1173 Coleman AveSan JoseCalifornia0001428439FALSE00014284392024-08-012024-08-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 1, 2024

Roku, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-38211 | 26-2087865 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | |

1173 Coleman Ave San Jose, California | | 95110 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(408) 556-9040

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class: | Trading Symbol(s): | Name of Exchange on Which Registered: |

| Class A Common Stock, $0.0001 par value | ROKU | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 1, 2024, Roku, Inc. (the “Company”) announced its financial results for the quarter ended June 30, 2024. The Company’s Shareholder Letter, which is attached hereto as Exhibit 99.1, is incorporated herein by reference.

The information in this report shall not be treated as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933 or the Securities Exchange Act of 1934, except as expressly stated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | |

| (d) | Exhibits. | |

| | | |

| Exhibit Number | Description | |

| | |

| 99.1* | |

| | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | |

*This exhibit is intended to be furnished and shall not be deemed “filed” for purposes of the Securities and Exchange Act of 1934.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Roku, Inc. |

| | |

Dated: August 1, 2024 | |

| | By: | /s/ Dan Jedda |

| | | Dan Jedda |

| | | Chief Financial Officer |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fellow Shareholders, | | | | | | | | August 1, 2024 |

We delivered solid results in Q2. Roku grew Streaming Households 14% YoY, Streaming Hours 20% YoY, and Platform revenue 11% YoY. The Roku Home Screen, which is the beginning of our viewers’ streaming experience, reaches U.S. households with over 120 million people every day. We achieved our fourth consecutive quarter of positive Adjusted EBITDA and Free Cash Flow (TTM) as a result of top-line growth and ongoing operational efficiencies. Importantly, Roku is executing well against initiatives to accelerate Platform revenue growth, which include maximizing ad demand for Roku, leveraging our Home Screen as the lead-in for TV, and growing Roku-billed subscriptions.

Q2 2024 Key Results

•Total net revenue was $968 million, up 14% year over year (YoY)

•Platform revenue was $824 million, up 11% YoY

•Gross profit was $425 million, up 12% YoY

•Streaming Households were 83.6 million, a net increase of 2.0 million from Q1 2024

•Streaming Hours were 30.1 billion, up 5.0 billion hours YoY

•Average Revenue Per User (ARPU) was $40.68 on a trailing 12-month basis (TTM), flat YoY

•Fourth consecutive quarter of positive Adjusted EBITDA and Free Cash Flow (TTM)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Key Operating Metrics | Q2 23 | | Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 | | YoY % |

| Streaming Households (millions) | 73.5 | | | 75.8 | | | 80.0 | | | 81.6 | | | 83.6 | | | 14 | % |

| Streaming Hours (billions) | 25.1 | | | 26.7 | | | 29.1 | | | 30.8 | | | 30.1 | | | 20 | % |

| ARPU ($ TTM) | $ | 40.67 | | | $ | 41.03 | | | $ | 39.92 | | | $ | 40.65 | | | $ | 40.68 | | | 0 | % |

| | | | | | | | | | | |

| Summary Financials ($ in millions) | Q2 23 | | Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 | | YoY % |

| Platform revenue | $ | 743.8 | | | $ | 786.8 | | | $ | 828.9 | | | $ | 754.9 | | | $ | 824.3 | | | 11 | % |

| Devices revenue | 103.4 | | | 125.2 | | | 155.6 | | | 126.5 | | | 143.8 | | | 39 | % |

| Total net revenue | 847.2 | | | 912.0 | | | 984.4 | | | 881.5 | | | 968.2 | | | 14 | % |

| Platform gross profit | 395.8 | | | 378.2 | | | 458.5 | | | 394.4 | | | 439.9 | | | 11 | % |

| Devices gross profit (loss) | (17.6) | | | (9.4) | | | (20.5) | | | (6.1) | | | (15.2) | | | 14 | % |

| Total gross profit | 378.3 | | | 368.8 | | | 437.9 | | | 388.3 | | | 424.7 | | | 12 | % |

| Platform gross margin % | 53.2 | % | | 48.1 | % | | 55.3 | % | | 52.2 | % | | 53.4 | % | | 0.1 | pts |

