false

0001826671

NONE

NONE

0001826671

2024-01-05

2024-01-05

0001826671

NIRLQ:CommonStockParValue0.0001PerShareMember

2024-01-05

2024-01-05

0001826671

NIRLQ:WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember

2024-01-05

2024-01-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): January 5, 2024

Near

Intelligence, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-39843 |

|

85-3187857 |

(State

or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S.

Employer

Identification No.) |

100

W Walnut St., Suite A-4

Pasadena, California |

|

91124 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (628) 889-7680

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s)(1) |

|

Name

of each exchange

on

which registered

|

| Common

Stock par Value $0.0001 per Share |

|

NIRLQ |

|

N/A |

| Warrants,

each exercisable for one share of Common Stock for $11.50 per share |

|

NIRWQ |

|

N/A |

| (1) | On December 19,

2023, our common stock and warrants were suspended from trading on the Nasdaq Global Market and the Nasdaq Capital Market, respectively.

On December 19, 2023, our common stock and warrants began trading on the OTC Pink Marketplace maintained by the OTC Markets Group, Inc.

under the symbol “NIRLQ” and “NIRWQ”, respectively. On December 27, 2023, Nasdaq Stock Market LLC filed a Form

25 delisting our common stock and warrants from trading on Nasdaq, which delisting will become effective ten days thereafter. In accordance

with Rule 12d2-2 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the de-registration of our

common stock under Section 12(b) of the Exchange Act will become effective 90 days from the date of the Form 25 filing. |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Exchange Act (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act

Item 7.01 Regulation FD Disclosure

As

previously disclosed, on December 8, 2023, Near Intelligence, Inc. (the “Company”) and certain of its subsidiaries

(such subsidiaries being Near Intelligence LLC, Near North America, Inc. and Near Intelligence Pte. Ltd.) (collectively, the “Debtors”)

filed voluntary petitions under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District

of Delaware (such court, the “Court” and such cases, the “Cases”).

Non-Debtor Report

On

January 5, 2024, the Company filed with the Court a periodic report in accordance with Rule 2015.3 of the Federal Rules of Bankruptcy

Procedure (the “Non-Debtor Report”) regarding the value, operations, profitability and certain other financial

information of certain non-debtor subsidiaries of the Company, a copy of which is attached hereto as Exhibit 99. 1 and is incorporated

herein by reference.

The

Company expects to file in the future similar reports and other documents with the Court while the Cases remain pending. The filing of

such reports and other documents may not be accompanied by a Form 8-K filing. These reports and other documents will also be

available for review free of charge at https://restructuring.ra.kroll.com/near/. Investors should review this website for additional

information regarding the Debtors and the Cases.

Cautionary

Statement Regarding Non-Debtor Reports and Other Documents

The

Company cautions investors and potential investors not to place undue reliance upon the information contained in the Non-Debtor Report

or any similar reports or other documents that have been or in the future are filed with the Court and that such reports are not prepared

for the purpose of providing the basis for an investment decision relating to any of the securities of the Company. The Non-Debtor Report

and any other reports or documents that have been or in the future are filed with the Court are limited in scope, cover a limited time

period, and are prepared solely for the purpose of complying with the reporting requirements of the Court. The Non-Debtor Report

and any similar reports or other documents that have been or in the future are filed with the Court are not audited or reviewed by independent

accountants, are not prepared in accordance with generally accepted accounting principles (“GAAP”) and therefore may

exclude items required by GAAP, such as certain reclassifications, eliminations, accruals, valuations and disclosures, are in a format

prescribed by applicable bankruptcy laws or rules, and are subject to future adjustment and reconciliation. There can be no assurance

that, from the perspective of an investor or potential investor in the Company’s securities, the Non-Debtor Report and

any similar reports or other documents that have been or in the future are filed with the Court are complete. Results and projections

set forth in the Non-Debtor Report or any similar reports or other documents that have been or in the future are filed with

the Court should not be viewed as indicative of future results.

Limitation

on Incorporation by Reference

In

accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01 is being furnished for informational purposes

only and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities

of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended,

except as otherwise expressly stated in such filing. The filing of this current report (including Exhibit 99.1 attached hereto) will

not be deemed an admission as to the materiality of any information required to be disclosed solely by Regulation FD.

Cautionary

Statements Regarding Trading in the Company’s Securities.

The

Company’s securityholders are cautioned that trading in the Company’s securities during the pendency of the Cases is highly

speculative and poses substantial risks. Trading prices for the Company’s securities may bear little or no relationship to the

actual recovery, if any, by holders thereof in the Cases. The Company currently does not expect that holders of the Company’s common

stock or other equity securities will receive any payment or other distribution on account of those securities in the Cases given the

expected sales proceeds (which currently under the Asset Purchase Agreement consists of a credit bid) and the amount of the Debtors’

liabilities to more senior creditors. Accordingly, the Company urges extreme caution with respect to existing and future investments

in its securities.

