Rigetti Computing, Inc. (Nasdaq: RGTI) (“Rigetti” or the

“Company”), a pioneer in full-stack quantum-classical computing,

today announced its financial results for the fourth quarter and

year ended December 31, 2024.

Fourth Quarter and Full-Year 2024 Financial

Highlights

- Revenues for the three months ended December 31, 2024 were $2.3

million

- Operating expenses for the three months ended December 31, 2024

were $19.5 million

- Operating loss for the three months ended December 31, 2024 was

$18.5 million

- Net loss for the three months ended December 31, 2024 was

$153.0 million, including $135.1 million of non-cash charges for

the fair value change in the earn-out and derivative warrant

liabilities

- For the year ended December 31, 2024, revenues were $10.8

million, operating expenses were $74.2 million, operating loss was

$68.5 million and net loss was $201.0 million, including $133.9

million of non-cash charges for the fair value change in the

earn-out and derivative warrant liabilities

- As of December 31, 2024 cash, cash equivalents and

available-for-sale securities totaled $217.2 million

- Received net proceeds of $153.3 million during the three months

ended December 31, 2024 from the sale of 88.1 million shares of

common stock through a registered direct offering and completion of

our at-the-market equity offering

- Prepaid in full all remaining amounts owed under our loan

agreement with Trinity Capital, Inc.

Business & Strategic Collaboration

Updates

New strategic collaboration with Quanta

ComputerRigetti has entered into a strategic collaboration

agreement with Quanta Computer, Inc. (“Quanta”), a Taiwan-based

Global Fortune 500 company and the global leader of computer server

manufacturing, with the goal of accelerating the development and

commercialization of superconducting quantum computing. The

companies have committed to investing more than $100 million each

over the next five years pursuant to the collaboration agreement,

with both sides focusing on their complementary strengths to

develop superconducting quantum computing technologies. In

addition, pursuant to a securities purchase agreement, Quanta will

invest $35 million to purchase shares of Rigetti common stock,

subject to regulatory clearance. The agreements were signed on

February 27, 2025.

“Quanta’s collaboration with Rigetti is designed to strengthen

our position in this flourishing market. Our companies’

complementary strengths -- Rigetti as a pioneer in superconducting

quantum technology, with open, modular architecture enabling

integration of innovative solutions across the stack, and Quanta as

the world’s leading notebook/server manufacturer with $43 billion

in annual sales -- will support us in our goal to be at the

forefront of the quantum computing industry,” says Dr. Subodh

Kulkarni, Rigetti CEO.

Montana State University purchases a Novera

QPURigetti sold a Novera QPU to Montana State University

(MSU) in December 2024, which was the Company’s first QPU sale to

an academic institution. The Novera will be located at MSU’s QCORE

to educate and train scientists and engineers on quantum computing

technologies, in addition to being used to create a testbed for

quantum computing R&D. MSU’s QCORE is a new center of

excellence for quantum enabling technologies established to

accelerate workforce development and the regional quantum

innovation ecosystem.

Technology Milestones

84-qubit Ankaa-3 system launches with record high

fidelity Rigetti launched its 84-qubit Ankaa™-3 system in

December 2024. Ankaa-3 features an extensive hardware redesign that

enables superior performance. Rigetti achieved major two-qubit gate

fidelity milestones with Ankaa-3: successfully halving error rates

in 2024 to achieve a 99.0% median iSWAP gate fidelity and

demonstrating 99.5% median fidelity with fSim gates. Rigetti’s

newest flagship quantum computer continues to feature Rigetti’s

scalable, industry-leading chip architecture with 3D signal

delivery while incorporating major enhancements to key

technologies.

Ankaa-3 is available to Rigetti’s partners via the Rigetti

Quantum Cloud Services platform (QCS®) and to the general public

via Microsoft Azure and Amazon Braket.

“We believe that superconducting qubits are the winning modality

for quantum computers given their fast gate speeds and scalability.

