ProSomnus, Inc. (“the Company” or “ProSomnus”)

(NASDAQ: OSA), a pioneer in precision medical devices for the

treatment of Obstructive Sleep Apnea (OSA), today announced

financial results for the first quarter ended March 31, 2023.

Recent Business Highlights

- Generated year-over year revenue

growth of 55% reflecting revenues of $5.8 million for the first

quarter compared to $3.7 million during the first quarter of 2022,

and in line with strong revenues in the fourth quarter of

2022.

- Continued traction on strategic

growth initiatives, including direct sales team expansion in

the U.S. and Europe, advancing our next generation

device with remote patient monitoring capability toward commercial

introduction during late 2023 and the continued generation of

clinical data.

- Commenced enrollment in the Severe

Obstructive Sleep Apnea (SOS) labeling expansion study, with five

centers activated and on track to complete enrollment in 2023.

- Successfully moved to our new

headquarters and manufacturing center of excellence. The move

quintupled our potential manufacturing capacity, positioning

ProSomnus to be able to meet the rapidly growing demand for the

company’s precision intraoral medical devices.

- Expanded the Company’s patent

portfolio by securing two additional patents covering its digital

manufacturing and iterative titration technologies.

“ProSomnus delivered strong operational results and made healthy

strategic progress during our first full quarter as a public

company,” said Len Liptak, Chief Executive Officer. “ProSomnus

generated record revenues for the quarter, underscored by year over

year revenue growth that exceeded 50%. These results reflect the

growing acceptance of our precision medical devices as a solution

for the millions suffering from OSA, driven by investments in our

direct sales and scientific marketing capabilities, the robust data

supporting precision oral appliance therapy, and the expansion of

our digital manufacturing operations.”

Financial Results for the First Quarter of

2023

Revenue for the three-month period and year ended March 31, 2023

totaled $5.8 million, an increase of 55% over $3.7 million in the

first quarter of 2022. Seasonal strength during the fourth quarter

historically has resulted in sequential quarter-over-quarter

softness in results, however the strong revenue performance of the

fourth quarter 2022 continued during the first quarter 2023 as

revenues of $5.8 million were reported for both periods. The

year-over-year increase was primarily driven by increased unit

volume due to increased sales and marketing investments and mix

shift to the new EVO Products.

Gross margin finished at 53% for the three-month period ended

March 31, 2023, consistent with the 54% for the three-month period

ended December 31, 2022. The decrease in gross margin compared to

58% for the three-month period ended March 31, 2022, reflects the

impact of our strategic investment in the Company’s new

manufacturing facility, which was completed during the first

quarter of 2023 and prepares the company for future growth. Cost of

revenues is driven principally by cost of materials combined with

direct and indirect labor and facilities overhead. We expect that

these modest period fluctuations will mitigate with the scale of

additional volume.

Sales and marketing expenses increased by $0.7

million, or 33%, for the three month ended March 31, 2023,

compared to the same period in the prior year and $0.4 million, or

17%, compared to the prior quarter. This increase was driven by

additional direct sales personnel reflecting the planned investment

in commercial resources that began in late 2022.

Research and development expenses increased by

$0.5 million, or 83%, for the three-months period ended March 31,

2023, compared to same period in the prior year and consistent with

the prior quarter. R&D expenses reflect the investments being

made in developing the next generation remote patient monitoring

device, execution of the FLOSAT head-to-head comparison study, and

commencement of the label expansion SOS study.

General and administrative expenses increased by

$2.0 million for the three months ended March 31, 2023,

compared to the three-month period ended March 31, 2022, and

decreased $2.0 million compared to the prior quarter. The first

quarter of 2023 reflects the first quarter of public company

operations including an increase in professional and consulting

services to facilitate the transition combined with continuing

expenses related to the consummation of the business combination

during December 2022. The fourth quarter included several

transaction-related charges including material stock-based

compensation charges that are not expected to recur or, if

recurring, are expected to recur at materially reduced levels.

