company reported Adjusted EBITDA of $11.1 million for the quarter, delivering an Adjusted EBITDA margin rate of 10.1%, equal to the prior year quarter.

The Company generated free cash flow of $7.3 million in the second quarter, or nearly $44.0 million on a trailing twelve-month basis. Given continued strength in cash generation, LSI reduced its ratio of net debt to trailing twelve-month Adjusted EBITDA to 0.4x from 1.3x in the prior-year period. At the end of the second quarter, LSI had cash and availability on its credit facility totaling $103 million.

The Company declared a regular cash dividend of $0.05 per share payable on February 13, 2024, to shareholders of record on February 5, 2024.

LSI Industries Fiscal 2024 Second Quarter Results

MANAGEMENT COMMENTARY

James A. Clark, President and Chief Executive Officer commented, “LSI delivered solid second quarter results, a performance that reflects the durability of our vertical market strategy, together with a proven ability to drive sustained margin expansion and profitability through the cycle. We continued to execute at a high-level while effectively navigating the transitory disruption in grocery market project activity, due to the pending merger of two large industry participants. LSI remains well-positioned to capitalize on an expected acceleration in project activity as market conditions normalize.

“During the last twelve months, we’ve generated nearly $44 million in free cash flow, including more than $7 million in the second quarter, positioning us to support further reduction in net debt, strategic investments in organic growth, and a robust return of capital program,“ continued Clark. “Since acquiring JSI in calendar year 2021, we’ve reduced our net leverage ratio from 3.2x to 0.4x, consistent with a focus on capital discipline and balance sheet flexibility.

“As outlined within our Fast Forward growth strategy, our teams remain highly focused on increasing the volume of LSI content and related solutions per customer through targeted cross-selling initiatives. In the second quarter, our cross-selling initiative positioned LSI to secure refrigerated display case project wins with two national refueling/c-store chains that currently use our lighting solutions. Each program represents multi-million-dollar sales on an annual basis. In both the QSR and Grocery verticals we have secured customer projects to provide indoor and outdoor lighting, in addition to existing display case and print graphics activity. Moving forward, we have a significant volume of additional cross-selling proposals currently under review, as customers continue to recognize the value of our comprehensive offering of products and services.

“We remain highly encouraged by the strong multi-year demand outlook within our key verticals, particularly the c-store and grocery verticals. Recently, the nation’s largest c-store chain committed to growing its sale of fresh food and proprietary beverages from 24% of its revenue to more than 34% of revenue over the next three years, while the second largest c-store chain has announced plans to increase fresh food revenue by a compounded annual growth rate of 10% over the next five years. In recent years, LSI has developed industry-leading products and solutions specifically designed to address the unique lighting, graphics and refrigeration solutions required for a larger, more upscale c-store environment, positioning us to successfully capitalize on upcoming customer investments in their premium, hot and cold fresh food offerings.

“While the pending FTC approval of the proposed merger of the second and third-largest grocery chains in the United States has led to a temporary slowing of project activity within our grocery vertical, we’ve used this time to position our business to support an expected return to normal demand levels, the majority of which we expect will occur regardless of the FTC ruling. For example, we recently completed the relocation to our new, larger display case manufacturing facility, which provides the additional production capacity to support an expected ongoing increase in demand levels. In addition, we received final regulatory approval on our new refrigerated display case line which utilizes the environmentally friendly R-290 technology. We shipped our first unit last week, and several customers have indicated their intent to fully convert to the R-290 range of products beginning this calendar year. We expect overall grocery demand to begin increasing in the fiscal third quarter and accelerate throughout the fiscal fourth quarter and into fiscal 2025.

LSI Industries Fiscal 2024 Second Quarter Results

“Within our Lighting segment, orders for the quarter were 10% above prior year, and quotation volumes in key verticals remain healthy. On a consolidated basis, second quarter sales were $45.7 million or 3% below strong prior year levels, while operating income increased 28% in the period. Segment adjusted gross margin rate improved 440 basis points to 35.0%, our highest rate in over a decade. The improved gross margin rate was driven by multiple factors, including stable pricing, higher-value sales mix, and ongoing cost and operational improvements.

