UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of February 2025

Commission

File Number 001-36896

MERCURITY

FINTECH HOLDING INC.

(Registrant’s

name)

1330

Avenue of the Americas, Fl 33,

New

York, NY 10019

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Entry

into a Material Definitive Agreement and Unregistered Sale of Equity Securities.

On

February 3, 2025, Mercurity Fintech Holding Inc. (the “Company”) entered into a securities purchase agreement (the “Securities

Purchase Agreement”) with a non-U.S. investor (the “Purchaser”) in connection with the issuance of an unsecured convertible

promissory note dated February 3, 2025 (the “2025 Note”) in the principal amount of $3,500,000 with five percent (5%) per

annum simple interest, due to mature on February 3, 2026 (the “Maturity Date”).

An

original promissory note dated February 2, 2023 (the “2023 Note”), issued by the Company to the Purchaser pursuant to the

securities purchase agreement dated January 31, 2023, had an initial principal amount of $9,000,000, of which the Company repaid $1,500,000

upon its original maturity, and the remaining principal of $7,500,000 was extended under an amendment dated February 2, 2024 (the “2024

Note”); (ii) upon the maturity of the 2024 Note, the Company repaid an additional $4,000,000, reducing the outstanding principal

to $3,500,000; and (iii) upon issuance of the 2025 Note under the Securities Purchase Agreement dated February 3, 2025, the 2023 Note,

as amended, was satisfied in full and deemed fully paid, with no further obligations owed by the Company under the 2023 Note or the 2024

Note.

The

2025 Note is subject to a variable conversion price, which is 90% of the closing price of the Company’s ordinary shares, as reported

on Nasdaq.com, on the trading day immediately preceding the date of the conversion notice, subject to a floor conversion price of $1.402

per share. The Purchaser has the right during two selected periods before the Maturity Date, being the fifteen-day period preceding the

calendar date six months after the issuance date of February 3, 2025 (the “First Election Period”), as well as the fifteen-day

period preceding the Maturity Date (the “Second Election Period”), at its election, to convert all or any portion of the

principal amount but excluding all interest into fully paid and non-assessable ordinary shares of the Company.

The

foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Securities

Purchase Agreement and the Note, which is attached hereto as Exhibit 10.1 and Exhibit 10.2, and is incorporated herein by reference.

EXHIBIT

INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Mercurity

Fintech Holding Inc. |

|

| |

|

|

| By: |

/s/

Shi Qiu |

|

| Name:

|

Shi

Qiu |

|

| Title: |

Chief

Executive Officer |

|

Date:

February 5, 2025

Exhibit

10.1

SECURITIES

PURCHASE AGREEMENT

THIS

SECURITIES PURCHASE AGREEMENT (this “Agreement”) dated ________02/03_______, 2025 is entered into by and between (i) Mercurity

Fintech Holding Inc., an exempted company with limited liability organized and existing under the laws of the Cayman Islands (the “Company”),

and (ii) the Person whose name is set forth on the signature page hereto (the “Purchaser”).

RECITALS

WHEREAS,

the Purchaser desires to subscribe for and purchase, and the Company desires to issue and sell, an Unsecured Convertible Promissory Note

(the “Note”) in the principal amount of three million and five hundred thousand dollars (US$3,500,000)

pursuant to the terms and conditions set forth in this Agreement and Note, in the form attached hereto as Exhibit A;

WHEREAS,

at the election of the holder of the Note, such Note shall be convertible into certain number of ordinary shares of the Company (the

“Conversion Shares”), pursuant to the terms and conditions set forth in this Agreement and Note.

NOW,

THEREFORE, in consideration of the foregoing and the mutual representations, warranties, covenants and agreements set forth herein, as

well as other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each of the Parties hereto,

intending to be legally bound, agrees as follows:

ARTICLE

I

DEFINITION AND INTERPRETATION

Section

1.01 Definition, Interpretation and Rules of Construction

(a) As used in this Agreement, the following terms have the following meanings:

“Affiliate”

means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common

control with such Person; provided that none of the Company, nor any of its Subsidiaries shall be considered an Affiliate of

the Purchaser. For purposes of this definition, “control” when used with respect to any Person means the power to direct

the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract

or otherwise, and the terms “controlling” and “controlled” have correlative meanings.

“Applicable

Law” means, with respect to any Person, any transnational, domestic or foreign, state or local law (statutory, common or otherwise),

constitution, treaty, convention, ordinance, code, rule, regulation, order, injunction, judgment, decree, ruling or other similar requirement

enacted, adopted, promulgated or applied by a Governmental Authority that is binding upon or applicable to such Person, as amended unless

expressly specified otherwise.

“Business

Day” means any day other than a Saturday, Sunday or another day on which commercial banks in the state of New York are required

or authorized by law or executive order to be closed.

“Company

Fundamental Warranties” means any representations and warranties of the Company contained in Section 4.01.

“Company

SEC Documents” means all registration statements, proxy statements and other statements, reports, schedules, forms and other

documents required to be filed or furnished by the Company with the SEC pursuant to the Exchange Act and the Securities Act and all exhibits

included therein and financial statements, notes and schedules thereto and documents incorporated by reference therein, in each case,

filed or furnished with the SEC.

“Condition”

means any condition to any Party’s obligation to effect the Closing as set forth in Article III, and collectively, the “Conditions.”

“Conversion

Shares” means the Ordinary Shares issuable pursuant to the terms of the Note.

“Exchange

Act” means the Securities Exchange Act of 1934, as amended, or any successor statute, and the rules and regulations promulgated

thereunder.

“Governmental

Authority” means any supranational, national, provincial, state, municipal, local or other government, whether U.S. or any

instrumentality, subdivision, administrative agency or commission thereof, court, other governmental authority or regulatory

body or instrumentality, or any quasi-governmental or private body exercising any regulatory, taxing, importing or other

governmental or quasi-governmental authority or any self-regulatory agency (including any stock exchange).

