UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

Filed

by the Registrant ☒

Filed

by a Party other than the Registrant ☐

Check

the appropriate box:

| |

☒ |

Preliminary

Proxy Statement |

| |

|

|

| |

☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

|

| |

☐ |

Definitive

Proxy Statement |

| |

|

|

| |

☐ |

Definitive

Additional Materials |

| |

|

|

| |

☐ |

Soliciting

Material Under Rule 14a-12 |

Microbot

Medical Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

| Payment

of Filing Fee (Check the appropriate box): |

| |

|

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

MICROBOT

MEDICAL INC.

288

Grove Street, Suite 388

Braintree,

MA 02184

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON

April 11, 2025

To

the Stockholders of Microbot Medical Inc.:

A

special meeting of stockholders (the “Special Meeting”) of Microbot Medical Inc. (“Microbot,” the “Company,”

“us,” “we” or “our”) will be held on April 11, 2025 at 11:00 a.m., Eastern time, at 175

Derby Street, Bld 27, Hingham, MA 02043. At the Special Meeting, you will be asked to consider and vote on:

| ● | the

issuance of Series I preferred investment options and placement agent options issued in

connection therewith, and shares of common stock underlying such options, issued

in connection with an offering and sale of securities of the Company that was consummated

on February 11, 2025, for purposes of complying with Nasdaq listing rule 5635(d) and satisfying

our contractual obligations to the holders of such options (the “Issuance Proposal”); |

| ● | an

amendment to the Company’s Certificate of Incorporation, as amended and/or restated

from time to time (the “Certificate of Incorporation”), to increase the total

number of shares of common stock authorized for issuance (the “Increase Proposal”);

and |

| ● | to

approve one or more adjournments of the Special Meeting, if necessary or appropriate, to

solicit additional proxies in favor of the Issuance Proposal and/or the Increase Proposal,

if there are not sufficient votes at the Special Meeting to approve and adopt the Issuance

Proposal or the Increase Proposal (the “Adjournment Proposal”). |

Action

will also be taken on any other matters that properly come before the Special Meeting. If you are a stockholder of record at the close

of business on February 10, 2025 (the “Record Date”), you are entitled to vote at the meeting or at any adjournment or postponement

of the meeting.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSALS IN THE PROXY STATEMENT.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE SPECIAL MEETING TO BE HELD ON APRIL 11, 2025, AT 11:00 A.M., EASTERN

TIME.

As

permitted by the “Notice and Access” rules of the Securities and Exchange Commission (the “SEC”), the Notice

of Special Stockholder Meeting, our Proxy Statement and a form of the proxy card are available online at www.microbotmedical.com.

The

accompanying Proxy Statement and Form of Proxy are dated [__], 2025. On or about [__], 2025, we commenced mailing to our stockholders

a Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”) that contains instructions on

how stockholders may access and review all of the proxy materials and how to vote. Also, on or about [__], 2025, we commenced mailing

printed copies of the proxy materials to stockholders that previously requested printed copies. If you received a Notice of Internet

Availability by mail, you will not receive a printed copy of the proxy materials in the mail unless you request a copy. If you received

a Notice of Internet Availability by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions

for requesting such materials included in the Notice of Internet Availability.

All

stockholders of the Company are cordially invited to attend the Special Meeting. To assure your representation at the Special Meeting,

however, you are urged to mark, sign and return the proxy as promptly as possible. If you later desire to revoke your proxy for any reason,

you may do so in the manner provided in the accompanying Proxy Statement. Your shares of the Company’s common stock will be voted

in accordance with the instructions you give in your proxy. You will find more instructions on how to vote in the accompanying Proxy

Statement and the Notice of Internet Availability.

You

may submit a proxy for your shares by mail, email or via the internet no later than [__] p.m., Eastern time, on April [__], 2025 (as

directed on the proxy card). If you choose to submit your proxy card by mail, the Company has enclosed an envelope for your use, which

is prepaid if mailed in the United States. If you attend the Special Meeting and your shares are registered in your name, you may also

vote in person at the Special Meeting until voting is closed. If your shares are held through a bank, broker or other nominee, because

you are not the stockholder of record, you may not vote your shares in person at the Special Meeting unless you request and obtain a

valid proxy in your name from your broker, bank or other nominee.

Accompanying

this Notice of Special Meeting to the Company’s stockholders are (a) the Proxy Statement, and (b) a Form of Proxy (or a voting

instruction form if you hold shares of common stock through a broker or other intermediary).

YOUR

VOTE IS IMPORTANT REGARDLESS OF THE NUMBER OF SHARES YOU OWN.

The

enclosed materials require the Company’s stockholders to make important decisions with respect to the Company. Please carefully

read the accompanying Proxy Statement, as these documents contain detailed information relating to the Company. If you are in doubt as to how to make these decisions, please consult your financial, legal or other professional advisors.

NEITHER

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES REGULATORY AGENCY HAS APPROVED OR DISAPPROVED ANY OF THE

MATTERS TO BE ACTED UPON AT THE SPECIAL MEETING, PASSED UPON THE MERITS OR FAIRNESS OF SUCH MATTERS OR PASSED UPON THE ADEQUACY OR ACCURACY

OF THE DISCLOSURE IN THIS PROXY STATEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| |

By

Order of the Board of Directors, |

|

| |

|

|

| |

/s/

Harel Gadot |

|

| |

Harel

Gadot |

|

| |

Chairman

of the Board of Directors |

|

| |

|

|

| [__],

2025 |

|

|

MICROBOT

MEDICAL INC.

288

Grove Street, Suite 388

Braintree,

MA 02184

PROXY

STATEMENT

SPECIAL

MEETING OF STOCKHOLDERS

April

11, 2025

The

special meeting of stockholders (the “Special Meeting”) of Microbot Medical Inc. (“Microbot,” the “Company,”

“us,” “we” or “our”) will be held on April 11, 2025 at 11:00 a.m., Eastern time, at 175

Derby Street, Bld 27, Hingham, MA 02043.

At

the Special Meeting, you will be asked to consider and vote on:

| ● | for

purposes of complying with Nasdaq listing rule 5635(d), the issuance of Series I preferred

investment options and placement agent options issued in connection therewith, and

shares of common stock underlying such options, issued in connection with an offering

and sale of securities of the Company that was consummated on February 11, 2025, for purposes

of complying with Nasdaq listing rule 5635(d) and satisfying our contractual obligations

to the holders of such options (the “Issuance Proposal”); |

| ● | an

amendment to the Company’s Certificate of Incorporation, as amended and/or restated

from time to time (the “Certificate of Incorporation”), to increase the total

number of shares of common stock authorized for issuance (the “Increase Proposal”);

and |

| ● | to

approve one or more adjournments of the Special Meeting, if necessary or appropriate, to

solicit additional proxies in favor of the Issuance Proposal and/or the Increase Proposal,

if there are not sufficient votes at the Special Meeting to approve and adopt the Issuance

Proposal or the Increase Proposal (the “Adjournment Proposal”). |

Action

will also be taken on any other matters that properly come before the Special Meeting. If you are a stockholder of record at the close

of business on February 10, 2025 (the “Record Date”), you are entitled to vote at the meeting or at any adjournment or postponement

of the meeting.

