Current Report Filing (8-k)

05 August 2015 - 6:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2015

RIGEL PHARMACEUTICALS, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

0-29889 |

|

94-3248524 |

|

(Commission File No.) |

|

(IRS Employer Identification No.) |

1180 Veterans Boulevard

South San Francisco, CA

(Address of principal executive offices)

94080

(Zip Code)

Registrant’s telephone number, including area code: (650) 624-1100

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

¨ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On August 4, 2015, Rigel Pharmaceuticals, Inc. (“Rigel”) announced certain financial results for its second quarter ended June 30, 2015. A copy of Rigel’s press release, titled “Rigel Announces Second Quarter 2015 Financial Results,” is furnished pursuant to Item 2.02 as Exhibit 99.1 hereto.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

Description |

|

99.1 |

|

Press Release, dated August 4, 2015, titled “Rigel Announces Second Quarter 2015 Financial Results.” |

The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission made by Rigel Pharmaceuticals, Inc., whether made before or after the date hereof, regardless of any general incorporation language in such filing.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: August 4, 2015 |

|

RIGEL PHARMACEUTICALS, INC. |

|

|

|

|

|

|

By: |

/s/ Dolly A. Vance |

|

|

|

Dolly A. Vance |

|

|

|

Executive Vice President, General Counsel and Corporate Secretary |

3

EXHIBIT INDEX

|

Exhibit |

|

Description |

|

99.1 |

|

Press Release, dated August 4, 2015, titled “Rigel Announces Second Quarter 2015 Financial Results.” |

4

Exhibit 99.1

Rigel Announces Second Quarter 2015 Financial Results

- Conference Call and Webcast Today at 4:30 PM Eastern Time -

SOUTH SAN FRANCISCO, Calif. — August 4, 2015 — Rigel Pharmaceuticals, Inc. (Nasdaq:RIGL) today reported financial results for the second quarter and six months ended June 30, 2015.

“The Phase 3 clinical studies with fostamatinib in ITP are progressing and we continue to expect results in the middle of 2016,” said Raul Rodriguez, president and chief executive officer of Rigel. “We are also focused on the advancement of our other clinical programs, including evaluating fostamatinib for new treatment indications, as well as establishing partnerships for some of our proprietary molecules,” he added.

For the second quarter of 2015, Rigel reported a net loss of $13.9 million, or $0.16 per share, compared to a net loss of $25.4 million, or $0.29 per share, in the same period of 2014. Weighted average shares outstanding for the second quarters of 2015 and 2014 were 88.1 million and 87.5 million, respectively.

Contract revenues from collaborations of $5.2 million in the second quarter of 2015 were comprised of $4.8 million from the amortization of the $30.0 million upfront payment from Bristol-Myers Squibb (BMS) pursuant to the collaboration and license agreement executed in February 2015 for the discovery, development and commercialization of potential immuno-oncology therapeutics and $350,000 payment from BMS for Rigel’s performance of research activities in connection with the collaboration and license agreement. There were no contract revenues from collaborations in the second quarter of 2014.

Rigel reported costs and expenses of $19.2 million in the second quarter of 2015, compared to $25.5 million for the same period in 2014. The decrease in operating expenses was primarily due to the decrease in facilities costs resulting from the sublease agreement executed in December 2014, as well as the decrease in research and development costs related to the Phase 3 clinical program for fostamatinib in immune thrombocytopenic purpura (ITP) due to certain non-recurring program start-up costs for fostamatinib in ITP in the second quarter of 2014. Additionally, research and development costs also decreased due to the completion in 2014 of a Phase 2 study of R348 in dry eye and the discontinuation of Rigel’s indirect AMPK activator program, R118.

For the six months ended June 30, 2015, Rigel reported a net loss of $32.1 million, or $0.36 per basic and diluted share, compared to a net loss of $47.7 million, or $0.54 per basic and diluted share, for the same period of 2014.

As of June 30, 2015, Rigel had cash, cash equivalents and short-term investments of $143.9 million, compared to $143.2 million as of December 31, 2014. Rigel expects to end 2015 with cash and investments in excess of $100.0 million, which is expected to be sufficient to fund operations into the second quarter of 2017.

Conference Call and Webcast Today at 4:30PM Eastern Time

Rigel will hold a live conference call and webcast today at 4:30pm Eastern Time (1:30pm Pacific Time).

Participants can access the live conference call by dialing 855-892-1489 (domestic) or 720-634-2939 (international) and using the Conference ID number 86332235. The conference call will also be webcast live and can be accessed from Rigel’s website at www.rigel.com. The webcast will be archived and available for replay for 30 days after the call via the Rigel website.

