0001538716☐00015387162024-02-032024-02-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

February 3, 2024

Date of Report (date of earliest event reported)

OPORTUN FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Commission File Number 001-39050 | | | | | | | | | | | |

| Delaware | | 45-3361983 |

State or Other Jurisdiction of

Incorporation or Organization | | I.R.S. Employer Identification No. |

| | | |

| 2 Circle Star Way | | |

| San Carlos, | CA | | 94070 |

| Address of Principal Executive Offices | | Zip Code |

(650) 810-8823

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | OPRT | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

Appointment of Directors

On February 3, 2024, the Board of Directors (the “Board”) of Oportun Financial Corporation (the “Company”) approved an increase in the number of directors on the Board from seven to nine and appointed Mr. Carlos Minetti and Mr. Mohit Daswani to serve as members of the Board. Mr. Minetti will serve in the class of directors whose term expires at the annual meeting of stockholders to be held in 2025 and was appointed to the Credit Risk and Finance Committee and the Nominating, Governance and Social Responsibility Committee. Mr. Daswani will serve in the class of directors whose term expires at the annual meeting of stockholders to be held in 2026 and was appointed to the Audit and Risk Committee and the Compensation and Leadership Committee.

Mr. Minetti was the Executive Vice President, President - Consumer Banking for Discover Financial Services (“Discover”), a role he held from February 2014 to September 2023. Previously, he served as Executive Vice President, President - Consumer Banking and Operations from 2010 to 2014, Executive Vice President, Cardmember Services and Consumer Banking from 2007 to 2010, and Executive Vice President for Cardmember Services and Chief Risk Officer from 2001 to 2007. Prior to joining Discover, Mr. Minetti worked in card operations and risk management for American Express Company from 1987 to 2000, where he last served as Senior Vice President. Mr. Minetti currently serves as a member of the board of directors of Trustmark Mutual Holding Company, the Better Business Bureau of Chicago and Northern Illinois, and the Ann & Robert H. Lurie Children's Hospital of Chicago Foundation. He was a member of the board of directors of Discover Bank from 2001 to 2023. Mr. Minetti holds a Bachelor’s degree in Industrial Engineering from Texas A&M University and an M.B.A. from the Booth School of Business at The University of Chicago.

Mohit Daswani currently serves as the Chief Financial Officer of ThoughtSpot, Inc., an AI-enabled business analytics company. Prior to joining ThoughtSpot in January 2020, Mr. Daswani was the Head of Strategy and Finance at Square, Inc. from 2017 to 2019. He previously held leadership roles in Corporate Development and Finance at PayPal, Inc., from 2013 to 2017, and was a private equity investor in the financial services, healthcare, and IT industries as a Principal at JMI Equity from 2008 to 2012, a Principal at FTV Capital from 2004 to 2008, and previously at JP Morgan Partners from 1997 through 2004 and before that at J.P. Morgan Chase & Co. from 1995 to 1997. Mr. Daswani is also an advisory Board Member of Centana Growth Partners since 2018. Mr. Daswani holds a Bachelor’s degree in Economics from Columbia University and an M.B.A. from the Harvard Business School.

Each of Messrs. Minetti and Daswani is entitled to cash and equity compensation for service on the Board in accordance with the Company’s non-employee director compensation policy as described under “Non-employee Director Compensation” in the Company’s proxy statement filed April 27, 2023. Consistent with the Company’s standard non-employee director annual equity award, each of Messrs. Minetti and Daswani will be granted a restricted stock unit award, under the Company’s 2019 Equity Incentive Plan, having a value equal to $125,000, prorated from the date of appointment to the Board in an amount of $41,096 (the “Initial Award”). The Initial Award will vest in two equal installments such that it will be fully vested on the earlier of June 6, 2024, or the date immediately preceding the 2024 annual stockholders meeting, subject to the applicable director’s continued service on the Board on each vesting date.

Each of Messrs. Minetti and Daswani will also enter into the Company’s standard form of indemnity agreement, which has been previously filed with the Securities and Exchange Commission.

