Oblong, Inc. (Nasdaq: OBLG) (“Oblong” or the “Company”), the

award-winning maker of multi-stream collaboration solutions, today

reported financial results for the third quarter ending September

30, 2022.

“Our results for the third quarter came in as previously

expected and, while our sales and profit results do not yet reflect

the strategic and financial actions taken in recent quarters to

shift our performance, we are confident in our stated objective to

pursue growth both organically and through inorganic means that may

include a business combination or sale of the company. Lastly, I

want to thank our team for their proven dedication and resilience

during this extraordinary and important time for our organization,”

commented Pete Holst, President & CEO of Oblong.

- As of September 30, 2022, the Company had $4.1 million of cash

and no debt.

- Total revenue was $1.2 million for the third quarter of 2022

versus $1.8 million for the third quarter of 2021.

- Net loss of $7.2 million for the third quarter of 2022,

compared to a net loss of $0.7 million for the third quarter of

2021. During the third quarter of 2022, the Company recorded

non-cash impairment charges on intangible and other assets of $5.2

million.

- Adjusted EBITDA (“AEBITDA”) loss of $1.4 million for the third

quarter of 2022, compared to an AEBITDA loss of $1.7 million for

the third quarter of 2021. AEBITDA loss is a non-GAAP financial

measure. See “Non-GAAP Financial Information” below for additional

information regarding this non-GAAP financial measure, and “GAAP to

Non-GAAP Reconciliation” for a reconciliation of this non-GAAP

financial measure to net loss.

Non-GAAP Financial Information

Adjusted EBITDA (“AEBITDA”) loss, a non-GAAP financial measure,

is defined as net loss before depreciation and amortization,

stock-based compensation and expense, impairment charges, casualty

loss, gain on extinguishment of debt, severance, income tax

expense, and interest and other (income) expense, net. AEBITDA loss

is not intended to replace operating loss, net loss, cash flow or

other measures of financial performance reported in accordance with

generally accepted accounting principles (GAAP). Rather, AEBITDA

loss is an important measure used by management to assess the

operating performance of the Company and to compare such

performance between periods. AEBITDA loss as defined here may not

be comparable to similarly titled measures reported by other

companies due to differences in accounting policies. Therefore,

AEBITDA loss should be considered in conjunction with net loss and

other performance measures prepared in accordance with GAAP, such

as operating loss or cash flow used in operating activities, and

should not be considered in isolation or as a substitute for GAAP

measures, such as net loss, operating loss or any other GAAP

measure of liquidity or financial performance. A GAAP to non-GAAP

reconciliation of net loss to AEBITDA loss is shown under “GAAP to

Non-GAAP Reconciliation” later in this release.

About Oblong, Inc.

Oblong (Nasdaq:OBLG) provides innovative and patented

technologies that change the way people work, create, and

communicate. Oblong’s flagship product Mezzanine™ is a remote

meeting technology platform that offers simultaneous content

sharing to achieve situational awareness for both in-room and

remote collaborators. Oblong supplies Mezzanine systems to Fortune

500 and enterprise customers. For more information, visit

www.oblong.com and Oblong’s Twitter and Facebook pages.

Forward looking and cautionary statements

This press release and any oral statements made regarding the

subject of this release contain forward-looking statements as

defined under Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, and are made under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. All statements,

other than statements of historical facts, that address activities

that Oblong assumes, plans, expects, believes, intends, projects,

estimates or anticipates (and other similar expressions) will,

should or may occur in the future are forward-looking statements.

Oblong’s actual results may differ materially from its

expectations, estimates and projections, and consequently you

should not rely on these forward-looking statements as predictions

of future events. Without limiting the generality of the foregoing,

forward-looking statements contained in this press release include

statements relating to (i) the Company exploring strategic

alternatives to maximize value for our shareholders and the timing

and results thereof, (ii) the Company’s potential future growth and

financial performance, and (iii) the success of its products and

services. There can be no assurance that the strategic review being

undertaken will result in a merger, sale or other business

combination involving the Company. The forward-looking statements

are based on management’s current belief, based on currently

available information, as to the outcome and timing of future

events, and involve factors, risks, and uncertainties, including

the volatility of market price for our securities, that may cause

actual results in future periods to differ materially from such

statements. A list and description of these and other risk factors

can be found in the Company’s Annual Report on Form 10-K for the

year ending December 31, 2021 and in other filings made by the

Company with the SEC from time to time. Any of these factors could

cause Oblong’s actual results and plans to differ materially from

those in the forward-looking statements. Therefore, the Company can

give no assurance that its future results will be as estimated. The

Company does not intend to, and disclaims any obligation to,

correct, update, or revise any information contained herein.