Total other income (expense) totaled an expense

of $2.7 million for the three-month period ended March 31, 2023,

compared to an expense of $1.1 million for the prior year and

income of $8.3 million for the prior quarter. Interest expenses

increased modestly to $1.2 million during the first quarter,

compared to the same quarter in the prior year and the prior

quarter, reflecting the first full quarter of interest on debt

entered into during December 2022. Liabilities recorded in

connection with the business combination are recorded at fair value

with changes in fair value reported as elements of other income

(expense).

On March 31, 2023, cash and cash equivalents

totaled $11.6 million.

Conference Call and Webcast Information

The Company will host a conference call to discuss its first

quarter 2023 financial results today, May 9, 2023, at 4:30 pm

ET. Interested parties may register for the conference call

using the following link: ProSomnus Q1 Earnings Registration

Link. You may access the live webcast of the conference call

by using the following link: ProSomnus Q1 Earnings Call. The

link will also be posted in the Investor Relations section of the

ProSomnus website at News & Events.

About ProSomnus

ProSomnus (NASDAQ: OSA) precision intraoral

medical devices offer effective, economical, and patient-preferred

treatment for patients suffering from Obstructive Sleep Apnea

(OSA). ProSomnus is the first manufacturer of mass-customized

Precision Oral Appliance Therapy (OAT) devices to treat OSA, which

affects over 74 million people in North America and is associated

with serious comorbidities, including heart failure, stroke,

hypertension, morbid obesity, and type 2 diabetes. ProSomnus’s

patented, FDA-cleared devices are a less invasive and more

comfortable alternative to Continuous Positive Airway Pressure

(CPAP) therapy, and lead to effective and patient-preferred

outcomes. A growing body of research, including studies published

by the Journal of Clinical Sleep Medicine and Military Medicine,

suggests ProSomnus’s Precision OAT devices are an effective

treatment for mild to moderate OSA. Additional clinical research

has shown that ProSomnus’s Precision OAT devices mitigate many of

the side effects associated with alternative treatments and improve

economics for payers and providers. With more than 200,000 devices

delivered, ProSomnus’s devices are the most prescribed Precision

OAT in the U.S. ProSomnus’s FDA-cleared devices are authorized by

the Department of Defense and the U.S. Army, and are often covered

by medical insurance, Medicare, and social health programs in key

international markets. To learn more, visit www.ProSomnus.com.

Important Notice Regarding Forward-Looking

Statements

This Press Release contains certain “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E the Securities Exchange Act of 1934, both as amended.

Statements that are not historical facts, including statements

regarding ProSomnus’s labeling expansion, its future growth and

expenses, and the growing markets for its devices, are

forward-looking statements. These forward-looking statements can be

identified by the use of forward-looking terminology, including the

words “believes,” “estimates,” “anticipates,” “expects,” “intends,”

“plans,” “may,” “will,” “potential,” “projects,” “predicts,”

“continue,” or “should,” or, in each case, their negative or other

variations or comparable terminology. The forward-looking

statements contained in this report are based on our current

expectations and beliefs concerning future developments and their

potential effects on us. These forward-looking statements are not

guarantees of future performance and are subject to various risks

and uncertainties, assumptions (including assumptions about general

economic, market, industry and operational factors), known or

unknown, which could cause the actual results to vary materially

from those indicated or anticipated.

