false

0001025561

0001025561

2024-01-17

2024-01-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act 1934

Date

of Report (date of earliest event reported): January 17, 2024

SHARPLINK

GAMING LTD.

(formerly

Mer Telemanagement Solutions Ltd.)

(Exact

name of registrant as specified in charter)

| Israel |

|

7999 |

|

98-1657258 |

(State

of

Incorporation) |

|

(Primary

Standard Industrial

Classification

Code Number.) |

|

(IRS

Employer

Identification

No.) |

333

Washington Avenue North, Suite 104

Minneapolis,

Minnesota 55402

(Address

of Principal Executive Offices) (Zip Code)

612-293-0619

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, is Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares |

|

SBET |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

8.01 OTHER EVENTS.

Receipt

of Tax Ruling from Israel Tax Authority in connection with the Domestication Merger

On

January 21, 2024, SharpLink Gaming Ltd. (“SharpLink Israel” or the “Company”), an Israel limited liability company,

received from the Israel Tax Authority (the “ITA”) a tax ruling (the “104H Tax Ruling”), dated January 17,

2024, with respect to the Israeli tax treatment applicable to the merger consideration payable to certain of SharpLink Israel’s

shareholders in connection with the domestication merger transaction involving SharpLink Israel, SharpLink Gaming Inc., a Delaware corporation

and wholly owned subsidiary of SharpLink Israel (“SharpLink US”), and SharpLink Merger Sub Ltd., an Israeli company and a

wholly owned subsidiary of SharpLink US (“Domestication Merger Sub”), (such merger, the “Domestication Merger”).

Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Agreement and Plan of Merger and

Reorganization (the “Domestication Merger Agreement”), submitted to the U.S. Securities and Exchange Commission as Annex

A of the Company’s Schedule 14A dated October 25, 2023.

The

104H Tax Ruling applies to any SharpLink Israel shareholder who is part of the “Interested Public” (as such term is defined

in the 104H Tax Ruling and more fully detailed below) and satisfies all the conditions stated in the 104H Tax Ruling.

The

following is a summary discussion of the material provisions of the 104H Tax Ruling. The following summary is included for general information

purposes only, is based upon current Israeli tax law and the rules promulgated thereunder, and the 104H Tax Ruling and should not be

construed as or considered to be tax advice to any particular holder of SharpLink Israel’s Ordinary Shares. No assurance can be

given that future legislation, regulation or interpretations will not significantly change the tax considerations described below, and

any such change may apply retroactively. This summary is not intended to be and does not constitute a complete review of all material

terms of the 104H Tax Ruling, nor does it discuss all material aspects of Israeli tax consequences that may apply to particular holders

of SharpLink Israel’s Ordinary Shares (in light of their particular circumstances). YOU SHOULD CAREFULLY READ THE CONVENIENCE

TRANSLATION OF THE 104H TAX RULING ATTACHED HERETO AS EXHIBIT 99.1 AND CONSULT YOUR TAX ADVISORS REGARDING THE TAX CONSEQUENCES OF THE

DOMESTICATION MERGER TO YOU. The original, Hebrew version of the 104H Tax Ruling will be uploaded to the Company’s website

under the “Investors” section. In the event of any discrepancy between the translation of the 104H Tax Ruling attached hereto

and the official, original Hebrew version of the 104H Tax Ruling, the official, original Hebrew version of the 104H Tax Ruling shall

govern. The 104H Tax Ruling and this Form 8-K do not address any non-Israeli tax matters.

Based

on the 104H Tax Ruling, with respect to the Merger Consideration payable to shareholders who are considered Interested Public and whose

sale of SharpLink Israel Ordinary Shares would have been taxable if not for the 104H Tax ruling, the transfer of SharpLink Israel’s

Ordinary Shares in exchange for shares of SharpLink US Common Stock shall not be deemed, subject to the terms and conditions of the 104H

Tax Ruling, on the Effective Date, as a sale under the Israeli Tax Ordinance (the “Ordinance”), and the ‘sale event’

shall be deferred until such time as such shares of SharpLink US Common Stock are actually sold by a shareholder. The 104H Tax Ruling

provides detailed provisions regarding the calculation of capital gains (including the methodology for calculating new tax basis in the

SharpLink US common stock), withholding and reporting (as and if applicable) with respect to such future sale event. The 104H Tax Ruling

further provides that issuance by SharpLink US of the Merger Consideration to SharpLink Israel shareholders who are considered Interested

Public and thus covered under the 104H Tax Ruling, is exempt from tax withholding under Israeli law.

The

104H Tax Ruling further provides that any SharpLink Israel shareholder who is part of the Interested Public may request to treat the

sale of its SharpLink Israel Ordinary Shares in exchange for shares of SharpLink US Common Stock as a tax event. If a shareholder makes

such a request, the provisions of the 104H Tax Ruling will not apply to such shareholder and the taxation of such shareholder shall be

in accordance with Israeli law.