| Devices gross margin % | (17.0) | % | | (7.5) | % | | (13.2) | % | | (4.8) | % | | (10.6) | % | | 6.4 | pts |

| Total gross margin % | 44.7 | % | | 40.4 | % | | 44.5 | % | | 44.1 | % | | 43.9 | % | | (0.8) | pts |

| Research and development | 192.4 | | | 282.2 | | | 183.8 | | | 180.5 | | | 175.5 | | | (9) | % |

| Sales and marketing | 227.2 | | | 307.7 | | | 264.6 | | | 202.1 | | | 221.7 | | | (2) | % |

| General and administrative | 84.7 | | | 128.7 | | | 93.7 | | | 77.7 | | | 98.8 | | | 17 | % |

| Total operating expenses | 504.2 | | | 718.6 | | | 542.1 | | | 460.3 | | | 495.9 | | | (2) | % |

| Loss from operations | (126.0) | | | (349.8) | | | (104.2) | | | (72.0) | | | (71.2) | | | 43 | % |

Adjusted EBITDA A | (17.8) | | | 43.4 | | | 47.7 | | | 40.9 | | | 43.6 | | | nm |

| Adjusted EBITDA margin % | (2.1) | % | | 4.8 | % | | 4.8 | % | | 4.6 | % | | 4.5 | % | | 6.6 | pts |

| Cash flow from operations (TTM) | 15.4 | | 246.9 | | 255.9 | | 456.0 | | 332.3 | | nm |

Free Cash Flow (TTM) A | (169.3) | | 100.8 | | 175.9 | | 426.8 | | 317.9 | | nm |

| | | | | | | | | | | |

| Outlook ($ in millions) | Q3 2024E | | A - Refer to the reconciliation of Net loss to Adjusted EBITDA and Cash flow from operations to Free Cash Flow in the non-GAAP information at the end of this letter. |

| Total net revenue | $1,010 | |

| Total gross profit | $440 | | B - Q3 2024E reconciling items between net loss and non-GAAP Adjusted EBITDA consist of stock-based compensation of approx. $105 million, depreciation and amortization of approx. $15 million, and other income of approx. $25 million. |

| Net income (loss) | $(50) | |

Adjusted EBITDA B | $45 | |

| | |

| Roku Q2 2024 Shareholder Letter |

1

Market-Leading Scale

In Q2, Roku grew Streaming Households1 to 83.6 million globally. Sequential net adds of 2.0 million were above Q2 2023 and driven by both TVs and streaming players. Roku continued to benefit from consumers’ focus on value, ease of use, and choice. The Roku operating system (OS) was again the #1 selling TV OS in the U.S.2, with TV unit sales greater than the next two TV operating systems combined. The Roku OS was also the #1 selling TV OS in Mexico and Canada2, where we continue to grow scale through the Roku TV licensing program. We are making good progress growing Streaming Households in the countries that we are prioritizing, across the Americas and the U.K.

We have expanded distribution of Roku-branded TVs (designed, made, and sold by Roku) to Target and other specialty retailers. In April, the new Roku Pro Series hit the market, and these higher-performing TVs continue to receive strong reviews, which are an important part of the consumer evaluation process. Yahoo! named the Pro Series their “favorite TV of 2024”; Tom’s Guide said, “Impressive as its underlying specs are for the price, few truly compare to its brilliant interface”; and Forbes stated, “Roku has proved unequivocally that they have the knowledge and talent to do it themselves and do it better than anyone else.”3

Driving Viewer Engagement

Globally, our users streamed 30.1 billion hours in Q2, up 20% YoY. We also grew engagement per household globally, with average Streaming Hours per Streaming Household per day of 4.0 hours in Q2 2024, up from 3.8 hours in Q2 2023. According to Comscore, streaming time on Roku in the U.S. is three times higher than the next streaming CTV brand4.

% of time spent by CTV brand in the U.S.

In the U.S., streaming time on Roku is three times higher than the next CTV brand.