Our

board of directors (the “Board of Directors”) is soliciting your proxy to vote your shares of common stock at the Special

Meeting or any adjournments of that meeting. This Proxy Statement, which was prepared by our management for the Board of Directors, contains

information about the matters to be considered at the Special Meeting or any adjournments or postponements of the Special Meeting. All

proxies will be voted in accordance with the instructions they contain. If you do not specify your voting instructions on the proxy you

submit for the Special Meeting, it will be voted in accordance with the recommendation of the Board of Directors. You may revoke your

proxy at any time before it is exercised at the Special Meeting by giving our Secretary written notice to that effect. This Proxy Statement

is first being sent to stockholders on or about [__], 2025.

QUESTIONS

AND ANSWERS ABOUT THE SPECIAL MEETING

What

is being considered at the Special Meeting?

The

proposals to be voted on at the Special Meeting are:

| ● | the

issuance of Series I preferred investment options and placement agent options issued in

connection therewith, and shares of common stock underlying such options, issued

in connection with an offering and sale of securities of the Company that was consummated

on February 11, 2025, for purposes of complying with Nasdaq listing rule 5635(d) and satisfying

our contractual obligations to the holders of such options (the “Issuance Proposal”); |

| ● | an

amendment to the Company’s Certificate of Incorporation, as amended and/or restated

from time to time (the “Certificate of Incorporation”), to increase the total

number of shares of common stock authorized for issuance (the “Increase Proposal”);

and |

| ● | to

approve one or more adjournments of the Special Meeting, if necessary or appropriate, to

solicit additional proxies in favor of the Issuance Proposal and/or the Increase Proposal,

if there are not sufficient votes at the Special Meeting to approve and adopt the Issuance

Proposal or the Increase Proposal (the “Adjournment Proposal”). |

In

addition, our management will address such other business as may properly come before the meeting or any adjournment thereof.

The

Board of Directors does not intend to present to the Special Meeting any matters not referred to in this Proxy Statement. If any proposal

not set forth in this Proxy Statement should be presented for action at the Special Meeting and is a matter which should come before

the Special Meeting, it is intended that the shares represented by proxies will be voted with respect to such matters in accordance with

the judgment of the persons voting them.

When

and where is the Special Meeting going to be held?

The

Special Meeting will be held on April 11, 2025 at 11:00 a.m., Eastern time, at 175 Derby Street, Bld 27, Hingham, MA 02043.

All stockholders of record are entitled to attend the Special Meeting in person, and no stockholder will be able to attend the Special

Meeting virtually.

Why

did I receive a Notice of Internet Availability instead of paper copies of the proxy materials?

We

are using the SEC’s Notice and Access model (“Notice and Access”), which allows us to deliver proxy materials over

the internet, as the primary means of furnishing proxy materials. We believe Notice and Access provides stockholders with a convenient

method to access the proxy materials and vote, while allowing us to conserve natural resources and reduce the costs of printing and distributing

the proxy materials. On or about [__], 2025, we began mailing to stockholders a Notice of Internet Availability containing instructions

on how to access our proxy materials on the internet and how to vote online. The Notice of Internet Availability is not a proxy card

and cannot be used to vote your shares. If you received a Notice of Internet Availability this year, you will not receive paper copies

of the proxy materials unless you request the materials by following the instructions on the Notice of Internet Availability.

How

many votes must be present to hold the Special Meeting?

Your

shares are counted as present at the Special Meeting if you attend the meeting and vote at the Special Meeting or if you properly return

a proxy by mail. For us to conduct our meeting, a majority of our outstanding shares of common stock as of the Record Date must be present

at the meeting, in person or by proxy. This is referred to as a quorum. On the Record Date, we had 28,641,187 shares of common

stock outstanding.

Who

can vote at the Special Meeting?

You

may vote if you owned our common stock as of the close of business on the Record Date. Each share of our common stock is entitled to

one vote.

What

should I do if I receive more than one proxy card or other set of proxy materials from the Company?

If

you hold your shares in multiple accounts or registrations, or in both registered and street name, you will receive a proxy card for

each account. Please sign, date, and return all proxy cards you receive from the Company. Only your latest dated proxy for each account

will be voted. We recommend that you contact your broker and/or our transfer agent, Computershare (www.computershare.com) to consolidate

as many accounts as possible under the same name and address.

What

is the difference between holding shares as a record holder and as a beneficial owner?

If

your shares are registered in your name with the Company’s transfer agent, Computershare, you are the “record holder”

of those shares. If you are a record holder, these proxy materials will be provided directly to you.

If

your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner”

of those shares, which are held in “street name.” If your shares are held in street name, these proxy materials have been

forwarded to you by that organization. As the beneficial owner, you have the right to instruct such organization on how to vote your

shares.

How

do I vote?

All

Company stockholders of record are invited to attend the Special Meeting in person. Any stockholder that attends the meeting in person

may deliver a completed proxy card in person or vote by completing a ballot, which will be available at the meeting. However, each stockholder

intending to vote in person at the Special Meeting should note that if his, her or its shares are held in the name of a bank, broker

or other nominee, such stockholder must obtain a legal proxy, executed in his, her or its favor, from the holder of record to be able

to vote at the Special Meeting. Stockholders should allow enough time prior to the Special Meeting to obtain this proxy from the holder

of record, if needed.

Whether

you hold shares directly as a registered stockholder of record or beneficially in street name, you may vote without attending the Special

Meeting. You may vote by granting a proxy or, for shares held in street name, by submitting voting instructions to your broker or nominee.

In most cases, you will be able to do this by telephone, by using the Internet or by mail. Please refer to these proxy materials

and on your proxy card. For shares held in street name, the voting instruction card will be included in the materials forwarded by the

broker or nominee. If you have telephone or Internet access, you may submit your proxy by following the instructions with your proxy

materials and on your proxy card. You may submit your proxy by mail by signing your proxy card or, for shares held in street name, by

following the voting instructions with your proxy materials and on your proxy card. You may submit your proxy by mail by signing your

proxy card or, for shares held in street name, by following the voting instruction card included in the materials forwarded by your stockbroker

or nominee and mailing it in the enclosed, postage paid envelope. If you provide specific voting instructions, your shares will be voted

as you have instructed.

