Sunrun (Nasdaq: RUN), the nation’s leading provider of clean energy

as a subscription service, today announced financial results for

the quarter ended September 30, 2024.

“Sunrun’s focus on providing customers with the best experience

and differentiated offerings is delivering strong operating and

financial results. In the third quarter, we again set new records

for both storage installation attachment rates and delivered solid

quarter-over-quarter growth for solar installations while reporting

higher Net Subscriber Values,” said Mary Powell, Sunrun’s

Chief Executive Officer. “The team delivered the second

consecutive quarter of positive Cash Generation. Our primary focus

continues to be expanding our differentiation for customers and

remaining a disciplined, margin-focused leader that drives

meaningful Cash Generation.”

“In the third quarter, we delivered on our commitments for solar

and storage installations, margin expansion and Cash Generation.

Net Subscriber Value was the highest level the company has ever

reported, a testament to our margin-focused and disciplined growth

strategy,” said Danny Abajian, Sunrun’s Chief Financial

Officer. “We have a strong balance sheet with no near-term

corporate debt maturities, having extended our recourse working

capital facility maturity to March 2027, and as of today, we have

reduced parent debt by over $100 million since March. As we

increase our Cash Generation, we will continue to allocate excess

unrestricted cash to further reduce parent recourse debt and are

committed to a capital allocation strategy beyond this initial

de-leveraging period that drives significant shareholder

value.”

Third Quarter Updates

- Storage Attachment Rates Reach 60%: Storage attachment rates on

installations reached 60% in Q3, up from 33% in the prior-year

period, with 336 Megawatt hours installed during the quarter.

Sunrun has installed more than 135,000 solar and storage systems,

representing over 2.1 Gigawatt hours of stored energy

capacity.

- Continued Momentum in New Homes Business: Sunrun is seeing

strong traction in its new homes division. Sunrun is working with 9

of the top 10 new home builders in California, and over half of the

top 20 home builders in the US. In September, Sunrun signed a

multi-year exclusive agreement with Toll Brothers (NYSE: TOL) in

California. While this division represents less than 5% of our

volumes currently, we expect this division to grow at least 50%

next year. Home builders appreciate our leading subscription

offerings, service commitments, and long track record. Our

subscription offering can provide new home buyers with immediate

value, including savings on energy and resiliency from backup

storage systems, without increasing the cost of purchasing the

home.

- Improving Grid Stability with Virtual Power Plants: In Q3,

Sunrun introduced several new virtual power plant programs to help

meet peak demand and enhance grid stability. In New York, Sunrun

activated the state’s largest residential virtual power plant in

collaboration with Orange & Rockland Utilities, Inc., a

subsidiary of Consolidated Edison, Inc. (NYSE: ED). Over 300

solar-plus-storage systems provided stored solar energy during

multiple peak demand events this summer, strengthening grid

reliability. Participating customers received a free or heavily

discounted home battery in exchange for their commitment to the

10-year program, while Sunrun received upfront payments from

O&R based on installed battery capacity. In Maryland, Sunrun

launched the nation’s first vehicle-to-home virtual power plant,

partnering with Baltimore Gas and Electric Company (BGE), a

subsidiary of Exelon Corporation (Nasdaq: EXC), to utilize a small

group of customer-owned Ford F-150 Lightnings. BGE was awarded

grant funding from the Department of Energy to create the program,

and Sunrun helped develop and administer it. Participating

customers can earn several hundred dollars by sharing energy from

their F-150 Lightning trucks. In Texas, Sunrun partnered with Tesla

Electric and Vistra on two virtual power plants. Still growing, the

Tesla Electric program has already enrolled more than 150 Sunrun

customers, leveraging home batteries to provide reserves during

peak consumption. Customers will receive an annual payment,

currently set at $400 per Powerwall for 2024, while Sunrun earns

recurring revenue through the program. The Vistra partnership also

offers customers financial incentives and credits for sharing

stored energy with the grid when demand is highest.

- Continued Strong Capital Markets Execution: In September,

Sunrun closed a $365 million securitization of residential solar

and battery systems, its fourth securitization placed in 2024. The

transaction was structured with two separate classes of publicly

placed A+ rated notes. The weighted average spread was 235 basis

points and the weighted average yield was 5.87%. The initial

balance of the Class A notes represents a 73.8% advance rate on the

Securitization Share of ADSAB (present value using a 6% discount

rate). Similar to prior transactions, Sunrun raised additional

capital in a subordinated non-recourse financing, which increased

the cumulative advance rate to above 80% as measured against the

initial Contracted Subscriber Value of the portfolio. Also, in

July, Sunrun expanded its non-recourse warehouse lending facility

by $280 million to $2,630 million in commitments, matching the

growing scale of Sunrun’s business.

- Extended Maturity of Recourse Working Capital Facility and

Reduced Parent Leverage Through Continued 2026 Convertible Note

Repurchases: We extended the maturity of our recourse Working

Capital Facility to March 2027 (from November 2025) as we were in

compliance with the provisions in the agreement, which calls for

having funds in a restricted reserve account equal to the amount of

our outstanding 2026 Convertible Notes. We continue to reduce

parent leverage with continued repurchasing of our 2026 Convertible

Notes. To date, we have repurchased $317 million of these notes,

leaving $83 million of the notes outstanding as of today. As of

September 30, 2024 the outstanding balance on the 2026 Convertible

Notes was $133.2 million.