We’ve developed critical IP to scale our systems and remain

confident in our plans to scale to 100+ qubits by the end of the

year with a targeted 2x reduction in error rates from the error

rates we achieved at the end of 2024. We believe our leadership in

superconducting quantum computing continues to be reinforced as we

push the boundaries of our system performance, as evidenced by the

success of Ankaa-3,” says Dr. Kulkarni.

Successful AI-powered calibration of a Rigetti

QPUAI-powered tools from Quantum Elements and Qruise

remotely automated the calibration of a Rigetti QPU integrated with

Quantum Machines’ control system. This work was part of the “AI for

Quantum Calibration Challenge” (the “Challenge”) hosted at the

Israeli Quantum Computing Center. The two companies participating

in the Challenge, Quantum Elements and Qruise, automated the

calibration of a 9-qubit Rigetti Novera™ QPU integrated with

Quantum Machines’ advanced OPX1000 control system and NVIDIA DGX

Quantum, a unified system for quantum-classical computing that

NVIDIA built with Quantum Machines. This achievement showcases the

potential of AI in quantum computer calibration and also highlights

the growing collaboration within the quantum computing

ecosystem.

Quantum Elements, Cruise, and Quantum Machines are members of

Rigetti's Novera QPU Partner Program -- an ecosystem of quantum

computing hardware, software, and service providers who build and

offer integral components of a functional quantum computing

system.

“We believe that another advantage we leverage is our modular

approach to developing our technology. By enabling our partners to

integrate their technology with ours, we can explore and advance

creative and flexible ways to improve quantum computing

capabilities,” says Dr. Kulkarni.

Research demonstrating optical reading technique

published in Nature PhysicsJoint research

with QphoX and Qblox demonstrating the ability to readout

superconducting qubits with an optical transducer was recently

published in Nature Physics. This approach to qubit signal

processing could have benefits in building scalable quantum

computers as it could be a more compact, modular approach for

measuring qubit performance in quantum computing systems that rely

on microwave amplification. Current qubit readout techniques used

by superconducting quantum computer systems in cryogenic

environments can be resource intensive from a thermal and power

usage perspective. A potential solution to this problem may be to

replace coaxial cables and other cryogenic components with optical

fibers, which have a considerably smaller footprint and negligible

thermal conductivity. To demonstrate the potential of this

technology, QphoX, Rigetti and Qblox connected a transducer to a

superconducting qubit, with the goal of measuring its state using

light transmitted through an optical fiber. It was discovered that

the transducer is capable of converting the signal that reads out

the qubit and the qubit can also be sufficiently protected from

decoherence introduced by thermal noise or stray optical photons

from the transducer during operation.

Conference Call and WebcastRigetti will host a

conference call later today, March 5, 2025, at 5:00 pm ET, or 2:00

pm PT, to discuss its fourth quarter and full-year 2024 financial

results.

You can listen to a live audio webcast of the conference call at

https://edge.media-server.com/mmc/p/5jaikwa8/ or the "Events &

Presentations" section of the Company's Investor Relations website

at https://investors.rigetti.com/. A replay of the conference call

will be available at the same locations following the conclusion of

the call for one year.

To participate in the live call, you must register using the

following link:

https://register.vevent.com/register/BIc3642ee5e70e4bea9d3311a88c4e128a.

Once registered, you will receive dial-in numbers and a unique PIN

number. When you dial in, you will input your PIN and be routed

into the call. If you register and forget your PIN, or lose the

registration confirmation email, simply re-register to receive a

new PIN.

About RigettiRigetti is a pioneer in full-stack

quantum computing. The Company has operated quantum computers over

the cloud since 2017 and serves global enterprise, government, and

research clients through its Rigetti Quantum Cloud Services

platform. In 2021, Rigetti began selling on-premises quantum

computing systems with qubit counts between 24 and 84 qubits,

supporting national laboratories and quantum computing centers.