Cautionary

Note Regarding Forward-Looking Statements

This

Form 8-K includes statements that are, or may be deemed, “forward-looking statements.” In some cases, these forward-looking

statements can be identified by the use of forward-looking terminology, including the terms “believes,” “estimates,”

“anticipates,” “expects,” “plans,” “intends,” “may,” “could,”

“might,” “will,” “should,” “approximately” or, in each case, their negative or other

variations thereon or comparable terminology, although not all forward-looking statements contain these words. These forward-looking

statements reflect the current beliefs and expectations of management made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. We caution you that forward-looking statements are not guarantees of future performance and that our actual

results of operations, financial condition and liquidity and the development of the industry in which we operate may differ materially

from the forward-looking statements contained herein. Any forward-looking statements that we make in this Form 8-K speak

only as of the date of such statement, and we undertake no obligation to update such statements to reflect events or circumstances after

the date of this Form 8-K or to reflect the occurrence of unanticipated events. The Company’s forward-looking statements in this

Form 8-K include, but are not limited to, statements about the Company’s plans to sell its assets pursuant to Chapter 11 of the

U.S. Bankruptcy Code and the timing of such sales and ability to satisfy closing conditions; the lack of distributions to equity securityholders

in the Cases; and other statements regarding the Company’s strategy and future operations, performance and prospects among others.

These forward-looking statements are based on current expectations and beliefs concerning future developments and their potential effects.

There can be no assurance that future developments affecting the Company will be those anticipated. These forward-looking statements

involve a number of risks, uncertainties (some of which are beyond the Company’s control) or other assumptions that may cause actual

results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and

uncertainties include, but are not limited to, the risks associated with the potential adverse impact of the Chapter 11 filings on the

Company’s liquidity and results of operations; changes in the Company’s ability to meet its financial obligations during

the Chapter 11 process and to maintain contracts that are critical to its operations; the outcome and timing of the Chapter 11 process

and any potential asset sale; the effect of the Chapter 11 filings and any potential asset sale on the Company’s relationships

with vendors, regulatory authorities, employees and other third parties; possible proceedings that may be brought by third parties in

connection with the Chapter 11 process or the potential asset sale; uncertainty regarding obtaining Court approval of a sale of the Company’s

assets or other conditions to the potential asset sale; and the timing or amount of any distributions, if any, to the Company’s

stakeholders.

Item 9.01. Financial Statements and Exhibits.

(d)

Exhibits:

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

NEAR INTELLIGENCE,

INC. |

| |

|

|

| Date: January 5, 2024 |

By: |

/s/

John Faieta |

| |

|

John Faieta |

| |

|

Chief Financial Officer |

-3-

Exhibit 99.1

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

| |

|

|

| In re: |

|

Chapter 11 |

| |

|

|

| NEAR INTELLIGENCE, INC., et al.,1 |

|

Case No. 23-11962 (TMH) |

| |

|

|

| Debtors. |

|

(Jointly Administered) |

| |

|

|

PERIODIC REPORT PURSUANT TO BANKRUPTCY RULE 2015.3

Pursuant to Rule

2015.3(a) of the Federal Rules of Bankruptcy Procedure, Near Intelligence, Inc. and its affiliated debtors, as debtors and debtors in

possession in the above-captioned chapter 11 cases (collectively, the “Debtors”), submit this report (this “Periodic

Report”) on the value, operations, and profitability of certain non-Debtor entities in which one or more Debtors hold a substantial

or controlling interest (each a “Controlled Non-Debtor Entity” and collectively the “Controlled Non-Debtor

Entities”). This Periodic Report has been prepared solely for the purpose of complying with the Federal Rules of Bankruptcy

Procedure. This Periodic Report includes the three non-Debtor entities that are directly owned by one or more of the Debtors.