Key Operating Metrics

In the third quarter of 2024, Customer Additions were 31,910

including 30,348 Subscriber Additions. As of September 30, 2024,

Sunrun had 1,015,910 Customers, including 858,477 Subscribers.

Customers grew 12% in the third quarter of 2024 compared to the

third quarter of 2023.

Annual Recurring Revenue from Subscribers was approximately $1.5

billion as of September 30, 2024. The Average Contract Life

Remaining of Subscribers was 17.6 years as of September 30,

2024.

Subscriber Value was $51,223 in the third quarter of 2024, a 9%

increase compared to the third quarter of 2023. Creation Cost was

$36,591 in the third quarter of 2024, a 2% increase compared to the

third quarter of 2023.

Net Subscriber Value was $14,632 in the third quarter of 2024.

Total Value Generated was $444 million in the third quarter of

2024. On a pro-forma basis assuming a 7.1% discount rate,

consistent with capital costs observed in the quarter, Subscriber

Value was $47,335 and Net Subscriber Value was $10,744 in the third

quarter of 2024.

Gross Earning Assets as of September 30, 2024, were $16.8

billion. Net Earning Assets were $6.2 billion, which included

$1,011 million in Total Cash, as of September 30, 2024.

Cash Generation was $2.5 million in the third quarter of 2024,

the second consecutive quarter of positive Cash Generation.

Storage Capacity Installed was 336.3 Megawatt hours in the third

quarter of 2024, a 92% increase compared to the third quarter of

2023.

Solar Energy Capacity Installed was 229.7 Megawatts in the third

quarter of 2024, an 11% decrease compared to the third quarter of

2023. Included in this figure is 220.7 Megawatts of Solar Energy

Capacity Installed for Subscribers in the third quarter of 2024, a

4% decrease compared to the third quarter of 2023.

Networked Solar Energy Capacity was 7,288 Megawatts as of

September 30, 2024. Included in this figure is 6,204 Megawatts of

Networked Solar Energy Capacity for Subscribers as of September 30,

2024.

Networked Storage Capacity was 2.1 Gigawatt hours as of

September 30, 2024.

The solar energy systems we deployed in Q3 are expected to

offset the emission of 4.7 million metric tons of CO2 over the next

thirty years. Over the last twelve months ended September 30, 2024,

Sunrun’s systems are estimated to have offset 4.1 million metric

tons of CO2.

Outlook

Management is reiterating Cash Generation guidance of $350

million to $600 million for the full-year 2025.

Management is reiterating guidance for Cash Generation of $50

million to $125 million in Q4.

Storage Capacity Installed is expected to be in a range of 320

to 350 Megawatt hours in Q4, reflecting 52% growth at the midpoint

compared to the prior year. For the full-year 2024, this implies

100% growth at the midpoint compared to 2023.

Solar Energy Capacity Installed is expected to be in a range of

240 to 250 Megawatts in Q4, reflecting 8% growth at the midpoint

compared to the prior year, and 7% growth at the midpoint compared

to Q3. For the full-year 2024, this implies a decline of 17% at the

midpoint compared to 2023.

Net Subscriber Value is expected to increase in Q4 compared to

Q3.

Third Quarter 2024 GAAP Results

Total revenue was $537.2 million in the third quarter of 2024,

down $26.0 million, or 5%, from the third quarter of 2023. Customer

agreements and incentives revenue was $405.9 million, an increase

of $89.3 million, or 28%, compared to the third quarter of 2023.

Solar energy systems and product sales revenue was $131.3 million,

a decrease of $115.3 million, or 47%, compared to the third quarter

of 2023. The increasing mix of Subscribers results in less upfront

revenue recognition, as revenue is recognized over the life of the

Customer Agreement, which is typically 20 or 25 years.

Total cost of revenue was $433.7 million, a decrease of 16%

year-over-year. Total operating expenses were $665.0 million, a

decrease of 111% year-over-year, on a pro-forma basis to exclude a

non-cash goodwill impairment and amortization of intangible assets,

which were incurred in the third quarter of 2023.

Net loss attributable to common stockholders was $83.8 million,

or $0.37 per basic and diluted share, in the third quarter of

2024.

Financing Activities

As of November 7, 2024, closed transactions and executed term

sheets provide us with expected tax equity to fund approximately

272 Megawatts of Solar Energy Capacity Installed for Subscribers

beyond what was deployed through September 30, 2024. Sunrun also

had $907 million available in its non-recourse senior revolving

warehouse facility at the end of Q3 to fund over 318 Megawatts of

Solar Energy Capacity Installed for Subscribers.

Conference Call Information

Sunrun is hosting a conference call for analysts and investors

to discuss its third quarter 2024 results and business outlook at

1:30 p.m. Pacific Time today, November 7, 2024. A live audio

webcast of the conference call along with supplemental financial

information will be accessible via the “Investor Relations” section

of Sunrun’s website at https://investors.sunrun.com. The conference

call can also be accessed live over the phone by dialing (877)

407-5989 (toll free) or (201) 689-8434 (toll). An audio replay will

be available following the call on the Sunrun Investor Relations

website for approximately one month.

About Sunrun

Sunrun Inc. (Nasdaq: RUN) revolutionized the solar industry in

2007 by removing financial barriers and democratizing access to

locally-generated, renewable energy. Today, Sunrun is the nation’s

leading provider of clean energy as a subscription service,

offering residential solar and storage with no upfront costs.

