Star Bulk Completes Merger With Eagle Bulk

09 April 2024 - 9:50PM

Star Bulk Carriers Corp. (“Star Bulk”) (Nasdaq: SBLK), a global

shipping company focusing on the transportation of dry bulk

cargoes, today announced that it has completed its merger with

Eagle Bulk Shipping Inc. (“Eagle”).

Under the terms of the merger agreement, each

Eagle shareholder received 2.6211 shares of Star Bulk common stock

for each share of Eagle common stock owned. Eagle common stock has

ceased trading and will no longer be listed on the New York Stock

Exchange.

Petros Pappas, Chief Executive Officer of Star

Bulk, said, “This is an exciting day for Star Bulk as we bring

together our companies and create a global leader in dry bulk

shipping. We are moving forward with greater scale, a stronger

financial profile and unique technical and commercial capabilities

to grow our business, better serve our customers and deliver

sustainable value for our shareholders.”

Board and Leadership Team

Appointments

In connection with the closing of the merger,

Gary Weston has joined the Star Bulk Board of Directors, Bo

Westergaard has joined Star Bulk’s new leadership team and Costa

Tsoutsoplides will serve as interim Senior Advisor to assist with

business integration.

Advisors

Cravath, Swaine & Moore LLP served as legal

counsel to Star Bulk. Houlihan Lokey served as financial advisor to

Eagle and Akin Gump Strauss Hauer & Feld LLP served as legal

counsel to Eagle and Hogan Lovells US LLP served as legal counsel

to the Board of Directors of Eagle.

About Star Bulk

Star Bulk is a global shipping company providing

worldwide seaborne transportation solutions in the dry bulk sector.

Star Bulk’s vessels transport major bulks, which include iron ore,

minerals and grain, and minor bulks, which include bauxite,

fertilizers and steel products. Star Bulk was incorporated in the

Marshall Islands on December 13, 2006 and maintains executive

offices in Athens, New York, Limassol, Singapore, Germany and

Denmark. Its common stock trades on the Nasdaq Global Select Market

under the symbol “SBLK”. As of April 9, 2024, Star Bulk has a fleet

of 163 owned vessels, with an aggregate capacity of 15.6 million

dwt, consisting of Newcastlemax, Capesize, Post Panamax, Kamsarmax,

Panamax, Ultramax and Supramax vessels with carrying capacities

between 53,489 dwt and 209,537 dwt.

Cautionary Statement Regarding Forward

Looking Statements

This press release contains certain statements

that are “forward-looking statements” within the meaning of Section

27A of the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934, as amended. Star Bulk has identified some of

these forward-looking statements with words like “believe,” “may,”

“could,” “would,” “might,” “possible,” “will,” “should,” “expect,”

“intend,” “plan,” “anticipate,” “estimate,” “potential,” “outlook”

or “continue,” the negative of these words, other terms of similar

meaning or the use of future dates. Forward-looking statements in

this press release include without limitation, statements about the

benefits of the transaction, including future financial and

operating results and synergies and Star Bulk’s plans, objectives,

expectations and intentions. Such statements are qualified by the

inherent risks and uncertainties surrounding future expectations

generally, and actual results could differ materially from those

currently anticipated due to a number of risks and uncertainties.

Risks and uncertainties that could cause results to differ from

expectations include: the effects of disruption caused by the

announcement of the transaction making it more difficult to

maintain relationships with employees, customers, vendors and other

business partners; the possibility that the expected synergies and

value creation from the transaction will not be realized, or will

not be realized within the expected time period; risks related to

Star Bulk’s ability to successfully integrate Eagle’s operations

and employees; the risk that the anticipated tax treatment of the

proposed transaction between Star Bulk and Eagle is not obtained;

other business effects, including the effects of industry, economic

or political conditions outside of the control of the parties to

the transaction; actual or contingent liabilities; and other risks

and uncertainties discussed in Star Bulk’s and Eagle’s filings with

the SEC, including in “Part I. Item 3. Key Information D. Risk

Factors” of Star Bulk’s Annual Report on Form 20-F for the fiscal

year ended December 31, 2023, “Part I. Item 1A. Risk Factors” of

Eagle’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023 and Star Bulk’s subsequent current reports on

Form 6-K. You can obtain copies of these documents free of charge

from the Securities and Exchange Commission’s website at

https://www.sec.gov. Star Bulk does not undertake any obligation to

update any forward-looking statements as a result of new

information, future developments or otherwise, except as expressly

required by law. All forward-looking statements in this press

release are qualified in their entirety by this cautionary

statement.

|

Contacts |

|

| |

|

| Investor Relations:Simos Spyrou,

Christos Begleris Co ‐ Chief Financial OfficersStar Bulk Carriers

Corp.c/o Star Bulk Management Inc. 40 Ag. Konstantinou Av.Maroussi

15124Athens, GreeceEmail: info@starbulk.comwww.starbulk.com |

Financial Media:Nicolas

BornozisPresidentCapital Link, Inc.230 Park Avenue, Suite 1536New

York, NY 10169Tel. (212) 661‐7566E‐mail:

starbulk@capitallink.comwww.capitallink.comJim Golden / Tali

Epstein / Jack KelleherCollected

StrategiesStarBulk-CS@collectedstrategies.com |

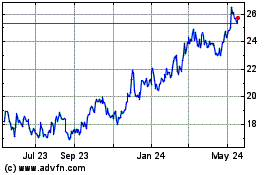

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Nov 2024 to Dec 2024

Star Bulk Carriers (NASDAQ:SBLK)

Historical Stock Chart

From Dec 2023 to Dec 2024