0001496099FALSE00014960992023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 13, 2023

New Mountain Finance Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 814-00832 | 27-2978010 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (IRS Employer Identification Number) |

| | | | | |

| 1633 Broadway, 48th Floor, | |

New York, New York | 10019 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (212) 720-0300

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | | NMFC | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

1.01.Entry into a Material Definitive Agreement.

On November 13, 2023, the Company and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association) (the “Trustee”) entered into a Fourth Supplemental Indenture (the “Fourth Supplemental Indenture”) to the indenture, dated August 20, 2018, between the Company and the Trustee (the “Base Indenture”; and together with the Fourth Supplemental Indenture, the “Indenture”). The Fourth Supplemental Indenture relates to the Company’s issuance and sale of $115,000,000 aggregate principal amount of the Company’s 8.250% Notes due 2028 (the “Notes” and the issuance and sale of the Notes, the “Offering”).

The Notes bear interest at a rate of 8.250% per year. The Notes will mature on November 15, 2028. The Company will pay interest on the Notes on February 15, May 15, August 15 and November 15 each year, beginning on February 15, 2024. The Company may redeem the Notes in whole or in part at any time, or from time to time on or after November 15, 2025, at the redemption price of 100% of the outstanding principal amount of the Notes, plus accrued interest.

The Company intends to use the net proceeds from the Offering to repay outstanding indebtedness under the Company’s senior secured revolving credit facility with Goldman Sachs Bank USA, Morgan Stanley Bank, N.A., Stifel Bank & Trust and MUFG Union Bank, N.A.

The Notes are the direct unsecured obligations of the Company and rank pari passu with all existing and future unsubordinated unsecured indebtedness issued by the Company, senior to any of the Company’s future indebtedness that expressly provides it is subordinated to the Notes, effectively subordinated to all of the existing and future secured indebtedness issued by the Company (including indebtedness that is initially unsecured in respect of which the Company subsequently grants security), to the extent of the value of the assets securing such indebtedness, including, without limitation, borrowings under the Company’s senior secured credit facilities, and structurally subordinated to all existing and future indebtedness and other obligations of any of the Company’s subsidiaries.

The Indenture contains certain covenants, including certain covenants requiring the Company to comply with Section 18(a)(1)(A) as modified by Section 61(a)(2) of the Investment Company Act of 1940, as amended (the “1940 Act”), or any successor provisions, whether or not the Company continues to be subject to such provisions of the 1940 Act, but giving effect, in either case, to any exemptive relief granted to the Company by the U.S. Securities and Exchange Commission (the “SEC”); to comply with Section 18(a)(1)(B) as modified by Section 61(a)(2) of the 1940 Act, or any successor provisions, after giving effect to any exemptive relief granted to the Company by the SEC and subject to certain other exceptions; and to provide financial information to the holders of the Notes and the Trustee if the Company is no longer subject to the reporting requirements under the Securities Exchange Act of 1934, as amended. These covenants are subject to important limitations and exceptions that are described in the Indenture.

The Notes were offered and sold in an offering registered under the Securities Act of 1933, as amended, pursuant to the Registration Statement on Form N-2 (File No. 333-272060), as supplemented by the preliminary prospectus supplement dated November 6, 2023, the pricing term sheet filed with the SEC on November 6, 2023, and the final prospectus supplement dated November 6, 2023. The transaction closed on November 13, 2023.

The foregoing descriptions of the Fourth Supplemental Indenture and the Notes do not purport to be complete and are qualified in their entirety by reference to the full text of the Fourth Supplemental Indenture and the form of global note representing the Notes, respectively, each filed as exhibits hereto and incorporated by reference herein.

2.03.Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information required by Item 2.03 contained in Item 1.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| | |

| 4.1 | | |

| | |

| 4.2 | | |

| | |

| 4.3 | | |

| | |

| 5.1 | | |

| | |

| 23.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NEW MOUNTAIN FINANCE CORPORATION |

| | |

| Date: November 13, 2023 | By: | /s/ Joseph W. Hartswell |

| Name: | Joseph W. Hartswell |

| Title: | Chief Compliance Officer and Corporate Secretary |

FOURTH SUPPLEMENTAL INDENTURE

between

NEW MOUNTAIN FINANCE CORPORATION

and

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION,

as Trustee

Dated as of November 13, 2023

THIS FOURTH SUPPLEMENTAL INDENTURE (this “Fourth Supplemental Indenture”), dated as of November 13, 2023, is between NEW MOUNTAIN FINANCE CORPORATION, a Delaware corporation (the “Company”), and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association), as trustee (the “Trustee”). All capitalized terms used herein shall have the meaning set forth in the Base Indenture (as defined below).

RECITALS OF THE COMPANY

The Company and the Trustee executed and delivered an Indenture, dated as of August 20, 2018 (the “Base Indenture” and, as supplemented by this Fourth Supplemental Indenture, the “Indenture”), to provide, among other things, for the issuance, from time to time, of the Company’s unsecured debt securities, in an unlimited aggregate principal amount (the “Securities”), in one or more series to be established by the Company under, and authenticated and delivered as provided in, the Base Indenture.

The Company desires to issue and sell up to $115,000,000 in aggregate principal amount of the Company’s 8.250% Notes due 2028 (the “Notes”).

The Company previously entered into the First Supplemental Indenture, dated as of August 20, 2018 (the “First Supplemental Indenture”), the Second Supplemental Indenture, dated as of September 25, 2018 (the “Second Supplemental Indenture”), and the Third Supplemental Indenture, dated as of November 2, 2022 (the “Third Supplemental Indenture”), each of which supplemented the Base Indenture. Neither the First Supplemental Indenture, the Second Supplemental Indenture, nor the Third Supplemental Indenture is applicable to the Notes.