(Comscore CTV Intelligence data for May ’24)

1 ”Streaming Households” are the number of distinct user accounts that have streamed content on our platform within the last 30 days of the period. Prior to the Q1 shareholder letter, we referred to “Streaming Households” as “Active Accounts.” While we have changed this term to better reflect the nature of our business, we calculate “Streaming Households” using the same methodology that we used to calculate “Active Accounts,” and this change in terminology does not change any metrics we have reported in prior periods.

2 Source: Circana, Retail Tracking Service, Unit Sales, Apr-June 2024 combined

3 yahoo!tech, Tom’s Guide, Forbes

4 Comscore CTV Intelligence data for May ’24

| | |

| Roku Q2 2024 Shareholder Letter |

2

Viewer Experience

The power of the Roku viewer experience begins with our Home Screen. Features that we own and operate, such as our Content Row, Live TV tile, Sports Experience, and What to Watch, guide viewers to great entertainment while growing monetization opportunities for Roku. In Q2, the percentage of app sessions launched from one of our owned and operated features increased 35% YoY.

Nearly half of Americans watch sports on TV every month5, and Roku is benefitting from the ongoing shift to streaming by leveraging our position as the lead-in to TV. One of our fastest growing features is the Roku Sports Experience. In addition to our NFL and NBA Zones, we recently launched the MLB Zone with T-Mobile as a sponsor. The MLB Zone aggregates and organizes live and upcoming games, nightly recaps, game highlights, a fully programmed MLB FAST channel, and more from across the Roku platform. Additionally, we secured the exclusive multi-year rights for MLB’s Sunday Leadoff live games, now available for free on The Roku Channel. Further, the zones elevate clips, scores, and related content that makes watching sports better on the Roku platform. In Q2, Streaming Hours originating from the Roku Sports Experience more than tripled YoY.

The MLB Zone in the Roku Sports Experience

We continue to create monetization opportunities on the Roku Home Screen. Recently, we launched a Content Row that makes personalized recommendations powered by AI. Early results show that these recommendations drove an increase in Streaming Households, average display ad impressions, and video ad reach of The Roku Channel6. We believe there is further opportunity to take advantage of the unique power and scale of our Home Screen.

5 Statista as of Nov 2023

6 Growth compared to households that did not receive Content Row

| | |

| Roku Q2 2024 Shareholder Letter |

3

The Roku Channel

The Roku Channel remained the #3 app on our platform in Q2 by both reach and engagement, with Streaming Hours up nearly 75% YoY. This ongoing growth is largely due to our position as the lead-in to TV, and our Home Screen’s power to drive viewership. More than 70% of The Roku Channel’s Streaming Hours in Q2 originated not from The Roku Channel app tile, but from Home Screen features such as the Content Row, Live TV, and What to Watch.

Streaming of news and other live programming continues to grow as viewers cut the cord. While viewership of the June 27 U.S. presidential debate on traditional TV was down 30% from the first debate in 20207, The Roku Channel’s FAST8 offering achieved its highest day for both reach and engagement. During the debate, more than 40% of The Roku Channel viewers watched on our live channels.

The U.S. presidential debate on June 27 drove

the highest day ever for both reach and engagement of The Roku Channel’s FAST offering.

While the foundation of our content spend remains with third-party licenses and revenue shares, we continue to leverage Roku Originals to attract viewers and advertisers. For the Roku Original “The Spiderwick Chronicles,” we drove viewers from various entry points across the Roku platform, including a takeover of the Roku Home Screen, Roku City™, and a “Spiderwick” tile (in the app grid). The series achieved the highest reach and engagement of any on-demand title in The Roku Channel’s history during its opening weekend and was sponsored by Airbnb.

7 CNN (June 27, 2024)

8 FAST: free ad-supported linear streaming TV, does not include on-demand content

| | |

| Roku Q2 2024 Shareholder Letter |

4

“The Spiderwick Chronicles” Roku City takeover

Growing Monetization

Platform revenue was $824 million in Q2, up 11% YoY, reflecting contributions from streaming services distribution and advertising activities, despite continued softness within the media and entertainment (M&E) vertical. In Q2, Platform gross margin was 53%, relatively in line YoY. ARPU was $40.68 in Q2 (on a trailing 12-month basis), relatively flat YoY. This reflects an increasing share of Streaming Households in international markets, where we are currently focused on scale and engagement with monetization efforts in the early stages.

