0001722010False00017220102024-01-252024-01-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________

FORM 8-K

____________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 25, 2024

____________________________________

OP BANCORP

(Exact name of registrant as specified in its charter)

____________________________________

| | | | | | | | |

| California | 001-38437 | 81-3114676 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | |

1000 Wilshire Blvd, Suite 500, Los Angeles, CA | | 90017 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (213) 892-9999

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

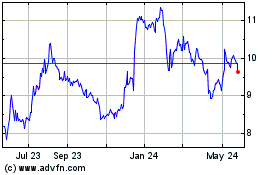

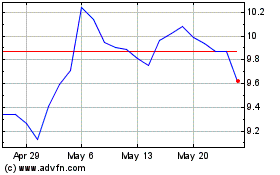

| Common Stock, no par value | | OPBK | | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 2.02. Results of Operations and Financial Condition

On January 25, 2024, OP Bancorp, (the “Company”), the holding company of Open Bank, issued a press release announcing preliminary unaudited results for the fourth quarter ended December 31, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report and is incorporated herein by reference. Also attached as Exhibit 99.3 is a slide presentation for the results for the fourth quarter.

The information in this report set forth under this Item 2.02 shall not be treated as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 as amended (the “Exchange Act”), nor shall it be deemed incorporated by reference into any registration statement or other filing pursuant to the Exchange Act or the Securities Act of 1934 as amended, except as expressly stated by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Exhibit Description |

| 99.1 | | |

| | |

| 99.2 | | |

| | |

| 99.3 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| OP Bancorp |

| | |

Date: January 25, 2024 | By: | /s/ Christine Oh |

| | Christine Oh |

| | Executive Vice President and |

| | Chief Financial Officer |

Exhibit 99.1

OP BANCORP REPORTS NET INCOME FOR 2023 FOURTH QUARTER

OF $5.2 MILLION AND DILUTED EARNINGS PER SHARE OF $0.34

2023 Fourth Quarter Highlights compared with 2023 Third Quarter:

•Financial Results:

◦Net income of $5.2 million, compared to $5.1 million

◦Diluted earnings per share of $0.34, compared to $0.33

◦Net interest income of $16.2 million, compared to $17.3 million

◦Net interest margin of 3.12%, compared to 3.38%

◦Provision for credit losses of $0.6 million, compared to $1.4 million

◦Total assets of $2.15 billion, compared to $2.14 billion

◦Gross loans of $1.77 billion, compared to $1.76 billion

◦Total deposits of $1.81 billion, compared to $1.83 billion

•Credit Quality:

◦Allowance for credit losses to gross loans of 1.25%, compared to 1.23%

◦Net charge-offs(1) to average gross loans(2) of 0.04%, compared to 0.11%

◦Nonperforming loans to gross loans of 0.34%, compared to 0.24%

◦Criticized loans(3) to gross loans of 0.76%, compared to 0.78%

•Capital Levels:

◦Remained well-capitalized with a Common Equity Tier 1 (“CET1”) ratio of 12.52%

◦Book value per common share increased to $12.84, compared to $12.17

◦Repurchased 150,000 shares of common stock at an average price of $8.72

◦Paid quarterly cash dividend of $0.12 per share for the periods

___________________________________________________________

(1) Annualized.

(2) Includes loans held for sale.

(3) Includes special mention, substandard, doubtful, and loss categories.

LOS ANGELES, January 25, 2024 — OP Bancorp (the “Company”) (NASDAQ: OPBK), the holding company of Open Bank (the “Bank”), today reported its financial results for the fourth quarter of 2023. Net income for the fourth quarter of 2023 was $5.2 million, or $0.34 per diluted common share, compared with $5.1 million, or $0.33 per diluted common share, for the third quarter of 2023, and $8.0 million, or $0.51 per diluted common share, for the fourth quarter of 2022. Net income for the full year of 2023 was $23.9 million, or $1.55 per diluted common share, compared with $33.3 million, or $2.14 per diluted common share, for the full year of 2022.

Min Kim, President and Chief Executive Officer:

“Given the continued stress in banking from the high interest rate environment, we have been focusing on managing our funding strategy for balancing effective cost control against the need to maintain ample liquidity. As comments from the Federal Reserve Open Markets Committee suggest that the Fed’s tightening cycle appears to be nearing an end, the pressure on funding cost seems to be fading away, and we expect to see a turnaround in our net interest margin in the coming quarters,” said Min Kim, President and Chief Executive.

“We know that our customers are going through this difficult time as well. To return our gratitude to our customer for their loyalty and trust they have in us, we will continue our effort to work together with the customers and provide all the support they need from us.”

Although we may encounter additional challenges in the short term, we remain hopeful to achieve our long term strategic goals while maintaining an appropriate risk and control environment.”

SELECTED FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands, except per share data) | | As of and For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Selected Income Statement Data: | | | | | | | | | | |

| Net interest income | | $ | 16,230 | | | $ | 17,313 | | | $ | 20,198 | | | (6.3) | % | | (19.6) | % |

| Provision for credit losses | | 630 | | | 1,359 | | | 977 | | | (53.6) | | (35.5) |

| Noninterest income | | 3,680 | | | 2,601 | | | 3,223 | | | 41.5 | | | 14.2 | |

| Noninterest expense | | 11,983 | | | 11,535 | | | 11,327 | | | 3.9 | | | 5.8 | |

| Income tax expense | | 2,125 | | | 1,899 | | | 3,089 | | | 11.9 | | | (31.2) | |

| Net income | | 5,172 | | | 5,121 | | | 8,028 | | | 1.0 | | | (35.6) | |

| Diluted earnings per share | | 0.34 | | | 0.33 | | | 0.51 | | | 3.0 | | | (33.3) | |

| Selected Balance Sheet Data: | | | | | | | | | | |

Gross loans | | $ | 1,765,845 | | | $ | 1,759,525 | | | $ | 1,678,292 | | | 0.4 | % | | 5.2 | % |

| Total deposits | | 1,807,558 | | | 1,825,171 | | | 1,885,771 | | | (1.0) | | | (4.1) | |

| Total assets | | 2,147,730 | | | 2,142,675 | | | 2,094,497 | | | 0.2 | | | 2.5 | |

Average loans(1) | | 1,787,540 | | | 1,740,188 | | | 1,691,642 | | | 2.7 | | | 5.7 | |

| Average deposits | | 1,813,411 | | | 1,821,361 | | | 1,836,736 | | | (0.4) | | | (1.3) | |

| Credit Quality: | | | | | | | | | | |

| Nonperforming loans | | $ | 6,082 | | | $ | 4,211 | | | $ | 2,033 | | | 44.4 | % | | 199.2 | % |

| Nonperforming loans to gross loans | | 0.34 | % | | 0.24 | % | | 0.12 | % | | 0.10 | | | 0.22 | |

Criticized loans(2) to gross loans | | 0.76 | | | 0.78 | | | 0.19 | | | (0.02) | | | 0.57 | |

Net charge-offs to average gross loans(3) | | 0.04 | | | 0.11 | | | 0.03 | | | (0.07) | | | 0.01 | |

| Allowance for credit losses to gross loans | | 1.25 | | | 1.23 | | | 1.15 | | | 0.02 | | | 0.10 | |

| Allowance for credit losses to nonperforming loans | | 362 | | | 513 | | | 946 | | | (151) | | | (584) | |

| Financial Ratios: | | | | | | | | | | |

Return on average assets(3) | | 0.96 | % | | 0.96 | % | | 1.56 | % | | — | % | | (0.60) | % |

Return on average equity(3) | | 11.18 | | | 11.07 | | | 18.58 | | | 0.11 | | | (7.40) | |

Net interest margin(3) | | 3.12 | | | 3.38 | | | 4.08 | | | (0.26) | | | (0.96) | |

Efficiency ratio(4) | | 60.19 | | | 57.92 | | | 48.36 | | | 2.27 | | | 11.83 | |

| Common equity tier 1 capital ratio | | 12.52 | | | 12.09 | | | 11.87 | | | 0.43 | | | 0.65 | |

| Leverage ratio | | 9.57 | | | 9.63 | | | 9.38 | | | (0.06) | | | 0.19 | |

| Book value per common share | | $ | 12.84 | | | $ | 12.17 | | | $ | 11.59 | | | 5.5 | | | 10.8 | |

| | | | | | | | | | |

(1)Includes loans held for sale.

(2)Includes special mention, substandard, doubtful, and loss categories.

(3)Annualized.

(4)Represents noninterest expense divided by the sum of net interest income and noninterest income.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands, except per share data) | | As of and For the Twelve Months Ended December 31, | | |

| 2023 | | 2022 | | % Change |

| Selected Income Statement Data: | | | | | | |

| Net interest income | | $ | 68,687 | | | $ | 76,911 | | | (10.7) | % |

| Provision for credit losses | | 1,651 | | | 2,976 | | | (44.5) | |

| Noninterest income | | 14,181 | | | 17,619 | | | (19.5) | |

| Noninterest expense | | 47,726 | | | 44,830 | | | 6.5 | |

| Income tax expense | | 9,573 | | | 13,414 | | | (28.6) | |

| Net income | | 23,918 | | | 33,310 | | | (28.2) | |

| Diluted earnings per share | | 1.55 | | | 2.14 | | | (27.6) | |

| Selected Balance Sheet Data: | | | | | | |

Average loans(1) | | $ | 1,744,878 | | | $ | 1,578,218 | | | 10.6 | % |

| Average deposits | | 1,829,717 | | | 1,716,758 | | | 6.6 | |

| Credit Quality: | | | | | | |

| Net charge-offs to average gross loans | | 0.04 | % | | — | % | | 0.04 | % |

| Financial Ratios: | | | | | | |

| Return on average assets | | 1.13 | % | | 1.74 | % | | (0.61) | % |

| Return on average equity | | 13.05 | | | 19.57 | | | (6.52) | |

| Net interest margin | | 3.37 | | | 4.18 | | | (0.81) | |

Efficiency ratio(2) | | 57.59 | | | 47.42 | | | 10.17 | |

| | | | | | |

(1)Includes loans held for sale.

