true000185027000018502702023-11-102023-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 10, 2023 |

PROKIDNEY CORP.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Cayman Islands |

001-40560 |

98-1586514 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2000 Frontis Plaza Blvd. Suite 250 |

|

Winston-Salem, North Carolina |

|

27103 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 336 999-7029 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A ordinary shares, $0.0001 par value per share |

|

PROK |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Current Report on Form 8-K/A (the “Amendment”) updates information originally provided under Item 5.02 in a Current Report on Form 8-K filed on November 13, 2023 (the “Original 8-K”), in which ProKidney Corp. (the “Company”) reported, among other things, that Bruce J. Culleton was appointed to serve as the Company’s Chief Executive Officers and a member of the Company’s Board of Directors, effective November 15, 2023. This Amendment is being filed solely for the purpose of providing a brief description of the material compensation arrangements being provided to Mr. Culleton in connection with his appointment as Chief Executive Officer. This Amendment does not otherwise modify or update any other disclosure contained in the Original 8-K, and should be read in conjunction with the Original 8-K.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In connection with Mr. Culleton’s appointment to serve as the Company’s Chief Executive Officer, on December 3, 2023, Dr. Culleton and ProKidney, LLC, a Delaware limited company and subsidiary of the Company, entered into an employment agreement, effective as of November 15, 2023 (the “Employment Agreement”), pursuant to which Dr. Culleton will serve as Chief Executive Officer of the Company and its subsidiaries and affiliates.

Pursuant to the terms of the Employment Agreement, Dr. Culleton’s annual base salary is $625,000, which may be increased by the Board of Directors or the Talent and Compensation Committee in its discretion. Dr. Culleton is eligible to receive an annual discretionary bonus with an initial target of 60% of his base salary, which will be prorated for the 2023 fiscal year. Dr. Culleton is also eligible to participate in the Company’s employee health and welfare benefit and retirement programs.

In addition, on December 3, 2023, and in connection with his entry into the Employment Agreement, Dr. Culleton received an option award under the Company’s 2022 Incentive Equity Plan to purchase 3,000,000 Class A ordinary shares of the Company at an exercise price of $1.69 (the “CEO Option Award”). With respect to 2,000,000 Class A ordinary shares subject to the CEO Option Award, the shares will vest as to 25% of the shares on November 15, 2024, and the remainder in equal quarterly installments over the following three years. With respect to 1,000,000 Class A ordinary shares subject to the CEO Option Award, the shares will vest subject to the achievement of both time and performance vesting conditions, with 25% of the shares vesting on November 15, 2024 and the remaining shares vesting in equal quarterly installments over the following three years, subject to the achievement of certain performance milestones.

The foregoing description of the Employment Agreement is not complete and is qualified in its entirety by reference to the full text of the Employment Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

The exhibits filed as part of this Current Report on Form 8-K are listed in the index to exhibits immediately preceding the signature page to this Current Report on Form 8-K, which index to exhibits is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

PROKIDNEY CORP. |

|

|

|

|

Date: |

December 5, 2023 |

By: |

/s/ Todd Girolamo |

|

|

|

Name: Todd Girolamo

Title: Chief Legal Officer |

Exhibit 10.1

November 15, 2023

Bruce Culleton, MD

93 Worcester Street

Wellesley, MA 02481

Dear Bruce:

This letter agreement (this “Agreement”) sets forth the terms and conditions of your continued employment with ProKidney, LLC, a Delaware limited liability company (the “Company”) as of November 15, 2023 (the “Effective Date”). This Agreement will govern your employment with the Company following the Effective Date on the following terms and conditions:

|

|

Term: |

The term of your employment with the Company will terminate upon delivery to you of notice to such effect, which notice may be given for any or no reason, or upon your earlier resignation, death or disability (as customarily defined by the Company). You acknowledge that no provision contained in this Agreement will entitle you to remain in the employment of the Company or any of its subsidiaries or affiliates or affect the right of the Company to terminate your employment hereunder at any time for any reason, subject to compliance with the termination provisions set forth herein. The period during which you are employed by the Company pursuant to this Agreement shall be referred to as the “Term.” |

Position: |

Chief Executive Officer |

Reporting: |

You will report directly to Board of Directors (the “Board”) of ProKidney Corp. (“Parent”). |

