false

0001826671

NONE

NONE

0001826671

2024-01-24

2024-01-24

0001826671

NIRLQ:CommonStockParValue0.0001PerShareMember

2024-01-24

2024-01-24

0001826671

NIRLQ:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-01-24

2024-01-24

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 24, 2024

Near

Intelligence, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39843 |

|

85-3187857 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

100 W Walnut St., Suite A-4

Pasadena, California |

|

91124 |

(Address of principal

executive offices) |

|

(Zip Code) |

Registrant’s

telephone number, including area code: (628) 889-7680

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading symbol(s)(1) |

|

Name of each exchange

on which registered |

| Common Stock par Value $0.0001 per Share |

|

NIRLQ |

|

N/A |

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

NIRWQ |

|

N/A |

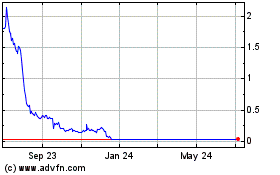

| (1) | On

December 19, 2023, our common stock and warrants were suspended from trading on the Nasdaq Global Market and the Nasdaq Capital Market,

respectively. On December 19, 2023, our common stock and warrants began trading on the OTC Pink Marketplace maintained by the OTC Markets

Group, Inc. under the symbol “NIRLQ” and “NIRWQ”, respectively. On December 27, 2023, Nasdaq Stock Market LLC

filed a Form 25 delisting our common stock and warrants from trading on Nasdaq, which delisting became effective at the opening of the

trading session on January 8, 2024. In accordance with Rule 12d2-2 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), the de-registration of our common stock under Section 12(b) of the Exchange Act will become effective 90 days from the

date of the Form 25 filing. |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Item

7.01 Regulation FD Disclosure

As

previously disclosed, on December 8, 2023, Near Intelligence, Inc. (the “Company”) and certain of its subsidiaries

(such subsidiaries being Near Intelligence LLC (“Near LLC”), Near North America, Inc. (“Near North America”)

and Near Intelligence Pte. Ltd. (“Near Singapore”)) (collectively, the “Debtors”) filed voluntary

petitions under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware (such

court, the “Court” and such cases, the “Cases”).

On

January 24, 2024, each of the Debtors filed their monthly operating reports (collectively, the “Monthly Operating Reports”),

with the Court for the reporting month ended December 31, 2023, copies of which are attached hereto as Exhibit 99.1, Exhibit 99.2, Exhibit

99.3 and Exhibit 99.4, respectively, and are incorporated herein by reference.

The

Company expects to file future Monthly Operating Reports and other documents with the Court while the Cases remain pending. The filing

of such reports and other documents may not be accompanied by a Form 8-K filing. These reports and other documents will also

be available for review free of charge at https://restructuring.ra.kroll.com/near/. Investors should review this website for additional

information regarding the Debtors and the Cases.

Cautionary

Note Regarding the Monthly Operating Reports

The

Company cautions investors and potential investors not to place undue reliance upon the information contained in the Monthly Operating

Reports, which were not prepared for the purpose of providing the basis for an investment decision relating to the Company’s securities.

The Monthly Operating Reports are limited in scope and have been prepared solely for the purpose of complying with requirements of the

Court. The Monthly Operating Reports were not reviewed by independent accountants, are in a format prescribed by applicable bankruptcy

laws, and are subject to future adjustment. The financial information in the Monthly Operating Reports are not prepared in accordance

with accounting principles generally accepted in the United States (“GAAP”) and, therefore, may exclude items required

by GAAP, such as certain reclassifications, eliminations, accruals, valuations and disclosures. The Monthly Operating Reports also relate

to periods that are different from the historical periods required in the Company’s reports pursuant to the Securities Act of 1933,

as amended, or the Exchange Act.

Limitation

on Incorporation by Reference

In

accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 is being furnished for informational purposes

only and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities

of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

except as otherwise expressly stated in such filing. The filing of this current report (including Exhibit 99.1, Exhibit 99.2, Exhibit

99.3 and Exhibit 99.4 attached hereto) will not be deemed an admission as to the materiality of any information required to be disclosed

solely by Regulation FD.

Cautionary

Statements Regarding Trading in the Company’s Securities.

The

Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Cases is highly

speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the

actual recovery, if any, by holders thereof in the Cases. The Company currently does not expect that holders of the Company’s common

stock or other equity securities will receive any payment or other distribution on account of those securities in the Cases given the

expected sales proceeds (which currently under the Asset Purchase Agreement consists of a credit bid) and the amount of the Debtors’

liabilities to more senior creditors. Accordingly, the Company urges extreme caution with respect to existing and future investments

in its securities.

Cautionary

Note Regarding Forward-Looking Statements

This

Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking

statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,”

“anticipates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “will,” “should,” “approximately” or, in each case, their negative or other

variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking

statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future performance and that our actual

results of operations, financial condition and liquidity and the development of the industry in which we operate may differ materially

from the forward-looking statements contained herein. Any forward-looking statements that we make in this Form 8-K speak

only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after

the date of this Form 8-K or to reflect the occurrence of unanticipated events. The Company’s forward-looking statements in this

Form 8-K include, but are not limited to, statements about the Company’s plans to sell its assets pursuant to Chapter 11 of the

U.S. Bankruptcy Code and the timing of such sales and ability to satisfy closing conditions; the lack of distributions to equity securityholders

in the Cases; and other statements regarding the Company’s strategy and future operations, performance and prospects among others.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting the Company will be those anticipated. These forward-looking statements

involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, the risks associated with the potential adverse impact of the Chapter 11 filings on the

Company’s liquidity and results of operations; changes in the Company’s ability to meet its financial obligations during

the Chapter 11 process and to maintain contracts that are critical to its operations; the outcome and timing of the Chapter 11 process

and any potential asset sale; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships

with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in

connection with the Chapter 11 process or the potential asset sale; uncertainty regarding obtaining Court approval of a sale of the Company’s

assets or other conditions to the potential asset sale; and the timing or amount of any distributions, if any, to the Company’s

stakeholders.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits:

| Exhibit |

|

Description |

| |

|

|

| 99.1 |

|

Near Intelligence, Inc., Monthly Operating Report, dated December 31, 2023. |

| |

|

|

| 99.2 |

|

Near Intelligence LLC, Monthly Operating Report, dated December 31, 2023. |

| |

|

|

| 99.3 |

|

Near North America Inc., Monthly Operating Report, dated December 31, 2023. |

| |

|

|

| 99.4 |

|

Near Intelligence Pte. Ltd., Monthly Operating Report, dated December 31, 2023. |

| |

|

|

| 104 |

|

The cover page from Near Intelligence, Inc.’s Current Report on Form 8-K is formatted in iXBRL. |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