Rigetti’s 9-qubit Novera QPU was introduced in 2023 supporting a

broader R&D community with a high-performance, on-premises QPU

designed to plug into a customer’s existing cryogenic and control

systems. The Company’s proprietary quantum-classical infrastructure

provides high-performance integration with public and private

clouds for practical quantum computing. Rigetti has developed the

industry’s first multi-chip quantum processor for scalable quantum

computing systems. The Company designs and manufactures its chips

in-house at Fab-1, the industry’s first dedicated and integrated

quantum device manufacturing facility. Learn more at

https://www.rigetti.com/.

Contacts

Rigetti Computing Investor Contact:IR@Rigetti.com

Rigetti Computing Media Contact:press@rigetti.com

Cautionary Language Concerning Forward-Looking

StatementsCertain statements in this communication may be

considered “forward-looking statements” within the meaning of the

federal securities laws, including statements with respect to the

Company’s future success and performance, including expectations

with respect to future revenues and the timing, availability and

impact of government programs relating to quantum information

science; expectations regarding the advantages and impact of the

strategic collaboration agreement with Quanta Computer on our

operations, technology roadmap, milestones, and our position in the

industry; the expectation that Rigetti and Quanta will each invest

more than $100 million over the next five years; expectations

regarding Quanta’s anticipated $35 million investment in Rigetti

through a purchase of Rigetti’s common stock; anticipated

regulatory clearance; expectations related to the Company’s ability

to achieve milestones including the development of future

generations of hardware, including any future generations developed

to achieve our targeted fidelities and qubit counts, or to

demonstrate narrow quantum advantage or broad quantum advantage,

each of which is an important anticipated milestone for our

technology roadmap and commercialization of our quantum computers;

expectations with respect to scaling to create larger qubit systems

without sacrificing gate performance using the Company’s modular

chip architecture, including expectations with respect to the

Company’s anticipated systems and targeted error rate reduction;

expectations with respect to future sales or leases of the Novera

QPU, customer adoption of the Ankaa-3 systems and Novera QPU; the

possibility that reading out superconducting qubits with an optical

transducer could have benefits in building scalable quantum

computers; the possibility that replacing coaxial cables and other

cryogenic components with optical fibers could result in less

thermal and power usage; expectations with respect to the Company’s

partners and customers and the quantum computing plans and

activities thereof; and expectations with respect to the

anticipated stages of quantum technology maturation, including the

Company’s ability to develop a quantum computer that is able to

solve practical, operationally relevant problems significantly

better, faster, or cheaper than a current classical solution and

achieve quantum advantage on the anticipated timing or at all.

These forward-looking statements are based upon estimates and

assumptions that, while considered reasonable by the Company and

its management, are inherently uncertain. Factors that may cause

actual results to differ materially from current expectations

include, but are not limited to: the Company’s ability to achieve

milestones, technological advancements, including with respect to

its technology roadmap; the ability of the Company to obtain

government contracts successfully and in a timely manner and the

availability of government funding; the potential of quantum

computing; the ability of the Company to expand its QPU sales and

the Novera QPU Partnership Program; the success of the Company’s

partnerships and collaborations, including the strategic

collaboration with Quanta Computer; the Company’s ability to

accelerate its development of multiple generations of quantum

processors; the outcome of any legal proceedings that may be

instituted against the Company or others; the ability to maintain

relationships with customers and suppliers and attract and retain

management and key employees; costs related to operating as a

public company; changes in applicable laws or regulations; the

possibility that the Company may be adversely affected by other

economic, business, or competitive factors; the Company’s estimates

of expenses and profitability; the evolution of the markets in

which the Company competes; the ability of the Company to implement

its strategic initiatives and expansion plans; the expected use of

proceeds from the Company’s past and future financings or other

capital; the sufficiency of the Company’s cash resources;