The

shares voted electronically or represented by the proxy cards received, properly marked, dated, signed and not revoked, will be voted

at the Special Meeting.

Use

of cameras, recording devices, computers and other electronic devices, such as smart phones and tablets, will not be permitted at the

Special Meeting. Please allow ample time for check-in. Parking is limited.

Will

my shares be voted if I do not provide my proxy?

Under

applicable rules, if you do not give instructions to your brokerage firm, it will still be able to vote your shares with respect to certain

“discretionary” items, but it will not be allowed to vote your shares with respect to certain “non-discretionary”

items. In the event that a broker, bank, or other agent indicates on a proxy that it does not have discretionary authority to vote certain

shares on a “non-discretionary” proposal, then those shares will be treated as broker non-votes. There are no “discretionary”

proposals being presented at the Special Meeting. Accordingly the Company does not expect that any broker non-votes will occur, but if

broker non-votes occurred, they will have no effect on the Issuance Proposal or the Increase Proposal. Please see “What vote

is required to approve the proposal to be considered at the Special Meeting?” for information regarding the vote required

to approve the proposals being considered at this Special Meeting.

If

you are a record holder, your shares will not be voted if you do not provide a proxy or vote at the Special Meeting.

Can

I change my vote?

Yes.

A proxy may be revoked at any time prior to the voting at the Special Meeting by submitting a later dated proxy (including a proxy authorization

submitted electronically via the internet prior to the deadline for submitting a proxy via the internet), by sending a properly signed

written notice of such revocation to the Company’s Secretary in advance of the Special Meeting or by attending the Special Meeting

and voting. If your shares are held through a bank, broker or other nominee, you may change your voting instructions by submitting a

later dated voting instruction form to your broker, bank or other nominee or fiduciary, or if you obtained a legal proxy from your broker,

bank nominee or fiduciary giving you the right to vote your shares, by attending the Special Meeting and voting.

What

if I return my proxy card but do not include voting instructions?

Proxy

cards of record holders that are signed and returned but do not include voting instructions will be voted:

“FOR”

the Issuance Proposal;

“FOR”

the Increase Proposal; and

“FOR”

the Adjournment Proposal.

Under

applicable rules, and as further described under “Will my shares be voted if I do not provide my proxy?”, if you do

not give instructions to your brokerage firm on any particular proposal, it will not vote your shares with respect to such proposal.

What

vote is required to approve the proposals to be considered at the Special Meeting?

Proposal

1 –Exercise Proposal

The

Exercise Proposal will be approved if the number of votes properly cast FOR the proposal at the Special Meeting exceeds the number of

votes cast AGAINST the proposal. Abstentions will have no effect on the voting of the Exercise Proposal.

The

Exercise Proposal is a non-routine matter. Therefore, if your shares are held by your brokerage firm in street name and you do not timely

provide voting instructions with respect to your shares, your brokerage firm cannot vote your shares on the Exercise Proposal. Shares

held in street name by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote

the shares on the Exercise Proposal will not be counted as votes cast. As a result, such “broker non-votes” will have no

effect on the voting on the Exercise Proposal.

Proposal

2 – Increase Proposal

The

Increase Proposal will be approved if the number of votes properly cast FOR the proposal at the Special Meeting exceeds the number of

votes cast AGAINST the proposal. Abstentions will have no effect on the voting of the Exercise Proposal.

The

Increase Proposal is a non-routine matter. Therefore, if your shares are held by your brokerage firm in street name and you do not timely

provide voting instructions with respect to your shares, your brokerage firm cannot vote your shares on the Increase Proposal. Shares

held in street name by banks, brokerage firms or other nominees who indicate on their proxies that they do not have authority to vote

the shares on the Increase Proposal will not be counted as votes cast. As a result, such “broker non-votes” will have no

effect on the voting on the Increase Proposal.

Proposal

3 – Adjournment Proposal

The

Adjournment Proposal will be approved if the number of votes properly cast FOR the proposal at the Special Meeting exceeds the number

of votes cast AGAINST the proposal; provided, that in the absence of a quorum, the affirmative vote of the holders of a majority of the

shares represented thereat is required for the Adjournment Proposal. Abstentions will have no effect on the voting of the Adjournment

Proposal (assuming the presence of a quorum), or, in the absence of a quorum, will have the same effect as a vote “AGAINST”

the Adjournment Proposal.

The

Adjournment Proposal is a non-routine matter. Therefore, if your shares are held by your brokerage firm in street name and

you do not timely provide voting instructions with respect to your shares, your brokerage firm cannot vote your shares on the Adjournment

Proposal. Shares held in street name by banks, brokerage firms or other nominees who indicate on their proxies that they do not have

authority to vote the shares on the Adjournment Proposal will not be counted as votes cast. As a result, such “broker non-votes”

will have no effect on the voting on the Adjournment Proposal.

When

proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Special Meeting in accordance

with the instructions of the stockholder. If no specific instructions are given, the shares will be voted in accordance with the recommendations

of the Board as described herein. If any matters not described in the proxy statement are properly presented at the Special Meeting,

the proxy holders will use their own judgment to determine how to vote your shares. If the Special Meeting is postponed or adjourned,

the proxy holders can vote your shares on the new meeting date as well, unless you have revoked your proxy instructions, as described

above under “Can I change my vote?”

How

will votes be counted?

Each

share of common stock voted will be counted as one vote according to the instructions contained on a proper proxy card, whether submitted

virtually at the Special Meeting, by mail, internet, or in accordance with the instructions provided by your broker. With respect to

all proposals, shares will not be voted in favor of the matter and will not be counted as voting on the matter if they are broker non-votes.

Assuming the presence of a quorum, abstentions and broker non-votes for a particular proposal will not be counted as votes cast to determine

the outcome of a particular proposal.

Who

will count the votes?

Representatives

of Computershare, the transfer agent for our common stock, will tabulate the votes.

Will

my vote be kept confidential?

Yes,

your vote will be kept confidential, and we will not disclose your vote, unless we are required to do so by law (including in connection

with the pursuit or defense of a legal or administrative action or proceeding).

How

does the Board of Directors recommend that I vote on the proposals?

The

Board of Directors recommends that you vote:

“FOR”

the Issuance Proposal;

“FOR”

the Increase Proposal; and

“FOR”

the Adjournment Proposal.

Where

can I find the voting results?

We

will report the voting results in a Current Report on Form 8-K within four business days after the conclusion of the Special Meeting.

How

can I access the proxy materials electronically?