We generate Platform revenue primarily from the sale of advertising (including direct and programmatic video advertising, M&E promotional spending, sponsorships, and related ad products and services), as well as streaming services distribution (including subscription and transactional revenue, the sale of Premium Subscriptions, and the sale of branded app buttons on remote controls).

Streaming Services Distribution Activities

In Q2, streaming services distribution activities grew faster than Platform revenue overall. This was due primarily to price increases for subscription-based apps on our platform. We have increased our focus on growing the share of subscriptions billed through Roku Pay, our payments and billing service that makes it easy for both our viewers and content partners to transact subscriptions. The new Content Row on our Home Screen is helping to drive Roku-billed subscription sign-ups, by highlighting popular titles from SVOD9 services on our platform, and we see upside ahead in this growth area.

Through our streaming services distribution activities, we collaborate with content partners to deliver experiences that benefit our viewers, as well as our partners and us. We partnered with NBCUniversal to create a zone in the Roku Sports Experience for the 2024 Olympic Games in Paris. This zone provides a single, simplified destination for live events, replays, daily primetime shows, and more. Viewers can subscribe to Peacock for full Olympics coverage directly through the Roku platform.

9 SVOD: subscription video on demand

| | |

| Roku Q2 2024 Shareholder Letter |

5

The NBC Olympics Zone, presented by Delta

Advertising Activities

In Q2, the YoY growth of advertising across the Roku platform – excluding M&E – outperformed both the overall ad market and the OTT ad market in the U.S.10 This performance is a result of our broad ad portfolio, the reach of the Roku Home Screen, and our expanding partnerships with third-party ad platforms.

The Roku Home Screen reaches U.S. households with more than 120 million people every day. This massive reach is highly valued by advertisers. Furthermore, while ad-supported streaming services are popular for their lower price, Antenna reports that 40% of consumers who face an SVOD ad choice select ad-free versions only. The Roku Home Screen provides advertisers with unique opportunities to reach these ad-free only viewers.

We recently enhanced the marquee ad unit on our Home Screen by adding video. Our limited, invite-only beta for this new video ad unit sold out in the first month, with participation from premier brands such as The Home Depot, Disney, and MINI USA. This is part of our ongoing effort to diversify display ads on our Home Screen beyond M&E advertisers. We are working to offer the marquee video ad to more brands, while maintaining a prized user experience.

10 2Q24 SMI data; OTT: over-the-top

| | |

| Roku Q2 2024 Shareholder Letter |

6

MINI USA was an early mover in taking advantage of Roku’s Video Marquee Ad (https://f.io/nhfM0IF4).

We are making it easier for advertisers to execute campaigns programmatically by expanding and deepening our relationships with third-party platforms. We recently partnered with The Trade Desk (TTD) so that TTD customers can leverage Roku Media and audience data programmatically to better understand and optimize their campaigns for TV streaming viewers. Today, we are expanding our relationship with Roku’s integration of Unified ID 2.0 (UID2), an identity solution developed by The Trade Desk. Roku advertisers will achieve more precise targeting and a secure means to facilitate data collaboration. We have also partnered with iSpot so advertisers on the Roku platform can receive best-in-class optimization and ad measurement through iSpot’s Unified Measurement solution.

We will continue to partner with more third-party demand-side platforms (DSPs). These integrations along with our expanding portfolio of ad products allow us to serve the entire demand curve at multiple price points. We believe this will drive incremental revenue that will grow over time.

Outlook

We are pleased with our continued growth in scale and engagement, along with the execution of our monetization initiatives that position us strongly in the ongoing shift to streaming. Looking to the second half of 2024, we expect these initiatives to help accelerate revenue from advertising activities.

For Q3, we estimate Total net revenue of $1.010 billion growing 11% YoY, with Platform revenue growing 9% YoY and Devices revenue growing 24% YoY. We expect Q3 total gross profit of $440 million and Adjusted EBITDA of $45 million, reflecting our ongoing operational discipline.

For Q4, we anticipate the YoY growth rate of Platform revenue will accelerate sequentially. We remain confident in our ability to accelerate Platform revenue in 2025 and beyond as we maximize ad demand, lean into our Home Screen as the lead-in for TV, and grow Roku-billed subscriptions.

