Creates a community-focused, regional financial

services partner with $27+ billion in assets

Announces $200 million in capital commitments

in support of the merger

WesBanco, Inc. (“WesBanco”) (NASDAQ: WSBC) and Premier Financial

Corp. (“Premier”) (NASDAQ: PFC) jointly announced today that they

have executed a definitive Agreement and Plan of Merger

(“Agreement”) providing for the merger of Premier with and into

WesBanco. Jeff Jackson, President and Chief Executive Officer of

WesBanco, and Gary Small, President and Chief Executive Officer of

Premier, made the joint announcement.

Under the terms of the Agreement, which has been unanimously

approved by the board of directors of both companies, WesBanco will

exchange shares of its common stock for all of the outstanding

shares of Premier common stock, in an all-stock transaction.

Premier shareholders will be entitled to receive 0.80 of a share of

WesBanco common stock for each share of Premier common stock they

own upon the effective time of the merger, for aggregate merger

consideration valued at approximately $959 million, or $26.66 per

share, based on WesBanco’s closing stock price of $33.32 as of July

24, 2024. The transaction values Premier at a price to June 30,

2024 tangible book value per share of 142% and a price to mean

analyst estimated 2024 earnings per share of 12.9 times. The merger

is expected to qualify as a tax-free reorganization.

WesBanco also announced today that it has entered into

subscription agreements with investors to raise capital to support

the merger, led by a $125 million investment from Wellington

Management. Additional investors include Glendon Capital Management

LP and Klaros Capital. In aggregate, $200 million of WesBanco

common stock will be issued. The capital raise is expected to close

on August 1, 2024. The proceeds of the capital raise are expected

to support the pro forma bank’s balance sheet and regulatory

capital ratios.

Upon completion of the merger, the shares issued to Premier

shareholders are expected to comprise 30% of the outstanding shares

of the combined company, the shares issued in the capital raise are

expected to represent 8% of the combined company, and 62% of the

outstanding shares of the combined company are expected to be held

by legacy WesBanco shareholders.

Jeff Jackson, President and Chief Executive Officer of WesBanco,

stated, “Today is an exciting day in WesBanco’s 155-year history as

we announce our proposed merger with Premier and mark another

milestone in our long-term growth strategy. This transformative

merger will bring together two high-caliber institutions to create

a community-focused, regional financial services partner strongly

positioned to serve the unique needs of both our new and legacy

communities. We are pleased to welcome Premier’s customers and

employees to the WesBanco family and look forward to delivering

exceptional customer experiences to our newest markets through a

broader offering of banking and wealth management services.

WesBanco has built an outstanding reputation for soundness,

profitability, customer service, employer of choice and community

development, as evidenced by multiple recent national accolades. We

look forward to extending our legacy through this merger and

bringing even greater value to our customers, teams, communities

and shareholders.”

With highly compatible cultures and business models, the

proposed merger will create a regional financial services

institution with approximately $27 billion in assets, significant

economies of scale, and strong pro forma profitability metrics.

With complementary and contiguous geographic footprints, the

combined company would be the 8th largest bank in Ohio, based on

deposit market share, have increased presence in Indiana, and serve

customers in nine states.

Excluding certain merger-related charges and transaction related

provision for credit losses, the transaction, with cost savings

fully phased in, is anticipated to be more than 40% accretive to

2025 earnings. Estimated tangible book value dilution at closing of

13% is expected to be earned back in approximately 2.8 years, using

the “cross-over” method. The merger is subject to a number of

customary conditions, including the approvals of the appropriate

regulatory authorities and approvals by the shareholders of both

WesBanco and Premier. It is expected that the transaction should be

completed during the first quarter of 2025. Upon completion of the

merger, four members of Premier’s current Board of Directors will

be appointed to WesBanco’s Board of Directors.

“The combination of WesBanco and Premier makes for an excellent

strategic fit. Both organizations value community level banking,

are well aligned from a culture perspective, and are focused on

performance,” said Gary Small, President and Chief Executive

Officer of Premier. “The expanded reach of the organization will

serve as a catalyst for growth and increased investment in products

and services, to the benefit of all stakeholders: customers,

associates, shareholders, as well as the communities we serve.”