NEAR INTELLIGENCE, INC. |

| |

|

|

| Date: January 24, 2024 |

By: |

/s/ John Faieta |

| |

|

John Faieta |

| |

|

Chief Financial Officer |

-3-

Exhibit

99.1

UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In Re. Near Intelligence, Inc. Debtor(s) † † † † Case No. 23 - 11962 Lead Case No. 23 - 11962 Jointly Administered Monthly Operating Report Chapter 11 Petition Date: 12/08/2023 Reporting Period Ended: 12/31/2023 Months Pending: 1 Reporting Method: 5 1 4 5 Industry Classification: Accrual Basis Cash Basis Debtor's Full - Time Employees (current): 0 Debtor's Full - Time Employees (as of date of order for relief): 0 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non - consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Printed Name of Responsible Party Date Rodney Square, 1000 North King Street Wilmington, DE 19801 Address /s/ Shane M. Reil Signature of Responsible Party 01/24/2024 Shane M. Reil 1 UST Form 11 - MOR (12/01/2021) STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. † 1320.4(a)(2) applies. Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 1 of 12

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month b. Total receipts (net of transfers between accounts) c. Total disbursements (net of transfers between accounts) d. Cash balance end of month (a+b - c) e. Disbursements made by third party for the benefit of the estate f. Total disbursements for quarterly fee calculation (c+e) $860 $4,697,500 $4,697,500 $1,377,614 $1,377,614 $3,320,747 $0 $1,377,614 $0 $1,377,614 Current Month Part 2: Asset and Liability Status (Not generally applicable to Individual Debtors. See Instructions.) $0 $0 (attach explanation)) a. Accounts receivable (total net of allowance) b. Accounts receivable over 90 days outstanding (net of allowance) c. d e. f. g. h. i. j. k. l. m. n. o. Inventory ( Book Market Other Total current assets Total assets Postpetition payables (excluding taxes) Postpetition payables past due (excluding taxes) Postpetition taxes payable Postpetition taxes past due Total postpetition debt (f+h) Prepetition secured debt Prepetition priority debt Prepetition unsecured debt Total liabilities (debt) (j+k+l+m) Ending equity/net worth (e - n) $0 $6,222,466 $6,222,466 $225,672 $15,758 $0 $0 $225,672 $0 $0 $33,257,233 $33,482,905 $ - 27,260,439 Part 3: Assets Sold or Transferred Current Month Cumulative a. b. c. $0 $0 Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business Net cash proceeds from assets sold/transferred outside the ordinary $0 $0 course of business (a - b) Cumulative Current Month Part 4: Income Statement (Statement of Operations) (Not generally applicable to Individual Debtors. See Instructions.) $0 a. Gross income/sales (net of returns and allowances) $0 b. Cost of goods sold (inclusive of depreciation, if applicable) $0 c. Gross profit (a - b) $4,699 d. Selling expenses $ - 186,882 e. General and administrative expenses $ - 2,490,147 f. Other expenses $0 g. Depreciation and/or amortization (not included in 4b) $9,439,309 h. Interest $ - 97,139 i. Taxes (local, state, and federal) $1,438,829 j. Reorganization items $ - 8,108,670 $ - 8,108,670 k. Profit (loss) Case 23 - 11962 - TMH 2 UST Form 11 - MOR (12/01/2021) Doc 206 Filed 01/24/24 Page 2 of 12

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 Part 5: Professional Fees and Expenses 3 UST Form 11 - MOR (12/01/2021) Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 3 of 12

4 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 4 of 12

5 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 5 of 12

6 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 6 of 12

7 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 7 of 12

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 xcix c c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative $0 $0 a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) Part 7: Questionnaire - During this reporting period: Yes Yes No No Yes Yes Yes Yes Yes No No No No No h. a. Were any payments made on prepetition debt? (if yes, see Instructions) b. Were any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? d. Are you current on postpetition tax return filings? e. Are you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? g. Was there any postpetition borrowing, other than trade credit? (if yes, see Instructions) Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? If yes, are your premiums current? Casualty/property insurance? If yes, are your premiums current? General liability insurance? If yes, are your premiums current? Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No N/A (if no, see Instructions) N/A (if no, see Instructions) N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? k. Has a disclosure statement been filed with the court? l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. † 1930 ? Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 8 of 12 8 UST Form 11 - MOR (12/01/2021)

Near Intelligence, Inc. Debtor's Name Case No. 23 - 11962 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages b. Gross income (receipts) from self - employment c. Gross income from all other sources d. Total income in the reporting period (a+b+c) e. Payroll deductions f. Self - employment related expenses g. Living expenses h. All other expenses i. Total expenses in the reporting period (e+f+g+h) j. Difference between total income and total expenses (d - i) k. List the total amount of all postpetition debts that are past due l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C † 101(14A)? m. If yes, have you made all Domestic Support Obligation payments? $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Yes No Yes No N/A Privacy Act Statement 28 U.S.C. † 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. †† 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. † 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST - 001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. † 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ John Faieta Signature of Responsible Party Chief Financial Officer Printed Name of Responsible Party 01/24/2024 Date Title John Faieta 9 UST Form 11 - MOR (12/01/2021) Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 9 of 12

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 10 of 12 10 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 11 of 12 11 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near Intelligence, Inc. Case No. 23 - 11962 PageFour PageThree Case 23 - 11962 - TMH Doc 206 Filed 01/24/24 Page 12 of 12 12 UST Form 11 - MOR (12/01/2021)

