false

0001820630

0001820630

2024-01-08

2024-01-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

January 8, 2024

| Proterra Inc |

| (Exact name of registrant as specified in its charter) |

| |

| Delaware |

001-39546 |

90-2099565 |

(State or other jurisdiction

of incorporation) |

(Commission

File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

1815 Rollins Road

Burlingame, California 94010 |

| (Address of principal executive offices, including zip code) |

| |

| (864) 438-0000 |

| (Registrant’s Telephone Number, Including Area Code) |

| |

| N/A |

| (Former Name or Former Address, if Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| |

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging

growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

As previously disclosed, on August 7, 2023, Proterra Inc, a Delaware

corporation (the “Company”), and its subsidiary Proterra Operating Company, Inc. (collectively, the “Debtors”)

filed voluntary petitions under Chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States

Bankruptcy Court for the District of Delaware (such court, the “Bankruptcy Court” and such proceedings, the “Chapter

11 Cases”). The Chapter 11 Cases are currently jointly administered under the caption In re Proterra Inc, Case No. 23-11120

(BLS). The Debtors continue to operate their businesses as “debtors-in-possession” under the jurisdiction of the Bankruptcy

Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court.

As previously disclosed, on November 13, 2023, the Company entered into

a certain asset purchase agreement (as subsequently amended on December 1, 2023 and December 15, 2023, the “Battery Leases APA”)

with Phoenix Motor Inc. (“Phoenix”) to sell certain battery leases of the Company and other related assets used in the conduct

of the Proterra Transit business (the “Battery Leases Assets”) to Phoenix (such sale, the “Battery Leases Sale”).

On January 11, 2024, the Company and Phoenix entered into a third

amendment to the Battery Leases APA to reflect, among other terms, an outside closing date of January 23, 2024 for the Battery Leases

Sale.

Item 8.01 Other Events

Closing of the Transit Sale

As previously disclosed, on November 13, 2023, following a Bankruptcy

Court-supervised process pursuant to Bankruptcy Court-approved bidding procedures, the Company entered into a certain asset purchase agreement

(as subsequently amended on December 1, 2023 and December 15, 2023, the “Transit APA”) with Phoenix, for the sale of substantially

all of the Company’s assets used in the conduct of the Proterra Transit business (the “Transit Assets”) to Phoenix as

described in the Transit APA (the “Transit Sale”). The Transit Sale was subject to the approval of the Bankruptcy Court. The

Bankruptcy Court entered an Order (as defined below) approving the Transit Sale on January 9, 2024.

On January 11, 2024, the Company and Phoenix consummated the Transit

Sale. The aggregate final purchase price of the Transit Assets was $3.5 million.

The Company expects that no proceeds from the Transit Sale will

be distributed to the Company’s stockholders. The Chapter 11 Cases remain pending. The terms of the proposed First Amended Joint

Chapter 11 Plan of Reorganization for Proterra Inc and its Debtor Affiliate, as filed with the Bankruptcy Court on January 2, 2024,

provide that holders of the Company’s common stock will not receive any recovery on account of those shares following the conclusion

of the Chapter 11 Cases.

Bankruptcy Court Approval of the Transit Sale and Battery Leases Sale

On January 9, 2024, the Bankruptcy Court entered an order (the

“Order”) (i) authorizing and approving the Company’s entry into the previously announced Transit APA, pursuant to which

Phoenix agreed to acquire the Transit Assets, (ii) authorizing and approving the Company’s entry into the previously announced Battery

Leases APA, pursuant to which Phoenix agreed to acquire the Battery Leases Assets, (iii) authorizing the Transit Sale and the Battery

Leases Sale, (iv) approving the Debtors’ assumption and assignment of certain contracts and leases to Phoenix and (v) granting related

relief.

A copy of the press release announcing the entry of the Order is

attached as Exhibit 99.1 to this Current Report on Form 8-K (“Form 8-K”) and incorporated into this Item 8.01 by reference.

The Transit APA, the Battery Leases APA, the Order, as well as other filings

for the Company’s bankruptcy proceedings and further information regarding such proceedings can be accessed free of charge at a

website maintained by the Company’s claims, noticing, and solicitation agent, Kurtzman Carson Consultants LLC, at www.kccllc.net/proterra.

The information in that website or available elsewhere is not incorporated by reference and does not constitute part of this Form 8-K.