About Rigel (www.rigel.com)

Rigel Pharmaceuticals, Inc. is a clinical-stage biotechnology company focused on the discovery and development of novel, small-molecule drugs for the treatment of inflammatory diseases, autoimmune diseases, and cancers. Rigel’s pioneering research focuses on signaling pathways that are critical to disease mechanisms. Rigel currently has the following product candidates in development: fostamatinib, an oral spleen tyrosine kinase (SYK) inhibitor, which is in Phase 3 clinical trials for ITP and a Phase 2 clinical trial for IgA nephropathy (IgAN); R348, a topical ophthalmic JAK/SYK inhibitor, in a Phase 2 clinical trial for dry eye in ocular graft-versus-host disease (GvHD); two oncology product candidates in Phase 1 development with partners BerGenBio AG and Daiichi Sankyo; and two preclinical programs with partners AstraZeneca, for R256 in asthma, and Bristol-Myers Squibb, for TGF beta inhibitors in immuno-oncology.

This release contains forward-looking statements relating to, among other things, the progress and timely execution of Phase 3 clinical studies with fostamatinib in ITP, the management and advancement of Rigel’s other clinical programs, the evaluation of fostamatinib for new treatment indications and Rigel’s ability to enter into potential partnerships with respect to its proprietary molecules, Rigel’s transition into a commercial stage company, moving fostamatinib to market in the foreseeable future and Rigel’s product pipeline and development programs. Any statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking statements. Words such as “planned,” “will,” “may,” “expect,” and similar expressions are intended to identify these forward-looking statements. These forward-looking statements are based on Rigel’s current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward looking statements as a result of these risks and uncertainties, which include, without limitation, the availability of resources to develop Rigel’s product candidates, Rigel’s need for additional capital in the future to sufficiently fund Rigel’s operations and research, the uncertain timing of completion of and the success of clinical trials, market competition, risks associated with and Rigel’s dependence on Rigel’s corporate partnerships, as

well as other risks detailed from time to time in Rigel’s reports filed with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the three months ended March 31, 2015. Rigel does not undertake any obligation to update forward-looking statements and expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein.

###

Contact: Ryan D. Maynard

Phone: 650.624.1284

Email: invrel@rigel.com

Media Contact: Susan C. Rogers, Rivily, Inc.

Phone: 650.430.3777

Email: susan@rivily.com

RIGEL PHARMACEUTICALS, INC.

STATEMENTS OF OPERATIONS

(in thousands, except per share amounts)

|

|

|

Three Months Ended June 30, |

|

Six Months Ended June 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

(unaudited) |

|

|

Revenues: |

|

|

|

|

|

|

|

|

|

|

Contract revenues from collaborations |

|

$ |

5,184 |

|

$ |

— |

|

$ |

7,362 |

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

Research and development (see Note A) |

|

15,059 |

|

20,063 |

|

30,761 |

|

36,932 |

|

|

General and administrative (see Note A) |

|

4,099 |

|

5,393 |

|

8,816 |

|

10,909 |

|

|

Total costs and expenses |

|

19,158 |

|

25,456 |

|

39,577 |

|

47,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

(13,974 |

) |

(25,456 |

) |

(32,215 |

) |

(47,841 |

) |

|

Interest income, net |

|

62 |

|

65 |

|

110 |

|

147 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(13,912 |

) |

$ |

(25,391 |

) |

$ |

(32,105 |

) |

$ |

(47,694 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

|

$ |

(0.16 |

) |

$ |

(0.29 |

) |

$ |

(0.36 |

) |

$ |

(0.54 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used in computing net loss per share, basic and diluted |

|

88,137 |

|

87,532 |

|

88,090 |

|

87,529 |

|

|

Note A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock-based compensation expense included in: |

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

1,056 |

|

$ |

1,189 |

|

$ |

2,216 |

|

$ |

2,503 |

|

|

General and administrative |

|

853 |

|

943 |

|

1,747 |

|

1,993 |

|

|

|

|

$ |

1,909 |

|

$ |

2,132 |

|

$ |

3,963 |

|

$ |

4,496 |

|

SUMMARY BALANCE SHEET DATA

(in thousands)

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 (1) |

|

|

|

|

(unaudited) |

|

|

|

|

Cash, cash equivalents and short-term investments |

|

$ |

143,942 |

|

$ |

143,159 |

|

|

Total assets |

|

148,353 |

|

154,135 |

|

|

Stockholders’ equity |

|

101,151 |

|

128,246 |

|

|

|

|

|

|

|

|

|

(1) Derived from audited financial statements

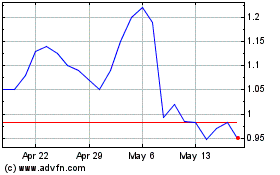

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From Apr 2024 to May 2024

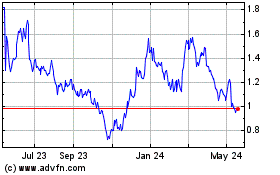

Rigel Pharmaceuticals (NASDAQ:RIGL)

Historical Stock Chart

From May 2023 to May 2024