UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary

Proxy Statement

☐ Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive

Proxy Statement

☒ Definitive

Additional Materials

☐ Soliciting

Material under § 240.14a-12

Qomolangma Acquisition Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement,

if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ No

fee required

☐ Fee

paid previously with preliminary materials

☐ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

PROXY SUPPLEMENT

Supplementary Information

About the Special Meeting of Stockholders

To Be Held on Tuesday, September 12, 2023

The sole purpose of this

proxy statement supplement (this “Supplement”) is to correct and change the record date disclosed in the Notice of Annual

Meeting of Stockholders (the “Notice”) of Qomolangma Acquisition Corp. (the “Company”), included in the Company’s

proxy materials for its Special Meeting of Stockholders filed with the Securities and Exchange Commission on August 21, 2023 (the “Proxy

Statement”). The Notice had incorrectly listed the record date as August 8, 2023. This Supplement updates and amends the Proxy Statement,

as appropriate in the Notice, to state the correct record date of August 9, 2023, as disclosed in other sections of the Proxy Statement.

Except as specifically amended by the information provided herein and reflected in the revised Notice below, all information set forth

in the Proxy Statement remains unchanged.

QOMOLANGMA ACQUISITION CORP.

1178 Broadway, 3rd Floor

New York, NY 10001

NOTICE OF SPECIAL MEETING

TO BE

HELD ON SEPTEMBER 12, 2023

TO THE STOCKHOLDERS OF QOMOLANGMA ACQUISITION CORP.:

You are cordially invited to attend the special meeting (the “special

meeting”) of stockholders of Qomolangma Acquisition Corp. (the “Company,” “we,”

“us” or “our”), to be held at 9:00 a.m., on September 12, 2023. The special

meeting will be held at Kramer Levin Naftalis & Frankel LLP, 1177 Avenue of the Americas, 29th Floor, New York, New York

10036.

At the special meeting, the stockholders will consider and vote

upon the following proposals:

| 1. | | To amend (the “Target Limitation Amendment”) the Company’s

Amended and Restated Certificate of Incorporation (our “charter”) to allow the Company to undertake an initial

business combination with an entity or business (“Target Business”), with a physical presence, operation, or other

significant ties to China (a “China-based Target”) or which may subject the post-business combination business to

the laws, regulations and policies of China (including Hong Kong and Macao), or entity or business that conducts operations in China

through variable interest entities, or VIEs, pursuant to a series of contractual arrangements (“VIE Agreements”)

with the VIE and its shareholders on one side, and a China-based subsidiary of the China-based Target (the “WFOE”),

on the other side (the “Target Limitation Amendment Proposal”). |

| 2. | | A proposal to approve the adjournment of the special meeting to a later date or dates, if

necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes to approve the Target Limitation

Amendment Proposal or if we determine that additional time is necessary to effectuate the foregoing proposals (the “Adjournment

Proposal”). The Adjournment Proposal will only be presented at the special meeting if there are not sufficient votes for,

or otherwise in connection with, the approval of the Target Limitation Amendment Proposal. |

Each of the Target Limitation Amendment Proposal and the Adjournment

Proposal is more fully described in the accompanying proxy statement. You will be able to attend the special meeting at Kramer Levin Naftalis

& Frankel LLP, 1177 Avenue of the Americas, 29th Floor, New York, New York 10036. Please see “Questions and Answers

about the Special Meeting — How do I attend the special meeting?” for more information.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

THE TARGET LIMITATION AMENDMENT PROPOSAL AND, IF PRESENTED, THE ADJOURNMENT PROPOSAL.

The purpose of the Target Limitation Amendment Proposal is to afford

the Company with flexibility to enter into an initial business combination with a China-based Target that conducts its operations through

the use of the VIE structure to manage and control its operations in China. The Company’s IPO prospectus provides that the Company

will not conduct an initial business combination with any target company that conducts its operations through variable interest entities,

or VIEs (the “Target Limitation”). If the Target Limitation Amendment Proposal is approved, the Company will

be allowed to undertake an initial business combination with a China-based Target that operates through a VIE, which will allow the Company

to access a larger pool of target candidates and provide additional flexibility for the Company to consummate an initial business combination

before the final extension date permitted under the Company’s charter. The Board has determined that, given the Company’s

expenditure of time, effort and money on identifying a suitable target business and completion of a business combination, and the market

opportunity the Company has observed in China (including Hong Kong and Macau), it is in the best interests of its stockholders to approve

the Target Limitation Amendment to allow the Company to undertake a business combination with a China-based Target that conducts its operations

through a VIE.

If the Target Limitation Amendment Proposal is approved, there will

be no restriction on the Company to pursue a business combination with a China-based Target that conducts its operations through a VIE.

If we undertake a business combination with a China-based Target, we will be subject to legal and operational risks associated with being

based in the People’s Republic of China (the “PRC”, or “China”). See “The Target

Limitation Amendment Proposal — Risks Related to Acquiring a China-Based Target” for details.