The

104H Tax Ruling determines that a SharpLink Israel shareholders will be deemed as part of the “Interested Public” and therefore

will be subject to the 104H Tax Ruling if they meets ALL of the following conditions:

| ● | They

are not controlling shareholders, as defined in Section 103 of the Ordinance; |

| ● | They

purchased all of their SharpLink Israel Ordinary Shares following its registration for trade

on the Nasdaq; |

| ● | They

hold all of their SharpLink Israel Ordinary Shares through stock exchange members, which

also include non-Israeli brokers or banks that hold shares through CEDE & Co. (the nominee

company of DTC); |

| ● | They

are not Registered Shareholders (i.e., shareholders whose SharpLink Israel Ordinary Shares

are registered in their name directly with SharpLink Israel’s transfer agent, Equiniti

(formerly known as American Stock Transfer & Trust Company LLC)and not through the nominee

company of DTC); |

| ● | They

are not Relatives (as such term is defined in Section 88 of the Ordinance) of Registered

Shareholders; |

| ● | They

are not “interested parties” or “office holders” (as defined in the

Israeli Securities Law, 5728-1968)1; |

| ● | They

have not previously received any tax ruling from the ITA that determines a tax arrangement

with respect to the taxation of their SharpLink Israel Ordinary Shares that contradicts the

104H Tax Ruling; and |

| ● | They

are not subject to any other arrangement from the ITA that contradicts the 104H Tax Ruling. |

A

holder that does not meet the definition of Interested Public, will be deemed not to meet such definition for all of his/her/its

SharpLink Israel Ordinary Shares, and therefore will not be considered as part of the Interested Public for that certain part of his/her/its

SharpLink Israel Ordinary Shares that meets all of the conditions for an “Interested Public,” even if such shares were purchased

independently and separately from other SharpLink Israel Ordinary Shares.

You

should carefully review the definition of Interested Public in order to determine whether you qualify as a member of this group. If you

are a holder of SharpLink Israel Ordinary Shares and you do not meet the definition

of Interested Public (other than in the event you hold all your SharpLink Israel Ordinary Shares

as a Registered Shareholder), you are requested to immediately contact SharpLink’s Investor Relations Group via email: ir@sharplink.com.

To the extent you do not meet the definition of Interested Public, the tax implications to you in connection with the Merger shall

be in accordance with Israeli law.

The

104H Tax Ruling provides that if the Domestication Merger is not accomplished within 90 days from the date of the 104H Tax Ruling (January

17, 2024), the 104H Tax Ruling will be cancelled retroactively.

The

104H Tax Ruling includes an Option Annex that generally provides that the exchange of SharpLink Israel Options or Warrants issued to

Israeli employees (and one former employee) or Israeli consultants, or SharpLink Israel Ordinary Shares that were upon conversion of

such SharpLink Israel Options or Warrants will not be deemed as a taxable event under Israeli tax laws.

1

An “interested party” is defined as a holder of five percent or more of the issued capital of a company or the voting

rights in the company, or a person entitled to appoint one or more of the members of the board of directors of the company or its general

manager, anyone who is a member of the board of directors or the general manager of a company, or a corporation that any of the foregoing

persons hold twenty five percent or more of its issued capital or voting rights or is entitled to appoint twenty five percent or more

of its members of the board of directors. This includes also a trustee, other than a nominee company. An “office holder”

is defined as a general manager, chief business manager, vice general manager, any other person assuming the responsibilities of any

of the foregoing positions without regard to such person’s title, and a director, or manager directly subordinate to the general

manager.

Israeli

Tax Treatment of Shareholders not covered by the 104H Tax Ruling

Any

SharpLink Israel shareholder who is not part of the Interested Public and is therefore not subject to the 104H Tax Ruling, may, to the

extent not eligible for an exemption from Israeli tax withholding, be subject to withholding of capital gains tax in connection with

the consummation of the Domestication Merger. A SharpLink Israel shareholder may generally be eligible for an exemption from Israeli

tax withholding based on either a foreign tax residency or in the event it is in a loss position on its SharpLink Israel Ordinary Shares.

Pending

receipt of the exemption from the ITA, the Merger Consideration to which such non-Interested Public shareholder will be entitled to,

will be held in trust by SharpLink US’s transfer agent, Equiniti (formerly American Stock Transfer & Trust Company, LLC). The

Company and SharpLink US will assist shareholders whose SharpLink US Common Stock will be held in trust with obtaining the withholding

exemption from the ITA, to the extent they are eligible for such an exemption, and subject to cooperation by such shareholders in the

event they will be requested to provide information, documentation or declarations to the ITA. In connection with the tax withholding

exemption process, each SharpLink Israel shareholder who is not a member of the Interested Public will be required initially to sign,

to the extent applicable, a “Declaration of Status for Israeli Income Purposes,” in the form attached hereto as Exhibit 99.2,

and provide it to the Company.

In

the event an exemption cannot be obtained or is not received within six months from the date of the Domestication Merger, the

relevant shareholder will be required to provide SharpLink US the amount in cash due in connection with the Israeli tax withholding

obligation. In the event that the shareholder fails to provide SharpLink US with the full cash amount necessary to satisfy such

Israeli tax withholding obligation (as determined in the sole discretion of the SharpLink US), SharpLink US shall be entitled to

sell the shares of SharpLink US Common Stock to the extent necessary to satisfy the full amount due with regards to such Israeli tax

withholding obligation (after taking into account any taxes due, if any, with respect to the sale of such Common Stock).

This

Current Report on Form 8-K is intended to provide general information to the Company’s shareholders and foreign-resident employees

of the main procedures registered shareholders and foreign-resident employees must follow in order to become eligible for exemption from

tax withholding under Israeli Law, to which they may be entitled under the Withholding Tax Ruling.

