0001636651false00016366512024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

OVID THERAPEUTICS INC.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-38085 | 46-5270895 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

441 Ninth Avenue, 14th Floor New York, New York | | 10001 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: 646-661-7661

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | OVID | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

Item 2.02.Results of Operations and Financial Condition.

On August 13, 2024, Ovid Therapeutics Inc. (the “Company”) issued a press release announcing Business Update, Second Quarter 2024 Financial Results. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information provided in this Item 2.02, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01.Financial Statements and Exhibits.

(d) Exhibit

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| OVID THERAPEUTICS INC. |

| | |

| By: | /s/ Thomas M. Perone |

| | Thomas M. Perone |

| | General Counsel & Corporate Secretary |

Dated: August 13, 2024

Exhibit 99.1

Ovid Therapeutics Reports Business Updates and Second Quarter 2024 Financial Results

•Appointed Dr. Amanda Banks, a tenured physician and biotech leader, as Chief Development Officer to lead clinical strategy and execution

•Expanded Scientific Advisory Board under the leadership of Dr. Robert Langer, adding top neurologists and neuroscientists to drive pipeline advancements

•Reduced workforce by 43%, streamlined operations, and initiated an ongoing prioritization process, which includes suspending the OV329 IV program to enable focused investment in priority clinical programs

•Maintained strong financial position of $77.0 million in cash and marketable securities as of June 30, 2024, which are expected to support operations and the potential to achieve five clinical and regulatory milestones by late H1 2026

NEW YORK, August 13, 2024 -- Ovid Therapeutics Inc. (Nasdaq: OVID), a biopharmaceutical company dedicated to improving the lives of people affected by rare epilepsies and brain conditions, today reported business updates and financial results for the second quarter ended June 30, 2024.

"Following Takeda's unexpected Phase 3 results for soticlestat, we moved rapidly to focus our resources to preserve capital. This approach included restructuring the organization and initiating ongoing program prioritization efforts to support the achievement of meaningful clinical and regulatory milestones within our financial plan,” explained Dr. Jeremy Levin, D. Phil, MB BChir., Chairman and CEO. "We are thrilled that our current pipeline remains on track to deliver anticipated results. To further our strategic objectives, we welcomed Dr. Amanda Banks as our Chief Development Officer. Her expertise, along with the expanded Scientific Advisory Board, will enhance our ability to capitalize on therapeutic opportunities and prioritize efforts where we can most benefit patients."

General Corporate & Business Updates

Ovid is streamlining its operations, while seeking to optimize its pipeline programs and strengthen its financial capital to focus on achieving near-term clinical milestones. Key initiatives include:

•Organizational restructuring: The Company streamlined its workforce by reducing 17 positions, or 43% of its headcount, to prioritize its core programs and extend its cash runway.

Ovid expects to incur $3.4 million of cash expenditures related to the restructuring. The cash expenditures will be completed by mid-2025.

•Financial strategy: Ovid expects its cash runway to support operations and clinical development through late H1 2026. During this period, Ovid plans to achieve five clinical and regulatory milestones and will explore partnerships and co-development opportunities for select programs.

•Pipeline strategy & prioritization: Ovid is actively evaluating its pipeline and undertaking an ongoing process to review indication and development strategies. As part of this process, the Company has currently focused resources on advancing OV888/GV101 and OV329 oral programs toward significant clinical milestones. It also paused the intravenous (IV) OV329 program and other preclinical programs.

•Talent strategy: In July, as part of Ovid's corporate strategy, Dr. Amanda Banks was appointed Chief Development Officer. Dr. Banks brings extensive expertise in clinical and corporate development strategy. She will oversee clinical execution, medical and regulatory affairs, and support business development. Additionally, in July 2024, Ovid expanded its Scientific Advisory Board and added distinguished neurologists, neuroscientists, and epileptologists, including: Drs. Imad Najm, Raman Sankar, Jamie McGuire, and Jeff Noebels. These experts will help guide the application of Ovid’s novel mechanisms into broader areas of neurology, for which they might offer potential therapeutic benefits.