“Material

Adverse Effect” with respect to a Party means any event, fact, circumstance or occurrence that, individually or in the

aggregate with any other events, facts, circumstances or occurrences, results in or would reasonably be expected to result in a

material adverse change in or a material adverse effect on (i) the financial condition, business or operations of such Party and its

Subsidiaries taken as a whole, or (ii) the ability of such Party to consummate the transactions contemplated by the Transaction

Agreements and to timely perform its obligations hereunder and thereunder; provided that in determining whether a Material

Adverse Effect has occurred under clause (i) above, there shall be excluded any events, facts, circumstances or occurrences relating

to or arising in connection with (a) changes in generally accepted accounting principles that are generally applicable to comparable

companies (to the extent not materially disproportionately affecting such Party and its Subsidiaries), (b) changes in general

economic and market conditions and capital market conditions or changes affecting any of the industries in which such Party and its

Subsidiaries operate generally (in each case to the extent not materially disproportionately affecting such Party and its

Subsidiaries). (c) the announcement or disclosure of this Agreement or any other Transaction Agreement or the consummation of

the transactions hereunder or thereunder, or any act or omission required or specifically permitted by this Agreement and/or any

other Transaction Agreement, (d) any pandemic (including the COVID-19 pandemic (or any mutation or

variation of the underlying virus thereof or related health condition)), earthquake, typhoon, tornado or other natural disaster or

similar force majeure event, (e) in the case of the Company, any failure to meet any internal or public projections, forecasts, or

guidance, or (f) in the case of the Company, any change in the Company’s stock price or trading volume, in and of itself; provided further

that the underlying causes giving rise to or contributing to any such change or failure under sub-clause (e) or (f) shall not be

excluded in determining whether a Material Adverse Effect has occurred except to the extent such underlying causes are otherwise

excluded pursuant to any of sub-clauses (a) through (d).

“Nasdaq”

means The Nasdaq Stock Market LLC.

“Ordinary

Shares” means the ordinary shares, par value US$0.004 per share, in the share capital of the Company.

“Parties”

means, collectively, the Company and the Purchaser.

“Person”

means an individual, corporation, partnership, limited liability company, association, trust or other entity or organization.

“Purchaser

Fundamental Warranties” means any representations and warranties of the Purchaser contained in Section 4.02.

“SEC”

means the Securities and Exchange Commission of the United States of America or any other federal agency at the time administering the

Securities Act.

“

Securities”

means individually or collectively the Note and the Conversion Shares.

“Securities

Act” means the Securities Act of 1933, as amended, and all of the rules and regulations promulgated thereunder.

“Subscription

Amount” means, as to each Purchaser, the aggregate amount to be paid for Note purchased hereunder as specified below such Purchaser’s

name on the signature page of this Agreement and next to the heading “Subscription Amount” in immediately available

funds. The aggregate “Subscription Amount” shall be US$3,500,000.00.

“Subsidiary”

of a Party means any organization or entity, whether incorporated or unincorporated, which is controlled by such Party and, for the avoidance

of doubt, the Subsidiaries of a Party shall include any variable interest entity over which such Party or any of its Subsidiaries effects

control pursuant to contractual arrangements and which is consolidated with such Party in accordance with generally accepted accounting

principles applicable to such Party and any Subsidiaries of such variable interest entity.

“Subject

Securities” means, collectively, the Note, and if applicable, Conversion Shares.

“Transaction

Agreements” means, collectively, this Agreement, the Note and each of the other agreements and documents entered

into or delivered by the parties hereto or their respective Affiliates in connection with the transactions contemplated by this

Agreement.

“Trading

Market” means any of the following markets or exchanges on which the Ordinary Shares are listed or quoted for trading on the

date in question: the NYSE MKT, the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the New York Stock

Exchange, the OTCQB or the OTC Markets (or any successors to any of the foregoing).

(b)

In this Agreement, except to the extent otherwise provided or that the context otherwise requires:

(i) The

words “Party” and “Parties” shall be construed to mean a party or the parties to this Agreement, and any reference

to a party to this Agreement or any other agreement or document contemplated hereby shall include such party’s successors and permitted

assigns.

(ii) When

a reference is made in this Agreement to an Article, Section, Exhibit, Schedule or clause, such reference is to an Article, Section,

Exhibit, Schedule or clause of this Agreement.

(iii) The

headings for this Agreement are for reference purposes only and do not affect in any way the meaning or interpretation of this Agreement.

(iv) Whenever

the words “include,” “includes” or “including” are used in this Agreement, they are deemed to be

followed by the words “without limitation.”

(v) The

words “hereof,” “herein” and “hereunder” and words of similar import, when used in this Agreement,

refer to this Agreement as a whole and not to any particular provision of this Agreement.

(vi) All

terms defined in this Agreement have the defined meanings when used in any certificate or other document made or delivered pursuant hereto,

unless otherwise defined therein.

(vii) The

definitions contained in this Agreement are applicable to the singular as well as the plural forms of such terms.

(viii) The

use of “or” is not intended to be exclusive unless expressly indicated otherwise.

(ix) The term “$” or “US$” means United States Dollars.

(x) The

word “will” shall be construed to have the same meaning and effect as the word “shall.”

(xi) References

to “law,” “laws” or to a particular statute or law shall be deemed also to include any and all Applicable Law.

(xii) A

reference to any legislation or to any provision of any legislation shall include any modification, amendment, re-enactment thereof,

any legislative provision substituted therefor and all rules, regulations and statutory instruments issued or related to such legislation.

(xiii) References herein to any gender include the other gender.

(xiv) The

parties hereto have each participated in the negotiation and drafting of this Agreement and if any ambiguity or question of interpretation

should arise, this Agreement shall be construed as if drafted jointly by the parties hereto and no presumption or burden of proof shall

arise favoring or burdening any Party by virtue of the authorship of any of the provisions in this Agreement or any interim drafts thereof.