The following exhibits are attached hereto:

| Exhibit A-1 |

Unaudited Balance Sheet for Controlled Non-Debtor Entities as of December 31, 2022 |

| Exhibit A-2 |

Unaudited Statement of Operations of Controlled Non-Debtor Entities as of December 31, 2022 |

| Exhibit A-3 |

Unaudited Statement of Changes in Equity of Controlled Non-Debtor Entities as of December 31, 2022 |

| Exhibit A-4 |

Unaudited Statement of Cash Flows of Controlled Non-Debtor Entities as of December 31, 2022 |

| Exhibit A-5 |

Unaudited Balance Sheet of Controlled Non-Debtor Entities as of September 30, 2023 |

| Exhibit A-6 |

Unaudited Statement of Operations of Controlled Non-Debtor Entities (January 2023 to September 2023) |

| Exhibit A-7 |

Unaudited Statement of Changes in Equity of Controlled Non-Debtor Entities (September 2023) |

| Exhibit A-8 |

Unaudited Statement of Cash Flows of Controlled Non-Debtor Entities (January 2023 to September 2023) |

| 1 | The Debtors in these chapter 11 cases, along with the last four digits of their federal tax identification

numbers, to the extent applicable, are Near Intelligence, Inc. (7857), Near Intelligence LLC (7857), Near North America, Inc. (9078),

and Near Intelligence Pte. Ltd. The Debtors’ headquarters is located at 100 W Walnut St., Suite A-4, Pasadena, CA 91124. |

| Exhibit B |

Description of Operations for the Controlled Non-Debtor Entities |

| Exhibit C |

Description of Claims Between the Controlled Non-Debtor Entities |

| Exhibit D |

Description of how taxes are allocated between the Controlled Non-Debtor Entities and the Debtors |

| Exhibit E |

Description of Controlled Non-Debtor Entities’ Payments of Administrative Expenses or Professional Fees Otherwise Payable by a Debtor |

The undersigned, having reviewed

the attached exhibits and this Periodic Report, and being familiar with the Debtors’ financial affairs, verifies under the penalty

of perjury that this Periodic Report is complete, accurate, and truthful to the best of his knowledge.

Date: January 5, 2023

| |

/s/ John Faieta |

| |

Name: |

John Faieta |

| |

Title: |

Chief Financial Officer |

GENERAL NOTES

Description of these Chapter 11 Cases

On December 8, 2023 (the “Petition

Date”), Near Intelligence, Inc. and its affiliated debtors in the above-captioned chapter 11 cases (collectively, the “Debtors”)

commenced with the United States Bankruptcy Court for the District of Delaware (the “Court”) voluntary cases under

chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”). The Debtors are authorized to continue operating

their businesses and managing their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

On December 11, 2023, the Bankruptcy Court entered an order authorizing the joint administration of these cases pursuant to Rule 1015(b)

of the Federal Rules of Bankruptcy Procedure. On December 22, 2023, the United States Trustee for the District of Delaware (the “U.S.

Trustee”) appointed an official committee of unsecured creditors pursuant to section 1102(a)(1) of the Bankruptcy Code. Additional

information about these chapter 11 cases, court filings, and claims information is available at the Debtors’ restructuring website:

https://cases.ra.kroll.com/near/.

Financial Statements

In this Periodic Report, the

Debtors provide balance sheets and statements of income (loss) for each Non-Debtor Entity for the period covered as indicated on each

Exhibit.

The financial statements contained

herein include the results of those entities in which the Debtors hold a direct or indirect substantial and controlling interest. The

financial statements are unaudited, limited in scope, have not been reviewed by an independent audit firm and do not fully comply with

generally accepted accounting principles in the United States of America (“U.S. GAAP”). The financial statements have

been derived from the books and records of the Debtors and the Controlled Non-Debtor Entities. If U.S. GAAP procedures had been applied

in full, the Debtors believe that the financial information could be subject to changes and these changes could be material.

Although the Debtors’

management made reasonable efforts to ensure that the financial information is accurate and complete based on information that was available

to them at the time of preparation, subsequent information or discovery may result in material changes to the information. Notwithstanding

any such discovery, new information, or errors or omissions, the Debtors do not undertake any obligation or commitment to update this

Periodic Report. Nothing contained in this Periodic Report shall constitute a waiver of any rights of the Debtors, including the right

to amend the information contained herein.

The financial information

disclosed herein was not prepared in accordance with federal or state securities laws or other applicable non-bankruptcy law or in lieu

of complying with any periodic reporting requirements thereunder. Persons and entities trading in or otherwise purchasing, selling, or

transferring the claims against or equity interests in the Debtors should evaluate this financial information in light of the purposes

for which it was prepared. The Debtors are not liable for and undertake no responsibility to indicate variations from securities laws

or for any evaluations of the Debtors based on this financial information or any other information.

The results of operations

contained herein are not necessarily indicative of results that are expected from any other period and may not necessarily reflect the

results of operations or financial position of the non-Debtors in the future. Further, this Periodic Report is limited in scope, covers

a limited time period, and has been prepared solely for purposes of fulfilling the requirements of Bankruptcy Rule 2015.3. Given, among

other things, the uncertainty surrounding the realization, measurement, and ownership of certain assets and the valuation and nature of

certain liabilities, to the extent that a non-Debtor entity shows more assets than liabilities, this is not an admission that the non-Debtor

entity was solvent on the Petition Date or at any time prior to the Petition Date, including the date as of or for the period of any financial

statements or other information included in this Periodic Report. Likewise, to the extent that a non-Debtor entity shows more liabilities

than assets, this is not an admission that the non-Debtor entity was insolvent on the Petition Date or at any time prior to the Petition

Date, including the date as of or for the period of any financial statements or other information included in this Periodic Report.