Neither

the Company nor any representative of the Company is requesting any forms or submissions by shareholders or foreign-resident employees

at this time. PLEASE DO NOT SUBMIT ANY FORMS OR OTHER MATERIALS TO THE COMPANY OR COMPANY REPRESENTATIVES IN CONNECTION WITH THE MERGER

UNTIL REQUESTED.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SHARPLINK

GAMING LTD. |

| |

|

|

| |

By:

|

/s/

Rob Phythian |

| |

Name:

|

Rob

Phythian |

| |

Title:

|

Chief

Executive Officer |

| Dated:

February 2, 2024 |

|

|

Exhibit

99.1

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

7

Shevat 5784

January

21, 2024

Application

No.: ______

To:

Vered

Kirshner, CPA

Kesselman

& Kesselman, CPAs

Dear

Madam,

Re:

Acquisition of Shares of SharpLink Gaming Ltd., No. 520042904 from Shareholders Among the Interested-Public as Defined in this Tax

Ruling - In Accordance with the Provisions of Section 104H of the Income Tax Ordinance

(Enclosed:

Your Application dated September 12, 2023)

Definitions

and References for Purposes of this Tax Ruling:

Each

term in this tax ruling shall have the meaning and definition determined for it in Part E2 of the Ordinance, unless expressly stated

otherwise. In addition, it should be clarified that the provisions of Section 104H shall apply except in a place in which it was determined

otherwise.

the

“Allocated Shares” – the shares that shall be allocated by the Receiving Company to shareholders of the Transferred

Company within the framework of the exchange of the shares as defined in Section 104H of the Ordinance, and including all of the securities

that will be received within the framework of the change of the capital of the Receiving Company, including the distribution of bonus

shares, split and every right that was allocated through them.

the

“Transferred Company” – SharpLink Gaming Ltd., no. 520042904, and regarding the Options annex, which is an integral

part of this taxation ruling, the “Allocating Company”. the “Receiving Company” – SharpLink

Gaming, Inc, and regarding the Options annex, which is an integral part of this taxation ruling, the “Acquiring Company”.

the

“Merger Company” – SharpLink Merger Sub Ltd. no. 516550258.

the

“Exchange Date” – The date on which the shares of the Transferred Company will actually be exchanged for the

shares of the Receiving Company.

The

“Registered Shareholders” - shareholders in the Transferred Company whose shares are registered directly in the name

of the shareholders and not through any registration company.

the

“Controlling Shareholder” – A foreign corporation, Alpha Capital Anstalt.

The

“Stock Exchange Members” –

| |

1. |

Israeli

stock exchange members (if there are any). |

| |

|

|

|

2. |

Brokers

/ foreign banks that hold the registered shares in CEDE & Co, the foreign registration company. |

the

“Foreign Registration Company” – CEDE & Co, which is the company equivalent to the company for registrations

with regard to shares traded on stock exchanges in the United States.

the

“Options annex” – the annex attached to this taxation ruling which includes facts and details regarding the

options issued by the Transferred Company.

The

“Interested Public” - The shareholders from the public in the Transferred Company that meet all of the following

conditions will collectively be called in this taxation ruling: the “Interested Public”:

| |

1.1. |

They

are not controlling shareholders, as defined in Section 103 of the Ordinance. |

| |

|

|

| |

1.2. |

They

purchased all of their shares in the Transferred Company following the Transferred Company’s registration for trade on the

NASDAQ. |

| |

|

|

| |

1.3. |

They

hold all of their shares in the Transferred Company through stock exchange members. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

1.4. |

They

are not Registered Shareholders. |

| |

|

|

| |

1.5. |

They

are not relatives of Registered Shareholders (as defined under Section 88 of the Ordinance). |

| |

|

|

| |

1.6. |

They

are not Interested Parties or senior officers (as defined in the Securities Law, 5728-1968). |

| |

|

|

| |

1.7. |

A

tax ruling was not previously issued by the Israel Tax Authority that determines a tax arrangement with respect to the taxation of

the shares owned by them that contradicts this tax ruling. |

| |

|

|

| |

1.8. |

No

other arrangement by the Tax Authority contradicts this decision applies to them. |

the

“Transaction” – A transaction within the framework of which, the Merger Company shall merge with and into the

Company (as the surviving company in the Merger) and shall cease to exist according to the provisions of Section 323 of the Companies

Law. As a result of the Merger, the Transferred Company is expected to become a wholly owned subsidiary of the Receiving Company, and

its shares shall cease to be traded on the NASDAQ. In consideration for the transfer of the shares of the Transferred Company to the

Receiving Company, the Transferred Company’s shareholders shall receive shares of the Receiving Company that are listed for trade

(the Interested Party shall exchange its untradeable preferred shares for untradeable preferred shares, and so on with respect to all

of the rights held by it).

the

“Allocated Shares” – The shares that will be received by shareholders in the Transferred Company in the Receiving

Company, which will replace their shares in the Transferred Company as part of the Transaction.

the

“Transferring shareholders” – The shareholders of the Transferred Company who meet the definition of the Interested

Public.

the

“Liable Transferring shareholders” –the Transferring shareholders whose sale of the Transferred Company shares

would have been taxable if not for this taxation ruling.

| 1. |

The

Fact as Presented to Us by You |

| |

1.1. |

The

Transferred Company is an Israeli resident company that was incorporated on December 27, 1995, and the shares of which were initially

registered for trade on the NASDAQ in 1997. The Transferred Company engages in the provision of digital marketing solutions for content

and sports gambling websites. The Company’s solutions allow companies to study consumer behavior, to refer users to gambling

websites and to convert users into participants on online sports websites. The Company’s platform allows for connections to

be made between users and websites, conversion, and monetization. As of today, all of the Company’s activity is performed via

foreign subsidiaries (The Transferred Company sold all of its business activities in 2022 for no consideration, exception of earn

out payments, whatever they may be. As of 2023, the Transferred Company has no business activity. According to the financial statements

of the Transferred Company as of 31/12/2020, the Transferred Company has a capital deficit in the amount of 101,762 thousand NIS). |

| |

|

|

| |

1.2. |

The

share register of the Transferred Company is managed by Equiniti / American Stock Transfer & Trust Company and the registered

shareholders and the foreign registration company are registered in it. |

| |

|

|

| |

1.3. |

The

issued and paid-up capital of the Transferred Company as of September 27, 2023, includes an amount of 2,863,734 ordinary shares with

a par value of NIS 0.60 each, all of which are registered for trade, the issued and paid-up Preferred A-1 share capital of the Company