Copies

of the Notice of Special Meeting and Proxy Statement, as well as other materials filed by the Company with the SEC, are available without

charge on the Company’s corporate website at www.microbotmedical.com or upon written request to the Company at Microbot Medical

Inc., 288 Grove Street, Suite 388, Braintree, MA 02184. You can elect to receive future annual reports, proxy statements and other proxy

materials electronically by marking the appropriate box on your proxy card or vote instruction form or by following the instructions

provided if you submit a proxy via the internet.

Who

pays the costs of soliciting these proxies?

We

will bear the costs of solicitation of proxies. The Company has engaged Sodali & Co. LLC to assist in the solicitation of proxies.

The Company has agreed to pay Sodali & Co. LLC its customary fees and expenses. In addition to solicitations by mail, our directors,

officers, and regular employees may solicit proxies by telephone, email and personal communication. No additional remuneration will be

paid to any director, officer, or employee of the Company for such solicitation. We will request brokers, custodians, and fiduciaries

to forward proxy soliciting material to the owners of shares of our common stock that they hold in their names. To the extent necessary

to assure sufficient representation, our officers and regular employees may request the return of proxies personally, by telephone or

email. The extent to which this will be necessary depends entirely upon how promptly proxies are received, and stockholders are urged

to send in their proxies without delay.

Who

can help answer my questions?

If

you have any additional questions about the Special Meeting, any proposal, how to submit your proxy, or if you need additional copies

of this Proxy Statement or the proxy card or voting instructions, you should contact the Company or Sodali & Co. LLC:

| ● | Microbot

Medical Inc., 288 Grove Street, Suite 388, Braintree, MA 02184, or by phone at (781) 875-3605. |

| ● | Sodali

& Co. LLC by phone at (800) 662-5200 or mbot@investor.sodali.com. |

What

if I vote for some but not all of the proposals?

Shares

of common stock held of record and represented by proxies received by the Company (whether received through the return of the proxy card,

received by email or via the internet) where the stockholder has provided voting instructions with respect to the proposals described

in this Proxy Statement will be voted in accordance with the voting instructions so made. If your proxy card is properly executed and

returned but does not contain voting instructions as to one or more of the proposals to be voted upon at the Special Meeting, or if you

give your proxy via the internet without indicating how you want to vote on each of the proposals to be voted upon at the Special Meeting,

your shares will be voted “FOR” each proposal.

All

of the proposals to be considered at the Special Meeting are “non-discretionary” and if you do not instruct your broker how

to vote with respect to such proposals, your broker will not have discretion to vote your shares with respect to those proposals and

those votes will be counted as “broker non-votes.” Please see “What vote is required to approve the proposals

to be considered at the Special Meeting?” for information regarding the vote required to approve the proposals being considered

at this Special Meeting and the treatment of broker non-votes.

HOUSEHOLDING

OF SPECIAL MEETING MATERIALS

Some

banks, brokers, and other nominee record holders may be participating in the practice of “householding” proxy statements

and annual reports. This means that only one copy of our Proxy Statement may have been sent to multiple stockholders in your household

unless we have received contrary instructions from one or more stockholders. We will promptly deliver a separate copy to you if you contact

us at the following address or telephone number: Microbot Medical Inc., 288 Grove Street, Suite 388, Braintree, MA 02184, tel.: (781)

875-3605. If you want to receive separate copies of the Proxy Statement in the future, or if you are receiving multiple copies and would

like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact

us at the above address.

PROPOSAL

1

TO AUTHORIZE, THE ISSUANCE OF SERIES I PREFERRED

INVESTMENT OPTIONS AND PLACEMENT AGENT OPTIONS, AND SHARES OF OUR COMMON STOCK UNDERLYING SUCH OPTIONS, ISSUED IN CONNECTION

WITH AN OFFERING AND SALE OF SECURITIES OF THE COMPANY THAT WAS CONSUMMATED ON FEBRUARY 11, 2025, FOR PURPOSES OF COMPLYING WITH NASDAQ

LISTING RULE 5635(D) AND SATISFYING OUR OBLIGATIONS TO THE HOLDERS OF SUCH OPTIONS

On

February 9, 2025, we entered into a securities purchase agreement with investors (the “Securities Purchase Agreement”), pursuant

to which we agreed to issue and sell, in a registered direct offering priced at-the-market under the rules of The Nasdaq Stock Market,

an aggregate of 6,103,289 shares of our common stock at an offering price of $2.13 per share. In a concurrent private placement, we agreed

to issue to the same investors Series I preferred investment options to purchase up to 12,206,578 shares of our common stock at an exercise

price of $2.13 per share. Each series I preferred investment option was exercisable commencing on or after the later of (i) the date

on which the amendment to the Company’s articles of incorporation that increases the number of authorized shares of common stock

to an amount of shares of common stock sufficient for the exercise in full of the Series I preferred investment options is filed and

accepted with the State of Delaware law (such date, the “Authorized Share Increase Date”) and (ii) the date on which approval

as may be required by the applicable rules and regulations of the Nasdaq Stock Market (or any successor entity) from the stockholders

of the Company with respect to the issuance of all the series I preferred investment options and the shares of common stock issuable

upon the exercise thereof, is received and deemed effective under Delaware (the “Stockholder Approval Date”) and will expire

two years from the initial exercise date. The offerings closed on January 11, 2025, and we raised approximately $11.8 million in aggregate

gross proceeds from such offerings, after deducting placement agent fees and expenses and related offering expenses. We also issued at

closing to the placement agent or its designees, options to purchase 305,164 shares of our common stock, which are exercisable on or

after the later of (i) the Authorized Share Increase Date and (ii) the Stockholder Approval Date, will expire two years from the initial

exercise date (but no later than February 9, 2030), and have an exercise price of $2.6625 per share (the “Placement Agent Options”

and, with the Series I preferred investment options, the “Options”).

Accordingly,

we are seeking stockholder approval of the issuance in accordance with the terms and conditions of the Securities Purchase Agreement

and Nasdaq Rule 5635(d), of 20% or more of our outstanding shares of common stock including the issuance of the Series I preferred

investment options and the Placement Agent Options, and subject to the terms of the applicable Options, any resulting issuance

of the shares of common stock underlying the Options inclusive of the adjustment provisions of the Options.

The

following summary of certain terms and provisions of the Series I preferred investment options and the Placement Agent Options, as

applicable, is not complete and is subject to and qualified in its entirety by the provisions of the forms of Series I preferred

investment option and Placement Agent Option, which were filed as exhibits to the Company’s Form 8-K filed with the SEC

on February 11, 2025.

Exercise.