“In the quarter, LSI was selected as the lighting supplier to a high-end luxury automotive brand. Our team worked closely with the automotive customer on developing proprietary lighting specifications to support the customer experience requirements of their dealership environments. This win is an example of our focus on higher-value vertical market applications where our products and solutions represent an essential part of our customers value proposition to their customers.

“Within our Display Solutions segment, second quarter performance was unfavorably impacted by the previously mentioned delay in grocery vertical spending. Other vertical markets continue to be active. For example, within our refueling vertical, LSI was recently awarded a large renovation program by a national oil company that includes 1325 sites across the United States. LSI will be the “turnkey provider” for this program, managing site planning, product fulfillment, and installation. This win follows the other major programs awarded in the first quarter, including the 7,500 site, 3.5-year program for another large global oil company, as well as international expansion programs in five Central American countries. In addition, QSR delivered a strong quarter, as sales increased significantly compared to the prior year, and pilot activity with several chains continues.

Clark concluded, “Our solid second quarter performance demonstrates the benefits of building strong market positions in multiple, high-value vertical markets, further strengthening relationships with customers and partners, combined with a disciplined approach to capital allocation. Given the positive underlying growth trends for our key verticals, together with our focus on strategic execution as outlined within our Fast Forward plan, our team is well-positioned to drive long-term value for our shareholders.”

FISCAL 2024 SECOND QUARTER CONFERENCE CALL

A conference call will be held today at 11:00 A.M. ET to review the Company’s financial results and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of LSI Industries’ website at www.lsicorp.com. Individuals can also participate by teleconference dial-in. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time to register, download and install any necessary audio software.

LSI Industries Fiscal 2024 Second Quarter Results

Details of the conference call are as follows:

Domestic Live: 877-407-4018

International Live: 201-689-8471

To listen to a replay of the teleconference, which subsequently will be available through February 8, 2024:

Domestic Replay: 844-512-2921

International Replay: 412-317-6671

Conference ID: 13743769

ABOUT LSI INDUSTRIES

Headquartered in Cincinnati, LSI Industries (Nasdaq: LYTS) specializes in the creation of advanced lighting, graphics, and display solutions. The company's American-made products, which include lighting, print graphics, digital graphics, refrigerated, and custom displays, are engineered to elevate brands in competitive markets. With a workforce of nearly 1,600 employees and 11 facilities throughout North America, LSI is dedicated to providing top-quality solutions to its customers. Additional information about LSI is available at www.lsicorp.com.

FORWARD-LOOKING STATEMENTS

For details on the uncertainties that may cause our actual results to be materially different than those expressed in our forward-looking statements, visit https://investors.lsicorp.com as well as our Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q which contain risk factors.

INVESTOR & MEDIA CONTACT

Noel Ryan, IRC

720.778.2415

LYTS@vallumadvisors.com

LSI Industries Fiscal 2024 Second Quarter Results

|

Three Months Ended

December 31

|

|

|

|

Six Months Ended

December 31

|

|

| |

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

(In thousands, except per share data)