Sections 901(4) and 901(6) of the Base Indenture provide that without the consent of Holders of the Securities of any series issued under the Indenture, the Company, when authorized by or pursuant to a Board Resolution, and the Trustee, at any time and from time to time, may enter into one or more indentures supplemental to the Base Indenture to (i) change or eliminate any of the provisions of the Indenture when there is no Security Outstanding of any series created prior to the execution of the supplemental indenture that is entitled to the benefit of such provision and (ii) establish the form or terms of Securities of any series as permitted by Section 201 and Section 301 of the Base Indenture.

The Company desires to establish the form and terms of the Notes and to modify, alter, supplement and change certain provisions of the Base Indenture for the benefit of the Holders of the Notes (except as may be provided in a future supplemental indenture to the Indenture (each, a “Future Supplemental Indenture”)).

The Company has duly authorized the execution and delivery of this Fourth Supplemental Indenture to provide for the issuance of the Notes and all acts and things necessary to make this Fourth Supplemental Indenture a valid, binding, and legal obligation of the Company and to constitute a valid agreement of the Company, in accordance with its terms, have been done and performed.

NOW, THEREFORE, for and in consideration of the premises and the purchase of the Notes by the Holders thereof, it is mutually agreed, for the equal and proportionate benefit of all Holders of the Notes, as follows:

ARTICLE I

TERMS OF THE NOTES

Section 1.01. Terms of the Notes. The following terms relating to the Notes are hereby established:

(a)The Notes shall constitute a series of Senior Securities having the title “8.250% Notes due 2028.” The Notes shall bear a CUSIP number of 647551 308 and an ISIN number of US6475513080, as may be supplemented or replaced from time to time.

(b)The aggregate principal amount of the Notes that may be initially authenticated and delivered under the Indenture (except for Notes authenticated and delivered upon registration of, transfer of, or in exchange for, or in lieu of, other Notes pursuant to Sections 304, 305, 306, 906, 1107 or 1305 of the Base Indenture, and except for any Securities that, pursuant to Section 303 of the Base Indenture, are deemed never to have been authenticated and delivered under the Indenture) shall be $115,000,000. Under a Board Resolution, Officers’ Certificate pursuant to Board Resolutions or an indenture supplement, the Company may from time to time, without the consent of the Holders of Notes, issue additional Notes (in any such case “Additional Notes”) having the same ranking and the same interest rate, maturity and other terms as the Notes; provided that, if such Additional Notes are not fungible with the Notes (or any other tranche of Additional Notes) for U.S. federal income tax purposes, then such Additional Notes will have different CUSIP numbers from the Notes (and any such other tranche of Additional Notes). Any Additional Notes and the existing Notes will constitute a single series under the Indenture and all references to the relevant Notes herein shall include the Additional Notes unless the context otherwise requires.

(c)The entire outstanding principal of the Notes shall be payable on November 15, 2028, unless earlier redeemed or repurchased in accordance with the provisions of this Fourth Supplemental Indenture.

(d)The rate at which the Notes shall bear interest shall be 8.250% per annum. The date from which interest shall accrue on the Notes shall be November 13, 2023, or the most recent Interest Payment Date to which interest has been paid or provided for; the Interest Payment Dates for the Notes shall be February 15, May 15, August 15 and November 15 of each year, commencing February 15, 2024 (if an Interest Payment Date falls on a day that is not a Business Day, then the applicable interest payment will be made on the next succeeding Business Day and no additional interest will accrue as a result of such delayed payment); the initial interest period will be the period from and including November 13, 2023, to, but excluding, the initial Interest Payment Date, and the subsequent interest periods will be the periods from and including an Interest Payment Date to, but excluding, the next Interest Payment Date or the Stated Maturity, as the case may be; the interest so payable, and punctually paid or duly provided for, on any Interest Payment Date, will be paid to the Person in whose name the Note (or one or more Predecessor Securities) is registered at the close of business on the Regular Record Date for such interest, which shall be February 1, May 1, August 1 or November 1 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date. Payment of principal of (and premium, if any, on) and any such interest on the Notes will be made at the office of the Trustee located at 111 Fillmore Avenue, St. Paul, MN 55107, Attention: New Mountain Finance Corporation (8.250% Notes Due 2028) or at such other address as designated by the Trustee, in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts; provided, however, that at the option of the Company payment of interest may be made by check mailed to the address of the Person entitled thereto as such address shall appear in the Security Register; provided, further, however, that, at the request of the registered Holder, the Company will pay the principal of (and premium, if any, on) and interest, if any, on the Notes by wire transfer of immediately available funds to an account at a bank in New York City, on the date when such amount is due and payable and as further set forth in Section 1001 of the Indenture; provided, further, however, that so long as the Notes are registered to Cede & Co., such payment will be made by wire transfer in accordance with the procedures established by The Depository Trust Company and the Trustee. Interest on the Notes will be computed on the basis of a 360-day year of twelve 30-day months.

(e)The Notes shall be initially issuable in global form (each such Note, a “Global Note”). The Global Notes and the Trustee’s certificate of authentication thereon shall be substantially in the form of Exhibit A to this Fourth Supplemental Indenture. Each Global Note shall represent the aggregate amount of the outstanding Notes as shall be specified therein and each shall provide that it shall represent the aggregate amount of outstanding Notes

from time to time endorsed thereon and that the aggregate amount of outstanding Notes represented thereby may from time to time be reduced or increased, as appropriate, to reflect exchanges and redemptions. Any endorsement of a Global Note to reflect the amount of any increase or decrease in the amount of outstanding Notes represented thereby shall be made by the Trustee or the Security Registrar, in accordance with Sections 203 and 305 of the Base Indenture.