Duties and Commitment: |

You shall be employed by the Company on a full-time basis and shall perform such duties and responsibilities on behalf of the Company and its subsidiaries and affiliates (collectively, the “Company Group”) as are consistent with your position, and such additional duties and responsibilities on behalf of the Company Group, as may be designated from time to time by the Board. You will be required to devote all of your business time to the business and affairs of the Company Group and to the promotion of its interests. Notwithstanding the foregoing, you may engage in other activities, such as personal investments and civic and charitable activities, so long as: (i) such activities do not interfere with your duties and obligations hereunder and (ii) such activities are disclosed in advance to the Board. In addition, you |

|

|

|

shall be permitted to serve as a director on one other company’s board of directors subject to the prior consent of the Board (which will not be unreasonably withheld). |

Base Salary: |

During the Term, your annual base salary will be $625,000 per year and will be payable in accordance with the Company’s normal payroll practices, less the applicable taxes and elective withholdings. Your base salary may be increased, but not decreased, as determined by the Board or the Compensation Committee of the Board (the “Compensation Committee”). |

Incentive Bonus Eligibility: |

During the Term, you will be eligible for an annual cash bonus pursuant to the Company’s annual cash bonus program based on the achievement of performance criteria established by the Compensation Committee for the applicable fiscal year, which may be corporate goals and/or individual criteria. Your initial target bonus will be in an amount equal to 60% of your base salary (“Target Bonus”). The actual amount of any bonus earned shall be determined by the Compensation Committee based on achievement of the applicable performance criteria after the end of the applicable fiscal year. For purposes of the 2023 fiscal year, your actual bonus will be prorated based on your start date with the Company and your actual base salary in effect over that period. |

|

Except as otherwise provided herein, you will be entitled to receive any earned bonus for a fiscal year of the Company if you are employed on the payment date for such bonus. |

Long-Term Incentive: |

In connection with your promotion to becoming the Company’s Chief Executive Officer, the Company will recommend that the Compensation Committee grant to you under the ProKidney Corp. 2022 Incentive Equity Plan (the “Incentive Equity Plan”) (or any successor plan thereto) an option award to purchase 3,000,000 Class A ordinary shares of the Company at an exercise price of equal to to the greater of (i) the thirty day average stock price of the Company’s Class A Shares on the Nasdaq Stock Market (“NASDAQ”) as of the date of grant (the “Grant Date”) and (ii) the closing price of the Company’s Class A Shares on NASDAQ as of the Grant Date (the “CEO Option Award”). The vesting terms for the CEO Option Award are set forth on Appendix A to this Agreement. As a result of receiving the CEO Option Award, you will not be eligible for an equity award under the Incentive Equity Plan in 2024. Thereafter, commencing in 2025, you will be eligible to receive long-term incentive awards pursuant to the terms of the Plan at the discretion of the Compensation Committee and in accordance with market guidelines for your role as approved by the Compensation Committee. |

Benefits: |

During your employment with the Company, you will be eligible for participation in employee health and welfare benefits programs, retirement |

2

|

|

|

programs, and other fringe benefits maintained by the Company, to the extent consistent with applicable law and the terms of the applicable plans and programs, which may include certain plans and programs available to similarly situated executives of the Company or otherwise applicable to your position from time to time, subject to all plan terms and eligibility requirements. The benefit plans and programs for which you may be eligible are more fully described in the applicable plan summaries and related documents. The Company retains all rights to amend or terminate any such benefit plans and programs, subject to the terms of such employee benefit plans and programs and applicable law, and nothing contained herein shall obligate the Company to continue any benefit plans or programs in the future. |

|

You will be eligible to receive vacation in accordance with the terms of the Company’s vacation/Paid Time Off “PTO” policy. |

Business Expenses: |

During the Term, the Company will reimburse you for reasonable business expenses, including travel, entertainment, and other expenses (including a mobile phone and data service) incurred by you in the furtherance of the performance of your duties hereunder, in accordance with the Company’s Travel and Entertainment policy as in effect from time to time. |