The Series I preferred investment options are exercisable

at any time after the Authorized Share Increase Date and the Stockholder Approval Date, and will expire two years from the initial exercise

date. The Placement Agent Options are exercisable at any time after the Authorized Share Increase Date and the Stockholder Approval

Date, and will expire two years from the initial exercise date (but no later than February 9, 2030). Each of the Options will be

exercisable, at the option of each holder, in whole or in part by delivering to us a duly executed exercise notice accompanied by payment

in full in immediately available funds for the number of shares of common stock subscribed for upon such exercise (except in the case

of a cashless exercise as discussed below).

Cashless Exercise.

If a registration statement registering the issuance

of the shares of common stock underlying the Options under the Securities Act is not effective or available, the holder may, in its sole

discretion, elect to exercise the Options through a cashless exercise, in which case the holder would receive upon such exercise the

net number of shares of common stock determined according to the formula set forth in the Options, as applicable.

Stock

Splits; Adjustments. The exercise price and share number of the Options will be subject to proportional adjustments upon the occurrence

of any stock split, stock dividend, stock combination and/or similar transactions.

Fractional

Shares. No fractional shares of common stock will be issued in connection with the exercise of an Option. In lieu of fractional shares,

we will pay the holder, at our election, an amount in cash equal to the fractional amount multiplied by the exercise price,

or round up to the next whole share.

Exercise

Limitation. A holder will not have the right to exercise any portion of the Options if the holder (together with its affiliates)

would beneficially own in excess of 4.99% (or, upon election by a holder prior to the issuance of any warrants, 9.99%) of the number

of shares of common stock outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in

accordance with the terms of the Options. However, any holder may increase or decrease such percentage to any other percentage not in

excess of 9.99%, upon at least 61 days’ prior notice from the holder to us with respect to any increase in such percentage.

Exercise

Price. The exercise price of each Series I preferred investment option is $2.13 per share, and of each Placement Agent Option is

$2.6625 per share.

Stockholder

Approval. Pursuant to the terms and conditions of the Securities Purchase Agreement and under Nasdaq listing rules, the Options

may not be exercised unless and until we obtain the approval of our stockholders. There is no guarantee that approval of the Issuance

Proposal will ever be obtained. If we are unable to obtain approval of the Issuance Proposal, the Options may not be exercised and will

have substantially less value. If the Company does not obtain approval of the Issuance Proposal at the Special Meeting, the Company shall

call a meeting every ninety days thereafter to seek such approval until the earlier of the date on which approval of both the Issuance

Proposal and the Increase Proposal are obtained or the Series I preferred investment option are no longer outstanding or, in the

case of the Placement Agent Options two years from the initial exercise date (but no later

than February 9, 2030). As a result, we will incur substantial cost, and management will devote substantial time and attention, in attempting

to obtain such approvals.

Transferability.

Subject to applicable laws, the Options may be offered for sale, sold, transferred or assigned without our consent.

Exchange

Listing. We do not intend to apply for the listing of the Options on any stock exchange. Without an active trading market, the liquidity

of the Options will be limited.

Rights

as a Stockholder. Except as otherwise provided in the Options or by virtue of such holder’s ownership of our shares of common

stock, the holder of an Option does not have the rights or privileges of a holder of our shares of common stock, including any voting

rights, until the holder exercises the Option.

Registration

Rights Agreement. The holders of the Options were granted certain customary registration rights.

Fundamental

Transaction. In the event of a fundamental transaction, as described in the Options, and generally including, with certain exceptions,

any reorganization, recapitalization or reclassification of our shares of common stock, the sale, transfer or other disposition of all

or substantially all of our properties or assets, our consolidation or merger with or into another person, the acquisition of more than

50% of our outstanding shares of common stock, or any person or group becoming the beneficial owner of 50% of the voting power represented

by our outstanding shares of common stock, the holders of the Options will be entitled to receive upon exercise thereof the kind and

amount of securities, cash or other property that the holders would have received had they exercised the warrants immediately prior to

such fundamental transaction.

Governing

Law. The Options are governed by New York law.

Purpose

of the Increase Proposal

The

stockholder approval requirement for issuances of the Series I preferred investment options and the Placement Agent Options,

and the shares of common stock underlying such Options, was incorporated into the Securities Purchase Agreement and Options in order

to comply with Nasdaq Listing Rule 5635(d)(2).

Since

the issuance of the Series I preferred investment options and the Placement Agent Options was a private placement instead of a public

offering, and since the total number of shares underlying the Options and the potential issuance of the shares underlying the Options,

is deemed a “20% Issuance,” the Company is required to obtain the approval of its stockholders in connection with the Offering

in order to comply with Nasdaq Listing Rule 5635(d) and satisfy our closing obligations with the holders of the Series I preferred investment

options. A “20% Issuance” is a transaction, other than a public offering, involving the sale, issuance or potential issuance

by the Company of common stock (or securities convertible into or exercisable for common stock) which, alone or together with sales by

officers, directors or substantial stockholders of the Company, equals 20% or more of the common stock or 20% or more of the voting power

outstanding before the issuance.

In

order to comply with Nasdaq Listing Rule 5635(d) and satisfy our closing obligations with the holders of the Series I preferred investment

options, and permit the holders to exercise the Options, the stockholders of the Company need to approve the issuance of the Options

and the shares of common stock underlying the Options issuable upon exercise of the Options together with the additional shares of our

Common Stock that may become issuable upon adjustments provided for under the Options and the provisions of the Options indicated above.

Until the Company obtains approval for the Issuance Proposal in order to comply with Nasdaq Listing Rule 5635(d) and satisfy our closing

obligations with the holders of the Series I preferred investment options, the Options are not exercisable.

Moreover,

if this Issuance Proposal does not pass, we will be required to seek approval again from stockholders at future special or annual meetings

every ninety days until passed, and the value of the Options will continue to be impaired.

Potential

Adverse Effects of the Approval of the Issuance Proposal

Following

approval by the stockholders of this proposal, existing stockholders will suffer dilution in their ownership interests in the future

as a result of the potential issuance of shares of common stock upon exercise of the Options. Assuming the full exercise of the Series

I preferred investment options at the $2.13 per share exercise price and the Placement Agent Options at the $2.6625 per share exercise

price, we may issue an aggregate of up to 12,511,742 shares of common stock, and the percentage ownership interest of our existing stockholders

would be correspondingly reduced. Such issuances will also significantly dilute the voting power of a person seeking control of the Company,

thereby deterring, or rendering more difficult a merger, tender offer, proxy contest or an extraordinary corporate transaction opposed

by the Company. The stockholders do not have preemptive rights to subscribe to additional shares that may be issued by the Company in

order to maintain their proportionate ownership of the common stock.

The

sale into the public market of these shares could materially and adversely affect the market price of our common stock.