The balance sheets and statements

of income have been included for the non-Debtor affiliates to the extent available on a basis consistent with the Debtor’s consolidated

financial statements.

Current Values

The Debtors do not maintain

fair market value or other bases of valuation for these entities, which may differ substantially from the net book value of these entities.

Reservation of Rights

Nothing contained in this

Periodic Report shall constitute a waiver or admission by the Debtors in any respect, nor shall this Periodic Report or any information

set forth herein waive or release any of the Debtors’ rights or admission with respect to these chapter 11 cases, or their estates,

including with respect to, among other things, matters involving objections to claims, substantive consolidation, equitable subordination,

defenses, characterization or re-characterization of contracts, assumption or rejection of contracts under the provisions of chapter 3

of the Bankruptcy Code and/or causes of action under the provisions of chapter 5 of the Bankruptcy Code or any other relevant applicable

laws to recover assets or avoid transfers. The Debtors are reviewing the assets and liabilities of their affiliates on an ongoing basis,

including without limitation with respect to intercompany claims and obligations, and nothing contained in this Periodic Report shall

constitute a waiver of any of the Debtors’ or their affiliates’ rights with respect to such assets, liabilities, claims, and

obligations that may exist.

Currency

The amounts herein are presented in U.S. Dollars, unless

otherwise stated.

EXHIBIT A-1

Unaudited Balance Sheet for Controlled Non-Debtor

Entities as of December 31, 2022

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-1 – Unaudited Balance Sheet as of December

31, 2022

| | |

Near

Intelligence | | |

Near

Intelligence | | |

Near

Intelligence | |

| USD Actuals | |

Pvt Ltd | | |

SAS | | |

Pty Ltd | |

| Assets | |

| | |

| | |

| |

| Current assets: | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 171,920 | | |

| 1,440,846 | | |

| 27,529 | |

| Restricted cash | |

| 32,198 | | |

| 307,373 | | |

| - | |

| Accounts receivable, net of allowance for credit losses | |

| 2,678,351 | | |

| 3,912,591 | | |

| 156,234 | |

| Prepaid expenses and other current assets | |

| 590,765 | | |

| 2,711,519 | | |

| 36,410 | |

| Total current assets | |

| 3,473,235 | | |

| 8,372,328 | | |

| 220,173 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 119,765 | | |

| 190,547 | | |

| 8,883 | |

| Operating lease right-of-use assets | |

| 813,832 | | |

| 2,014,123 | | |

| - | |

| Other assets | |

| 84,470 | | |

| - | | |

| (2,221 | ) |

| Total assets | |

| 4,491,302 | | |

| 10,576,998 | | |

| 226,835 | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Current portion of long-term borrowings | |

| - | | |

| - | | |

| - | |

| Accounts payable | |

| 48,481 | | |

| 1,845,170 | | |

| 19,753 | |

| Accrued expenses and other current liabilities | |

| 2,658,786 | | |

| 2,449,921 | | |

| 87,575 | |

| Current portion of operating lease liabilities | |

| 325,439 | | |

| 314,390 | | |

| - | |

| Derivative liabilities | |

| - | | |

| - | | |

| - | |

| Total current liabilities | |

| 3,032,705 | | |

| 4,609,480 | | |

| 107,328 | |

| | |

| | | |

| | | |

| | |

| Long-term borrowings, less current portion | |

| - | | |

| 1,588,270 | | |

| - | |

| Long-term operating lease liabilities | |

| 559,891 | | |

| 1,795,512 | | |

| - | |

| Long-term derivative liabilities | |

| - | | |

| - | | |

| - | |

| Other liabilities | |

| 188,285 | | |

| - | | |

| - | |

| Total liabilities | |

| 3,780,881 | | |

| 7,993,262 | | |

| 107,328 | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity (deficit) | |

| | | |

| | | |

| | |

| Common stock | |

| 1,365 | | |

| 69,263 | | |

| - | |

| Additional paid-in-capital | |

| (242,046 | ) | |

| 1,530,423 | | |

| - | |

| Accumulated deficit | |

| 998,681 | | |

| 941,284 | | |

| 123,146 | |

| Accumulated other comprehensive loss | |

| (47,579 | ) | |

| 42,766 | | |

| (3,639 | ) |

| Total stockholders’ equity (deficit) | |

| 710,422 | | |

| 2,583,736 | | |

| 119,507 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and stockholders’ equity (deficit) | |

| 4,491,303 | | |

| 10,576,998 | | |

| 226,835 | |

EXHIBIT A-2

Unaudited Statement of

Operations of Controlled Non-Debtor Entities as of December 31, 2022

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-2 – Unaudited Statement of Operations - (January