(f)The depositary for such Global Notes (the “Depositary”) shall be The Depository Trust Company, New York, New York. The Security Registrar with respect to the Global Notes shall be the Trustee.

(g)The Notes shall be defeasible pursuant to Section 1402 or Section 1403 of the Base Indenture. Covenant defeasance contained in Section 1403 of the Base Indenture shall apply to the covenants contained in Sections 1007, 1008, and 1009 of the Indenture.

(h)The Notes shall be redeemable pursuant to Section 1101 of the Base Indenture and as follows:

(i)The Notes will be redeemable in whole or in part at any time or from time to time, at the option of the Company, on or after November 15, 2025, upon not less than 30 days nor more than 60 days written notice by mail prior to the date fixed for redemption thereof, at a Redemption Price equal to 100% of the outstanding principal amount thereof, plus accrued and unpaid interest payments otherwise payable for the then-current quarterly interest period accrued to, but excluding, the Redemption Date.

(ii)Notice of redemption shall be given in writing and mailed, first-class postage prepaid or by overnight courier guaranteeing next-day delivery, to each Holder of the Notes to be redeemed, not less than thirty (30) nor more than sixty (60) days prior to the Redemption Date, at the Holder’s address appearing in the Security Register. All notices of redemption shall contain the information set forth in Section 1104 of the Base Indenture.

(iii)Any exercise of the Company’s option to redeem the Notes will be done in compliance with the Indenture and the Investment Company Act, to the extent applicable.

(iv)If the Company elects to redeem only a portion of the Notes, the Trustee or, with respect to the Global Notes, the Depositary will determine the method for selecting the particular Notes to be redeemed, in accordance with Section 1103 of the Base Indenture and the Investment Company Act and the rules of any national securities exchange or quotation system on which the Notes are listed, in each case to the extent applicable.

(v)Unless the Company defaults in payment of the Redemption Price, on and after the Redemption Date, interest will cease to accrue on the Notes called for redemption hereunder.

(i)The Notes shall not be subject to any sinking fund pursuant to Section 1201 of the Base Indenture.

(j)The Notes shall be issuable in denominations of $25.00 and integral multiples of $25.00 in excess thereof.

(k)Holders of the Notes will not have the option to have the Notes repaid prior to the Stated Maturity.

(i)The Notes are hereby designated as “Senior Securities” under the Indenture.

ARTICLE II

DEFINITIONS AND OTHER PROVISIONS OF GENERAL APPLICATION

Section 2.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Article One of the Base Indenture shall be amended by adding the following defined terms to Section 101 in appropriate alphabetical sequence, as follows:

“Business Day” means any day, other than a Saturday, a Sunday or a day on which the Federal Reserve Bank of New York or the Trustee is authorized or required by law or executive order to close or be closed.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and any statute successor thereto.

“GAAP” means generally accepted accounting principles as in effect from time to time in the United States of America.

“Investment Company Act” means the Investment Company Act of 1940, as amended, and the rules, regulations and interpretations promulgated thereunder, to the extent applicable, and any statute successor thereto.

“Person” means an individual, partnership, corporation, limited liability company, association, trust, unincorporated organization, business entity or Governmental Authority.

Section 2.02. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Section 104 of the Base Indenture shall be amended by replacing clause (d) thereof with the following:

“(d) If the Company shall solicit from the Holders of Registered Securities any request, demand, authorization, direction, notice, consent, waiver or other Act, the Company may, at its option, in or pursuant to a Board Resolution, fix in advance a record date for the determination of Holders entitled to give such request, demand, authorization, direction, notice, consent, waiver or other Act, but the Company shall have no obligation to do so. Such record date shall be the record date specified in or pursuant to such Board Resolution, which date shall be a date not earlier than the date 30 days prior to the first solicitation of Holders generally in connection therewith and not later than the date such solicitation is completed. If such a record date is fixed, such request, demand, authorization, direction, notice, consent, waiver or other Act may be given before or after such record date, but only the Holders of record at the close of business on such record date shall be deemed to be Holders for the purposes of determining whether Holders of the requisite proportion of Outstanding Securities have authorized or agreed or consented to such request, demand, authorization, direction, notice, consent, waiver or other Act, and for that purpose the Outstanding Securities shall be computed as of such record date; provided that no such authorization, agreement or consent by the Holders on such record date shall be deemed effective unless it shall become effective pursuant to the provisions of this Indenture not later than eleven months after the record date.”

ARTICLE III

REMEDIES

Section 3.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Section 502 of the Base Indenture shall be amended by replacing the first paragraph thereof with the following:

“If an Event of Default (other than an Event of Default referred to in clause (5) or (6) of Section 501) with respect to Securities of any series at the time Outstanding occurs and is continuing, then and in every such case the Trustee or the Holders of not less than 25% in principal amount of the Outstanding Securities of that series may (and the Trustee shall at the request of such Holders) declare the principal (or, if any Securities are Original Issue Discount Securities or Indexed Securities, such portion of the principal as may be specified in the terms thereof) of all the Securities of that series to be due and payable immediately, by a notice in writing to the Company (and to the Trustee if given by the Holders), and upon any such declaration such principal or specified portion thereof shall become immediately due and payable. If an Event of Default referred to in clause (5) or (6) of Section 501 with respect to the Company has occurred, the entire principal amount of all of the Notes shall automatically become due and immediately payable.”

ARTICLE IV

COVENANTS

Section 4.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Article Ten of the Base Indenture shall be amended by adding the following new Sections 1007, 1008, and 1009 thereto, each as set forth below:

“Section 1007. Section 18(a)(1)(A) of the Investment Company Act.