(2)Represents noninterest expense divided by the sum of net interest income and noninterest income.

INCOME STATEMENT HIGHLIGHTS

Net Interest Income and Net Interest Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Interest Income | | | | | | | | | | |

| Interest income | | $ | 31,783 | | | $ | 31,186 | | | $ | 26,886 | | | 1.9 | % | | 18.2 | % |

| Interest expense | | 15,553 | | | 13,873 | | | 6,688 | | | 12.1 | | | 132.6 | |

| Net interest income | | $ | 16,230 | | | $ | 17,313 | | | $ | 20,198 | | | (6.3) | % | | (19.6) | % |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Average Balance | | Interest

and Fees | | Yield/Rate(1) | | Average Balance | | Interest

and Fees | | Yield/Rate(1) | | Average Balance | | Interest

and Fees | | Yield/Rate(1) |

| Interest-earning Assets: | | | | | | | | | | | | | | | | | | |

| Loans | | $ | 1,787,540 | | | $ | 28,914 | | | 6.43 | % | | $ | 1,740,188 | | | $ | 28,250 | | | 6.45 | % | | $ | 1,691,642 | | | $ | 24,719 | | | 5.81 | % |

| Total interest-earning assets | | 2,071,613 | | | 31,783 | | | 6.10 | | | 2,038,321 | | | 31,186 | | | 6.08 | | | 1,966,165 | | | 26,886 | | | 5.43 | |

| Interest-bearing Liabilities: | | | | | | | | | | | | | | | | | | |

| Interest-bearing deposits | | 1,243,446 | | | 14,127 | | | 4.51 | | | 1,222,099 | | | 13,006 | | | 4.22 | | | 1,085,331 | | | 6,598 | | | 2.41 | |

| Total interest-bearing liabilities | | 1,362,210 | | | 15,553 | | | 4.53 | | | 1,301,990 | | | 13,873 | | | 4.23 | | | 1,093,489 | | | 6,688 | | | 2.43 | |

| Ratios: | | | | | | | | | | | | | | | | | | |

| Net interest income / interest rate spreads | | | | 16,230 | | | 1.57 | | | | | 17,313 | | | 1.85 | | | | | 20,198 | | | 3.00 | |

| Net interest margin | | | | | | 3.12 | | | | | | | 3.38 | | | | | | | 4.08 | |

| Total deposits / cost of deposits | | 1,813,411 | | | 14,127 | | | 3.09 | | | 1,821,361 | | | 13,006 | | | 2.83 | | | 1,836,736 | | | 6,598 | | | 1.43 | |

| Total funding liabilities / cost of funds | | 1,932,175 | | | 15,553 | | | 3.19 | | | 1,901,252 | | | 13,873 | | | 2.90 | | | 1,844,894 | | | 6,688 | | | 1.44 | |

| | | | | | | | | | | | | | | | | | |

(1)Annualized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | Yield Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | |

| Interest

& Fees | | Yield(1) | | Interest

& Fees | | Yield(1) | | Interest

& Fees | | Yield(1) | | 3Q2023 | | 4Q2022 |

| Loan Yield Component: | | | | | | | | | | | | | | | | |

| Contractual interest rate | | $ | 28,596 | | | 6.36 | % | | $ | 27,319 | | | 6.24 | % | | $ | 23,694 | | | 5.57 | % | | 0.12 | % | | 0.79 | % |

| SBA discount accretion | | 960 | | | 0.21 | | | 1,263 | | | 0.29 | | | 1,034 | | | 0.24 | | | (0.08) | | | (0.03) | |

| Amortization of net deferred fees | | (67) | | | -0.01 | | | 1 | | | — | | | 46 | | | 0.01 | | | (0.01) | | | (0.02) | |

| Amortization of premium | | (423) | | | (0.09) | | | (445) | | | (0.10) | | | (344) | | | (0.08) | | | 0.01 | | | (0.01) | |

| Net interest recognized on nonaccrual loans | | (345) | | | (0.08) | | | (26) | | | (0.01) | | | — | | | — | | | (0.07) | | | (0.08) | |

Prepayment penalties(2) and other fees | | 193 | | | 0.04 | | | 138 | | | 0.03 | | | 289 | | | 0.07 | | | 0.01 | | | (0.03) | |

| Yield on loans | | $ | 28,914 | | | 6.43 | % | | $ | 28,250 | | | 6.45 | % | | $ | 24,719 | | | 5.81 | % | | (0.02) | % | | 0.62 | % |

| | | | | | | | | | | | | | | | |

| Amortization of Net Deferred Fees: | | | | | | | | | | | | | | | | |

| PPP loan forgiveness | | $ | — | | | — | % | | $ | 3 | | | — | % | | $ | 15 | | | — | % | | — | % | | — | % |

| Other | | (67) | | | (0.01) | | | (2) | | | — | | | 31 | | | 0.01 | | | (0.01) | | | (0.02) | |

| Total amortization of net deferred fees | | $ | (67) | | | (0.01) | % | | $ | 1 | | | — | % | | $ | 46 | | | 0.01 | % | | (0.01) | % | | (0.02) | % |

| | | | | | | | | | | | | | | | |

(1)Annualized.

(2)Prepayment penalty income of $43 thousand and $172 thousand for the three months ended December 31, 2023 and December 31, 2022, respectively, was from Commercial Real Estate (“CRE”) and Commercial and Industrial (“C&I”) loans.

Impact of Hana Loan Purchase on Average Loan Yield and Net Interest Margin

During the second quarter of 2021, the Bank purchased an SBA portfolio of 638 loans with an ending balance of $100.0 million, excluding loan discount of $8.9 million from Hana Small Business Lending, Inc. (“Hana”). The following table presents impacts of the Hana loan purchase on average loan yield and net interest margin:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Hana Loan Purchase: | | | | | | |

| Contractual interest rate | | $ | 1,160 | | | $ | 1,383 | | | $ | 1,286 | |

| Purchased loan discount accretion | | 226 | | | 513 | | | 374 | |

| Other fees | | 9 | | | 27 | | | 25 | |

| Total interest income | | $ | 1,395 | | | $ | 1,923 | | | $ | 1,685 | |

| | | | | | |

Effect on average loan yield(1) | | 0.14 | % | | 0.25 | % | | 0.20 | % |

Effect on net interest margin(1) | | 0.20 | % | | 0.30 | % | | 0.22 | % |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Average

Balance | | Interest

and Fees | | Yield/

Rate | | Average

Balance | | Interest

and Fees | | Yield/

Rate | | Average

Balance | | Interest

and Fees | | Yield/

Rate |

Average loan yield(1) | | $ | 1,787,540 | | | $ | 28,914 | | | 6.43 | % | | $ | 1,740,188 | | | $ | 28,250 | | | 6.45 | % | | $ | 1,691,642 | | | $ | 24,719 | | | 5.81 | % |

Adjusted average loan yield excluding purchased Hana loans(1)(2) | | 1,739,603 | | | 27,519 | | | 6.29 | | | 1,688,404 | | | 26,327 | | | 6.20 | | | 1,631,128 | | | 23,034 | | | 5.61 | |

| | | | | | | | | | | | | | | | | | |

Net interest margin(1) | | 2,071,613 | | | 16,230 | | | 3.12 | | | 2,038,321 | | | 17,313 | | | 3.38 | | | 1,966,165 | | | 20,198 | | | 4.08 | |

Adjusted interest margin excluding purchased Hana loans(1)(2) | | 2,023,676 | | | 14,835 | | | 2.92 | | | 1,986,537 | | | 15,390 | | | 3.08 | | | 1,905,651 | | | 18,513 | | | 3.86 | |

| | | | | | | | | | | | | | | | | | |

(1)Annualized.

(2)See reconciliation of GAAP to non-GAAP financial measures.

Fourth Quarter 2023 vs. Third Quarter 2023

Net interest income decreased $1.1 million, or 6.3%, primarily due to higher interest expense on deposits and borrowings, partially offset by higher interest income on loans. Net interest margin was 3.12%, a decrease of 26 basis points from 3.38%.

◦A $1.1 million increase in interest expense on interest-bearing deposits was primarily due to a 29 basis point increase in average cost as deposit accounts continued to reprice following the Federal Reserve’s rate increases in 2022 and 2023.

◦A $559 thousand increase in interest expense on borrowings was primarily due to a $38.9 million, or 49%, increase in average balance to complement our liability management strategy for effective cost controls.

◦A $664 thousand increase in interest income on loans was primarily due to a $47.4 million, or 3%, increase in average balance.

Fourth Quarter 2023 vs. Fourth Quarter 2022

Net interest income decreased $4.0 million, or 19.6%, primarily due to higher interest expense on deposits and borrowings, partially offset by higher interest income on loans as our deposit and borrowing costs repriced more quickly than our interest-earning assets. Net interest margin was 3.12%, a decrease of 96 basis points from 4.08%.

◦A $7.5 million increase in interest expense on interest-bearing deposits was primarily due to a $158.1 million, or 15%, increase in average balance and a 210 basis point increase in average cost driven by the Federal Reserve’s rate increases.

◦A $1.3 million increase in interest expense on borrowings was primarily due to a $110.6 million, or 1,356%, increase in average balance and a 41 basis point increase in average cost driven by the Federal Reserve’s rate increases.