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: NEAR INTELLIGENCE, INC., et al. , 1 Debtors. Chapter 11 Case No. 23 - 11962 (TMH) (Jointly Administered) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING MONTHLY OPERATING REPORT The debtors and debtors in poss e ssio n in the above - captioned chapter 1 1 cases (each, a “ Debtor ,” and collectively, the “ Debtors ”) have prepared and filed the attached monthly operating report (the “ MOR ”) for the period including December 8 , 2023 through December 31 , 2023 (the “ Reporting Period ”) in the United States Bankruptcy Court for the District of Delaware (the “ Court ”) . The financial information contained herein is presented on a preliminary and unaudited basi s , remains subject to adjustments, and does not purport to represent financial statements prepared in accordance with accounting principles generally accepted in the United States (“ GAAP ”) in all material respects, and it is not intended to fully reconcile to the consolidated financial statements prepared b y the Debtors . Because the Debtors’ accounting systems , policies, and practices were developed to produce consolidated financial statements, rather than financial statements by legal entity, it is possible that not all assets, liabilities, income, or expenses have been recorded on the correct legal entity . This information has not been subjected to procedures that would typically be applied to financial information presented in accordance with U . S . GAA P or any other recognized financial reporting framework, and upon application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material . Therefore, to comply with their obligations to provide MO R s during these chapter 11 cases, the Debtors have prepared this MOR using the best information presently available to them, which has been collected, maintained, and prepared in accordance with their historical accounting practices . Accordingly, this MO R i s true and accurate to the best of the Debtors’ knowledge, information, and belief, based on currently-available data . The results of operations and financial position contained herein are not necessarily indicative of results that may be expected for any period other than the Reporting Period, and may not necessarily reflect the Debtors’ future consolidated results of operations and financial position . Unless otherwise noted herein, the M O R generally reflects the Debtors’ books and record and financial activity occurring during the Reporting Period . Except as may be otherwise noted, no adjustments have been made for activity occurring after the close of the Reporting Period . RESERVATION OF RIGHTS This MOR is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Debtors’ chapter 11 cases . 1 1 The Debtors in these chapter 11 cases, along with the last four digits of their federal tax identification numbers, to the extent applicable, are Near Intelligence, Inc . ( 7857 ), Near Intelligence LLC ( 7857 ), Near North America, Inc . ( 9078 ), and Near Intelligence Pte . Ltd . The Debtors’ headquarters is located at 100 W Walnut St . , Suite A - 4 , Pasadena, CA 91124 . Case 23 - 11962 - TMH Doc 206 - 1 Filed 01/24/24 Page 1 of 3

2 The preliminary unaudited financial statements have been derived from the Debtors’ books and records . The information presented herein has not been subject to all procedures that typically would be applied to financial information presented in accordance with GAAP or any other reporting framework . Upon the application of such procedures, the Debtors believe that the financial information could be subject to material change . The information furnished in this MOR includes normal recurring adjustments, but does not include all of the adjustments that typically would be made for interim financial statements presented in accordance with GAAP . Although the Debtors made commercially reasonable efforts to ensure the accuracy and completeness of the MOR, inadvertent errors or omissions may exist . Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of any claim amount, agreement, representation, or other statement set forth in this MOR . Further, the Debtors reserve the right to amend or supplement this MOR in all respects, if necessary or appropriate, but undertake no obligation to do so . Nothing contained in this MOR shall constitute a waiver or any of the Debtors’ rights or an admission with respect to their chapter 11 cases . For the reasons discussed above, there can be no assurance that the consolidated financial information presented herein is complete, and readers are cautioned not to place undue reliance on the MOR . The financial statements of the Debtors’ non - debtor affiliates have not been included in the MOR. Unless otherwise indicated, all amounts in the MOR are reflected in U.S. dollars. SUPPORTING DOCUMENTATION Statement of Cash Receipts and Disbursements . Reported cash receipts and disbursements exclude intercompany and debtor - to - debtor transactions, as provided in the instructions to the MOR . As a result, for those debtors with net intercompany cash outflows or inflows during the reporting period, the ending cash balances reported on Form 11 - MOR Part 1 may not match the ending cash balances per the Debtors’ bank statements or the Debtors’ books and records . In addition, the escrow transfers for the weekly Debtor professional fee estimates under the Interim DIP Order [Docket No . 66 ] are not included as those funds will remain in the escrow account until each respective professional’s fee applications are approved . When funds are transferred out of the escrow account, such disbursements will be included as cash disbursements . In December, the total amount transferred to the escrow account was $ 1 , 391 , 420 . 61 . For additional information on ending cash balances per the Debtors’ books and records, see the attached cash balances per MOR - 1 : Cash Receipts and Disbursements . Balance Sheet . Liabilities subject to compromise (“ LSTC ”) have been reported at the amounts recorded on the Debtors' books and records as of the date of the MOR . The amounts classified as LSTC in the financial statements included herein are preliminary and may be subject to future adjustments depending on developments with respect to, among other things : disputed claims ; determinations of the secured status of certain claims ; the values of any collateral securing such claims ; rejection of executory contracts ; reconciliation of claims ; and other events . Scheduled claims are subject to change and reconciliation to any filed claims . Income Statement . As noted, although the Debtors generally prepare financial statements on a consolidated basis, these MORs are prepared on an entity - by - entity basis. In December the Case 23 - 11962 - TMH Doc 206 - 1 Filed 01/24/24 Page 2 of 3

3 debtor entities recognized many one - time impairment, provisions, and write - off expenses that are reported in Part 4 (f) “Other expenses” of each respective Debtor entity’s Income Statement on the MOR . These adjustments can be found in each respective Debtor entity’s Part 4 exhibit and relate to (i) impairment expenses related to subsidiary investments, intangible assets, and doubtful account trade receivables, (ii) write - offs for unamortized interest and finance costs, derivative liabilities, RSU cancellation/forfeiture costs, and D&O insurance run off policies, and (iii) provisions for doubtful supplier advances . Part 6 Postpetition Employer Taxes Near North America contracted TriNet HR III, Inc . as a Professional Employer Organization (“ PEO ”) and under this agreement TriNet is the payroll employer of record for Near North America employees . Federal payroll taxes, such as income withholding, Social Security, Medicare and unemployment tax are paid by TriNet and the taxes are reported, in aggregate, under TriNet’s name and FEIN on Forms 940 and 941 . Additionally, all state and local withholding taxes are paid and filed on behalf of the Debtor under TriNet’s name, FEIN and account numbers . Part 7 Questionnaire . Pursuant to certain orders of the Bankruptcy Court entered in the Debtors’ chapter 11 cases (the “ First Day Orders ”), the Debtors were authorized to issue payments on account of certain prepetition obligations . Please see the attachments to the MORs for a list of such payments . These disbursements exclude payments related to insiders, which are separately disclosed in the schedule of payments to insiders . Case 23 - 11962 - TMH Doc 206 - 1 Filed 01/24/24 Page 3 of 3