Thank you for your support, and Happy Streaming™!

Anthony Wood, Founder and CEO, and Dan Jedda, CFO

| | |

| Roku Q2 2024 Shareholder Letter |

7

Conference Call Webcast – August 1, 2024, at 2 p.m. PT

The Company will host a webcast of its conference call to discuss the Q2 2024 results at 2 p.m. Pacific Time / 5 p.m. Eastern Time on August 1, 2024. Participants may access the live webcast in listen-only mode on the Roku investor relations website at www.roku.com/investor. An archived webcast of the conference call will also be available at www.roku.com/investor after the call.

About Roku, Inc.

Roku pioneered streaming to the TV. We connect viewers to the streaming content they love, enable content publishers to build and monetize large audiences, and provide advertisers with unique capabilities to engage consumers. Roku streaming players and TV-related audio devices are available in the U.S. and in select countries through direct retail sales and licensing arrangements with service operators. Roku TV™ models are available in the U.S. and in select countries through licensing arrangements with TV OEM brands. Roku Smart Home products, including cameras, video doorbells, lighting, plugs, and more are available in the U.S. Roku is headquartered in San Jose, Calif. U.S.A.

Roku, Roku TV, Roku City, the Roku logo and other trade names, trademarks or service marks of Roku appearing in this shareholder letter are the property of Roku. Trade names, trademarks and service marks of other companies appearing in this shareholder letter are the property of their respective holders.

| | | | | |

Investor Relations Conrad Grodd cgrodd@roku.com | Media Jack Evans jackevans@roku.com |

| | |

| Roku Q2 2024 Shareholder Letter |

8

Use of Non-GAAP Measures

In addition to financial information prepared in accordance with generally accepted accounting principles in the United States (GAAP), this shareholder letter includes certain non-GAAP financial measures. These non-GAAP measures include Adjusted EBITDA and Free Cash Flow (FCF). In order for our investors to be better able to compare our current results with those of previous periods, we have included a reconciliation of GAAP to non-GAAP financial measures in the tables at the end of this letter. The Adjusted EBITDA reconciliation excludes other income (expense), net, stock-based compensation expense, depreciation and amortization, restructuring charges, and income tax (benefit)/expense from net income (loss), and the FCF reconciliation excludes purchases of property and equipment and effects of exchange rates on cash from the cash flows from operating activities, in each case where applicable. We believe these non-GAAP financial measures are useful as a supplement in evaluating our ongoing operational performance and enhancing an overall understanding of our past financial performance. However, these non-GAAP financial measures have limitations, and should not be considered in isolation or as a substitute for our GAAP financial information, such as GAAP net income (loss) and cash flows from operating activities. In addition, these non-GAAP financial measures may not be comparable to similarly titled metrics of other companies due to differences in methods of calculation.

Forward-Looking Statements

This shareholder letter contains “forward-looking” statements that are based on our beliefs and assumptions and on information currently available to us. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,” “expect,” “may,” "plan,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms. Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our beliefs and assumptions only as of the date of this letter. These statements include those related the power, benefits, growth, reach, and monetization opportunities of the Roku Home Screen; our execution on platform revenue growth initiatives; our ability to grow scale outside the U.S.; the availability, functionality, and reception of our Roku-branded TVs; the expansion of our retail distribution; our ability to benefit from the ongoing shift of sports to streaming; the shift of TV and TV advertising to streaming; our ability to grow subscriptions billed through Roku Pay; The Roku Channel’s growth; the benefits of our position as the lead-in to TV; the growth of news and live TV streaming; the value of Roku Originals; our international expansion; our ability to collaborate with content partners to improve the viewer experience; our expanding ad portfolio; the value and expanded offering of our marquee video ad; our expanding relationships with third-party measurement partners and advertising platforms, such as our UID2 integration with The Trade Desk; the growth of our ad revenue over time; our continued growth in scale and engagement; our operational discipline; our execution of growth initiatives; our financial outlook for the third quarter of 2024; sequential acceleration of YoY growth rate of platform revenue in the fourth quarter of 2024; our ability to accelerate growth of Platform revenue in 2025 and beyond; our additional qualitative color on our business for the rest of 2024 and beyond; and our overall business trajectory. Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in the forward-looking statements, even if new information becomes available in the future. Further information on factors that could cause actual results to differ materially from the results anticipated by our forward-looking statements is included in the reports we have filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2023. Additional information also will be available in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024. All information provided in this shareholder letter and in the tables attached hereto is as of August 1, 2024, and we undertake no duty to update this information unless required by law.