ARTICLE

II

PURCHASE AND SALE; CLOSING

Section

2.01 Purchase and Sale of Securities.

(a) Upon

the terms and subject to the conditions of this Agreement and subject to applicable laws, at Closing (as defined below), the Purchaser

hereby agrees to subscribe for and purchase, and the Company hereby agrees to issue and sell to the Purchaser, the Note in consideration

of the Purchaser’s payment of the Subscription Amount as set forth on such Purchaser’s signature page in the manner set forth

below. By execution of this Agreement, the Purchaser hereby acknowledges and agrees that (i) the original promissory note dated February

2, 2023 (the “2023 Note”), issued pursuant to the Securities Purchase Agreement dated January 31, 2023, had an initial principal

amount of US$9,000,000, of which the Company repaid US$1,500,000 upon its original maturity, and the remaining principal of US$7,500,000

was extended under an amendment dated February 2, 2024 (the “2024 Note”); (ii) upon the maturity of the 2024 Note, the Company

repaid an additional US$4,000,000, reducing the outstanding principal to US$3,500,000; and (iii) upon issuance of the Note under this

Agreement, the 2023 Note, as amended, will have been satisfied in full and deemed fully paid, with no further obligations owed by the

Company under the 2023 Note or the 2024 Note.

(b) As

set forth in the Note, at the election of the holder of the Note, such Note shall be convertible into certain number of ordinary shares

of the Company at the Conversion Price, being 90% of the closing price, pursuant to Nasdaq.com, of the Company’s Ordinary Shares

on the trading day immediately preceding the date of the Conversion Notice, which shall not be lower than the Floor Price, being 20%

of the Nasdaq Official Closing Price of the Company’s Ordinary Shares immediately prior to the execution of this Agreement.

Section

2.02 Closing.

| (a) | Closing.

Subject to satisfaction or, to the extent permissible, waiver by the Party or Parties entitled

to the benefit of the relevant Conditions, of all the Conditions (other than Conditions that

by their nature are to be satisfied at Closing, but subject to the satisfaction or, to the

extent permissible, waiver of those Conditions at Closing), the closing of the sale and purchase

of the Note pursuant to this Section 2.02(a) (the “Closing”) shall

take place remotely by electronic means on the date of this Agreement (the “Closing

Date”). |

| | | |

| (b) | Payment

and Delivery. At Closing, |

| (i) | the

Purchaser shall deliver to the Company an executed copy of this Agreement. |

| |

(ii) |

the Company shall deliver to the Purchaser (1) an executed

copy of this Agreement, and (2) a copy of the duly executed Note in the name of such Purchaser electronically. |

| (c) | Restrictive

Legend. The Note shall bear the following legend: |

THIS

SECURITY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) OR UNDER THE SECURITIES LAWS OF

ANY STATE. THIS SECURITY MAY NOT BE TRANSFERRED, SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED WITHIN THE UNITED STATES IN THE ABSENCE

OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR TO ANY “U.S. PERSON,” AS SUCH TERM IS DEFINED IN REGULATION S UNDER

THE ACT, DURING THE 40 DAYS FOLLOWING ACQUISITION OF THE SECURITY BY THE HOLDER THEREOF. ANY ATTEMPT TO TRANSFER, SELL, PLEDGE OR HYPOTHECATE

THIS SECURITY IN VIOLATION OF THESE RESTRICTIONS SHALL BE VOID.

ARTICLE

III

CONDITIONS TO CLOSING

Section

3.01 Conditions to Obligations of All Parties.

(a) No

Governmental Authority shall have enacted, issued, promulgated, enforced or entered any law, rule, regulation, judgment, injunction,

order or decree (in each case, whether temporary, preliminary or permanent) that is in effect and restrains, enjoins, prevents, prohibits

or otherwise makes illegal the consummation of the transactions contemplated by the Transaction Agreements.

(b) No

action, suit, proceeding or investigation shall have been instituted or threatened by a Governmental Authority or any third party that

seeks to restrain, enjoin, prevent, prohibit or otherwise make illegal the consummation of the transactions contemplated by the Transaction

Agreements.

Section

3.02 Conditions to Obligations of Purchaser. The obligations of the Purchaser to subscribe for, purchase and pay for the

Subject Securities as contemplated by this Agreement are subject to the satisfaction, on or before the Closing Date, of the

following conditions, any of which may be waived in writing by such Purchaser in its sole discretion:

(a)

The Company Fundamental Warranties shall have been true and correct in all respects on and as of the Closing Date as though such

representations and warranties were made on and as of the Closing Date (except for representations and warranties that expressly

speak as of a specified date, in which case on and as of such specified date). Other representations and warranties of the Company

contained in Section 4.01 of this Agreement shall have been true and correct in all material respects (or, if qualified by

“materiality,” “Material Adverse Effect” or similar qualifications, true and correct in all respects) on and

as of the Closing Date as though such representations and warranties were made on and as of the Closing Date (except for

representations and warranties that expressly speak as of a specified date, in which case on and as of such specified

date).

(b) The

Company shall have duly executed and delivered or shall have caused to be duly executed and delivered each Transaction Agreement to which

it is a party to the Purchaser at or prior to Closing.

Section

3.03 Conditions to Obligations of the Company. The obligations of the Company to issue and sell the Subject Securities to the

Purchaser as contemplated by this Agreement are subject to the satisfaction, on or before the Closing Date, of each of the following

conditions with respect to such Purchaser, any of which may be waived in writing by the Company in its sole discretion:

(a) The

Purchaser Fundamental Warranties shall have been true and correct in all respects on and as of the Closing Date as though such representations

and warranties were made on and as of the Closing Date (except for representations and warranties that expressly speak as of a specified

date, in which case on and as of such specified date). Other representations and warranties of the Purchaser contained in Section 4.02

of this Agreement shall have been true and correct in all material respects (or, if qualified by “materiality,” “Material

Adverse Effect” or similar qualifications, true and correct in all respects) on and as of the Closing Date as though such representations

and warranties were made on and as of the Closing Date (except for representations and warranties that expressly speak as of a specified

date, in which case on and as of such specified date).