Pipeline Updates

Ovid is advancing pipeline programs including: OV888/GV101, OV329 and OV350. Updates include:

•OV888/GV101 capsule advancing to Phase 2 proof-of-concept study in cerebral cavernous malformations (CCM): In June 2024, Ovid and its partner, Graviton Bioscience, announced topline results from a Phase 1 clinical trial studying OV888/GV101 capsule. The study met its objective, demonstrating a favorable safety and tolerability profile with no serious adverse events. All drug-associated clinical adverse events (AEs) were mild and resolved. The most commonly reported clinical AE was headache (in 23% of participants), and all cases were transient and resolved. The study additionally showed:

◦Target engagement. A dose dependent decrease in proinflammatory cytokines IL-17 and IL-21 secretion by stimulated peripheral blood mononuclear cells was observed. These decreases indicate that rho-associated coiled- coil containing protein kinase 2 (ROCK2) inhibition is occurring and suggest that OV888/GV101 is biologically active in humans at the target clinical dose and elicits a pharmacodynamic response.

◦Exposure and half-life supportive of daily dosing. OV888/GV101 capsule has an average half-life of approximately 12 hours, suggesting that it is suited for once daily dosing. A dose dependent increase in Cmax and AUC0-24 was seen through the target dose for Phase 2.

◦Timing of proof-of-concept study. Ovid and Graviton Bioscience are on track to initiate a Phase 2 proof-of-concept program evaluating the safety and efficacy of OV888/GV101 in H2 2024.

•Timing for OV329 (oral) Phase 1 results: Ovid anticipates the completion of a Phase 1 multiple ascending dose (MAD) study of OV329 in H2 2024. That study is ongoing and applies magnetic resonance spectrometry and transcranial magnetic stimulation, respectively, as biomarkers of target engagement and clinical efficacy. In addition, Ovid expects to present:

◦Ocular accumulation data at Epilepsy Foundation Pipeline Conference 2024. In September 2024, Ovid expects to present results from a pharmacokinetic study examining whether OV329 has a similar tendency as vigabatrin to accumulate in rodent eyeballs, and more specifically, the retina, after multiple days of continuous infusion. The mechanistic insights gained from this study may inform how OV329 could differentiate from vigabatrin relative to ocular safety.

•Suspending development of OV329 IV formulation. As part of Ovid's ongoing portfolio prioritization efforts, the Company has paused the OV329 IV program for refractory status epilepticus.

•OV350 regulatory submission and potassium chloride co-transporter 2 (KCC2) direct activator library. Ovid intends to submit an application to study an IV formulation of OV350 in healthy human volunteers in H2 2024. OV350 is the first program emerging from Ovid’s novel portfolio of KCC2 direct activators. The Company believes several of its direct activators have the potential to treat multiple diseases, including psychiatric and anticonvulsant indications, thereby enabling possible partnering and co-development opportunities.

•Soticlestat: Following the release of topline findings for soticlestat in June 2024, Takeda has stated that it plans to engage with the FDA to explore a potential path forward for soticlestat based upon the totality of the data generated in Dravet syndrome across Phase 2 and Phase 3 programs. Takeda reported in its June 2024 topline findings release that the SKYLINE trial in Dravet narrowly missed its primary endpoint, though it showed significance in pre-specified sub-populations and in certain secondary endpoints. During Takeda's Q1 FY2024 earnings call, it announced that soticlestat did not show clinical benefit for patients with Lennox-Gastaut Syndrome (LGS) and that the development in LGS has been discontinued.