Termination: |

(a) Upon your termination of employment for any reason, the Company shall pay to you (i) your base salary earned through the date of such termination, (ii) amounts for accrued but unused vacation days in the year of termination and (iii) any unreimbursed business expenses in accordance with the Company’s reimbursement policy, not later than thirty (30) business days after the customary documentation regarding such expenses has been received and only to the extent that such expenses are submitted within one year of your termination (collectively, “Accrued Amounts”). |

|

(b) In the event your employment is terminated during the Term by the Company without Cause (as defined below) or by you for Good Reason (as defined below), in addition to the Accrued Amounts, you will be entitled to receive, subject to your timely execution and non-revocation of a Release (as defined below) (i) any earned but unpaid bonus for any prior completed fiscal year, payable when such payments would otherwise be paid, (ii) salary continuation for a period of 12 months following your termination date, payable in accordance with the Company’s normal payroll cycle and (iii) continued participation in the Company’s group health plan at active employee rates for a period of 12 months following your termination date. Notwithstanding the foregoing, upon a termination of your employment by the Company without Cause or by you for Good Reason within 18 months following a Change in Control (as defined in the Incentive Equity Plan), in addition to the Accrued Amounts, you will be entitled to receive, subject to your timely execution and non-revocation of a Release (i) a lump sum |

3

|

|

|

payment equal to 1.5 times the sum of your then-current base salary as of immediately prior to the Change in Control and 100% of your then-current Target Bonus, (ii) continued participation in the Company’s group health plan at active employee rates for a period of eighteen (18) months following your termination date and (iii) full vesting of any equity awards then outstanding held by you (with any performance-based equity awards vesting at “target” levels), including the CEO Option Award. Notwithstanding anything to the contrary set forth in this Agreement and any terms set forth in an award agreement relating to the grant of equity awards to you, the terms of the applicable award agreement shall prevail. |

|

(c) In the event that your employment is terminated other than for reasons described in subsection (b) above, other than the amounts specified in subsection (a) above, you will not be entitled to receive any payments under this Agreement. |

|

(d) Payment of any severance payments or benefits pursuant to subsection (b) above is expressly conditioned upon your (i) execution of a general waiver and release of claims substantially in the form attached hereto as Exhibit A (the “Release”), within fifty (50) days of your termination, and the Release becoming effective upon the expiration of the revocation period (which is 7 days after the Release is executed and returned to the Company) and (ii) continued compliance with this Agreement and the Covenant Agreement (as defined below), provided that in the event your employment is terminated by the Company without Cause, and in accordance with applicable law, the Release shall contain a non-competition covenant in a form substantially similar to the non-competition covenant contained in the Covenant Agreement. If an executed Release is not returned to the Company within fifty (50) days of termination or the Release is revoked by you, the Company shall be relieved of all obligations to pay you severance under this Agreement. The payment described in subsection (b)(ii) will be made on the sixtieth (60th) day following your termination of employment. Any payments described in subsection (b)(i) that would have been paid from the termination date through the sixtieth (60th) day following your termination of employment will be paid in a lump sum on the sixtieth (60th) day following your termination and the remaining installments will commence as of the next payroll period following the sixtieth (60th) day following your termination of employment. Notwithstanding the foregoing, if such sixty (60) day period spans two calendar years, then the foregoing payments shall not commence until the second calendar year. All severance payments shall be subject to legally required tax withholdings and any elective withholdings. |

|

(e) For purposes of this Agreement: |

|

“Cause” means (i) any theft, fraud, embezzlement, dishonesty, willful misconduct, breach of fiduciary duty for personal profit, falsification of any documents or records of the Company or any member of the Company |

4

|

|

|

Group, felony or similar act by you (whether or not related to your relationship with the Company); (ii) an act of moral turpitude by you, or any act that causes significant injury to, or is otherwise adversely affecting, the reputation, business, assets, operations or business relationship of the Company (or any member of the Company Group); (iii) any breach by you of any material agreement with or of any material duty of yours to the Company or any member of the Company Group (including breach of confidentiality, non-disclosure, non-use non-competition or non-solicitation covenants towards the Company or any member of the Company Group) or failure to abide by code of conduct or other policies (including, without limitation, policies relating to confidentiality and reasonable workplace conduct); or (iv) any act which constitutes a breach of your fiduciary duty towards the Company or any member of the Company Group including disclosure of confidential or proprietary information thereof or acceptance or solicitation to receive unauthorized or undisclosed benefits, irrespective of their nature, or funds, or promises to receive either, from individuals, consultants or corporate entities that the Company or a Subsidiary does business with; (v) your unauthorized use, misappropriation, destruction, or diversion of any tangible or intangible asset or corporate opportunity of the Company or any member of the Company Group (including, without limitation, the improper use or disclosure of confidential or proprietary information). For the avoidance of doubt, the determination as to whether a termination is for Cause for purposes of this Agreement shall be made in good faith by the Compensation Committee and shall be final and binding on you. |