Such risks and uncertainties include, but are not limited to:

(i) risk related to being unable to comply with its debt covenants

or successfully renegotiate such covenants; (ii) the risk of

potential future significant dilution to stockholders resulting

from lender conversions under the convertible debt financing; (iii)

uncertainty of the projected financial information with respect to

ProSomnus; (iv) ProSomnus’s limited operating history and history

of losses; (v) the roll-out of ProSomnus’s business and the timing

of expected business milestones; (vi) the understanding and

adoption by dentists and other healthcare professionals of

ProSomnus oral devices for mild-to-moderate OSA; (vii) expectations

concerning the effectiveness of OSA treatment using ProSomnus oral

devices and the potential for patient relapse after completion of

treatment; (viii) ProSomnus’s ability to maintain and grow its

profit margin from sales of ProSomnus oral devices; (ix)

ProSomnus’s ability to formulate, implement and modify as necessary

effective sales, marketing, and strategic initiatives to drive

revenue growth; (x) ProSomnus’s ability to expand internationally;

(xi) the viability of ProSomnus’s intellectual property and

intellectual property created in the future; (xii) government

regulations and ProSomnus’s ability to obtain applicable regulatory

approvals and comply with government regulations, including under

healthcare laws and the rules and regulations of the U.S. Food

and Drug Administration; (xiii) the risk of downturns in the market

and ProSomnus’s industry including, but not limited to, as a result

of the COVID-19 pandemic; and (xiv) the outcome of any legal

proceedings that may be instituted against ProSomnus. A further

list and description of risks and uncertainties can be found in

ProSomnus’s annual reports on Form 10-K filed with

the Securities and Exchange Commission (the “SEC”) any

subsequently filed quarterly reports on Form 10-Q, and other

documents that the parties may file or furnish with the SEC,

which you are encouraged to read. Should one or more of these risks

or uncertainties materialize, or should underlying assumptions

prove incorrect, actual results may vary materially from those

indicated or anticipated by such forward-looking statements.

Forward-looking statements do not represent our views as of any

subsequent date, and we do not undertake any obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws. Accordingly, you are cautioned not to

place undue reliance on these forward-looking statements.

| PROSOMNUS,

INC. |

|

| UNAUDITED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Three-month period ended |

