false

0001496099

0001496099

2023-12-08

2023-12-08

0001496099

us-gaap:CommonStockMember

2023-12-08

2023-12-08

0001496099

NMFC:Notes8.250PercentDue2028Member

2023-12-08

2023-12-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): December 8, 2023

New Mountain Finance Corporation

(Exact name of registrant as specified in its

charter)

| Delaware |

|

814-00832 |

|

27-2978010 |

(State or other jurisdiction

of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

1633 Broadway, 48th Floor, New York, NY 10019

(Address of principal executive offices) (Zip

code)

Registrant’s telephone number, including

area code: (212) 720-0300

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol (s) |

|

Name of each exchange on which registered |

| Common stock, par value $0.01 per share |

|

NMFC |

|

NASDAQ Global Select Market |

| 8.250% Notes due 2028 |

|

NMFCZ |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On December 13, 2023, New Mountain Finance Corporation (the “Company”) issued a press release to announce that, on December

8, 2023, its board of directors (i) declared a special distribution of $0.10 per share payable on December 29, 2023 to shareholders of

record as of December 22, 2023 and (ii) approved an extension of the Company's stock repurchase program. The press release is attached

as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

NEW MOUNTAIN FINANCE CORPORATION |

| |

|

|

| Date: December 13, 2023 |

By: |

/s/ Joseph W. Hartswell |

| |

|

Name: |

Joseph W. Hartswell |

| |

|

Title: |

Chief Compliance Officer and Corporate Secretary |

Exhibit 99.1

New Mountain Finance Corporation Declares a

Special Distribution and Announces the Extension of its Stock Repurchase Program

NEW YORK--(BUSINESS WIRE)—December 13, 2023--New Mountain Finance

Corporation (NASDAQ: NMFC) (“NMFC” or “the Company”) today announced that on December 8, 2023, its board of directors

declared a special distribution of the Company’s excess undistributed taxable income. The special distribution will be in the amount

of $0.10 per share payable on December 29, 2023 to shareholders of record as of December 22, 2023. The special distribution is driven

primarily from the gain realized on our investment in Haven Midstream Holdings LLC, which, due to unique circumstances, was treated as

taxable ordinary income. Regulated investment company rules require distribution of at least 90% of annual ordinary taxable income.

This special distribution is being made to enable NMFC to comply with this requirement.

In addition, the Company’s board of directors authorized an extension

of a previously established stock repurchase program (the “Repurchase Program”). Pursuant to the Repurchase Program, the Company

can repurchase up to $50 million worth of its common stock at the discretion of NMFC’s management team. The Repurchase Program was

set to expire on December 31, 2023, but the Company’s board of directors elected to extend the Repurchase Program through December

31, 2024. Under the Repurchase Program, NMFC may, but is not obligated to, repurchase its outstanding common stock in the open market

from time to time provided that NMFC complies with the prohibitions under its Code of Ethics and the guidelines specified in Rule 10b-18

of the Securities Exchange Act of 1934, as amended, including certain price, market volume and timing constraints. Unless further extended

by NMFC’s board of directors, the Company expects the Repurchase Program to be in place until the earlier of December 31, 2024 or

until $50 million worth of NMFC’s outstanding shares of common stock have been repurchased. To date, approximately $2.9 million

worth of repurchases have been made by the Company under the Repurchase Program.

The Company’s board of directors authorized the extension of

the Repurchase Program because it believes that sustained market volatility and uncertainty may cause NMFC’s common stock to be

undervalued from time to time. The timing and number of shares to be repurchased will depend on a number of factors, including market

conditions and alternative investment opportunities. In addition, any subsequent repurchases will also be conducted in accordance with

the Investment Company Act of 1940, as amended. There are no assurances that the Company will engage in additional repurchases, but if

market conditions warrant, the Company now has an extended period of time to take advantage of situations where NMFC’s management

believes share repurchases would be advantageous to the Company and to its shareholders.

ABOUT NEW MOUNTAIN FINANCE CORPORATION

New Mountain Finance Corporation (NASDAQ: NMFC) is a leading business

development company (BDC) focused on providing direct lending solutions to U.S. middle market companies backed by top private equity sponsors.

Our portfolio consists primarily of senior secured loans, and select junior capital positions, to growing businesses in defensive industries

that offer attractive risk-adjusted returns. Our differentiated investment approach leverages the deep sector knowledge and operating

resources of New Mountain Capital, a global investment firm with over $45 billion of assets under management as of September 30, 2023.

ABOUT NEW MOUNTAIN CAPITAL

New Mountain Capital is a New York-based investment

firm that emphasizes business building and growth, rather than debt, as it pursues long-term capital appreciation. The firm currently

manages private equity, credit and net lease investment strategies with over $45 billion in assets under management. New Mountain seeks

out what it believes to be the highest quality growth leaders in carefully selected industry sectors and then works intensively with management

to build the value of these companies.

FORWARD-LOOKING STATEMENTS

Statements included herein may contain “forward-looking

statements”, which relate to the Company’s business, including, but not limited to, the timing and the number of shares to

be repurchased, if any, under the Repurchase Program, future operations, future performance or the Company’s financial condition.

Forward-looking statements are not guarantees of future performance, condition or results and involve a number of risks and uncertainties,

including the current conflict between Russia and Ukraine, conflict in the Middle East, changes in base interest rates and significant

volatility on the Company’s business, portfolio companies, the Company’s industry and the global economy. Actual results and

outcomes may differ materially from those anticipated in the forward-looking statements as a result of a variety of factors, including

those described from time to time in the Company’s filings with the Securities and Exchange Commission or factors that are beyond

the Company’s control. The Company undertakes no obligation to publicly update or revise any forward-looking statements made herein,

except as may be required by law. All forward-looking statements speak only as of the time of this press release.

Contact

New Mountain Finance Corporation

Investor Relations

Laura C. Holson, Authorized Representative

NMFCIR@newmountaincapital.com

(212) 220-3505

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=NMFC_Notes8.250PercentDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

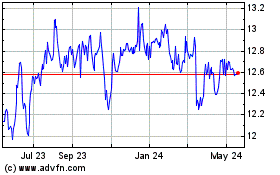

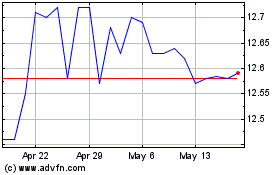

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From Apr 2024 to May 2024

New Mountain Finance (NASDAQ:NMFC)

Historical Stock Chart

From May 2023 to May 2024