At June 30, 2024, WesBanco had consolidated assets of

approximately $18.1 billion, deposits of $13.4 billion, total loans

of $12.3 billion, and shareholders’ equity of $2.5 billion.

At June 30, 2024, Premier had consolidated assets of

approximately $8.8 billion, deposits of $7.2 billion, total loans

of $6.8 billion, and shareholders’ equity of $1.0 billion.

When the transaction is consummated, WesBanco will have more

than 250 financial centers, as well as loan production offices,

across nine states. The transaction will expand WesBanco’s

franchise by 73 financial centers located primary throughout

northern Ohio, as well as in southern Michigan and northeastern

Indiana. Officials of both organizations are optimistic that

organizing around customer services and product delivery can be

accomplished with as little employee disruption as possible.

As a condition to WesBanco’s willingness to enter into the

Agreement, all of the directors and executive officers of Premier

have entered into voting agreements with WesBanco pursuant to which

they have agreed to vote their shares in favor of the merger.

Financial advisors involved in the transaction were Raymond

James & Associates, Inc., representing WesBanco, and Piper

Sandler & Co., representing Premier. Raymond James &

Associates, Inc. also served as placement agent on the private

placement.

Legal representations in the transaction include Phillips,

Gardill, Kaiser & Altmeyer, PLLC and K&L Gates LLP for

WesBanco, Nelson Mullins Riley & Scarborough, LLP for Premier,

Hunton Andrews Kurth LLP for Raymond James and Schulte Roth &

Zabel LLP for Wellington Management.

Forward-Looking Statements

The statements in this press release that are not historical

facts, in particular the statements with respect to the expected

timing of and benefits of the proposed merger between WesBanco and

Premier, the parties’ plans, obligations, expectations, and

intentions, and the statements with respect to accretion and earn

back of tangible book value dilution, constitute forward-looking

statements as defined by federal securities laws. Such statements

are subject to numerous assumptions, risks, and uncertainties.

Actual results could differ materially from those contained or

implied by such statements for a variety of factors including: the

businesses of WesBanco and Premier may not be integrated

successfully or such integration may take longer to accomplish than

expected; the expected cost savings and any revenue synergies from

the proposed merger may not be fully realized within the expected

timeframes; disruption from the proposed merger may make it more

difficult to maintain relationships with clients, associates, or

suppliers; the required governmental approvals of the proposed

merger may not be obtained on the expected terms and schedule;

Premier’s shareholders and/or WesBanco’s shareholders may not

approve the proposed merger and the merger agreement, and

WesBanco’s shareholders may not approve the issuance of shares of

WesBanco common stock in the proposed merger; changes in economic

conditions; movements in interest rates; competitive pressures on

product pricing and services; success and timing of other business

strategies; the nature, extent, and timing of governmental actions

and reforms; and extended disruption of vital infrastructure; and

other factors described in WesBanco’s 2023 Annual Report on Form

10-K, Premier’s 2023 Annual Report on Form 10-K, and documents

subsequently filed by WesBanco and Premier with the Securities and

Exchange Commission (SEC). Annualized, pro forma, projected and

estimated numbers are used for illustrative purposes only, are not

forecasts and may not reflect actual results. All forward-looking

statements included herein are based on information available at

the time of the release. Neither WesBanco nor Premier assumes any

obligation to update any forward-looking statement.

Conference Call Information

WesBanco will host a conference call and webcast to discuss the

Agreement and Plan of Merger at 10:00 a.m. ET on July 26, 2024.

Interested parties can access the live webcast of the conference

call through the Investor Relations section of WesBanco's website,

www.wesbanco.com. Participants can also listen to the conference

call by dialing 888-347-6607 (domestic), 855-669-9657 (Canada), or

1-412-902-4290 (international), and asking to be joined into the

WesBanco call. Please log in or dial in at least 10 minutes prior

to the start time to ensure a connection.