◦A $4.2 million increase in interest income on loans was primarily due to a $95.9 million, or 6%, increase in average balance and a 62 basis point increase in average yield as a result of the Federal Reserve’s rate increases.

Provision for Credit Losses

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Provision for credit losses on loans | | $ | 537 | | | $ | 1,303 | | | $ | 977 | |

Provision for credit losses on off-balance sheet exposure(1) | | 93 | | | 56 | | | 74 | |

| Total provision for credit losses | | $ | 630 | | | $ | 1,359 | | | $ | 1,051 | |

| | | | | | |

(1) Provision for credit losses on off-balance sheet exposure of $93 thousand and $56 thousand for the three months ended December 31, 2023 and September 30, 2023, respectively, was included in total provision for credit losses. Prior to CECL adoption, provisions for credit losses on off-balance sheet exposure of $74 thousand for the three months ended December 31, 2022 was included in other expenses.

Fourth Quarter 2023 vs. Third Quarter 2023

The Company recorded a $630 thousand provision for credit losses, a decrease of $729 thousand, compared with a $1.4 million provision for credit losses.

Provision for credit losses on loans was $537 thousand, primarily due to a $341 thousand in specific reserves on two individually evaluated SBA loans, a $161 thousand in net charge-offs, and a $44 thousand increase in qualitative factor adjustments. The change in quantitative general reserve during the quarter was insignificant as the impact from a 0.4% growth in gross loans was mostly offset by a decrease in historical loss factors.

Fourth Quarter 2023 vs. Fourth Quarter 2022

The Company recorded a $630 thousand provision for credit losses, a decrease of $421 thousand, compared with a $1.1 million provision for credit losses.

Noninterest Income

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Noninterest Income | | | | | | | | | | |

| Service charges on deposits | | $ | 557 | | | $ | 575 | | | $ | 406 | | | (3.1) | % | | 37.2 | % |

| Loan servicing fees, net of amortization | | 540 | | | 468 | | | 705 | | | 15.4 | | | (23.4) | |

| Gain on sale of loans | | 1,996 | | | 1,179 | | | 1,684 | | | 69.3 | | | 18.5 | |

| Other income | | 587 | | | 379 | | | 428 | | | 54.9 | | | 37.1 | |

| Total noninterest income | | $ | 3,680 | | | $ | 2,601 | | | $ | 3,223 | | | 41.5 | % | | 14.2 | % |

| | | | | | | | | | |

Fourth Quarter 2023 vs. Third Quarter 2023

Noninterest income increased $1.1 million, or 41.5%, primarily due to higher gain on sale of loans and other income.

◦Gain on sale of loans was $2.0 million, an increase of $817 thousand from $1.2 million, primarily due to a higher SBA loan sold amount. The Bank sold $40.1 million in SBA loans at an average premium rate of 5.99%, compared to the sale of $23.4 million at an average premium rate of 6.50%.

◦Other income was $587 thousand, an increase of $208 thousand from $379 thousand. The increase was primarily due to a $259 thousand increase in holding gain on equity investment for CRA purposes driven by a significant drop in the yields curve.

Fourth Quarter 2023 vs. Fourth Quarter 2022

Noninterest income increased $457 thousand, or 14.2%, primarily due to higher gain on sale of loans.

◦Gain on sale of loans was $2.0 million, an increase of $312 thousand from $1.7 million, primarily due to a higher SBA loan sold amount. The Bank sold $40.1 million in SBA loans at an average premium rate of 5.99%, compared to the sale of $32.2 million at an average premium rate of 6.13%.

◦Service charges on deposits was $557 thousand, and increase of $151 thousand from $406 thousand, primarily due to an increase in deposit analysis fees from an increase in the number of analysis accounts.

◦Loan servicing fees, net of amortization was $540 thousand, a decrease of $165 thousand from $705 thousand, primarily due to an increase in servicing fee amortization driven by higher loan payoffs.

◦Other income was $587 thousand, an increase of $159 thousand from $428 thousand, primarily due to a $146 thousand increase in holding gain on equity investment for CRA purposes driven by a drop in the yield curve.

Noninterest Expense

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Noninterest Expense | | | | | | | | | | |

| Salaries and employee benefits | | $ | 7,646 | | | $ | 7,014 | | | $ | 7,080 | | | 9.0 | % | | 8.0 | % |

| Occupancy and equipment | | 1,616 | | | 1,706 | | | 1,560 | | | (5.3) | | | 3.6 | |

| Data processing and communication | | 644 | | | 369 | | | 514 | | | 74.5 | | | 25.3 | |

| Professional fees | | 391 | | | 440 | | | 330 | | | (11.1) | | | 18.5 | |

| FDIC insurance and regulatory assessments | | 237 | | | 333 | | | 176 | | | (28.8) | | | 34.7 | |

| Promotion and advertising | | 86 | | | 207 | | | 12 | | | (58.5) | | | 616.7 | |

| Directors’ fees | | 145 | | | 164 | | | 145 | | | (11.6) | | | — | |

| Foundation donation and other contributions | | 524 | | | 529 | | | 851 | | | (0.9) | | | (38.4) | |

| Other expenses | | 694 | | | 773 | | | 659 | | | (10.2) | | | 5.3 | |

| Total noninterest expense | | $ | 11,983 | | | $ | 11,535 | | | $ | 11,327 | | | 3.9 | % | | 5.8 | % |

| | | | | | | | | | |

Fourth Quarter 2023 vs. Third Quarter 2023

Noninterest expense increased $448 thousand, or 3.9%, primarily due to higher salaries and employee benefits, and data processing communication, partially offset by decreases in noninterest expense items listed below.

◦Salaries and employee benefits increased $632 thousand, primarily due to a $491 thousand increase in employee incentive accruals.

◦Data processing and communication increased $275 thousand primarily due to an accrual adjustment for a credit received on data processing fees in the third quarter of 2023.

◦Promotion and advertising decreased $121 thousand, FDIC insurance and regulatory assessments decreased $96 thousand, and occupancy and equipment decreased $90 thousand, primarily due to year end accrual adjustments.

Fourth Quarter 2023 vs. Fourth Quarter 2022

Noninterest expense increased $656 thousand, or 5.8%, primarily due to higher salaries and employee benefits and data processing and communication, partially offset by lower foundation donation and other contributions.

◦Salaries and employee benefits increased $566 thousand, primarily due to an increase from employee salary adjustments in 2023 and an increase in employee incentive accruals.

◦Data processing and communication increased $130 thousand, primarily due to an increase in data and item processing fees in line with the Bank’s growth.

◦Foundation donations and other contributions decreased $327 thousand, primarily due to a lower donation accrual for Open Stewardship as a result of lower net income.

Income Tax Expense

Fourth Quarter 2023 vs. Third Quarter 2023

Income tax expense was $2.1 million and the effective tax rate was 29.1%, compared to income tax expense of $1.9 million and the effective rate of 27.1%. The increase in the effective tax rate was primarily due to an adjustment for differences between the prior year tax provision and the final tax returns that were applied in the third quarter of 2023.

Fourth Quarter 2023 vs. Fourth Quarter 2022

Income tax expense was $2.1 million and the effective tax rate was 29.1%, compared to income tax expense of $3.1 million and an effective rate of 27.8%. The increase in the effective tax rate was primarily due to an adjustment for differences between the tax provision for 2021 and the final 2021 tax returns that were applied in the fourth quarter of 2022.

BALANCE SHEET HIGHLIGHTS

Loans

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | As of | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| CRE loans | | $ | 885,585 | | | $ | 878,824 | | | $ | 842,208 | | | 0.8 | % | | 5.2 | % |

| SBA loans | | 239,692 | | | 240,154 | | | 234,717 | | | (0.2) | | | 2.1 | |

| C&I loans | | 120,970 | | | 124,632 | | | 116,951 | | | (2.9) | | | 3.4 | |

| Home mortgage loans | | 518,024 | | | 515,789 | | | 482,949 | | | 0.4 | | | 7.3 | |

| Consumer & other loans | | 1,574 | | | 126 | | | 1,467 | | | n/m | | 7.3 | |

| Gross loans | | $ | 1,765,845 | | | $ | 1,759,525 | | | $ | 1,678,292 | | | 0.4 | % | | 5.2 | % |

| | | | | | | | | | |

The following table presents new loan originations based on loan commitment amounts for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| CRE loans | | $ | 15,885 | | | $ | 33,222 | | | $ | 44,416 | | | (52.2) | % | | (64.2) | % |

SBA loans | | 51,855 | | | 39,079 | | | 55,594 | | | 32.7 | | | (6.7) | |

| C&I loans | | 15,270 | | | 14,617 | | | 46,014 | | | 4.5 | | | (66.8) | |

| Home mortgage loans | | 12,417 | | | 9,137 | | | 28,188 | | | 35.9 | | | (55.9) | |

| Consumer & other loans | | 1,500 | | | — | | | — | | | — | | — | |

| Gross loans | | $ | 96,927 | | | $ | 96,055 | | | $ | 174,212 | | | 0.9 | % | | (44.4) | % |

| | | | | | | | | | |

The following table presents changes in gross loans by loan activity for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | For the Three Months Ended | | For the Twelve Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 4Q2023 | | 4Q2022 |

| Loan Activities: | | | | | | | | | | |

| Gross loans, beginning | | $ | 1,759,525 | | | $ | 1,716,197 | | | $ | 1,618,018 | | | $ | 1,678,292 | | | 1,314,019 | |

| New originations | | 96,927 | | | 96,055 | | | 174,212 | | | 374,503 | | | 645,188 | |

| Net line advances | | (7,350) | | | 22,146 | | | (80,144) | | | (809) | | | (120,820) | |

| Purchases | | 2,371 | | | 6,732 | | | 49,980 | | | 27,604 | | | 225,133 | |

| Sales | | (40,122) | | | (23,377) | | | (32,204) | | | (145,311) | | | (182,315) | |

| Paydowns | | (19,901) | | | (22,169) | | | (22,939) | | | (99,470) | | | (73,975) | |

| Payoffs | | (23,590) | | | (36,024) | | | (23,238) | | | (113,909) | | | (139,544) | |

| PPP payoffs | | — | | | (250) | | | (657) | | | (450) | | | (41,289) | |

| Decrease in loans held for sale | | (1,795) | | | — | | | (7,693) | | | 42,541 | | | — | |

| Other | | (220) | | | 215 | | | 2,957 | | | 2,854 | | | 51,895 | |

| Total | | 6,320 | | | 43,328 | | | 60,274 | | | 87,553 | | | 364,273 | |

| Gross loans, ending | | $ | 1,765,845 | | | $ | 1,759,525 | | | $ | 1,678,292 | | | $ | 1,765,845 | | | $ | 1,678,292 | |

| | | | | | | | | | |

As of December 31, 2023 vs. September 30, 2023

Gross loans were $1.77 billion as of December 31, 2023, up $6.3 million from September 30, 2023, primarily due to new loan originations, partially offset by loan sales, payoffs and paydowns.