unfavorable conditions in the Company’s industry, the global

economy or global supply chain, including rising inflation and

interest rates, deteriorating international trade relations,

political turmoil, natural catastrophes, warfare and terrorist

attacks; and other risks and uncertainties set forth in the section

entitled “Risk Factors” and “Cautionary Note Regarding

Forward-Looking Statements” in the Company’s Annual Report on Form

10-K for the year ended December 31, 2023 and Quarterly Report on

Form 10-Q for the quarter ended September 30, 2024, and other

documents filed by the Company from time to time with the SEC.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and the Company assumes no obligation and does not

intend to update or revise these forward-looking statements other

than as required by applicable law. The Company does not give any

assurance that it will achieve its expectations.

|

RIGETTI COMPUTING, INC. |

|

CONSOLIDATED BALANCE SHEETS |

|

(in thousands, except number of shares and par value) |

| |

|

|

|

|

|

|

|

December 31, |

|

December 31, |

| |

2024 |

|

2023 |

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

67,674 |

|

|

$ |

21,392 |

|

|

Available-for-sale investments - short-term |

|

124,420 |

|

|

|

78,537 |

|

|

Accounts receivable |

|

2,427 |

|

|

|

5,029 |

|

|

Prepaid expenses |

|

3,156 |

|

|

|

1,938 |

|

|

Other current assets |

|

9,081 |

|

|

|

771 |

|

|

Total current assets |

|

206,758 |

|

|

|

107,667 |

|

| Available-for-sale investments

- long-term |

|

25,068 |

|

|

|

— |

|

| Property and equipment,

net |

|

44,643 |

|

|

|

44,483 |

|

| Operating lease right-of-use

assets |

|

7,993 |

|

|

|

7,634 |

|

| Other assets |

|

325 |

|

|

|

129 |

|

|

Total assets |

$ |

284,787 |

|

|

$ |

159,913 |

|

| |

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

1,590 |

|

|

$ |

5,772 |

|

|

Accrued expenses and other current liabilities |

|

8,005 |

|

|

|

8,563 |

|

|

Current portion of deferred revenue |

|

113 |

|

|

|

343 |

|

|

Current portion of debt |

|

— |

|

|

|

12,164 |

|

|

Current portion of operating lease liabilities |

|

2,159 |

|

|

|

2,210 |

|

|

Total current liabilities |

|

11,867 |

|

|

|

29,052 |

|

| Debt, less current

portion |

|

— |

|

|

|

9,894 |

|

| Deferred revenue, less current

portion |

|

698 |

|

|

|

— |

|

| Operating lease liabilities,

less current portion |

|

6,641 |

|

|

|

6,297 |

|

| Derivative warrant

liabilities |

|

93,095 |

|

|

|

2,927 |

|

| Earn-out liabilities |

|

45,897 |

|

|

|

2,155 |

|

|

Total liabilities |

|

158,198 |

|

|

|

50,325 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

| Preferred stock, par value

$0.0001 per share, 10,000,000 shares authorized, none

outstanding |

|

— |

|

|

|

— |

|

| Common stock, par value

$0.0001 per share, 1,000,000,000 shares authorized, 283,546,871

shares issued and outstanding at December 31, 2024 and 147,066,336

shares issued and outstanding at December 31, 2023 |

|

29 |

|

|

|

14 |

|

| Additional paid-in

capital |

|

681,202 |

|

|

|

463,089 |

|

| Accumulated other

comprehensive income |

|

105 |

|

|

|

244 |

|

| Accumulated deficit |

|

(554,747 |

) |

|

|

(353,759 |

) |

|

Total stockholders’ equity |

|

126,589 |

|

|

|

109,588 |

|

|

Total liabilities and stockholders’ equity |

$ |

284,787 |

|

|

$ |

159,913 |

|

| |

|

|

|

|

|

|

|

|

RIGETTI COMPUTING, INC. |

|

CONSOLIDATED STATEMENTS OF OPERATIONS |

|

(in thousands, except per share data) |

| |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Year Ended December 31, |