is 7,202 shares with a par value of NIS 0.60 each , and the issued and paid-up Preferred B share capital of the Company is 12,481

shares with a par value of NIS 0.60 each. Out of the capital, an amount of 1,523,613 ordinary shares of the Transferred Company,

that constitute approximately 56.7% of the issued and paid-up capital of the Transferred Company, are named shares that are registered

directly in the name of the shareholders, and not via a nominee company of any kind. |

| |

|

|

| |

1.4. |

The

Interested Public holds only ordinary shares of the Transferred Company. |

| |

|

|

| |

1.5. |

The

Registered Shareholders, who are residents of Israel to the best of the Transferred Company’s knowledge (with an Israeli address)

hold approximately 0.21% of the issued and paid-up capital of the Company. |

| |

|

|

| |

1.6. |

The

Controlling Shareholder is the only controlling owner that meets the definition of a controlling shareholder in section 103 of the

Ordinance and is a foreign corporation registered in Liechtenstein. The Controlling Shareholder holds approximately 101,406 Ordinary

Shares that constitute approximately 3.6% of the issued and paid-up capital of the Company, 7,202 Preferred A-1 Shares, 12,481 Preferred

B Shares, options for the purchase of 1,146,667 Ordinary Shares, and bonds that are convertible into 1,391,798 Ordinary Shares. The

Preferred A shares are convertible to Ordinary Shares at a ratio of 1:1, and the Preferred B Shares are convertible to Ordinary Shares

at a ratio of 2.321:1. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

1.7. |

Preferred

A-1 Shares are entitled to similar rights to ordinary shares and to vote in the company’s general meetings on an as converted

basis, subject to a voting limit that states that the owner of the preferred share and entities related to him will not be allowed

to vote more than 9.99% of the voting rights in the company and are entitled to be converted into ordinary shares of the company

in the ratio detailed above. As of this date, Preferred B Shares are not entitled to vote in the company’s general meeting,

they have priority in the liquidation of the company to receive the price paid for them, and they are entitled to be converted into

ordinary shares of the company in the ratio specified above. |

| |

|

|

| |

1.8. |

In

addition, the Transferred Company allocated non-tradable options to the company’s ordinary shares, according to the provisions

of section 102 under its old version, sections 102(b)(2) and 102(b)(3) and 3(i) of the Ordinance as detailed in the options appendix. |

| |

1.8.1. |

As

of the date of writing this tax ruling, the value of the shares held by a former employee and the options granted to the Employee

and the Consultant as detailed in the options appendix is approx. than NIS 30,000. |

| |

|

|

| |

1.8.2. |

In

addition, the Transferred Company granted non-tradable options to non-Israeli tax resident employees of foreign subsidiaries of the

Transferred Company that can be exercised for ordinary shares of the Transferred. |

| |

1.9. |

A

list of the holdings of interested parties and senior officers of the Transferred Company, in accordance with U.S. securities law,

as of 24.10.2023, is attached as Appendix A to this tax ruling. |

| |

|

|

| |

1.10. |

The

Receiving Company is a U.S. resident company that was incorporated in 2022 and established for the purposes of the reorganization.

The company holds the Merger Company, that was also established for purposes of the aforementioned reorganization. |

| |

|

|

| |

1.11. |

It

will be clarified that the only consideration in the transaction is the Allocated Shares and that the shareholders of the Transferred

Company will not receive any consideration other than them. |

| |

|

|

| |

1.12. |

It

is agreed and clarified, and for the removal of doubt, that for purposes of the exchange of the shares no debt shall be given to

the Transferred Company or to a directly or indirectly held subsidiary of the Transferred Company, and no liabilities whatsoever

shall be transferred to the Transferred Company in relation to the exchange of the shares. |

| |

|

|

| |

1.13. |

According

to your declaration, the Transaction Consideration in its entirety solely reflects capital consideration and does not include employment

income and anything like it. |

| |

|

|

| |

1.14. |

According

to your declaration, all of the components that were received in the Transaction by the owners of the Transferred Shares are capital

consideration that are subject to tax in accordance with Part E of the Ordinance, and within the framework of the consideration no

consideration was directly or indirectly included that is income that is not capital in nature according to Part E of the Ordinance. |

| |

|

|

| |

1.15. |

According

to your declaration, the Transferred Company and/or the Receiving Company are not a Real Estate Association, as this term is defined

in the Real Estate Taxation Law (Appreciation and Acquisition), 5723-1963. |

| |

|

|

| |

1.16. |

According

to your declaration, the exchange of shares transaction is not a Tax Planning that Must be Reported in accordance with the Income

Tax Regulations (Tax Planning the Must be Reported), 5767-2006. |

| |

|

|

| |

1.17. |

According

to your declaration, the exchange of shares transaction is not part of a multi-step transaction the primary objective of which is

the improper reduction of tax. |

| |

|

|

| |

1.18. |

According

to your declaration, no reorganizations according to Part E2 of the Ordinance have been executed by each of the companies participating

in the Transaction during the three tax years that preceded the year in which the exchange of shares falls, and the Required Period

for any previous reorganization will have ended as of the date of the exchange of the shares. |

| |

|

|

| |

1.19. |

According

to your declaration, prior to the reorganization that is the subject of this tax ruling, there are no balances whatsoever between

the Transferred Company and its shareholders, in their standing as shareholders. |

| |

|

|

| |

1.20. |

According

to your declaration, based on the trading data that is published by the NASDAQ, the average daily trading turnover on the stock exchange

of the shares of the Transferred Company during the period from October 1, 2021, through September 30, 2023, stands at approximately

35,378 shares on average per day. When taking into account the number of traded shares of the Transferred Company, which is 2,833,734,

on average, all of the aforementioned shares are sold on the stock exchange over a range of time of approximately 77 days (not including

the shares of the Controlling Shareholder) and 80 days (including the shares of the Controlling Shareholder). |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