◦Financial interest: Ovid retains a financial interest in soticlestat following the sale of its 50% rights to Takeda in March 2021. If soticlestat is approved and commercialized, Ovid is eligible to receive regulatory and commercial milestone payments, as well as tiered, low double-digit royalties up to 20% on global net sales from Takeda. Of these potential future payments, Ovid sold a 13% interest to Ligand Pharmaceuticals for $30.0 million in October 2023. Ovid retains 87% of its interest in any milestone payments and royalties. Ovid has no ongoing obligations or costs associated with the development of soticlestat.

Second Quarter 2024 Financial Results

•Cash, cash equivalents and marketable securities as of June 30, 2024, totaled $77.0 million.

•Revenue from royalty agreements were $169,000 for the second quarter ended June 30, 2024, as compared to $75,000 in the same period in 2023.

•Research and development expenses were $12.6 million for the second quarter ended June 30, 2024, compared to $6.0 million in the same period in 2023. The increase is related to advancement of Ovid's clinical pipeline as described above, including the addition of the OV888/GV101 Phase 1 MAD program and expanded OV329 clinical development activities, as well as $1.6 million in one-time costs due to organizational restructuring during the period.

•General and administrative (G&A) expenses were $8.1 million for the second quarter ended June 30, 2024, as compared to $8.2 million for the same period in 2023. G&A costs included a one-time $1.8 million expense associated with the above mentioned organizational restructuring.

•Total operating expenses were $20.7 million for the second quarter ended June 30, 2024, as compared to $14.2 million for the same period last year, and included a total of $3.4 million of one-time costs related to the above mentioned organizational restructuring.

•Ovid reported a net income of $8.5 million, or basic and diluted net income per share attributable to common stockholders of $0.12, for the second quarter of 2024, as compared to a net loss of $12.4 million, or basic and diluted net loss per share attributable to common stockholders of $0.18, for the same period in 2023. Net income in the second quarter of 2024 included a $29.0 million gain due to a fair value adjustment to the royalty monetization liability. Following the results of the two pivotal studies that Takeda conducted with soticlestat, Ovid reassessed assumptions about the fair value of the royalty monetization liability. This reassessment led to a decrease in the royalty monetization liability which is recognized in Ovid's second quarter financial results.

About Ovid Therapeutics

Ovid Therapeutics Inc. is a New York-based biopharmaceutical company that is dedicated to improving the lives of people affected by rare epilepsies and brain conditions with seizure symptoms. The Company is advancing a pipeline of novel, targeted small molecule candidates that modulate the intrinsic and extrinsic factors involved in neuronal hyperexcitability causative of seizures and other neurological symptoms. Ovid is developing: OV888/GV101 capsule, a potent and highly selective ROCK2 inhibitor, for the potential treatment of cerebral cavernous malformations and other rare central nervous system diseases; OV329, a GABA-aminotransferase inhibitor, a potential therapy for treatment-resistant seizures; and OV350, a direct activator of the KCC2 transporter, for the potential treatment of epilepsies and other psychiatric conditions. For more information about these and other Ovid research programs, please visit www.ovidrx.com.

Forward-Looking Statements

This press release includes certain disclosures by Ovid that contain “forward-looking statements” including, without limitation: statements regarding the potential success of Ovid’s Scientific Advisory Board; Ovid’s ability to achieve projected cost savings in connection with the organizational restructuring and related pipeline prioritization efforts; Ovid’s expectations regarding the duration of its cash runway and the expectation that it will support the advancement of Ovid’s pipeline; the expected timing of initiation of Ovid’s Phase 2 clinical programs studying OV888/GV101 in CCM; the expected timing of completion of the Phase 1 MAD study of OV329 and expected timing of data presentation; the potential use and development of OV888/GV101, OV329, OV350 and compounds from Ovid’s library of direct activators of KCC2; the potential therapeutic opportunity of OV888/GV101, OV329, OV350 and compounds from Ovid’s library of direct activators of KCC2; the potential opportunity for soticlestat in Dravet syndrome and the outcome of Takeda's interactions with regulators regarding marketing authorization for soticlestat in Dravet syndrome; Ovid’s potential future business development opportunities; the potential application of Ovid’s pipeline programs and mechanisms of action to broader areas of neurology; and other statements that are not historical fact. You can identify forward-looking statements because they contain words such as “anticipates,” “believes,” “expects,” “intends,” “may,” “plan,” “potentially,” and “will,” and similar expressions (as well as other words or expressions referencing future events, conditions or circumstances). Forward-looking statements are based on Ovid’s current expectations and assumptions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements, which are neither statements of historical fact nor guarantees or assurances of future performance. Important factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, impediments to Ovid’s ability to achieve projected cost savings in connection with the organizational restructuring and related pipeline prioritization efforts, uncertainties inherent in the preclinical and clinical development and regulatory approval processes,