Potential

Effects of Non-Approval of this Proposal

The

Company is not seeking the approval of stockholders to authorize its entry into the transactions described above, as the Company has

already done so and such documents are already binding obligations of the Company. The failure of stockholders to approve this Issuance

Proposal will not negate the existing terms of the transactions or the relevant documents, which will remain binding on the Company.

If

this Issuance Proposal is not approved by the stockholders, the Options would not be exercisable and all obligations to facilitate the

issuances of Options and the shares of our common stock underlying the Options would remain in effect and may result in obligations

to which the Company may not have the resources to satisfy. Furthermore, the Company’s satisfaction of any such potential

obligations could materially impair the Company’s working capital. The inability to exercise the Options into common stock may

also materially adversely affect the Company’s future ability to raise equity or debt capital from third parties on attractive

terms, if at all, and also risks impairing the operations, assets and ongoing viability of the Company.

If

the Company does not obtain approval of the Issuance Proposal at the Special Meeting, the Company shall call a meeting every ninety days

thereafter to seek such approval until the earlier of the date on which approval of both the Issuance Proposal and the Increase Proposal

are obtained or the Series I preferred investment option are no longer outstanding or, in the case of the Placement Agent Options

two years from the initial exercise date (but no later than February 9, 2030). As a result,

we will incur substantial cost, and management will devote substantial time and attention, in attempting to obtain such approvals.

Interest

of Certain Persons in Matters to Be Acted Upon

No

director or executive officer has any substantial interest, direct or indirect, by security holdings or otherwise, in this Proposal that

is not shared by all of our other stockholders.

Vote

Required

Approval

of this Proposal requires the affirmative vote of the majority of the votes cast on this Proposal. Abstentions and broker non-votes are

not considered votes cast and will have no effect on the outcome of this Proposal.

Board of Directors

Recommendation

OUR

BOARD RECOMMENDS A VOTE “FOR” APPROVAL, THE ISSUANCE OF OPTIONS AND SHARES OF OUR COMMON STOCK UNDERLYING THE OPTIONS, ISSUED

IN CONNECTION WITH AN OFFERING AND SALE OF SECURITIES OF THE COMPANY THAT WAS CONSUMMATED ON FEBRUARY 11, 2025, BECAUSE THE TERMS OF

THE SECURITIES REQUIRE US TO SEEK SUCH STOCKHOLDER APPROVAL AND FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D). APPROVAL

BY STOCKHOLDERS OF THIS ISSUANCE PROPOSAL IS NOT CONDITIONED UPON APPROVAL OF THE INCREASE PROPOSAL OR THE ADJOURNMENT PROPOSAL; CONVERSELY,

APPROVAL BY STOCKHOLDERS OF THE INCREASE PROPOSAL AND THE ADJOURNMENT PROPOSAL ARE NOT CONDITIONED UPON APPROVAL OF THIS ISSUANCE PROPOSAL.

PROPOSAL

2

AMENDMENT

OF THE COMPANY’S CERTIFICATE OF INCORPORATION TO

INCREASE

THE AMOUNT OF COMMON STOCK AUTHORIZED

Background

The

Certificate of Incorporation currently authorizes the issuance of a total of 61,000,000 shares of capital stock. Of such shares, 60,000,000

are designated as common stock and 1,000,000 are designated as undesignated preferred stock. As of the Record Date, there were 28,641,187

shares of common stock issued and outstanding, and no shares of preferred stock issued or outstanding. Our Board of Directors may establish

the rights and preferences of the undesignated preferred stock from time to time.

In

addition to the 28,641,187 shares of common stock outstanding, as of the Record Date, the Company had reserved for issuance:

| ● | 3,002,145

shares of our common stock issuable upon the exercise of outstanding stock options granted

to employees, directors and consultants, with exercise prices ranging from approximately

$0.005 to $15.75 and having a weighted-average exercise price of $4.19 per share; |

| ● | 156,585

shares of our common stock reserved for future grant under our 2017 Equity Incentive Plan;

and |

| ● | 147,217

shares of our common stock reserved for future grant under our 2020 Omnibus Performance Award

Plan. |

| ● | 51,125

shares of our common stock issuable upon the exercise of outstanding warrants expiring in

October 2027, at an exercise price per share of $6.1125; |

| ● | 32,778

shares of our common stock issuable upon the exercise of outstanding warrants expiring in

November 2026, at an exercise price per share of $2.75; |

| ● | 60,476

shares of our common stock issuable upon the exercise of outstanding warrants expiring in

November 2026, at an exercise price per share of $2.75; |

| ● | 35,088

shares of our common stock issuable upon the exercise of outstanding warrants expiring in

November 2026, at an exercise price per share of $2.6719; |

| ● | 1,075,165

shares of our common stock issuable upon the exercise of outstanding series E preferred investment

options expiring in July 2029, at an exercise price per share of $1.50; |

| ● | 3,133,338

shares of our common stock issuable upon the exercise of outstanding series F preferred investment

options expiring in June 2026, at an exercise price per share of $1.50; |

| ● | 8,000,002

shares of our common stock issuable upon the exercise of outstanding series G preferred investment

options expiring in January 2027, at an exercise price per share of $1.75; |

| ● | 7,577,100

shares of our common stock issuable upon the exercise of outstanding series H preferred investment

options expiring in January 2027, at an exercise price per share of $2.10; |

| ● | 31,231

shares of our common stock issuable upon the exercise of outstanding warrants expiring in

June 2028, at an exercise price per share of $4.0625; |

| ● | 84,284

shares of our common stock issuable upon the exercise of outstanding placement agent preferred

investment options expiring in July 2029, at an exercise price per share of $2.025; |

| ● | 78,333

shares of our common stock issuable upon the exercise of outstanding placement agent preferred

investment options expiring in June 2026, at an exercise price per share of $1.875; |

| ● | 200,000

shares of our common stock issuable upon the exercise of outstanding placement agent preferred

investment options expiring in January 2027, at an exercise price per share of $2.1875; and |

| ● | 189,428

shares of our common stock issuable upon the exercise of outstanding placement agent preferred

investment options expiring in January 2027, at an exercise price of $2.8375. |

The

above list of reserved securities does not take into account the Options, which were issued subsequent to the Record Date, or the shares

underlying the Options.

As of the Record

Date, the

aggregate number of outstanding and reserved shares of common stock is 52,495,482, leaving only 7,504,518 shares of common stock

available for future issuances. In addition, if stockholders approve the Issuance Proposal and this Increase Proposal, we would need

5,007,224 shares in excess of our current authorized shares of 60,000,000 in order to issue all of the shares underlying the Options.

Additionally, future issuances may include issuances of securities in order to raise capital, the payment of consideration for acquisitions,

additional shares issued in connection with grants made to employees under new or expanded existing compensation plans or arrangements,

and other uses not currently anticipated.