New loan originations, loan sales, and loan payoffs and paydowns were $96.9 million $40.1 million and $43.5 million, respectively, for the fourth quarter of 2023, compared with $96.1 million, $23.4 million and $58.4 million, respectively, for the third quarter of 2023.

As of December 31, 2023 vs. December 31, 2022

Gross loans were $1.77 billion as of December 31, 2023, up $87.6 million from December 31, 2022, primarily due to new loan originations of $374.5 million and loan purchases of $27.6 million, primarily offset by loan sales of $145.3 million and loan payoffs and paydowns of $213.8 million.

The following table presents the composition of gross loans by interest rate type accompanied with the weighted average contractual rates as of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| ($ in thousands) | | As of |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| % | | Rate | | % | | Rate | | % | | Rate |

| Fixed rate | | 35.1 | % | | 5.07 | % | | 36.3 | % | | 4.95 | % | | 36.0 | % | | 4.63 | % |

| Hybrid rate | | 33.9 | | | 5.15 | | | 34.0 | | | 5.08 | | | 33.8 | | | 4.79 | |

| Variable rate | | 31.0 | | | 9.15 | | | 29.7 | | | 9.23 | | | 30.2 | | | 8.46 | |

| Gross loans | | 100.0 | % | | 6.36 | % | | 100.0 | % | | 6.27 | % | | 100.0 | % | | 5.84 | % |

| | | | | | | | | | | | |

The following table presents the maturity of gross loans by interest rate type accompanied with the weighted average contractual rates for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| ($ in thousands) | | As of December 31, 2023 |

| Within One Year | | One Year Through Five Years | | After Five Years | | Total |

| Amount | | Rate | | Amount | | Rate | | Amount | | Rate | | Amount | | Rate |

| Fixed rate | | $ | 85,254 | | | 5.55 | % | | $ | 300,165 | | | 4.89 | % | | $ | 235,510 | | | 5.13 | % | | $ | 620,929 | | | 5.07 | % |

| Hybrid rate | | — | | | — | | | 122,695 | | | 4.28 | | | 475,633 | | | 5.38 | | | 598,328 | | | 5.15 | |

| Variable rate | | 116,289 | | | 8.83 | | | 110,647 | | | 9.02 | | | 319,652 | | | 9.31 | | | 546,588 | | | 9.15 | |

| Gross loans | | $ | 201,543 | | | 7.44 | % | | $ | 533,507 | | | 5.60 | % | | $ | 1,030,795 | | | 6.54 | % | | $ | 1,765,845 | | | 6.36 | % |

| | | | | | | | | | | | | | | | |

Allowance for Credit Losses

The Company adopted the CECL accounting standard effective as of January 1, 2023 under a modified retrospective approach. The adoption resulted in a $1.9 million increase to the allowance for credit losses on loans, a $184 thousand increase to the allowance for credit losses on off-balance sheet exposure, a $624 thousand increase to deferred tax assets, and a $1.5 million charge to retained earnings.

The following table presents impact of CECL adoption for allowance for credit losses and related items on January 1, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| ($ in thousands) | | Allowance For Credit Losses on Loans | | Allowance For Credit Losses on Off-Balance Sheet Exposure | | Deferred Tax Assets | | Retained Earnings |

| As of December 31, 2022 | | $ | 19,241 | | | $ | 263 | | | $ | 14,316 | | | $ | 105,690 | |

| Day 1 adjustments on January 1, 2023 | | 1,924 | | | 184 | | | 624 | | | (1,484) | |

| After Day 1 adjustments | | $ | 21,165 | | | $ | 447 | | | $ | 14,940 | | | $ | 104,206 | |

| | | | | | | | |

The following table presents allowance for credit losses and provision for credit losses as of and for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | As of and For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Allowance for credit losses on loans, beginning | | $ | 21,617 | | | $ | 20,802 | | | $ | 18,369 | | | 3.9 | % | | 17.7 | % |

| | | | | | | | | | |

Provision for credit losses | | 537 | | | 1,303 | | | 977 | | | (58.8) | | | (45.0) | |

| Gross charge-offs | | (236) | | | (492) | | | (109) | | | (52.0) | | | 116.5 | |

| Gross recoveries | | 75 | | | 4 | | | 4 | | | 1775.0 | | | 1775.0 | |

| Net charge-offs | | (161) | | | (488) | | | (105) | | | (67.0) | | | 53.3 | |

Allowance for credit losses on loans, ending(1) | | $ | 21,993 | | | $ | 21,617 | | | $ | 19,241 | | | 1.7 | % | | 14.3 | % |

| | | | | | | | | | |

| Allowance for credit losses on off-balance sheet exposure, beginning | | $ | 423 | | | $ | 367 | | | $ | 189 | | | 15.3 | % | | 123.8 | % |

| Impact of CECL adoption | | — | | | — | | | — | | | — | | | — | |

Provision for credit losses | | 93 | | | 56 | | | 74 | | | 66.1 | | | 25.7 | |

Allowance for credit losses on off-balance sheet exposure, ending(1) | | $ | 516 | | | $ | 423 | | | $ | 263 | | | 22.0 | % | | 96.2 | % |

| | | | | | | | | | |

(1) Allowance for credit losses as of December 31, 2023 and September 30, 2023 were calculated under the CECL methodology while allowance for loan losses for December 31, 2022 was calculated under the incurred loss methodology.

Asset Quality

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | As of and For the Three Months Ended | | Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Loans 30-89 days past due and still accruing | | $ | 9,607 | | | $ | 8,356 | | | $ | 3,477 | | | 15.0 | % | | 176.3 | % |

| As a % of gross loans | | 0.54 | % | | 0.47 | % | | 0.21 | % | | 0.07 | | | 0.33 | |

| | | | | | | | | | |

Nonperforming loans(1) | | $ | 6,082 | | | $ | 4,211 | | | $ | 2,033 | | | 44.4 | % | | 199.2 | % |

Nonperforming assets(1) | | 6,082 | | | 4,211 | | | 2,033 | | | 44.4 | | | 199.2 | |

| Nonperforming loans to gross loans | | 0.34 | % | | 0.24 | % | | 0.12 | % | | 0.10 | | | 0.22 | |

| Nonperforming assets to total assets | | 0.28 | % | | 0.20 | % | | 0.10 | % | | 0.08 | | | 0.18 | |

| | | | | | | | | | |

Criticized loans(1)(2) | | $ | 13,349 | | | $ | 13,790 | | | $ | 3,264 | | | (3.2) | % | | 309.0 | % |

| Criticized loans to gross loans | | 0.76 | % | | 0.78 | % | | 0.19 | % | | (0.02) | | | 0.57 | |

| | | | | | | | | | |

| Allowance for credit losses ratios: | | | | | | | | | | |

| As a % of gross loans | | 1.25 | % | | 1.23 | % | | 1.15 | % | | 0.02 | % | | 0.10 | % |

As an adjusted % of gross loans(3) | | 1.27 | | | 1.26 | | | 1.18 | | | 0.01 | | | 0.09 | |

| As a % of nonperforming loans | | 362 | | | 513 | | | 946 | | | (151) | | | (584) | |

| As a % of nonperforming assets | | 362 | | | 513 | | | 946 | | | (151) | | | (584) | |

| As a % of criticized loans | | 165 | | | 157 | | | 589 | | | 8 | | | (424) | |

Net charge-offs(4) to average gross loans(5) | | 0.04 | | | 0.11 | | | 0.03 | | | (0.07) | | | 0.01 | |

| | | | | | | | | | |

(1)Excludes the guaranteed portion of SBA loans that are in liquidation totaling $2.0 million, $5.2 million and $1.0 million as of December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

(2)Consists of special mention, substandard, doubtful and loss categories.

(3)See the Reconciliation of GAAP to NON-GAAP Financial Measures.

(4)Annualized.

(5)Includes loans held for sale.

Overall, the Bank continued to maintain low levels of nonperforming loans and net charge-offs. Our allowance remained strong with an adjusted allowance to gross loans ratio of 1.27%.

◦Loans 30-89 days past due and still accruing were $9.6 million or 0.54% of gross loans as of December 31, 2023, compared with $8.4 million or 0.47% as of September 30, 2023. Subsequent to December 31, 2023, payments on loans totaling $3.2 million were collected, and the loans are now current.