2022 to December 2022)

| | |

Near

Intelligence | | |

Near

Intelligence | | |

Near

Intelligence | |

| USD Actuals | |

Pvt Ltd | | |

SAS | | |

Pty Ltd | |

| Revenue | |

| 6,196,077 | | |

| 11,780,862 | | |

| 1,920,278 | |

| Costs and expenses: | |

| | | |

| | | |

| | |

| Cost of revenue (exclusive of depreciation and amortization shown separately below) | |

| 693,082 | | |

| 4,786,064 | | |

| - | |

| Product and technology | |

| 2,618,054 | | |

| - | | |

| - | |

| Sales and marketing | |

| 523,938 | | |

| 4,564,184 | | |

| 1,596,325 | |

| General and administrative | |

| 1,497,653 | | |

| 1,334,886 | | |

| 177,958 | |

| Depreciation and amortization | |

| 56,984 | | |

| 25,341 | | |

| 4,364 | |

| Total costs and expenses | |

| 5,389,711 | | |

| 10,710,474 | | |

| 1,778,648 | |

| Operating Profit (loss) | |

| 806,366 | | |

| 1,070,387 | | |

| 141,630 | |

| Interest expense, net | |

| 52,252 | | |

| 43,011 | | |

| - | |

| Changes in fair value of derivative liabilities | |

| - | | |

| - | | |

| - | |

| Loss (gain) on extinguishment of debt, net | |

| - | | |

| (663,091 | ) | |

| - | |

| Other income, net | |

| (353,023 | ) | |

| (636,578 | ) | |

| - | |

| Income (Loss) before income tax expense | |

| 1,107,138 | | |

| 2,327,046 | | |

| 141,630 | |

| Income tax expense | |

| 282,993 | | |

| 165,427 | | |

| 35,408 | |

| Net Income (loss) | |

| 824,144 | | |

| 2,161,619 | | |

| 106,222 | |

EXHIBIT A-3

Unaudited Statement of

Changes in Equity of Controlled Non-Debtor Entities as of December 31, 2022

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-3 – Unaudited Statement of Changes in Equity

(December 2022)

| USD Actuals | |

Near

Intelligence

Pvt Ltd | | |

Near

Intelligence

SAS | | |

Near

Intelligence

Pty Ltd | |

| Total Equity (12/31/2021) | |

| (67,842 | ) | |

| 415,679 | | |

| 16,410 | |

| Common Stock | |

$ | - | | |

| - | | |

| - | |

| Additional Paid in Capital | |

| - | | |

| - | | |

| - | |

| Retained Earnings | |

| 824,144 | | |

| 2,161,619 | | |

| 106,222 | |

| Currency translation adjustments | |

| (45,882 | ) | |

| 6,438 | | |

| (3,125 | ) |

| Total Equity (12/31/2022) | |

$ | 710,421 | | |

$ | 2,583,736 | | |

$ | 119,507 | |

EXHIBIT A-4

Unaudited Statement of

Cash Flows of Controlled Non-Debtor Entities as of December 31, 2022

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-4 – Unaudited Statement of Cash Flows (January

2022 to December 2022)

| USD Actuals | |

Near

Intelligence

Pvt Ltd | | |

Near

Intelligence

SAS | | |

Near

Intelligence

Pty Ltd | |

| Cash flows from operating activities: | |

| | |

| | |

| |

| Net Profit | |

| 824,144 | | |

| 2,161,619 | | |

| 106,222 | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | |

| Add Depreciation and amortization | |

| 56,984 | | |

| 25,341 | | |

| 4,364 | |

| Add Amortisation of ROU & Interest on Leases | |

| (2,923 | ) | |

| 95,778 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable & Other current assets | |

| (2,765,391 | ) | |

| (2,339,179 | ) | |

| (16,732 | ) |

| Other assets | |

| (7,623 | ) | |

| 21,201 | | |

| 2,261 | |

| Accounts payable | |

| 2,397,690 | | |

| 2,620,571 | | |

| (60,130 | ) |

| Accrued expenses and other current liabilities | |

| (329,291 | ) | |

| (721,665 | ) | |

| - | |

| Net cash used in operating activities | |

| 173,591 | | |

| 1,863,666 | | |

| 35,985 | |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | |

| Additions to property and equipment | |

| (54,757 | ) | |

| (142,477 | ) | |

| (6,647 | ) |

| Net cash provided by investing activities | |

| (54,757 | ) | |

| (142,477 | ) | |

| (6,647 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Repaymnet of debts | |