|

| |

|

March 31, |

|

December 31, |

|

March 31, |

|

| |

|

2023 |

|

2022 |

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

5,808,380 |

|

|

$ |

5,792,312 |

|

|

$ |

3,743,143 |

|

|

|

Cost of revenue |

|

|

2,756,631 |

|

|

|

2,686,863 |

|

|

|

1,578,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

3,051,749 |

|

|

|

3,105,449 |

|

|

|

2,164,647 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing |

|

|

2,824,048 |

|

|

|

2,415,155 |

|

|

|

2,117,419 |

|

|

|

Research and development |

|

1,018,969 |

|

|

|

1,065,750 |

|

|

|

557,633 |

|

|

|

General and administrative |

|

3,353,007 |

|

|

|

5,674,961 |

|

|

|

1,353,735 |

|

|

|

Total operating expenses |

|

|

7,196,024 |

|

|

|

9,155,866 |

|

|

|

4,028,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(4,144,275 |

) |

|

|

(6,050,417 |

) |

|

|

(1,864,140 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(1,171,810 |

) |

|

|

(2,405,029 |

) |

|

|

(1,095,837 |

) |

|

|

Change in fair value of earnout liability |

|

|

1,500,000 |

|

|

|

9,260,000 |

|

|

|

- |

|

|

|

Change in fair value of debt |

|

(1,827,000 |

) |

|

|

553,235 |

|

|

|

- |

|

|

|

Change in fair value of warrant liability |

|

|

(842,559 |

) |

|

|

3,255,342 |

|

|

|

(20,756 |

) |

|

|

Other |

|

|

(406,527 |

) |

|

|

- |

|

|

|

- |

|

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

(2,405,111 |

) |

|

|

- |

|

|

|

Total other income (expense) |

|

(2,747,896 |

) |

|

|

8,258,437 |

|

|

|

(1,116,593 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Net

loss |

|

$ |

(6,892,171 |

) |

|

$ |

2,208,020 |

|

|

$ |

(2,980,733 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

| PROSOMNUS,

INC. |

| UNAUDITED

CONDENSED CONSOLIDATED BALANCE SHEETS |

| |

|

|

|

|

|

|

| |

|

March

31, |

|

December 31, |

| |

|

2023 |

|

2022 |

|

ASSETS |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

11,560,319 |

|

|

$ |

15,916,141 |

|

|

Accounts receivable, net |

|

|

2,662,752 |

|

|

|

2,843,148 |

|

|

Inventory |

|

|

758,188 |

|

|

|

639,945 |

|

|

Prepaid expenses and other current assets |

|

|

1,571,197 |

|

|

|

1,846,870 |

|

|

Total current assets |

|

|

16,552,456 |

|

|

|

21,246,104 |

|

| |

|

|

|

|

|

|

| Property and

equipment, net |

|

|

2,994,769 |

|

|

|

2,404,402 |

|

| Right-of-use

assets, net |

|

|

8,775,016 |

|

|

|

9,283,222 |

|

| Other

assets |

|

|

262,913 |

|

|

|

262,913 |

|

|

Total assets |

|

$ |

28,585,154 |

|

|

$ |

33,196,641 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

1,309,656 |

|

|

$ |

2,101,572 |

|

|

Accrued Expenses |

|

|

4,906,746 |

|

|

|

3,706,094 |

|

|

Equipment financing obligation |

|

|

57,839 |

|

|

|

58,973 |

|

|

Finance lease liabilities |

|

|

898,027 |

|

|

|

1,008,587 |

|

|

Operating lease liabilities |

|

|

329,767 |

|

|

|

215,043 |

|

|

Total current liabilities |

|

|

7,502,035 |

|

|

|

7,090,269 |

|

| |

|

|

|

|

|

|

| Equipment

financing obligation, net of current portion |

|

|

171,984 |

|

|

|

185,645 |

|

| Finance

lease liabilities, net of current portion |

|

|

1,917,877 |

|

|

|

2,081,410 |

|

| Operating

lease liabilities, net of current portion |

|

|

5,452,282 |

|

|

|

5,525,562 |

|

| Senior

Convertible notes |

|

|

14,478,000 |

|

|

|

13,651,000 |

|

| Subordinated

Convertible note |

|

|

12,079,380 |

|

|

|

10,355,681 |

|

| Earnout

Liability |

|

|

11,310,000 |

|

|

|

12,810,000 |

|

| Warrant

liability |

|

|

2,834,062 |

|

|

|

1,991,503 |

|

|

Total liabilities |

|

|

55,745,620 |

|

|

|

53,691,070 |

|

| |

|

|

|

|

|

|

|

Stockholders’ deficit: |

|

|

|

|

|

|

|

Common stock (16,041,464 shares issued and outstanding at March 31,

2023 and December 31, 2022) |

|

|

1,604 |

|

|

|

1,604 |

|

|

Additional paid-in capital |

|

|

190,524,696 |

|

|

|

190,298,562 |

|

|

Accumulated deficit |

|

|

(217,686,766 |

) |

|

|

(210,794,595 |

) |

|

Total stockholders’ deficit |

|

|

(27,160,466 |

) |

|

|

(20,494,429 |

) |

|

Total liabilities and stockholders’ deficit |

|

$ |

28,585,154 |

|

|

$ |

33,196,641 |

|

Investor ContactMike CavanaughICR

WestwickePhone:

+1.617.877.9641Email: Mike.Cavanaugh@westwicke.com

Media ContactSean LeousICR WestwickePhone:

+1.646.866.4012Email: Sean.Leous@westwicke.com

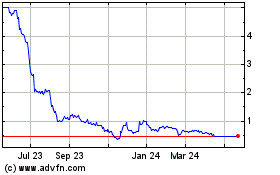

ProSomnus (NASDAQ:OSA)

Historical Stock Chart

From Feb 2025 to Mar 2025

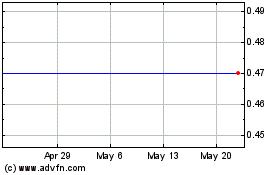

ProSomnus (NASDAQ:OSA)

Historical Stock Chart

From Mar 2024 to Mar 2025