UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Amendment No. 7)

Under the Securities Exchange

Act of 1934

SEMLER SCIENTIFIC, INC.

(Name of Issuer)

Common

Stock, par value $0.001 per share

(Title of Class of Securities)

81684M

104

(CUSIP Number)

Marianne C. Sarrazin, Esq.

Goodwin Procter LLP

3 Embarcadero Center

San Francisco, CA 94111

Telephone:

(415) 733-6000

(Name, Address and Telephone

Number of Person

Authorized to Receive Notices

and Communications)

November 7, 2024

(Date of Event Which Requires

Filing of this Statement)

If the filing person has previously

filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ¨

SCHEDULE 13D

| CUSIP No. 81684M 104 |

| 1. |

NAMES OF REPORTING PERSONS

|

| |

Douglas Murphy-Chutorian, M.D. |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

| |

(a) ¨ (b) ¨ |

| 3. |

SEC USE ONLY

|

|

4. |

SOURCE OF FUNDS

PF |

| 5. |

CHECK BOX IF

DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2 (e)

o |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United States |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE VOTING POWER

605,000 shares |

| 8. |

SHARED VOTING POWER

100,313 shares |

| 9. |

SOLE DISPOSITIVE POWER

605,000 shares |

| 10. |

SHARED DISPOSITIVE POWER

100,313 shares |

| 11. |

AGGREGATE AMOUNT

BENEFICIALLY OWNED BY EACH REPORTING PERSON

705,313 shares |

| 12. |

CHECK BOX IF

THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

o |

| 13. |

PERCENT OF CLASS

REPRESENTED BY AMOUNT IN ROW (11)

8.85%* |

| 14. |

TYPE OF REPORTING

PERSON*

IN |

* Based upon an aggregate of (i) 7,266,242 shares of the Issuer’s (as defined below) common stock outstanding as of October 31,

2024 as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 filed on November 5, 2024

plus (ii) 100,000 shares issued November 7, 2024 upon exercise of options as reported herein. Sole voting power consists solely of stock

options to acquire common stock held by the Reporting Person (as defined below), 590,000 of which are fully vested and exercisable, 15,000

of which are subject to vesting.

CUSIP No. 81684M 104

Item 1. Security and Issuer.

The equity securities covered

by this Schedule 13D (Amendment No. 7) are shares of common stock, $0.001 par value, of Semler Scientific, Inc., a Delaware corporation

(the “Issuer”). The Issuer’s principal executive offices are located at 2340-2348 Walsh Avenue, Suite 2344, Santa Clara,

CA 95051.

Item 2. Identity and Background.

This statement is filed by Douglas Murphy-Chutorian,

M.D., a U.S. citizen (the “Reporting Person”). The Reporting Person’s business address is the same as that of the Issuer,

2340-2348 Walsh Avenue, Suite 2344, Santa Clara, CA 95051, and his present principal occupation is serving as Chief Executive

Officer and a Director of the Issuer.

The Reporting Person has not, during the last

five years, (a) been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors) or (b) been party to a

civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to

a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws or finding any violation with respect to such laws.

Item 3. Source and Amount

of Funds or Other Consideration.

The information contained in

Item 5 is incorporated by reference into this Item 3.

Item 4. Purpose of Transaction.

The information contained in Item 5 is incorporated

by reference into this Item 4.

Except as set forth or incorporated by reference

in this Item 4, the Reporting Person has no present plans or proposals that relate to, or that would result in, any of the actions specified

in clauses (a) through (j) of Item 4 of Schedule 13D.

Item 5. Interest in Securities of the Issuer.

On

August 26, 2024, the Reporting Person exercised in full an option to purchase 71,000 shares of the Issuer’s common stock at an exercise

price of $2.10 per share, of which 33,377 shares of the Issuer’s common stock were withheld by the Issuer at a price of $29.34

per share to cover the exercise price and tax withholding obligations of the Reporting Person. Accordingly, 37,623 shares of common stock

were issued to the Reporting Person. Following the exercise of this option, between August 28, 2024 and August 29, 2024, the Reporting

Person sold an aggregate of 10,881 shares of the Issuer’s common stock, for an aggregate amount of $305,540.00.

On September 5, 2024, the

Reporting Person transferred 26,742 shares of the Issuer’s common stock to his family trust over which he is co-Trustee with his

spouse for no consideration.

On November 7, 2024, the Reporting

Person exercised an option to purchase (i) 75,000 shares of the Issuer’s common stock at an exercise price of $1.96 per share, and

(ii) 25,000 shares of the Issuer’s common stock at an exercise price of $3.44 per share, for an aggregate cash exercise price of

$233,000.00. Immediately following the exercise, the Reporting Person sold an aggregate of 50,000 shares of the Issuer’s common

stock at $37.93 per share for an aggregate cash proceeds of $1,896,500.00, and transferred the remaining 50,000 shares of the Issuer’s

common stock to his family trust over which he is co-Trustee with his spouse for no consideration.

Following

the transactions described in this Item 5, the Reporting Person is the beneficial owner of an aggregate of 705,313 shares of the Issuer’s

common stock (approximately 8.85% based on 7,266,242 shares issued and outstanding on October 31, 2024 plus 100,000 shares issued

pursuant to the option exercises reported herein), which consists of (i) of 590,000 shares subject to options that are currently exercisable

and 15,000 shares subject to an option that remain subject to vesting, in each case over which the Reporting Person has sole voting and

investment control and (ii) 100,313 shares of common stock held in the Reporting Person’s family trust, over which he shares voting

and investment control with his spouse.

Depending upon future evaluations

of the business prospects of the Issuer and upon other developments, including, but not limited to, general economic and business conditions

and stock market conditions, the Reporting Person may purchase additional equity or other securities of the Issuer or dispose of some

or all of his holdings in the open market, in public offerings, in privately negotiated transactions or in other transactions, including

future dispositions back to the Issuer, or in any combination of the foregoing, subject to the Issuer’s insider trading policy and

relevant applicable securities laws and regulations.

Item 6. Contracts, Arrangements,

Understandings or Relationships with Respect to Securities of the Issuer.

None.

Item 7. Materials to be Filed

as Exhibits.

None.

SIGNATURE

After reasonable inquiry and

to the best of such Reporting Person’s knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

Dated: November 12, 2024

| |

/s/

Douglas Murphy-Chutorian, M.D. |

| |

Douglas

Murphy-Chutorian, M.D. |

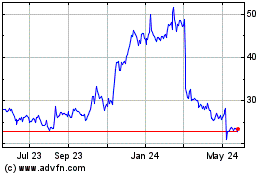

Semier Scientific (NASDAQ:SMLR)

Historical Stock Chart

From Dec 2024 to Jan 2025

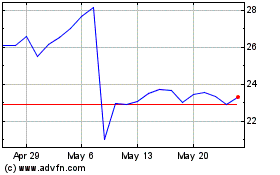

Semier Scientific (NASDAQ:SMLR)

Historical Stock Chart

From Jan 2024 to Jan 2025