Phathom Pharmaceuticals Reports Second Quarter 2024 Financial Results and Provides Business Update

08 August 2024 - 10:00PM

Phathom Pharmaceuticals, Inc. (Nasdaq: PHAT), a biopharmaceutical

company focused on developing and commercializing novel treatments

for gastrointestinal (GI) diseases, today reported financial

results for the second quarter of 2024, and provided recent

business updates.

“Our impressive progress through the second full quarter of

launch highlights the strong and growing demand for VOQUEZNA, an

innovative treatment now approved across the entire GERD market,”

said Terrie Curran, President and CEO of Phathom. “Following our

recent FDA approval and the expanded label for VOQUEZNA last month,

we immediately began promotional efforts to ensure millions of

Non-Erosive GERD sufferers, and their physicians, are informed

about this powerful new treatment option. We are very excited by

the growth across all key metrics and the positive feedback from

those who have experienced the benefits of VOQUEZNA. Additionally,

with commercial coverage secured for over 116 million estimated

lives, we are in a strong position to expand our patient base and

ensure broad access to our first-in-class therapy. We remain

dedicated to building VOQUEZNA into a potential blockbuster and are

committed to our mission to change the treatment landscape for

acid-related disorders."

Recent Business Highlights and Second Quarter 2024

Results:

VOQUEZNA Launch Progress:

- The commercial launch of VOQUEZNA continued to accelerate with

total product demand and filled prescriptions growing throughout

the second quarter 2024. As of July 26, 2024, total estimated

prescription demand for VOQUEZNA tablets, VOQUEZNA TRIPLE PAK®, and

VOQUEZNA DUAL PAK® now exceeds 122,000 prescriptions written,

compared to 43,000 at the company’s last quarterly report, a 184%

increase. Total prescription demand represents the cumulative

number of prescriptions that have been written, regardless of

whether the prescription has been filled or dispensed. Over 60,000

prescriptions for VOQUEZNA products have been filled, launch to

date, through both retail pharmacies and patient support at

BlinkRx, an increase of more than 240% compared to 17,500 filled

prescriptions as of the company’s last quarterly report. The

sequential growth of filled prescriptions for the second quarter

2024 alone surpassed 265% with over 35,000 prescriptions for

VOQUEZNA products filled, compared to approximately 9,500 filled

prescriptions in the first quarter 2024.

- The prescriber base for VOQUEZNA is also rapidly expanding with

prescribers growing over 115% since the company’s last quarterly

report. As of July 19, 2024, total filled prescriptions were

generated by more than 8,200 cumulative prescribers.

- Phathom continues to make significant progress securing and

expanding commercial coverage for VOQUEZNA. Over 116 million

commercially covered lives in the U.S. now have access to VOQUEZNA

tablets, comprising an estimated 77% of total U.S. commercial

lives. On July 30, 2024, Phathom announced that CVS Caremark, the

largest pharmacy benefit manager (PBM) in the U.S., added VOQUEZNA

tablets to its national formularies for its more than 26 million

commercially insured members. In addition, UnitedHealthcare, one of

the largest commercial health plans in the U.S., added VOQUEZNA

tablets to its national Prescription Drug List (PDL) for its more

than 12 million Employer and Individual (Commercial) members.

Recent Business and Regulatory Highlights:

- On July 18, 2024, Phathom announced the FDA approval of

VOQUEZNA 10 mg tablets for the relief of heartburn associated with

Non-Erosive GERD in adults. This marked the third FDA approval for

VOQUEZNA, which is also approved to treat all severities of Erosive

GERD and related heartburn, and in combination with antibiotics for

the eradication of Helicobacter pylori (H. pylori) infection. The

approval was supported by the positive results from the

PHALCON-NERD-301 study, where VOQUEZNA met its primary endpoint by

demonstrating a significant and rapid reduction of heartburn with

daily treatment. VOQUEZNA represents the first major innovation in

GERD treatment in over 30 years and the only FDA-approved treatment

of its kind available in the U.S.

- Phathom plans to initiate a separate Phase 3 Non-Erosive GERD

program later this year to investigate As Needed dosing of VOQUEZNA

for active heartburn episodes, a unique and differentiated dosing

regimen for which PPIs are not approved in the U.S.

- Phathom plans to initiate a Phase 2 study to investigate

VOQUEZNA as a potential treatment for Eosinophilic Esophagitis

(EoE) in adults and adolescents by the end of the year.

