Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

14 November 2024 - 8:34AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material Pursuant to §240.14a-12 |

TransCode Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

November 12, 2024

Open Letter to Shareholders

Dear Shareholders,

At our upcoming Special Meeting to be held November 22, shareholders

are being asked to authorize our Board of Directors to effect a reverse split – only if the Board determines that doing so is necessary

as described below.

Many shareholders rightly ask why this request. Some believe that the

potential announcement of additional positive clinical data or other good news will favorably impact our stock price. However, there is

no assurance that any good news will occur, will occur by the deadline required, or that the stock will rise after any such positive announcement(s).

A reverse split is NOT something directors or management wishes to

do – we all hope it won’t be needed. But the Nasdaq Hearings Panel that approved the extension to continue our Nasdaq listing

did so on the condition that our shareholders authorize a reverse split – should one be necessary. The reverse split will not be

necessary if our stock closes at $1.00 per share or more for any ten-day period prior to December 31, 2024.

If our stock does not meet this Nasdaq requirement, and we do not have

your vote in favor of the reverse split, Nasdaq will delist our stock. A Nasdaq delisting would in all likelihood have a material adverse

effect on the value of our company and the value of your stock.

Our assessment boils down to this: your vote is your decision about

whether you support our efforts to maintain our Nasdaq listing. Given our need to raise additional capital as soon as possible to continue

the clinical trial and other operations, we believe having our stock remain on Nasdaq is critical to raising the needed capital.

TransCode’s management and directors are unanimously determined

to maintain our Nasdaq listing. This is why we need you to authorize the reverse split, with all of us hoping that we will not have to

implement this decision.

We call for your understanding and greatly appreciate your support.

Your Board and Management

TransCode

Therapeutics, Inc.• 6 Liberty Square #2382 • Boston, MA 02109

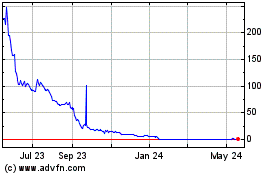

TransCode Therapeutics (NASDAQ:RNAZ)

Historical Stock Chart

From Nov 2024 to Dec 2024

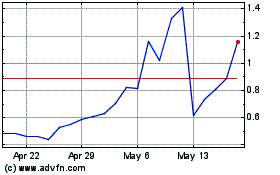

TransCode Therapeutics (NASDAQ:RNAZ)

Historical Stock Chart

From Dec 2023 to Dec 2024