The Company hereby agrees that for the period of time during which Notes are Outstanding, the Company will not violate Section 18(a)(1)(A) as modified by such provisions of Section 61(a) of the Investment Company Act as may be applicable to the Company from time to time or any successor provisions thereto, whether or not the Company continues to be subject to such provisions of the Investment Company Act, but giving effect, in either case, to any exemptive relief granted to the Company by the Commission.”

“Section 1008. Section 18(a)(1)(B) of the Investment Company Act.

The Company hereby agrees that for the period of time during which the Notes are outstanding, the Company will not violate Section 18(a)(1)(B) as modified by (i) Section 61(a)(2) of the 1940 Act or any successor provisions and after giving effect to any exemptive relief granted to the Company by the SEC and (ii) the two other exceptions set forth below. The Company will be permitted to declare a cash dividend or distribution notwithstanding the prohibition contained in Section 18(a)(1)(B) as modified by Section 61(a)(2) of the Investment Company Act or any successor provisions, but only up to such amount as is necessary for the Company to maintain its status as a RIC under Subchapter M of the Code. Furthermore, the covenant will not be triggered unless and until such time as the Company’s asset coverage has not been in compliance with the minimum asset coverage required by Section 18(a)(1)(B) as modified by Section 61(a)(2) of the Investment Company Act or any successor provisions (after giving effect to any exemptive relief granted to the Company by the SEC) for more than six consecutive months.”

“Section 1009. Commission Reports and Reports to Holders.

If, at any time, the Company is not subject to the reporting requirements of Sections 13 or 15(d) of the Exchange Act to file any periodic reports with the Commission, the Company agrees to furnish to the Holders of the Notes and the Trustee for the period of time during which the Notes are Outstanding: (i) within 90 days after the end of the each fiscal year of the Company, audited annual consolidated financial statements of the Company and (ii) within 45 days after the end of each fiscal quarter of the Company (other than the Company’s fourth fiscal quarter), unaudited interim consolidated financial statements of the Company. All such financial statements shall be prepared, in all material respects, in accordance with GAAP.”

ARTICLE V

REDEMPTION OF SECURITIES

Section 5.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Section 1103 of the Base Indenture shall be amended by replacing the first paragraph thereof with the following:

“If less than all the Securities of any series issued on the same day with the same terms are to be redeemed, the particular Securities to be redeemed shall be selected by the Trustee, or by the Depositary in the case of global Securities, in compliance with the requirements of DTC, from the Outstanding Securities of such series issued on such date with the same terms not previously called for redemption, in compliance with the requirements of the principal national securities exchange on which the Securities are listed (if the Securities are listed on any national securities exchange), or if the Securities are not held through DTC or listed on any national securities exchange, or DTC prescribed no method of selection, by such method as the Trustee shall deem fair and appropriate and subject to and otherwise in accordance with the procedures of the applicable Depositary; provided that such method complies with the rules of any national securities exchange or quotation system on which the Securities are listed, and may provide for the selection for redemption of portions (equal to the minimum authorized denomination for Securities of that series or any integral multiple thereof) of the principal amount of Securities of such series of a denomination larger than the minimum authorized denomination for Securities of that series; provided, however, that no such partial redemption shall reduce the portion of the principal amount of a Security not redeemed to less than the minimum authorized denomination for Securities of such series.”

ARTICLE VI

PAYMENT

Section 6.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Section 1001 of the Base Indenture shall be amended by adding the following at the end of such Section:

“Alternatively, at the request of the registered Holder, the Company will pay the principal of (and premium, if any, on) and interest, if any, on the Notes by wire transfer of immediately available funds to an account at a bank in New York City, on the date when such amount is due and payable. To request payment by wire transfer, the registered Holder must give the Paying Agent appropriate transfer instructions at least 15 Business Days before the requested payment is due. In the case of any interest payment due on an Interest Payment Date, the instructions must be given by the person who is the registered Holder on the relevant Regular Record Date. Any wire instructions, once properly given, will remain in effect unless and until new instructions are given in accordance with this Section.”

ARTICLE VII

MEETINGS OF HOLDERS OF SECURITIES

Section 7.01. Except as may be provided in a Future Supplemental Indenture, for the benefit of the Holders of the Notes but no other series of Securities under the Indenture, whether now or hereafter issued and Outstanding, Section 1505 of the Base Indenture shall be amended by replacing clause (c) thereof with the following:

“(c) At any meeting of Holders, each Holder of a Security of such series or proxy shall be entitled to one vote for each $25.00 principal amount of the Outstanding Securities of such series held or represented by such Holder; provided, however, that no vote shall be cast or counted at any meeting in respect of any Security challenged as not Outstanding and ruled by the chairman of the meeting to be not Outstanding. The chairman of the meeting shall have no right to vote, except as a Holder of a Security of such series or proxy.”

ARTICLE VIII

MISCELLANEOUS

Section 8.01. This Fourth Supplemental Indenture and the Notes shall be governed by and construed in accordance with the law of the State of New York, without regard to principles of conflicts of laws. This Fourth Supplemental Indenture is subject to the provisions of the Trust Indenture Act that are required to be part of the Indenture and shall, to the extent applicable, be governed by such provisions.

Section 8.02. In case any provision in this Fourth Supplemental Indenture or in the Notes shall be invalid, illegal or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

Section 8.03. This Fourth Supplemental Indenture may be executed in counterparts, each of which will be an original, but such counterparts will together constitute but one and the same Fourth Supplemental Indenture. The exchange of copies of this Fourth Supplemental Indenture and of signature pages by facsimile, .pdf transmission, email or other electronic means shall constitute effective execution and delivery of this Fourth Supplemental Indenture for all purposes. Signatures of the parties hereto transmitted by facsimile, .pdf transmission, email or other electronic means shall be deemed to be their original signatures for all purposes.