| | |

| Roku Q2 2024 Shareholder Letter |

9

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2024 | | June 30, 2023 | | June 30, 2024 | | June 30, 2023 |

| Net Revenue: | | | | | | | |

| Platform | $ | 824,333 | | | $ | 743,835 | | | $ | 1,579,268 | | | $ | 1,378,453 | |

| Devices | 143,846 | | | 103,351 | | | 270,380 | | | 209,723 | |

| Total net revenue | 968,179 | | | 847,186 | | | 1,849,648 | | | 1,588,176 | |

| Cost of Revenue: | | | | | | | |

| Platform (1) | 384,454 | | | 348,010 | | | 745,020 | | | 648,597 | |

| Devices (1) | 159,025 | | | 120,905 | | | 291,637 | | | 223,711 | |

| Total cost of revenue | 543,479 | | | 468,915 | | | 1,036,657 | | | 872,308 | |

| Gross Profit (Loss): | | | | | | | |

| Platform | 439,879 | | | 395,825 | | | 834,248 | | | 729,856 | |

| Devices | (15,179) | | | (17,554) | | | (21,257) | | | (13,988) | |

| Total gross profit | 424,700 | | | 378,271 | | | 812,991 | | | 715,868 | |

| Operating Expenses: | | | | | | | |

| Research and development (1) | 175,481 | | | 192,387 | | | 355,940 | | | 412,472 | |

| Sales and marketing (1) | 221,656 | | | 227,192 | | | 423,780 | | | 461,111 | |

| General and administrative (1) | 98,806 | | | 84,652 | | | 176,550 | | | 180,705 | |

| Total operating expenses | 495,943 | | | 504,231 | | | 956,270 | | | 1,054,288 | |

| Loss from Operations | (71,243) | | | (125,960) | | | (143,279) | | | (338,420) | |

| Other income, net | 28,129 | | | 19,995 | | | 54,075 | | | 42,415 | |

| Loss Before Income Taxes | (43,114) | | | (105,965) | | | (89,204) | | | (296,005) | |

| Income tax expense (benefit) | (9,161) | | | 1,630 | | | (4,396) | | | 5,194 | |

| Net Loss | $ | (33,953) | | | $ | (107,595) | | | $ | (84,808) | | | $ | (301,199) | |

| | | | | | | |

| Net loss per share — basic and diluted | $ | (0.24) | | | $ | (0.76) | | | $ | (0.59) | | | $ | (2.14) | |

| | | | | | | |

| | | | | | | |

| Weighted-average common shares outstanding — basic and diluted | 144,339 | | | 141,033 | | | 144,045 | | | 140,685 | |

| | | | | | | |

(1) Stock-based compensation was allocated as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Cost of revenue, platform | $ | 282 | | | $ | 349 | | | $ | 696 | | | $ | 688 | |

| Cost of revenue, devices | 139 | | | 812 | | | 1,038 | | | 1,616 | |

| Research and development | 33,365 | | | 34,824 | | | 70,955 | | | 73,487 | |

| Sales and marketing | 31,431 | | | 31,225 | | | 63,952 | | | 65,364 | |

| General and administrative | 23,179 | | | 22,369 | | | 46,387 | | | 44,896 | |

| Total stock-based compensation | $ | 88,396 | | | $ | 89,579 | | | $ | 183,028 | | | $ | 186,051 | |

| | |

| Roku Q2 2024 Shareholder Letter |

10

ROKU, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except par value data)