◦Nonperforming loans were $6.1 million or 0.34% of gross loans as of December 31, 2023, compared with $4.2 million or 0.24% as of September 30, 2023. The increase was due to an addition of $2.2 million on two SBA loans, one of which was from Hana purchased pool of loans with discount. The loans were individually evaluated for impairment, and a $183 thousand provision for credit losses was recorded. Of these nonperforming loans, two loans totaling $1.8 million are under workout and performing, three loans totaling $3.4 million are

listed for sale, and two loans totaling $528 thousand are performing and current. The Bank expects minimum losses from these loans.

◦Nonperforming assets were $6.1 million or 0.28% of total assets as of December 31, 2023, compared with $4.2 million or 0.20% as of September 30, 2023. The Company did not have OREO as of December 31, 2023 or September 30, 2023.

◦Criticized loans were $13.3 million or 0.76% of gross loans as of December 31, 2023, compared with $13.8 million or 0.78% as of September 30, 2023.

◦Net charge-offs were $161 thousand or 0.04% of average loans in the fourth quarter of 2023, compared to net charge-offs of $488 thousand, or 0.11% of average loans in the third quarter of 2023 and of $105 thousand, or 0.03% of average loans in the fourth quarter of 2022.

◦

Deposits

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| ($ in thousands) | | As of | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | |

| Amount | | % | | Amount | | % | | Amount | | % | | 3Q2023 | | 4Q2022 |

| Noninterest-bearing deposits | | $ | 522,751 | | | 28.9 | % | | $ | 605,509 | | | 33.2 | % | | $ | 701,584 | | | 37.2 | % | | (13.7) | % | | (25.5) | % |

| Money market deposits and others | | 399,018 | | | 22.1 | | | 348,869 | | | 19.1 | | | 526,321 | | | 27.9 | | | 14.4 | | | (24.2) | |

| Time deposits | | 885,789 | | | 49.0 | | | 870,793 | | | 47.7 | | | 657,866 | | | 34.9 | | | 1.7 | | | 34.6 | |

| Total deposits | | $ | 1,807,558 | | | 100.0 | % | | $ | 1,825,171 | | | 100.0 | % | | $ | 1,885,771 | | | 100.0 | % | | (1.0) | % | | (4.1) | % |

| | | | | | | | | | | | | | | | |

| Estimated uninsured deposits | | $ | 1,156,270 | | | 64.0 | % | | $ | 1,061,964 | | | 58.2 | % | | $ | 938,329 | | | 49.8 | % | | 8.9 | % | | 23.2 | % |

| | | | | | | | | | | | | | | | |

As of December 31, 2023 vs. September 30, 2023

Total deposits were $1.81 billion as of December 31, 2023, down $17.6 million from September 30, 2023, primarily due to a decrease of $82.8 million in noninterest-bearing deposits, partially offset by a $50.1 million increase in money market deposits and a $15.0 million in time deposits. Noninterest-bearing deposits, as a percentage of total deposits, decreased to 28.9% from 33.2%. The composition shift to money market and time deposits was primarily due to customers’ continued preference for high-rate deposit products driven by the Federal Reserve’s rate increases.

As of December 31, 2023 vs. December 31, 2022

Total deposits were $1.81 billion as of December 31, 2023, down $78.2 million from December 31, 2022, primarily driven by decreases of $178.8 million in noninterest-bearing deposits and $127.3 million in money market deposits, partially offset by an increase of $227.9 million in time deposits. The composition shift to time deposits was primarily due to customers’ preference for high-rate deposit products driven by market rate increases as a result of the Federal Reserve’s rate increases.

The following table sets forth the maturity of time deposits as of December 31, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | As of December 31, 2023 |

| ($ in thousands) | | Within Three

Months | | Three to

Six Months | | Six to Nine Months | | Nine to Twelve

Months | | After

Twelve Months | | Total |

| Time deposits (more than $250) | | $ | 177,329 | | | $ | 75,343 | | | $ | 48,158 | | | $ | 130,795 | | | $ | 2,267 | | | $ | 433,892 | |

| Time deposits ($250 or less) | | 94,692 | | | 131,152 | | | 60,472 | | | 123,316 | | | 42,265 | | | 451,897 | |

| Total time deposits | | $ | 272,021 | | | $ | 206,495 | | | $ | 108,630 | | | $ | 254,111 | | | $ | 44,532 | | | $ | 885,789 | |

| Weighted average rate | | 4.54 | % | | 4.92 | % | | 4.89 | % | | 5.17 | % | | 4.16 | % | | 4.83 | % |

| | | | | | | | | | | | |

OTHER HIGHLIGHTS

Liquidity

The Company maintains ample access to liquidity, including highly liquid assets on our balance sheet and available unused borrowings from other financial institutions. The following table presents the Company's liquid assets and available borrowings as of dates presented:

| | | | | | | | | | | | | | | | | | | | |

| | | | |

| ($ in thousands) | | 4Q2023 | | 3Q2023 | | 4Q2022 |

| Liquidity Assets: | | | | | | |

| Cash and cash equivalents | | $ | 91,216 | | | $ | 105,740 | | | $ | 82,972 | |

| Available-for-sale debt securities | | 194,250 | | | 191,313 | | | 209,809 | |

| Liquid assets | | $ | 285,466 | | | $ | 297,053 | | | $ | 292,781 | |

| Liquid assets to total assets | | 13.3 | % | | 13.9 | % | | 14.0 | % |

| | | | | | |

| Available borrowings: | | | | | | |

| Federal Home Loan Bank—San Francisco | | $ | 363,615 | | | $ | 375,874 | | | $ | 440,358 | |

| Federal Reserve Bank | | 182,989 | | | 186,380 | | | 175,605 | |

| Pacific Coast Bankers Bank | | 50,000 | | | 50,000 | | | 50,000 | |

| Zions Bank | | 25,000 | | | 25,000 | | | 25,000 | |

| First Horizon Bank | | 25,000 | | | 25,000 | | | 24,950 | |

| Total available borrowings | | $ | 646,604 | | | $ | 662,254 | | | $ | 715,913 | |

| Total available borrowings to total assets | | 30.1 | % | | 30.9 | % | | 34.2 | % |

| | | | | | |

| Liquid assets and available borrowings to total deposits | | 51.6 | % | | 52.6 | % | | 53.5 | % |

| | | | |

Capital and Capital Ratios

The Company’s Board of Directors declared a quarterly cash dividend of $0.12 per share of its common stock. The cash dividend is payable on or about February 22, 2024 to all shareholders of record as of the close of business on February 8, 2024.

The Company repurchased 150,000 shares of its common stock at an average price of $8.72 during the fourth quarter of 2023 under the stock repurchase program announced in August 2023. Since the announcement of the initial stock repurchase program in January 2019, the Company repurchased a total of 2,020,000 shares of its common stock at an average repurchase price of $8.59 per share through December 31, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | Basel III |

| OP Bancorp(1) | | Open Bank | | Minimum Well

Capitalized

Ratio | | Minimum Capital Ratio+ Conservation Buffer(2) |

| Risk-Based Capital Ratios: | | | | | | | | |

| Total risk-based capital ratio | | 13.77 | % | | 13.66 | % | | 10.00 | % | | 10.50 | % |

| Tier 1 risk-based capital ratio | | 12.52 | | | 12.41 | | | 8.00 | | | 8.50 | |

| Common equity tier 1 ratio | | 12.52 | | | 12.41 | | | 6.50 | | | 7.00 | |

| Leverage ratio | | 9.57 | | | 9.49 | | | 5.00 | | | 4.00 | |

| | | | | | | | |

(1)The capital requirements are only applicable to the Bank, and the Company's ratios are included for comparison purpose.

(2)An additional 2.5% capital conservation buffer above the minimum capital ratios are required in order to avoid limitations on distributions, including dividend payments and certain discretionary bonuses to executive officers.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| OP Bancorp | | Basel III | | Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Risk-Based Capital Ratios: | | | | | | | | | | |

| Total risk-based capital ratio | | 13.77 | % | | 13.31 | % | | 13.06 | % | | 0.46 | % | | 0.71 | % |

| Tier 1 risk-based capital ratio | | 12.52 | | | 12.09 | | | 11.87 | | | 0.43 | | | 0.65 | |

| Common equity tier 1 ratio | | 12.52 | | | 12.09 | | | 11.87 | | | 0.43 | | | 0.65 | |

| Leverage ratio | | 9.57 | | | 9.63 | | | 9.38 | | | (0.06) | | | 0.19 | |

| Risk-weighted Assets ($ in thousands) | | $ | 1,667,067 | | | $ | 1,707,318 | | | $ | 1,638,040 | | | (2.36) | | | 1.77 | |

| | | | | | | | | | |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

In addition to GAAP measures, management uses certain non-GAAP financial measures to provide supplemental information regarding the Company’s performance.