|

“Good Reason” means the occurrence of any of the following without your consent: (i) a material reduction in your then-current base salary, other than any such reduction that applies generally to similarly situated employees of the Company; (ii) a material diminution in your authority, duties or responsibilities under this Agreement; provided, that you will not have the right to resign for Good Reason pursuant to this provision of the Good Reason definition due to a change in authority, duties or responsibilities solely as a result of Parent or the Company no longer being a publicly traded company; or (iii) a relocation of your principal place of employment by more than 50 miles from its location as of the date hereof. Notwithstanding the foregoing, you will not be deemed to have resigned for Good Reason unless (x) you have provided written notice to the Company of the existence of the circumstances providing grounds for termination for Good Reason within 15 days of the initial existence of such grounds, (y) the Company has not cured such circumstances within 30 days from the date on which such notice is provided and (z) you resign from your employment effective no later than 60 days after the initial existence of such grounds. |

5

|

|

Resignation: |

Effective as of the date of your termination of employment, unless otherwise requested by the Company in writing, you will, automatically and without further action on your part or any other person or entity, resign from all offices, boards of directors (or similar governing bodies) and committees of each member of the Company Group. You agree that you will, at the request of the Company, execute and deliver such documentation as may be required to effect such resignations, and authorize any member of the Company Group to file (or cause to be filed) such documentation, as necessary, with any applicable governmental authority. |

Cooperation: |

In consideration for the promises and payments by the Company pursuant to this Agreement, at the request of the Company, for a one-year period following your termination of employment for any reason, you agree to cooperate to the fullest extent possible with respect to matters involving any member of the Company Group about which you have or may have knowledge, including any such matters which may arise before or after the Term; provided such cooperation shall not unreasonably interfere with any obligations you may have to your current employer at the time. The Company will reimburse you for any reasonable, properly documented out-of-pocket expenses, including your travel expenses and attorneys’ fees that you actually incur in connection with such cooperation. |

Section 409A: |

All references in this Agreement to your termination of employment shall mean your “separation from service” within the meaning of Section 409A of the Code and Treasury regulations promulgated thereunder. This Agreement is intended to comply with Section 409A of the Code or an exemption thereunder and shall be construed and administered in accordance with Section 409A. Any payments under this Agreement that may be excluded from Section 409A either as separation pay due to an involuntary separation from service or as a short-term deferral shall be excluded from Section 409A to the maximum extent possible. In the event the terms of this Agreement would subject you to the imposition of taxes and penalties under Section 409A (“409A Penalties”), the Company and you shall cooperate diligently to amend the terms of this Agreement to avoid such 409A Penalties, to the extent possible; provided that, for the avoidance of doubt, you shall be solely liable for any 409A Penalties incurred by you. To the extent that any amounts payable in installments under this Agreement are reasonably determined to be “nonqualified deferred compensation” within the meaning of Section 409A of the Code, then each such installment shall be treated as a right to receive a series of separate payments and, accordingly, each such installment payment shall at all times be considered a separate and distinct payment as permitted under Section 409A of the Code. Notwithstanding any other provision in this Agreement, if as of the date on which your employment terminates, you are a “specified employee”, as determined by the Company, then with respect to any amount payable or |

6

|

|

|

benefit provided under this Agreement or otherwise that the Company reasonably determines would be nonqualified deferred compensation within the meaning of Section 409A of the Code and that under the terms of this Agreement would be payable prior to the six-month anniversary of your effective date of termination, then if required in order to avoid any penalties under Section 409A of the Code, such payment or benefit shall be delayed until the earlier to occur of (a) the first payroll date following the six-month anniversary of such termination date and (b) the date of your death. With respect to any reimbursements under this Agreement, such reimbursement shall be made on or before the last day of your taxable year following the taxable year in which you incurred the expense. The amount of any expenses eligible for reimbursement or the amount of any in-kind benefits provided, as the case may be, under this Agreement during any calendar year shall not affect the amount of expenses eligible for reimbursement or the amount of any in-kind benefits provided during any other calendar year. The right to reimbursement or to any in-kind benefit pursuant to this Agreement shall not be subject to liquidation or exchange for any other benefit. You acknowledge and agree that notwithstanding any provision of this Agreement, the Company and its affiliates are not providing you with any tax advice with respect to Section 409A of the Code or otherwise and are not making any guarantees or other assurances of any kind to you with respect to the tax consequences or treatment of any amounts paid or payable to you under this Agreement. |