Sunrun’s innovative products and solutions can connect homes to the

cleanest energy on earth, providing them with energy security,

predictability, and peace of mind. Sunrun also manages energy

services that benefit communities, utilities, and the electric grid

while enhancing customer value. Discover more at www.sunrun.com

Forward Looking Statements

This communication contains forward-looking statements related

to Sunrun (the “Company”) within the meaning of Section 27A of the

Securities Act of 1933, and Section 21E of the Securities Exchange

Act of 1934 and the Private Securities Litigation Reform Act of

1995. Such forward-looking statements include, but are not limited

to, statements related to: the Company’s financial and operating

guidance and expectations; the Company’s business plan, trajectory,

expectations, market leadership, competitive advantages,

operational and financial results and metrics (and the assumptions

related to the calculation of such metrics); the Company’s momentum

in its business strategies including its ESG efforts, expectations

regarding market share, total addressable market, customer value

proposition, market penetration, growth of certain divisions,

financing activities, financing capacity, product mix, and ability

to manage cash flow and liquidity; the growth of the solar

industry; the Company’s financing activities and expectations to

refinance, amend, and/or extend any financing facilities; trends or

potential trends within the solar industry, our business, customer

base, and market; the Company’s ability to derive value from the

anticipated benefits of partnerships, new technologies, and pilot

programs, including contract renewal and repowering programs;

anticipated demand, market acceptance, and market adoption of the

Company’s offerings, including new products, services, and

technologies; the Company’s strategy to be a storage-first company;

the ability to increase margins based on a shift in product focus;

expectations regarding the growth of home electrification, electric

vehicles, virtual power plants, and distributed energy resources;

the Company’s ability to manage suppliers, inventory, and

workforce; supply chains and regulatory impacts affecting supply

chains; the Company’s leadership team and talent development; the

legislative and regulatory environment of the solar industry and

the potential impacts of proposed, amended, and newly adopted

legislation and regulation on the solar industry and our business;

the ongoing expectations regarding the Company’s storage and energy

services businesses and anticipated emissions reductions due to

utilization of the Company’s solar energy systems; and factors

outside of the Company’s control such as macroeconomic trends, bank

failures, public health emergencies, natural disasters, acts of

war, terrorism, geopolitical conflict, or armed conflict /

invasion, and the impacts of climate change. These statements are

not guarantees of future performance; they reflect the Company’s

current views with respect to future events and are based on

assumptions and estimates and are subject to known and unknown

risks, uncertainties and other factors that may cause actual

results, performance or achievements to be materially different

from expectations or results projected or implied by

forward-looking statements. The risks and uncertainties that could

cause the Company’s results to differ materially from those

expressed or implied by such forward-looking statements include:

the Company’s continued ability to manage costs and compete

effectively; the availability of additional financing on acceptable

terms; worldwide economic conditions, including slow or negative

growth rates and inflation; volatile or rising interest rates;

changes in policies and regulations, including net metering,

interconnection limits, and fixed fees, or caps and licensing

restrictions and the impact of these changes on the solar industry

and our business; the Company’s ability to attract and retain the

Company’s business partners; supply chain risks and associated

costs; realizing the anticipated benefits of past or future

investments, partnerships, strategic transactions, or acquisitions,

and integrating those acquisitions; the Company’s leadership team

and ability to attract and retain key employees; changes in the

retail prices of traditional utility generated electricity; the

availability of rebates, tax credits and other incentives; the

availability of solar panels, batteries, and other components and

raw materials; the Company’s business plan and the Company’s

ability to effectively manage the Company’s growth and labor

constraints; the Company’s ability to meet the covenants in the

Company’s investment funds and debt facilities; factors impacting

the home electrification and solar industry generally, and such

other risks and uncertainties identified in the reports that we

file with the U.S. Securities and Exchange Commission from time to

time. All forward-looking statements used herein are based on

information available to us as of the date hereof, and we assume no

obligation to update publicly these forward-looking statements for

any reason, except as required by law.

Citations to industry and market statistics used herein may be

found in our Investor Presentation, available via the “Investor

Relations” section of Sunrun’s website at

https://investors.sunrun.com.