Pre-provision net revenue removes provision for credit losses and income tax expense. Management believes that this non-GAAP measure, when taken together with the corresponding GAAP financial measures (as applicable), provides meaningful supplemental information regarding our performance. This non-GAAP financial measure also facilitates a comparison of our performance to prior periods.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Interest income | | $ | 31,783 | | | $ | 31,186 | | | $ | 26,886 | |

| Interest expense | | 15,553 | | | 13,873 | | | 6,688 | |

| Net interest income | | 16,230 | | | 17,313 | | | 20,198 | |

| Noninterest income | | 3,680 | | | 2,601 | | | 3,223 | |

| Noninterest expense | | 11,983 | | | 11,535 | | | 11,327 | |

| Pre-provision net revenue | (a) | $ | 7,927 | | | $ | 8,379 | | | $ | 12,094 | |

| Reconciliation to net income | | | | | | |

| Provision for credit losses | (b) | 630 | | | 1,359 | | | 977 | |

| Income tax expense | (c) | 2,125 | | | 1,899 | | | 3,089 | |

| Net income | (a)-(b)-(c) | $ | 5,172 | | | $ | 5,121 | | | $ | 8,028 | |

| | | | | | |

During the second quarter of 2021, the Bank purchased 638 loans from Hana for a total purchase price of $97.6 million. The Company evaluated $100.0 million of the loans purchased in accordance with the provisions of ASC 310-20, Nonrefundable Fees and Other Costs, which were recorded with a $8.9 million discount. As a result, the fair value discount on these loans is being accreted into interest income over the expected life of the loans using the effective yield method. Adjusted loan yield and net interest margin for the three months ended December 31, 2023, September 30, 2023 and December 31, 2022 excluded the impacts of contractual interest and discount accretion of the purchased Hana loans as management does not consider purchasing loan portfolios to be normal or recurring transactions. Management believes that presenting the adjusted average loan yield and net interest margin provide comparability to prior periods and these non-GAAP financial measures provide supplemental information regarding the Company’s performance.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Yield on Average Loans | | | | | | |

| Interest income on loans | | $ | 28,914 | | | $ | 28,250 | | | $ | 24,719 | |

| Less: interest income on purchased Hana loans | | 1,395 | | | 1,923 | | | 1,685 | |

| Adjusted interest income on loans | (a) | $ | 27,519 | | | $ | 26,327 | | | $ | 23,034 | |

| | | | | | |

| Average loans | | $ | 1,787,540 | | | $ | 1,740,188 | | | $ | 1,691,642 | |

| Less: Average purchased Hana loans | | 47,937 | | | 51,784 | | | 60,514 | |

| Adjusted average loans | (b) | $ | 1,739,603 | | | $ | 1,688,404 | | | $ | 1,631,128 | |

| | | | | | |

Average loan yield(1) | | 6.43 | % | | 6.45 | % | | 5.81 | % |

Effect on average loan yield(1) | | 0.14 | | | 0.25 | | | 0.20 | |

Adjusted average loan yield(1) | (a)/(b) | 6.29 | % | | 6.20 | % | | 5.61 | % |

| | | | | | |

| Net Interest Margin | | | | | | |

| Net interest income | | $ | 16,230 | | | $ | 17,313 | | | $ | 20,198 | |

| Less: interest income on purchased Hana loans | | 1,395 | | | 1,923 | | | 1,685 | |

| Adjusted net interest income | (c) | $ | 14,835 | | | $ | 15,390 | | | $ | 18,513 | |

| | | | | | |

| Average interest-earning assets | | $ | 2,071,613 | | | $ | 2,038,321 | | | $ | 1,966,165 | |

| Less: Average purchased Hana loans | | 47,937 | | | 51,784 | | | 60,514 | |

| Adjusted average interest-earning assets | (d) | $ | 2,023,676 | | | $ | 1,986,537 | | | $ | 1,905,651 | |

| | | | | | |

Net interest margin(1) | | 3.12 | % | | 3.38 | % | | 4.08 | % |

Effect on net interest margin(1) | | 0.20 | | | 0.30 | | | 0.22 | |

Adjusted net interest margin(1) | (c)/(d) | 2.92 | % | | 3.08 | % | | 3.86 | % |

| | | | | | |

(1)Annualized.

Adjusted allowance to gross loans ratio removes the impacts of purchased Hana loans, PPP loans and allowance on accrued interest receivable. Management believes that this ratio provides greater consistency and comparability between the Company’s results and those of its peer banks.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

| Gross loans | | $ | 1,765,845 | | | $ | 1,759,525 | | | $ | 1,678,292 | |

| Less: Purchased Hana loans | | (47,272) | | | (48,780) | | | (58,966) | |

PPP loans(1) | | (1) | | | (1) | | | (434) | |

| Adjusted gross loans | (a) | $ | 1,718,572 | | | $ | 1,710,744 | | | $ | 1,618,892 | |

| | | | | | |

| Accrued interest receivable on loans | | $ | 7,331 | | | $ | 7,057 | | | $ | 6,413 | |

| Less: Accrued interest receivable on purchased Hana loans | | (306) | | | (402) | | | (397) | |

| Accrued interest receivable on PPP loans | | — | | | — | | | (8) | |

| | | | | | |

| Adjusted accrued interest receivable on loans | (b) | $ | 7,025 | | | $ | 6,655 | | | $ | 6,008 | |

| Adjusted gross loans and accrued interest receivable | (a)+(b)=(c) | $ | 1,725,597 | | | $ | 1,717,399 | | | $ | 1,624,900 | |

| | | | | | |

| Allowance for credit losses | | $ | 21,993 | | | $ | 21,617 | | | $ | 19,241 | |

| Add: Allowance on accrued interest receivable | | — | | | — | | | — | |

| Adjusted Allowance | (d) | $ | 21,993 | | | $ | 21,617 | | | $ | 19,241 | |

| Adjusted allowance to gross loans ratio | (d)/(c) | 1.27 | % | | 1.26 | % | | 1.18 | % |

| | | | | | |

(1)Excludes purchased PPP loans of $8 thousand as of December 31, 2022.

ABOUT OP BANCORP

OP Bancorp, the holding company for Open Bank (the “Bank”), is a California corporation whose common stock is quoted on the Nasdaq Global Market under the ticker symbol, “OPBK.” The Bank is engaged in the general commercial banking business in Los Angeles, Orange, and Santa Clara Counties in California, the Dallas metropolitan area in Texas, and Clark County in Nevada and is focused on serving the banking needs of small- and medium-sized businesses, professionals, and residents with a particular emphasis on Korean and other ethnic minority communities. The Bank currently operates eleven full-service branch offices in Downtown Los Angeles, Los Angeles Fashion District, Los Angeles Koreatown, Cerritos, Gardena, Buena Park, and Santa Clara, California, Carrollton, Texas and Las Vegas, Nevada. The Bank also has four loan production offices in Pleasanton, California, Atlanta, Georgia, Aurora, Colorado, and Lynnwood, Washington. The Bank commenced its operations on June 10, 2005 as First Standard Bank and changed its name to Open Bank in October 2010. Its headquarters is located at 1000 Wilshire Blvd., Suite 500, Los Angeles, California 90017. Phone 213.892.9999; www.myopenbank.com.

Cautionary Note Regarding Forward-Looking Statements

Certain matters set forth herein constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including forward-looking statements relating to the Company’s current business plans and expectations regarding future operating results. These forward-looking statements are subject to risks and uncertainties that could cause actual results, performance or achievements to differ materially from those projected. These risks and uncertainties, some of which are beyond our control, include, but are not limited to: the effects of substantial fluctuations in interest rates on our borrowers’ ability to perform in accordance with the terms of their loans and on our deposit customers’ expectation for higher rates on deposit products; business and economic conditions, particularly those affecting the financial services industry and our primary market areas; the continuing effects of inflation and monetary policies, particularly those relating to the decisions and indicators of intent expressed by the Federal Reserve Open Markets Committee, as those circumstances impact our current and prospective borrowers and depositors; our ability to balance deposit liabilities and liquidity sources (including our ability to reprice those instruments to keep pace with changing market conditions) in a manner that balances the need to meet current and expected withdrawals while investing a sufficient portion of our assets to promote strong earning capacity; our ability to successfully manage our credit risk and to assess, adjust and monitor the sufficiency of our allowance for credit losses; factors that can impact the performance of our loan portfolio, including real estate values and liquidity in our primary market areas, the financial health of our commercial borrowers, the success of construction projects that we finance, including any loans acquired in acquisition transactions; the impacts of credit quality on our earnings and the related effects of increases to the reserve on our net income; our ability to effectively execute our strategic plan and manage our growth; interest rate fluctuations, which could have an adverse effect on our profitability; external economic and/or market factors, such as changes in monetary and fiscal policies and laws, including inflation or deflation, changes in the demand for loans, and fluctuations in consumer spending, borrowing and savings habits, which may have an adverse impact on our financial condition; continued or increasing competition from other financial institutions, credit unions, and non-bank financial services companies, many of which are subject to less restrictive or less costly regulations than we are; challenges arising from unsuccessful attempts to expand into new geographic markets, products, or services; practical and regulatory constraints on the ability of Open Bank to pay dividends to us; increased capital requirements imposed by banking regulators, which may require us to raise capital at a time when capital is not available on favorable terms or at all; a failure in the internal controls we have implemented to address the risks inherent to the business of banking; including internal controls that affect the reliability of our publicly reported financial statements; inaccuracies in our assumptions about future events, which could result in material differences between our financial projections and actual financial performance, particularly with respect to the effects of predictions of future economic conditions

as those circumstances affect our estimates for the adequacy of our allowance for credit losses and the related provision expense; changes in our management personnel or our inability to retain motivate and hire qualified management personnel; disruptions, security breaches, or other adverse events, failures or interruptions in, or attacks on, our information technology systems; disruptions, security breaches, or other adverse events affecting the third-party vendors who perform several of our critical processing functions; an inability to keep pace with the rate of technological advances due to a lack of resources to invest in new technologies; risks related to potential acquisitions; political developments, uncertainties or instability, catastrophic events, acts of war or terrorism, or natural disasters, such as earthquakes, fires, drought, pandemic diseases (such as the coronavirus) or extreme weather events, any of which may affect services we use or affect our customers, employees or third parties with which we conduct business; incremental costs and obligations associated with operating as a public company; the impact of any claims or legal actions to which we may be subject, including any effect on our reputation; compliance with governmental and regulatory requirements, including the Dodd-Frank Act and others relating to banking, consumer protection, securities and tax matters, and our ability to maintain licenses required in connection with commercial mortgage origination, sale and servicing operations; changes in federal tax law or policy; and our ability the manage the foregoing and other factors set forth in the Company’s public reports. We describe these and other risks that could affect our results in Item 1A. “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2022 and in our other subsequent filings with the Securities and Exchange Commission.