Section 8.04. The Base Indenture, as supplemented and amended by this Fourth Supplemental Indenture, is in all respects ratified and confirmed, and the Base Indenture and this Fourth Supplemental Indenture shall be read, taken and construed as one and the same instrument with respect to the Notes. All provisions included in this Fourth Supplemental Indenture supersede any conflicting provisions included in the Base Indenture with respect to the Notes, unless not permitted by law. The Trustee accepts the trusts created by the Base Indenture, as supplemented by this Fourth Supplemental Indenture, and agrees to perform the same upon the terms and conditions of the Base Indenture, as supplemented by this Fourth Supplemental Indenture.

Section 8.05. The provisions of this Fourth Supplemental Indenture shall become effective as of the date hereof.

Section 8.06. Notwithstanding anything else to the contrary herein, the terms and provisions of this Fourth Supplemental Indenture shall apply only to the Notes and shall not apply to any other series of Securities under the Indenture and this Fourth Supplemental Indenture shall not and does not otherwise affect, modify, alter, supplement or change the terms and provisions of any other series of Securities under the Indenture, whether now or hereafter issued and Outstanding.

Section 8.07. The recitals contained herein and in the Notes shall be taken as the statements of the Company, and the Trustee assumes no responsibility for their correctness. The Trustee makes no representations as to the validity or sufficiency of this Fourth Supplemental Indenture, the Notes or any Additional Notes, except that the Trustee represents that it is duly authorized to execute and deliver this Fourth Supplemental Indenture, authenticate the Notes and any Additional Notes and perform its obligations hereunder. The Trustee shall not be accountable for the use or application by the Company of the Notes or any Additional Notes or the proceeds thereof.

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Supplemental Indenture to be duly executed as of the day and year first above written.

| | | | | |

| NEW MOUNTAIN FINANCE CORPORATION |

| |

| By: | /s/ Laura Holson |

| Name: Laura Holson |

| Title: Chief Operating Officer and Interim Chief Financial Officer |

| | | | | | | | |

U.S. BANK TRUST COMPANY, NATIONAL

ASSOCIATION (as successor in interest to U.S. Bank National Association), as Trustee |

| | |

| By: | /s/ Carolina D. Altomare |

| Name: | Carolina D. Altomare |

| Title: | Vice President |

[NMFC – Fourth Supplemental Indenture (Baby Bond – Nov. 2023)]

Exhibit A – Form of Global Note

This Security is a Global Security within the meaning of the Indenture hereinafter referred to and is registered in the name of The Depository Trust Company or a nominee thereof. This Security may not be exchanged in whole or in part for a Security registered, and no transfer of this Security in whole or in part may be registered, in the name of any Person other than The Depository Trust Company or a nominee thereof, except in the limited circumstances described in the Indenture.

Unless this certificate is presented by an authorized representative of The Depository Trust Company to the issuer or its agent for registration of transfer, exchange or payment and such certificate issued in exchange for this certificate is registered in the name of Cede & Co., or such other name as requested by an authorized representative of The Depository Trust Company, any transfer, pledge or other use hereof for value or otherwise by or to any person is wrongful, as the registered owner hereof, Cede & Co., has an interest herein.

New Mountain Finance Corporation

| | | | | |

| No. | $ |

| CUSIP No. 647551 308 |

| ISIN No. US6475513080 |

8.250% Notes due 2028

New Mountain Finance Corporation, a corporation duly organized and existing under the laws of Delaware (herein called the “Company,” which term includes any successor Person under the Indenture hereinafter referred to), for value received, hereby promises to pay to Cede & Co., or registered assigns, the principal sum of (U.S. ) on November 15, 2028, and to pay interest thereon from November 13, 2023, or from the most recent Interest Payment Date to which interest has been paid or duly provided for, quarterly on February 15, May 15, August 15 and November 15, commencing February 15, 2024, at the rate of 8.250% per annum, until the principal hereof is paid or made available for payment. The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date will, as provided in such Indenture, be paid to the Person in whose name this Security is registered at the close of business on the Regular Record Date for such interest, which shall be February 1, May 1, August 1 or November 1 (whether or not a Business Day), as the case may be, next preceding such Interest Payment Date. Any such interest not so punctually paid or duly provided for will forthwith cease to be payable to the Holder on such Regular Record Date and may either be paid to the Person in whose name this Security is registered at the close of business on a Special Record Date for the payment of such Defaulted Interest to be fixed by the Trustee, notice whereof shall be given to Holders of Securities of this series not less than 10 days prior to such Special Record Date, or be paid at any time in any other lawful manner not inconsistent with the requirements of any securities exchange on which the Securities of this series may be listed, and upon such notice as may be required by such exchange, all as more fully provided in said Indenture. This Security may be issued as part of a series.

Payment of the principal of (and premium, if any, on) and any such interest on this Security will be made at the office of the Trustee located at 111 Fillmore Avenue, St. Paul, MN 55107, Attention: NEW MOUNTAIN FINANCE CORPORATION (8.250% Notes Due 2028) or at such other address as designated by the Trustee, in such coin or currency of the United States of America as at the time of payment is legal tender for payment of public and private debts; provided, however, that at the option of the Company payment of interest may be made by check mailed to the address of the Person entitled thereto as such address shall appear in the Security Register; provided, further, however, that, at the request of the registered Holder, the Company will pay the principal of (and premium, if any, on) and interest, if any, on the Securities by wire transfer of immediately available funds to an account at a bank in New York City, on the date when such amount is due and payable and as further set forth in Section 1001 of the Indenture; provided, further, however, that so long as this Security is registered to Cede & Co., such payment will be made by wire transfer in accordance with the procedures established by The Depository Trust Company and the Trustee.