| - | | |

| (1,400,354 | ) | |

| - | |

| Net cash provided by financing activities | |

| - | | |

| (1,400,354 | ) | |

| - | |

| | |

| | | |

| | | |

| | |

| | |

| (45,882 | ) | |

| 6,438 | | |

| (3,125 | ) |

| Effect of exchange rates on cash, cash equivalents

and restricted cash | |

| (21,999 | ) | |

| (109,060 | ) | |

| (1,809 | ) |

| Net (decrease) increase in cash, cash equivalents and restricted cash | |

| 96,834 | | |

| 211,774 | | |

| 27,529 | |

| | |

| | | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at beginning of year | |

| 107,284 | | |

| 1,536,444 | | |

| - | |

| | |

| | | |

| | | |

| | |

| Cash, cash equivalents and restricted cash at the end of the year | |

| 204,118 | | |

| 1,748,219 | | |

| 27,529 | |

| | |

| | | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 171,920 | | |

| 1,440,846 | | |

| 27,529 | |

| Restricted cash | |

| 32,198 | | |

| 307,373 | | |

| - | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flow | |

| 204,118 | | |

| 1,748,219 | | |

| 27,529 | |

EXHIBIT A-5

Unaudited Balance Sheet

of Controlled Non-Debtor Entities as of September 30, 2023

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-5 – Unaudited Balance Sheet as of September

30, 2023

| USD Actuals | |

Near

Intelligence

Pvt Ltd | | |

Near

Intelligence

SAS | | |

Near

Intelligence

Pty Ltd | |

| Assets | |

| | |

| | |

| |

| Current assets: | |

| | |

| | |

| |

| Cash and cash equivalents | |

| 143,352 | | |

$ | 1,133,581 | | |

$ | 40,299 | |

| Restricted cash | |

| 33,005 | | |

| 200,442 | | |

| - | |

| Accounts receivable, net of allowance for credit losses | |

| 1,413,734 | | |

| 3,822,768 | | |

| 279,952 | |

| Prepaid expenses and other current assets | |

| 753,477 | | |

| 5,388,114 | | |

| 62,442 | |

| Total current assets | |

| 2,343,569 | | |

| 10,544,905 | | |

| 382,693 | |

| | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 122,017 | | |

| 289,973 | | |

| 6,313 | |

| Operating lease right-of-use assets | |

| 580,943 | | |

| 1,749,847 | | |

| - | |

| Other assets | |

| 83,959 | | |

| - | | |

| (2,097 | ) |

| Total assets | |

$ | 3,130,489 | | |

$ | 12,584,725 | | |

$ | 386,909 | |

| | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | | |

| | |

| Current portion of long-term borrowings | |

| - | | |

| - | | |

| - | |

| Accounts payable | |

| 88,224 | | |

| 2,240,299 | | |

| 14,723 | |

| Accrued expenses and other current liabilities | |

| 896,435 | | |

| 2,206,862 | | |

| 154,101 | |

| Current portion of operating lease liabilities | |

| 396,566 | | |

| 351,044 | | |

| - | |

| Derivative liabilities | |

| - | | |

| - | | |

| - | |

| Total current liabilities | |

| 1,381,225 | | |

| 4,798,205 | | |

| 168,824 | |

| | |

| | | |

| | | |

| | |

| Long-term borrowings, less current portion | |

| - | | |

| 1,169,977 | | |

| - | |

| Long-term operating lease liabilities | |

| 244,997 | | |

| 1,508,936 | | |

| - | |

| Long-term derivative liabilities | |

| - | | |

| - | | |

| - | |

| Other liabilities | |

| 248,669 | | |

| - | | |

| - | |

| Total liabilities | |

$ | 1,874,891 | | |

$ | 7,477,117 | | |

$ | 168,824 | |

| | |

| | | |

| | | |

| | |

| Stockholders’ equity (deficit) | |

| | | |

| | | |

| | |

| Common stock | |

| 1,365 | | |

| 69,263 | | |

| - | |

| Additional paid-in-capital | |

| (242,046 | ) | |

| 1,530,423 | | |

| - | |

| Accumulated deficit | |

| 1,554,074 | | |

| 3,559,125 | | |

| 232,508 | |

| Accumulated other comprehensive loss | |

| (57,795 | ) | |

| (51,204 | ) | |

| (14,424 | ) |

| Total stockholders’ equity (deficit) | |

| 1,255,598 | | |

| 5,107,607 | | |

| 218,085 | |

| | |

| | | |

| | | |

| | |

| Total liabilities and stockholders’ equity (deficit) | |

$ | 3,130,490 | | |

$ | 12,584,725 | | |

$ | 386,909 | |

EXHIBIT A-6

Unaudited Statement of

Operations of Controlled Non-Debtor Entities (January 2023 to September 2023)