For the Period 12/8/2023 through 12/31/2023 12/8 - 12/31 $ 860 Beginning Cash Balance Receipts 4,697,500 DIP Borrowing 4,697,500 Total Receipts - Operating Disbursements Payroll - Cost of Revenue (503) Trade Payables - Rent (127,111) Insurance - Taxes - Debt (127,614) Total Operating Disbursements 4,569,886 Operating Cash Flow (1,250,000) Restructuring Related Reimbursement of Lenders' expenses (1,250,000) Total Restructuring Related 3,319,886 Net Cash Flow $ 3,320,747 Ending Cash Balance Near Intelligence, Inc. Part 1 - Statement of Cash Receipts and Disbursements Case 23 - 11962 - TMH Doc 206 - 2 Filed 01/24/24 Page 1 of 5

Near Intelligence, In c C . as e 23 - 11962 - TMH Part 2 - Balance Sheet As of December 31, 2023 Dec - 23 Assets Current assets: Cash and cash equivalents Restricted cash Accounts receivable, net Prepayments and other current assets Intercompany advances Total current assets 1,929,326 - - 708,908 3,584,233 6,222,466 Property and equipment, net Operating lease right - of - use assets Goodwill Intangible assets Other assets Investment in Subsidiaries Total assets - - - - - - 6,222,466 $ Liabilities: Current liabilities: 2,791,380 Borrowings - DIP Financing 65,672 Accounts payable 160,000 Accrued expenses - Other current liabilties - Operating lease liabilities 17,579,490 Convertible debentures 7,660,933 Intercompany Liabilities 5,225,430 Liabilities subject to compromise 33,482,905 Total current liabilities Long - term borrowings, less current portion Long - term operating lease liabilities Long - term derivative liabilities Other liabilities Total liabilities - - - - 33,482,905 $ Stockholders’ equity (deficit) 5,671 Common stock (3,763,549) Additional paid - in - capital (23,502,561) Accumulated deficit - Accumulated other comprehensive loss (27,260,439) Total stockholders’ equity (deficit) Total liabilities and stockholders’ equity (deficit) 6,222,466 $ Doc 206 - 2 Filed 01/24/24 Page 2 of 5

For the Period 12/8/2023 through 12/31/2023 Near Intelligence, In c C . as e 23 - 11962 - TMH Part 4 - Income Statement 12/8 - 12/31 Revenue Costs and expenses: Cost of revenue excluding depreciation and amortization Product and technology Sales and marketing General and administrative Depreciation and amortization Total costs and expenses Operating Profit (loss) Interest and Finance cost Derivative Liabilities - Written back Impairment of Subsidiary Investment Provision for Doubtful advance Reorganization cost RSU cost due to cancellation/Forfeiture Impairment loss of Trade receivables Impairment of Intangible assets Run off insurance policy written off Other income/(expense) net Income (Loss) before income tax expense Income tax expense Net Income (loss) - - - 4,699 (186,882) - (182,183) 182,183 9,439,309 (7,318,405) - - 1,438,829 - - - 4,828,258 - (8,205,809) (97,139) (8,108,670) Doc 206 - 2 Filed 01/24/24 Page 3 of 5

Near Intelligence, Inc. Part 7(a) - payments made on prepetition debt December 2023 Reason for providing value Dates of Payments Amount Creditor Name Debtor Name Approved as Adequate Protection Payments for DIP Lender's counsel under the Interim Order on DIP Financing 15 - Dec - 23 $1,250,000.00 King & Spalding LLP Near Intelligence, Inc. Approved under Final Order Authorizing Debtors to Continue Insurance Policies 26 - Dec - 23 $127,110.94 Marsh USA LLC Near Intelligence, Inc. $1,377,110.94 Total Case 23 - 11962 - TMH Doc 206 - 2 Filed 01/24/24 Page 4 of 5

Near Intelligence, Inc. Part 7(g) - postpetition borrowing December 2023 Reason for providing value Dates of Payments Amount Creditor Name Debtor Name Initial borrowing request under the Interim Order on DIP Financing 12 - Dec - 23 $4,697,500.00 Blue Torch Capital Near Intelligence, Inc. $4,697,500.00 Total Case 23 - 11962 - TMH Doc 206 - 2 Filed 01/24/24 Page 5 of 5

Exhibit

99.2

UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In Re. Near Intelligence LLC Debtor(s) † † † † Case No. 23 - 11965 Lead Case No. 23 - 11962 Jointly Administered Monthly Operating Report Chapter 11 Petition Date: 12/08/2023 Reporting Period Ended: 12/31/2023 Months Pending: 1 Reporting Method: 5 1 4 5 Industry Classification: Accrual Basis Cash Basis Debtor's Full - Time Employees (current): 0 Debtor's Full - Time Employees (as of date of order for relief): 0 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non - consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Printed Name of Responsible Party Date Rodney Square, 1000 North King Street Wilmington, DE 19801 Address /s/ Shane M. Reil Signature of Responsible Party 01/24/2024 Shane M. Reil 1 UST Form 11 - MOR (12/01/2021) STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. † 1320.4(a)(2) applies. Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 1 of 12

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month b. Total receipts (net of transfers between accounts) c. Total disbursements (net of transfers between accounts) d. Cash balance end of month (a+b - c) e. Disbursements made by third party for the benefit of the estate f. Total disbursements for quarterly fee calculation (c+e) $7,246 $0 $0 $233 $233 $7,013 $0 $0 $233 $233 Current Month Part 2: Asset and Liability Status (Not generally applicable to Individual Debtors. See Instructions.) $0 $0 (attach explanation)) a. Accounts receivable (total net of allowance) b. Accounts receivable over 90 days outstanding (net of allowance) c. d e. f. g. h. i. j. k. l. m. n. o. Inventory ( Book Market Other Total current assets Total assets Postpetition payables (excluding taxes) Postpetition payables past due (excluding taxes) Postpetition taxes payable Postpetition taxes past due Total postpetition debt (f+h) Prepetition secured debt Prepetition priority debt Prepetition unsecured debt Total liabilities (debt) (j+k+l+m) Ending equity/net worth (e - n) $0 $63,804,661 $76,722,276 $5,381,140 $0 $0 $0 $5,381,140 $80,015,350 $0 $12,489,138 $97,885,628 $ - 21,163,352 Part 3: Assets Sold or Transferred Current Month Cumulative a. b. c. $0 $0 Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business Net cash proceeds from assets sold/transferred outside the ordinary $0 $0 course of business (a - b) Cumulative Current Month Part 4: Income Statement (Statement of Operations) (Not generally applicable to Individual Debtors. See Instructions.) $0 a. Gross income/sales (net of returns and allowances) $231,450 b. Cost of goods sold (inclusive of depreciation, if applicable) $ - 231,450 c. Gross profit (a - b) $0 d. Selling expenses $42,624 e. General and administrative expenses $34,381,954 f. Other expenses $262,894 g. Depreciation and/or amortization (not included in 4b) $17,723,184 h. Interest $ - 5,966 i. Taxes (local, state, and federal) $0 j. Reorganization items $ - 52,636,140 $ - 52,636,140 k. Profit (loss) Case 23 - 11962 - TMH 2 UST Form 11 - MOR (12/01/2021) Doc 207 Filed 01/24/24 Page 2 of 12