(unaudited)

| | | | | | | | | | | |

| As of |

| June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 2,058,465 | | | $ | 2,025,891 | |

| | | |

Accounts receivable, net of allowances of $39,864 and $34,127 as of | 669,136 | | | 816,337 | |

| June 30, 2024 and December 31, 2023, respectively | | | |

| Inventories | 96,351 | | | 92,129 | |

| Prepaid expenses and other current assets | 153,434 | | | 138,585 | |

| Total current assets | 2,977,386 | | | 3,072,942 | |

| Property and equipment, net | 240,035 | | | 264,556 | |

| Operating lease right-of-use assets | 338,422 | | | 371,444 | |

| Content assets, net | 240,596 | | | 257,395 | |

| Intangible assets, net | 34,551 | | | 41,753 | |

| Goodwill | 161,519 | | | 161,519 | |

| Other non-current assets | 111,865 | | | 92,183 | |

| Total Assets | $ | 4,104,374 | | | $ | 4,261,792 | |

| Liabilities and Stockholders’ Equity | | | |

| Current Liabilities: | | | |

| Accounts payable | $ | 276,118 | | | $ | 385,330 | |

| Accrued liabilities | 724,467 | | | 788,040 | |

| Deferred revenue, current portion | 95,974 | | | 102,157 | |

| Total current liabilities | 1,096,559 | | | 1,275,527 | |

| Deferred revenue, non-current portion | 23,471 | | | 24,572 | |

| Operating lease liability, non-current portion | 553,375 | | | 586,174 | |

| Other long-term liabilities | 40,180 | | | 49,186 | |

| Total Liabilities | 1,713,585 | | | 1,935,459 | |

| Stockholders’ Equity: | | | |

| Common stock, $0.0001 par value | 14 | | | 14 | |

| Additional paid-in capital | 3,773,831 | | | 3,623,747 | |

| Accumulated other comprehensive income (loss) | (661) | | | 159 | |

| Accumulated deficit | (1,382,395) | | | (1,297,587) | |

| Total stockholders’ equity | 2,390,789 | | | 2,326,333 | |

| Total Liabilities and Stockholders’ Equity | $ | 4,104,374 | | | $ | 4,261,792 | |

| | |

| Roku Q2 2024 Shareholder Letter |

11

ROKU, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Six Months Ended |

| June 30, 2024 | | June 30, 2023 |

| Cash flows from operating activities: | | | |

| Net Loss | $ | (84,808) | | | $ | (301,199) | |

| Adjustments to reconcile net loss to net cash from operating activities: | | | |

| Depreciation and amortization | 32,280 | | | 34,181 | |

| Stock-based compensation expense | 183,028 | | | 186,051 | |

| Amortization of right-of-use assets | 23,767 | | | 30,532 | |

| Amortization and write-off of content assets | 108,022 | | | 102,314 | |

| Foreign currency remeasurement losses | 2,385 | | | 1,760 | |

| Change in fair value of the Strategic Investment | (3,634) | | | (3,090) | |

| Impairment of assets | 11,506 | | | 4,338 | |

| Provision for doubtful accounts | 4,344 | | | 2,962 | |

| Other items, net | (1,489) | | | (224) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 142,463 | | | 50,430 | |

| Inventories | (4,222) | | | 13,533 | |

| Prepaid expenses and other current assets | (25,012) | | | 3,736 | |

| Content assets and liabilities, net | (91,226) | | | (120,522) | |

| Other non-current assets | (17,279) | | | 4,379 | |

| Accounts payable | (108,606) | | | 72,291 | |

| Accrued liabilities | (66,715) | | | (92,289) | |

| Operating lease liabilities | (27,751) | | | (5,754) | |

| Other long-term liabilities | 320 | | | (1,074) | |

| Deferred revenue | (7,284) | | | 11,286 | |

| Net cash provided by (used in) operating activities | 70,089 | | | (6,359) | |

| Cash flows from investing activities: | | | |

| Purchases of property and equipment | (1,547) | | | (72,316) | |

| Purchase of Strategic Investment | — | | | (10,000) | |

| Net cash used in investing activities | (1,547) | | | (82,316) | |

| Cash flows from financing activities: | | | |

| Repayments of borrowings | — | | | (80,000) | |

| Proceeds from equity issued under incentive plans | 8,679 | | | 1,504 | |

| Taxes paid related to net share settlement of equity awards | (41,623) | | | — | |

