false

0001069899

0001069899

2024-02-06

2024-02-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 6, 2024

Phibro Animal Health Corporation

(EXACT NAME OF REGISTRANT AS SPECIFIED IN CHARTER)

| Delaware |

|

001-36410 |

|

13-1840497 |

(State or other

jurisdiction of

incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

Glenpointe Centre East, 3rd Floor

300 Frank W. Burr Boulevard, Suite 21

Teaneck, New Jersey 07666-6712

(Address of Principal Executive Offices, including

Zip Code)

(201) 329-7300

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed

since last report)

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share |

|

PAHC |

|

NASDAQ Stock Market |

Check the appropriate box below if this

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| ITEM 5.02 |

DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS. |

On February 6, 2024, Phibro Animal Health Corporation

(“Phibro” or the “Company”) announced that Glenn C. David has joined Phibro and will assume the role of Chief

Financial Officer effective February 9, 2024 (the “Start Date”), pursuant to the terms and conditions of that certain offer

letter, entered into between Phibro and Mr. David dated October 12, 2023 (the “Offer Letter”). Mr. Richard Johnson, who has

served as Phibro’s interim Chief Financial Officer since September 29, 2023, will continue with Phibro for a period of time in an

advisory capacity to ensure a smooth transition with Mr. David.

Mr. David, age 52, brings over 30 years of experience

in commercial and financial leadership roles. Mr. David’s most recent role was Executive Vice President and Group President, US

Operations, Diagnostics, Biodevices and Insurance at Zoetis Inc. Prior to that, he served as Executive Vice President and Group President,

International Operations, Aquaculture, Biodevices and Insurance at Zoetis. Mr. David was the Chief Financial Officer at Zoetis from 2016-2021,

where he maintained a well-capitalized and financially disciplined business, creating significant value for shareholders and earlier in

his career, he served as Senior Vice President of Finance Operations for Zoetis during its Initial Public Offering in 2013. Before the

Zoetis IPO, Mr. David served in various financial roles at Pfizer Inc., including Vice President of Global Finance for Pfizer Animal Health

and Vice President of Finance for the U.S. Primary Care franchise. Mr. David has a Bachelor of Science in Finance from Binghamton University

and a Masters of Business Administration in Finance from New York University.

There are no family relationships between Mr. David

and any director, executive officer or person nominated or chosen by the Company to become a director or executive officer. Additionally,

there have been no transactions involving Mr. David that would require disclosure under Item 404(a) of Regulation S-K.

Summary of Offer Letter to Mr. David

Pursuant to the Offer Letter, Mr. David will receive

an annual base salary of $650,000 and an annual bonus opportunity with a target payout equal to 50% of his base salary. In addition, Mr.

David will receive a signing bonus equal to $135,000 (the “Signing Bonus”), which will be paid on or about September 15, 2024,

subject to continued employment through the payment date; provided that, in the event Mr. David’s employment is terminated by the

Company without Cause or Mr. David resigns for Good Reason (each as defined in the Offer Letter, and each a “Qualifying Termination”),

Mr. David will receive the Signing Bonus on or before September 15, 2024.

Mr. David will receive 300,000 restricted stock

units (“RSUs”), pursuant to the Company’s 2008 Incentive Plan and an RSU award agreement (the “Award Agreement”)

to be granted on or as soon as reasonably practicable following the Start Date (such date, the “Grant Date”). Pursuant to

the Award Agreement, the RSUs shall vest as follows: (i) 150,000 RSUs will be subject to time vesting (collectively, the “Time Vesting

RSUs”) and will vest in equal installments on each of the first five anniversaries of the Grant Date, subject to continued service

through each such vesting date, and (ii) 150,000 RSUs will be subject to performance vesting (collectively, the “Performance Vesting

RSUs”) and will vest (with linear interpolation to apply for achievement between increments) based upon achievement of the arithmetic

average of the Company’s closing stock price per share for each trading day in the 90-calendar day period (the “90-Day Average”)

ending five years from the Grant Date, from $20 to $60 and above, subject to Mr. David’s continued employment on such date.

In the event of a Qualifying Termination, subject

to Mr. David’s execution and non-revocation of a general release of claims and continued compliance with all applicable restrictive

covenants, the Time Vesting RSUs will become fully vested upon the date of such termination and the Performance Vesting RSUs will vest

based on the 90-Day Average of the Company’s stock price ending on a date selected by Mr. David during the period beginning on the

date of the Qualifying Termination and ending on the first to occur of (x) five years from the Grant Date, (y) the first anniversary of

the Qualifying Termination and (z) March 15 of the year following the date the Qualifying Termination. None of the Performance Vesting

RSUs will vest if the 90-Day Average is below $20, and the maximum vesting percentage for the Performance Vesting RSUs is 100% for achievement

of a 90-Day Average of $60 or above.

In the event of a change in control of the Company,

following which either (i) 100% of the Company’s shares of stock cease to be traded on a nationally recognized stock exchange and

the Company is no longer listed on any such exchange or (ii) a Qualifying Termination occurs within 12 months, all unvested RSUs will

immediately vest in full.