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

| $ |

109,005 |

|

|

$ |

128,804 |

|

|

|

-15 |

% |

Net sales

|

|

$ |

232,446 |

|

|

$ |

255,873 |

|

|

|

-9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

7,819 |

|

|

|

9,038 |

|

|

|

-13 |

% |

Operating income as reported

|

|

|

18,847 |

|

|

|

19,059 |

|

|

|

-1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

849 |

|

|

|

1,002 |

|

|

|

|

|

Long-Term Performance Based Compensation

|

|

|

2,174 |

|

|

|

1,553 |

|

|

|

|

|

| |

- |

|

|

|

486 |

|

|

|

|

|

Consulting expense: Commercial Growth Initiatives

|

|

|

19 |

|

|

|

789 |

|

|

|

|

|

| |

35 |

|

|

|

33 |

|

|

|

|

|

Severance costs and Restructuring costs

|

|

|

388 |

|

|

|

46 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

8,703 |

|

|

$ |

10,559 |

|

|

|

-18 |

% |

Operating income as adjusted

|

|

$ |

21,428 |

|

|

$ |

21,447 |

|

|

|

0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

5,906 |

|

|

$ |

6,417 |

|

|

|

-8 |

% |

Net income as reported

|

|

$ |

13,934 |

|

|

$ |

12,678 |

|

|

|

10 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

6,364 |

|

|

$ |

7,627 |

|

|

|

-17 |

% |

Net income as adjusted

|

|

$ |

15,104 |

|

|

$ |

14,704 |

|

|

|

3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

0.20 |

|

|

$ |

0.22 |

|

|

|

-11 |

% |

Earnings per share (diluted) as reported

|

|

$ |

0.47 |

|

|

$ |

0.44 |

|

|

|

6 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

0.21 |

|

|

$ |

0.26 |

|

|

|

-19 |

% |

Earnings per share (diluted) as adjusted

|

|

$ |

0.50 |

|

|

$ |

0.51 |

|

|

|

-1 |

% |

| |

|

(amounts in thousands)

|

|

| |

|

December 31

|

|

|

June 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

Working capital

|

|

$ |

75,839 |

|

|

$ |

73,314 |

|

|

Total assets

|

|

$ |

287,548 |

|

|

$ |

296,150 |

|

|

Long-term debt

|

|

$ |

17,950 |

|

|

$ |

31,629 |

|

|

Other long-term liabilities

|

|

$ |

11,110 |

|

|

$ |

10,380 |

|

|

Shareholders' equity

|

|

$ |

192,934 |

|

|

$ |

177,578 |

|

Three Months Ended December 31, 2023, Results

Net sales for the three months ended December 31, 2023, were $109.0 million, down 15% from the three months ended December 31, 2022, net sales of $128.8 million. Lighting Segment net sales of $64.8 million decreased 3% and Display Solutions Segment net sales of $44.2 million decreased 29% from last year’s second quarter net sales. Net income for the three months ended December 31, 2023, was $5.9 million, or $0.20 per share, compared to $6.4 million or $0.22 per share for the three months ended December 31, 2022. Earnings per share represents diluted earnings per share.

Six Months Ended December 31, 2023, Results

Net sales for the six months ended December 31, 2023, were $232.4 million, down 9% from the six months ended December 31, 2022, net sales of $255.9 million. Lighting Segment net sales of $132.4 million decreased 1% and Display Solutions Segment net sales of $100.0 million decreased 18% from last year’s net sales. Net income for the six months ended December 31, 2023, was $13.9 million, or $0.47 per share, compared to $12.7 million or $0.44 per share for the six months ended December 31, 2022. Earnings per share represents diluted earnings per share.

LSI Industries Fiscal 2024 Second Quarter Results

Balance Sheet

The balance sheet at December 31, 2023, included current assets of $141.4 million, current liabilities of $65.6 million and working capital of $75.8 million, which includes cash of $2.7 million. The current ratio was 2.2 to 1. The balance sheet also included shareholders’ equity of $192.9 million and long-term debt of $18.0 million. It is the Company’s priority to continuously generate sufficient cash flow, coupled with an approved credit facility, to adequately fund operations.

Cash Dividend Actions

The Board of Directors declared a regular quarterly cash dividend of $0.05 per share in connection with the second quarter of fiscal 2024, payable February 13, 2024, to shareholders of record as of the close of business on February 5, 2024. The indicated annual cash dividend rate is $0.20 per share. The Board of Directors has adopted a policy regarding dividends which provides that dividends will be determined by the Board of Directors in its discretion based upon its evaluation of earnings both on a GAAP and non-GAAP basis, cash flow requirements, financial condition, debt levels, stock repurchases, future business developments and opportunities, and other factors deemed relevant by the Board.