1.21. |

According

to your declaration, the Company shall act to obtain all of the necessary approvals, including approvals from the U.S. Securities

and Exchange Commission, for purposes of executing this transaction. |

| |

|

|

| |

1.22. |

According

to your declaration, there is no impediment to carrying out the exchange of shares, which is the subject of this decision, in the

outline described therein, and no party is known to oppose the exchange of shares. |

| |

|

|

| |

1.23. |

According

to your declaration, with respect to the registered shareholders, an application was made to receive a taxation ruling from the capital

market department numbered PR231709, while the controlling shareholder applied for an exemption in the transaction in accordance

with section 97(b3). Apart from the registered shareholders, the former employee and the controlling shareholder, all other shareholders

in the Transferred Company meet the definition of an interested public. |

| |

|

|

| |

1.24. |

The

market value of the Transferred Company as of January 16, 2024, as reflected by the share price quoted in the stock exchange, is

approx. 4.58 million dollars. |

| |

|

|

| |

1.25. |

The

appendices attached to this tax ruling constitute an integral part thereof. |

| |

2.1. |

The

receipt of an approval that the exchange of the Transferred Shares by the Liable Transferring shareholders in consideration

for the allocation of shares in the Receiving Company shall not be considered a sale on the exchange date, but rather upon the actual

sale of the Allocated Shares by them. |

| |

|

|

| |

2.2. |

A

withholding tax obligation shall not apply to the Receiving Company and/or any party acting on its behalf with respect to the allocation

of shares of the Receiving Company to shareholders of the Transferred Company that are Interested-Public. |

Obtaining

an approval that the adoption of the options plan by the Acquiring, and the allocation of the new shares and options to the former employee,

the employee and the consultant in place of the existing shares and options shall not be considered as a taxable event at the level of

the former employee, the employee and the consultant and at the level of the Allocating Company and a tax continuity will apply.

| |

3.1. |

Subject

to the correctness of all of the aforementioned declarations and facts, by virtue of my authority according to Section 104H(b)(e)

of the Ordinance, I hereby certify that with respect to the exchange of the shares of the Transferred Company with the shares of

the Receiving Company for the Liable Transferring shareholders only a tax deferral will apply, as a result the Receiving Company

will not be liable for withholding tax obligation for the Liable Transferring shareholders for the allocation of the allocated shares

passed their shares in the Transferred Company |

| |

|

|

| |

3.2. |

Despite

the definition of a sale day in section 104h, the day of sale of the allocated shares by the Liable Transferring shareholders will

be considered as the actual date of sale of the allocated shares. The calculation of the capital gain or loss and the calculation

of the tax derived from it that will accrue to which of the Liable Transferring shareholders, will be done only at the time of the

sale of the allocated shares for the first time and for each part sold. It is clarified that all shareholders who are residents of

Israel are required to report the sale of the allocated shares in the future and pay tax in accordance with the provisions of the

Ordinance and its regulations. |

| |

|

|

| |

3.3. |

As

for the Transferring shareholders, who are not part of the Liable Transferring shareholders, the exchange of their shares in the

Transferred Company with shares of the receiving company will be exempt from withholding tax by the receiving company. |

| |

|

|

| |

3.4. |

I

hereby certify that the if the date of the Exchange of the Shares will not be done within 90 days from the date of issuing this tax

ruling, this taxation ruling will be canceled retroactively. |

| |

|

|

| |

3.5. |

For

the avoidance of doubt, it will be clarified that in calculating the capital gain from the sale of the allocated shares, each of

the Liable Transferring shareholders will not be entitled to any credit, deduction or exemption, which they were not entitled to

at the time of the exchange of shares. It will be clarified that the sale of the allocated shares by each of the Liable Transferring

shareholders will be considered as if they had been sold by a resident of Israel, even if at the time of the sale of the allocated

shares the selling shareholder was a foreign resident and that he will not be entitled to a foreign tax credit as defined in section

199 of the Ordinance insofar as these are paid by him or Relief by virtue of the provisions of the Convention for the of Double Taxation

Treaty to the extent that he would not have been entitled to them if the Receiving Company had been a company resident in Israel. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

3.6. |

It

will be clarified that if a shareholder from the Interested Public requests to see the exchange of shares as a taxable event, the

provisions of this taxation ruling will not apply to him, but the provisions of all law will apply. |

| |

|

|

| |

3.7. |

The

withholding of tax upon the sale of the Allocated Shares by the Transferring Shareholders that hold their shares via Israeli banks

and/or Israeli stock exchange members only shall be executed in accordance with the provisions of the Income Tax Regulations (Withholding

from Consideration, from a Payment or from Capital Gain upon the Sale of a Security, upon the Sale of a Mutual Fund Unit or in a

Future Transaction), 5763-2002. |

| |

|

|

| |

3.8. |

The

purchase date and cost of the Allocated Shares for the Liable Transferring shareholders shall be determined in accordance with the

provisions of Section 104F. |

| |

|

|

| |

3.9. |

It

is agreed that there is nothing in this tax ruling in order to determine the classification of the income upon the sale of the Allocated

Shares by the Interested-Public, for any matter. Such a classification and the tax implications stemming therefrom shall be examined

by the relevant assessing officers. |

| |

|

|

| |

3.10. |

The

terms of this taxation ruling will be published by the Transferred Company as part of an immediate report to its shareholders prior

to the completion of the Transaction through the reporting system of the American Securities and Exchange Commission (the EDGAR system). |

Options

| |

3.11. |

It

is agreed that with respect to shares allocated with the exercise of options 102, options 102 and options 3(i), what is stated in

the options appendix, which is an integral part of this taxation decision, will apply. |