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 Part 5: Professional Fees and Expenses 3 UST Form 11 - MOR (12/01/2021) Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 3 of 12

4 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence LLC Case No. 23 - 11965 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 4 of 12

5 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence LLC Case No. 23 - 11965 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 5 of 12

6 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence LLC Case No. 23 - 11965 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 6 of 12

7 UST Form 11 - MOR (12/01/2021) Debtor's Name Near Intelligence LLC Case No. 23 - 11965 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 7 of 12

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 xcix c c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative $0 $0 a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) Part 7: Questionnaire - During this reporting period: Yes Yes No No Yes Yes Yes Yes Yes No No No No No h. a. Were any payments made on prepetition debt? (if yes, see Instructions) b. Were any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? d. Are you current on postpetition tax return filings? e. Are you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? g. Was there any postpetition borrowing, other than trade credit? (if yes, see Instructions) Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? If yes, are your premiums current? Casualty/property insurance? If yes, are your premiums current? General liability insurance? If yes, are your premiums current? Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No N/A (if no, see Instructions) N/A (if no, see Instructions) N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? k. Has a disclosure statement been filed with the court? l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. † 1930 ? Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 8 of 12 8 UST Form 11 - MOR (12/01/2021)

Near Intelligence LLC Debtor's Name Case No. 23 - 11965 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages b. Gross income (receipts) from self - employment c. Gross income from all other sources d. Total income in the reporting period (a+b+c) e. Payroll deductions f. Self - employment related expenses g. Living expenses h. All other expenses i. Total expenses in the reporting period (e+f+g+h) j. Difference between total income and total expenses (d - i) k. List the total amount of all postpetition debts that are past due l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C † 101(14A)? m. If yes, have you made all Domestic Support Obligation payments? $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Yes No Yes No N/A Privacy Act Statement 28 U.S.C. † 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. †† 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. † 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST - 001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. † 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ John Faieta Signature of Responsible Party Chief Financial Officer Printed Name of Responsible Party 01/24/2024 Date Title John Faieta 9 UST Form 11 - MOR (12/01/2021) Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 9 of 12

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 10 of 12 10 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 11 of 12 11 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near Intelligence LLC Case No. 23 - 11965 PageFour PageThree Case 23 - 11962 - TMH Doc 207 Filed 01/24/24 Page 12 of 12 12 UST Form 11 - MOR (12/01/2021)

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: NEAR INTELLIGENCE, INC., et al. , 1 Debtors. Chapter 11 Case No. 23 - 11962 (TMH) (Jointly Administered) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING MONTHLY OPERATING REPORT The debtors and debtors in poss e ssio n in the above - captioned chapter 1 1 cases (each, a “ Debtor ,” and collectively, the “ Debtors ”) have prepared and filed the attached monthly operating report (the “ MOR ”) for the period including December 8 , 2023 through December 31 , 2023 (the “ Reporting Period ”) in the United States Bankruptcy Court for the District of Delaware (the “ Court ”) . The financial information contained herein is presented on a preliminary and unaudited basi s , remains subject to adjustments, and does not purport to represent financial statements prepared in accordance with accounting principles generally accepted in the United States (“ GAAP ”) in all material respects, and it is not intended to fully reconcile to the consolidated financial statements prepared b y the Debtors . Because the Debtors’ accounting systems , policies, and practices were developed to produce consolidated financial statements, rather than financial statements by legal entity, it is possible that not all assets, liabilities, income, or expenses have been recorded on the correct legal entity . This information has not been subjected to procedures that would typically be applied to financial information presented in accordance with U . S . GAA P or any other recognized financial reporting framework, and upon application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material . Therefore, to comply with their obligations to provide MO R s during these chapter 11 cases, the Debtors have prepared this MOR using the best information presently available to them, which has been collected, maintained, and prepared in accordance with their historical accounting practices . Accordingly, this MO R i s true and accurate to the best of the Debtors’ knowledge, information, and belief, based on currently-available data . The results of operations and financial position contained herein are not necessarily indicative of results that may be expected for any period other than the Reporting Period, and may not necessarily reflect the Debtors’ future consolidated results of operations and financial position . Unless otherwise noted herein, the M O R generally reflects the Debtors’ books and record and financial activity occurring during the Reporting Period . Except as may be otherwise noted, no adjustments have been made for activity occurring after the close of the Reporting Period . RESERVATION OF RIGHTS This MOR is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Debtors’ chapter 11 cases . 1 1 The Debtors in these chapter 11 cases, along with the last four digits of their federal tax identification numbers, to the extent applicable, are Near Intelligence, Inc . ( 7857 ), Near Intelligence LLC ( 7857 ), Near North America, Inc . ( 9078 ), and Near Intelligence Pte . Ltd . The Debtors’ headquarters is located at 100 W Walnut St . , Suite A - 4 , Pasadena, CA 91124 . Case 23 - 11962 - TMH Doc 207 - 1 Filed 01/24/24 Page 1 of 3