Reference is hereby made to the further provisions of this Security set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee referred to on the reverse hereof by manual signature, this Security shall not be entitled to any benefit under the Indenture or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company has caused this instrument to be duly executed.

Dated:

| | | | | |

| NEW MOUNTAIN FINANCE CORPORATION |

| |

| By: | |

| Name: | |

| Title: | |

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

| | | | | |

U.S. BANK TRUST COMPANY, NATIONAL ASSOCIATION (as successor in

interest to U.S. Bank National Association), as Trustee |

| |

| By: | |

| Authorized Signatory |

New Mountain Finance Corporation

8.250% Notes due 2028

This Security is one of a duly authorized issue of Senior Securities of the Company (herein called the “Securities”), issued and to be issued in one or more series under an Indenture, dated as of August 20, 2018 (herein called the “Base Indenture”, which term shall have the meaning assigned to it in such instrument), between the Company and U.S. Bank Trust Company, National Association (as successor in interest to U.S. Bank National Association), as Trustee (herein called the “Trustee”, which term includes any successor trustee under the Base Indenture), and reference is hereby made to the Base Indenture for a statement of the respective rights, limitations of rights, duties and immunities thereunder of the Company, the Trustee, and the Holders of the Securities and of the terms upon which the Securities are, and are to be, authenticated and delivered, as amended and supplemented by the Fourth Supplemental Indenture relating to the Securities, dated as of November 13, 2023, by and between the Company and the Trustee (herein called the “Fourth Supplemental Indenture”; the Fourth Supplemental Indenture, together with the Base Indenture, collectively are herein called the “Indenture”). In the event of any conflict between the Base Indenture and the Fourth Supplemental Indenture, the Fourth Supplemental Indenture shall govern and control.

This Security is one of the series designated on the face hereof, which series is initially limited in aggregate principal amount to $115,000,000. Under a Board Resolution, Officers’ Certificate pursuant to Board Resolutions or an indenture supplement, the Company may from time to time, without the consent of the Holders of Securities, issue additional Securities of this series (in any such case “Additional Securities”) having the same ranking and the same interest rate, maturity and other terms as the Securities; provided that, if such Additional Securities are not fungible with the Securities (or any other tranche of Additional Securities for U.S. federal income tax purposes, then such Additional Securities will have a different CUSIP numbers from the Securities (and any such other tranche of Additional Securities)). Any Additional Securities and the existing Securities will constitute a single series under the Indenture and all references to the relevant Securities herein shall include the Additional Securities unless the context otherwise requires. The aggregate amount of outstanding Securities represented hereby may from time to time be reduced or increased, as appropriate, to reflect exchanges and redemptions.

The Securities of this series are subject to redemption in whole or in part at any time or from time to time, at the option of the Company, on or after November 15, 2025, at a Redemption Price per Security equal to 100% of the outstanding principal amount thereof plus accrued and unpaid interest payments otherwise payable for the then-current quarterly interest period accrued to, but excluding, the Redemption Date.

Notice of redemption shall be given in writing and mailed, first-class postage prepaid or by overnight courier guaranteeing next-day delivery, to each Holder of the Securities to be redeemed, not less than thirty (30) nor more than sixty (60) days prior to the Redemption Date, at the Holder’s address appearing in the Security Register. All notices of redemption shall contain the information set forth in Section 1104 of the Base Indenture.

Any exercise of the Company’s option to redeem the Securities will be done in compliance with the Indenture and the Investment Company Act, to the extent applicable.

If the Company elects to redeem only a portion of the Securities, the Trustee or, with respect to global Securities, the Depositary will determine the method for selecting the particular Securities to be redeemed, in accordance with Section 1.01 of the Fourth Supplemental Indenture, Section 1103 of the Base Indenture and the Investment Company Act, to the extent applicable. In the event of redemption of this Security in part only, a new Security or Securities of this series and of like tenor for the unredeemed portion hereof will be issued in the name of the Holder hereof upon the cancellation hereof.

Unless the Company defaults in payment of the Redemption Price, on and after the Redemption Date, interest will cease to accrue on the Securities called for redemption.

Holders of Securities do not have the option to have the Securities repaid prior to November 15, 2028.

The Indenture contains provisions for defeasance at any time of the entire indebtedness of this Security or certain restrictive covenants and Events of Default with respect to this Security, in each case upon compliance with certain conditions set forth in the Indenture.

If an Event of Default (other than an Event of Default referred to in clause (5) or (6) of Section 501 of the Base Indenture) with respect to Securities of this series shall occur and be continuing, the principal of the Securities of this series may be declared due and payable in the manner and with the effect provided in the Indenture. If an Event of Default referred to in clause (5) or (6) of Section 501 of the Base Indenture with respect to the Company has occurred, the entire principal amount of all of the Securities shall automatically become due and immediately payable.

The Indenture permits, with certain exceptions as therein provided, the amendment thereof and the modification of the rights and obligations of the Company and the rights of the Holders of the Securities of each series to be affected under the Indenture at any time by the Company and the Trustee with the consent of the Holders of not less than a majority in principal amount of the Securities at the time Outstanding of each series to be affected. The Indenture also contains provisions permitting the Holders of specified percentages in principal amount of the Securities of each series at the time Outstanding, on behalf of the Holders of all Securities of such series, to waive compliance by the Company with certain provisions of the Indenture and certain past defaults under the Indenture and their consequences. Any such consent or waiver by the Holder of this Security shall be conclusive and binding upon such Holder and upon all future Holders of this Security and of any Security issued upon the registration of transfer hereof or in exchange herefor or in lieu hereof, whether or not notation of such consent or waiver is made upon this Security.