Second Quarter Financial Results:

- Revenue: Net revenues for the second quarter

2024 were $7.3 million related to sales of VOQUEZNA,

VOQUEZNA TRIPLE PAK, and VOQUEZNA DUAL PAK. There were no revenues

for the second quarter 2023 due to the launch of VOQUEZNA taking

place in the fourth quarter 2023.

- Research and development (R&D) expenses:

R&D expenses for the second quarter 2024 were $7.4 million, a

decrease of $5.4 million compared to $12.8 million for second

quarter 2023. The decrease was a result of lower chemistry

manufacturing and controls activity, decreased personnel costs, and

lower clinical trial expenses due to the wrap-up of activities

related to the Phase 3 PHALCON-NERD-301 daily dosing study.

- Selling, general and administrative (SG&A)

expenses: SG&A expenses for the second quarter 2024

were $75.9 million, an increase of $57.0 million compared to $18.9

million for second quarter 2023. The increase was a result of

higher personnel costs and increased activity related to the

ongoing buildout of commercial infrastructure and marketing

activity in support of the launch of VOQUEZNA products.

- Net loss: Net loss for the second quarter 2024

was $91.4 million, compared to $41.0 million for the second quarter

2023. Second quarter 2024 net loss included a non-cash charge

related to stock-based compensation of $6.1 million compared to

$7.3 million for second quarter 2023. Non-GAAP adjusted net loss

for the second quarter 2024 was $73.3 million compared to $27.8

million for the same period in 2023. These non-GAAP adjusted net

losses, more fully described below under "Non-GAAP Financial

Measures," exclude non-cash stock-based compensation charges,

non-cash interest expense related to the accounting for our revenue

interest financing liability, which are in excess of the actual

interest owed, and interest expense related to the amortization of

debt discount on our term loan. A reconciliation of the GAAP

financial results to non-GAAP financial results is included in the

tables below.

- Cash and cash equivalents: As of June 30,

2024, cash and cash equivalents were $276.2 million. Up to an

additional $125.0 million is also available under the Company’s

term loan with Hercules.

- Cash runway: Based on its current cash

resources and operating plan, including expected product revenues,

and the funds potentially available under its existing term loan,

the Company believes it will have sufficient capital to fund

operations through the end of 2026.

Conference Call and WebcastPhathom will host a

conference call and webcast to discuss its second quarter financial

results and business highlights today, August 8, 2024, at 8:30 am

ET. A live webcast will be available on the investors page of

Phathom’s website under Events & Presentations. A replay of the

webcast will be available following the completion of the event and

will be archived for up to 90 days.

Non-GAAP Financial MeasuresThis press release

includes financial results prepared in accordance with accounting

principles generally accepted in the United States (GAAP), and also

certain non-GAAP financial measures. In particular, Phathom has

provided non-GAAP adjusted net loss and adjusted net loss per

share, adjusted to exclude the items below. Non-GAAP financial

measures are not an alternative for financial measures prepared in

accordance with GAAP. However, Phathom believes the presentation of

non-GAAP adjusted net loss and adjusted net loss per share, when

viewed in conjunction with GAAP results, provides investors with a

more meaningful understanding of ongoing operating performance.

These measures exclude (i) non-cash stock-based compensation, which

is substantially dependent on changes in the market price of common

shares, (ii) interest expense related to the accounting for our

revenue interest financing liability, which are in excess of the

actual interest owed, and (iii) interest expense related to the

amortization of debt discount on our term loan.

Phathom believes the presentation of these non-GAAP financial

measures provides useful information to management and investors

regarding Phathom's results of operations. When GAAP financial

measures are viewed in conjunction with these non-GAAP financial

measures, investors are provided with a more meaningful

understanding of Phathom's ongoing operating performance and are

better able to compare Phathom's performance between periods. In

addition, these non-GAAP financial measures are among those

indicators Phathom uses as a basis for evaluating performance, and

planning and forecasting future periods. These non-GAAP financial

measures are not intended to be considered in isolation or as a

substitute for GAAP financial measures. A reconciliation between

these non-GAAP measures and the most directly comparable GAAP

measures is provided later in this press release.