2 The preliminary unaudited financial statements have been derived from the Debtors’ books and records . The information presented herein has not been subject to all procedures that typically would be applied to financial information presented in accordance with GAAP or any other reporting framework . Upon the application of such procedures, the Debtors believe that the financial information could be subject to material change . The information furnished in this MOR includes normal recurring adjustments, but does not include all of the adjustments that typically would be made for interim financial statements presented in accordance with GAAP . Although the Debtors made commercially reasonable efforts to ensure the accuracy and completeness of the MOR, inadvertent errors or omissions may exist . Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of any claim amount, agreement, representation, or other statement set forth in this MOR . Further, the Debtors reserve the right to amend or supplement this MOR in all respects, if necessary or appropriate, but undertake no obligation to do so . Nothing contained in this MOR shall constitute a waiver or any of the Debtors’ rights or an admission with respect to their chapter 11 cases . For the reasons discussed above, there can be no assurance that the consolidated financial information presented herein is complete, and readers are cautioned not to place undue reliance on the MOR . The financial statements of the Debtors’ non - debtor affiliates have not been included in the MOR. Unless otherwise indicated, all amounts in the MOR are reflected in U.S. dollars. SUPPORTING DOCUMENTATION Statement of Cash Receipts and Disbursements . Reported cash receipts and disbursements exclude intercompany and debtor - to - debtor transactions, as provided in the instructions to the MOR . As a result, for those debtors with net intercompany cash outflows or inflows during the reporting period, the ending cash balances reported on Form 11 - MOR Part 1 may not match the ending cash balances per the Debtors’ bank statements or the Debtors’ books and records . In addition, the escrow transfers for the weekly Debtor professional fee estimates under the Interim DIP Order [Docket No . 66 ] are not included as those funds will remain in the escrow account until each respective professional’s fee applications are approved . When funds are transferred out of the escrow account, such disbursements will be included as cash disbursements . In December, the total amount transferred to the escrow account was $ 1 , 391 , 420 . 61 . For additional information on ending cash balances per the Debtors’ books and records, see the attached cash balances per MOR - 1 : Cash Receipts and Disbursements . Balance Sheet . Liabilities subject to compromise (“ LSTC ”) have been reported at the amounts recorded on the Debtors' books and records as of the date of the MOR . The amounts classified as LSTC in the financial statements included herein are preliminary and may be subject to future adjustments depending on developments with respect to, among other things : disputed claims ; determinations of the secured status of certain claims ; the values of any collateral securing such claims ; rejection of executory contracts ; reconciliation of claims ; and other events . Scheduled claims are subject to change and reconciliation to any filed claims . Income Statement . As noted, although the Debtors generally prepare financial statements on a consolidated basis, these MORs are prepared on an entity - by - entity basis. In December the Case 23 - 11962 - TMH Doc 207 - 1 Filed 01/24/24 Page 2 of 3

3 debtor entities recognized many one - time impairment, provisions, and write - off expenses that are reported in Part 4 (f) “Other expenses” of each respective Debtor entity’s Income Statement on the MOR . These adjustments can be found in each respective Debtor entity’s Part 4 exhibit and relate to (i) impairment expenses related to subsidiary investments, intangible assets, and doubtful account trade receivables, (ii) write - offs for unamortized interest and finance costs, derivative liabilities, RSU cancellation/forfeiture costs, and D&O insurance run off policies, and (iii) provisions for doubtful supplier advances . Part 6 Postpetition Employer Taxes Near North America contracted TriNet HR III, Inc . as a Professional Employer Organization (“ PEO ”) and under this agreement TriNet is the payroll employer of record for Near North America employees . Federal payroll taxes, such as income withholding, Social Security, Medicare and unemployment tax are paid by TriNet and the taxes are reported, in aggregate, under TriNet’s name and FEIN on Forms 940 and 941 . Additionally, all state and local withholding taxes are paid and filed on behalf of the Debtor under TriNet’s name, FEIN and account numbers . Part 7 Questionnaire . Pursuant to certain orders of the Bankruptcy Court entered in the Debtors’ chapter 11 cases (the “ First Day Orders ”), the Debtors were authorized to issue payments on account of certain prepetition obligations . Please see the attachments to the MORs for a list of such payments . These disbursements exclude payments related to insiders, which are separately disclosed in the schedule of payments to insiders . Case 23 - 11962 - TMH Doc 207 - 1 Filed 01/24/24 Page 3 of 3

Near Intelligence LLC Part 1 - Statement of Cash Receipts and Disbursements For the Period 12/8/2023 through 12/31/2023 12/8 - 12/31 Amount ($ Actual) $ 7,246 Beginning Cash Balance - Receipts Costumer collections - Total Receipts - Operating Disbursements Payroll - Cost of Revenue (233) Trade Payables - Rent - Insurance - Taxes - Debt (233) Total Operating Disbursements (233) Operating Cash Flow - Restructuring Related Restructuring Professional Fees - Total Restructuring Related (233) Net Cash Flow $ 7,013 Ending Cash Balance Case 23 - 11962 - TMH Doc 207 - 2 Filed 01/24/24 Page 1 of 3

Near Intelligence, L L C C as e 23 - 11962 - TMH Balance Sheet Part 2 - Balance Sheet Dec - 23 Assets Current assets: Cash and cash equivalents Restricted cash Accounts receivable, net Prepayments and other current assets Intercompany advances Total current assets 7,013 - - 14,652 63,782,996 63,804,661 - Property and equipment, net - Operating lease right - of - use assets - Goodwill - Intangible assets 279 Other assets 12,917,336 Investment in Subsidiaries $ 76,722,276 Total assets Liabilities: Current liabilities: 80,015,350 Borrowings 5,042,692 DIP Financing 338,460 Accounts payable (1) Accrued expenses - Other current liabilties - Operating lease liabilities - Convertible debentures 3,584,233 Intercompany Liabilities 8,904,905 Liabilities subject to compromise 97,885,639 Total current liabilities Long - term borrowings, less current portion Long - term operating lease liabilities Long - term derivative liabilities Other liabilities Total liabilities - - - - 97,885,639 $ Stockholders’ equity (deficit) Common stock Additional paid - in - capital Accumulated deficit Accumulated other comprehensive loss Total stockholders’ equity (deficit) - 156,677,961 (177,841,324) - (21,163,363) Total liabilities and stockholders’ equity (deficit) 76,722,276 $ Doc 207 - 2 Filed 01/24/24 Page 2 of 3