|

Consolidated Balance Sheets(In Thousands) |

| |

|

September 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current

assets: |

|

|

|

|

|

Cash |

|

$ |

533,863 |

|

$ |

678,821 |

|

Restricted cash |

|

|

476,606 |

|

|

308,869 |

|

Accounts receivable, net |

|

|

182,513 |

|

|

172,001 |

|

Inventories |

|

|

342,348 |

|

|

459,746 |

|

Prepaid expenses and other current assets |

|

|

67,132 |

|

|

262,822 |

|

Total current assets |

|

|

1,602,462 |

|

|

1,882,259 |

|

Restricted cash |

|

|

148 |

|

|

148 |

|

Solar energy systems, net |

|

|

14,427,903 |

|

|

13,028,871 |

|

Property and equipment, net |

|

|

134,613 |

|

|

149,139 |

|

Goodwill |

|

|

3,122,168 |

|

|

3,122,168 |

|

Other assets |

|

|

2,817,029 |

|

|

2,267,652 |

|

Total assets |

|

$ |

22,104,323 |

|

$ |

20,450,237 |

| Liabilities and total

equity |

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

244,184 |

|

$ |

230,723 |

|

Distributions payable to noncontrolling interests and redeemable

noncontrolling interests |

|

|

43,871 |

|

|

35,180 |

|

Accrued expenses and other liabilities |

|

|

410,488 |

|

|

499,225 |

|

Deferred revenue, current portion |

|

|

120,991 |

|

|

128,600 |

|

Deferred grants, current portion |

|

|

8,165 |

|

|

8,199 |

|

Finance lease obligations, current portion |

|

|

26,532 |

|

|

22,053 |

|

Non-recourse debt, current portion |

|

|

236,227 |

|

|

547,870 |

|

Pass-through financing obligation, current portion |

|

|

1,050 |

|

|

16,309 |

|

Total current liabilities |

|

|

1,091,508 |

|

|

1,488,159 |

|

Deferred revenue, net of current portion |

|

|

1,171,925 |

|

|

1,067,461 |

|

Deferred grants, net of current portion |

|

|

188,589 |

|

|

195,724 |

|

Finance lease obligations, net of current portion |

|

|

74,627 |

|

|

68,753 |

|

Convertible senior notes |

|

|

603,510 |

|

|

392,867 |

|

Line of credit |

|

|

392,524 |

|

|

539,502 |

|

Non-recourse debt, net of current portion |

|

|

11,219,898 |

|

|

9,191,689 |

|

Pass-through financing obligation, net of current portion |

|

|

— |

|

|

278,333 |

|

Other liabilities |

|

|

212,091 |

|

|

190,866 |

|

Deferred tax liabilities |

|

|

115,258 |

|

|

122,870 |

|

Total liabilities |

|

|

15,069,930 |

|

|

13,536,224 |

| Redeemable noncontrolling

interests |

|

|

633,817 |

|

|

676,177 |

| Total stockholders’

equity |

|

|

5,278,033 |

|

|

5,230,228 |

| Noncontrolling interests |

|

|

1,122,543 |

|

|

1,007,608 |

|

Total equity |

|

|

6,400,576 |

|

|

6,237,836 |

|

Total liabilities, redeemable noncontrolling interests and

total equity |

|

$ |

22,104,323 |

|

$ |

20,450,237 |

|

|

|

Consolidated Statements of Operations(In Thousands, Except

Per Share Amounts) |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenue: |

|

|

|

|

|

|

|

|

|

Customer agreements and incentives |

|

$ |

405,861 |

|

|

$ |

316,528 |

|

|

$ |

1,116,653 |

|

|

$ |

865,151 |

|

|

Solar energy systems and product sales |

|

|

131,312 |

|

|

|

246,653 |

|

|

|

402,574 |

|

|

|

878,072 |

|

|

Total revenue |

|

|

537,173 |

|

|

|

563,181 |

|

|

|

1,519,227 |

|

|

|

1,743,223 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Cost of customer agreements and incentives |

|

|

308,382 |

|

|

|

283,742 |

|

|

|

876,581 |

|

|

|

789,334 |

|

|

Cost of solar energy systems and product sales |

|

|

125,312 |

|

|

|

234,274 |

|

|

|

411,591 |

|

|

|

824,830 |

|

|

Sales and marketing |

|

|

162,490 |

|

|

|

176,349 |

|

|

|

466,411 |

|

|

|

574,061 |

|

|

Research and development |

|

|

8,180 |

|

|

|

5,039 |

|

|

|

30,510 |

|

|

|

14,153 |

|

|

General and administrative |

|

|

60,587 |

|

|

|

53,254 |

|

|

|

173,082 |

|

|

|

163,957 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

1,158,000 |

|

|

|

— |

|

|

|

1,158,000 |

|

|

Total operating expenses |

|

|

664,951 |

|

|

|

1,910,658 |

|

|

|

1,958,175 |

|

|

|

3,524,335 |

|

| Loss from operations |

|

|

(127,778 |

) |

|

|

(1,347,477 |

) |

|

|

(438,948 |

) |

|

|

(1,781,112 |

) |

| Interest expense, net |

|

|

(215,615 |

) |

|

|

(171,288 |

) |

|

|

(614,981 |

) |

|

|

(471,163 |

) |

| Other (expense) income,

net |

|

|

(82,598 |

) |

|

|

77,673 |

|

|

|

71,710 |

|

|

|

93,744 |

|

| Loss before income taxes |

|

|

(425,991 |

) |

|

|

(1,441,092 |

) |

|

|

(982,219 |

) |

|

|

(2,158,531 |

) |

| Income tax (benefit)