General

Provisions:

| |

3.12. |

It

is clarified and agreed that the relevant provisions of Section 104H shall apply to the Receiving Company. |

| |

|

|

| |

3.13. |

This

tax ruling was provided subject to the correctness of all the facts and declarations that were provided by you, and there is nothing

in it to restrict and/or detract in any way whatsoever from the authority of the assessing officer and/or the Israel Tax Authority

to conduct assessments for any party. |

| |

|

|

| |

3.14. |

For

the avoidance of doubt, it is hereby clarified and agreed that there is nothing in this tax ruling that constitutes the performance

of an assessment in any way for any party and/or a confirmation of the facts and/or for actions and/or for transactions and/or for

figures that were presented by you - all of which are issues that may be examined by the assessing officer and/or the Israel Tax

Authority. |

| |

|

|

| |

3.15. |

For

the avoidance of doubt, it is hereby clarified and agreed that there is nothing in this tax ruling that detracts and/or restricts

in any way the authority of the assessing officer and/or the Israel Tax Authority according to the provisions of the Ordinance and

according to the provisions of any law. |

| |

|

|

| |

3.16. |

It

should be clarified that there is nothing in this tax ruling in order to determine the classification of the income upon the sale

of the Allocated Shares by the Interested-Public as a capital sale, in any way. Such a classification shall be examined by the relevant

assessing officers. |

| |

|

|

| |

3.17. |

This

tax ruling is granted on the basis of the representations and documents provided to us in writing and verbally, including those detailed

in this tax ruling, and subject to the conditions stipulated in Part E2 of the Ordinance. The Reorganizations Department has the

right to cancel this tax ruling on a retroactive basis if it becomes clear that the details and the facts that were provided to us

within the framework of the application are not correct or are not substantially complete, or if it becomes clear that material details

that were detailed were not fulfilled, or if the conditions that the Director prescribed in this tax ruling were not met. |

| |

|

|

| |

3.18. |

It

is hereby clarified that all expenses directly or indirectly associated with the Exchange of the Shares, including legal expenses,

audit expenses, expenses for experts, expenses for consultants, and assorted fees, shall not be deductible, directly or indirectly,

for the Receiving Company or the Transferred Company, as detailed in the tax ruling, and/or for a party related to them, as a deduction

or as an expense according to Section 17 of the Ordinance. |

| |

|

|

| |

3.19. |

For

the removal of doubt, it should be clarified that in the calculation of the capital gain from the sale of the Allocated Shares, each

one of the Transferring Shareholders shall not be entitled to a credit, deduction, or exemption of any kind for which he or she was

not eligible at the time of the Exchange of the Shares. |

This

tax ruling is conditional upon the Receiving Company and the Transferred Company confirming to the Reorganizations Department and to

the assessing officer, within 60 days from the date of the receipt of this tax ruling, that it accepts all of the conditions of this

tax ruling exactly as written and without any reservations.

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

Sincerely,

Zvika

Barel, CPA (JD)

Director

of the Reorganizations Department

Cc:

Mr.

Roland Am-Shalem, CPA (JD) – Deputy CEO for Professional Matters

Mr.

Nadav Naggar, CPA (JD) – (Senior) Department Director – Professional Department

Mr.

Rafi Tawina, Adv. – Legal Advisor – Reorganizations

Mr.

Nadav Ashe CPA – Reorganizations Department

Mr.

Eran Caduri, CPA (JD) - Reorganizations Department

Re:

The transaction for the purchase of shares of SharpLink Gaming Ltd., Private Company No. 520042904 from the shareholders from among the

Interested-Public as defined in this taxation ruling - in accordance with the provisions of Section 104H of the Income Tax Ordinance

- Options annex

| |

1.1. |

The

Allocating Company has a plan for allocating options that was filed for approval to Tel-Aviv 5 Assessing Officer on 2003 (hereinafter:

the “Allocation Plan”). Please find as Appendix B. |

Under

the Allocation Plan compensation was given to offerees and employees of the Reporting Company and/or employees of subsidiaries of the

Allocating Company, who are not controlling shareholders, as this term is defined by Section 102 to the Income Tax Ordinance (hereinafter:

the “Ordinance”, the “Employees”, respectively), through options exercisable into ordinary shares

and/or units to purchase ordinary shares and/or ordinary shares as follows (hereinafter: the “Allocations/ Securities”):

☐

Allocations through a trustee, according to the provisions of the capital gains alternative in Section 102 to the Ordinance;

☐

Allocations according to the provisions of Section 3(i) to the Ordinance (By virtue of a separate allocation plan);

☐

Allocations according to the provisions of Section 102 prior to amendment No. 132 of the Ordinance;

It

was stipulated in the Allocation Plan that the allocation with all its conditions (mainly: the exercise price, the expiration date and

the vesting dates) will be presented to the authorized body of the company, as a rule the company’s board of directors (or a committee

of the company’s board of directors which has been authorized for this) and/or the general meeting and will be approved by it in

advance.