(b) The

Purchaser shall have performed and complied with all, and not be in breach or default under any, agreements, covenants, conditions and

obligations contained in this Agreement that are required to be performed or complied with on or before the Closing Date, including making

the payments of the Subscription Amount to the Company.

ARTICLE

IV

REPRESENTATIONS AND WARRANTIES

Section

4.01 Representations and Warranties of the Company. The Company hereby represents and warrants to the Purchaser that, except

as set forth in the Company SEC Documents:

(a) Due

Formation. The Company is an exempted company, duly incorporated, validly existing and in good standing under the laws of the Cayman

Islands.

(b) Authority;

Valid Agreement. The Company has all requisite legal power and authority to execute, deliver and perform its obligations under the

Transaction Agreements to which it is a party and each other agreement, certificate, document and instrument to be executed by the Company

pursuant to this Agreement and each other Transaction Agreement. The execution, delivery and performance by the Company of this Agreement

and each other Transaction Agreement to which it is a party and the performance by the Company of its obligations hereunder and thereunder

have been duly authorized by all necessary corporate action on the part of the Company. This Agreement has been, and each other Transaction

Agreement to which it is a party will be duly executed and delivered by the Company and, assuming due authorization, execution and delivery

by the relevant Purchaser(s), constitutes (or, when executed and delivered in accordance herewith will constitute) a legal, valid and

binding obligation of the Company, enforceable against the Company in accordance with its terms, except as enforcement may be limited

by general principles of equity, whether applied in a court of law or a court of equity, and by applicable bankruptcy, insolvency, fraudulent

transfer, reorganization, moratorium and similar law affecting creditors’ rights and remedies generally (the “Bankruptcy

and Equity Exception”).

(c) Capitalization.

The authorized capital stock of the Company is US$250,000 divided into 25,000,000,000 Ordinary Shares with a par value of US$0.00001

each. All issued and outstanding Ordinary Shares have been duly authorized and validly issued and are fully paid and non-assessable,

are free of preemptive rights, were issued in compliance with applicable U.S. and other applicable securities laws.

(d) Valid

Issuance. The Subject Securities have been duly and validly authorized for issuance by the Company. The Ordinary Shares that will

be issued upon conversion of the Note pursuant to the terms therein, when issued and delivered by the Company to the Purchaser and registered

in the register of members of the Company will (i) be duly and validly issued, fully paid and non-assessable, (ii) rank pari passu

with, and carry the same rights in all respects as, the other Ordinary Shares then in issue, (iii) be entitled to all dividends and

other distributions declared, paid or made thereon, and (iv) free and clear of any pledge, mortgage, security interest, encumbrance,

lien, charge, assessment, right of first refusal, right of pre-emption, third party right or interest, claim or restriction of any kind

or nature, except for restrictions arising under the Securities Act or as disclosed in the Company SEC Documents or created by virtue

of the transactions under this Agreement (collectively, the “Encumbrances”).

(e) Non-contravention.

None of the execution and the delivery of this Agreement and other Transaction Agreements, nor the consummation of the transactions contemplated

hereby or thereby, will (i) violate any provision of the organizational documents of the Company, (ii) violate any constitution, statute,

regulation, rule, injunction, judgment, order, decree, ruling, charge, or other restriction of any government, governmental entity or

court to which the Company is subject, or (iii) conflict with, result in a breach of, constitute a default under, result in the acceleration

of or creation of any Encumbrances under, or create in any party the right to accelerate, terminate, modify, or cancel, any agreement,

contract, lease, license, instrument, or other arrangement to which the Company or any of its Subsidiaries is a party or by which the

Company or any of its Subsidiaries is bound or to which any of the Company’s or any of its Subsidiaries’ assets are subject,

except, in the case of (ii) and (iii) above, for such conflicts, breach, defaults, rights or violations, which would not reasonably be

expected to result in a Material Adverse Effect. There is no action, suit or proceeding, pending or, to the knowledge of the Company,

threatened against the Company that questions the validity of the Transaction Agreements or the right of the Company to enter into this

Agreement or to consummate the transactions contemplated hereby or thereby.

(f) Consents

and Approvals. None of the execution and delivery by the Company of this Agreement or any Transaction Agreement, nor the consummation

by the Company of any of the transactions contemplated hereby or thereby, nor the performance by the Company of this Agreement or other

Transaction Agreements in accordance with their respective terms requires the consent, approval, order or authorization of, or registration

with, or the giving notice to, any governmental or public body or authority or any third party, except such as have been or will have

been obtained, made or given on or prior to the Closing Date and except for any filing or notification required to made with the SEC

or the Nasdaq regarding the issuance of the Subject Securities.

(g) Litigation.

Except as disclosed in the Company SEC Documents and to the knowledge of the Company there are no pending or threatened actions,

claims, demands, investigations, examinations, indictments, litigations, suits or other criminal, civil or administrative or

investigative proceedings before or by any Governmental Authority or by any other person against the Company or any of its

Subsidiaries, which would, individually or in the aggregate, have a Material Adverse Effect.

(h) No

Additional Representations. The Company makes no representations or warranties as to any matter whatsoever except as expressly set

forth in this Agreement or in any certificate delivered by the Company to the Purchaser in accordance with the terms thereof.

Section

4.02 Representations and Warranties of The Purchaser. The Purchaser hereby represents and warrants as of the date hereof and

as of the Closing Dates to the Company as follows (unless as of a specific date therein):

(a) Organization;

Authority. The Purchaser is either an individual or an entity duly incorporated or formed, validly existing and in good standing

under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company

or similar power and authority to enter into and to consummate the transactions contemplated by the Transaction Agreements and otherwise

to carry out its obligations hereunder and thereunder. The execution and delivery of the Transaction Agreements and performance by the

Purchaser of the transactions contemplated by the Transaction Agreements have been duly authorized by all necessary corporate, partnership,

limited liability company or similar action, as applicable, on the part of the Purchaser. Each Transaction Agreement to which it is a

party has been duly executed by the Purchaser, and when delivered by the Purchaser in accordance with the terms hereof, will constitute

the valid and legally binding obligation of the Purchaser, enforceable against it in accordance with its terms, except: (i) as limited

by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application

affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating to the availability of specific performance,

injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution provisions may be limited by applicable

law.