Non-GAAP Financial Measures

This press release includes adjustments to GAAP operating income, net income, and earnings per share for the three and six months ended December 31, 2023, and 2022. Operating income, net income, and earnings per share, which exclude the impact of long-term performance based compensation expense, commercial growth initiative expense, and severance and restructuring costs, are non-GAAP financial measures. We exclude these items because we believe they are not representative of the ongoing results of operations of the business. Also included in this press release are non-GAAP financial measures, including Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and before long-term performance based compensation expense, commercial growth initiative expense, and severance and restructuring expense (Adjusted EBITDA), and Free Cash Flow. We believe that these are useful as supplemental measures in assessing the operating performance of our business. These measures are used by our management, including our chief operating decision maker, to evaluate business results, and are frequently referenced by those who follow the Company. These non-GAAP measures may be different from non-GAAP measures used by other companies. In addition, the non-GAAP measures are not based on any comprehensive set of accounting rules or principles. Non-GAAP measures have limitations, in that they do not reflect all amounts associated with our results as determined in accordance with U.S. GAAP. Therefore, these measures should be used only to evaluate our results in conjunction with corresponding GAAP measures. Below is a reconciliation of these non-GAAP measures to net income and earnings per share reported for the periods indicated along with the calculation of EBITDA, Adjusted EBITDA, Free Cash Flow, and Net Debt to Adjusted EBITDA

LSI Industries Fiscal 2024 Second Quarter Results

|

Three Months Ended

|

|

|

|

Six Months Ended

|

|

|

December 31

|

|

|

|

December 31

|

|

|

2023

|

|

|

|

|

|

|

2022

|

|

|

|

|

|

(In thousands, except per share data)

|

|

2023

|

|

|

|

|

|

|

2022

|

|

|

|

|

|

| |

|

|

|

Diluted

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

|

|

|

Diluted

|

|

|

|

|

|

|

Diluted

|

|

| |

|

|

|

EPS |

|

|

|

|

|

|

EPS |

|

Reconciliation of net income to adjusted net income

|

|

|

|

|

|

EPS |

|

|

|

|

|

|

EPS |

|

| $ |

5,906 |

|

|

$ |

0.20 |

|

|

$ |

6,417 |

|

|

$ |

0.22 |

|

Net income as reported

|

|

$ |

13,934 |

|

|

$ |

0.47 |

|

|

$ |

12,678 |

|

|

$ |

0.44 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

625 |

|

|

|

0.02 |

|

|

|

785 |

|

|

|

0.03 |

|

Long-Term Performance Based Compensation

|

|

|

1,599 |

|

|

$ |

0.05 |

|

|

|

1,341 |

|

|

|

0.05 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

- |

|

|

|

- |

|

|

|

399 |

|

|

|

0.01 |

|

Consulting expense: Commercial Growth Initiatives

|

|

|

13 |

|

|

$ |

- |

|

|

|

647 |

|

|

|

0.02 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

34 |

|

|

|

- |

|

|

|

26 |

|

|

|

- |

|

Severance costs and Restructuring costs

|

|

|

290 |

|

|

$ |

0.01 |

|

|

|

38 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(201 |

) |

|

|

(0.01 |

) |

|

|

- |

|

|

|

- |

|

Tax rate difference between reported and adjusted

net income

|

|

|

(732 |

) |

|

$ |

(0.03 |

) |

|

|

- |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

6,364 |

|

|

$ |

0.21 |

|

|

$ |

7,627 |

|

|

$ |

0.26 |

|

Net income adjusted

|

|

$ |

15,104 |

|

|

$ |

0.50 |

|

|

$ |

14,704 |

|

|

$ |

0.51 |

|

|

Three Months Ended

December 31

|

|

(Unaudited; In thousands)

|

|

Six Months Ended

December 31

|

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

Net Income to Adjusted EBITDA |

|

2023

|

|

|

2022

|

|

|

% Change

|

|

| $ |

5,906 |

|

|

$ |

6,417 |

|

|

|

|

|

Net Income as reported

|

|

$ |

13,934 |

|

|

$ |

12,678 |

|

|

|

|

|

| |

1,489 |

|

|

|

1,418 |

|

|

|

|

|

Income Tax

|

|

|

3,827 |

|

|

|

4,177 |

|

|

|

|

|

| |

453 |

|

|

|

1,258 |

|

|

|

|

|

Interest Expense, net

|

|

|

1,019 |

|

|

|

2,046 |

|

|

|

|

|

| |

(29 |

) |

|

|

(55 |

) |

|

|

|

|

Other expense (income)