Please

find as Appendix C, all allocations listed above (that appendix needs to include, among other information, the following details:

Name of the employee, name of the employing company, type of shares, amount of shares, percentage of holding, status of the offer: employee

(position)/director, allocation date, allocation route, exercise supplement, deposit date in the hands of the trustee (both of the board

of directors’ decision and a general meeting [as far as relevant] and of the grant letter), the date of conversion to shares, the

vesting dates and the expiration date).

| |

1.2. |

Allocations

through a trustee under Section 102 to the Ordinance were deposited with the ESOP Management and Trust Services Ltd, Withholding

file #935877779, from the date of their allocation, according to guidance of income tax authorities and/or a tax ruling regarding

oversight trustees, as applicable (hereinafter: the “Trustee”). For the avoidance of any doubt, it is clarified

that the appointment of the trustee was approved by the Allocating Company prior to filing the Allocation Plan for approval by the

Assessing Officer, as required by Section 102 to the Ordinance, and since that date, the Trustee serves in the role of trustee of

the Allocation Plan. |

| |

|

|

| |

1.3. |

The

shares of the Allocating Company were allocated to the offerees of ordinary shares in accordance with the instructions of the Ordinance

and the rules as follows [please mark]: |

☐

Allocations through a trustee, according to the provisions of the capital gains alternative in Section 102(b)(2) to the Ordinance;

☐

Allocations according to the provisions of Section 102 prior to amendment No. 132 of the Ordinance;

☐

Allocations according to the provisions of Section 3(i) to the Ordinance.

| |

1.4. |

Under

the agreement, it was determined that the allocations, which were referred to above and listed in the attached Appendix C, will be

converted on Closing Date into rights to ordinary shares and/or ordinary shares of the Acquiring Company, as applicable (hereinafter:

the “Securities Replacement”, “New Securities”, respectively), and all according to the conversion

rate set for the Transaction. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

1.5. |

It

was determined in the Transaction that the New Securities will be allocated under the Allocation Plan to be adopted by the Acquiring

Company. |

| |

|

|

| |

1.6. |

It

is declared that the original terms of allocation of the securities will continue to apply also to the New Securities. Additionally,

the conversion rate set in the Transaction reflects the economic value of the replaced securities, which is derived from the price

of the Transaction, meaning that no additional benefit was given to the Employees. |

| |

|

|

| |

1.7. |

It

is declared that the employees, including the Consultant related to this tax ruling, are individuals who meet the definition of the

term “employee” in section 102 of the Ordinance, from the date of assignment to the date of application for this tax

ruling, and among other things that the remuneration agreement in full was concluded between the employer (as defined in section

102(a) of the Ordinance) and the individual is in the status of an employee or director (that is, he is not in the status of a service

provider (independent)) and is not entitled to any remuneration through a company under his control. Also, he is not a “controlling

shareholder” as the term is defined in section 32(9) of the Ordinance in full and exact compliance including and among other

things a direct or indirect right to appoint a manager, direct or indirect possession, alone and/or together with “relative”

as the term is defined in section 76(d) ) to the Ordinance. |

| |

|

|

| |

1.8. |

It

is declared that the Allocation Plan is classified for accounting purposes as a capital plan (settled by equity instruments) under

ASC 718 (formerly FAS 123R) of US GAAP; IFRS 2 under International Financial Reporting Standards; and Israel Accounting Standard

24, as published by the Israel Accounting Standards Board; and is not classified as a liability plan (settled in cash), including

the grant of phantom shares to the Employees. |

| |

|

|

| |

1.9. |

The

Allocation Plan in any other contract for engagement with the Employees, provide no possibility to exercise the ordinary shares arising

from the Allocations in question in this tax ruling through using put and/or call options, except through an advance approval of

the ITA Professional Department and under the terms set. |

| |

|

|

| |

1.10. |

The

Allocating Company and/or the Reporting Company declare that no other application has been submitted regarding the options in question

in this tax ruling, nor to any function in the ITA, regarding either the tax impact to the Allocating Company and/or the Reporting

Company or the tax impact to its Employees. |

To

determine the tax arrangement to govern the New Securities subsequent to the Replacement.

| 3. |

The

tax arrangement and its terms and conditions: |

| |

3.1. |

Any

term in this tax ruling shall have the meaning ascribed to it in Part E-1 of the Ordinance, unless expressly stated otherwise. |

The

replacement of the securities in the Allocation through a trustee under Section 102 to the Ordinance

| |

3.2. |

In

relation to the Securities that were granted as part of an allocation through a trustee under Section 102 to the Ordinance, the replacement

of the said Securities by the New Securities shall not be a taxable event for both the Employees and the Allocating Company and/or

the Reporting Company, and tax continuity will apply for all intents and purposes, including an uninterrupted period for determining

“end of period” (as this term is defined by Section 102 to the Ordinance), and the tax provisions in Section 102(b) to

the Ordinance, such that the restriction period is not reset on the date of replacing the Securities. |

| |

|

|

| |

3.3. |

The

New Securities will continue to be governed by the provisions of Section 102 to the Ordinance and all applicable rules thereunder

as part of an allocation through a trustee, such that the taxable event related to the New Securities will take place upon the earlier

of selling the shares to be allocated by virtue of the New Securities or when they leave the possession of the Trustee, and the classification

of the income under Section 102 to the Ordinance shall not be changed as a result of the replacement of the Securities as above. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

3.4. |

The

New Securities will be held by the Trustee until the date of the tax event. |

Replacement

of Securities by non-trustee allocation under Section 102 to the Ordinance

| |

3.5. |

In

relation to the non-trustee Securities under Section 102 to the Ordinance, the replacement of the said Securities by the New Securities

shall not be a taxable event for both the Employees and the Allocating Company and/or the Reporting Company, and tax continuity will

apply for all intents and purposes. The tax provisions in Section 102 (c) to the Ordinance shall continue to apply to the New Securities. |

Replacement

of securities allocated under Section 3(i) to the Ordinance

| |

3.6. |

In

relation to Securities allocated under Section 3(i) to the Ordinance, and as long as the Securities were not converted or to be converted

upon replacement into shares, then the replacement of the said Securities by the New Securities shall not be a taxable event for

both the Employees and the Allocating Company and/or the Reporting Company, and tax continuity will apply for all intents and purposes.