(b) Own

Account. The Purchaser is acquiring the Subject Securities as principal for its own account and has no direct or indirect arrangement

or understandings with any other persons to distribute or regarding the distribution of such Subject Securities (this representation

and warranty not limiting the Purchaser’s right to sell the Subject Securities pursuant to the Registration Statement or otherwise

in compliance with applicable federal and state securities laws). The Purchaser is acquiring the Subject Securities hereunder in the

ordinary course of its business.

(c) Purchaser

Status. Such Purchaser is not a “U.S. person” as defined in Rule 902 of Regulation S. Such Purchaser has not been subject

to any “directed selling efforts” within the meaning of Rule 903 of Regulation S under the Securities Act in connection with

its execution of this Agreement. At the time the Purchaser was offered the Securities, it was, and as of the date hereof it is, either:

(i) an “accredited investor” as defined in Rule 501 under the Securities Act or (ii) a “qualified institutional buyer”

as defined in Rule 144A(a) under the Securities Act.

(d) Experience

of The Purchaser. The Purchaser, either alone or together with its representatives, has such knowledge, sophistication and experience

in business and financial matters so as to be capable of evaluating the merits and risks of the prospective investment in the Subject

Securities, and has so evaluated the merits and risks of such investment. The Purchaser is able to bear the economic risk of an investment

in the Subject Securities and, at the present time, is able to afford a complete loss of such investment.

(e) Access

to Information. The Purchaser acknowledges that it has had the opportunity to review the Transaction Agreements (including all exhibits

and schedules thereto) and the Company SEC Documents and has been afforded, (i) the opportunity to ask such questions as it has deemed

necessary of, and to receive answers from, representatives of the Company concerning the terms and conditions of the offering of the

Subject Securities and the merits and risks of investing in the Subject Securities; (ii) access to information about the Company and

its financial condition, results of operations, business, properties, management and prospects sufficient to enable it to evaluate its

investment; and (iii) the opportunity to obtain such additional information that the Company possesses or can acquire without unreasonable

effort or expense that is necessary to make an informed investment decision with respect to the investment.

ARTICLE

V

OTHER

AGREEMENTS OF THE PARTIES

Section

5.01 Distribution Compliance Period. The Purchaser agrees not to resell, pledge or transfer any of its Note and/or Conversion

Shares within the United States or to any U.S. Person, as each of those terms is defined in Regulation S, during the forty (40) days

following its Closing Date.

Section

5.02 Further Assurances. From the date of this Agreement until the Closing Date, the Company and such Purchaser shall use

their reasonable best efforts to fulfill or obtain the fulfillment of the conditions precedent to the consummation of the

transactions contemplated hereby with respect to such Purchaser.

Section

5.03 Integration. The Company shall not sell, offer for sale or solicit offers to buy or otherwise negotiate in respect of

any security (as defined in Section 2 of the Securities Act) that would be integrated with the offer or sale of the Securities in a manner

that would require the registration under the Securities Act of the sale of the Securities or that would be integrated with the offer

or sale of the Securities for purposes of the rules and regulations of any Trading Market such that it would require shareholder approval

prior to the closing of such other transaction unless shareholder approval is obtained before the closing of such subsequent transaction.

Section

5.04 Securities Laws Disclosure; Publicity. Within the time required by the Exchange Act, the Company shall file a Current

Report on Form 6-K, including the Transaction Agreements as exhibits thereto, with the SEC.

Section

5.05 Non-Public Information. Except with respect to the material terms and conditions of the transactions contemplated by the

Transaction Documents, the Company covenants and agrees that neither it, nor any other Person acting on its behalf, will provide the

Purchaser or its agents or counsel with any information that the Company believes constitutes material non-public

information.

ARTICLE

VI

MISCELLANEOUS

Section

6.01 Venue. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions

contemplated by this Agreement and any other Transaction Agreements (whether brought against a party hereto or its respective affiliates,

directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state or federal courts

sitting in the Borough of Manhattan, New York, New York. Each Party hereby irrevocably submits to the exclusive jurisdiction of the state

and federal courts sitting in the Borough of Manhattan, New York, New York for the adjudication of any dispute hereunder or in connection

herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of the Transaction

Agreements), and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally

subject to the jurisdiction of any such court, that such suit, action or proceeding is improper or is an inconvenient venue for such

proceeding.

Section

6.02 Governing Law. This Agreement and all questions concerning the construction, validity, enforcement and interpretation

of this Agreement shall be governed by and construed in accordance with the laws of State of New York without giving effect to any choice

of law rule that would cause the application of the laws of any jurisdiction other than the State of New York to the rights and duties

of the Parties hereunder.

Section

6.03 No Third Party Beneficiaries. A person who is not a party to this Agreement has no right to enforce any term of this Agreement.

Section

6.04 Amendment. This Agreement shall not be amended, changed or modified, except by another agreement in writing executed by

the Parties hereto.

Section

6.05 Binding Effect. This Agreement shall inure to the benefit of, and be binding upon, each of the parties and their respective

heirs, successors and permitted assigns and legal representatives.

Section

6.06 Assignment. Neither this Agreement nor any of the rights, duties or obligations hereunder may be assigned, as between the

Purchaser and the Company, without the express written consent of such Purchaser and the Company. Any purported assignment in violation

of the foregoing sentence shall be null and void.

Section

6.07 Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall

be in writing and shall be deemed given and effective on the earliest of: (a) the date of transmission, if such notice or communication

is delivered via facsimile at the facsimile number set forth on the signature pages attached hereto at or prior to 5:30 p.m. (New York

City time) on a Trading Day, (b) the next Trading Day after the date of transmission, if such notice or communication is delivered via

facsimile on a day that is not a Trading Day or later than 5:30 p.m. (New York City time) on any Trading Day, (c) the second (2nd) Trading

Day following the date of mailing, if sent by U.S. nationally recognized overnight courier service or (d) upon actual receipt by the

party to whom such notice is required to be given. The address for such notices and communications shall be as set forth below or on

the signature pages attached hereto.