As provided in and subject to the provisions of the Indenture, the Holder of this Security shall not have the right to institute any proceeding with respect to the Indenture or for the appointment of a receiver or trustee or for any other remedy thereunder, unless such Holder shall have previously given the Trustee written notice of a continuing Event of Default with respect to the Securities of this series, the Holders of not less than 25% in principal amount of the Securities of this series at the time Outstanding shall have made written request to the Trustee to institute proceedings in respect of such Event of Default as Trustee and offered the Trustee indemnity, security or both reasonably satisfactory to the Trustee against the costs, expenses and liabilities to be incurred in compliance with such request, and the Trustee shall not have received from the Holders of a majority in principal amount of Securities of this series at the time Outstanding a direction inconsistent with such request, and shall have failed to institute any such proceeding, for sixty (60) days after receipt of such notice, request and offer of indemnity and/or security. The foregoing shall not apply to any suit instituted by the Holder of this Security for the enforcement of any payment of principal hereof or any premium or interest hereon on or after the respective due dates expressed herein.

No reference herein to the Indenture and no provision of this Security or of the Indenture shall alter or impair the obligation of the Company, which is absolute and unconditional, to pay the principal of and any premium and interest on this Security at the times, place and rate, and in the coin or currency, herein prescribed.

As provided in the Indenture and subject to certain limitations therein set forth, the transfer of this Security is registrable in the Security Register, upon surrender of this Security for registration of transfer at the office or agency of the Company in any place where the principal of and any premium and interest on this Security are payable, duly endorsed by, or accompanied by a written instrument of transfer in form satisfactory to the Company and the Security Registrar duly executed by, the Holder hereof or his attorney duly authorized in writing, and thereupon one or more new Securities of this series and of like tenor, of authorized denominations and for the same aggregate principal amount, will be issued to the designated transferee or transferees.

The Securities of this series are issuable only in registered form without coupons in denominations of $25.00 and any integral multiples of $25.00 in excess thereof. As provided in the Indenture and subject to certain limitations therein set forth, Securities of this series are exchangeable for a like aggregate principal amount of Securities of this series and of like tenor of a different authorized denomination, as requested by the Holder surrendering the same.

No service charge shall be made for any such registration of transfer or exchange, but the Company, the Trustee, or the Security Registrar may require payment of a sum sufficient to cover any tax or other governmental charge payable in connection therewith.

Prior to due presentment of this Security for registration of transfer, the Company, the Trustee, or the Security Registrar and any agent of the Company, the Trustee, or the Security Registrar shall treat the Person in whose name this Security is registered as the owner hereof for all purposes, whether or not this Security be overdue, and none of the Company, the Trustee, the Security Registrar, or any agent thereof shall be affected by notice to the contrary.

All terms used in this Security which are defined in the Indenture shall have the meanings assigned to them in the Indenture.

To the extent any provision of this Security conflicts with the express provisions of the Indenture, the provisions of the Indenture shall govern and be controlling.

The Indenture and this Security shall be governed by and construed in accordance with the laws of the State of New York, without regard to principles of conflicts of laws.

| | | | | | | | | | | | | | |

| | | | |

| November 13, 2023 |

| | | |

| New Mountain Finance Corporation | |

| 1633 Broadway | | |

| 48th Floor | | |

| New York, New York 10019 | | |

| | | | |

| | Ladies and Gentlemen: We have acted as counsel to New Mountain Finance Corporation, a Delaware corporation (the “Company”), in connection with the Company’s Registration Statement on Form N-2 (File No. 333-272060) filed under the Securities Act of 1933, as amended (the “Securities Act”), which Registration Statement was filed with the Securities and Exchange Commission (the “Commission”) on May 18, 2023 and became effective automatically pursuant to Rule 462(e) under the Securities Act (such Registration Statement, including the exhibits and schedules thereto, all documents incorporated or deemed to be incorporated by reference into the Registration Statement, any information contained in a prospectus supplement relating to the Notes (as defined below) subsequently filed with the Commission pursuant to Rule 424 under the Securities Act and deemed to be a part of the Registration Statement at the time of effectiveness pursuant to Rule 430B under the Securities Act, and any registration statement filed pursuant to Rule 462(b) under the Securities Act, is hereinafter referred to as the “Registration Statement”). The Registration Statement relates to the public offering of securities of the Company that may be offered by the Company from time to time as set forth in the base prospectus included in the Registration Statement, dated as of May 18, 2023, together with the information incorporated or deemed to be incorporated therein by reference (the “Base Prospectus”), and as may be set forth from time to time in one or more supplements to the Base Prospectus. This opinion letter is rendered in connection with the issuance and sale under the Securities Act of $115,000,000 in aggregate principal amount of the Company’s 8.250% Notes due 2028 (the “Notes”), as described in (i) the Base Prospectus and (ii) the prospectus supplement, dated November 6, 2023, relating to the Notes (together with the Base Prospectus and together with the information and documents incorporated or deemed to be incorporated by reference therein, the “Prospectus Supplement”). All of the Notes are to be sold by the Company as described in the Registration Statement, the Base Prospectus and the Prospectus Supplement. The Notes will be issued pursuant to the indenture, dated as of August 20, 2018 (the “Base Indenture”), entered into between the Company and U.S. Bank Trust Company National Association (as successor in interest to U.S. Bank National Association), as trustee (the “Trustee”), as supplemented by a fourth supplemental indenture, dated as of November 13, 2023 (the “Fourth Supplemental Indenture,” and together with the Base Indenture, the “Indenture”). As counsel to the Company, we have participated in the preparation of the Registration Statement, the Prospectus, and the Prospectus Supplement and have examined the originals or copies of the following: (i) the Amended and Restated Certificate of Incorporation of the Company, as amended by the (a) Certificate of Change of Registered Agent and/or Registered Office thereto and (b) Certificate of Amendment to the Amended and Restated Certificate of Incorporation of the Company, certified as of a recent date by the Delaware Secretary of State (the “Certificate of Incorporation”); |