There are no arrangements or understandings between Messrs. Minetti or Daswani and any other person pursuant to which either was selected as a director. There are no family relationships between Messrs. Minetti or Daswani and any director or executive officer of the Company, and neither has any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

A copy of the Company’s press release announcing the foregoing appointments is attached hereto as Exhibit 99.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | |

| 99.1 | |

| 104 | Cover Page Interactive Data File embedded within the Inline XBRL document |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| OPORTUN FINANCIAL CORPORATION |

| (Registrant) |

| | | |

| Date: | February 5, 2024 | By: | /s/ Kathleen Layton |

| | | Kathleen Layton |

| | | Chief Legal Officer |

| | | |

Oportun Appoints Two New Independent Members to its Board of Directors

SAN CARLOS, Calif., February 5, 2024 – Oportun (Nasdaq: OPRT) today announced the addition of two new independent board members to its Board of Directors. Effective as of February 7, 2024, the appointments expand Oportun’s board from seven to nine members with the additions of Carlos Minetti and Mohit Daswani.

Carlos Minetti has more than 35 years of experience in consumer lending and credit risk. Most recently as President, Consumer Banking, at Discover Financial Services, a position he held from 2010 to 2023. Minetti led the company’s diversification into Consumer Banking, which included personal loans, student loans, home loans and on-line banking. At Discover, he also previously held the role of EVP, Cardmember Services, where he was responsible for firmwide operations, including customer service, collections, statement and payment processing, new accounts underwriting, card authorizations, and fraud prevention. In his prior role as Discover’s Chief Risk and Credit Officer, Minetti managed credit risk and provided enterprise oversight for market, liquidity, and operational risk. Prior to Discover, Minetti spent more than a decade at American Express in a variety of roles with increasing responsibility. Minetti holds a Bachelor's degree from the Texas A&M University and an MBA from the University of Chicago.

Mohit Daswani is the Chief Financial Officer of ThoughtSpot, Inc., an A.I.-powered analytics company, where he leads the finance and accounting, people, legal, corporate development, IT and real estate teams. Prior to ThoughtSpot, Daswani was Head of Strategy and Finance at Square (now Block) during a period of rapid revenue growth. Daswani was also CFO of Payments, Platform and Risk at PayPal as the company was decoupling from eBay. A veteran of the investment banking and private equity industries, Daswani developed vertical expertise in financial services, healthcare, and IT, as a Principal at JMI Equity, a Principal at FTV Capital, and previously as a long-tenured private equity professional at J.P. Morgan. Daswani earned his MBA from Harvard Business School and a BA in Economics from Columbia University.

“After an extensive search that considered many qualified independent candidates, our committee unanimously recommended and the full board has unanimously appointed both Carlos and Mohit, to the Oportun board,” said Ginny Lee, Chair, Oportun Nominating, Governance and Social Responsibility Committee. “Their backgrounds in consumer finance, along with their extensive executive and public company experience, provide us with the confidence that both Carlos and Mohit will prove to be outstanding independent directors who will champion the interests of our shareholders and other stakeholders.”

“Carlos and Mohit offer a wealth of experience and expertise that will fortify our path towards profitable, sustainable growth.,” said Raul Vazquez, CEO of Oportun. “I expect that the board and the leadership team will immediately leverage their deep knowledge in consumer-related financial services.”

About Oportun

Oportun (Nasdaq: OPRT) is a mission-driven fintech that puts its 2.1 million members' financial goals within reach. With intelligent borrowing, savings, and budgeting capabilities, Oportun empowers members with the confidence to build a better financial future. Since inception, Oportun has provided more than $17.2 billion in responsible and affordable credit, saved its members more than $2.4 billion in interest and fees, and helped its members save an average of more than $1,800 annually. For more information, visit Oportun.com.

###

Oportun Investor Contact

Dorian Hare

(650) 590-4323

ir@oportun.com

Oportun Media Contact

Usher Lieberman

(650) 769-9414

usher.lieberman@oportun.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

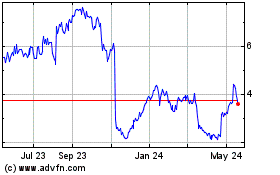

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Dec 2024 to Jan 2025

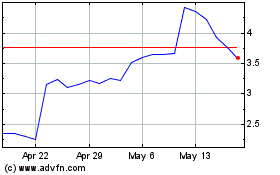

Oportun Financial (NASDAQ:OPRT)

Historical Stock Chart

From Jan 2024 to Jan 2025