false

0001025561

0001025561

2024-02-07

2024-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act 1934

Date

of Report (date of earliest event reported): February 7, 2024

SHARPLINK

GAMING LTD.

(formerly

Mer Telemanagement Solutions Ltd.)

(Exact

name of registrant as specified in charter)

| Israel |

|

7999 |

|

98-1657258 |

(State

of

Incorporation) |

|

(Primary

Standard Industrial

Classification

Code Number.) |

|

(IRS

Employer

Identification

No.) |

333

Washington Avenue North, Suite 104

Minneapolis,

Minnesota 55402

(Address

of Principal Executive Offices) (Zip Code)

612-293-0619

(Registrant’s

Telephone Number, Including Area Code)

(Former

Name or Former Address, is Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Ordinary

Shares |

|

SBET |

|

The

Nasdaq Stock Market, LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM

3.01 NOTICE OF DELISTING OR FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

As

previously disclosed, on May 23, 2023, the Listing Qualifications staff (the “Staff”) of The Nasdaq Stock Market, LLC (“Nasdaq”)

had notified SharpLink Gaming Ltd. (“SharpLink” or the “Company”) that it did not comply with the minimum $2,500,000

stockholders’ equity requirement for continued listing set forth in Nasdaq Listing Rule 5550(b)(1) (the “Rule”); however,

on August 9, 2023, the Staff granted the Company’s request for an extension until November 20, 2023 to comply with this requirement.

On November 21, 2023, the Company received a delist determination letter from the Staff advising the Company that the Staff had determined

that SharpLink did not meet the terms of the extension. Specifically, the Company did not complete its proposed transactions and was

unable to file a Current Report Form 8-K on or before the November 20, 2023 deadline previously required by the Staff, evidencing compliance

with the Rule.

As

reported on a Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 12, 2023, SharpLink submitted

a hearing request with the Nasdaq Hearings Panel (the “Panel”) on November 28, 2023, relating to the Staff’s determination

to delist the Company’s securities from Nasdaq due to the Company’s failure to meet the minimum $2.5 million shareholders’

equity requirement for continued listing as defined by the Rule. On November 28, 2023, the Company was notified by Nasdaq that an oral

hearing (the “Hearing”) had been scheduled for February 20, 2024; and, the delisting action referenced in the Staff’s

determination letter, dated November 21, 2023, had been stayed, pending a final determination by the Panel.

On

January 25, 2024, SharpLink filed a Current Report on Form 8-K with the SEC, disclosing details of the sale of its SportsHub/fantasy

sports and free to play sports game development business units to RSports Interactive, Inc. for $22.5 million in an all-cash transaction

(the “Equity Sale”). The Company further disclosed that it used a portion of the proceeds from the Equity Sale to retire

approximately $19.4 million, in aggregate, in outstanding debt obligations, thereby significantly strengthening its balance sheet. As

a result of the Equity Sale, the Company’s total stockholders’ equity now exceeds $2.5 million as of the date of the above

referenced Form 8-K filing. As a result of the Equity Sale, the Company believes that it has regained compliance with all applicable

continued listing requirements and has requested that the Staff determine whether the Hearing should be cancelled.

On

February 7, 2024, SharpLink received formal notification from Nasdaq that the Company’s previously announced deficiency under the

Rule has been cured, and the Company has regained compliance with all applicable continued listing standards. Therefore, the Hearing

before the Nasdaq Hearings Panel, originally scheduled for February 20, 2024, has been cancelled. SharpLink’s ordinary shares continue

to be listed and traded on Nasdaq.

The

Company issued a press release announcing the foregoing, which press release is attached to this Current Report on Form 8-K as Exhibit

99.1 and is incorporated by reference herein.

| ITEM

9.01 |

FINANCIAL

STATEMENTS AND EXHIBITS. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SHARPLINK

GAMING LTD. |

| |

|

|

| |

By:

|

/s/

Rob Phythian |

| |

Name:

|

Rob

Phythian |

| |

Title:

|

Chief

Executive Officer |

| Dated:

February 8, 2024 |

|

|

Exhibit

99.1

SharpLink

Gaming Regains Full Compliance with

Nasdaq

Continued Listing Standards

MINNEAPOLIS

– (GLOBE NEWSWIRE) – February 8, 2024 – SharpLink Gaming Ltd.

(Nasdaq: SBET) (“SharpLink” or the “Company”) today announced that it received formal notification from

the Nasdaq Stock Market (“Nasdaq”) that its deficiency under Listing rule 5550(b) has been cured, and that the Company is

back in compliance with all applicable continued listing standards. As a result, the hearing before the Nasdaq Listing Qualifications

Panel, originally scheduled for February 20, 2024, has been cancelled; and SharpLink’s ordinary shares will continue to be listed

and traded on Nasdaq.

About

SharpLink Gaming Ltd.

Founded

in 2019, SharpLink is an online performance marketing company that delivers unique fan activation solutions to its sportsbook and casino

partners. Through its iGaming and affiliate marketing network, known as PAS.net, SharpLink focuses on driving qualified traffic and player

acquisitions, retention and conversions to U.S. regulated and global iGaming operator partners worldwide. In fact, PAS.net won industry

recognition as the European online gambling industry’s Top Affiliate Website and Top Affiliate Program for four consecutive years

by both igamingbusiness.com and igamingaffiliate.com. For more information, please visit www.sharplink.com.

Forward-Looking

Statements

This

release contains forward-looking statements that are subject to various risks and uncertainties. Such statements include statements regarding

the Company’s ability to grow its affiliate marketing business, the potential benefits of the Company’s products, services

and technologies and other statements that are not historical facts, including statements which may be accompanied by the words “intends,”

“may,” “will,” “plans,” “expects,” “anticipates,” “projects,”

“predicts,” “estimates,” “aims,” “believes,” “hopes,” “potential”

or similar words. Actual results could differ materially from those described in these forward-looking statements due to certain factors,

including without limitation, the Company’s ability to achieve profitable operations, government regulation of online betting,

customer acceptance of new products and services, the demand for its products and its customers’ economic condition, the impact

of competitive products and pricing, the lengthy sales cycle, proprietary rights of the Company and its competitors, general economic

conditions and other risk factors detailed in the Company’s annual report and other filings with the United States Securities and

Exchange Commission. The Company does not undertake any responsibility to update the forward-looking statements in this release.

CONTACT

INFORMATION:

INVESTOR

AND MEDIA RELATIONS

ir@sharplink.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

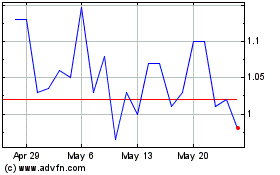

SharpLink Gaming (NASDAQ:SBET)

Historical Stock Chart

From Dec 2024 to Jan 2025

SharpLink Gaming (NASDAQ:SBET)

Historical Stock Chart

From Jan 2024 to Jan 2025