About Phathom Pharmaceuticals, Inc.Phathom

Pharmaceuticals is a biopharmaceutical company focused on the

development and commercialization of novel treatments for

gastrointestinal diseases. Phathom has in-licensed the exclusive

rights to vonoprazan, a first-in-class potassium-competitive acid

blocker (PCAB) that is currently marketed in the United States as

VOQUEZNA® (vonoprazan) tablets for the treatment of heartburn

associated with Non-Erosive GERD in adults, the healing and

maintenance of healing of Erosive GERD in adults and associated

heartburn, in addition to VOQUEZNA® TRIPLE PAK® (vonoprazan

tablets, amoxicillin capsules, clarithromycin tablets) and

VOQUEZNA® DUAL PAK® (vonoprazan tablets, amoxicillin capsules) for

the treatment of H. pylori infection in adults. For more

information about Phathom, visit the company’s website at

www.phathompharma.com and follow on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements.

Investors are cautioned not to place undue reliance on these

forward-looking statements, including statements about the timing

of commencement of the Phase 3 As Needed dosing Non-Erosive GERD

and Phase 2 EoE trials, the availability of additional funds under

our term loan agreement, future growth in demand and our ability to

secure additional commercial coverage for our products, and our

cash runway. The inclusion of forward-looking statements should not

be regarded as a representation by Phathom that any of its plans

will be achieved. Actual results may differ from those set forth in

this press release due to the risks and uncertainties inherent in

Phathom’s business, including, without limitation: we may not be

able to successfully commercialize VOQUEZNA, VOQUEZNA TRIPLE PAK

and VOQUEZNA DUAL PAK, which will depend on a number of factors

including coverage and reimbursement levels from governmental

authorities and health insurers as well as market acceptance by

healthcare providers; we may use our capital resources sooner than

expected, or our operating plan may overestimate our expected

product revenues, which could require us to reduce expenses or

raise additional capital sooner than expected; the inherent risks

of clinical development of vonoprazan; Phathom’s dependence on

third parties in connection with product manufacturing, research

and preclinical and clinical testing; regulatory developments in

the United States and foreign countries; unexpected adverse side

effects or inadequate efficacy of vonoprazan that may limit its

development, regulatory approval and/or commercialization, or may

result in recalls or product liability claims; Phathom’s ability to

obtain and maintain intellectual property protection and non-patent

regulatory exclusivity for vonoprazan; Phathom’s estimates

regarding patient population and commercial coverage could prove to

be inaccurate; and other risks described in the Company’s prior

press releases and the Company’s filings with the Securities and

Exchange Commission (SEC), including under the heading “Risk

Factors” in the Company’s most recent Annual Report on Form 10-K

and any subsequent filings with the SEC. You are cautioned not to

place undue reliance on these forward-looking statements, which

speak only as of the date hereof, and Phathom undertakes no

obligation to update such statements to reflect events that occur

or circumstances that exist after the date hereof. All

forward-looking statements are qualified in their entirety by this

cautionary statement, which is made under the safe harbor

provisions of the Private Securities Litigation Reform Act of

1995.