Section 280G: |

If the present value of your Severance Benefits, either alone or together with other payments which you have the right to receive from the Company (the “Benefits”), would constitute a “parachute payment” as defined in Section 280G of the Code, then your Benefits shall be either (i) provided to you in full, or (ii) provided to you only as to such lesser extent that would result in no portion of such Benefits being subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), whichever of the foregoing amounts, taking into account the applicable federal, state, and local income and employment taxes and the Excise Tax, results in the receipt by you, on an after-tax basis, of the greatest amount of benefits, notwithstanding that all or some portion of such Benefits may be taxable under the Excise Tax. Unless the Company and you otherwise agree, any determination required under section shall be made in writing in good faith by the Company’s independent accounting firm or such other nationally or regionally recognized accounting firm selected by the Company (the “Accountants”), whose determination shall be conclusive and binding upon you and the Company for all purposes. In the event that a reduction to the Benefits under this section, the reduction shall apply first to the |

7

|

|

|

Benefits that are not deferred compensation subject to Section 409A of the Code and you shall be given the choice, subject to approval by the Company, of which of such Benefits to reduce; provided, that such reduction achieves the result specified in clause (ii) above of this section. If a reduction in the Benefits that are subject to Section 409A of the Code is required, such Benefits shall be reduced pro rata, but with no change in the time at which such Benefits shall be paid. For purposes of making the calculations required by this section, the Accountants may make reasonable assumptions and approximations concerning applicable taxes and may rely on reasonable, good faith interpretations concerning the application of the Code. The Company and you shall furnish to the Accountants such information and documents as the Accountants may reasonably request in order to make a determination under this section. The Company shall bear all costs the Accountants may reasonably incur in connection with any calculations contemplated by this section. |

As a condition of your employment, you acknowledge and agree that you will continue to be subject to Confidentiality, Non-Competition, Non-Solicitation, and Intellectual Property Assignment Agreement signed by you June 6, 2023 (the “Covenant Agreement”). Notwithstanding any provision in this Agreement, the Covenant Agreement or otherwise to the contrary, nothing in this Agreement, the Covenant Agreement or otherwise precludes or otherwise limits your ability to (A) communicate directly with and provide information, including documents, not otherwise protected from disclosure by any applicable law or privilege to the Securities and Exchange Commission (the “SEC”) or any other federal, state or local governmental agency or commission (“Government Agency”) or self-regulatory organization regarding possible legal violations, without disclosure to the Company, or (B) disclose information which is required to be disclosed by applicable law, regulation, or order or requirement (including without limitation, by deposition, interrogatory, requests for documents, subpoena, civil investigative demand or similar process) of courts, administrative agencies, the SEC, any Government Agency or self-regulatory organizations, provided that you provide the Company with prior notice of the contemplated disclosure and cooperate with the Company in seeking a protective order or other appropriate protection of such information. The Company may not retaliate against you for any of these activities.

You represent that your performance of all of the terms of this Agreement and the performance of the services for the Company Group do not and will not breach or conflict with any agreement with a third party, including an agreement not to compete or to keep in confidence any proprietary information of another entity acquired by you in confidence or in trust prior to the date of this Agreement. You agree that you will not enter into any agreement that conflicts with this Agreement at any time prior to the Effective Date or during the term of your employment with the Company.

All payments made under this Agreement shall be reduced by any tax or other amounts required to be withheld under applicable law.

The parties hereby agree that any suit, action or proceeding seeking to enforce any provision of, or based on any matter arising out of or in connection with, this Agreement shall only

8

be brought in the Chancery Court of the State of Delaware (or other appropriate state court in the State of Delaware) or the Federal courts located in the State of Delaware and not in any other State or Federal courts located in the United States of America or any court in any other country, and each of the parties hereby consents to the jurisdiction of such courts (and of the appropriate appellate courts therefrom) in any such suit, action or proceeding and irrevocably waives, to the fullest extent permitted by law, any objection that it may now or hereafter have to the laying of the venue of any such suit, action or proceeding in any such court or that any such suit, action or proceeding which is brought in any such court has been brought in an inconvenient form. The parties hereby agree that process in any such suit, action or proceeding may be served on either party anywhere in the world, whether within or without the jurisdiction of any such court. EACH OF THE PARTIES HERETO HEREBY IRREVOCABLY WAIVES ANY AND ALL RIGHTS TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATED TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY.