|

|

|

67 |

|

|

|

158 |

|

|

|

|

|

| $ |

7,819 |

|

|

$ |

9,038 |

|

|

|

-13 |

% |

Operating Income as reported

|

|

$ |

18,847 |

|

|

$ |

19,059 |

|

|

|

-1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2,357 |

|

|

|

2,419 |

|

|

|

|

|

Depreciation and amortization

|

|

|

4,728 |

|

|

|

4,840 |

|

|

|

|

|

| $ |

10,176 |

|

|

$ |

11,457 |

|

|

|

-11 |

% |

EBITDA

|

|

$ |

23,575 |

|

|

$ |

23,899 |

|

|

|

-1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

849 |

|

|

|

1,002 |

|

|

|

|

|

Long-Term Performance Based Compensation

|

|

|

2,174 |

|

|

|

1,553 |

|

|

|

|

|

| |

- |

|

|

|

486 |

|

|

|

|

|

Consulting expense: Commercial Growth Initiatives

|

|

|

19 |

|

|

|

789 |

|

|

|

|

|

| |

35 |

|

|

|

33 |

|

|

|

|

|

Severance costs and Restructuring costs

|

|

|

388 |

|

|

|

46 |

|

|

|

|

|

| $ |

11,060 |

|

|

$ |

12,978 |

|

|

|

-15 |

% |

Adjusted EBITDA

|

|

$ |

26,156 |

|

|

$ |

26,287 |

|

|

|

0 |

% |

| |

10.1 |

% |

|

|

10.1 |

% |

|

|

|

|

Adjusted EBITDA as a percentage of Sales

|

|

|

11.3 |

% |

|

|

10.3 |

% |

|

|

|

|

|

Three Months Ended

December 31

|

|

(Unaudited; In thousands)

|

|

Six Months Ended

December 31

|

|

|

2023

|

|

|

2022

|

|

|

% Change

|

|

Free Cash Flow |

|

2023

|

|

|

2022

|

|

|

% Change

|

|

| $ |

9,276 |

|

|

$ |

9,481 |

|

|

|

NM |

|

Cash flow from operations

|

|

$ |

19,868 |

|

|

$ |

20,064 |

|

|

|

NM |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1,956 |

) |

|

|

(561 |

) |

|

|

|

|

Capital expenditures

|

|

|

(3,349 |

) |

|

|

(994 |

) |

|

|

|

|

| $ |

7,320 |

|

|

$ |

8,920 |

|

|

|

NM |

|

Free cash flow

|

|

$ |

16,519 |

|

|

$ |

19,070 |

|

|

|

NM |

|

|

Net Debt to Adjusted EBITDA Ratio

|

|

December 31

|

|

|

(amounts in thousands)

|

|

2023

|

|

|

2022

|

|

|

Current Maturity of Debt

|

|

$ |

3,571 |

|

|

$ |

3,571 |

|

|

Long-Term Debt

|

|

|

17,950 |

|

|

|

59,250 |

|

|

Total Debt

|

|

$ |

21,521 |

|

|

$ |

62,821 |

|

|

Less: Cash

|

|

|

(2,660 |

) |

|

|

(2,765 |

) |

|

Net Debt

|

|

$ |

18,861 |

|

|

$ |

60,056 |

|

|

Adjusted EBITDA - Trailing Twelve Months

|

|

$ |

51,489 |

|

|

$ |

45,387 |

|

|

Net Debt to Adjusted EBITDA Ratio

|

|

|

0.4 |

|

|

|

1.3 |

|

LSI Industries Fiscal 2024 Second Quarter Results

|

Three Months Ended

December 31

|

|

(Unaudited) |

|

Six Months Ended

December 31

|

|

|

2023

|

|

|

2022

|

|

(In thousands, except per share data)