OBLONG, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

($ in thousands)

September 30, 2022

December 31, 2021

(Unaudited)

ASSETS

Current assets:

Cash

$

4,143

$

8,939

Restricted cash

—

61

Accounts receivable, net

357

849

Inventory

1,027

1,821

Prepaid expenses and other current

assets

868

1,081

Total current assets

6,395

12,751

Property and equipment, net

25

159

Goodwill

—

7,367

Intangibles, net

690

7,562

Right-of-use assets, net

201

659

Other assets

53

109

Total assets

$

7,364

$

28,607

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

401

259

Accrued expenses and other current

liabilities

1,088

959

Current portion of deferred revenue

571

783

Current portion of operating lease

liabilities

306

492

Total current liabilities

2,366

2,493

Long-term liabilities:

Operating lease liabilities, net of

current portion

43

236

Deferred revenue, net of current

portion

152

381

Total long-term liabilities

195

617

Total liabilities

2,561

3,110

Commitments and contingencies

Stockholders’ equity:

Common stock, $.0001 par value;

150,000,000 shares authorized; 30,929,331 shares issued and

30,816,048 outstanding at September 30, 2022 and December 31,

2021

3

3

Treasury stock, 113,283 shares of common

stock at September 30, 2022 and December 31, 2021

(181

)

(181

)

Additional paid-in capital

227,611

227,581

Accumulated deficit

(222,630

)

(201,906

)

Total stockholders' equity

4,803

25,497

Total liabilities and stockholders’

equity

$

7,364

$

28,607

OBLONG, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

($ in thousands)

(Unaudited)

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Revenue

$

1,185

$

1,799

4,050

5,766

Cost of revenue (exclusive of depreciation

and amortization and casualty loss)

841

1,228

2,800

3,767

Gross profit

344

571

1,250

1,999

Operating expenses:

Research and development

232

693

1,634

1,984

Sales and marketing

282

438

1,161

1,537

General and administrative

1,229

1,628

4,104

5,078

Impairment charges

5,169

254

12,715

302

Casualty loss

—

—

533

—

Depreciation and amortization

592

669

1,818

2,098

Total operating expenses

7,504

3,682

21,965

10,999

Loss from operations

(7,160

)

(3,111

)

(20,715

)

(9,000

)

Interest and other expense (income),

net

(5

)

(2,449

)

1

(2,659

)

Loss before income taxes

(7,155

)

(662

)

(20,716

)

(6,341

)

Income tax expense (benefit)

(3

)

—

8

—

Net loss

$

(7,152

)

$

(662

)

(20,724

)

(6,341

)

GAAP to Non-GAAP

Reconciliation:

Three Months Ended

Nine Months Ended

September 30,

September 30,

2022

2021

2022

2021

Net loss

$

(7,152

)

$

(662

)

$

(20,724

)

$

(6,341

)

Depreciation and amortization

592

669

1,818

2,098

Interest and other expense (income),

net

(5

)

(2,449

)

1

(2,659

)

Income tax expense (benefit)

(3

)

—

8

—

Impairment charges

5,169

254

12,715

302

Severance

—

12

294

23

Casualty loss

—

—

533

—

Stock-based expense

31

502

30

925

Adjusted EBITDA Loss

$

(1,368

)

$

(1,674

)

$

(5,325

)

$

(5,652

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221110005966/en/

David Clark investors@oblong.com (213) 683-8863 ext 2205

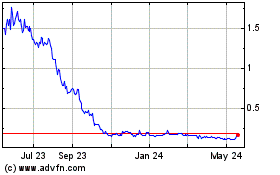

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Jan 2025 to Feb 2025

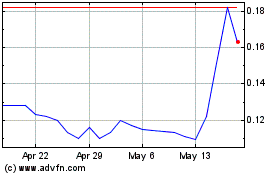

Oblong (NASDAQ:OBLG)

Historical Stock Chart

From Feb 2024 to Feb 2025