For the Period 12/8/2023 through 12/31/2023 Near Intelligence L L C C as e 23 - 11962 - TMH Part 4 - Income Statement Dec - 23 Revenue Costs and expenses: - 231,450 Cost of revenue excluding depreciation and a 411 Product and technology - Sales and marketing 42,624 General and administrative 262,894 Depreciation and amortization 537,379 Total costs and expenses (537,379) Operating Profit (loss) 17,723,184 Interest and Finance cost (9,390,670) Derivative Liabilities - Written back 56,423,109 Impairment of Subsidiary Investment 180,000 Provision for Doubtful advance - Reorganization cost (12,830,896) RSU cost due to cancellation/Forfeiture - Impairment loss of Trade receivables - Impairment of Intangible assets - Run off insurance policy written off - Other income/(expense) net (52,642,106) Income (Loss) before income tax expense (5,966) Income tax expense (52,636,140) Net Income (loss) Doc 207 - 2 Filed 01/24/24 Page 3 of 3

Exhibit 99.3

UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In Re. Near North America, Inc. Debtor(s) † † † † Case No. 23 - 11967 Lead Case No. 23 - 11962 Jointly Administered Monthly Operating Report Chapter 11 Petition Date: 12/08/2023 Reporting Period Ended: 12/31/2023 Months Pending: 1 Reporting Method: 5 1 4 5 Industry Classification: Accrual Basis Cash Basis Debtor's Full - Time Employees (current): 37 Debtor's Full - Time Employees (as of date of order for relief): 37 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non - consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Printed Name of Responsible Party Date Rodney Square, 1000 North King Street Wilmington, DE 19801 Address /s/ Shane M. Reil Signature of Responsible Party 01/24/2024 Shane M. Reil 1 UST Form 11 - MOR (12/01/2021) STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. † 1320.4(a)(2) applies. Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 1 of 12

Debtor's Name Near North America, Inc. Case No. 23 - 11967 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month b. Total receipts (net of transfers between accounts) c. Total disbursements (net of transfers between accounts) d. Cash balance end of month (a+b - c) e. Disbursements made by third party for the benefit of the estate f. Total disbursements for quarterly fee calculation (c+e) $125,010 $717,493 $717,493 $315,856 $315,856 $526,648 $0 $315,856 $0 $315,856 Current Month Part 2: Asset and Liability Status (Not generally applicable to Individual Debtors. See Instructions.) $4,359,650 $232,007 (attach explanation)) a. Accounts receivable (total net of allowance) b. Accounts receivable over 90 days outstanding (net of allowance) c. d e. f. g. h. i. j. k. l. m. n. o. Inventory ( Book Market Other Total current assets Total assets Postpetition payables (excluding taxes) Postpetition payables past due (excluding taxes) Postpetition taxes payable Postpetition taxes past due Total postpetition debt (f+h) Prepetition secured debt Prepetition priority debt Prepetition unsecured debt Total liabilities (debt) (j+k+l+m) Ending equity/net worth (e - n) $0 $34,850,717 $35,804,684 $5,257,053 $49,414 $0 $0 $5,257,053 $0 $0 $52,380,338 $57,637,391 $ - 21,832,707 Part 3: Assets Sold or Transferred Current Month Cumulative a. b. c. $0 $0 Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business Net cash proceeds from assets sold/transferred outside the ordinary $0 $0 course of business (a - b) Cumulative Current Month Part 4: Income Statement (Statement of Operations) (Not generally applicable to Individual Debtors. See Instructions.) $1,550,163 a. Gross income/sales (net of returns and allowances) $468,179 b. Cost of goods sold (inclusive of depreciation, if applicable) $1,081,984 c. Gross profit (a - b) $216,194 d. Selling expenses $518,323 e. General and administrative expenses $12,153,273 f. Other expenses $2,680 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $0 i. Taxes (local, state, and federal) $0 j. Reorganization items $0 $ - 11,808,486 k. Profit (loss) Case 23 - 11962 - TMH 2 UST Form 11 - MOR (12/01/2021) Doc 209 Filed 01/24/24 Page 2 of 12

Debtor's Name Near North America, Inc. Case No. 23 - 11967 Part 5: Professional Fees and Expenses 3 UST Form 11 - MOR (12/01/2021) Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 3 of 12

4 UST Form 11 - MOR (12/01/2021) Debtor's Name Near North America, Inc. Case No. 23 - 11967 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 4 of 12

5 UST Form 11 - MOR (12/01/2021) Debtor's Name Near North America, Inc. Case No. 23 - 11967 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Paid Cumulative Paid Current Month Approved Cumulative Approved Current Month b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Role Firm Name i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 5 of 12

6 UST Form 11 - MOR (12/01/2021) Debtor's Name Near North America, Inc. Case No. 23 - 11967 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 6 of 12

7 UST Form 11 - MOR (12/01/2021) Debtor's Name Near North America, Inc. Case No. 23 - 11967 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 7 of 12

Debtor's Name Near North America, Inc. Case No. 23 - 11967 xcix c c. All professional fees and expenses (debtor & committees) Part 6: Postpetition Taxes Current Month Cumulative $0 $0 a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $0 $0 d. Postpetition employer payroll taxes paid $0 $0 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) Part 7: Questionnaire - During this reporting period: Yes Yes No No Yes Yes Yes Yes Yes No No No No No h. a. Were any payments made on prepetition debt? (if yes, see Instructions) b. Were any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Were any payments made to or on behalf of insiders? d. Are you current on postpetition tax return filings? e. Are you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? g. Was there any postpetition borrowing, other than trade credit? (if yes, see Instructions) Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? If yes, are your premiums current? Casualty/property insurance? If yes, are your premiums current? General liability insurance? If yes, are your premiums current? Yes Yes Yes Yes Yes Yes Yes Yes Yes No No No No No No No No No N/A (if no, see Instructions) N/A (if no, see Instructions) N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? k. Has a disclosure statement been filed with the court? l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. † 1930 ? Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 8 of 12 8 UST Form 11 - MOR (12/01/2021)

Near North America, Inc. Debtor's Name Case No. 23 - 11967 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages b. Gross income (receipts) from self - employment c. Gross income from all other sources d. Total income in the reporting period (a+b+c) e. Payroll deductions f. Self - employment related expenses g. Living expenses h. All other expenses i. Total expenses in the reporting period (e+f+g+h) j. Difference between total income and total expenses (d - i) k. List the total amount of all postpetition debts that are past due l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C † 101(14A)? m. If yes, have you made all Domestic Support Obligation payments? $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Yes No Yes No N/A Privacy Act Statement 28 U.S.C. † 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. †† 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. † 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST - 001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. † 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ John Faieta Signature of Responsible Party Chief Financial Officer Printed Name of Responsible Party 01/24/2024 Date Title John Faieta 9 UST Form 11 - MOR (12/01/2021) Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 9 of 12