If

to the Company:

Mercurity

Fintech Holding Inc.

| |

Address: |

1330 Avenue of the Americas,

33rd Floor, New York, NY 10019 |

| |

Email: |

[REDUCTED] and

[REDUCTED] |

| |

Attention: |

Shi Qiu |

With

a copy to the Company’s Counsel at (which shall not constitute notice):

| |

Address: |

1185

Avenue of the Americas, 31st Floor, New York, New York 10036 |

| |

Email: |

[REDUCTED] |

| |

Attention: |

Huan

Lou

|

If

to the Purchaser(s): see the Purchaser’s signature page.

Any

Party may change its address for purposes of this Section 6.07 by giving the other Parties hereto written notice of the new address

in the manner set forth above. For the avoidance of doubt, only notice delivered to the address and person of the Parties to this Agreement

shall constitute effective notice to such Party for the purposes of this Agreement.

Section

6.08 Entire Agreement. This Agreement and the other Transaction Agreements including the schedules and exhibits hereto and

thereto constitutes the entire understanding and agreement between the Parties with respect to the matters covered hereby and thereby,

and all prior agreements and understandings, oral or in writing, if any, between the Parties with respect to the matters covered hereby

and thereby are merged and superseded by this Agreement and the other Transaction Agreements.

Section

6.09 Severability. If any provisions of this Agreement shall be adjudicated to be illegal, invalid or unenforceable in any

action or proceeding whether in its entirety or in any portion, then such provision shall be deemed amended, if possible, or deleted,

as the case may be, from the Agreement in order to render the remainder of the Agreement and any provision thereof both valid and enforceable,

and all other provisions hereof shall be given effect separately therefrom and shall not be affected thereby.

Section

6.10 Fees and Expenses. The expenses incurred in connection with the negotiation, preparation and execution of this Agreement

and other Transaction Agreements and the transactions contemplated hereby and thereby, including fees and expenses of attorneys, accountants,

consultants and financial advisors, shall be the responsibility of the Party incurring such expenses.

Section

6.11 Termination.

(a) This

Agreement shall automatically terminate as between the Company and the Purchaser upon the earliest to occur of:

(i) the written consent of each of the Company and such Purchaser; or

(ii) by

the Company or such Purchaser in the event that any Governmental Authority shall have issued a judgment or taken any other action restraining,

enjoining or otherwise prohibiting the transactions contemplated by the Transaction Agreements and such judgment or other action shall

have become final and non-appealable.

(b) Upon

the termination of this Agreement, this Agreement will have no further force or effect, except for the provisions of Section 6

hereof, which shall survive any termination under this Section 6; provided that neither the Company nor the Purchaser shall

be relieved or released from any liabilities or damages arising out of (i) fraud or (ii) any breach of this Agreement prior to such termination.

Section

6.12 Headings. The headings of the various articles and sections of this Agreement are inserted merely for the purpose of convenience

and do not expressly or by implication limit, define or extend the specific terms of the section so designated.

Section

6.13 Execution in Counterparts. For the convenience of the Parties and to facilitate execution, this Agreement may be executed

in one or more counterparts, each of which shall be deemed to be an original, but all of which together shall constitute but one and

the same instrument. Signatures in the form of facsimile or electronically imaged “PDF” shall be deemed to be original signatures

for all purposes hereunder.

Section

6.14 Waiver. No waiver of any provision of this Agreement shall be effective unless set forth in a written instrument signed

by the Party waiving such provision. No failure or delay by a Party in exercising any right, power or remedy under this Agreement shall

operate as a waiver thereof, nor shall any single or partial exercise of the same preclude any further exercise thereof or the exercise

of any other right, power or remedy.

Section

6.15 Adjustment of Share Numbers. If there is a subdivision, split, stock dividend, combination, reclassification or similar

event with respect to any of the ordinary shares, including the Conversion Shares referred to in this Agreement, then, in any such event,

the numbers and types of shares referred to in this Agreement shall be equitably adjusted as appropriate to the number and types of shares

of such stock that a holder of such number of shares of such stock would own or be entitled to receive as a result of such event of such

holder had held such number of shares immediately prior to the record date for, or effectiveness of, such event.

[Signature

pages follow]

IN

WITNESS WHEREOF, the Parties have caused this Agreement to be executed on the date first above written.

| For and on behalf of |

|

| Mercurity

Fintech Holding Inc. |

|

| |

|

|

| By: |

/s/

Shi Qiu |

|

| Name: |

Shi

Qiu |

|

| Title: |

Chief

Executive Officer |

|

[Signature

Page to Securities Purchase Agreement]

IN

WITNESS WHEREOF, the undersigned has caused this Agreement to be executed on the date first above written.

Name of Purchaser: Viner

Total Investments Fund

| Signature

of Authorized Signatory of Purchaser: |

|

| |

|

| Name

of Authorized Signatory: |

|

Title

of Authorized Signatory: Director of Investment Manager

Address

for Notice to Purchaser: [REDUCTED]

Address

for Delivery of Securities to Purchaser (if not same as address for notice):

Email Address:

Subscription

Amount: US$3,500,000.00

Number of Note to Be Issued: one (1)

Note Subscription Date: February 3, 2025

[Signature

Page to Securities Purchase Agreement]

EXHIBIT

A

FORM

OF UNSECURED CONVERTIBLE PROMISSORY NOTE

Exhibit

10.2

THIS

SECURITY HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) OR UNDER THE SECURITIES LAWS OF

ANY STATE. THIS SECURITY MAY NOT BE TRANSFERRED, SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED WITHIN THE UNITED STATES IN THE ABSENCE

OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR TO ANY “U.S. PERSON,” AS SUCH TERM IS DEFINED IN REGULATION S UNDER

THE ACT, DURING THE 40 DAYS FOLLOWING ACQUISITION OF THE SECURITY BY THE HOLDER THEREOF. ANY ATTEMPT TO TRANSFER, SELL, PLEDGE OR HYPOTHECATE

THIS SECURITY IN VIOLATION OF THESE RESTRICTIONS SHALL BE VOID.