Cautionary Note Regarding Trading in the Company’s

Common Stock

The Company’s stockholders are cautioned that trading in shares of

the Company’s common stock during the pendency of the Company’s bankruptcy proceedings will be highly speculative and will

pose substantial risks. The terms of the proposed First Amended Joint Chapter 11 Plan of Reorganization for Proterra Inc and its Debtor

Affiliate, as filed with the Bankruptcy Court on January 2, 2024, provide that holders of the Company’s common stock will not

receive any recovery on account of those shares following the conclusion of the bankruptcy proceedings. As a result, the shares of common

stock may have little or no value. Trading prices for the Company’s common stock may bear little or no relation to the absence of

any recovery by holders thereof in the Company’s bankruptcy proceedings. Accordingly, the Company urges extreme caution with respect

to existing and future investments in its common stock.

Cautionary Note Regarding Forward-Looking Statements

This Form 8-K contains forward-looking statements within the meaning of

Section 27A of the Securities Act and Section 21E of the Exchange. The Company’s actual results may differ materially from those

anticipated in these forward-looking statements as a result of certain risks and other factors, including risks and uncertainties relating

to the Company’s Chapter 11 Cases. Many factors could cause actual future events to differ materially from the forward-looking statements

in this Form 8-K, including risks and uncertainties set forth in the sections entitled “Risk Factors” in the Company’s

Annual Report for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March

17, 2023, as amended on May 1, 2023, the Company’s quarterly report for the three and nine months ended September 30, 2023, filed

on November 6, 2023 or the Company’s other filings with the SEC. The forward-looking statements included in this Form 8-K speak

only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes

no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future

events, or otherwise. The Company does not give any assurance that it will achieve its expectations.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 12, 2024

| |

PROTERRA, INC. |

|

| |

|

|

|

|

| |

By: |

/s/ Gareth T. Joyce |

|

| |

|

Name: |

Gareth T. Joyce |

|

| |

|

Title: |

Chief Executive Officer |

|

EXHIBIT

99.1

Proterra

Receives Court Approval for Sale of Proterra Transit Business Line

BURLINGAME,

Calif., Jan. 08, 2024 – Proterra Inc (OTC: PTRAQ) (“Proterra” or the “Company”), a leading innovator

in commercial vehicle electrification technology, today announced that the Company has received approval from the U.S. Bankruptcy Court

for the sale of the Company’s Proterra Transit business line to Phoenix Motor, Inc. (“Phoenix”). Proterra

Transit is a leading manufacturer of zero-emission, electric transit vehicles serving the North American public transportation market.

The

consummation of the transaction remains subject to certain closing conditions.

Additional

Information

All

court filings regarding the Chapter 11 sales process, as well as additional information about Proterra’s Chapter 11 proceedings

are available at https://www.kccllc.net/proterra or by calling call

888-251-3076 for U.S./Canadian calls or 310-751-2617 for international calls.

Moelis

& Company LLC is acting as the Company’s investment banker, FTI Consulting is acting as the Company’s financial advisor,

and Paul Weiss, Rifkind, Wharton & Garrison LLP is acting as the Company’s legal advisor.

About

Proterra

Proterra

is a leader in the design and manufacture of zero-emission electric transit vehicles and EV technology solutions for commercial applications.

With industry-leading durability and energy efficiency based on rigorous U.S. independent testing, Proterra products are proudly designed,

engineered, and manufactured in America, with offices in Silicon Valley and South Carolina. For more information, please visit www.proterra.com.

Cautionary

Note Regarding Forward-Looking Statements

This

press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. The Company’s actual results may differ materially from those anticipated

in these forward-looking statements as a result of certain risks and other factors, including risks and uncertainties relating to the

Company’s Chapter 11 cases. Many factors could cause actual future events to differ materially from the forward-looking statements

in this press release, including risks and uncertainties set forth in the sections entitled “Risk Factors” in the Company’s

Annual Report for the year ended December 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on March

17, 2023, as amended on May 1, 2023, the Company’s quarterly report for the three and nine months ended September 30, 2023, filed

on November 6, 2023 or the Company’s other filings with the SEC. The forward-looking statements included in this press release

speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company

assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information,

future events, or otherwise. The Company does not give any assurance that it will achieve its expectations.

Media

Contact

PR@proterra.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

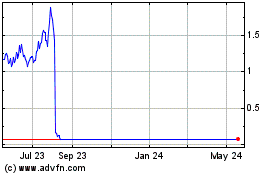

Proterra (NASDAQ:PTRA)

Historical Stock Chart

From Apr 2024 to May 2024

Proterra (NASDAQ:PTRA)

Historical Stock Chart

From May 2023 to May 2024