Solid Biosciences Inc. (Nasdaq: SLDB) (the “Company” or “Solid”), a

life sciences company developing precision genetic medicines for

neuromuscular and cardiac diseases, today announced the pricing of

an underwritten offering of 35,739,810 shares of its common stock

at an offering price of $4.03 per share and, in lieu of common

stock to certain investors, pre-funded warrants to purchase

13,888,340 shares of common stock at an offering price of $4.029

per pre-funded warrant. The aggregate gross proceeds of the

offering are expected to be approximately $200.0 million, before

deducting underwriting discounts and commissions and other offering

expenses. Each pre-funded warrant will have an exercise price of

$0.001 per share, will be exercisable immediately and will be

exercisable until all of the pre-funded warrants are exercised in

full. All of the securities in the offering are being sold by

Solid. The offering is expected to close on or about February 19,

2025, subject to the satisfaction of customary closing conditions.

The financing includes new and existing investors, including

Adage Capital Partners LP, Bain Capital Life Sciences, Invus,

Perceptive Advisors, RA Capital Management, TCGX, Venrock

Healthcare Capital Partners, Vestal Point Capital, a U.S.-based

life-sciences focused institutional investor, a major mutual fund

and a large investment management firm.

Jefferies, Leerink Partners and William Blair are acting as

joint book-running managers for the offering. H.C. Wainwright &

Co. is acting as lead manager for the offering.

The securities are being offered pursuant to a shelf

registration statement on Form S-3 (File No. 333-277871) that was

declared effective by the Securities and Exchange Commission

(“SEC”) on May 17, 2024. The offering is being made only by means

of a prospectus supplement and the accompanying prospectus that

form a part of the registration statement. A final prospectus

supplement relating to the offering will be filed with the SEC.

When available, copies of the prospectus supplement and the

accompanying prospectus may also be obtained by contacting:

Jefferies LLC, Attention: Equity Syndicate Prospectus Department,

520 Madison Avenue, 2nd Floor, New York, NY 10022, by telephone at

(877) 821-7388, or by email at prospectus_department@jefferies.com;

Leerink Partners LLC, Attention: Syndicate Department, 53 State

Street, 40th Floor, Boston, MA 02109, by telephone at (800)

808-7525, ext. 6105, or by email at syndicate@leerink.com; or

William Blair & Company, L.L.C., Attention: Prospectus

Department, 150 North Riverside Plaza, Chicago, Illinois 60606, by

telephone at (800) 621-0687 or by email at

prospectus@williamblair.com.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy these securities, nor shall there

be any sale of, these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Solid Biosciences

Solid Biosciences is a precision genetic medicine company

focused on advancing a portfolio of gene therapy candidates

targeting rare neuromuscular and cardiac diseases, including

Duchenne muscular dystrophy (Duchenne), Friedreich’s ataxia (FA),

catecholaminergic polymorphic ventricular tachycardia (CPVT),

TNNT2-mediated dilated cardiomyopathy, BAG3-mediated dilated

cardiomyopathy, and additional fatal, genetic cardiac diseases. The

Company is also focused on developing innovative libraries of

genetic regulators and other enabling technologies with promising

potential to significantly impact gene therapy delivery

cross-industry. Solid is advancing its diverse pipeline and

delivery platform in the pursuit of uniting experts in science,

technology, disease management, and care. Patient-focused and

founded by those directly impacted by Duchenne, Solid’s mission is

to improve the daily lives of patients living with devastating rare

diseases.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995, such as those, among others, relating to the Company’s plans

to consummate its offering, including the satisfaction of customary

closing conditions relating to the offering and the expected

closing of the offering. The words “anticipate,” “believe,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,”

“would” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these identifying words. The Company may not

actually achieve the plans, intentions or expectations disclosed in

its forward-looking statements, and you should not place undue

reliance on its forward-looking statements. Actual results or

events could differ materially from the plans, intentions and

expectations disclosed in the forward-looking statements the

Company makes as a result of various risks and uncertainties,

including but not limited to, market and other financial

conditions, the satisfaction of customary closing conditions

related to the offering, the Company’s ability to advance its

product candidates, whether our cash resources will be sufficient

to fund the Company’s foreseeable and unforeseeable operating

expenses and capital expenditure requirements on its expected

timeline and the impact of general economic, industry or political

conditions in the United States or internationally. Additional

risks and uncertainties relating to the offering, the Company and

its business can be found under the caption “Risk Factors” included

in the Company’s Quarterly Report on Form 10-Q for the quarter

ended September 30, 2024 and other filings that the Company may

make with the SEC in the future. In addition, the forward-looking

statements included in this press release represent the Company’s

views as of the date hereof and should not be relied upon as

representing the Company’s views as of any date subsequent to the

date hereof. The Company anticipates that subsequent events and

developments will cause the Company’s views to change. However,

while the Company may elect to update these forward-looking

statements at some point in the future, the Company specifically

disclaims any obligation to do so.

Solid Biosciences Investor Contact:Nicole

AndersonDirector, Investor Relations and Corporate

CommunicationsSolid Biosciences Inc.investors@solidbio.com

Media Contact:Glenn SilverFINN

Partnersglenn.silver@finnpartners.com

This press release was published by a CLEAR® Verified

individual.

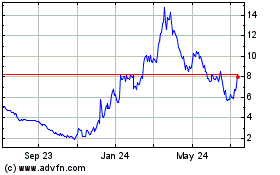

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Feb 2025 to Mar 2025

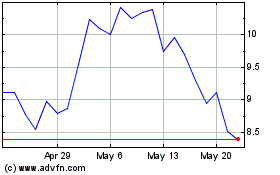

Solid Biosciences (NASDAQ:SLDB)

Historical Stock Chart

From Mar 2024 to Mar 2025