The Company expects that there will be significant redemptions at

the special meeting.

In the event that we enter into a definitive agreement for an initial

business combination prior to the special meeting, we will issue a press release and file a Current Report on Form 8-K with the United States

Securities and Exchange Commission announcing the proposed business combination. The purpose of the Adjournment Proposal is to allow the

Company to adjourn the special meeting to a later date or dates if we determine that additional time is necessary to permit further solicitation

and vote of proxies in the event that there are insufficient votes to approve the Target Limitation Amendment Proposal.

The affirmative vote of at least a majority of the Company’s

outstanding common stock, par value $0.0001 per share, held by the Company’s public stockholders (the “public shares”),

and the outstanding common stock, par value $0.0001 per share, held by the Company’s initial stockholders (the “founder

shares” and, together with the public shares, the “common stock”), will be required to approve

the Target Limitation Amendment Proposal. Approval of the Target Limitation Amendment Proposal is a condition to the Company undertaking

our initial business combination with a China-based Target that conducts its operations through a VIE. Approval of the Adjournment Proposal

requires the affirmative vote of the majority of the votes cast by stockholders represented in person or by proxy at the special meeting.

Our Board has fixed the close of business on August 9, 2023 as the

record date for determining the Company’s stockholders entitled to receive notice of and vote at the special meeting and any adjournment

thereof. Only holders of record of the Company’s common stock on that date are entitled to have their votes counted at the special

meeting or any adjournment thereof. A complete list of stockholders of record entitled to vote at the special meeting will be available

for ten days before the special meeting at the Company’s principal executive offices for inspection by stockholders during

ordinary business hours for any purpose germane to the special meeting.

In connection with the Target Limitation Amendment Proposal, holders

of public shares (“public stockholders”) may elect to redeem their public shares for a per share price, payable

in cash, equal to the aggregate amount then on deposit in the trust account as of two business days prior to such approval, including

interest earned on the funds held in the trust account and not previously released to the Company to pay taxes, divided by the number

of then outstanding public shares (the “Election”), regardless of whether such public stockholders vote on the

Target Limitation Amendment Proposal. If the Target Limitation Amendment Proposal is approved by the requisite vote of stockholders, holders

of public shares that do not make the Election will retain the opportunity to have their public shares redeemed in conjunction with the

consummation of a business combination, subject to any limitations set forth in our charter, as amended. In addition, public stockholders

who do not make the Election would be entitled to have their public shares redeemed for cash if the Company has not completed a business

combination by August 4, 2024.

The Company estimates that the per share price at which the public

shares may be redeemed from cash held in the trust account will be approximately $10.61 at the time of the special meeting. The closing

price of the Company’s common stock on The Nasdaq Stock Market on August 18, 2023, was $11.11. Accordingly, if the market price

were to remain the same until the date of the special meeting, exercising redemption rights would result in a public stockholder receiving

approximately $0.50 less per share than if such stockholder sold the public shares in the open market. The Company cannot assure public

stockholders that they will be able to sell their public shares in the open market, even if the market price per share is higher than

the redemption price stated above, as there may not be sufficient liquidity in its securities when such stockholders wish to sell their

shares.

The Adjournment Proposal, if adopted, will allow our Board to adjourn

the special meeting to a later date or dates, if necessary or appropriate, to permit further solicitation of proxies. The Adjournment

Proposal will be presented to our stockholders only in the event that there are insufficient votes for, or otherwise in connection with,

the approval of the Target Limitation Amendment Proposal.

You are not being asked to vote on a business combination at this

time. If the Target Limitation Proposal is approved and implemented and you do not elect to redeem your public shares in connection with

such approval, you will retain the right to vote on a business combination when it is submitted to the public stockholders (provided that

you are a stockholder on the record date for a meeting to consider a business combination) and the right to redeem your public shares

for a pro rata portion of the trust account in the event a business combination is approved and completed or the Company has not consummated

a business combination by August 4, 2024.

After careful consideration of all relevant factors, our Board

has determined that the Target Limitation Amendment Proposal and, if presented, the Adjournment Proposal are advisable and recommends

that you vote or give instruction to vote “FOR” the Target Limitation Amendment Proposal and, if presented, the Adjournment

Proposal.

Enclosed is the proxy statement containing detailed information concerning

the Target Limitation Amendment Proposal and the Adjournment Proposal and the special meeting. Whether or not you plan to attend the special

meeting, the Company urges you to read this material carefully and vote your shares.

| August 21, 2023 |

By Order of the Board of Directors, |

| |

|

| |

|

| |

Jonathan P. Myers |

| |

Chief Executive Officer, President and Chairman of the Board |

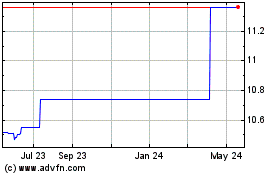

Qomolangma Acquisition (NASDAQ:QOMOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Qomolangma Acquisition (NASDAQ:QOMOU)

Historical Stock Chart

From Apr 2023 to Apr 2024