Potential

Effects of Approval of this Proposal

The

Company is proposing to increase the number of authorized shares authorized shares of Common Stock from 60,000,000 shares to 120,000,000

shares, with a corresponding increase in the total authorized shares from 61,000,000 to 121,000,000. The increase of authorized

Common Stock proposed would allow the Company to complete the Company’s obligation to issue the Options and the shares underlying

the Options and have sufficient additional shares of Common Stock available for future uses, although no such future uses are specifically

contemplated at this time. The Company believes that such increase is in the best interests of the Company and its stockholders, as it

would provide the Company with flexibility and alternatives in structuring future transactions.

This

amendment would not change any of the rights, restrictions, terms or provisions relating to the common stock or the undesignated

preferred stock. Under the General Corporation Law of the State of Delaware, stockholders are not entitled to appraisal rights with respect

to this amendment. The Company will not independently provide stockholders with any such right. Additionally, holders of common stock

do not have any preemptive rights with respect to the issuance of common stock.

Future

issuances of common stock could affect stockholders. Any future issuance of common stock, other than on a pro-rata basis to then-existing

stockholders, would dilute the percentage ownership and voting interest of the then current stockholders.

If

this Increase Proposal is approved, regardless of whether the other proposals presented in the proxy statement are approved, the Company

will file an amendment to the Certificate of Incorporation to increase the number of authorized shares to 121,000,000 and of common stock

to 120,000,000, a copy of which amendment is attached hereto as Appendix A, unless the Board of Directors determines otherwise.

Potential

Effects of Non-Approval of this Proposal

If

this Increase Proposal is not approved by the stockholders, the Options would not be exercisable and all obligations to facilitate the

issuances of Options and the shares of our common stock underlying the Options would remain in effect and may result in obligations

to which the Company may not have the resources to satisfy. Furthermore, the Company’s satisfaction of any such potential

obligations could materially impair the Company’s working capital. The inability to exercise the Options into common stock may

also materially adversely affect the Company’s future ability to raise equity or debt capital from third parties on attractive

terms, if at all, and also risks impairing the operations, assets and ongoing viability of the Company.

In

addition, if the Company does not obtain approval of the Increase Proposal at the Special Meeting, the Company shall call a meeting every

ninety days thereafter to seek such approval until the earlier of the date on which approval of both the Issuance Proposal and the Increase

Proposal are obtained or the Series I preferred investment option are no longer outstanding or, in the case of the Placement Agent

Options two years from the initial exercise date (but no later than February 9, 2030). As

a result, we will incur substantial cost, and management will devote substantial time and attention, in attempting to obtain such approvals.

Interest of Certain Persons in Matters to Be

Acted Upon

No director or executive

officer has any substantial interest, direct or indirect, by security holdings or otherwise, in this Proposal that is not shared by all

of our other stockholders.

Vote Required

Approval of this Proposal

requires the affirmative vote of the majority of the votes cast on this Proposal. Abstentions and broker non-votes are not considered

votes cast and will have no effect on the outcome of this Proposal.

Board

of Directors Recommendation

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE AMENDMENT OF THE CERTIFICATE OF INCORPORATION

TO INCREASE THE TOTAL NUMBER OF SHARES OF COMMON STOCK AUTHORIZED FOR ISSUANCE. APPROVAL BY STOCKHOLDERS OF THIS INCREASE PROPOSAL IS

NOT CONDITIONED UPON APPROVAL OF THE ISSUANCE PROPOSAL OR THE ADJOURNMENT PROPOSAL; CONVERSELY, APPROVAL BY STOCKHOLDERS OF THE ISSUANCE

PROPOSAL AND THE ADJOURNMENT PROPOSAL ARE NOT CONDITIONED UPON APPROVAL OF THIS INCREASE PROPOSAL.

PROPOSAL

3

TO

APPROVE ONE OR MORE ADJOURNMENTS OF THE SPECIAL MEETING, IF NECESSARY OR

APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES IN FAVOR OF THE INCREASE

PROPOSAL

OR THE ISSUANCE PROPOSAL IF THERE ARE NOT SUFFICIENT VOTES AT THE SPECIAL

MEETING

TO APPROVE AND ADOPT THE INCREASE PROPOSAL OR THE ISSUANCE PROPOSAL

General

In

addition to the Increase Proposal and the Issuance Proposal, our stockholders are also being asked to approve one or more adjournments

of the Special Meeting, if necessary or appropriate, to solicit additional proxies in favor of any or all of the Increase Proposal and

the Issuance Proposal, if there are insufficient votes at the time of such adjournment to approve and adopt any or all of the Increase

Proposal and the Issuance Proposal (the “Adjournment Proposal”). If the Adjournment Proposal is approved, the Special Meeting

could be successively adjourned to another date. In addition, the Board could postpone the Special Meeting before it commences, whether

for the purpose of soliciting additional proxies or for other reasons. If the Special Meeting is adjourned for the purpose of soliciting

additional proxies, stockholders who have already submitted their proxies will be able to revoke them at any time prior to their exercise

at the adjourned meeting.

Interest

of Certain Persons in Matters to Be Acted Upon

No

director or executive officer has any substantial interest, direct or indirect, by security holdings or otherwise, in this Adjournment

Proposal that is not shared by all of our other stockholders.

Vote

Required

The

Adjournment Proposal will be approved if the number of votes properly cast FOR the proposal at the Special Meeting exceeds the number

of votes cast AGAINST the proposal; provided, that in the absence of a quorum, the affirmative vote of the holders of a majority of the

shares represented thereat is required for the Adjournment Proposal. Abstentions will have no effect on the voting of the Adjournment

Proposal (assuming the presence of a quorum), or, in the absence of a quorum, will have the same effect as a vote “AGAINST”

the Adjournment Proposal.

Board of Directors

Recommendation

OUR

BOARD RECOMMENDS A VOTE “FOR” ONE OR MORE ADJOURNMENTS OF THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL

PROXIES IN FAVOR OF THE INCREASE PROPOSAL OR THE ISSUANCE PROPOSAL IF THERE ARE NOT SUFFICIENT VOTES AT THE SPECIAL MEETING TO APPROVE

AND ADOPT THE INCREASE PROPOSAL OR THE ISSUANCE PROPOSAL.

SECURITY

OWNERSHIP

The

following table sets forth information as of the Record Date regarding the beneficial ownership of our common stock by (i) each person

we know to be the beneficial owner of 5% or more of our common stock, (ii) each of our named executive officers, as defined below, (iii)

each of our directors, and (iv) all of our current executive officers and directors as a group. Information with respect to beneficial

ownership has been furnished by each director and executive officer, as the case may be. There are no beneficial owners of 5% or more

of our common stock other than the directors and executive officers included below. The address for all executive officers and directors

is c/o Microbot Medical Inc., 288 Grove Street, Suite 388, Braintree, MA 02184.