This Agreement shall be governed, construed, interpreted and enforced in accordance with its express terms, and otherwise in accordance with the substantive laws of the State of Delaware, without reference to the principles of conflicts of law or choice of law of the State of Delaware, or any other jurisdiction, and where applicable, the laws of the United States.

The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

The terms of this Agreement and the Covenant Agreement are intended by the parties to be the final expression of their agreement with respect to your employment by the Company and supersede, effective as of the Effective Date, all prior understandings and agreements with respect to your employment by the Company, whether written or oral. For the avoidance of doubt, if the Effective Date does not occur, this Agreement will be void ab initio.

By signing this Agreement, you acknowledge that the terms of this Agreement are confidential and may not be disclosed in any manner or form to any party, other than as required by applicable law (including any public disclosure requirements) or as necessary to enforce the terms of this Agreement or to your spouse, attorney and/or tax advisor (if any), without the prior written approval of the Company. You further acknowledge that you will be bound by the terms and conditions contained in the Company’s employee handbook, as it may be amended from time to time to the extent not inconsistent with this Agreement and will, upon request of the Company, sign a copy thereof from time to time.

The rights and benefits under this Agreement are personal to you and such rights and benefits shall not be subject to assignment, alienation or transfer, except to the extent such rights and benefits are lawfully available to your estate or any of your beneficiaries upon your death. The Company may assign this Agreement to any affiliate or subsidiary at any time and shall require any entity which at any time becomes a successor, whether by merger, purchase, or otherwise, or otherwise acquires all or substantially all of the assets, membership interests or business of the Company, to expressly assume this Agreement.

9

This Agreement may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together will constitute one and the same Agreement. Signatures delivered by facsimile shall be deemed effective for all purposes.

[Signature page follows]

10

Please sign and date this Agreement in the space indicated and return it to my attention to evidence your understanding and acceptance of the terms set forth herein.

|

|

Sincerely, PROKIDNEY |

By: |

/s/ Pablo Legorreta |

Name: Pablo Legorreta |

Position: Chairman |

|

Agreed to and Accepted: /s/ Bruce Culleton, MD |

Bruce Culleton, MD Date: 12/3/2023 |

11

v3.23.3

Document And Entity Information

|

Nov. 10, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Amendment Flag |

true

|

| Document Period End Date |

Nov. 10, 2023

|

| Entity Registrant Name |

PROKIDNEY CORP.

|

| Entity Central Index Key |

0001850270

|

| Entity Emerging Growth Company |

true

|

| Entity File Number |

001-40560

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Tax Identification Number |

98-1586514

|

| Entity Address, Address Line One |

2000 Frontis Plaza Blvd.

|

| Entity Address, Address Line Two |

Suite 250

|

| Entity Address, City or Town |

Winston-Salem

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

27103

|

| City Area Code |

336

|

| Local Phone Number |

999-7029

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Ex Transition Period |

false

|

| Title of 12(b) Security |

Class A ordinary shares, $0.0001 par value per share

|

| Trading Symbol |

PROK

|

| Security Exchange Name |

NASDAQ

|

| Amendment Description |

This Current Report on Form 8-K/A (the “Amendment”) updates information originally provided under Item 5.02 in a Current Report on Form 8-K filed on November 13, 2023 (the “Original 8-K”), in which ProKidney Corp. (the “Company”) reported, among other things, that Bruce J. Culleton was appointed to serve as the Company’s Chief Executive Officers and a member of the Company’s Board of Directors, effective November 15, 2023. This Amendment is being filed solely for the purpose of providing a brief description of the material compensation arrangements being provided to Mr. Culleton in connection with his appointment as Chief Executive Officer. This Amendment does not otherwise modify or update any other disclosure contained in the Original 8-K, and should be read in conjunction with the Original 8-K.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

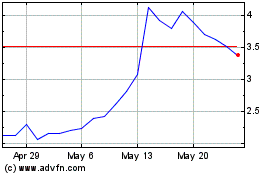

ProKidney (NASDAQ:PROK)

Historical Stock Chart

From Apr 2024 to May 2024

ProKidney (NASDAQ:PROK)

Historical Stock Chart

From May 2023 to May 2024