expense |

|

|

(13,803 |

) |

|

|

29,846 |

|

|

|

(26,953 |

) |

|

|

(11,096 |

) |

| Net loss |

|

|

(412,188 |

) |

|

|

(1,470,938 |

) |

|

|

(955,266 |

) |

|

|

(2,147,435 |

) |

|

Net loss attributable to noncontrolling interests and redeemable

noncontrolling interests |

|

|

(328,422 |

) |

|

|

(401,479 |

) |

|

|

(922,756 |

) |

|

|

(893,062 |

) |

|

Net loss attributable to common stockholders |

|

$ |

(83,766 |

) |

|

$ |

(1,069,459 |

) |

|

$ |

(32,510 |

) |

|

$ |

(1,254,373 |

) |

|

Net loss per share attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.37 |

) |

|

$ |

(4.92 |

) |

|

$ |

(0.15 |

) |

|

$ |

(5.81 |

) |

|

Diluted |

|

$ |

(0.37 |

) |

|

$ |

(4.92 |

) |

|

$ |

(0.15 |

) |

|

$ |

(5.81 |

) |

|

Weighted average shares used to compute net loss per share

attributable to common stockholders |

|

|

|

|

|

|

|

|

|

Basic |

|

|

223,695 |

|

|

|

217,344 |

|

|

|

222,078 |

|

|

|

216,029 |

|

|

Diluted |

|

|

223,695 |

|

|

|

217,344 |

|

|

|

222,078 |

|

|

|

216,029 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows(In

Thousands) |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Operating

activities: |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(412,188 |

) |

|

$ |

(1,470,938 |

) |

|

$ |

(955,266 |

) |

|

$ |

(2,147,435 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

|

|

|

|

|

Depreciation and amortization, net of amortization of deferred

grants |

|

|

155,528 |

|

|

|

138,756 |

|

|

|

458,533 |

|

|

|

388,645 |

|

|

Goodwill impairment |

|

|

— |

|

|

|

1,158,000 |

|

|

|

— |

|

|

|

1,158,000 |

|

|

Deferred income taxes |

|

|

(13,803 |

) |

|

|

29,844 |

|

|

|

(26,953 |

) |

|

|

(11,093 |

) |

|

Stock-based compensation expense |

|

|

26,992 |

|

|

|

27,723 |

|

|

|

83,956 |

|

|

|

84,226 |

|

|

Interest on pass-through financing obligations |

|

|

— |

|

|

|

4,886 |

|

|

|

8,837 |

|

|

|

14,642 |

|

|

Reduction in pass-through financing obligations |

|

|

(1,599 |

) |

|

|

(10,485 |

) |

|

|

(20,787 |

) |

|

|

(30,532 |

) |

|

Unrealized (loss) gain on derivatives |

|

|

73,870 |

|

|

|

(74,390 |

) |

|

|

2,311 |

|

|

|

(80,121 |

) |

|

Other noncash items |

|

|

65,436 |

|

|

|

63,750 |

|

|

|

105,259 |

|

|

|

142,434 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(7,113 |

) |

|

|

22,688 |

|

|

|

(20,715 |

) |

|

|

9,986 |

|

|

Inventories |

|

|

10,777 |

|

|

|

129,939 |

|

|

|

117,398 |

|

|

|

122,103 |

|

|

Prepaid expenses and other assets |

|

|

(199,993 |

) |

|

|

(83,510 |

) |

|

|

(470,617 |

) |

|

|

(334,190 |

) |

|

Accounts payable |

|

|

45,217 |

|

|

|

(36,439 |

) |

|

|

36,379 |

|

|

|

(56,271 |

) |

|

Accrued expenses and other liabilities |

|

|

68,707 |

|

|

|

24,023 |

|

|

|

76,406 |

|

|

|

(24,487 |

) |

|

Deferred revenue |

|

|

32,013 |

|

|

|

12,913 |

|

|

|

97,465 |

|

|

|

59,360 |

|

|

Net cash used in operating activities |

|

|

(156,156 |

) |

|

|

(63,240 |

) |

|

|

(507,794 |

) |

|

|

(704,733 |

) |

| Investing

activities: |

|

|

|

|

|

|

|

|

|

Payments for the costs of solar energy systems |

|

|

(764,161 |

) |

|

|

(736,781 |

) |

|

|

(1,907,667 |

) |

|

|

(1,935,721 |

) |

|

Purchases of property and equipment, net |

|

|

(202 |

) |

|

|

(4,666 |

) |

|

|

(945 |

) |

|

|

(16,298 |

) |

|

Net cash used in investing activities |

|

|

(764,363 |

) |

|

|

(741,447 |

) |

|

|

(1,908,612 |

) |

|

|

(1,952,019 |

) |

| Financing

activities: |

|

|

|

|

|

|

|

|

|

Proceeds from state tax credits, net of recapture |

|

|

— |

|

|

|

— |

|

|

|

5,203 |

|

|

|

4,033 |

|

|

Proceeds from line of credit |

|

|

161,824 |

|

|

|

295,014 |

|

|

|

305,556 |

|

|

|

651,398 |

|

|

Repayment of line of credit |

|

|

(160,229 |

) |

|

|

(359,572 |

) |

|

|

(452,534 |

) |

|

|

(639,308 |

) |

|

Proceeds from issuance of convertible senior notes, net of capped

call transaction |

|

|

— |

|

|

|

— |

|

|

|

444,822 |

|

|

|

— |

|

|

Repurchase of convertible senior notes |

|

|

(45,562 |

) |

|

|

— |

|

|

|

(229,346 |

) |

|

|

— |

|

|

Proceeds from issuance of non-recourse debt |

|

|

749,700 |

|

|

|

1,724,370 |

|

|

|

3,364,956 |

|

|

|

3,189,480 |

|

|

Repayment of non-recourse debt |

|

|

(238,489 |

) |

|

|

(1,061,809 |

) |

|

|

(1,692,214 |

) |

|

|

(1,399,799 |

) |

|

Payment of debt fees |

|

|

(10,723 |

) |

|

|

(29,809 |

) |

|

|

(93,747 |

) |

|

|

(46,930 |