Additional Information about the Merger

and Where to Find It

In connection with the proposed merger, WesBanco will file with

the SEC a Registration Statement on Form S-4 that will include a

proxy statement of WesBanco and Premier and a prospectus of

WesBanco, as well as other relevant documents concerning the

proposed transaction. SHAREHOLDERS OF WESBANCO, SHAREHOLDERS OF

PREMIER, AND OTHER INTERESTED PARTIES ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS

REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER

RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR

SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. The Joint Proxy Statement/Prospectus will be

mailed to shareholders of WesBanco and shareholders of Premier

prior to the respective shareholder meetings, which have not yet

been scheduled. In addition, when the Registration Statement on

Form S-4, which will include the Joint Proxy Statements/Prospectus,

and other related documents are filed by WesBanco or Premier with

the SEC, they may be obtained for free at the SEC’s website at

http://www.sec.gov, and from either WesBanco’s website at

https://www.wesbanco.com or Premier’s website at

https://www.premierfincorp.com/.

Participants in the

Solicitation

WesBanco, Premier, and their respective executive officers and

directors may be deemed to be participants in the solicitation of

proxies from the shareholders of WesBanco and Premier in connection

with the proposed merger. Information about the directors and

executive officers of WesBanco is set forth in the proxy statement

for WesBanco’s 2024 annual meeting of shareholders, as filed with

the SEC on March 13, 2024. Information about the directors and

executive officers of Premier is set forth in the proxy statement

for Premier’s 2024 annual meeting of shareholders, as filed with

the SEC on March 18, 2024. Information about any other persons who

may, under the rules of the SEC, be considered participants in the

solicitation of shareholders of WesBanco or Premier in connection

with the proposed merger will be included in the Joint Proxy

Statement/Prospectus. You can obtain free copies of these documents

from the SEC, WesBanco, or Premier using the website information

above. This communication does not constitute an offer to sell or

the solicitation of an offer to buy any securities, nor shall there

be any sale of securities in any jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction.

WESBANCO SHAREHOLDERS AND PREMIER SHAREHOLDERS ARE URGED TO

READ THE JOINT PROXY STATEMENT/PROSPECTUS CAREFULLY WHEN IT BECOMES

AVAILABLE BEFORE MAKING ANY VOTING OR INVESTMENT DECISIONS WITH

RESPECT TO THE PROPOSED MERGER.

About Premier Financial Corp.

Premier Financial Corp. (Nasdaq: PFC), headquartered in

Defiance, Ohio, is the holding company for Premier Bank. Premier

Bank, headquartered in Youngstown, Ohio, operates 73 branches and

nine loan offices in Ohio, Michigan, Indiana and Pennsylvania and

also serves clients through a team of wealth professionals

dedicated to each community banking branch. For more information,

visit Premier’s website at www.PremierFinCorp.com.

About WesBanco, Inc.

With over 150 years as a community-focused, regional financial

services partner, WesBanco Inc. (NASDAQ: WSBC) and its subsidiaries

build lasting prosperity through relationships and solutions that

empower our customers for success in their financial journeys.

Customers across our eight-state footprint choose WesBanco for the

comprehensive range and personalized delivery of our retail and

commercial banking solutions, as well as trust, brokerage, wealth

management and insurance services, all designed to advance their

financial goals. Through the strength of our teams, we leverage

large bank capabilities and local focus to help make every

community we serve a better place for people and businesses to

thrive. Headquartered in Wheeling, West Virginia, WesBanco has

$18.1 billion in total assets, with our Trust and Investment

Services holding $5.6 billion of assets under management and

securities account values (including annuities) of $1.8 billion

through our broker/dealer, as of June 30, 2024. Learn more at

www.wesbanco.com and follow @WesBanco on Facebook, LinkedIn and

Instagram.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240726561038/en/

WesBanco Company Contacts John

Iannone Senior Vice President, Investor Relations (304)

905-7021

Alisha Hipwell Executive Vice President, Corporate

Communications (304) 234-9230

Premier Company Contact Kathy

Bushway Senior Vice President, Chief Marketing Officer (330)

742-0638

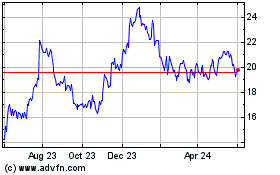

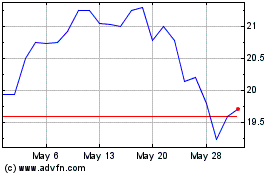

Premier Financial (NASDAQ:PFC)

Historical Stock Chart

From Nov 2024 to Dec 2024

Premier Financial (NASDAQ:PFC)

Historical Stock Chart

From Dec 2023 to Dec 2024