| |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

Revenue |

$ |

2,274 |

|

|

$ |

3,376 |

|

|

$ |

10,790 |

|

|

$ |

12,008 |

|

| Cost of revenue |

|

1,271 |

|

|

|

860 |

|

|

|

5,093 |

|

|

|

2,800 |

|

| Total gross profit |

|

1,003 |

|

|

|

2,516 |

|

|

|

5,697 |

|

|

|

9,208 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

13,657 |

|

|

|

12,787 |

|

|

|

49,750 |

|

|

|

52,768 |

|

|

Selling, general and administrative |

|

5,840 |

|

|

|

6,936 |

|

|

|

24,457 |

|

|

|

27,744 |

|

|

Restructuring |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

991 |

|

|

Total operating expenses |

|

19,497 |

|

|

|

19,723 |

|

|

|

74,207 |

|

|

|

81,503 |

|

|

Loss from operations |

|

(18,494 |

) |

|

|

(17,207 |

) |

|

|

(68,510 |

) |

|

|

(72,295 |

) |

| Other income (expense),

net |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

(446 |

) |

|

|

(1,268 |

) |

|

|

(3,255 |

) |

|

|

(5,779 |

) |

| Interest income |

|

1,546 |

|

|

|

1,330 |

|

|

|

5,113 |

|

|

|

5,076 |

|

| Change in fair value of

derivative warrant liabilities |

|

(90,885 |

) |

|

|

3,160 |

|

|

|

(90,168 |

) |

|

|

(1,160 |

) |

| Change in fair value of

earn-out liabilities |

|

(44,256 |

) |

|

|

1,413 |

|

|

|

(43,742 |

) |

|

|

(949 |

) |

| Loss on extinguishment of

debt |

|

(426 |

) |

|

|

— |

|

|

|

(426 |

) |

|

|

— |

|

| Total other expense, net |

|

(134,467 |

) |

|

|

4,635 |

|

|

|

(132,478 |

) |

|

|

(2,812 |

) |

|

Net loss before provision for income taxes |

|

(152,961 |

) |

|

|

(12,572 |

) |

|

|

(200,988 |

) |

|

|

(75,107 |

) |

| Provision for income

taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net loss |

$ |

(152,961 |

) |

|

$ |

(12,572 |

) |

|

$ |

(200,988 |

) |

|

$ |

(75,107 |

) |

|

Net loss per share attributable to common stockholders – basic

and diluted |

$ |

(0.68 |

) |

|

$ |

(0.09 |

) |

|

$ |

(1.09 |

) |

|

$ |

(0.57 |

) |

| Weighted average shares used

in computing net loss per share attributable to common

stockholders – basic and diluted |

|

226,364 |

|

|

|

140,537 |

|

|

|

184,666 |

|

|

|

131,977 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RIGETTI COMPUTING INC. |