) |

|

Proceeds from pass-through financing and other obligations,

net |

|

|

1,192 |

|

|

|

2,392 |

|

|

|

4,795 |

|

|

|

6,712 |

|

|

Early repayment of pass-through financing obligation |

|

|

— |

|

|

|

— |

|

|

|

(240,288 |

) |

|

|

— |

|

|

Payment of finance lease obligations |

|

|

(6,884 |

) |

|

|

(6,035 |

) |

|

|

(20,635 |

) |

|

|

(16,795 |

) |

|

Contributions received from noncontrolling interests and redeemable

noncontrolling interests |

|

|

494,569 |

|

|

|

355,002 |

|

|

|

1,290,486 |

|

|

|

1,112,541 |

|

|

Distributions paid to noncontrolling interests and redeemable

noncontrolling interests |

|

|

(55,985 |

) |

|

|

(52,192 |

) |

|

|

(238,388 |

) |

|

|

(173,536 |

) |

|

Acquisition of noncontrolling interests |

|

|

(1,501 |

) |

|

|

(32,090 |

) |

|

|

(21,434 |

) |

|

|

(46,274 |

) |

|

Proceeds from transfer of investment tax credits |

|

|

222,891 |

|

|

|

— |

|

|

|

557,111 |

|

|

|

— |

|

|

Payments to redeemable noncontrolling interests and noncontrolling

interests of investment tax credits |

|

|

(222,891 |

) |

|

|

— |

|

|

|

(557,111 |

) |

|

|

— |

|

|

Net proceeds related to stock-based award activities |

|

|

976 |

|

|

|

283 |

|

|

|

11,953 |

|

|

|

14,152 |

|

|

Net cash provided by financing activities |

|

|

888,888 |

|

|

|

835,554 |

|

|

|

2,439,185 |

|

|

|

2,655,674 |

|

| Net change in cash and

restricted cash |

|

|

(31,631 |

) |

|

|

30,867 |

|

|

|

22,779 |

|

|

|

(1,078 |

) |

| Cash and restricted cash,

beginning of period |

|

|

1,042,248 |

|

|

|

921,078 |

|

|

|

987,838 |

|

|

|

953,023 |

|

| Cash and restricted cash, end

of period |

|

$ |

1,010,617 |

|

|

$ |

951,945 |

|

|

$ |

1,010,617 |

|

|

$ |

951,945 |

|

Key Operating and Financial

Metrics

The following operating metrics are used by management to

evaluate the performance of the business. Management believes these

metrics, when taken together with other information contained in

our filings with the SEC and within this press release, provide

investors with helpful information to determine the economic

performance of the business activities in a period that would

otherwise not be observable from historic GAAP measures. Management

believes that it is helpful to investors to evaluate the present

value of cash flows expected from subscribers over the full

expected relationship with such subscribers (“Subscriber Value”,

more fully defined in the definitions appendix below) in comparison

to the costs associated with adding these customers, regardless of

whether or not the costs are expensed or capitalized in the period

(“Creation Cost”, more fully defined in the definitions appendix

below). The Company also believes that Subscriber Value, Creation

Costs, and Total Value Generated are useful metrics for investors

because they present an unlevered view of all of the costs

associated with new customers in a period compared to the expected

future cash flows from these customers over a 30-year period, based

on contracted pricing terms with its customers, which is not

observable in any current or historic GAAP-derived metric.

Management believes it is useful for investors to also evaluate the

future expected cash flows from all customers that have been

deployed through the respective measurement date, less estimated

costs to maintain such systems and estimated distributions to tax

equity partners in consolidated joint venture partnership flip

structures, and distributions to project equity investors (“Gross

Earning Assets”, more fully defined in the definitions appendix

below). The Company also believes Gross Earning Assets is useful

for management and investors because it represents the remaining

future expected cash flows from existing customers, which is not a

current or historic GAAP-derived measure.

Various assumptions are made when calculating these metrics.

Both Subscriber Value and Gross Earning Assets utilize a 6% rate to

discount future cash flows to the present period. Furthermore,

these metrics assume that customers renew after the initial

contract period at a rate equal to 90% of the rate in effect at the

end of the initial contract term. For Customer Agreements with

25-year initial contract terms, a 5-year renewal period is assumed.

For a 20-year initial contract term, a 10-year renewal period is

assumed. In all instances, we assume a 30-year customer

relationship, although the customer may renew for additional years,

or purchase the system. Estimated cost of servicing assets has been

deducted and is estimated based on the service agreements

underlying each fund.