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-6 – Unaudited Statement of Operations - (January

2023 to September 2023)

| | |

Near

Intelligence | | |

Near

Intelligence | | |

Near

Intelligence | |

| USD Actuals | |

Pvt Ltd | | |

SAS | | |

Pty Ltd | |

| Revenue | |

| 5,278,609 | | |

| 11,988,363 | | |

| 1,838,265 | |

| Costs and expenses: | |

| | | |

| | | |

| | |

| Cost of revenue (exclusive of depreciation and amortization shown separately below) | |

| 360,669 | | |

| 4,914,175 | | |

| - | |

| Product and technology | |

| 2,052,091 | | |

| 1,276,834 | | |

| - | |

| Sales and marketing | |

| 614,187 | | |

| 1,940,223 | | |

| 1,490,217 | |

| General and administrative | |

| 1,425,945 | | |

| 1,386,252 | | |

| 212,102 | |

| Depreciation and amortization | |

| 45,351 | | |

| 30,274 | | |

| 3,068 | |

| Total costs and expenses | |

| 4,498,242 | | |

| 9,547,758 | | |

| 1,705,387 | |

| | |

| | | |

| | | |

| | |

| Operating Profit (loss) | |

| 780,367 | | |

| 2,440,604 | | |

| 132,879 | |

| Interest expense, net | |

| 33,816 | | |

| (21,449 | ) | |

| - | |

| Changes in fair value of derivative liabilities | |

| - | | |

| - | | |

| - | |

| Loss (gain) on extinguishment of debt, net | |

| - | | |

| - | | |

| - | |

| Other income, net | |

| 35,186 | | |

| (358,890 | ) | |

| - | |

| Income (Loss) before income tax expense | |

| 711,365 | | |

| 2,820,944 | | |

| 132,879 | |

| Income tax expense | |

| 155,972 | | |

| 203,102 | | |

| 23,517 | |

| Net Income (loss) | |

| 555,393 | | |

| 2,617,841 | | |

| 109,362 | |

EXHIBIT A-7

Unaudited Statement of

Changes in Equity of Controlled Non-Debtor Entities (September 2023)

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-7 – Unaudited Statement of Changes in Equity

(September 2023)

| USD Actuals | |

Near

Intelligence

Pvt Ltd | | |

Near

Intelligence

SAS | | |

Near

Intelligence

Pty Ltd | |

| Total Equity (12/31/2022) | |

| 710,421 | | |

| 2,583,736 | | |

| 119,507 | |

| Common Stock | |

$ | - | | |

$ | - | | |

$ | - | |

| Additional Paid in Capital | |

| - | | |

| - | | |

| - | |

| Retained Earnings | |

| 555,393 | | |

| 2,617,841 | | |

| 109,362 | |

| Currency translation adjustments | |

| (10,216 | ) | |

| (93,970 | ) | |

| (10,784 | ) |

| Total Equity (09/30/2023) | |

$ | 1,255,598 | | |

$ | 5,107,607 | | |

$ | 218,085 | |

EXHIBIT A-8

Unaudited Statement of

Cash Flows of Controlled Non-Debtor Entities (January 2023 to September 2023)

NEAR INTELLIGENCE, INC., ET AL.

NON-DEBTOR AFFILIATES

Exhibit A-8 – Unaudited Statement of Cash Flows (January

2023 to September 2023)