|

CONSOLIDATED STATEMENTS OF CASH FLOW |

|

(in thousands) |

| |

|

| |

Year Ended December 31, |

| |

2024 |

|

2023 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

Net loss |

$ |

(200,988 |

) |

|

$ |

(75,107 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

6,906 |

|

|

|

7,426 |

|

|

Stock-based compensation |

|

13,069 |

|

|

|

12,409 |

|

|

Change in fair value of earn-out liabilities |

|

43,742 |

|

|

|

949 |

|

|

Change in fair value of derivative warrant liabilities |

|

90,168 |

|

|

|

1,160 |

|

|

Change in fair value of forward contract |

|

— |

|

|

|

2,229 |

|

|

Impairment of deferred offering costs |

|

— |

|

|

|

836 |

|

|

Accretion of available-for-sale securities |

|

(3,622 |

) |

|

|

(3,121 |

) |

|

Loss on extinguishment of debt |

|

426 |

|

|

|

— |

|

|

Amortization of debt issuance costs, commitment fees and accretion

of final payment fees |

|

844 |

|

|

|

1,453 |

|

|

Non-cash lease expense |

|

1,909 |

|

|

|

1,682 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

2,602 |

|

|

|

1,206 |

|

|

Prepaid expenses, other current assets and other assets |

|

(2,434 |

) |

|

|

(259 |

) |

|

Deferred revenue |

|

468 |

|

|

|

(618 |

) |

|

Accounts payable |

|

(1,036 |

) |

|

|

895 |

|

|

Accrued expenses and operating lease liabilities |

|

(2,681 |

) |

|

|

(1,719 |

) |

| Net cash used in operating

activities |

|

(50,627 |

) |

|

|

(50,579 |

) |

| Cash flows from

investing activities: |

|

|

|

|

|

|

Purchases of property and equipment |

|

(11,098 |

) |

|

|

(9,059 |

) |

|

Purchases of available-for-sale securities |

|

(224,764 |

) |

|

|

(109,252 |

) |

|

Maturities of available-for-sale securities |

|

157,500 |

|

|

|

119,084 |

|

| Net cash (used in) provided by

investing activities |

|

(78,362 |

) |

|

|

773 |

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

Principal repayments and prepayment and final payment fees of notes

payable |

|

(23,328 |

) |

|

|

(8,333 |

) |

|

Net payments of tax withholdings on sell-to-cover equity award

transactions |

|

(6,272 |

) |

|

|

— |

|

|

Proceeds from sale of common stock through Common Stock Purchase

Agreement |

|

12,838 |

|

|

|

20,544 |

|

|

Proceeds from sale of common stock through At-The-Market (ATM)

Offering |

|

97,500 |

|

|

|

— |

|

|

Proceeds from sale of common stock through registered direct

offering |

|

96,000 |

|

|

|

— |

|

|

Payments of offering costs |

|

(1,833 |

) |

|

|

(107 |

) |

|

Proceeds from issuance of common stock upon exercise of stock

options and warrants |

|

554 |

|

|

|

1,126 |

|

| Net cash provided by financing

activities |

|

175,459 |

|

|

|

13,230 |

|

| Effects of exchange rate

changes on cash and cash equivalents |

|

(188 |

) |

|

|

80 |

|

| Net increase (decrease) in

cash and cash equivalents |

|

46,282 |

|

|

|

(36,496 |

) |

| Cash and cash equivalents –

beginning of period |

|

21,392 |

|

|

|

57,888 |

|

| Cash and cash equivalents –

end of period |

$ |

67,674 |

|

|

$ |

21,392 |

|

| Supplemental

disclosures of other cash flow information: |

|

|

|

|

|

|

Cash paid for interest |

$ |

2,350 |

|

|

$ |

4,340 |

|

| Non-cash investing and

financing activities: |

|

|

|

|

|

|

Capitalization of deferred costs to equity upon share issuance |

|

— |

|

|

|

13 |

|

|

Purchases of property and equipment recorded in accounts

payable |

|

466 |

|

|

|

3,612 |

|

|

Purchases of property and equipment recorded in accrued

expenses |

|

150 |

|

|

|

1,019 |

|

|

Non-cash addition to operating lease right-of-use assets and lease

liability |

|

2,268 |

|

|

|

— |

|

|

Unrealized gain on short term investments |

|

66 |

|

|

|

325 |

|

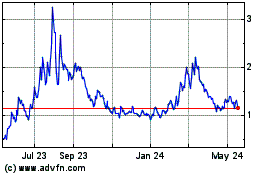

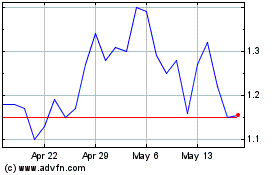

Rigetti Computing (NASDAQ:RGTI)

Historical Stock Chart

From Feb 2025 to Mar 2025

Rigetti Computing (NASDAQ:RGTI)

Historical Stock Chart

From Mar 2024 to Mar 2025