| In-period volume

metrics: |

Three Months EndedSeptember 30,

2024 |

|

|

Customer Additions |

|

31,910 |

|

|

Subscriber Additions (included within Customer Additions) |

|

30,348 |

|

|

Solar Energy Capacity Installed (in Megawatts) |

|

229.7 |

|

|

Solar Energy Capacity Installed for Subscribers (in Megawatts) |

|

220.7 |

|

|

Storage Capacity Installed (in Megawatt hours) |

|

336.3 |

|

| |

|

|

| In-period value

creation metrics: |

Three Months EndedSeptember 30,

2024 |

|

|

Subscriber Value Contracted Period |

$ |

47,557 |

|

|

Subscriber Value Renewal Period |

$ |

3,666 |

|

|

Subscriber Value |

$ |

51,223 |

|

|

Creation Cost |

$ |

36,591 |

|

|

Net Subscriber Value |

$ |

14,632 |

|

|

Total Value Generated (in millions) |

$ |

444.1 |

|

| |

|

|

| In-period

environmental impact metrics: |

Three Months EndedSeptember 30,

2024 |

|

|

Positive Environmental Impact from Customers (over trailing twelve

months, in millions of metric tons of CO2 avoidance) |

|

4.1 |

|

|

Positive Expected Lifetime Environmental Impact from Customer

Additions (in millions of metric tons of CO2 avoidance) |

|

4.7 |

|

| |

|

|

| Period-end

metrics: |

September 30, 2024 |

|

|

Customers |

|

1,015,910 |

|

|

Subscribers (subset of Customers) |

|

858,477 |

|

|

Households Served in Low-Income Multifamily Properties |

|

19,321 |

|

|

Networked Solar Energy Capacity (in Megawatts) |

|

7,288 |

|

|

Networked Solar Energy Capacity for Subscribers (in Megawatts) |

|

6,204 |

|

|

Networked Storage Capacity (in Megawatt hours) |

|

2,133 |

|

|

Annual Recurring Revenue (in millions) |

$ |

1,517 |

|

|

Average Contract Life Remaining (in years) |

|

17.6 |

|

|

Gross Earning Assets Contracted Period (in millions) |

$ |

12,964 |

|

|

Gross Earning Assets Renewal Period (in millions) |

$ |

3,815 |

|

|

Gross Earning Assets (in millions) |

$ |

16,780 |

|

|

Net Earning Assets (in millions) |

$ |

6,231 |

|

|

|

|

|

|

Figures presented above may not sum due to rounding. For

adjustments related to Subscriber Value and Creation Cost, please

see the supplemental Creation Cost and Net Subscriber Value

calculation memo for each applicable period, which is available on

investors.sunrun.com.

Definitions

Deployments represent solar or storage systems,

whether sold directly to customers or subject to executed Customer

Agreements (i) for which we have confirmation that the systems are

installed, subject to final inspection, or (ii) in the case of

certain system installations by our partners, for which we have

accrued at least 80% of the expected project cost (inclusive of

acquisitions of installed systems).

Customer Agreements refer to, collectively,

solar or storage power purchase agreements and leases.

Subscriber Additions represent the number of

Deployments in the period that are subject to executed Customer

Agreements.

Customer Additions represent the number of

Deployments in the period.

Solar Energy Capacity Installed represents the

aggregate megawatt production capacity of our solar energy systems

that were recognized as Deployments in the period.

Solar Energy Capacity Installed for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that were recognized as Deployments in the period

that are subject to executed Customer Agreements.

Storage Capacity Installed represents the

aggregate megawatt hour capacity of storage systems that were

recognized as Deployments in the period.

Creation Cost represents the sum of certain

operating expenses and capital expenditures incurred divided by

applicable Customer Additions and Subscriber Additions in the

period. Creation Cost is comprised of (i) installation costs, which

includes the increase in gross solar energy system assets and the

cost of customer agreement revenue, excluding depreciation expense

of fixed solar assets, and operating and maintenance expenses

associated with existing Subscribers, plus (ii) sales and marketing

costs, including increases to the gross capitalized costs to obtain

contracts, net of the amortization expense of the costs to obtain

contracts, plus (iii) general and administrative costs, and less

(iv) the gross profit derived from selling systems to customers

under sale agreements and Sunrun’s product distribution and lead

generation businesses. Creation Cost excludes stock based

compensation, amortization of intangibles, and research and

development expenses, along with other items the company deems to

be non-recurring or extraordinary in nature. The gross margin

derived from solar energy systems and product sales is included as

an offset to Creation Cost since these sales are ancillary to the

overall business model and lowers our overall cost of business. The

sales, marketing, general and administrative costs in Creation

Costs is inclusive of sales, marketing, general and administrative

activities related to the entire business, including solar energy

system and product sales. As such, by including the gross margin on

solar energy system and product sales as a contra cost, the value

of all activities of the Company’s segment are represented in the

Net Subscriber Value.

Subscriber Value represents the per subscriber

value of upfront and future cash flows (discounted at 6%) from

Subscriber Additions in the period, including expected payments

from customers as set forth in Customer Agreements, net proceeds

from tax equity finance partners, payments from utility incentive

and state rebate programs, contracted net grid service program cash

flows, projected future cash flows from solar energy renewable

energy credit sales, less estimated operating and maintenance costs

to service the systems and replace equipment, consistent with

estimates by independent engineers, over the initial term of the

Customer Agreements and estimated renewal period. For Customer

Agreements with 25 year initial contract terms, a 5 year renewal

period is assumed. For a 20 year initial contract term, a 10 year

renewal period is assumed. In all instances, we assume a 30-year

customer relationship, although the customer may renew for

additional years, or purchase the system.

Net Subscriber Value represents Subscriber

Value less Creation Cost.

Total Value Generated represents Net Subscriber

Value multiplied by Subscriber Additions.

Customers represent the cumulative number of

Deployments, from the company’s inception through the measurement

date.

Subscribers represent the cumulative number of

Customer Agreements for systems that have been recognized as

Deployments through the measurement date.

Networked Solar Energy Capacity represents the

aggregate megawatt production capacity of our solar energy systems

that have been recognized as Deployments, from the company’s

inception through the measurement date.

Networked Solar Energy Capacity for Subscribers

represents the aggregate megawatt production capacity of our solar

energy systems that have been recognized as Deployments, from the

company’s inception through the measurement date, that have been

subject to executed Customer Agreements.

Networked Storage Capacity represents the

aggregate megawatt hour capacity of our storage systems that have

been recognized as Deployments, from the company’s inception

through the measurement date.

Gross Earning Assets is calculated as Gross

Earning Assets Contracted Period plus Gross Earning Assets Renewal

Period.