Percentage

of beneficial ownership in the table below is calculated based on 28,641,187 shares of common stock outstanding as of the Record Date.

Beneficial ownership is determined in accordance with the rules of the SEC, which generally attribute beneficial ownership of securities

to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common

stock issuable pursuant to the exercise of stock options, warrants or other securities that are immediately exercisable or convertible

or exercisable or convertible within 60 days of the Record Date. Unless otherwise indicated, the persons or entities identified in this

table have sole voting and investment power with respect to all shares shown as beneficially owned by them.

| Beneficial Owner | |

Number of Shares Beneficially Owned | | |

Percentage of Common Stock Beneficially Owned | |

| Harel Gadot(1)(2) | |

| 1,073,927 | | |

| 3.63 | % |

| Scott Burell(3) | |

| 74,554 | | |

| * | |

| Martin Madden(3) | |

| 74,554 | | |

| * | |

| Prattipati Laxminarain(3) | |

| 74,554 | | |

| * | |

| Aileen Stockburger(3) | |

| 69,458 | | |

| * | |

| Simon Sharon(2)(3) | |

| 107,795 | | |

| * | |

| Tal Wenderow(3) | |

| 67,867 | | |

| * | |

| Rachel Vaknin(2)(3) | |

| 72,700 | | |

| * | |

| Juan Diaz-Cartelle(2)(3) | |

| 18,875 | | |

| - | |

| David J. Wilson | |

| - | | |

| - | |

| All current directors and executive officers as a group (10 persons)(2) | |

| 1,634,284 | | |

| 5.42 | % |

| * |

Less

than 1%. |

| (1) |

Includes

(i) 136,847 shares of our common stock owned by MEDX Ventures Group LLC, and (ii) 937,080 shares of our common stock issuable upon

the exercise of options granted to Mr. Gadot. Mr. Gadot is the Chief Executive Officer, Company Group Chairman and majority equity

owner of MEDX Venture Group, LLC and thus may be deemed to share voting and investment power over the shares and options beneficially

owned by this entity. |

| (2) |

Does

not include performance-based options, the vesting of which remains subject to confirmation by the Company’s Compensation Committee.

See “Executive Compensation—Executive Employment Agreements” above. |

| (3) |

Represents

options to acquire shares of our common stock. |

| (4) |

Includes

shares of our common stock issuable upon the exercise of options as set forth in footnotes (1) and (3). |

WHERE

YOU CAN FIND MORE INFORMATION

This

proxy statement refers to certain documents that are not presented herein or delivered herewith. Such documents are available to any

person, including any beneficial owner of our shares, to whom this proxy statement is delivered upon oral or written request by email,

without charge. Requests for such documents should be directed to Microbot Medical Inc., 288 Grove Street, Suite 388, Braintree, MA 02184;

Attention: Secretary. Please note that additional information can be obtained from our website at www.microbotmedical.com.

We

file annual and special reports and other information with the SEC. Certain of our SEC filings are available over the Internet at the

SEC’s web site at http://www.sec.gov. You may also read and copy any document we file with the SEC at its public reference facilities:

Public

Reference Room Office

100 F Street, N.E.

Room

1580

Washington,

D.C. 20549

You

may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E.,

Room 1580, Washington, D.C. 20549. Callers in the United States can also call (202) 551-8090 for further information on the operations

of the public reference facilities.

*

* * * *

APPENDIX

A

CERTIFICATE

OF AMENDMENT

TO

CERTIFICATE

OF INCORPORATION

OF

MICROBOT

MEDICAL INC.

_________________________

Pursuant

to

§

242 of the General Corporation Law

of

the State of Delaware

_________________________

The

undersigned, being the Chief Executive Officer of Microbot Medical Inc., a Delaware corporation (the “Corporation”), pursuant

to Section 242 of the General Corporation Law of the State of Delaware, as amended (the “DGCL”), does hereby certify as follows:

| 1. | The

Board of Directors of the Corporation (the “Board”), by unanimous written consent

dated [_____], 2025, adopted resolutions (the “Amending Resolutions”) to further

amend the Certificate of Incorporation of the Corporation, as filed with the Delaware Secretary

of State on August 2, 1988, as amended and/or restated (together with any amendments, restatements

and certificates of designations, the “Certificate of Incorporation”); and |

| | |

| 2. | The

Certificate of Amendment of Certificate of Incorporation was duly adopted in accordance with

the provisions of Section 242 of the DGCL. The Board duly adopted the Amending Resolutions

setting forth and declaring advisable this Certificate of Amendment to Certificate of Incorporation

and directed that such amendment be considered by the stockholders of the Corporation. A

special meeting of the stockholders was duly called upon notice in accordance with Section

222 of the DGCL and held on [_____], 2025 at which meeting the required number of shares

were voted in favor of such amendment. The stockholders of the Corporation duly adopted the

Certificate of Amendment to Certificate of Incorporation. |

NOW,

THEREFORE, to effect the Amending Resolutions:

| 1. |

Upon

the Effective Time (as defined below), the first paragraph of Paragraph THREE of the Certificate of Incorporation is hereby stricken

and replaced with the following: |

“The

total number of shares of capital stock that the Corporation is authorized to issue is one hundred and twenty one million (121,000,000),

of which one hundred and twenty million (120,000,000) shares are common stock having a par value of $0.01 per share (the “Common

Stock”), and one million (1,000,000) shares are undesignated preferred stock having a par value of $0.01 per share (the “Undesignated

Preferred Stock”).”

| 2. |

This

Certificate of Amendment to Certificate of Incorporation shall become effective on [●], 2025 (the “Effective Time”). |

*

* * * *

IN

WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to the Certificate of Incorporation of Microbot Medical Inc.

to be signed by Harel Gadot, Chief Executive Officer, this [●] day of [●], 2025, who acknowledges that the foregoing is the

act and deed of the Corporation and that the facts stated herein are true.

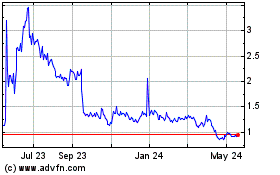

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Jan 2025 to Feb 2025

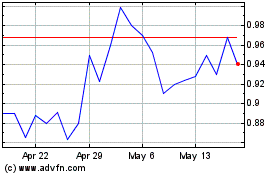

Microbot Medical (NASDAQ:MBOT)

Historical Stock Chart

From Feb 2024 to Feb 2025