UNSECURED CONVERTIBLE PROMISSORY NOTE

| Issuance

Date: February 3 , 2025 |

Principal

Amount: U.S. $3,500,000.00 |

FOR

VALUE RECEIVED, Mercurity Fintech Holding Inc., an exempted company with limited liability organized under the laws of the Cayman Islands

(“Borrower”), promises to pay to Viner Total Investments Fund or its successors or assigns (“Lender”),

US$3,500,000.00 and interest on the Principal Amount at the rate of five percent (5%) per annum simple interest from the Issuance Date,

both of which shall be paid on the date that is twelve (12) months after the Issuance Date (and if such date is not a Business Day, the

next Business Day) (the “Maturity Date”) in accordance with the terms set forth herein. All interest calculations

hereunder shall be computed on the basis of a 365-day year and actual days elapsed and shall be payable in accordance with the terms

of this Note. This Note is issued pursuant to that certain Securities Purchase Agreement dated [_02/03__], 2025, as the same may be amended

from time to time, by and between Borrower and Lender (the “Purchase Agreement”). Certain capitalized terms used herein

are defined in Attachment 1 attached hereto and in the Purchase Agreement.

1. Payment.

All payments owing hereunder shall be in lawful money of the United States of America or Conversion Shares (as defined below), as provided

for herein, and delivered to Lender at the address or bank account furnished to Borrower for that purpose. All payments shall be applied

first to (a) accrued and unpaid interest, and thereafter, to (b) principal amount.

2.

Prepayment. This Note may be prepaid by the Borrower at any time prior to the Maturity Date.

3. Conversions.

Lender has the right during two selected periods before the Maturity Date, being the fifteen-day period preceding the calendar date six

months after the Issuance Date (the “First Election Period”), as well as the fifteen-day period preceding the Maturity

Date (the “Second Election Period”), at its election, to convert (such conversion is referred to herein as the “Conversion”)

all or any portion of the Principal Amount but excluding all interest into fully paid and non-assessable Ordinary Shares (“Conversion

Shares”) as per the following conversion formula: the number of Conversion Shares equals the amount of the Principal Amount

being converted (the “Conversion Amount”) divided by the Conversion Price. Conversion notices in the form attached

hereto as Appendix A (each, a “Conversion Notice”) may be effectively delivered to Borrower by any method set

forth in the “Notices” section of the Purchase Agreement, and all Conversions shall be cashless and not require further payment

from Lender. Borrower shall deliver the Conversion Shares from any Conversion to Lender in accordance with Section 8 below. In

the event that the Lender converts the Principal Amount, then the Borrower shall remain obligated to repay any portion of the accrued

but unpaid interest on this Note, but no interest shall continue to accrue on the Note following the date of the Conversion.

4. Defaults. The

following are events of defaults under this Note (each, a “Default Event”): (a) the Borrower fails to pay timely

any of the principal amount of or any accrued interest or other amounts due under this Note on the date the same becomes due and

payable; (b) the Borrower files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law

or any other law for the relief of, or relating to, debtors, now or hereafter in effect, or makes any assignment for the benefit of

creditors or takes any corporate action in furtherance of any of the foregoing; or (c) an involuntary petition is filed against the

Borrower (unless such petition is dismissed or discharged within ninety (90) days under any bankruptcy statute now or hereafter in

effect, or a custodian, receiver, trustee, assignee for the benefit of creditors (or other similar official) is appointed to take

possession, custody or control of any property of the Borrower).

5. Unconditional

Obligation; No Offset. Borrower acknowledges that this Note is an unconditional, valid, binding and enforceable obligation of Borrower

not subject to offset, deduction or counterclaim of any kind. Borrower hereby waives any rights of offset it now has or may have hereafter

against Lender, its successors and assigns, and agrees to make the payments or Conversions called for herein in accordance with the terms

of this Note.

6. Waiver.

No waiver of any provision of this Note shall be effective unless it is in the form of a writing signed by the party granting the waiver.

No waiver of any provision or consent to any prohibited action shall constitute a waiver of any other provision or consent to any other

prohibited action, whether or not similar. No waiver or consent shall constitute a continuing waiver or consent or commit a party to

provide a waiver or consent in the future except to the extent specifically set forth in writing.

7. Rights

Upon Issuance of Securities. Without limiting any provision hereof, if Borrower at any time on or after the Issuance Date subdivides

(by any stock split, stock dividend, recapitalization, or otherwise) one or more classes of its outstanding Ordinary Shares into a greater

number of Ordinary Shares, the Conversion Price in effect immediately prior to such subdivision will be proportionately reduced. Without

limiting any provision hereof, if Borrower at any time on or after the Issuance Date combines (by combination, reverse stock split, or

otherwise) one or more classes of its outstanding Ordinary Shares into a smaller number of Ordinary Shares, the Conversion Price in effect

immediately prior to such combination will be proportionately increased. Any adjustment pursuant to this Section 7 shall become

effective immediately after the effective date of such subdivision or combination. If any event requiring an adjustment under this Section

7 occurs during the period that a Conversion Price is calculated hereunder, then the calculation of such Conversion Price shall be

adjusted appropriately to reflect such event.