MEDIA CONTACTNick

Benedetto1-877-742-8466media@phathompharma.com

INVESTOR CONTACTEric

Sciorilli1-877-742-8466ir@phathompharma.com

|

|

|

Selected Condensed Balance Sheets(in

thousands)(unaudited) |

|

|

|

|

|

|

|

|

|

June 30,2024 |

|

December 31,2023 |

|

Assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

276,237 |

|

|

$ |

381,393 |

|

| Total assets |

|

$ |

319,376 |

|

|

$ |

413,842 |

|

| Total liabilities |

|

$ |

553,205 |

|

|

$ |

486,601 |

|

| Total stockholders’ deficit |

|

$ |

(233,829 |

) |

|

$ |

(72,759 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

Statements of Operations and Comprehensive

Loss(in thousands, except share and per share

amounts)(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

Three Months

EndedJune 30, |

|

Six Months

EndedJune 30, |

|

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Product revenue, net |

|

$ |

7,324 |

|

|

$ |

- |

|

|

$ |

9,236 |

|

|

$ |

- |

|

| Cost of revenue |

|

|

1,376 |

|

|

|

- |

|

|

|

1,802 |

|

|

|

- |

|

| Gross profit |

|

|

5,948 |

|

|

|

- |

|

|

|

7,434 |

|

|

|

- |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

7,376 |

|

|

|

12,764 |

|

|

|

16,806 |

|

|

|

24,242 |

|

|

Selling, general and administrative |

|

|

75,872 |

|

|

|

18,937 |

|

|

|

137,882 |

|

|

|

37,536 |

|

| Total operating expenses |

|

|

83,248 |

|

|

|

31,701 |

|

|

|

154,688 |

|

|

|

61,778 |

|

| Loss from operations |

|

|

(77,300 |

) |

|

|

(31,701 |

) |

|

|

(147,254 |

) |

|

|

(61,778 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

3,624 |

|

|

|

348 |

|

|

|

7,937 |

|

|

|

1,808 |

|

|

Interest expense |

|

|

(17,764 |

) |

|

|

(9,615 |

) |

|

|

(34,932 |

) |

|

|

(18,832 |

) |

|

Other (expense) income, net |

|

|

(6 |

) |

|

|

3 |

|

|

|

(49 |

) |

|

|

23 |

|

| Total other expense |

|

|

(14,146 |

) |

|

|

(9,264 |

) |

|

|

(27,044 |

) |

|

|

(17,001 |

) |

| Net loss and comprehensive

loss |

|

$ |

(91,446 |

) |

|

$ |

(40,965 |

) |

|

$ |

(174,298 |

) |

|

$ |

(78,779 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(1.56 |

) |

|

$ |

(0.84 |

) |

|

$ |

(2.98 |

) |

|

$ |

(1.73 |

) |

| Weighted-average shares of common

stock outstanding, basic and diluted |

|

|

58,558,145 |

|

|

|

48,500,516 |

|

|

|

58,464,813 |

|

|

|

45,444,496 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Reconciliation of GAAP to Non-GAAP Financial

Measures(in thousands, except share and per share

amounts)(unaudited) |

| |

|

|

|

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

| Reconciliation of GAAP

to Non-GAAP adjusted net loss: |

|

|

|

|

|

|

|

| GAAP net loss |

($91,446 |

) |

|

($40,965 |

) |

|

($174,298 |

) |

|

($78,779 |

) |

|

Stock-based compensation expense (A) |

|

6,099 |

|

|

|

7,253 |

|

|

|

11,725 |

|

|

|

14,301 |

|

| Non-cash interest on revenue

interest financing liability |

|

11,553 |

|

|

|

5,397 |

|

|

|

23,509 |

|

|

|

10,550 |

|

| Interest expense related to

amortization of debt discount |

|

499 |

|

|

|

523 |

|

|

|

974 |

|

|

|

1,019 |

|

| Non-GAAP adjusted net

loss |

($73,295 |

) |

|

($27,792 |

) |

|

($138,090 |

) |

|

($52,909 |

) |

|

|

|

|

|

|

|

|

|

| Reconciliation of GAAP

to Non-GAAP adjusted net loss per share — basic and

diluted: |

|

|

|

|

|

|

|

| GAAP net loss per share —

basic and diluted |

($1.56 |

) |

|

($0.84 |

) |

|

($2.98 |

) |

|

($1.73 |

) |

| Stock-based compensation

expense (A) |

|

0.10 |

|

|

|

0.15 |

|

|

|

0.20 |

|

|

|

0.31 |

|

| Non-cash interest on revenue

interest financing liability |

|

0.20 |

|

|

|

0.11 |

|

|

|

0.40 |

|

|

|

0.23 |

|

| Interest expense related to

amortization of debt discount |

|

0.01 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.02 |

|

| Non-GAAP net loss per share —

basic and diluted |

($1.25 |

) |

|

($0.57 |

) |

|

($2.36 |

) |

|

($1.17 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (A) Stock-based

compensation consists of the following: |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Research and development |

1,331 |

|

|

1,803 |

|

|

2,580 |

|

|

3,580 |

|

|

Selling, general and administrative |

4,768 |

|

|

5,450 |

|

|

9,145 |

|

|

10,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

© 2024 Phathom Pharmaceuticals. All rights reserved. VOQUEZNA,

VOQUEZNA DUAL PAK, VOQUEZNA TRIPLE PAK, Phathom Pharmaceuticals,

and their respective logos are registered trademarks of Phathom

Pharmaceuticals, Inc.

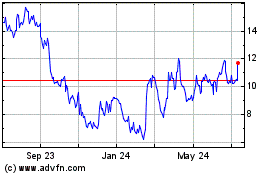

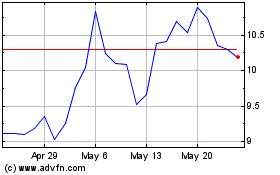

Phathom Pharmaceuticals (NASDAQ:PHAT)

Historical Stock Chart

From Jan 2025 to Feb 2025

Phathom Pharmaceuticals (NASDAQ:PHAT)

Historical Stock Chart

From Feb 2024 to Feb 2025