Contact

Investor Relations

OP Bancorp

Christine Oh

EVP & CFO

213.892.1192

Christine.oh@myopenbank.com

CONSOLIDATED BALANCE SHEETS (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands) | | As of | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Assets | | | | | | | | | | |

| Cash and due from banks | | $ | 16,948 | | | $ | 21,748 | | | $ | 12,952 | | | (22.1) | % | | 30.9 | % |

| Interest-bearing deposits in other banks | | 74,268 | | | 83,992 | | | 70,020 | | | (11.6) | | | 6.1 | |

| Cash and cash equivalents | | 91,216 | | | 105,740 | | | 82,972 | | | (13.7) | | | 9.9 | |

| Available-for-sale debt securities, at fair value | | 194,250 | | | 191,313 | | | 209,809 | | | 1.5 | | | (7.4) | |

| Other investments | | 16,276 | | | 16,100 | | | 12,098 | | | 1.1 | | | 34.5 | |

| Loans held for sale | | 1,795 | | | — | | | 44,335 | | | n/m | | (96.0) | |

| CRE loans | | 885,585 | | | 878,824 | | | 842,208 | | | 0.8 | | | 5.2 | |

| SBA loans | | 239,692 | | | 240,154 | | | 234,717 | | | (0.2) | | | 2.1 | |

| C&I loans | | 120,970 | | | 124,632 | | | 116,951 | | | (2.9) | | | 3.4 | |

| Home mortgage loans | | 518,024 | | | 515,789 | | | 482,949 | | | 0.4 | | | 7.3 | |

| Consumer loans | | 1,574 | | | 126 | | | 1,467 | | | n/m | | 7.3 | |

| Gross loans receivable | | 1,765,845 | | | 1,759,525 | | | 1,678,292 | | | 0.4 | | | 5.2 | |

| Allowance for credit losses | | (21,993) | | | (21,617) | | | (19,241) | | | 1.7 | | | 14.3 | |

| Net loans receivable | | 1,743,852 | | | 1,737,908 | | | 1,659,051 | | | 0.3 | | | 5.1 | |

| Premises and equipment, net | | 5,248 | | | 5,378 | | | 4,400 | | | (2.4) | | | 19.3 | |

| Accrued interest receivable, net | | 8,259 | | | 7,996 | | | 7,180 | | | 3.3 | | | 15.0 | |

| Servicing assets | | 11,741 | | | 11,931 | | | 12,759 | | | (1.6) | | | (8.0) | |

| Company owned life insurance | | 22,233 | | | 22,071 | | | 21,613 | | | 0.7 | | | 2.9 | |

| Deferred tax assets, net | | 13,309 | | | 15,061 | | | 14,316 | | | (11.6) | | | (7.0) | |

| Operating right-of-use assets | | 8,497 | | | 8,993 | | | 9,097 | | | (5.5) | | | (6.6) | |

| Other assets | | 31,054 | | | 20,184 | | | 16,867 | | | 53.9 | | | 84.1 | |

| Total assets | | $ | 2,147,730 | | | $ | 2,142,675 | | | $ | 2,094,497 | | | 0.2 | % | | 2.5 | % |

| Liabilities and Shareholders' Equity | | | | | | | | | | |

| Liabilities: | | | | | | | | | | |

| Noninterest-bearing | | $ | 522,751 | | | $ | 605,509 | | | $ | 701,584 | | | (13.7) | % | | (25.5) | % |

| Money market and others | | 399,018 | | | 348,869 | | | 526,321 | | | 14.4 | | | (24.2) | |

| Time deposits greater than $250 | | 433,892 | | | 420,162 | | | 356,197 | | | 3.3 | | | 21.8 | |

| Other time deposits | | 451,897 | | | 450,631 | | | 301,669 | | | 0.3 | | | 49.8 | |

| Total deposits | | 1,807,558 | | | 1,825,171 | | | 1,885,771 | | | (1.0) | | | (4.1) | |

| Federal Home Loan Bank advances | | 105,000 | | | 95,000 | | | — | | | 10.5 | | | n/m |

| Accrued interest payable | | 12,628 | | | 13,552 | | | 2,771 | | | (6.8) | | | 355.7 | |

| Operating lease liabilities | | 9,341 | | | 9,926 | | | 10,213 | | | (5.9) | | | (8.5) | |

| Other liabilities | | 20,538 | | | 14,719 | | | 18,826 | | | 39.5 | | | 9.1 | |

| Total liabilities | | 1,955,065 | | | 1,958,368 | | | 1,917,581 | | | (0.2) | | | 2.0 | |

| Shareholders' equity: | | | | | | | | | | |

| Common stock | | 76,319 | | | 77,632 | | | 79,326 | | | (1.7) | | | (3.8) | |

| Additional paid-in capital | | 10,942 | | | 10,606 | | | 9,743 | | | 3.2 | | | 12.3 | |

| Retained earnings | | 120,855 | | | 117,483 | | | 105,690 | | | 2.9 | | | 14.3 | |

| Accumulated other comprehensive loss | | (15,451) | | | (21,414) | | | (17,843) | | | (27.8) | | | (13.4) | |

| Total shareholders’ equity | | 192,665 | | | 184,307 | | | 176,916 | | | 4.5 | | | 8.9 | |

| Total liabilities and shareholders' equity | | $ | 2,147,730 | | | $ | 2,142,675 | | | $ | 2,094,497 | | | 0.2 | % | | 2.5 | % |

| | | | | | | | | | |

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| ($ in thousands, except share and per share data) | | For the Three Months Ended | | % Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

| Interest income | | | | | | | | | | |

| Interest and fees on loans | | $ | 28,914 | | | $ | 28,250 | | | $ | 24,719 | | | 2.4 | % | | 17.0 | % |

| Interest on available-for-sale debt securities | | 1,484 | | | 1,519 | | | 1,237 | | | (2.3) | | | 20.0 | |

| Other interest income | | 1,385 | | | 1,417 | | | 930 | | | (2.3) | | | 48.9 | |

| Total interest income | | 31,783 | | | 31,186 | | | 26,886 | | | 1.9 | | | 18.2 | |

| Interest expense | | | | | | | | | | |

| Interest on deposits | | 14,127 | | | 13,006 | | | 6,597 | | | 8.6 | | | 114.1 | |

| Interest on borrowings | | 1,426 | | | 867 | | | 91 | | | 64.5 | | | n/m |

| Total interest expense | | 15,553 | | | 13,873 | | | 6,688 | | | 12.1 | | | 132.6 | |

| Net interest income | | 16,230 | | | 17,313 | | | 20,198 | | | (6.3) | | | (19.6) | |

| Provision for credit losses | | 630 | | | 1,359 | | | 977 | | | (53.6) | | | (35.5) | |

| Net interest income after provision for credit losses | | 15,600 | | | 15,954 | | | 19,221 | | | (2.2) | | | (18.8) | |

| Noninterest income | | | | | | | | | | |

| Service charges on deposits | | 557 | | | 575 | | | 406 | | | (3.1) | | | 37.2 | |

| Loan servicing fees, net of amortization | | 540 | | | 468 | | | 705 | | | 15.4 | | | (23.4) | |

| Gain on sale of loans | | 1,996 | | | 1,179 | | | 1,684 | | | 69.3 | | | 18.5 | |

| Other income | | 587 | | | 379 | | | 428 | | | 54.9 | | | 37.1 | |

| Total noninterest income | | 3,680 | | | 2,601 | | | 3,223 | | | 41.5 | | | 14.2 | |

| Noninterest expense | | | | | | | | | | |

| Salaries and employee benefits | | 7,646 | | | 7,014 | | | 7,080 | | | 9.0 | | | 8.0 | |

| Occupancy and equipment | | 1,616 | | | 1,706 | | | 1,560 | | | (5.3) | | | 3.6 | |

| Data processing and communication | | 644 | | | 369 | | | 514 | | | 74.5 | | | 25.3 | |

| Professional fees | | 391 | | | 440 | | | 330 | | | (11.1) | | | 18.5 | |

| FDIC insurance and regulatory assessments | | 237 | | | 333 | | | 176 | | | (28.8) | | | 34.7 | |

| Promotion and advertising | | 86 | | | 207 | | | 12 | | | (58.5) | | | 616.7 | |

| Directors’ fees | | 145 | | | 164 | | | 145 | | | (11.6) | | | — | |

| Foundation donation and other contributions | | 524 | | | 529 | | | 851 | | | (0.9) | | | (38.4) | |

| Other expenses | | 694 | | | 773 | | | 659 | | | (10.2) | | | 5.3 | |

| Total noninterest expense | | 11,983 | | | 11,535 | | | 11,327 | | | 3.9 | | | 5.8 | |

| Income before income tax expense | | 7,297 | | | 7,020 | | | 11,117 | | | 3.9 | | | (34.4) | |

| Income tax expense | | 2,125 | | | 1,899 | | | 3,089 | | | 11.9 | | | (31.2) | |

| Net income | | $ | 5,172 | | | $ | 5,121 | | | $ | 8,028 | | | 1.0 | % | | (35.6) | % |

| | | | | | | | | | |

| Book value per share | | $ | 12.84 | | | $ | 12.17 | | | $ | 11.59 | | | 5.5 | % | | 10.8 | % |

| Earnings per share - basic | | 0.34 | | | 0.33 | | | 0.52 | | | 3.0 | | | (34.6) | |

| Earnings per share - diluted | | 0.34 | | | 0.33 | | | 0.51 | | | 3.0 | | | (33.3) | |

| | | | | | | | | | |

| Shares of common stock outstanding, at period end | | 15,000,436 | | 15,149,203 | | 15,270,344 | | (1.0) | % | | (1.8) | % |

| Weighted average shares: | | | | | | | | | | |

| - Basic | | 15,027,110 | | 15,131,587 | | 15,208,308 | | (0.7) | % | | (1.2) | % |

| - Diluted | | 15,034,822 | | 15,140,577 | | 15,264,971 | | (0.7) | | | (1.5) | |

| | | | | | | | | | |

KEY RATIOS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | For the Three Months Ended | | Change 4Q2023 vs. |

| 4Q2023 | | 3Q2023 | | 4Q2022 | | 3Q2023 | | 4Q2022 |

Return on average assets (ROA)(1) | | 0.96 | % | | 0.96 | % | | 1.56 | % | | — | % | | (0.6) | % |