Mr. David will be bound by customary confidentiality,

noncompete, nonsolicitation, and intellectual property provisions, which generally apply during employment and thereafter.

| ITEM 7.01 |

REGULATION FD DISCLOSURE. |

On February 6, 2024, the Company issued a press

release announcing Mr. David joining the Company and his appointment as Chief Financial Officer effective as of the Start Date. A copy

of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01 and

in the press release is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of, or otherwise

regarded as filed under, the Securities Exchange Act of 1934, as amended (the “Exchange Act”), nor shall it be deemed incorporated

by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth

by specific reference in such filing.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

PHIBRO ANIMAL HEALTH CORPORATION

Registrant |

| |

|

| Date: February 6, 2024 |

|

| |

|

| |

By: |

/s/ Judith Weinstein |

| |

Name: |

Judith Weinstein |

| |

Title: |

Senior Vice President, General Counsel and Corporate Secretary |

Exhibit 99.1

For Immediate Release

Phibro Animal Health Corporation Announces Chief Financial Officer

Changes

TEANECK, N.J., February 6, 2024 (Business Wire) –

TEANECK, N.J., February 6, 2024 (Business Wire) – Phibro Animal Health Corporation (Nasdaq: PAHC) (the “Company”

or “Phibro”) today announced that Glenn C. David has joined Phibro and will assume the role of Chief Financial Officer

effective February 9, 2024. Mr. Richard Johnson, who is currently serving as Phibro’s interim Chief Financial Officer since

September 29, 2023, will continue with Phibro for a period of time in an advisory capacity to ensure a smooth transition with his

successor.

Mr. David brings over 30 years of experience in commercial and financial

leadership roles. Mr. David’s most recent role was Executive Vice President and Group President, US Operations, Diagnostics, Biodevices

and Insurance at Zoetis Inc. Prior to that, he served as Executive Vice President and Group President, International Operations, Aquaculture,

Biodevices and Insurance at Zoetis. Mr. David was the Chief Financial Officer at Zoetis from 2016-2021, where he maintained a well-capitalized

and financially disciplined business, creating significant value for shareholders and earlier in his career, he served as Senior Vice

President of Finance Operations for Zoetis during its Initial Public Offering in 2013. Before the Zoetis IPO, Mr. David served in various

financial roles at Pfizer Inc., including Vice President of Global Finance for Pfizer Animal Health and Vice President of Finance for

the U.S. Primary Care franchise.

I am very excited to welcome Glenn to Phibro. Glenn brings a wealth

of knowledge and experience not only in financial matters but in the animal health industry which will be beneficial for Phibro as we

continue to grow our business and bring value to our shareholders. He brings the skills and experience needed to play a key role in Phibro’s

future success,” said Jack Bendheim, Phibro’s Chairman, President and Chief Executive Officer. “I also want to thank

Dick Johnson, who previously served as Phibro’s Chief Financial Officer for more than 18 years, for leading us through this transition

period and for his help in ensuring the continued success of our business.”

Mr. David has a Bachelor of Science in Finance from Binghamton University

and a Masters of Business Administration in Finance from New York University.

About Phibro Animal Health Corporation

Phibro Animal Health Corporation is a leading global diversified animal

health and nutrition company. We strive to be a trusted partner with livestock producers, farmers, veterinarians and consumers who raise

or care for farm and companion animals by providing solutions to help them maintain and enhance the health of their animals. For further

information, please visit www.pahc.com.

Contacts

Phibro Animal Health Corporation

Richard Johnson

Chief Financial Officer, Phibro Animal Health Corporation

+1-201-329-7300

Or

investor.relations@pahc.com

v3.24.0.1

Cover

|

Feb. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 06, 2024

|

| Entity File Number |

001-36410

|

| Entity Registrant Name |

Phibro Animal Health Corporation

|

| Entity Central Index Key |

0001069899

|

| Entity Tax Identification Number |

13-1840497

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Glenpointe Centre East, 3rd Floor

|

| Entity Address, Address Line Two |

300 Frank W. Burr Boulevard, Suite 21

|

| Entity Address, City or Town |

Teaneck

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07666-6712

|

| City Area Code |

201

|

| Local Phone Number |

329-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.0001 par value per share

|

| Trading Symbol |

PAHC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

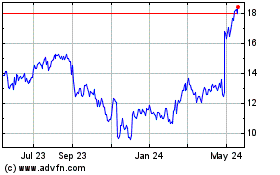

Phibro Animal Health (NASDAQ:PAHC)

Historical Stock Chart

From Mar 2024 to Apr 2024

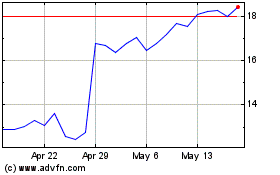

Phibro Animal Health (NASDAQ:PAHC)

Historical Stock Chart

From Apr 2023 to Apr 2024