Note that on exercise date (as this term is defined by Section 3(i) to the Ordinance), the provisions of Section 3(i) to the Ordinance

shall apply, as may be the case. |

General

provisions:

| |

3.7. |

For

the avoidance of any doubt, note that the allocation of the New Securities shall be exempt from tax withholding. |

| |

|

|

| |

3.8. |

All

benefit that may be given to the offeree/employee by way of conversion rate and/or exercise price, etc. that departs from the conversion

rate set in the Transaction shall be deemed work income or business income earned by the offeree/employee, and the Company or Trustee

shall withhold tax in its respect, on the date of allocation of the New Securities, at the marginal tax rate of the offeree/employee,

as provided by Section 121 to the Ordinance and Section 121B to the Ordinance, or tax as provided by Income Tax Regulations (Withholding

from Payments for Services or Assets), 1977, unless the offeree/employee presents to the Company or the trustee a valid approval

from the Assessing Officer for withholding at a reduced rate. |

| |

|

|

| |

3.9. |

It

is clarified that if securities are allocated through a trustee under the provisions in the capital gain alternative in Section 102

to the Ordinance within the 90 days preceding signing date, the provisions of Section 102(b)(3) to the Ordinance shall apply, and

the value of the employment income benefit in their respect shall be calculated at the average share price of the Acquiring Company

at trading day’s closing in the 30 trading days preceding Closing Date. If the Acquiring Company is a private Company, the

value of the work income benefit is to be calculated at the difference between the price of the Company’s share on Transaction

date and the exercise price of the said securities as determined on the original allocation date of those securities. |

| |

|

|

| |

3.10. |

It

is hereby clarified that no expense shall be tax deductible in respect to the value of benefit attributed to the Employees in respect

to the allocations through a trustee and/or non-trustee allocations, except in accordance and subject to the provisions of Section

102(d) to the Ordinance, as the case may be. |

| |

|

|

| |

3.11. |

The

value of benefit in the Securities in question in this tax ruling on exercise date shall be seen as generated in Israel. Additionally,

the offerees/employees shall be seen as Israeli residents until exercise date regarding income from the Securities in question in

this tax ruling. |

Israel

Tax Authority

Professional

Unit

Reorganizations

Department

| |

3.12. |

When

calculating the profit and tax as discussed in this tax ruling, no deductions (except exercise price), offsets, exemptions, profit

spreading and/or reduced tax rate and/or tax credit (including foreign tax credits) shall be permitted, and the provisions of Sections

94B, 101 and 100A to the Ordinance shall not apply. If it is proven by an offeree/employee in their individual tax return that they

were charged foreign tax for the income from exercising the shares in question in this tax ruling, and that they paid that tax, the

ITA shall consider granting foreign tax credit under any law and double-tax treaties. |

| |

|

|

| |

3.13. |

The

Reporting Company shall not claim any expenses in respect of the replacement of the Securities, including professional fees related

to their issue, except as permitted by Section 102(d) to the Ordinance. |

| |

|

|

| |

3.14. |

The

Securities, the Employees, the Reporting Company and the Trustee are all subject to all terms and conditions set by Section 102 to

the Ordinance and the rules enacted thereunder. Additionally, this tax ruling shall be in effect only subject to compliance with

all provisions of Section 102 to the Ordinance and the rules thereunder, and provided that this tax ruling does not determine otherwise

(hereinafter: the “Legal Conditions”). |

| |

|

|

| |

3.15. |

This

ruling is issued based on the presentations that were made to us in writing and verbally, including those presented in section 1

above. However, if it is found that the information in the application, entirely or part thereof, are incorrect or materially incomplete

and/or one of the terms of the tax ruling is not complied with and/or the Legal Conditions are not satisfied and/or the Shares or

the New Securities are transferred from the Trustee other than for selling to a non-relative third party, as this term is defined

by Section 88 to the Ordinance (hereinafter together: the “Violation”), then the following shall apply: the violating

offerees/employees to whom the Securities are allocated shall be charged tax as work income under Section 2(1) or Section 2(2) to

the Ordinance for the higher of the value of benefit on the date of allocation and the value of benefit on the date of exercise or

violation. In addition, in the aforementioned cases, no expense will be allowed to the Allocating Company and/or the Reporting Company

and/or the employing company in respect of the Securities subject of this tax ruling. |

| |

|

|

| |

3.16. |

This

tax ruling does not constitute an approval of the Allocation Plan and/or a plan of the Acquiring Company, under the meaning assigned

to it by Section 102 to the Ordinance, and adherence to the provisions in Section 102 to the Ordinance and the rules thereunder. |

| |

|

|

| |

3.17. |

Without

prejudice to the above, and in addition, note that this tax ruling may not grant exemption to Employees that are legally required

to file a tax return in Israel, including due to additional tax payment, as this term is defined by Section 121B to the Ordinance. |

| |

|

|

| |

3.18. |

Nothing

in this tax ruling can be construed as an assessment and certification of the facts as you presented. The facts presented above shall

be reviewed by the Assessing Officer in an audit of the Reporting Company and/or Security holders, as the case may be. |

| |

|

|

| |

3.19. |

Nothing

in this tax ruling constitutes certification of any valuation. |

| |

|

|

| |

3.20. |

It

is hereby clarified that this tax ruling applies only to the offerees/employees holding the Securities in question in this

tax ruling, as discussed and elaborated in Appendix C, and nothing in this tax ruling may determine the tax liability and/or the

withholding liability of other shareholders of the Company and/or in the allocating group and/or other option holders. |

Exhibit

99.2

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

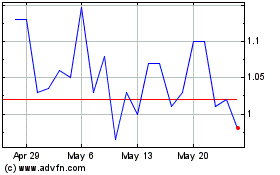

SharpLink Gaming (NASDAQ:SBET)

Historical Stock Chart

From Apr 2024 to May 2024

SharpLink Gaming (NASDAQ:SBET)

Historical Stock Chart

From May 2023 to May 2024