8. Method

of Conversion Share Delivery. On or before the close of business on the third (3rd) Trading Day following the date of delivery of

a Conversion Notice (the “Delivery Date”), Borrower shall deliver to Lender or its designee (as designated in the

Conversion Notice) a book-entry account statement representing the Conversion Shares, or a certificate via reputable overnight courier

representing the number of Ordinary Shares equal to the number of Conversion Shares to which Lender shall be entitled, registered in

the name of Lender or its designee. With respect to such Conversion Shares, the restricted securities legend shall read as follows:

THESE

SECURITIES HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”) OR UNDER THE SECURITIES LAWS

OF ANY STATE. THESE SECURITIES MAY NOT BE TRANSFERRED, SOLD, OFFERED FOR SALE, PLEDGED OR HYPOTHECATED WITHIN THE UNITED STATES IN THE

ABSENCE OF AN EFFECTIVE REGISTRATION STATEMENT UNDER THE ACT OR TO ANY “U.S. PERSON,” AS SUCH TERM IS DEFINED IN REGULATION

S UNDER THE ACT, DURING THE 40 DAYS FOLLOWING ACQUISITION OF THE SECURITY BY THE HOLDER THEREOF. ANY ATTEMPT TO TRANSFER, SELL, PLEDGE

OR HYPOTHECATE THESE SECURITIES IN VIOLATION OF THESE RESTRICTIONS SHALL BE VOID.

9. Opinion

of Counsel. In the event that an opinion of counsel is needed for any Conversion under this Note, or to cause such shares to be issued

without a restrictive legend, Lender has the right to have any such opinion provided by its counsel.

10. Governing

Law; Venue. This Note shall be construed and enforced in accordance with, and all questions concerning the construction, validity,

interpretation and performance of this Note shall be governed by, the internal laws of the State of New York, without giving effect to

any choice of law or conflict of law provision or rule (whether of the State of New York or any other jurisdiction) that would cause

the application of the laws of any jurisdiction other than the State of New York. The provisions set forth in the Purchase Agreement

to determine the proper venue for any disputes are incorporated herein by this reference.

11. Cancellation.

After repayment or conversion of the entire Principal Amount, this Note shall be deemed paid in full, shall automatically be deemed canceled,

and shall not be reissued.

12. Amendments.

The prior written consent of both parties hereto shall be required for any change or amendment to this Note.

13. Assignments.

Borrower may not assign this Note without the prior written consent of Lender. This Note and any Conversion Shares issued upon conversion

of this Note may be offered, sold, assigned or transferred by Lender without the consent of Borrower, so long as such transfer is in

accordance with applicable federal and state securities laws.

14. Notices.

Whenever notice is required to be given under this Note, unless otherwise provided herein, such notice shall be given in accordance with

the subsection of the Purchase Agreement titled “Notices.”

15. Severability.

If any part of this Note is construed to be in violation of any law, such part shall be modified to achieve the objective of Borrower

and Lender to the fullest extent permitted by law and the balance of this Note shall remain in full force and effect.

[Remainder

of page intentionally left blank; signature page follows]

IN

WITNESS WHEREOF, Borrower has caused this Note to be duly executed as of the Issuance Date.

| |

BORROWER: |

| |

Mercurity

Fintech Holding Inc. |

| |

|

|

| |

By: |

/s/

Shi Qiu |

| |

|

Shi Qiu |

| |

|

Chief

Executive Officer |

| ACKNOWLEDGED,

ACCEPTED AND AGREED: |

|

| |

|

| LENDER: |

|

| Viner

Total Investments Fund |

|

| |

|

|

| By: |

|

|

[Signature

Page to Convertible Promissory Note]

ATTACHMENT

1

DEFINITIONS

For

purposes of this Note, the following terms shall have the following meanings:

A1. “Ordinary

Shares” means Borrower’s Ordinary Shares, par value $0.004 per share.

A2. “Conversion

Price” means the Market Price, but in no event shall the Conversion Price be less than the Floor Price.

A3.

“Floor Price” means $[_1.402_] per share.

A4. “Market

Price” equals 90% of the closing price, pursuant to Nasdaq.com, of the Borrower’s Ordinary Shares on the Trading Day

immediately preceding the date of the Conversion Notice.

A5. “Trading

Day” means any day on which Nasdaq (or such other principal market for the Ordinary Shares) is open for trading.

[Remainder

of page intentionally left blank]

APPENDIX

A

CONVERSION

NOTICE

The

above-captioned Lender hereby gives notice to Mercurity Fintech Holding Inc., a Cayman Islands exempted company (the “Borrower”),

pursuant to that certain Unsecured Convertible Promissory Note made by Borrower in favor of Lender on , 2025 (the “Note”),

that Lender elects to convert the portion of the Note balance set forth below into fully paid and non-assessable Ordinary Shares of Borrower

as of the date of conversion specified below. Said conversion shall be based on the Conversion Price set forth below. In the event of

a conflict between this Conversion Notice and the Note, the Note shall govern, or, in the alternative, at the election of Lender in its

sole discretion, Lender may provide a new form of Conversion Notice to conform to the Note. Capitalized terms used in this notice without

definition shall have the meanings given to them in the Note.

| |

A. |

Date

of Conversion: _________________ |

| |

|

|

| |

B. |

Conversion

Amount: _________________ |

| |

|

|

| |

C. |

Conversion

Price: _________________ |

| |

|

|

| |

D. |

Number

of Conversion Shares: _________________ (B divided by C) |

Please

issue the Conversion Shares in the name of the following:

| Name: |

|

|

| |

|

|

| Email: |

|

|

| |

|

|

| Phone

Number: |

|

|

| |

|

|

| Address:

|

|

|

| |

|

|

| |

|

|

| |

|

|

| Tax

ID (if applicable): |

|

|

| |

Lender: |

| |

|

| |

Viner

Total Investments Fund |

| |

|

|

| |

By:

|

|

| |

Name:

|

|

| |

Title: |

|

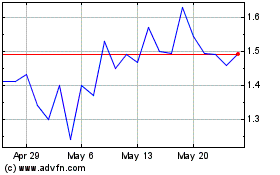

Mercurity Fintech (NASDAQ:MFH)

Historical Stock Chart

From Jan 2025 to Feb 2025

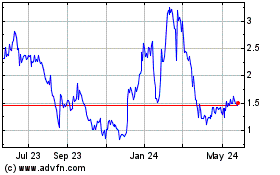

Mercurity Fintech (NASDAQ:MFH)

Historical Stock Chart

From Feb 2024 to Feb 2025