Debtor's Name Near North America, Inc. Case No. 23 - 11967 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 10 of 12 10 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near North America, Inc. Case No. 23 - 11967 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 11 of 12 11 UST Form 11 - MOR (12/01/2021)

Debtor's Name Near North America, Inc. Case No. 23 - 11967 PageFour PageThree Case 23 - 11962 - TMH Doc 209 Filed 01/24/24 Page 12 of 12 12 UST Form 11 - MOR (12/01/2021)

IN THE UNITED STATES BANKRUPTCY COURT FOR THE DISTRICT OF DELAWARE In re: NEAR INTELLIGENCE, INC., et al. , 1 Debtors. Chapter 11 Case No. 23 - 11962 (TMH) (Jointly Administered) GLOBAL NOTES AND STATEMENT OF LIMITATIONS, METHODOLOGY, AND DISCLAIMERS REGARDING MONTHLY OPERATING REPORT The debtors and debtors in poss e ssio n in the above - captioned chapter 1 1 cases (each, a “ Debtor ,” and collectively, the “ Debtors ”) have prepared and filed the attached monthly operating report (the “ MOR ”) for the period including December 8 , 2023 through December 31 , 2023 (the “ Reporting Period ”) in the United States Bankruptcy Court for the District of Delaware (the “ Court ”) . The financial information contained herein is presented on a preliminary and unaudited basi s , remains subject to adjustments, and does not purport to represent financial statements prepared in accordance with accounting principles generally accepted in the United States (“ GAAP ”) in all material respects, and it is not intended to fully reconcile to the consolidated financial statements prepared b y the Debtors . Because the Debtors’ accounting systems , policies, and practices were developed to produce consolidated financial statements, rather than financial statements by legal entity, it is possible that not all assets, liabilities, income, or expenses have been recorded on the correct legal entity . This information has not been subjected to procedures that would typically be applied to financial information presented in accordance with U . S . GAA P or any other recognized financial reporting framework, and upon application of such procedures, the Debtors believe that the financial information could be subject to changes, and these changes could be material . Therefore, to comply with their obligations to provide MO R s during these chapter 11 cases, the Debtors have prepared this MOR using the best information presently available to them, which has been collected, maintained, and prepared in accordance with their historical accounting practices . Accordingly, this MO R i s true and accurate to the best of the Debtors’ knowledge, information, and belief, based on currently-available data . The results of operations and financial position contained herein are not necessarily indicative of results that may be expected for any period other than the Reporting Period, and may not necessarily reflect the Debtors’ future consolidated results of operations and financial position . Unless otherwise noted herein, the M O R generally reflects the Debtors’ books and record and financial activity occurring during the Reporting Period . Except as may be otherwise noted, no adjustments have been made for activity occurring after the close of the Reporting Period . RESERVATION OF RIGHTS This MOR is limited in scope, covers a limited time period, and has been prepared solely for the purpose of complying with the monthly reporting requirements of the Debtors’ chapter 11 cases . 1 1 The Debtors in these chapter 11 cases, along with the last four digits of their federal tax identification numbers, to the extent applicable, are Near Intelligence, Inc . ( 7857 ), Near Intelligence LLC ( 7857 ), Near North America, Inc . ( 9078 ), and Near Intelligence Pte . Ltd . The Debtors’ headquarters is located at 100 W Walnut St . , Suite A - 4 , Pasadena, CA 91124 . Case 23 - 11962 - TMH Doc 209 - 1 Filed 01/24/24 Page 1 of 3

2 The preliminary unaudited financial statements have been derived from the Debtors’ books and records . The information presented herein has not been subject to all procedures that typically would be applied to financial information presented in accordance with GAAP or any other reporting framework . Upon the application of such procedures, the Debtors believe that the financial information could be subject to material change . The information furnished in this MOR includes normal recurring adjustments, but does not include all of the adjustments that typically would be made for interim financial statements presented in accordance with GAAP . Although the Debtors made commercially reasonable efforts to ensure the accuracy and completeness of the MOR, inadvertent errors or omissions may exist . Accordingly, the Debtors hereby reserve all of their rights to dispute the validity, status, enforceability, or executory nature of any claim amount, agreement, representation, or other statement set forth in this MOR . Further, the Debtors reserve the right to amend or supplement this MOR in all respects, if necessary or appropriate, but undertake no obligation to do so . Nothing contained in this MOR shall constitute a waiver or any of the Debtors’ rights or an admission with respect to their chapter 11 cases . For the reasons discussed above, there can be no assurance that the consolidated financial information presented herein is complete, and readers are cautioned not to place undue reliance on the MOR . The financial statements of the Debtors’ non - debtor affiliates have not been included in the MOR. Unless otherwise indicated, all amounts in the MOR are reflected in U.S. dollars. SUPPORTING DOCUMENTATION Statement of Cash Receipts and Disbursements . Reported cash receipts and disbursements exclude intercompany and debtor - to - debtor transactions, as provided in the instructions to the MOR . As a result, for those debtors with net intercompany cash outflows or inflows during the reporting period, the ending cash balances reported on Form 11 - MOR Part 1 may not match the ending cash balances per the Debtors’ bank statements or the Debtors’ books and records . In addition, the escrow transfers for the weekly Debtor professional fee estimates under the Interim DIP Order [Docket No . 66 ] are not included as those funds will remain in the escrow account until each respective professional’s fee applications are approved . When funds are transferred out of the escrow account, such disbursements will be included as cash disbursements . In December, the total amount transferred to the escrow account was $ 1 , 391 , 420 . 61 . For additional information on ending cash balances per the Debtors’ books and records, see the attached cash balances per MOR - 1 : Cash Receipts and Disbursements . Balance Sheet . Liabilities subject to compromise (“ LSTC ”) have been reported at the amounts recorded on the Debtors' books and records as of the date of the MOR . The amounts classified as LSTC in the financial statements included herein are preliminary and may be subject to future adjustments depending on developments with respect to, among other things : disputed claims ; determinations of the secured status of certain claims ; the values of any collateral securing such claims ; rejection of executory contracts ; reconciliation of claims ; and other events . Scheduled claims are subject to change and reconciliation to any filed claims . Income Statement . As noted, although the Debtors generally prepare financial statements on a consolidated basis, these MORs are prepared on an entity - by - entity basis. In December the Case 23 - 11962 - TMH Doc 209 - 1 Filed 01/24/24 Page 2 of 3