risks related to Ovid’s ability to achieve its financial objectives, the risk that Ovid may not be able to realize the intended benefits of its technology or its business strategy, or risks related to Ovid’s ability to identify business development targets or strategic partners, to enter into strategic transactions on favorable terms, or to consummate and realize the benefits of any business development transactions. Additional risks that could cause actual results to differ materially from those in the forward-looking statements are set forth under the caption “Risk Factors” in Ovid’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (“SEC”) on May 14, 2024, and in future filings Ovid makes with the SEC. Any forward-looking statements contained in this press release speak only as of the date hereof, and Ovid assumes no obligation to update any forward-looking statements contained herein, whether because of any new information, future events, changed circumstances or otherwise, except as otherwise required by law.

Condensed Consolidated Statements of Operations

Unaudited

| | | | | | | | | | | | | | | |

(in thousands, except share and per share data) | For The Three Months Ended

June 30, 2024 | | For The Three Months Ended

June 30, 2023 | | | | |

| Revenue: | | | | | | | |

| License and other revenue | $ | 169 | | | $ | 75 | | | | | |

| Total revenue | 169 | | | 75 | | | | | |

| Operating expenses: | | | | | | | |

| Research and development | 12,582 | | | 5,999 | | | | | |

| General and administrative | 8,104 | | | 8,248 | | | | | |

| Total operating expenses | 20,686 | | | 14,247 | | | | | |

| Loss from operations | (20,517) | | | (14,172) | | | | | |

| Other income (expense), net | 29,038 | | | 1,764 | | | | | |

| Income (loss) before provision for income taxes | 8,521 | | | (12,408) | | | | | |

| Provision for income taxes | — | | | — | | | | | |

| Net income (loss) | $ | 8,521 | | | $ | (12,408) | | | | | |

| Net income (loss) per share, basic | $ | 0.12 | | | $ | (0.18) | | | | | |

| Net income (loss) per share, diluted | $ | 0.12 | | | $ | (0.18) | | | | | |

| Weighted-average common shares outstanding, basic | 70,916,471 | | 70,534,181 | | | | |

| Weighted-average common shares outstanding, diluted | 71,200,798 | | 70,534,181 | | | | |

Select Condensed Consolidated Balance Sheet Data

Unaudited

| | | | | | | | | | | |

(in thousands) | June 30, 2024 | | December 31, 2023 |

| Cash, cash equivalents and marketable securities | $ | 76,974 | | | $ | 105,834 | |

Working capital(1) | 66,770 | | | 98,123 | |

| Total assets | 118,093 | | | 144,027 | |

| Total stockholder's equity | 88,903 | | | 87,797 | |

(1)Working capital defined as current assets less current liabilities |

Contacts

Investor Relations

Garret Bonney

IR@ovidrx.com

(617) 735-6093

Media

Raquel Cabo

RCabo@ovidrx.com

(646) 647-6553

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

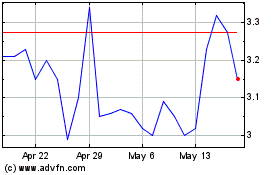

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ovid Therapeutics (NASDAQ:OVID)

Historical Stock Chart

From Mar 2024 to Mar 2025