| Net cash used in financing activities | (32,944) | | | (78,496) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 35,598 | | | (167,171) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (4,002) | | | 1,189 | |

| Cash, cash equivalents and restricted cash —beginning of period | 2,066,604 | | | 1,961,956 | |

| Cash, cash equivalents and restricted cash —end of period | $ | 2,098,200 | | | $ | 1,795,974 | |

| | |

| Roku Q2 2024 Shareholder Letter |

12

| | | | | | | | | | | |

| Six Months Ended |

| June 30, 2024 | | June 30, 2023 |

| Cash, cash equivalents and restricted cash at end of period: | | | |

| Cash and cash equivalents | $ | 2,058,465 | | | $ | 1,755,261 | |

| Restricted cash, current | 39,735 | | | 40,713 | |

| | | |

| Cash, cash equivalents and restricted cash —end of period | $ | 2,098,200 | | | $ | 1,795,974 | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid for interest | $ | 61 | | | $ | 871 | |

| Cash paid for income taxes | $ | 6,702 | | | $ | 3,955 | |

| Supplemental disclosures of non-cash investing and financing activities: | | | |

| Unpaid portion of property and equipment purchases | $ | 69 | | | $ | 4,094 | |

| | |

| Roku Q2 2024 Shareholder Letter |

13

NON-GAAP INFORMATION

(in thousands)

(unaudited)

Reconciliation of Net loss to Adjusted EBITDA:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2024 | | June 30, 2023 | | June 30, 2024 | | June 30, 2023 |

| Net Loss | $ | (33,953) | | | $ | (107,595) | | | $ | (84,808) | | | $ | (301,199) | |

| Other income, net | (28,129) | | | (19,995) | | | (54,075) | | | (42,415) | |

| Stock-based compensation | 88,396 | | | 89,579 | | | 183,028 | | | 186,051 | |

| Depreciation and amortization | 15,807 | | | 18,545 | | | 32,280 | | | 34,181 | |

Restructuring charges (1) | 10,682 | | | 46 | | | 12,478 | | | 31,316 | |

| Income tax expense | (9,161) | | | 1,630 | | | (4,396) | | | 5,194 | |

| Adjusted EBITDA | $ | 43,642 | | | $ | (17,790) | | | $ | 84,507 | | | $ | (86,872) | |

(1) Restructuring charges for the three months ended June 30, 2024 primarily include asset impairment charges of $10.7 million.

Restructuring charges for the six months ended June 30, 2024 primarily include asset impairment charges of $11.5 million.

Restructuring charges for the six months ended June 30, 2023 include severance and related charges of $25.4 million, asset impairment charges of $4.3 million, and facilities exit costs of $1.6 million.

Reconciliation of Cash flow from operations to Free Cash Flow (TTM):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 23 | | Q3 23 | | Q4 23 | | Q1 24 | | Q2 24 |

| Net cash provided by operating activities | $ | 15,383 | | | $ | 246,882 | | | $ | 255,856 | | | $ | 455,951 | | | $ | 332,304 | |

| Less: Purchases of property and equipment | (181,803) | | | (144,477) | | | (82,619) | | | (29,048) | | | (11,850) | |

| Add/(Less): Effect of exchange rate changes on cash, cash equivalents and restricted cash | (2,914) | | | (1,599) | | | 2,654 | | | (149) | | | (2,537) | |

| Free Cash Flow (TTM) | $ | (169,334) | | | $ | 100,806 | | | $ | 175,891 | | | $ | 426,754 | | | $ | 317,917 | |

| | |

| Roku Q2 2024 Shareholder Letter |

14

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

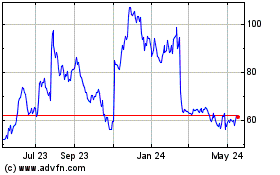

Roku (NASDAQ:ROKU)

Historical Stock Chart

From Dec 2024 to Jan 2025

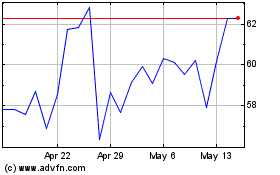

Roku (NASDAQ:ROKU)

Historical Stock Chart

From Jan 2024 to Jan 2025