| USD Actuals | |

Near

Intelligence

Pvt Ltd | | |

Near

Intelligence

SAS | | |

Near

Intelligence

Pty Ltd | |

| Cash flows from operating activities: | |

| | |

| | |

| |

| Net Profit | |

| 555,393 | | |

| 2,617,841 | | |

| 109,362 | |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | | |

| | |

| Add Depreciation and amortization | |

| 45,351 | | |

| 30,274 | | |

| 3,068 | |

| Add Amortisation of ROU & Interest on Leases | |

| (10,878 | ) | |

| 14,354 | | |

| - | |

| Changes in operating assets and liabilities: | |

| | | |

| | | |

| | |

| Accounts receivable | |

| 1,119,903 | | |

| (2,262,326 | ) | |

| (139,738 | ) |

| Other assets | |

| 519 | | |

| - | | |

| (116 | ) |

| Accounts payable | |

| (1,763,032 | ) | |

| (263,967 | ) | |

| 57,384 | |

| Accrued expenses and other current liabilities | |

| 73,659 | | |

| - | | |

| - | |

| Net cash used in operating activities | |

| 20,915 | | |

| 136,177 | | |

| 29,960 | |

| | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | |

| Additions to property and equipment | |

| (47,603 | ) | |

| (129,700 | ) | |

| (498 | ) |

| Net cash provided by investing activities | |

| (47,603 | ) | |

| (129,700 | ) | |

| (498 | ) |

| | |

| | | |

| | | |

| | |

| Cash flows from financing activities | |

| | | |

| | | |

| | |

| Repaymnet of debts | |

| - | | |

| (418,293 | ) | |

| - | |

| Net cash provided by financing activities | |

| - | | |

| (418,293 | ) | |

| - | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | |

| (1,072 | ) | |

| (2,381 | ) | |

| (16,693 | ) |

| Net (decrease) increase in cash, cash equivalents and restricted cash | |

| (27,760 | ) | |

| (414,196 | ) | |

| 12,770 | |

| Cash, cash equivalents and restricted cash at beginning of period | |

| 204,118 | | |

| 1,748,219 | | |

| 27,529 | |

| Cash, cash equivalents and restricted cash at the end of the period | |

| 176,358 | | |

| 1,334,022 | | |

| 40,299 | |

| | |

| | | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | | |

| | |

| Reconciliation of cash, cash equivalents and restricted cash: | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 143,352 | | |

| 1,133,581 | | |

| 40,299 | |

| Restricted cash | |

| 33,005 | | |

| 200,442 | | |

| - | |

| Total cash, cash equivalents and restricted cash shown in the statement of cash flow | |

| 176,358 | | |

| 1,334,022 | | |

| 40,299 | |

EXHIBIT B

Description of Operations for the Controlled

Non-Debtor Entities

| Name of Entity |

|

Description of Business |

| Near Intelligence SAS |

|

Sale of marketing intelligence services |

| Near Intelligence Pty. Ltd |

|

Sale of marketing intelligence services |

| Near Intelligence Pty. Ltd |

|

Back-office/ shared services provide for other Near Debtor and Non-Debtor Entities |

EXHIBIT C

Description of Claims Between the Controlled

Non-Debtor Entities

The Controlled Non-Debtor Entities do not have

claims with or between each other.

EXHIBIT D

Description of How Taxes Are Allocated Between the

Controlled Non-Debtor Entities and the Debtors

Each legal entity files its own tax returns and there are no tax sharing

agreements between the entities.

EXHIBIT E

Description of the Controlled Non-Debtor Entities’

Payments of

Administrative Expenses or Professional Fees

Otherwise Payable by a Debtor

Currently, there are no known payments made, or

obligations incurred (or claims purchased) by any Controlled Non-Debtor Entity in connection with any claims, administrative expenses,

or professional fees that have been or could be asserted against the Debtors. However, in the ordinary course of business, the Debtors

engage in routine business relationships among and between the Debtors and between the Debtors and the Controlled Non-Debtor Entities

(the “Intercompany Transactions”) related to, among other things, cross charges and intercompany funding and loans,

which may result in intercompany receivables and payables (the “Intercompany Claims”). These Intercompany Transactions

occur as part of regular business operations, and at any given time, there may be Intercompany Claims owing between the Debtors and between

the Debtors and the Controlled Non-Debtor Entities.

22

v3.23.4

Cover

|

Jan. 05, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 05, 2024

|

| Entity File Number |

001-39843

|

| Entity Registrant Name |

Near

Intelligence, Inc.

|

| Entity Central Index Key |

0001826671

|

| Entity Tax Identification Number |

85-3187857

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

100

W Walnut St.

|

| Entity Address, Address Line Two |

Suite A-4

|

| Entity Address, City or Town |

Pasadena

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

91124

|

| City Area Code |

628

|

| Local Phone Number |

889-7680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common Stock par Value $0.0001 per Share |

|

| Title of 12(b) Security |

Common

Stock par Value $0.0001 per Share

|

| Trading Symbol |

NIRLQ

|

| Security Exchange Name |

NONE

|

| Warrants, each exercisable for one share of Common Stock for $11.50 per share |

|

| Title of 12(b) Security |

Warrants,

each exercisable for one share of Common Stock for $11.50 per share

|

| Trading Symbol |

NIRWQ

|

| Security Exchange Name |

NONE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIRLQ_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NIRLQ_WarrantsEachExercisableForOneShareOfCommonStockFor11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

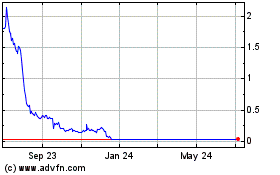

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From Apr 2024 to May 2024

Near Intelligence (NASDAQ:NIR)

Historical Stock Chart

From May 2023 to May 2024