Return on average equity (ROE)(1) | | 11.18 | | | 11.07 | | | 18.58 | | | 0.1 | | | (7.4) | |

Net interest margin(1) | | 3.12 | | | 3.38 | | | 4.08 | | | (0.3) | | | (1.0) | |

| Efficiency ratio | | 60.19 | | | 57.92 | | | 48.36 | | | 2.3 | | | 11.8 | |

| | | | | | | | | | |

| Total risk-based capital ratio | | 13.77 | % | | 13.31 | % | | 13.06 | % | | 0.5 | % | | 0.7 | % |

| Tier 1 risk-based capital ratio | | 12.52 | | | 12.09 | | | 11.87 | | | 0.4 | | | 0.7 | |

| Common equity tier 1 ratio | | 12.52 | | | 12.09 | | | 11.87 | | | 0.4 | | | 0.7 | |

| Leverage ratio | | 9.57 | | | 9.63 | | | 9.38 | | | (0.1) | | | 0.2 | |

| | | | | | | | | | |

(1)Annualized.

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands, except share and per share data) | | For the Twelve Months Ended |

| 4Q2023 | | 4Q2022 | | % Change |

| Interest income | | | | | | |

| Interest and fees on loans | | $ | 110,463 | | | $ | 82,864 | | | 33.3 | % |

| Interest on available-for-sale debt securities | | 6,131 | | | 3,351 | | | 83.0 | |

| Other interest income | | 5,071 | | | 1,997 | | | 153.9 | |

| Total interest income | | 121,665 | | | 88,212 | | | 37.9 | |

| Interest expense | | | | | | |

| Interest on deposits | | 49,435 | | | 11,210 | | | 341.0 | |

| Interest on borrowings | | 3,543 | | | 91 | | | 3793.4 | |

| Total interest expense | | 52,978 | | | 11,301 | | | 368.8 | |

| Net interest income | | 68,687 | | | 76,911 | | | (10.7) | |

| Provision for credit losses | | 1,651 | | | 2,976 | | | (44.5) | |

| Net interest income after provision for credit losses | | 67,036 | | | 73,935 | | | (9.3) | |

| Noninterest income | | | | | | |

| Service charges on deposits | | 2,123 | | | 1,675 | | | 26.7 | |

| Loan servicing fees, net of amortization | | 2,449 | | | 2,416 | | | 1.4 | |

| Gain on sale of loans | | 7,843 | | | 12,285 | | | (36.2) | |

| Other income | | 1,766 | | | 1,243 | | | 42.1 | |

| Total noninterest income | | 14,181 | | | 17,619 | | | (19.5) | |

| Noninterest expense | | | | | | |

| Salaries and employee benefits | | 29,593 | | | 27,189 | | | 8.8 | |

| Occupancy and equipment | | 6,490 | | | 5,964 | | | 8.8 | |

| Data processing and communication | | 2,109 | | | 2,085 | | | 1.2 | |

| Professional fees | | 1,571 | | | 1,620 | | | (3.0) | |

| FDIC insurance and regulatory assessments | | 1,457 | | | 813 | | | 79.2 | |

| Promotion and advertising | | 614 | | | 543 | | | 13.1 | |

| Directors’ fees | | 680 | | | 682 | | | (0.3) | |

| Foundation donation and other contributions | | 2,400 | | | 3,393 | | | (29.3) | |

| Other expenses | | 2,812 | | | 2,541 | | | 10.7 | |

| Total noninterest expense | | 47,726 | | | 44,830 | | | 6.5 | |

| Income before income tax expense | | 33,491 | | | 46,724 | | | (28.3) | |

| Income tax expense | | 9,573 | | | 13,414 | | | (28.6) | |

| Net income | | $ | 23,918 | | | $ | 33,310 | | | (28.2) | % |

| | | | | | |

| Book value per share | | $ | 12.84 | | | $ | 11.59 | | | 10.8 | % |

| Earnings per share - basic | | 1.55 | | | 2.15 | | | (27.9) | |

| Earnings per share - diluted | | 1.55 | | | 2.14 | | | (27.6) | |

| | | | | | |

| Shares of common stock outstanding, at period end | | 15,000,436 | | 15,270,344 | | (1.8) | % |

| Weighted average shares: | | | | | | |

| - Basic | | 15,149,597 | | 15,171,240 | | (0.1) | % |

| - Diluted | | 15,158,857 | | 15,231,418 | | (0.5) | |

| | | | | | |

KEY RATIOS

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | For the Twelve Months Ended |

| 4Q2023 | | 4Q2022 | | % Change |

| Return on average assets (ROA) | | 1.13 | % | | 1.74 | % | | (0.6) | % |

| Return on average equity (ROE) | | 13.05 | | | 19.57 | | | (6.5) | |

| Net interest margin | | 3.37 | | | 4.18 | | | (0.8) | |

| Efficiency ratio | | 57.59 | | | 47.42 | | | 10.2 | |

| | | | | | |

| Total risk-based capital ratio | | 13.77 | % | | 13.06 | % | | 0.7 | % |

| Tier 1 risk-based capital ratio | | 12.52 | | | 11.87 | | | 0.7 | |

| Common equity tier 1 ratio | | 12.52 | | | 11.87 | | | 0.7 | |

| Leverage ratio | | 9.57 | | | 9.38 | | | 0.2 | |

| | | | | | |

ASSET QUALITY

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | As of and For the Three Months Ended |

| 4Q2023 | | 3Q2023 | | 4Q2022 |

Nonaccrual loans(1) | | $ | 6,082 | | | $ | 4,211 | | | $ | 2,033 | |

Loans 90 days or more past due, accruing(2) | | — | | | — | | | — | |

| | | | | | |

| Nonperforming loans | | 6,082 | | | 4,211 | | | 2,033 | |

| Other real estate owned ("OREO") | | — | | | — | | | — | |

| Nonperforming assets | | $ | 6,082 | | | $ | 4,211 | | | $ | 2,033 | |

| | | | | | |

| Criticized loans by risk categories: | | | | | | |

| Special mention loans | | $ | 1,428 | | | $ | 3,651 | | | $ | 563 | |

Classified loans(1)(3) | | 11,921 | | | 10,139 | | | 2,701 | |

| Total criticized loans | | $ | 13,349 | | | $ | 13,790 | | | $ | 3,264 | |

| | | | | | |

| Criticized loans by loan type: | | | | | | |

| CRE loans | | $ | 4,995 | | | $ | 5,130 | | | $ | 563 | |

| SBA loans | | 5,864 | | | 6,169 | | | 1,142 | |

| C&I loans | | — | | | — | | | 279 | |

| Home mortgage loans | | 2,490 | | | 2,491 | | | 1,280 | |

| Total criticized loans | | $ | 13,349 | | | $ | 13,790 | | | $ | 3,264 | |

| | | | | | |

| Nonperforming loans / gross loans | | 0.34 | % | | 0.24 | % | | 0.12 | % |

| Nonperforming assets / gross loans plus OREO | | 0.34 | | | 0.24 | | | 0.12 | |

| Nonperforming assets / total assets | | 0.28 | | | 0.20 | | | 0.10 | |

| Classified loans / gross loans | | 0.68 | | | 0.58 | | | 0.16 | |

| Criticized loans / gross loans | | 0.76 | | | 0.78 | | | 0.19 | |

| | | | | | |

| Allowance for credit losses ratios: | | | | | | |

| As a % of gross loans | | 1.25 | % | | 1.23 | % | | 1.15 | % |

As an adjusted % of gross loans(4) | | 1.27 | | | 1.26 | | | 1.18 | |

| As a % of nonperforming loans | | 362 | | | 513 | | | 946 | |

| As a % of nonperforming assets | | 362 | | | 513 | | | 946 | |

| As a % of classified loans | | 184 | | | 213 | | | 712 | |

| As a % of criticized loans | | 165 | | | 157 | | | 589 | |

| | | | | | |

| Net charge-offs | | $ | 161 | | | $ | 488 | | | $ | 105 | |

Net charge-offs(5) to average gross loans(6) | | 0.04 | % | | 0.11 | % | | 0.03 | % |

| | | | | | |

(1)Excludes the guaranteed portion of SBA loans that are in liquidation totaling $2.0 million, $5.2 million and $606 thousand as of December 31, 2023, September 30, 2023 and December 31, 2022, respectively.

(2)Excludes the guaranteed portion of SBA loans that are in liquidation totaling $441 thousand as of December 31, 2022.

(3)Consists of substandard, doubtful and loss categories.

(4)See the Reconciliation of GAAP to NON-GAAP Financial Measures.

(5)Annualized.

(6)Includes loans held for sale.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| ($ in thousands) | | 4Q2023 | | 3Q2023 | | 4Q2022 |

| Accruing delinquent loans 30-89 days past due | | | | | | |

| 30-59 days | | $ | 5,945 | | | $ | 5,979 | | | $ | 1,918 | |

| 60-89 days | | 3,662 | | | 2,377 | | | 1,559 | |

| Total | | $ | 9,607 | | | $ | 8,356 | | | $ | 3,477 | |

| | | | | | |