|

|

2023

|

|

|

2022

|

|

| $ |

109,005 |

|

|

$ |

128,804 |

|

Net sales

|

|

$ |

232,446 |

|

|

$ |

255,873 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

77,438 |

|

|

|

94,646 |

|

Cost of products sold

|

|

|

163,943 |

|

|

|

186,964 |

|

| |

31 |

|

|

|

18 |

|

Severance costs and Restructuring costs

|

|

|

378 |

|

|

|

31 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

31,536 |

|

|

|

34,140 |

|

Gross profit

|

|

|

68,125 |

|

|

|

68,878 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

4 |

|

|

|

15 |

|

Severance costs and Restructuring costs

|

|

|

10 |

|

|

|

15 |

|

| |

- |

|

|

|

486 |

|

Consulting expense: Commercial Growth Initiatives

|

|

|

19 |

|

|

|

789 |

|

| |

23,713 |

|

|

|

24,601 |

|

Selling and administrative costs

|

|

|

49,249 |

|

|

|

49,015 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

7,819 |

|

|

|

9,038 |

|

Operating Income

|

|

|

18,847 |

|

|

|

19,059 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(29 |

) |

|

|

(55 |

) |

Other (income) expense

|

|

|

67 |

|

|

|

158 |

|

| |

453 |

|

|

|

1,258 |

|

Interest expense, net

|

|

|

1,019 |

|

|

|

2,046 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

7,395 |

|

|

|

7,835 |

|

Income before taxes

|

|

|

17,761 |

|

|

|

16,855 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1,489 |

|

|

|

1,418 |

|

Income tax

|

|

|

3,827 |

|

|

|

4,177 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| $ |

5,906 |

|

|

$ |

6,417 |

|

Net income

|

|

$ |

13,934 |

|

|

$ |

12,678 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Weighted Average Common Shares Outstanding |

|

|

|

|

|

|

|

|

| |

29,024 |

|

|

|

28,078 |

|

Basic

|

|

|

28,890 |

|

|

|

27,874 |

|

| |

30,043 |

|

|

|

29,204 |

|

Diluted

|

|

|

29,949 |

|

|

|

28,766 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

Earnings Per Share

|

|

|

|

|

|

|

|

|

| $ |

0.20 |

|

|

$ |

0.23 |

|

Basic

|

|

$ |

0.48 |

|

|

$ |

0.45 |

|

| $ |

0.20 |

|

|

$ |

0.22 |

|

Diluted

|

|

$ |

0.47 |

|

|

$ |

0.44 |

|

LSI Industries Fiscal 2024 Second Quarter Results

| |

|

(amounts in thousands)

|

|

| |

|

Decmber 31

|

|

|

June 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

Current assets

|

|

$ |

141,393 |

|

|

$ |

149,876 |

|

|

Property, plant and equipment, net

|

|

|

26,232 |

|

|

|

25,431 |

|

|

Other assets

|

|

|

119,923 |

|

|

|

120,842 |

|

|

Total assets

|

|

$ |

287,548 |

|

|

$ |

296,149 |

|

| |

|

|

|

|

|

|

|

|

|

Current maturities of long-term debt

|

|

$ |

3,571 |

|

|

$ |

3,571 |

|

|

Other current liabilities

|

|

|

61,983 |

|

|

|

72,991 |

|

|

Long-term debt

|

|

|

17,950 |

|

|

|

31,629 |

|

|

Other long-term liabilities

|

|

|

11,110 |

|

|

|

10,380 |

|

|

Shareholders' equity

|

|

|

192,934 |

|

|

|

177,578 |

|

| |

|

$ |

287,548 |

|

|

$ |

296,149 |

|

Exhibit 99.2

v3.23.4

Document And Entity Information

|

Jan. 25, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

LSI INDUSTRIES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 25, 2024

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

01-13375

|

| Entity, Tax Identification Number |

31-0888951

|

| Entity, Address, Address Line One |

10000 Alliance Road

|

| Entity, Address, City or Town |

Cincinnati

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

45242

|

| City Area Code |

513

|

| Local Phone Number |

793-3200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

LYTS

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000763532

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

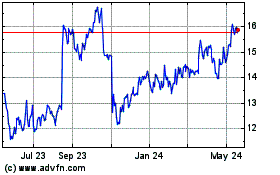

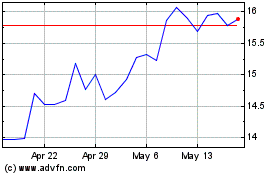

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From Apr 2024 to May 2024

LSI Industries (NASDAQ:LYTS)

Historical Stock Chart

From May 2023 to May 2024