Gross Earning Assets Contracted Period

represents the present value of the remaining net cash flows

(discounted at 6%) during the initial term of our Customer

Agreements as of the measurement date. It is calculated as the

present value of cash flows (discounted at 6%) that we would

receive from Subscribers in future periods as set forth in Customer

Agreements, after deducting expected operating and maintenance

costs, equipment replacements costs, distributions to tax equity

partners in consolidated joint venture partnership flip structures,

and distributions to project equity investors. We include cash

flows we expect to receive in future periods from tax equity

partners, government incentive and rebate programs, contracted

sales of solar renewable energy credits, and awarded net cash flows

from grid service programs with utilities or grid operators.

Gross Earning Assets Renewal Period is the

forecasted net present value we would receive upon or following the

expiration of the initial Customer Agreement term but before the

30th anniversary of the system’s activation (either in the form of

cash payments during any applicable renewal period or a system

purchase at the end of the initial term), for Subscribers as of the

measurement date. We calculate the Gross Earning Assets Renewal

Period amount at the expiration of the initial contract term

assuming either a system purchase or a renewal, forecasting only a

30-year customer relationship (although the customer may renew for

additional years, or purchase the system), at a contract rate equal

to 90% of the customer’s contractual rate in effect at the end of

the initial contract term. After the initial contract term, our

Customer Agreements typically automatically renew on an annual

basis and the rate is initially set at up to a 10% discount to

then-prevailing utility power prices.

Net Earning Assets represents Gross Earning

Assets, plus total cash, less adjusted debt and less pass-through

financing obligations, as of the same measurement date. Debt is

adjusted to exclude a pro-rata share of non-recourse debt

associated with funds with project equity structures along with

debt associated with the company’s ITC safe harboring facility.

Because estimated cash distributions to our project equity partners

are deducted from Gross Earning Assets, a proportional share of the

corresponding project level non-recourse debt is deducted from Net

Earning Assets, as such debt would be serviced from cash flows

already excluded from Gross Earning Assets.

Cash Generation is calculated using the change

in our unrestricted cash balance from our consolidated balance

sheet, less net proceeds (or plus net repayments) from all recourse

debt (inclusive of convertible debt), and less any primary equity

issuances or net proceeds derived from employee stock award

activity (or plus any stock buybacks or dividends paid to common

stockholders) as presented on the Company’s consolidated statement

of cash flows. The Company expects to continue to raise tax equity

and asset-level non-recourse debt to fund growth, and as such,

these sources of cash are included in the definition of Cash

Generation. Cash Generation also excludes long-term asset or

business divestitures and equity investments in external

non-consolidated businesses (or less dividends or distributions

received in connection with such equity investments). Restricted

cash in a reserve account with a balance equal to the amount

outstanding of 2026 convertible notes is considered unrestricted

cash for the purposes of calculating Cash Generation.

Annual Recurring Revenue represents revenue

arising from Customer Agreements over the following twelve months

for Subscribers that have met initial revenue recognition criteria

as of the measurement date.

Average Contract Life Remaining represents the

average number of years remaining in the initial term of Customer

Agreements for Subscribers that have met revenue recognition

criteria as of the measurement date.

Households Served in Low-Income Multifamily

Properties represent the number of individual rental units

served in low-income multi-family properties from shared solar

energy systems deployed by Sunrun. Households are counted when the

solar energy system has interconnected with the grid, which may

differ from Deployment recognition criteria.

Positive Environmental Impact from Customers

represents the estimated reduction in carbon emissions as a result

of energy produced from our Networked Solar Energy Capacity over

the trailing twelve months. The figure is presented in millions of

metric tons of avoided carbon emissions and is calculated using the

Environmental Protection Agency’s AVERT tool. The figure is

calculated using the most recent published tool from the EPA, using

the current-year avoided emission factor for distributed resources

on a state by state basis. The environmental impact is estimated

based on the system, regardless of whether or not Sunrun continues

to own the system or any associated renewable energy credits.

Positive Expected Lifetime Environmental Impact from

Customer Additions represents the estimated reduction in

carbon emissions over thirty years as a result of energy produced

from solar energy systems that were recognized as Deployments in

the period. The figure is presented in millions of metric tons of

avoided carbon emissions and is calculated using the Environmental

Protection Agency’s AVERT tool. The figure is calculated using the

most recent published tool from the EPA, using the current-year

avoided emission factor for distributed resources on a state by

state basis, leveraging our estimated production figures for such

systems, which degrade over time, and is extrapolated for 30 years.

The environmental impact is estimated based on the system,

regardless of whether or not Sunrun continues to own the system or

any associated renewable energy credits.

Total Cash represents the total of the

restricted cash balance and unrestricted cash balance from our

consolidated balance sheet.

Investor & Analyst Contact:

Patrick JobinSVP, Deputy CFO & Investor Relations

Officerinvestors@sunrun.com

Media Contact:

Wyatt SemanekDirector, Corporate

Communicationspress@sunrun.com

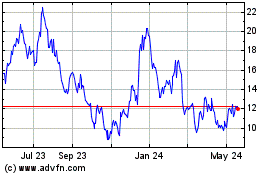

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Nov 2024 to Dec 2024

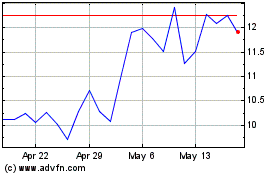

Sunrun (NASDAQ:RUN)

Historical Stock Chart

From Dec 2023 to Dec 2024