| | | | | | | | | | | | | | |

| | (ii) the Amended and Restated Bylaws of the Company, certified as of the date hereof by an officer of the Company; (iii) a Certificate of Good Standing with respect to the Company issued by the Secretary of State of the State of Delaware on November 13, 2023; (iv) resolutions of the Board of Directors of the Company (the “Board”) relating to, among other things, (a) the authorization and approval of the preparation and filing of the Registration Statement, (b) the authorization, execution and delivery of the Indenture, and (c) the authorization, issuance and sale of the Notes; (v) the Indenture; (vi) the Underwriting Agreement, dated as of November 6, 2023, by and among the Company, New Mountain Finance Administration, L.L.C., and New Mountain Finance Advisers BDC, L.L.C. on the one hand, and Wells Fargo Securities, LLC, BofA Securities, LLC, Morgan Stanley & Co. LLC, and UBS Securities LLC, as representatives of the several underwriters named in Schedule I to the Underwriting Agreement, on the other hand; and (vii) a specimen copy of the form of the Notes to be issued pursuant to the Indenture in the form attached to the Indenture. With respect to such examination and our opinion expressed herein, we have assumed, without any independent investigation or verification, (i) the genuineness of all signatures on all documents submitted to us for examination, (ii) the legal capacity of all natural persons, (iii) the authenticity of all documents submitted to us as originals, (iv) the conformity to original documents of all documents submitted to us as conformed or reproduced copies and the authenticity of the originals of such copied documents, (v) that all certificates issued by public officials have been properly issued, (vi) the accuracy and completeness of all corporate records made available to us by the Company, (vii) that the Indenture will be a valid and legally binding obligation of the parties thereto (other than the Company), and (viii) that at the time of issuance of the Notes, after giving effect to such issuance, the Company will be in compliance with Section 18(a)(1)(A) of the Investment Company Act of 1940, as amended (the “1940 Act”), giving effect to Section 61(a) of the 1940 Act. As to certain matters of fact relevant to the opinion in this opinion letter, we have relied upon certificates and/or representations of officers of the Company. We have also relied on certificates of public officials and confirmations. We have not independently established the facts or, in the case of certificates or confirmations of public officials, the other statements, so relied upon. The opinion set forth below is limited to the contract laws of the State of New York, in each case, as in effect on the date hereof, and we express no opinion with respect to any other laws of the State of New York or the laws of any other jurisdiction. Without limiting the preceding sentence, we express no opinion as to any state securities or broker-dealer laws or regulations thereunder relating to the offer, issuance or sale of the Notes. This opinion letter has been prepared, and should be interpreted, in accordance with customary practice followed in the preparation of opinion letters by lawyers who regularly give, and such customary practice followed by lawyers who on behalf of their clients regularly advise opinion recipients regarding, opinion letters of this kind. |

| | | | | | | | | | | | | | |

| | Based upon and subject to the limitations, exceptions, qualifications and assumptions set forth in this opinion letter, we are of the opinion that, when the Notes are duly executed and delivered by duly authorized officers of the Company and duly authenticated by the Trustee, all in accordance with the provisions of the Indenture, and delivered to the purchasers thereof against payment of the agreed consideration therefor, the Notes will constitute valid and legally binding obligations of the Company, enforceable against the Company in accordance with their terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, receivership, moratorium, fraudulent conveyance, and other similar laws affecting the rights and remedies of creditors generally and to general principles of equity (including without limitation the availability of specific performance or injunctive relief and the application of concepts of materiality, reasonableness, good faith and fair dealing), regardless of whether considered in a proceeding at law or in equity. The opinion expressed in this opinion letter is: (i) strictly limited to the matters stated in this opinion letter, and without limiting the foregoing, no other opinions are to be inferred; and (ii) only as of the date of this opinion letter, and we are under no obligation, and do not undertake, to advise the Company or any other person or entity either of any change of law or fact that occurs, or of any fact that comes to our attention, after the date of this opinion letter, even though such change or such fact may affect the legal analysis or a legal conclusion in this opinion letter. We hereby consent to the filing of this opinion letter as an exhibit to the Company’s Current Report on Form 8-K, to be filed with the Commission on the date hereof for incorporation by reference in the Registration Statement and to the reference to our firm in the “Legal Matters” section in the Registration Statement, the Base Prospectus and Prospectus Supplement. We do not admit by giving this consent that we are in the category of persons whose consent is required under Section 7 of the Securities Act. |

| | |

| Respectfully submitted, |

|

| /s/ Eversheds Sutherland (US) LLP |

Cover

|

Nov. 13, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity Registrant Name |

New Mountain Finance Corporation

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

814-00832

|

| Entity Tax Identification Number |

27-2978010

|

| Entity Address, Address Line One |

1633 Broadway, 48th Floor,

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10019

|

| City Area Code |

212

|

| Local Phone Number |

720-0300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01 per share

|

| Trading Symbol |

NMFC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001496099

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

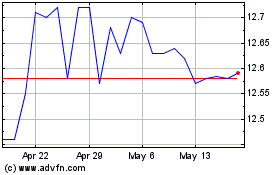

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From Apr 2024 to May 2024

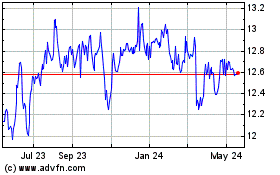

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From May 2023 to May 2024